Global Radiopharmaceuticals Market

Marktgröße in Milliarden USD

CAGR :

%

USD

16.30 Billion

USD

26.98 Billion

2024

2032

USD

16.30 Billion

USD

26.98 Billion

2024

2032

| 2025 –2032 | |

| USD 16.30 Billion | |

| USD 26.98 Billion | |

|

|

|

|

Globale Marktsegmentierung für Radiopharmazeutika nach Typ (diagnostische Radiopharmazeutika und therapeutische Radiopharmazeutika), Anwendung (diagnostisch und therapeutisch), Quelle (Kernreaktoren und Zyklotrone), Endverbraucher (Krankenhäuser, Diagnosezentren, Krebsforschungsinstitute, ambulante chirurgische Zentren und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Radiopharmazeutika

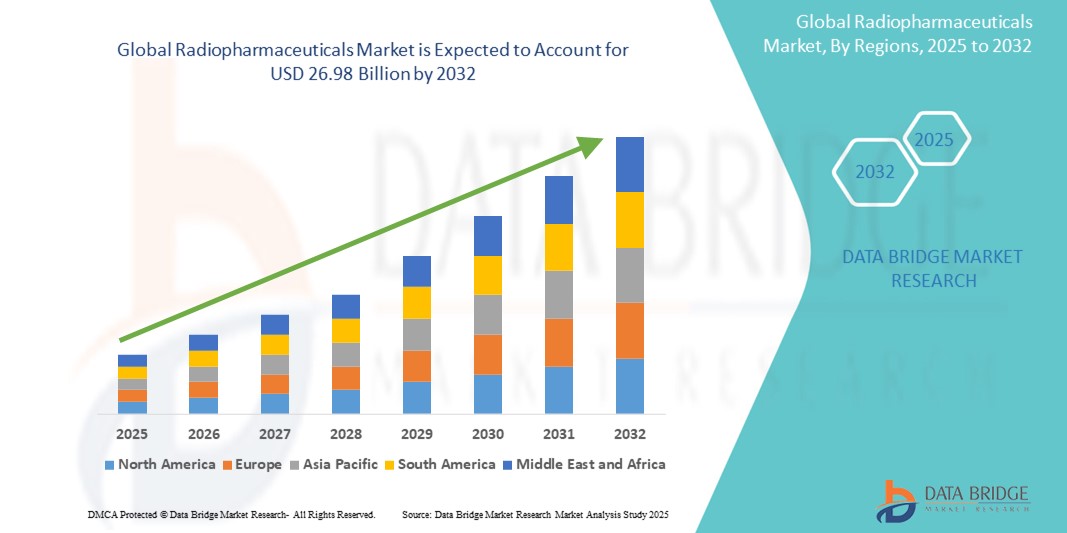

- Der globale Markt für Radiopharmazeutika wurde im Jahr 2024 auf 16,30 Milliarden US-Dollar geschätzt und soll bis 2032 26,98 Milliarden US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer jährlichen Wachstumsrate von 6,50 % wachsen, vor allem aufgrund der steigenden Prävalenz von Krebs und Herz-Kreislauf-Erkrankungen sowie der zunehmenden Einführung gezielter Diagnose- und Therapieverfahren.

- Dieses Wachstum wird durch Faktoren wie die Fortschritte in der Nuklearmedizin, die wachsende Nachfrage nach personalisierter Behandlung und erhöhte Investitionen in die radiopharmazeutische Forschung und Entwicklung vorangetrieben.

Marktanalyse für Radiopharmazeutika

- Radiopharmaka sind spezielle Arzneimittelformulierungen mit Radioisotopen, die in der Diagnostik und Therapie, insbesondere in der Onkologie, Kardiologie und Neurologie, eingesetzt werden. Diese Verbindungen ermöglichen eine präzise Bildgebung und gezielte Behandlung auf molekularer Ebene und verbessern so die Krankheitserkennung und die Behandlungsergebnisse deutlich.

- Die Marktnachfrage wird maßgeblich durch die steigende Zahl von Krebs- und Herz-Kreislauf-Erkrankungen sowie die zunehmende Nutzung nuklearmedizinischer und PET/CT-Bildgebungstechnologien getrieben. Ein gesteigertes Bewusstsein und Bemühungen zur Früherkennung von Krankheiten tragen ebenfalls zur Expansion des Marktes bei.

- Nordamerika ist die dominierende Region auf dem globalen Markt für Radiopharmazeutika, aufgrund seiner starken Gesundheitsinfrastruktur, der hohen Gesundheitsausgaben und der Präsenz wichtiger Branchenakteure, die sich auf Forschung und Entwicklung sowie die Zulassung neuer Produkte konzentrieren.

- In den USA beispielsweise ist ein deutlicher Anstieg der Verwendung von PET-Bildgebung in der onkologischen Diagnostik zu verzeichnen, wobei staatliche Unterstützung und klinische Studien die Einführung neuer Radiotracer und Theranostika beschleunigen.

- Radiopharmaka gelten weltweit als eine der wichtigsten Komponenten der Nuklearmedizin und rangieren in ihrer Bedeutung gleich hinter bildgebenden Geräten. Ihre Rolle bei der Ermöglichung präziser, nicht-invasiver Diagnosen und personalisierter Behandlungen verändert das moderne Gesundheitswesen kontinuierlich.

Berichtsumfang und Marktsegmentierung für Radiopharmazeutika

|

Eigenschaften |

Wichtige Markteinblicke für Radiopharmazeutika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Radiopharmazeutika

Fortschritte in der Theranostik und zielgerichteten Radiopharmazeutika

- Ein herausragender Trend auf dem globalen Markt für Radiopharmazeutika ist der schnelle Fortschritt bei theranostischen Anwendungen und die Entwicklung hochgradig zielgerichteter Radiopharmazeutika

- Diese Innovationen ermöglichen die gleichzeitige Diagnose und Behandlung, insbesondere in der Onkologie, indem sie dieselbe molekulare Plattform nutzen, um Krebszellen präzise zu erkennen und zu zerstören

- So werden beispielsweise theranostische Wirkstoffe wie Lutetium-177-markierte Verbindungen sowohl zur Visualisierung als auch zur Behandlung neuroendokriner Tumore und Prostatakrebs eingesetzt und ermöglichen so eine individuellere und effektivere Behandlung.

- Der Trend umfasst auch die Entwicklung von Radiopharmazeutika mit längeren Halbwertszeiten und verbesserten Zielmöglichkeiten, was sowohl den Patientenkomfort als auch die klinischen Ergebnisse verbessert.

- Diese Fortschritte verändern die Nuklearmedizin, indem sie die therapeutische Wirksamkeit verbessern, Nebenwirkungen reduzieren und die Nachfrage nach Radiopharmazeutika der nächsten Generation auf den globalen Märkten ankurbeln.

Marktdynamik für Radiopharmazeutika

Treiber

Steigende Belastung durch Krebs und Herz-Kreislauf-Erkrankungen

- Die weltweit zunehmende Verbreitung von Krebs und Herz-Kreislauf-Erkrankungen ist ein Hauptgrund für die steigende Nachfrage nach Radiopharmazeutika, die eine entscheidende Rolle bei der Früherkennung und gezielten Behandlung dieser lebensbedrohlichen Erkrankungen spielen.

- Da Krebs weltweit weiterhin eine der häufigsten Todesursachen ist, führt der Bedarf an präziser diagnostischer Bildgebung und minimalinvasiven Therapien dazu, dass Gesundheitssysteme verstärkt nuklearmedizinische Lösungen einsetzen.

- Auch bei Herz-Kreislauf-Erkrankungen, insbesondere bei der koronaren Herzkrankheit, sind Radiotracer für bildgebende Verfahren wie Myokardperfusionsscans stark von Bedeutung. Sie verbessern die diagnostische Genauigkeit und ermöglichen die Erstellung effektiver Behandlungspläne.

- Technologische Fortschritte in der Radiopharmazie, einschließlich der PET- und SPECT-Bildgebung, haben die Sensitivität und Spezifität der Krankheitserkennung deutlich verbessert und ermöglichen es Klinikern, schnellere und fundiertere Entscheidungen zu treffen

- Der Ausbau der onkologischen und kardiologischen Abteilungen in Krankenhäusern, gepaart mit einem wachsenden Bewusstsein der Patienten und staatlichen Initiativen zur Förderung frühzeitiger Screenings, unterstützt das Marktwachstum zusätzlich.

Zum Beispiel,

- Im Oktober 2022 berichtete die Weltgesundheitsorganisation (WHO), dass Krebs im Jahr 2020 weltweit für fast 10 Millionen Todesfälle verantwortlich war, was den dringenden Bedarf an fortschrittlichen Diagnose- und Therapieinstrumenten wie Radiopharmaka unterstreicht.

- Laut der American Heart Association sind Herz-Kreislauf-Erkrankungen weltweit nach wie vor die häufigste Todesursache. Die Nuklearkardiologie spielt dabei eine immer wichtigere Rolle bei der nicht-invasiven Diagnose.

- Infolgedessen treibt die zunehmende Belastung durch Krebs und Herzerkrankungen die Nachfrage nach Radiopharmazeutika an und verstärkt ihre entscheidende Rolle in modernen Diagnose- und Therapieverfahren.

Gelegenheit

Erweiterung des Potenzials durch Integration künstlicher Intelligenz in die nukleare Bildgebung

- Die Integration künstlicher Intelligenz (KI) in die Nuklearmedizin eröffnet neue Möglichkeiten für radiopharmazeutische Anwendungen durch verbesserte Bilderfassung, -interpretation und personalisierte Behandlungsplanung

- KI-gestützte Bildgebungstools können komplexe PET- und SPECT-Scandaten schneller und präziser analysieren und so Krankheiten wie Krebs, Alzheimer und Herzerkrankungen früher und genauer erkennen.

- Darüber hinaus unterstützen diese Systeme die automatische Erkennung von Läsionen, die quantitative Analyse und die Prognosevorhersage, sodass Ärzte fundiertere Entscheidungen treffen und die Behandlungsergebnisse für die Patienten verbessern können.

Zum Beispiel

- Im Februar 2024 wurde in einer im Journal of Nuclear Medicine veröffentlichten Studie hervorgehoben, wie Deep-Learning-Algorithmen die Genauigkeit der PET-Scan-Interpretation bei der Erkennung von Prostatakrebs im Frühstadium deutlich verbesserten, Fehlalarme reduzierten und den Arbeitsablauf optimierten.

- Im August 2023 wurde laut dem European Journal of Nuclear Medicine and Molecular Imaging gezeigt, dass KI-basierte Tools die Myokardperfusionsbildgebung verbessern, indem sie Bewegungsartefakte reduzieren und die diagnostische Sicherheit bei Herzuntersuchungen erhöhen.

- Die Synergie zwischen KI und Radiopharmazeutika fördert auch die Entwicklung intelligenter Theranostik-Plattformen, die sich an patientenspezifische Krankheitsprofile anpassen und hochgradig individualisierte Therapieschemata ermöglichen.

- Da Gesundheitsdienstleister weiterhin die digitale Transformation vorantreiben, wird erwartet, dass die Anwendung von KI in der radiopharmazeutischen Bildgebung das Marktwachstum vorantreibt, die Effizienz verbessert und eine präzisere und kostengünstigere Versorgung auf globaler Ebene ermöglicht.

Einschränkung/Herausforderung

Hohe Kosten und eingeschränkte Verfügbarkeit von Radiopharmazeutika

- Die hohen Kosten für Produktion, Lagerung und Vertrieb von Radiopharmaka stellen eine erhebliche Herausforderung dar, insbesondere in Ländern mit niedrigem und mittlerem Einkommen, in denen die nuklearmedizinische Infrastruktur begrenzt oder unterentwickelt ist.

- Aufgrund ihrer kurzen Halbwertszeit und ihrer radioaktiven Natur erfordern Radiopharmaka häufig spezielle Anlagen für die Synthese und Handhabung, was die Betriebs- und Logistikkosten für Krankenhäuser und Diagnosezentren in die Höhe treibt.

- Diese Kostenbarriere kann die Einführung fortschrittlicher nuklearmedizinischer Verfahren behindern und den Zugang der Patienten zu modernsten Diagnose- und Therapiemöglichkeiten einschränken.

Zum Beispiel

- Laut einem im Oktober 2023 veröffentlichten Bericht der Internationalen Atomenergie-Organisation (IAEA) sind die hohen Produktionskosten und der Mangel an inländischen Radioisotopen in vielen Ländern die Hauptfaktoren, die die breite Einführung von Radiopharmazeutika in der klinischen Praxis behindern.

- Im Juni 2024 wurde in einem Artikel in Frontiers in Nuclear Medicine hervorgehoben, dass Gesundheitseinrichtungen in Entwicklungsregionen aufgrund der Nichtverfügbarkeit oder Unerschwinglichkeit radioaktiver Wirkstoffe häufig mit Verzögerungen oder Absagen von Eingriffen konfrontiert sind, was sich auf die Patientenversorgung und die klinische Effizienz auswirkt.

- Folglich können diese kostenbezogenen und logistischen Herausforderungen die Marktdurchdringung verlangsamen, zu Ungleichheiten in der Gesundheitsversorgung führen und die breitere globale Wirkung radiopharmazeutischer Fortschritte einschränken.

Marktumfang für Radiopharmazeutika

Der Markt ist nach Typ, Anwendung, Quelle und Endbenutzer segmentiert

|

Segmentierung |

Untersegmentierung |

|

Nach Typ |

|

|

Nach Anwendung |

|

|

Nach Quelle |

|

|

Nach Endbenutzer |

|

Regionale Analyse des Marktes für Radiopharmazeutika

Nordamerika ist die dominierende Region auf dem Markt für Radiopharmazeutika

- Nordamerika ist führend auf dem globalen Markt für Radiopharmazeutika. Dies wird durch eine hochentwickelte Gesundheitsinfrastruktur, erhebliche Investitionen in die Nuklearmedizin und die frühzeitige Einführung innovativer Diagnose- und Therapietechnologien vorangetrieben.

- Die USA verfügen über den größten Marktanteil aufgrund der hohen Prävalenz von Krebs und Herz-Kreislauf-Erkrankungen, der starken Unterstützung der klinischen Forschung und günstiger regulatorischer Rahmenbedingungen für die Zulassung neuer radiopharmazeutischer Produkte

- Die Präsenz wichtiger Branchenakteure, der umfassende Einsatz von PET- und SPECT-Bildgebungsverfahren und das wachsende Bewusstsein für personalisierte Medizin stärken die Führungsrolle der Region weiter.

- Darüber hinaus tragen die steigende Zahl nuklearmedizinischer Verfahren und die kontinuierliche technologische Weiterentwicklung bei Radiotracern und Bildgebungsmitteln zur starken Nachfrage nach Radiopharmazeutika in der gesamten Region bei.

Asien-Pazifik wird voraussichtlich die höchste Wachstumsrate verzeichnen

- Der asiatisch-pazifische Raum wird voraussichtlich die höchste Wachstumsrate im Markt für Radiopharmazeutika verzeichnen, getrieben durch eine wachsende Patientenzahl, einen verbesserten Zugang zur Gesundheitsversorgung und steigende Investitionen in die nuklearmedizinische Infrastruktur.

- Länder wie China, Indien und Japan entwickeln sich zu wichtigen Märkten, da dort die Zahl der Krebs- und Herz-Kreislauf-Erkrankungen zunimmt und das Bewusstsein für die Früherkennung von Krankheiten und personalisierte Therapien wächst.

- Japan ist ein Vorreiter bei der Einführung der Nuklearmedizin mit starken Forschungskapazitäten und staatlicher Unterstützung, während China und Indien ihre Kapazitäten für die diagnostische Bildgebung rasch ausbauen, um den steigenden Anforderungen im Gesundheitswesen gerecht zu werden.

- Verbesserte regulatorische Rahmenbedingungen, die Ausweitung der Zusammenarbeit mit globalen Pharmaunternehmen und staatliche Initiativen zur Verbesserung des Zugangs zur Nuklearmedizin beschleunigen das Marktwachstum im gesamten asiatisch-pazifischen Raum weiter.

Marktanteil von Radiopharmazeutika

Die Wettbewerbslandschaft des Marktes bietet detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Finanzdaten, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Daten beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Novartis AG (Schweiz)

- Siemens Healthineers AG (Deutschland)

- Bayer AG (Deutschland)

- GE HealthCare (USA)

- Lantheus (USA)

- Curium (Frankreich)

- Jubilant Radiopharma (Kanada)

- Eckert & Ziegler (Deutschland)

- Cardinal Health (USA)

- Telix Pharmaceuticals Limited (Australien)

- Bracco (Italien)

- Lilly (USA)

- AstraZeneca (Großbritannien)

- F. Hoffmann-La Roche Ltd (Schweiz)

- Boehringer Ingelheim International GmbH (Deutschland)

- GSK plc (Großbritannien)

- Mallinckrodt (Irland)

- McKesson Corporation (USA)

- Advanced Accelerator Applications SA (Frankreich)

- PharmaLogic (USA)

Neueste Entwicklungen auf dem globalen Markt für Radiopharmazeutika

- Im März 2024 gab AstraZeneca die Übernahme von Fusion Pharmaceuticals für bis zu 2,4 Milliarden US-Dollar bekannt. Ziel ist es, im Bereich der Radiopharmazeutika Fortschritte zu erzielen, indem radioaktive Isotope direkt an Krebszellen abgegeben werden.

- Im Mai 2024 haben sich Intermountain Health und PharmaLogic Holdings Corp. zusammengeschlossen, um neuartige Radiopharmazeutika für die Krebsdiagnose zu entwickeln und so die diagnostischen Möglichkeiten in der Onkologie zu verbessern.

- Im Juli 2024 reichte Curium einen Zulassungsantrag (NDA) für sein Radiopharmakon Lutetium-177 (Lu-177) DOTATATE ein, das zur Behandlung von Somatostatinrezeptor-positiven gastroenteropankreatischen neuroendokrinen Tumoren (GEP-NETs) bestimmt ist.

- Im Juli 2024 schlossen Nusano Inc. und PharmaLogic Holdings Corp. einen Liefervertrag ab, um die Verfügbarkeit medizinischer Radioisotope zu verbessern und so eine effizientere und zuverlässigere Versorgung mit pharmazeutischen Produkten zu gewährleisten.

- Im Oktober 2024 schloss Siemens Healthineers einen Vertrag zum Kauf eines Teils des Advanced Accelerator Applications (AAA)-Geschäfts von Novartis für über 200 Millionen Euro ab und stärkte damit sein PET-Radiopharmaziegeschäft durch die Lieferung kritischer radioaktiver Chemikalien für Krebsscans.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.