Global Self Adhesive Tear Tape Market

Marktgröße in Milliarden USD

CAGR :

%

USD

238.07 Million

USD

421.76 Million

2024

2032

USD

238.07 Million

USD

421.76 Million

2024

2032

| 2025 –2032 | |

| USD 238.07 Million | |

| USD 421.76 Million | |

|

|

|

|

Globaler Markt für selbstklebende Aufreißbänder nach Breite (bis 2,5 mm, 2,6 mm bis 5,0 mm und über 5,0 mm), Material (Polypropylen (PP), Polyvinylchlorid (PVC), Polyethylenterephthalat (PET), Polyethylen (PE) und andere), Anwendung (Lebensmittel und Getränke, Tabakverpackungsindustrie, Elektro- und Elektronikindustrie, Pharmazie, Körperpflege und andere) – Branchentrends und Prognose bis 2032.

Marktgröße für selbstklebende Aufreißbänder

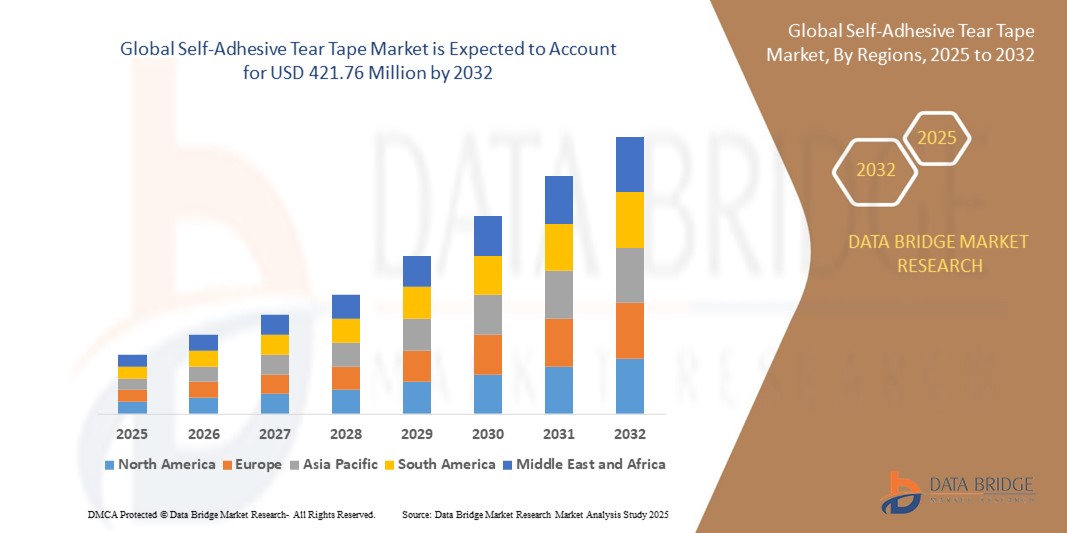

- Der globale Markt für selbstklebende Aufreißbänder wird im Jahr 2024 auf 238,07 Millionen US-Dollar geschätzt und soll bis 2032 421,76 Millionen US-Dollar erreichen , bei einer CAGR von 7,41 % im Prognosezeitraum.

- Das Marktwachstum wird vor allem durch die steigende Nachfrage nach praktischen und manipulationssicheren Verpackungslösungen in verschiedenen Branchen sowie durch Fortschritte in der Verpackungstechnologie vorangetrieben.

- Die zunehmende Vorliebe der Verbraucher für leicht zu öffnende Verpackungen und die zunehmende Bedeutung von Produktsicherheit und Markenschutz treiben die Einführung selbstklebender Aufreißbänder weiter voran und fördern das Wachstum der Branche erheblich.

Marktanalyse für selbstklebende Aufreißbänder

- Selbstklebende Aufreißbänder, die für einfaches Öffnen und manipulationssichere Verpackungen konzipiert sind, sind aufgrund ihrer Zweckmäßigkeit, Haltbarkeit und Fähigkeit, die Produktsicherheit zu erhöhen, ein integraler Bestandteil moderner Verpackungslösungen in Branchen wie der Lebensmittel- und Getränkeindustrie, der Tabak- und Pharmaindustrie.

- Der Anstieg der Nachfrage nach selbstklebenden Aufreißbändern wird durch das Wachstum des E-Commerce, den steigenden Bedarf an sicheren und benutzerfreundlichen Verpackungen und die zunehmende Verwendung nachhaltiger Verpackungsmaterialien vorangetrieben.

- Nordamerika dominierte den Markt für selbstklebende Aufreißbänder mit dem größten Umsatzanteil von 38,5 % im Jahr 2024, angetrieben durch eine fortschrittliche Verpackungsinfrastruktur, die hohe Akzeptanz innovativer Verpackungslösungen und die Präsenz wichtiger Branchenakteure

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region sein, angetrieben durch die schnelle Urbanisierung, steigende Konsumausgaben und die Expansion des Fertigungssektors in Ländern wie China und Indien.

- Das Segment von 2,6 mm bis 5,0 mm dominierte im Jahr 2023 mit 46 % den größten Marktumsatzanteil, was auf seine Vielseitigkeit und seinen weit verbreiteten Einsatz in Anwendungen wie Lebensmittelverpackungen, Tabak und Pharmazeutika zurückzuführen ist, wo es Benutzerfreundlichkeit und Funktionalität in Einklang bringt.

Berichtsumfang und Marktsegmentierung für selbstklebende Aufreißbänder

|

Eigenschaften |

Wichtige Markteinblicke zu selbstklebenden Aufreißbändern |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für selbstklebende Aufreißbänder

„Zunehmende Akzeptanz nachhaltiger und intelligenter Verpackungslösungen“

- Der globale Markt für selbstklebende Aufreißbänder verzeichnet einen bemerkenswerten Trend zur Integration umweltfreundlicher Materialien und intelligenter Verpackungstechnologien

- Hersteller verwenden zunehmend biologisch abbaubare und recycelbare Materialien wie biobasiertes Polypropylen (PP) und Polyethylenterephthalat (PET), um den Anforderungen der Verbraucher und der Behörden an nachhaltige Verpackungen gerecht zu werden.

- Intelligente Aufreißbänder mit Funktionen wie manipulationssicheren Hologrammen und aufgedruckten QR-Codes gewinnen an Bedeutung und ermöglichen eine verbesserte Produktsicherheit und Markendifferenzierung

- Beispielsweise entwickeln Unternehmen Aufreißbänder mit eingebetteten Tracking-Technologien, um die Rückverfolgbarkeit und den Schutz vor Fälschungen zu gewährleisten, insbesondere in der Pharma- und Tabakverpackungsindustrie.

- Dieser Trend steigert die Attraktivität selbstklebender Aufreißbänder für Branchen wie Lebensmittel und Getränke, Körperpflege und Elektronik und treibt das Marktwachstum voran.

- Der Einsatz fortschrittlicher Drucktechnologien auf Aufreißbändern ermöglicht eine individuelle Markenbildung, verbessert die Kundenbindung und die Produktsichtbarkeit

Marktdynamik für selbstklebende Aufreißbänder

Treiber

„Steigende Nachfrage nach praktischen und manipulationssicheren Verpackungen“

- Die steigende Vorliebe der Verbraucher für benutzerfreundliche Verpackungslösungen, wie beispielsweise leicht zu öffnende Aufreißbänder, ist ein wichtiger Treiber für den globalen Markt für selbstklebende Aufreißbänder.

- Selbstklebende Aufreißbänder erhöhen den Verpackungskomfort, indem sie einen einfachen Zugriff auf Produkte wie Snackpackungen, Tabakwaren und Arzneimittel ermöglichen, ohne dass zusätzliche Werkzeuge erforderlich sind.

- Strenge Vorschriften in Regionen wie Nordamerika, insbesondere in den USA, die manipulationssichere Verpackungen für Lebensmittel, Getränke und pharmazeutische Produkte vorschreiben, fördern die Einführung von Aufreißbändern

- Die Expansion des E-Commerce und der Bedarf an sicheren, manipulationssicheren Verpackungen während des Transports treiben die Nachfrage nach selbstklebenden Aufreißbändern in Anwendungen wie Elektro- und Elektronikartikeln sowie Körperpflegeprodukten weiter an.

- Die Verbreitung des Einzelhandels und der schnelldrehenden Konsumgüterindustrie (FMCG), insbesondere im asiatisch-pazifischen Raum, unterstützt das Marktwachstum, indem sie den Bedarf an effizienten Verpackungslösungen erhöht.

Einschränkung/Herausforderung

„Hohe Produktionskosten und Probleme bei der Einhaltung gesetzlicher Vorschriften“

- Die erheblichen Kosten, die mit der Herstellung selbstklebender Aufreißbänder verbunden sind, einschließlich Rohstoffen wie Polypropylen (PP), Polyethylen (PE) und Spezialklebstoffen, stellen ein Hindernis für die Marktexpansion dar, insbesondere in kostensensiblen Schwellenmärkten.

- Die Integration erweiterter Funktionen wie holografischer oder intelligenter Aufreißbänder erhöht die Komplexität und die Kosten der Herstellung und schränkt die Akzeptanz bei kleineren Herstellern ein.

- Herausforderungen im Hinblick auf Datenschutz und Einhaltung gesetzlicher Vorschriften ergeben sich bei der Verwendung intelligenter Aufreißbänder mit Tracking- oder Fälschungsschutztechnologien, da diese unterschiedliche globale Standards zur Datennutzung und Produktsicherheit einhalten müssen.

- Das fragmentierte regulatorische Umfeld in den Regionen, wie beispielsweise unterschiedliche Umweltstandards in Nordamerika und im asiatisch-pazifischen Raum, erschwert die Produktion und den Vertrieb für globale Hersteller

- Diese Faktoren können die Einführung in preissensiblen Märkten und Regionen mit strengen Umweltvorschriften behindern und so möglicherweise das Marktwachstum behindern.

Marktumfang für selbstklebende Aufreißbänder

Der Markt ist nach Breite, Material und Anwendung segmentiert.

- Nach Breite

Der globale Markt für selbstklebende Aufreißbänder ist in die Breiten bis 2,5 mm, 2,6 mm bis 5,0 mm und über 5,0 mm unterteilt. Das Segment 2,6 mm bis 5,0 mm hatte 2023 mit 46 % den größten Marktanteil, was auf seine Vielseitigkeit und die weit verbreitete Verwendung in Anwendungen wie Lebensmittelverpackungen, Tabak und Pharmazeutika zurückzuführen ist, wo es Benutzerfreundlichkeit und Funktionalität in Einklang bringt. Dieses Segment wird aufgrund seiner Eignung für großvolumige Verpackungsumgebungen bevorzugt, die eine effiziente Versiegelung und ein einfaches Öffnen erfordern.

Das Segment „Bis zu 2,5 mm“ wird voraussichtlich von 2025 bis 2032 mit 8,2 % das höchste Wachstum verzeichnen. Dies wird durch die steigende Nachfrage nach Präzisionsanwendungen wie Elektronik- und Einzelhandelsverpackungen vorangetrieben, bei denen Platzeffizienz und Manipulationssicherheit entscheidend sind. Der Aufstieg des E-Commerce und kompakter Verpackungslösungen beschleunigt die Akzeptanz zusätzlich.

- Nach Material

Der globale Markt für selbstklebende Aufreißbänder ist nach Material in Polypropylen (PP), Polyvinylchlorid (PVC), Polyethylenterephthalat (PET), Polyethylen (PE) und andere unterteilt. Das Segment Polypropylen (PP) dominierte mit einem Marktanteil von 44 % im Jahr 2023 aufgrund seiner Kosteneffizienz, hohen Zugfestigkeit, Flexibilität sowie Feuchtigkeits- und Chemikalienbeständigkeit. PP-Aufreißbänder, insbesondere biaxial orientiertes Polypropylen (BOPP), werden aufgrund ihrer Langlebigkeit und Recyclingfähigkeit häufig in Lebensmittel-, Getränke- und Tabakverpackungen verwendet und tragen so zu Nachhaltigkeitszielen bei.

Das Segment Polyethylenterephthalat (PET) wird voraussichtlich von 2025 bis 2032 mit 8,5 % das höchste Wachstum verzeichnen. Dies ist auf die Eignung für Spezialanwendungen zurückzuführen, die eine höhere Haltbarkeit und Transparenz erfordern, wie beispielsweise Verpackungen für Arzneimittel und Körperpflegeprodukte. Fortschritte bei umweltfreundlichen PET-Formulierungen und die steigende Nachfrage nach Hochleistungsklebebändern beflügeln dieses Segment zusätzlich.

- Nach Anwendung

Der globale Markt für selbstklebende Aufreißbänder ist nach Anwendungsgebieten in die Bereiche Lebensmittel und Getränke, Tabakverpackungsindustrie, Elektro- und Elektronikindustrie, Pharmazie, Körperpflege und Sonstige unterteilt. Das Segment Lebensmittel und Getränke hatte 2023 mit 34 % den größten Marktanteil, angetrieben durch die wachsende Nachfrage nach praktischen, manipulationssicheren Verpackungslösungen für schnelldrehende Konsumgüter (FMCG) wie Snacks, Getränke und Lebensmittel. Aufreißbänder verbessern das Benutzererlebnis, indem sie ein einfaches Öffnen ohne Werkzeug ermöglichen und so die Kundenzufriedenheit steigern.

Das Segment Tabakverpackungsindustrie wird voraussichtlich zwischen 2025 und 2032 mit 7,9 % das höchste Wachstum verzeichnen. Grund dafür ist die hohe Nachfrage nach sicheren und manipulationssicheren Verpackungen in der Tabakindustrie, insbesondere in den asiatisch-pazifischen Märkten wie China und Indien, wo der Verbrauch weiterhin hoch ist. Innovationen bei bedruckten Aufreißbändern für Markenbildung und Fälschungsschutz treiben die Akzeptanz zusätzlich voran.

Regionale Analyse des Marktes für selbstklebende Aufreißbänder

- Nordamerika dominierte den Markt für selbstklebende Aufreißbänder mit dem größten Umsatzanteil von 38,5 % im Jahr 2024, angetrieben durch eine fortschrittliche Verpackungsinfrastruktur, die hohe Akzeptanz innovativer Verpackungslösungen und die Präsenz wichtiger Branchenakteure

- Verbraucher bevorzugen selbstklebende Aufreißbänder, um die Produktsicherheit zu erhöhen, ein einfaches Öffnen zu gewährleisten und die Markendifferenzierung zu unterstützen, insbesondere in Branchen mit strengen Sicherheits- und Komfortanforderungen.

- Das Wachstum wird durch Fortschritte in der Klebstofftechnologie, einschließlich umweltfreundlicher und leistungsstarker Klebebänder, sowie durch die zunehmende Akzeptanz in der Fertigung und im Einzelhandel unterstützt.

Markteinblick für selbstklebende Aufreißbänder in den USA

Der US-Markt für selbstklebende Aufreißbänder erzielte 2024 mit 73,8 % den größten Umsatzanteil in Nordamerika. Dies ist auf die starke Nachfrage im Lebensmittel-, Getränke- und Tabakverpackungssektor und das wachsende Bewusstsein der Verbraucher für die Vorteile manipulationssicherer Verpackungen zurückzuführen. Der Trend zu nachhaltigen Verpackungen und zunehmende Vorschriften zur Produktsicherheit fördern das Marktwachstum zusätzlich. Die Integration von Aufreißbändern in Primär- und Sekundärverpackungen durch die Hersteller ergänzt den Einzelhandel und schafft so ein vielfältiges Produkt-Ökosystem.

Markteinblick für selbstklebende Aufreißbänder in Europa

Der europäische Markt für selbstklebende Aufreißbänder wird voraussichtlich deutlich wachsen, unterstützt durch die regulatorische Fokussierung auf nachhaltige Verpackungen und Verbraucherfreundlichkeit. Verbraucher wünschen sich Bänder, die Manipulationssicherheit bieten und gleichzeitig einfach zu handhaben sind. Das Wachstum ist sowohl bei neuen Verpackungslösungen als auch bei Nachrüstanwendungen deutlich, wobei Länder wie Deutschland und Frankreich aufgrund des zunehmenden Umweltbewusstseins und des Wachstums des E-Commerce eine deutliche Nachfrage verzeichnen.

Markteinblick in selbstklebende Aufreißbänder in Großbritannien

Der britische Markt für selbstklebende Aufreißbänder wird voraussichtlich rasant wachsen, angetrieben durch die Nachfrage nach mehr Verbraucherkomfort und Produktsicherheit im Einzelhandel und E-Commerce. Das zunehmende Interesse an nachhaltigen Verpackungen und das wachsende Bewusstsein für die Vorteile von Manipulationsschutz fördern die Akzeptanz. Neue Vorschriften zur Verpackungssicherheit beeinflussen die Verbraucherentscheidungen und sorgen für ein ausgewogenes Verhältnis zwischen Funktionalität und Konformität.

Markteinblick für selbstklebende Aufreißbänder in Deutschland

In Deutschland wird ein rasantes Wachstum des Marktes für selbstklebende Aufreißbänder erwartet. Dies ist auf den fortschrittlichen Fertigungssektor und den hohen Verbraucherfokus auf Produktsicherheit und Komfort zurückzuführen. Deutsche Verbraucher bevorzugen technologisch fortschrittliche Bänder, die die Verpackungssicherheit erhöhen und umweltfreundliche Initiativen unterstützen. Die Integration dieser Bänder in Premiumverpackungen und Aftermarket-Lösungen unterstützt ein nachhaltiges Marktwachstum.

Markteinblick für selbstklebende Aufreißbänder im asiatisch-pazifischen Raum

Die Region Asien-Pazifik wird voraussichtlich das höchste Wachstum verzeichnen, angetrieben durch die wachsende Industrieproduktion und steigende verfügbare Einkommen in Ländern wie China, Indien und Japan. Das zunehmende Bewusstsein für Produktsicherheit, Komfort und Markendifferenzierung treibt die Nachfrage an. Regierungsinitiativen zur Förderung nachhaltiger Verpackungen und Produktsicherheit fördern den Einsatz moderner selbstklebender Aufreißbänder zusätzlich.

Markteinblick für selbstklebende Aufreißbänder in Japan

Der japanische Markt für selbstklebende Aufreißbänder dürfte aufgrund der starken Verbraucherpräferenz für hochwertige, technologisch fortschrittliche Bänder, die den Verpackungskomfort und die Sicherheit erhöhen, rasant wachsen. Die Präsenz großer Hersteller und die Integration von Aufreißbändern in Konsumgüterverpackungen beschleunigen die Marktdurchdringung. Das steigende Interesse an maßgeschneiderten Verpackungslösungen trägt ebenfalls zum Wachstum bei.

Markteinblick in selbstklebende Aufreißbänder in China

China hält den größten Anteil am Markt für selbstklebende Aufreißbänder im asiatisch-pazifischen Raum. Dies ist auf die rasante Urbanisierung, die steigende Nachfrage nach Konsumgütern und den zunehmenden Bedarf an sicheren und praktischen Verpackungslösungen zurückzuführen. Die wachsende Mittelschicht des Landes und der Fokus auf den E-Commerce unterstützen die Einführung moderner Aufreißbänder. Starke inländische Produktionskapazitäten und wettbewerbsfähige Preise verbessern die Marktzugänglichkeit.

Marktanteil von selbstklebenden Aufreißbändern

Die Branche der selbstklebenden Aufreißbänder wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- NADCO Tapes & Labels, Inc. (USA)

- 3M (USA)

- Stamar Packaging (USA)

- TANN GERMANY GmbH (Deutschland)

- Essentra plc (Großbritannien)

- DS Smith (Großbritannien)

- HB Fuller Company (USA)

- Marotech Inc. (USA)

- tesa Tapes (India) Private Limited (Indien)

- Wavelock Holdings Co., Ltd. (Taiwan)

- Western Paper Industries (Pvt) Ltd. (Sri Lanka)

- Beiersdorf AG (Deutschland)

- AVERY DENNISON CORPORATION (USA)

- Binhao (Guangzhou) Verpackungsmaterialien Co., Ltd. (China)

- Suzhou Image Laser Technology Co., Ltd. (China)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für selbstklebende Aufreißbänder?

- Im März 2023 schloss die Avery Dennison Corporation die Übernahme von Thermopatch ab, einem Spezialisten für Etiketten, Veredelungen und Thermotransfers für Branchen wie Industriewäscherei, Sportbekleidung, Berufsbekleidung und Gastronomie. Thermopatch mit Hauptsitz in Syracuse, New York, erzielte 2022 Umsatz und gehört nun zur Solutions Group von Avery Dennison. Dieser strategische Schritt stärkt Avery Dennisons Position im Markt für Veredelungen und Etiketten und kann durch erweiterte Verpackungs- und Branding-Kapazitäten das Angebot an selbstklebenden Aufreißbändern potenziell beeinflussen. Die Übernahme spiegelt einen breiteren Fokus auf Innovation und Marktdiversifizierung wider.

- Im Februar 2023 brachte 3M das Medical Tape 4578 auf den Markt, eine bahnbrechende Klebelösung, die bis zu 28 Tage lang sicher auf der Haut haftet. Entwickelt für die Fernüberwachung und medizinische Langzeit-Wearables, unterstützt dieses Tape Geräte wie Glukosemessgeräte, EKGs und Herzsensoren. Diese Innovation stellt einen deutlichen Fortschritt gegenüber dem bisherigen 14-Tage-Standard dar und bietet verbesserte Haltbarkeit, Komfort und Stabilität ohne Trägermaterial. Obwohl es sich in erster Linie um ein Medizinprodukt handelt, können Fortschritte in der Klebetechnologie wie diese die Entwicklung selbstklebender Aufreißbänder beeinflussen und deren Leistung und Langlebigkeit in verschiedenen Branchen verbessern.

- Im Oktober 2021 stellte 3M sein hochfestes Aufreißband 9003 vor, das für eine Vielzahl von Verpackungsanwendungen außergewöhnliche Festigkeit und Haltbarkeit bietet. Dieses Aufreißband wurde entwickelt, um die Verpackungsintegrität zu verbessern und unterstützt sichere und effiziente Öffnungsmechanismen in Branchen wie der Lebensmittel-, Pharma- und Elektronikindustrie. Die Markteinführung spiegelt 3Ms Engagement für Innovationen in der Klebstofftechnologie wider, stärkt seine Marktposition und erweitert sein Portfolio an selbstklebenden Lösungen. Das robuste Design des Bandes gewährleistet zuverlässige Leistung in anspruchsvollen Umgebungen und beeinflusst möglicherweise zukünftige Entwicklungen in Bezug auf Funktionalität und Vielseitigkeit von Aufreißbändern.

- Im September 2021 brachte Tesa SE EasySplice FilmLine auf den Markt, ein spezielles Spleißband zur Steigerung von Effizienz und Qualität in Verpackungs- und Druckprozessen. Entwickelt für den fliegenden Rollenwechsel mit hoher Geschwindigkeit, bietet EasySplice FilmLine sichere Haftung, schnelle Vorbereitung und minimalen Abfall und ist damit ideal für Foliensubstrate im Flexo-, Tiefdruck- und Laminierprozess. Die fortschrittliche Klebstoffformulierung und der integrierte Trennstreifen sorgen für zuverlässige Leistung und Prozessstabilität. Diese Innovation stärkt die Rolle von Tesa SE als wichtiger Akteur im Verpackungssektor und hat das Potenzial, die Technologie für selbstklebende Aufreißbänder zu beeinflussen.

- Im Juli 2021 stellte Avery Dennison das Clear Tape vor, das speziell für die Anforderungen der Lebensmittelindustrie an sichere und saubere Verpackungen entwickelt wurde. Das auf Klarheit, Zuverlässigkeit und starke Haftung ausgelegte Klebeband gewährleistet optimalen Produktschutz und sorgt gleichzeitig für ein ansprechendes Erscheinungsbild. Sein transparentes Design unterstützt Branding und Sichtbarkeit und macht es ideal für Lebensmittelverpackungen, die sowohl Funktionalität als auch Ästhetik erfordern. Die Markteinführung unterstreicht Avery Dennisons Engagement für innovative Klebelösungen und stärkt seine Rolle im Verpackungssektor, mit potenziellen Auswirkungen auf die selbstklebende Aufreißbandtechnologie.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.