Global Street Roadway Lighting Market

Marktgröße in Milliarden USD

CAGR :

%

USD

10.27 Billion

USD

16.31 Billion

2024

2032

USD

10.27 Billion

USD

16.31 Billion

2024

2032

| 2025 –2032 | |

| USD 10.27 Billion | |

| USD 16.31 Billion | |

|

|

|

|

Globale Marktsegmentierung für Straßen- und Fahrbahnbeleuchtung nach Beleuchtungstyp (konventionelle Beleuchtung und intelligente Beleuchtung), Lichtquelle (LEDs, Leuchtstofflampen und HID-Lampen), Wattzahltyp (weniger als 50 W, zwischen 50 W und 150 W und mehr als 150 W), Endbenutzer (Autobahnen, Straßen und Fahrbahnen und andere), Angebot (Hardware, Software und Dienstleistungen) – Branchentrends und Prognose bis 2032

Marktgröße für Straßen- und Fahrbahnbeleuchtung

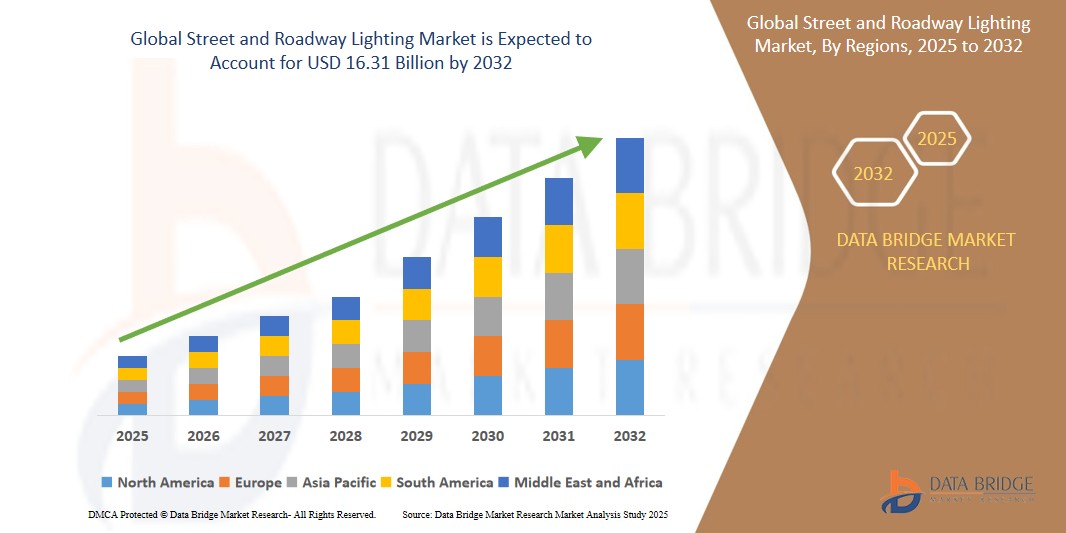

- Der globale Markt für Straßen- und Fahrbahnbeleuchtung wurde im Jahr 2024 auf 10,27 Milliarden US-Dollar geschätzt und dürfte bis 2032 16,31 Milliarden US-Dollar erreichen , bei einer jährlichen Wachstumsrate von 5,96 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie wachsende Smart-City-Initiativen, die steigende Nachfrage nach energieeffizienten Lösungen, unterstützende staatliche Vorschriften, Fortschritte im IoT und in der Sensortechnologie sowie die schnelle Urbanisierung, die die Infrastrukturentwicklung vorantreibt, vorangetrieben.

Marktanalyse für Straßen- und Fahrbahnbeleuchtung

- Straßen- und Fahrbahnbeleuchtung umfasst Systeme und Technologien zur Beleuchtung öffentlicher Straßen, Autobahnen und städtischer Gebiete. Sie dienen der Verbesserung der Sichtbarkeit, der Gewährleistung der Verkehrssicherheit und der Unterstützung der städtischen Infrastruktur. Zu diesen Systemen gehören verschiedene Lösungen wie LED-Leuchten, intelligente Beleuchtungsnetze und herkömmliche Lichtquellen.

- Der Markt für Straßen- und Fahrbahnbeleuchtung verzeichnet ein starkes Wachstum. Dies ist auf steigende globale Investitionen in die Smart-City-Infrastruktur, die steigende Nachfrage nach energieeffizienten Beleuchtungslösungen, die rasante Urbanisierung, staatliche Vorgaben für eine nachhaltige öffentliche Beleuchtung und Fortschritte bei IoT-fähigen Smart-Lighting- Technologien zurückzuführen.

- Der asiatisch-pazifische Raum wird voraussichtlich den Markt für Straßen- und Fahrbahnbeleuchtung dominieren, da in den wichtigsten Volkswirtschaften starke Regierungsinitiativen zur Förderung der Entwicklung intelligenter Städte und zur Modernisierung energieeffizienter Infrastrukturen bestehen.

- Europa dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für Straßen- und Fahrbahnbeleuchtung sein, da strenge gesetzliche Auflagen zur Verbesserung der Energieeffizienz, Nachhaltigkeit und öffentlichen Sicherheit gelten.

- Es wird erwartet, dass das LED-Segment den Markt mit einem Marktanteil von 80,2 % dominieren wird. Dies ist auf die höhere Energieeffizienz, die längere Lebensdauer, die geringeren Wartungskosten und die wachsenden globalen Initiativen zurückzuführen, die sich auf die Entwicklung einer nachhaltigen und intelligenten Stadtinfrastruktur konzentrieren.

Berichtsumfang und Marktsegmentierung für Straßen- und Fahrbahnbeleuchtung

|

Eigenschaften |

Wichtige Markteinblicke zur Straßen- und Fahrbahnbeleuchtung |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Markttrends für Straßen- und Fahrbahnbeleuchtung

„Zunehmende Verbreitung intelligenter Beleuchtungssysteme“

- Ein herausragender Trend auf dem globalen Markt für Straßen- und Fahrbahnbeleuchtung ist die zunehmende Einführung intelligenter Beleuchtungssysteme

- Dieser Trend wird durch den wachsenden Bedarf an Energieeffizienz, reduzierten Betriebskosten und Echtzeit-Steuerungsmöglichkeiten durch IoT, KI und sensorbasierte Technologien vorangetrieben.

- Viele Städte setzen beispielsweise auf adaptive Straßenbeleuchtung, die die Helligkeit an den Verkehrsfluss und die Umgebungsbedingungen anpasst und so den Energieverbrauch senkt und die öffentliche Sicherheit verbessert.

- Die Einführung intelligenter Beleuchtung breitet sich sowohl in entwickelten Regionen wie Europa und Nordamerika als auch in sich schnell urbanisierenden Gebieten im asiatisch-pazifischen Raum aus, wo Smart-City-Initiativen Priorität haben.

- Da städtische Gebiete nach Nachhaltigkeit, Automatisierung und verbesserter Infrastrukturleistung streben, wird erwartet, dass sich der Übergang zu intelligenten Beleuchtungssystemen beschleunigt und die Zukunft des Marktes für Straßen- und Fahrbahnbeleuchtung prägt.

Marktdynamik für Straßen- und Fahrbahnbeleuchtung

Treiber

„Zunehmende staatliche Regulierung“

- Zunehmende staatliche Vorschriften zur Energieeffizienz und zu Umweltstandards treiben das Wachstum des Marktes für Straßen- und Fahrbahnbeleuchtung voran, da strengere Richtlinien nachhaltigere und energieeffizientere Beleuchtungslösungen erfordern.

- Diese Regelungen gewinnen weltweit an Bedeutung, insbesondere in städtischen Gebieten, wo die Regierungen durch eine bessere Straßenbeleuchtungsinfrastruktur den CO2-Fußabdruck verringern und den Energieverbrauch senken wollen.

- Die Nachfrage nach intelligenten, energieeffizienten und langlebigen Beleuchtungssystemen steigt und führt zu einer Verlagerung hin zu LED-Technologie und anderen fortschrittlichen Lösungen, die den gesetzlichen Standards entsprechen und gleichzeitig die Betriebskosten senken.

- Regierungen fördern die Einführung dieser Technologien, indem sie Kommunen Rabatte, Zuschüsse oder Steuergutschriften anbieten, um veraltete Beleuchtungssysteme durch energieeffiziente Alternativen zu ersetzen.

- Angesichts der immer strengeren Vorschriften wird zunehmend Wert auf die Integration intelligenter Netze und die Automatisierung von Beleuchtungssystemen gelegt, um die Steuerung zu verbessern, Energieverschwendung zu reduzieren und Nachhaltigkeitsziele zu erreichen.

Zum Beispiel,

- Unternehmen wie Signify (ehemals Philips Lighting) entwickeln innovative vernetzte LED-Straßenlaternen und integrieren intelligente Technologien, um höhere Energieeinsparungen und eine längere Lebensdauer zu ermöglichen und gleichzeitig die gesetzlichen Standards einzuhalten.

- Die Forschungs- und Entwicklungsbemühungen konzentrieren sich auf die Schaffung energieeffizienter Straßenbeleuchtungssysteme, die die staatlichen Energievorschriften erfüllen oder übertreffen und gleichzeitig für mehr öffentliche Sicherheit und Sichtbarkeit sorgen.

- Da Nachhaltigkeit und Energieeffizienz weiterhin hohe Priorität für die Regierungen haben, wird erwartet, dass der Markt für Straßen- und Fahrbahnbeleuchtung ein schnelles Wachstum bei der Einführung konformer, intelligenter und umweltfreundlicher Lösungen erleben wird.

Gelegenheit

„Zunahme von Initiativen zur Energieeffizienz“

- Der zunehmende Fokus auf Energieeffizienz stellt eine bedeutende Chance für den Markt für Straßen- und Fahrbahnbeleuchtung dar, da Kommunen und private Einrichtungen zunehmend auf die Reduzierung des Energieverbrauchs und der Betriebskosten achten.

- Regierungen, Stadtplaner und Infrastrukturunternehmen nutzen energieeffiziente Beleuchtungstechnologien wie LED-Straßenlaternen, um den Stromverbrauch zu senken, die Wartungskosten zu reduzieren und Nachhaltigkeitsziele zu erreichen.

- Diese Chance steht im Einklang mit wachsenden globalen Initiativen zur Reduzierung der Kohlenstoffemissionen, zur Verbesserung der ökologischen Nachhaltigkeit und zur Unterstützung einer intelligenteren, effizienteren städtischen Infrastruktur

Zum Beispiel,

- Unternehmen wie Cree Lighting und Acuity Brands sind führend in der Entwicklung energieeffizienter, intelligenter Beleuchtungslösungen, die langfristige Kosteneinsparungen ermöglichen und gleichzeitig die Energieeffizienzvorschriften erfüllen.

- Durch die Integration intelligenter Beleuchtungssysteme mit Sensoren und Automatisierung können Städte ihren Energieverbrauch weiter senken und gleichzeitig die öffentliche Sicherheit und den Komfort verbessern.

- Da Initiativen zur Energieeffizienz weltweit an Dynamik gewinnen, ist der Markt für Straßen- und Fahrbahnbeleuchtung gut aufgestellt, um diese Chance zu nutzen, indem er fortschrittliche Beleuchtungslösungen anbietet, die sowohl Kosteneinsparungen als auch Umweltvorteile bieten.

Einschränkung/Herausforderung

„Zunehmende Infrastrukturbeschränkungen“

- Zunehmende Infrastrukturbeschränkungen stellen eine erhebliche Herausforderung für den Markt für Straßen- und Fahrbahnbeleuchtung dar, da die veraltete Infrastruktur, unzureichende Finanzierung und mangelnde Modernisierung die Einführung energieeffizienter Beleuchtungssysteme in vielen Regionen behindern.

- Das langsame Tempo der Infrastrukturverbesserungen in älteren Städten und ländlichen Gebieten führt dazu, dass die Bemühungen, veraltete Straßenlaternen durch energieeffiziente LED-Systeme zu ersetzen, oft verzögert werden, was wiederum das Wachstums- und Nachhaltigkeitspotenzial des Marktes einschränkt.

- Diese Herausforderung ist besonders ausgeprägt in Entwicklungsregionen und Städten mit begrenzten Budgets, wo finanzielle Einschränkungen die Umsetzung fortschrittlicher Beleuchtungslösungen verhindern und den Übergang zu intelligenteren und energieeffizienteren Systemen verlangsamen können.

Zum Beispiel,

- In einigen Teilen der USA haben städtische Gebiete Schwierigkeiten, die Finanzierung für groß angelegte Modernisierungen der Beleuchtung zu sichern. Dies führt zu Verzögerungen bei der Einführung neuer Technologien, die den Energieverbrauch und die Wartungskosten senken könnten.

- Ohne strategische Investitionen in die Modernisierung der Infrastruktur, eine verstärkte Finanzierung von Smart-City-Initiativen und eine stärkere staatliche Unterstützung könnten diese Einschränkungen das Wachstum und die Weiterentwicklung des Marktes für Straßen- und Fahrbahnbeleuchtung erheblich behindern.

Marktumfang für Straßen- und Fahrbahnbeleuchtung

Der Markt ist nach Beleuchtungsart, Lichtquelle, Wattzahl, Endbenutzer und Angebot segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Beleuchtungstyp |

|

|

Nach Lichtquelle |

|

|

Nach Watttyp |

|

|

Nach Endbenutzer

|

|

|

Durch das Angebot |

|

Im Jahr 2025 werden die LEDs voraussichtlich den Markt dominieren und den größten Anteil im Lichtquellensegment haben.

Aufgrund ihrer höheren Energieeffizienz, längeren Lebensdauer und geringeren Wartungskosten sowie wachsender globaler Initiativen zur Entwicklung einer nachhaltigen und intelligenten städtischen Infrastruktur wird das LED-Segment voraussichtlich im Jahr 2025 mit 80,2 % den Markt für Straßen- und Fahrbahnbeleuchtung dominieren .

Es wird erwartet, dass die intelligente Beleuchtung im Prognosezeitraum den größten Anteil im Beleuchtungssegment ausmachen wird

Im Jahr 2025 wird das Segment der intelligenten Beleuchtung voraussichtlich den Markt dominieren, da IoT- und sensorbasierte Technologien zunehmend eingesetzt werden, die Fernüberwachung, adaptive Beleuchtung, Energieeinsparungen und eine verbesserte öffentliche Sicherheit durch Echtzeit-Datenanalyse und automatisierte Steuerungssysteme ermöglichen.

Regionale Analyse des Marktes für Straßen- und Fahrbahnbeleuchtung

„Der asiatisch-pazifische Raum hält den größten Anteil am Markt für Straßen- und Fahrbahnbeleuchtung“

- Der asiatisch-pazifische Raum dominiert den Markt für Straßen- und Fahrbahnbeleuchtung, angetrieben von den starken Regierungsinitiativen zur Förderung der Entwicklung intelligenter Städte und der Modernisierung energieeffizienter Infrastrukturen in den wichtigsten Volkswirtschaften.

- China hält aufgrund der starken Urbanisierung, des großflächigen Einsatzes von LEDs in der öffentlichen Infrastruktur und der hohen Investitionen der Zentral- und Kommunalregierungen in intelligente Beleuchtungssysteme einen erheblichen Anteil.

- Die regionale Dominanz wird durch günstige Regulierungsrichtlinien, öffentlich-private Partnerschaften und schnelle Fortschritte bei vernetzten Beleuchtungstechnologien und der Digitalisierung von Städten weiter unterstützt.

- Mit dem anhaltenden Fokus auf die Reduzierung der CO2-Emissionen und die Verbesserung der öffentlichen Sicherheit durch intelligente Beleuchtungsnetze wird der asiatisch-pazifische Raum voraussichtlich seine führende Position auf dem Markt für Straßen- und Fahrbahnbeleuchtung bis 2032 behaupten.

„Europa wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate im Markt für Straßen- und Fahrbahnbeleuchtung verzeichnen“

- In Europa wird voraussichtlich die höchste Wachstumsrate im Markt für Straßen- und Fahrbahnbeleuchtung verzeichnet, angetrieben durch strenge gesetzliche Auflagen zur Verbesserung der Energieeffizienz, Nachhaltigkeit und öffentlichen Sicherheit.

- Deutschland hält einen bedeutenden Anteil aufgrund der aggressiven Einführung intelligenter Beleuchtungslösungen, des starken Engagements für grüne Infrastruktur und staatlich geförderter Programme zur Stadtmodernisierung.

- Das Wachstum wird durch die steigende Nachfrage nach intelligenten Beleuchtungssystemen, die Integration von IoT-basierten Steuerungen und den zunehmenden Ersatz konventioneller Beleuchtung durch LEDs in den Gemeinden weiter beschleunigt.

- Mit kontinuierlichen Investitionen in Smart-City-Konzepte und nachhaltige öffentliche Infrastruktur dürfte Europa bis 2032 die am schnellsten wachsende Region im Markt für Straßen- und Fahrbahnbeleuchtung sein.

Marktanteile für Straßen- und Fahrbahnbeleuchtung

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Koninklijke Philips NV . (Niederlande)

- Cree, Inc. (USA)

- General Electric Company (USA)

- ACUITY BRANDS LIGHTING, INC. (USA)

- Hubbell (USA)

- Dongguan Kingsun Optoelectronic Co., Ltd. (China)

- Thorn (Großbritannien)

- LED ROADWAY LIGHTING LTD (Kanada)

- Syska (Indien)

- Virtuelle Erweiterung (Israel)

- Eaton (Irland)

- OSRAM Opto Semiconductors GmbH (Deutschland)

- CIMCON Lighting, Inc. (USA)

- AGC Inc. (Japan)

- Electrolite Fitting & Equipments (Indien)

- Cree-Beleuchtung (USA)

- SpecGrade LED (USA)

- LEDVANCE GmbH (Deutschland)

- SKYLER TEK, Inc. dba SKYLER LED Lighting (USA)

- Itron Inc. (USA)

Neueste Entwicklungen auf dem globalen Markt für Straßen- und Fahrbahnbeleuchtung

- Im Juni 2023 genehmigte die indische Regierung die Installation von 90.000 intelligenten Straßenlaternen auf allen Straßen des Public Works Department (PWD) in Delhi. Diese Initiative zielt darauf ab, dunkle Flecken zu beseitigen und die Sicherheit von Frauen zu erhöhen. Der Schwerpunkt liegt dabei auf einem robusten zentralen Überwachungssystem, das den unterbrechungsfreien Betrieb der Beleuchtung gewährleistet.

- Im Februar 2023 gab der Stadtrat von Monroe die Genehmigung eines Antrags auf einen Zuschuss beim Southeast Michigan Council of Governments (SEMCOG) bekannt. Der Zuschuss würde, falls genehmigt, bis zu 80 Prozent der Kosten für die Umstellung der Straßenlaternen der Stadt auf LED-Lampen decken und so die finanzielle Belastung der Stadt erheblich reduzieren.

- Im April 2022 gab Ams OSRAM Pläne zum Aufbau einer 800 Millionen Euro teuren LED-Produktionsanlage in Malaysia bekannt. Das Unternehmen kündigte außerdem erhebliche Investitionen in fortschrittliche 8-Zoll-LED-Frontend-Kapazitäten in Malaysia an, um die Produktion modernster LED-Technologien und Mikro-LEDs zu steigern.

- Im März 2021 übernahm Smart Global Holdings Inc. den Geschäftsbereich LED-Produkte von Cree Inc. Diese Übernahme ist Teil der Strategie von Smart Global Holdings, sein Portfolio zu diversifizieren und seine Präsenz auf dem LED-Markt auszubauen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.