Global Skin Graft Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.44 Billion

USD

3.08 Billion

2024

2032

USD

1.44 Billion

USD

3.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 3.08 Billion | |

|

|

|

|

Globaler Markt für Hauttransplantate nach Typ (allogen, autolog, xenogen, prothetisch, isogen), Transplantatdicke (Spalthaut, Vollhaut, Verbundtransplantat), Anwendung (Verbrennungen, ausgedehnte Wunden, Hautkrebs, Infektionen), Gerätetyp (Dermatom, allgemeine chirurgische Instrumente, Verbrauchsmaterialien, sonstige), Endverbraucher ( ambulante chirurgische Zentren , Krankenhäuser, dermatologische Kliniken, akademische Einrichtungen und Forschung, sonstige) – Branchentrends und Prognose bis 2030.

Hauttransplantationsmarktanalyse und -größe

Unter einer Hauttransplantation versteht man die Entnahme von Spenderhaut aus einem separaten Körperteil/Spenderbereich des Patienten, die dann an die gewünschte Stelle transplantiert wird, um die Hauttransplantation abzuschließen. Bei diesem Verfahren wird Haut entnommen, die normalerweise nicht sichtbar oder bedeckt ist, und es wird verwendet, um die durch Verbrennungen, verschiedene Hauterkrankungen, Verletzungen und verschiedene andere Komplikationen verursachten Komplikationen rückgängig zu machen oder zu verringern.

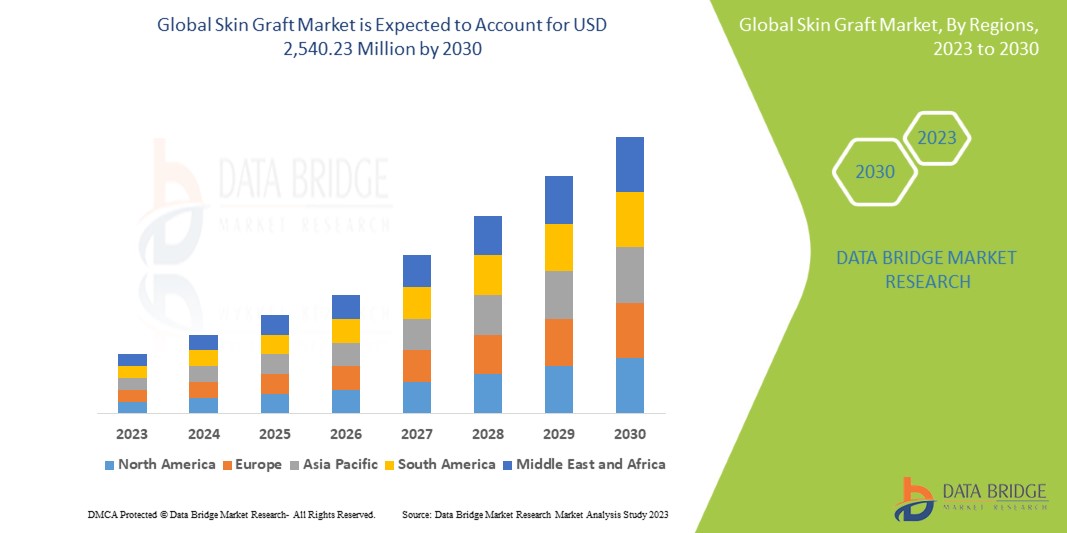

Data Bridge Market Research analysiert, dass der Markt für Hauttransplantationen, der im Jahr 2022 1.193,13 Millionen USD betrug, bis 2030 voraussichtlich 2.540,23 Millionen USD erreichen wird und im Prognosezeitraum von 2023 bis 2030 eine durchschnittliche jährliche Wachstumsrate von 9,97 % aufweisen wird. Aufgrund der steigenden Nachfrage nach Hauttransplantationen dominiert „Allogen“ das Typensegment des Marktes für Hauttransplantationen. Neben Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Nach Typ (Allogen, Autolog, Xenogen, Prothetisch, Isogen), Transplantatdicke (Spalttransplantat, Volltransplantat, Verbundtransplantat), Anwendung (Verbrennungen, ausgedehnte Wunden, Hautkrebs, Infektion), Gerätetyp (Dermatom, allgemeine chirurgische Instrumente, Verbrauchsmaterialien, Sonstiges), Endnutzer (Ambulante chirurgische Zentren, Krankenhäuser, dermatologische Kliniken, akademische Einrichtungen und Forschung, Sonstiges) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika, Brasilien, Argentinien und Restliches Südamerika |

|

Abgedeckte Marktteilnehmer |

Smith & Nephew Plc (Großbritannien), MiMedx (USA), Tissue Regenix (Großbritannien), Integra LifeSciences Corporation (USA), Organogenesis Inc. (USA), Zimmer Biomet (USA), NOUVAG AG (Schweiz), De Soutter Medical (Großbritannien), Mallinckrodt (Großbritannien), B. Braun Melsungen AG (Deutschland), AVITA Medical (Großbritannien), Surtex Instruments Limited (Großbritannien), Exsurco Medical, Inc. (USA), Specmed (Polen), ConvaTec Inc. (Großbritannien), CryoLife, Inc. (USA), Athersys Inc. (USA), LifeNet Health (USA), US Stem Cell, Inc. (USA), Isto Biologics (USA), Allergan (USA) |

|

Marktchancen |

|

Marktdefinition

Eine Hauttransplantation ist ein chirurgischer Eingriff, bei dem ein Stück gesunder Haut von einem Körperteil (Spenderstelle) entnommen und an einen anderen Körperteil (Empfängerstelle) transplantiert wird, der seine Haut aufgrund von Verletzungen, Verbrennungen oder anderen Erkrankungen verloren hat. Die transplantierte Haut dient als Ersatz für die beschädigte oder fehlende Haut, unterstützt die Wundheilung und fördert die Geweberegeneration. Hauttransplantate können in der Dicke variieren und helfen, die Schutzfunktion der Haut wiederherzustellen und ihr Aussehen zu verbessern.

Globale Marktdynamik für Hauttransplantate

Treiber

- Immer mehr Fälle chronischer Wunden

Die zunehmende Häufigkeit chronischer Wunden, darunter diabetische Geschwüre, Druckgeschwüre und venöse Beingeschwüre, ist ein wichtiger Treiber des Hauttransplantatmarktes. Chronische Wunden stellen eine erhebliche Belastung für Gesundheitssysteme und Patienten dar. Hauttransplantate werden häufig eingesetzt, um den Wundverschluss zu erleichtern, die Heilung zu verbessern und Infektionen vorzubeugen. Da die Zahl chronischer Wunden zunimmt, wird erwartet, dass auch die Nachfrage nach Hauttransplantaten steigen wird. Hauttransplantate, insbesondere autologe und allogene Transplantate, spielen eine entscheidende Rolle bei der Behandlung chronischer Wunden. Sie fördern die Heilung, indem sie eine Schutzbarriere bilden, die Geweberegeneration verbessern und das Risiko von Komplikationen verringern. Der Anstieg von Diabetes und verwandten Erkrankungen trägt zu einer erhöhten Prävalenz chronischer Wunden bei, wodurch Hauttransplantate zu einem wesentlichen Bestandteil der modernen Wundversorgung werden.

- Fortschritte in der Pfropftechnologie

Fortschritte in der Transplantationstechnologie treiben den Markt für Hauttransplantate erheblich voran. Diese Technologien umfassen sowohl die Transplantationsmaterialien als auch die für die Transplantation verwendeten Techniken. Innovationen bei Transplantationsmaterialien, wie die Entwicklung synthetischer Hautersatzstoffe, haben die Palette der für medizinisches Fachpersonal verfügbaren Optionen erweitert. Synthetische Hautersatzstoffe haben sich als spannende Entwicklung herausgestellt. Sie ahmen häufig die Struktur und Funktion natürlicher Haut nach, wodurch sie sich für die Wundabdeckung und -heilung wirksam eignen. Diese Ersatzstoffe sollen die Geweberegeneration fördern und das Risiko einer Transplantatabstoßung verringern. Darüber hinaus gehen sie auf Bedenken hinsichtlich der begrenzten Verfügbarkeit von Spenderstellen ein, die bei herkömmlichen Transplantationen eine Einschränkung darstellen. Darüber hinaus hat die Verbesserung von Transplantationstechniken, wie laserunterstützte Transplantation und Gewebezüchtung, die Erfolgsrate von Hauttransplantationen erhöht. Die Lasertechnologie ermöglicht eine präzise Entnahme und Vorbereitung des Transplantats und verringert so das Risiko einer Transplantatschädigung und eines Transplantatversagens. Gewebezüchtungstechniken helfen bei der Herstellung maßgeschneiderter Transplantate unter Verwendung der eigenen Zellen eines Patienten, wodurch die Wahrscheinlichkeit einer Abstoßung weiter verringert wird.

- Steigende Fälle von Hautkrankheiten

Die Zunahme von Hautkrankheiten, darunter Hautkrebs und dermatologische Erkrankungen, ist ein weiterer Treiber des Hauttransplantationsmarktes. Patienten mit umfangreichen Hautschäden aufgrund von Krankheiten benötigen häufig Transplantate, um beschädigtes Gewebe zu reparieren und zu ersetzen. Die Zunahme der Prävalenz von Hautkrankheiten erhöht die Nachfrage nach Hauttransplantationen sowohl aus medizinischen als auch aus kosmetischen Gründen. Insbesondere Autotransplantate werden häufig in dermatologischen Anwendungen eingesetzt. Sie helfen bei der Rekonstruktion beschädigter Hautbereiche nach chirurgischen Entfernungen von Hautkrebs oder der Behandlung von Verbrennungen. Hauttransplantationen können nicht nur das Aussehen wiederherstellen, sondern auch Funktionsbeeinträchtigungen vorbeugen, die durch den Verlust von Hautgewebe entstehen können. Das steigende Bewusstsein für die Bedeutung der frühzeitigen Erkennung und Behandlung von Hautkrankheiten unterstreicht den Bedarf an wirksamen Hauttransplantationslösungen. Da immer mehr Menschen medizinische Eingriffe bei Hauterkrankungen in Anspruch nehmen, wird der Markt für Hauttransplantationen voraussichtlich wachsen.

Gelegenheiten

- Schnelle Fortschritte im Tissue Engineering

Die schnellen Fortschritte in der Gewebezüchtung bieten eine große Chance auf dem Markt für Hauttransplantate. Die Verfahren der Gewebezüchtung werden immer ausgefeilter und bieten die Möglichkeit, maßgeschneiderte Transplantate aus den eigenen Zellen des Patienten herzustellen. Dieser personalisierte Ansatz kann das Risiko einer Transplantatabstoßung erheblich senken und die Transplantationsergebnisse verbessern. Darüber hinaus erforscht die Gewebezüchtung die Entwicklung bioaktiver Gerüste, die die Geweberegeneration verbessern und langfristige Vorteile bieten können. Mit Verfahren der Gewebezüchtung hergestellte maßgeschneiderte Transplantate können der Anatomie des Patienten angepasst werden und so sowohl Funktion als auch Ästhetik verbessern. Die Chance besteht darin, Lösungen der Gewebezüchtung allgemeiner verfügbar zu machen und die Prozesse zur individuellen Herstellung von Transplantaten zu optimieren .

- Erweiterung des Veredelungsangebots

Die Ausweitung der Transplantationsdienste auf unterversorgte Regionen und Gemeinden stellt eine große Chance dar. Viele Menschen in Entwicklungsregionen oder abgelegenen Gebieten haben keinen Zugang zu fortschrittlichen Transplantationsverfahren. Die Ausweitung der Transplantationsdienste kann ungedeckte Gesundheitsbedürfnisse decken und die Qualität der Versorgung für eine breitere Bevölkerung verbessern. Diese Chance erfordert die Zusammenarbeit zwischen Gesundheitsorganisationen, Nichtregierungsorganisationen (NGOs) und Regierungen, um Transplantationsdienste in unterversorgten Regionen bereitzustellen. Mobile medizinische Einheiten und Telemedizinlösungen können ebenfalls eine wichtige Rolle bei der Ausweitung der Transplantationsdienste auf abgelegene Gemeinden spielen.

Einschränkungen/Herausforderungen

- Hohe Kosten für Hauttransplantationen

Die hohen Kosten von Hauttransplantationen stellen eine erhebliche Einschränkung auf dem Markt für Hauttransplantationen dar. Hauttransplantationen können aufgrund des chirurgischen Eingriffs selbst, des Transplantatmaterials und der Notwendigkeit spezialisierter medizinischer Fachkenntnisse ein teurer medizinischer Eingriff sein. Der Kostenfaktor kann den Zugang zu Hauttransplantationen einschränken, insbesondere für Patienten ohne ausreichenden Versicherungsschutz oder finanzielle Mittel. Diese Einschränkung ist insbesondere für Entwicklungsregionen relevant, in denen die Gesundheitsressourcen begrenzt sind und sich Patienten den Eingriff möglicherweise nicht leisten können. Um diese Einschränkung zu beseitigen, müssen kostengünstige Transplantationslösungen erforscht, die Versicherungsdeckung für notwendige Transplantationen gefördert und Hauttransplantationen einer breiteren Bevölkerung zugänglicher gemacht werden.

-

Begrenzte Verfügbarkeit von Spendestellen

Die begrenzte Verfügbarkeit von Spenderstellen ist ein spezifisches Problem bei autologen Transplantaten. Autologe Transplantate bergen zwar ein geringeres Risiko einer Transplantatabstoßung, erfordern jedoch häufig eine Spenderstelle im Körper des Patienten. Diese Spenderstelle ist in der Regel gesunde Haut, aus der Transplantate für die Transplantation entnommen werden können. Die Herausforderung besteht darin, dass die Spenderstellen begrenzt sind und Transplantationen von diesen Stellen zu Narbenbildung, Komplikationen und weiteren Wunden führen können. Die Beschränkung der begrenzten Spenderstellen kann insbesondere für Patienten relevant sein, die umfangreiche Transplantationsverfahren benötigen oder mehrere Erkrankungen haben, die Transplantate erfordern. Um dieses Problem zu lösen, müssen synthetische Hautersatzstoffe und alternative Transplantatmaterialien entwickelt werden, die den Bedarf an autologen Transplantaten verringern können. Diese Alternativen können wirksame Transplantationslösungen bieten und gleichzeitig die begrenzten Spenderstellen erhalten.

Dieser Bericht zum Hauttransplantationsmarkt enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Hauttransplantationsmarkt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Jüngste Entwicklung

- Im April 2023 hat Kerecis MariGen Shield angekündigt, das das bewährte Fischhauttransplantat des Unternehmens mit einer Silikonkontaktschicht zur Behandlung chronischer und komplexer Wunden integriert. Das medizinische Fischhautunternehmen gab außerdem die Ergebnisse einer klinischen Studie bekannt, in der die Wirksamkeit der Kerecis-Fischhauttransplantate mit einer Standardbehandlung für diabetische Fußgeschwüre verglichen wurde. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu erweitern

Globaler Marktumfang für Hauttransplantate

Der Markt für Hauttransplantate ist nach Typ, Transplantatdicke, Anwendung, Gerätetyp und Endnutzer segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Allogen

- Autolog

- Xenogen

- Prothetik

- Isogen

Transplantatdicke

- Spaltdicke

- Volle Dicke

- Verbundtransplantat

Anwendung

- Verbrennungen

- Große Wunde

- Hautkrebs

- Infektion

Gerätetyp

- Dermatom

- Allgemeine chirurgische Instrumente

- Verbrauchsmaterial

- Sonstiges

Endbenutzer

- Ambulante Chirurgische Zentren

- Krankenhäuser

- Dermatologische Kliniken

- Wissenschaft und Forschung und Sonstiges

Globaler Hauttransplantatmarkt – Regionale Analyse/Einblicke

Der Markt für Hauttransplantationen wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ, Transplantatdicke, Anwendung, Gerätetyp und Endbenutzer wie oben angegeben bereitgestellt.

The countries covered in the skin graft market report are U.S., Canada and Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and rest of South America as part of South America

North America is expected to dominate the skin graft market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2023 to 2030, due of the increase in the expenditure for research and development proficiencies, increasing government’s initiatives and improved health care infrastructure in various countries.

Asia-Pacific on the other hand is projected to exhibit the highest growth rate in the skin graft market during the forecast period of 2023 to 2030 due to the increasing government expenditure on healthcare sector and rising technological advancements and initiatives by the government.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The skin graft market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for skin graft market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the skin graft market. The data is available for historic period 2015-2020.

Competitive Landscape and Global Skin Graft Market Share Analysis

The skin graft market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to skin graft market.

Zu den wichtigsten Akteuren auf dem Markt für Hauttransplantationen zählen:

- Smith & Nephew Plc (Großbritannien)

- MiMedx (USA)

- Tissue Regenix (Großbritannien)

- Integra LifeSciences Corporation (USA)

- Organogenesis Inc. (USA)

- Zimmer Biomet (US)

- NOUVAG AG (Schweiz)

- De Soutter Medical (Großbritannien)

- Mallinckrodt (Großbritannien)

- B. Braun Melsungen AG (Deutschland)

- AVITA Medical (Großbritannien)

- Surtex Instruments Limited (Großbritannien)

- Exsurco Medical, Inc. (USA)

- Specmed (Polen)

- ConvaTec Inc. (Großbritannien)

- CryoLife, Inc. (USA)

- Athersys Inc. (USA)

- LifeNet Health (USA)

- US Stem Cell, Inc. (USA)

- Isto Biologics (USA)

- Allergan (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.