Global Tax Management Market

Marktgröße in Milliarden USD

CAGR :

%

USD

24.55 Billion

USD

57.40 Billion

2025

2033

USD

24.55 Billion

USD

57.40 Billion

2025

2033

| 2026 –2033 | |

| USD 24.55 Billion | |

| USD 57.40 Billion | |

|

|

|

|

Globaler Markt für Steuermanagement, nach Komponente (Software und Dienstleistungen), Steuerart (indirekte und direkte Steuern), Bereitstellungsmodus (Cloud-basiert und vor Ort), Unternehmensgröße (kleine und mittlere Unternehmen (KMU) und große Unternehmen), Branche (Banken, Finanzdienstleistungen und Versicherungen (BFSI), Informationstechnologie (IT) und Telekommunikation, Fertigung, Energie- und Versorgungsunternehmen, Einzelhandel, Gesundheitswesen und Biowissenschaften, Medien und Unterhaltung, Sonstige), Land (USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Restliches Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher asiatisch-pazifischer Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika) Branchentrends und Prognose bis 2028

Marktanalyse und Einblicke: Globaler Markt für Steuermanagement

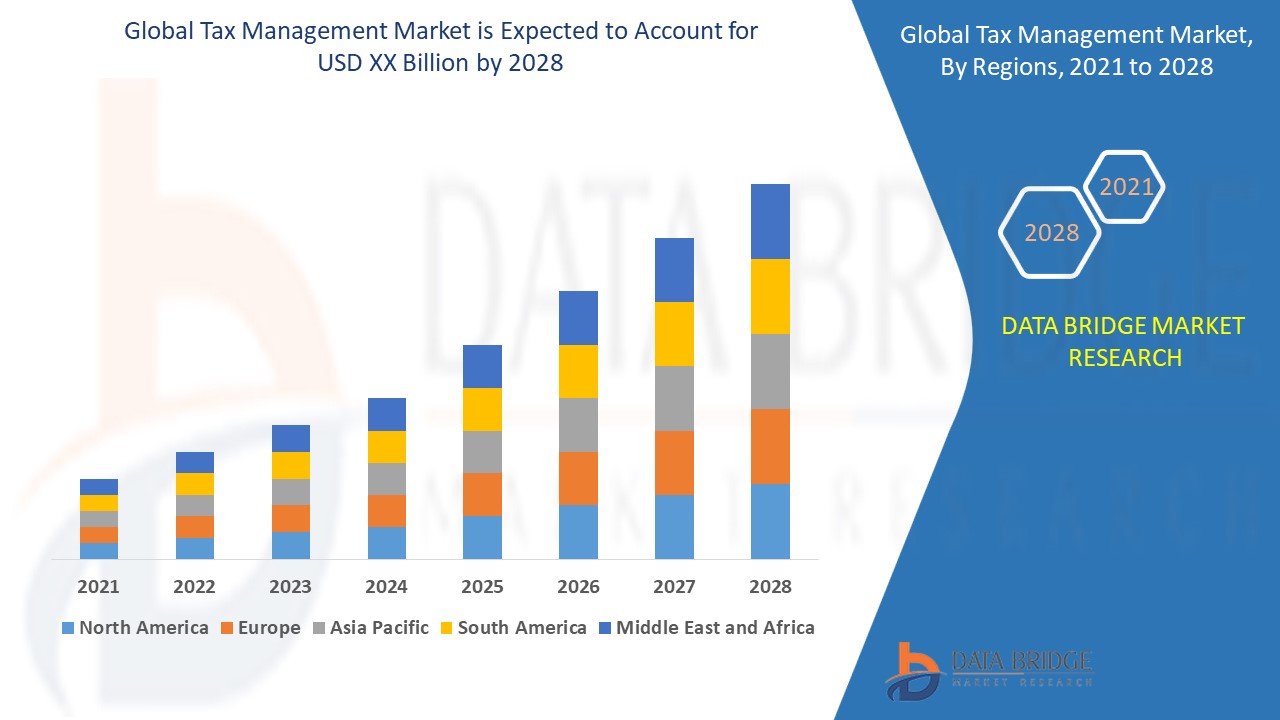

Für den Markt für Steuermanagement wird im Prognosezeitraum von 2021 bis 2028 ein Marktwachstum von 11,20 % erwartet. Der Marktforschungsbericht von Data Bridge zum Markt für Steuermanagement bietet Analysen und Erkenntnisse zu den verschiedenen Faktoren, die voraussichtlich im gesamten Prognosezeitraum vorherrschen werden, und gibt Aufschluss über ihre Auswirkungen auf das Marktwachstum.

Steuermanagement bezeichnet die Verwaltung von Geldern und Vermögenswerten zur Zahlung von Steuern. Das Hauptziel des Steuermanagements besteht darin, die Anforderungen der Einkommensteuergesetze und -vorschriften zu erfüllen. Ebenso umfasst es den Quellensteuerabzug, die Prüfung der Konten und die rechtzeitige Abgabe von Steuererklärungen usw.

Wichtige Faktoren, die das Wachstum des Steuermanagementmarktes im Prognosezeitraum ankurbeln dürften, sind die wachsende Menge an Finanztransaktionen in allen Branchen aufgrund der Digitalisierung, die Komplexität des Steuersystems und die zunehmende Akzeptanz der elektronischen Buchhaltung. Darüber hinaus sind die Schwierigkeiten im Zusammenhang mit den bestehenden Steuersystemen, die Wachsamkeit der Steuerbehörden und die zunehmenden Investitionen in digitale Lösungen einige der anderen Faktoren, die voraussichtlich eine wichtige Rolle bei der Förderung des Wachstums des Steuermanagementmarktes spielen werden.

Der zunehmende Diebstahl vertraulicher Daten, die Sicherheits- und Netzwerkbedenken bei Cloud-Anwendungen und das fehlende Verständnis für Steuerverwaltungssoftware sind jedoch einige der Faktoren, die das Wachstum des Steuerverwaltungsmarktes im Zeitrahmen wahrscheinlich behindern werden. Darüber hinaus wird die Nutzung der Blockchain-Technologie in den kommenden Jahren weitere vorteilhafte Möglichkeiten für das Wachstum des Steuerverwaltungsmarktes bieten. Trotzdem könnten die regelmäßigen Änderungen der Steuergesetze und das Fehlen standardisierter Steuerregeln das Wachstum des Steuerverwaltungsmarktes in naher Zukunft weiter behindern.

Dieser Bericht zum Markt für Steuermanagement enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Steuermanagement zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Steuermanagement – Marktumfang und Marktgröße

Der Markt für Steuermanagement ist nach Komponenten, Steuerarten, Bereitstellungsmethoden, Unternehmensgrößen und Branchen segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und bestimmt Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten.

- Basierend auf den Komponenten ist der Markt für Steuerverwaltung in Software und Dienstleistungen segmentiert.

- Basierend auf der Steuerart ist der Steuerverwaltungsmarkt in indirekte und direkte Steuern segmentiert.

- Basierend auf dem Bereitstellungsmodus ist der Markt für Steuerverwaltung in Cloud-basiert und vor Ort segmentiert.

- Basierend auf der Unternehmensgröße ist der Steuermanagementmarkt in kleine und mittlere Unternehmen (KMU) sowie große Unternehmen segmentiert.

- Basierend auf der Vertikalen ist der Markt für Steuermanagement segmentiert in Banken, Finanzdienstleistungen und Versicherungen (BFSI), Informationstechnologie (IT) und Telekommunikation, Fertigung, Energie- und Versorgungseinzelhandel, Gesundheitswesen und Biowissenschaften, Medien und Unterhaltung, Sonstiges. Sonstiges ist weiter unterteilt in Immobilien und Bauwesen sowie Transport und Logistik.

Steuermanagement Markt – Länderebene Analyse

Der Markt für Steuermanagement wird analysiert und Informationen zu Marktgröße und Volumen werden nach Land, Lasertypen, Komponenten, Übertragungsmedien, Vertriebskanälen und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht zum Steuermanagement abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Brasilien, Argentinien und der Rest von Südamerika als Teil von Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Rest von Europa in Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Rest von Asien-Pazifik (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Rest von Nahem Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA).

Nordamerika dominiert den Markt für Steuermanagement aufgrund der steigenden Investitionen in neue Sportanalyse-Technologien. Darüber hinaus werden die Komplexität des Steuersystems und die Unterschiede zwischen Steuer- und Arbeitsrecht das Wachstum des Marktes für Steuermanagement in der Region im Prognosezeitraum weiter ankurbeln. Im asiatisch-pazifischen Raum wird aufgrund der steigenden Anzahl von Sportligen ein deutliches Wachstum des Marktes für Steuermanagement erwartet. Darüber hinaus wird erwartet, dass der zunehmende Trend zur Digitalisierung und die fortgesetzten Bemühungen der Regierung, ihre Steuerbasis zu schützen, Steuerreformen und die Häufigkeit von Steuerprüfungen das Wachstum des Marktes für Steuermanagement in der Region in den kommenden Jahren weiter vorantreiben werden.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Steuermanagement Marktanteilsanalyse

Die Wettbewerbslandschaft des Steuermanagementmarktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, regionale Präsenz, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Steuermanagementmarkt.

Die wichtigsten Akteure, die im Bericht zum Steuermanagementmarkt behandelt werden, sind Avalara, Inc., ADP, Inc., Wolters Kluwer NV, Thomson Reuters., Intuit Inc., H&R Block, Inc., SAP, Blucora, Inc., Sovos Compliance, LLC., Vertex Corporate, Shoeboxed, Inc., Sailotech., SAXTAX Software, Paychex Inc., CrowdReason, LLC., Defmacro Software Private Limited, OUTRIGHT MARKETING PRIVATE LIMITED, DAVO Technologies., Xero Limited., TaxSlayer LLC, Taxback International, TaxCloud, Drake Enterprises, Canopy Tax, Inc., TaxJar., neben anderen inländischen und internationalen Akteuren. Marktanteilsdaten sind für global, Nordamerika, Europa, Asien-Pazifik (APAC), Naher Osten und Afrika (MEA) und Südamerika separat verfügbar. DBMR-Analysten verstehen Wettbewerbsstärken und erstellen Wettbewerbsanalysen für jeden Wettbewerber separat.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.