Global Orthopedic Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

52.75 Billion

USD

85.99 Billion

2024

2032

USD

52.75 Billion

USD

85.99 Billion

2024

2032

| 2025 –2032 | |

| USD 52.75 Billion | |

| USD 85.99 Billion | |

|

|

|

|

Globale Marktsegmentierung für orthopädische Geräte, nach Produkten (orthopädische Fixationsgeräte, orthopädische Ersatzgeräte, orthopädische Prothesen, orthopädische Orthesen und Stützprodukte, Wirbelsäulenimplantate und chirurgische Geräte, Arthroskopieinstrumente, Orthobiologie und Knochentransplantatersatz), Standort (Knie- und Oberschenkelimplantate, Schulter-, Hüftimplantate, Hand- und Handgelenk-, Fuß- und Knöchelimplantate, Wirbelsäulen-, Arm- und Ellenbogen- und kraniokillofaziale Implantate), Anwendung (Frakturbehandlung und -wiederherstellung, Bänderverletzungen, neurologische Störungen, diabetische Fußerkrankungen und Wirbelsäulenfusion, -fixierung und -dekompression), Endbenutzer (Krankenhäuser, ambulante Pflegezentren, Fachkliniken, orthopädische Zentren, häusliche Pflegeeinrichtungen und andere) – Branchentrends und Prognose bis 2032

Marktgröße für orthopädische Geräte

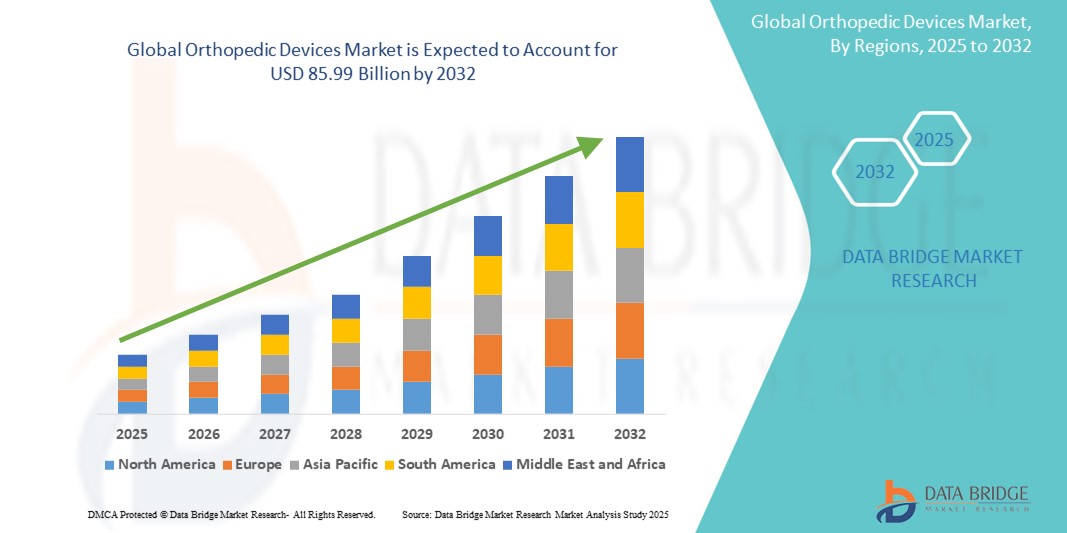

- Der globale Markt für orthopädische Geräte wurde im Jahr 2024 auf 52,75 Milliarden US-Dollar geschätzt und soll bis 2032 85,99 Milliarden US-Dollar erreichen , bei einer CAGR von 6,30 % im Prognosezeitraum.

- Dieses Wachstum ist auf Faktoren wie die zunehmende Alterung der Bevölkerung, die zunehmende Häufigkeit orthopädischer Erkrankungen und Verletzungen sowie die zunehmende Anzahl von Gelenkersatz- und Wirbelsäulenoperationen zurückzuführen.

Marktanalyse für orthopädische Geräte

- Orthopädische Geräte sind unverzichtbare Hilfsmittel für die Diagnose, Behandlung und Rehabilitation von Erkrankungen des Bewegungsapparates, darunter Frakturen, Gelenkerkrankungen, Wirbelsäulendeformationen und Weichteilverletzungen. Sie spielen eine entscheidende Rolle bei der Wiederherstellung der Mobilität, der Verbesserung der Patientenergebnisse und der Unterstützung chirurgischer Präzision bei orthopädischen Eingriffen.

- Der Markt für orthopädische Geräte verzeichnet ein stetiges Wachstum, das durch die zunehmende Verbreitung von Knochen- und Gelenkerkrankungen, die steigende Zahl geriatrischer Menschen, Fortschritte in der Implantattechnologie und die wachsende Nachfrage nach minimalinvasiven Operationstechniken angetrieben wird.

- Nordamerika wird voraussichtlich den Markt für orthopädische Geräte mit einem Anteil von 45,5 % dominieren , was auf die zunehmende Alterung der Bevölkerung und die steigende Zahl orthopädischer Erkrankungen wie Arthrose und Wirbelsäulenerkrankungen zurückzuführen ist.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund steigender Gesundheitsausgaben, eines wachsenden Bewusstseins für die Gesundheit des Bewegungsapparats und eines verbesserten Zugangs zur medizinischen Versorgung die am schnellsten wachsende Region im Markt für orthopädische Geräte sein.

- Das Segment der orthopädischen Ersatzgeräte wird voraussichtlich mit einem Marktanteil von 42,2 % den Markt dominieren. Grund dafür sind die steigende Prävalenz von Gelenkerkrankungen wie Osteoarthritis und rheumatoider Arthritis , die weltweite Zunahme geriatrischer Bevölkerungsgruppen und die steigende Zahl von Hüft- und Knieersatzoperationen aufgrund verbesserter Operationstechniken und Implantattechnologien.

Berichtsumfang und Marktsegmentierung für orthopädische Geräte

|

Eigenschaften |

Wichtige Markteinblicke für orthopädische Geräte |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Markttrends für orthopädische Geräte

„Zunehmende Prävalenz von Muskel-Skelett-Erkrankungen“

- Ein wichtiger Trend auf dem globalen Markt für orthopädische Geräte ist die zunehmende Verbreitung von Erkrankungen des Bewegungsapparates

- Dieser Trend wird durch die zunehmende Alterung der Bevölkerung, eine Zunahme sitzender Tätigkeiten und eine höhere Rate an Knochen- und Gelenkerkrankungen wie Arthrose, Osteoporose und Sportverletzungen vorangetrieben.

- So verzeichnen Länder wie die USA und Japan einen Anstieg der Gelenkersatzoperationen, während Schwellenländer wie Indien und China aufgrund des verbesserten Zugangs zur Gesundheitsversorgung und des steigenden Bewusstseins für die zunehmende Nachfrage nach orthopädischen Lösungen eine höhere Nachfrage verzeichnen.

- Die Nachfrage nach orthopädischen Geräten ist besonders stark sowohl in entwickelten Regionen, wo die Gesundheitssysteme gut etabliert sind, als auch in Schwellenländern, wo sich die Gesundheitsinfrastruktur rasch weiterentwickelt.

- Da Muskel-Skelett-Erkrankungen immer häufiger auftreten, wird der Markt für orthopädische Geräte voraussichtlich deutlich wachsen. Kontinuierliche Innovationen bei Implantatmaterialien, Operationstechniken und postoperativen Rehabilitationslösungen erweitern die Behandlungsmöglichkeiten.

Marktdynamik für orthopädische Geräte

Treiber

„Zunehmende Sportverletzungen“

- Die steigende Zahl von Sportverletzungen ist ein wichtiger Treiber für den Markt für orthopädische Geräte, da Sportler und aktive Menschen fortschrittliche orthopädische Lösungen für die Behandlung und Rehabilitation von Knochenbrüchen, Bänderrissen und Gelenkverletzungen benötigen.

- Diese Nachfrage steigt weltweit, insbesondere durch die zunehmende Teilnahme an Sport und körperlichen Aktivitäten, verbunden mit einem stärkeren Fokus auf die Verbesserung der sportlichen Leistung und Erholung.

- Da Sportverletzungen immer häufiger auftreten, verlagert sich der Schwerpunkt auf die Entwicklung langlebigerer, leistungsfähigerer Implantate und Geräte, die eine schnellere Genesung und verbesserte Mobilität der Sportler unterstützen.

- Die Hersteller reagieren darauf mit Innovationen bei fortschrittlichen Materialien wie bioresorbierbaren Implantaten und intelligenten orthopädischen Geräten, die die Genesungszeiten verkürzen und Komplikationen vorbeugen sollen.

- Darüber hinaus treiben die zunehmende Anwendung minimalinvasiver Operationen und die Nachfrage nach anpassbaren orthopädischen Lösungen das Marktwachstum weiter voran.

Zum Beispiel,

- Unternehmen wie DePuy Synthes bieten eine Reihe orthopädischer Lösungen an, die speziell für Sportverletzungen entwickelt wurden, darunter Geräte zur Gelenkrekonstruktion und Frakturfixierung

- Zimmer Biomet entwickelt spezialisierte Implantate und Instrumente für die Sportmedizin und konzentriert sich dabei auf die Verbesserung der Behandlungsergebnisse von Sportlern aller Leistungsklassen.

- Da die Teilnahme am Sport weltweit weiter zunimmt, wird für den Markt für orthopädische Geräte eine anhaltende Nachfrage erwartet, wobei Innovationen bei Behandlungsmöglichkeiten und Operationstechniken das Marktwachstum vorantreiben.

Gelegenheit

„Steigende Patientenpräferenz für minimalinvasive Eingriffe“

- Die zunehmende Präferenz für minimalinvasive Verfahren stellt eine bedeutende Chance für den Markt für orthopädische Geräte dar, da Patienten nach weniger invasiven Alternativen für Gelenkersatz, Wirbelsäulenchirurgie und Frakturfixierung suchen.

- Hersteller orthopädischer Geräte profitieren von diesem Wandel, indem sie fortschrittliche Implantate und chirurgische Instrumente entwickeln, die minimalinvasive Techniken unterstützen und Vorteile wie kleinere Einschnitte, schnellere Genesungszeiten und ein geringeres Komplikationsrisiko bieten.

- Diese Chance steht im Einklang mit dem allgemeinen Trend zur Verbesserung chirurgischer Ergebnisse und Patientenerfahrungen, da Gesundheitsdienstleister zunehmend Technologien einsetzen, die die Präzision erhöhen und die Genesungszeiten verkürzen.

Zum Beispiel,

- Unternehmen wie Stryker und Johnson & Johnson sind führende Innovationen bei roboterassistierten Chirurgiesystemen und minimalinvasiven Gelenkersatzimplantaten

- Zimmer Biomet bietet eine Reihe von Spezialgeräten für minimalinvasive Eingriffe an der Wirbelsäule an, die die Genesung und Zufriedenheit der Patienten verbessern.

- Da die Patientennachfrage nach minimalinvasiven Operationen insbesondere in entwickelten Märkten weiter steigt, ist der Markt für orthopädische Geräte gut positioniert, um von diesem Trend zu profitieren, indem er innovative Lösungen anbietet, die der wachsenden Nachfrage nach weniger invasiven und effizienteren Behandlungsmöglichkeiten gerecht werden.

Einschränkung/Herausforderung

„Hohe Kosten für orthopädische Geräte“

- Die hohen Kosten orthopädischer Geräte stellen eine erhebliche Herausforderung für den Markt für orthopädische Geräte dar, da die Hersteller unter dem Druck stehen, fortschrittliche Technologie, hochwertige Materialien und wettbewerbsfähige Preise unter Wahrung der Rentabilität zu vereinen.

- Der Bedarf an fortschrittlichen Implantaten, wie beispielsweise individuell angefertigten Gelenkersatzteilen und Wirbelsäulenimplantaten, erfordert komplexe Herstellungsverfahren, die die Produktionskosten in die Höhe treiben und die Zugänglichkeit für einige Patientengruppen einschränken können.

- Steigende Materialkosten, die Einhaltung gesetzlicher Vorschriften sowie Forschungs- und Entwicklungsanstrengungen zur Gewährleistung der Sicherheit und Wirksamkeit von Geräten können es schwierig machen, erschwingliche Lösungen anzubieten, insbesondere in Schwellenländern mit niedrigeren Gesundheitsbudgets.

Zum Beispiel,

- Die Kosten für moderne Wirbelsäulenimplantate und roboterassistierte Chirurgiesysteme können unerschwinglich hoch sein, was ihre Einführung in bestimmten Regionen oder Gesundheitseinrichtungen einschränkt.

- Wenn diese Herausforderungen nicht durch Innovationen bei kosteneffizienten Fertigungstechniken, der Materialbeschaffung und durch Skaleneffekte angegangen werden, könnten die hohen Kosten für orthopädische Geräte das Marktwachstum hemmen und den Zugang der Patienten zu modernsten Behandlungen einschränken.

Marktumfang für orthopädische Geräte

Der Markt ist nach Produkten, Standorten, Anwendungen und Endbenutzern segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkten |

|

|

Nach Site |

|

|

Nach Anwendung |

|

|

Nach Endbenutzer

|

|

Im Jahr 2025 werden orthopädische Ersatzgeräte voraussichtlich den Markt mit dem größten Anteil im Produktsegment dominieren

Das Segment der orthopädischen Ersatzgeräte wird voraussichtlich im Jahr 2025 mit einem Anteil von 42,2 % den Markt für orthopädische Geräte dominieren. Grund dafür sind die steigende Prävalenz von Gelenkerkrankungen wie Osteoarthritis und rheumatoider Arthritis, die weltweit zunehmende geriatrische Bevölkerung und die steigende Zahl von Hüft- und Knieersatzoperationen aufgrund verbesserter Operationstechniken und Implantattechnologien.

Es wird erwartet, dass die Wirbelsäule im Prognosezeitraum den größten Anteil im Site-Segment ausmacht

Im Jahr 2025 wird das Wirbelsäulensegment voraussichtlich den Markt dominieren. Grund dafür sind die zunehmende Häufigkeit von Wirbelsäulenerkrankungen wie degenerativen Bandscheibenerkrankungen und Spinalkanalstenosen, die steigende Nachfrage nach minimalinvasiven Wirbelsäulenoperationen und die technologischen Fortschritte bei Wirbelsäulenimplantaten und Navigationssystemen, die Operationsergebnisse und Genesungszeiten verbessern.

Regionale Analyse des Marktes für orthopädische Geräte

„Nordamerika hält den größten Anteil am Markt für orthopädische Geräte“

- Nordamerika dominiert den Markt für orthopädische Geräte mit einem Anteil von 45,5 % , was auf die zunehmende Alterung der Bevölkerung und die steigende Zahl orthopädischer Erkrankungen wie Arthrose und Wirbelsäulenerkrankungen zurückzuführen ist.

- Die USA halten einen signifikanten Anteil von 93,8 % aufgrund ihrer fortschrittlichen Gesundheitsinfrastruktur, der frühen Einführung innovativer orthopädischer Implantate und einer starken Präsenz führender Hersteller orthopädischer Geräte

- Die Marktstärke wird durch günstige Erstattungsrichtlinien, ein steigendes Volumen an Gelenkersatzoperationen und hohe Gesundheitsausgaben weiter unterstützt

- Kontinuierliche Innovationen in der orthopädischen Technologie, darunter roboterassistierte Chirurgie und 3D-gedruckte Implantate, gepaart mit der Ausweitung ambulanter orthopädischer Verfahren, werden Nordamerika helfen, seine Führungsposition bis 2032 zu behaupten.

„Im asiatisch-pazifischen Raum wird auf dem Markt für orthopädische Geräte voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate verzeichnet“

- Im asiatisch-pazifischen Raum wird das höchste Wachstum im Markt für orthopädische Geräte erwartet , was auf steigende Gesundheitsausgaben, ein wachsendes Bewusstsein für die Gesundheit des Bewegungsapparats und einen verbesserten Zugang zur medizinischen Versorgung zurückzuführen ist.

- China hat aufgrund seiner schnell alternden Bevölkerung, der hohen Prävalenz von Osteoporose und Gelenkerkrankungen sowie des Anstiegs der lokalen Produktion erschwinglicher orthopädischer Geräte einen erheblichen Anteil.

- Staatlich geförderte Forschungs- und Entwicklungsprogramme, Infrastrukturinvestitionen und Medizintourismus beschleunigen das regionale Marktwachstum zusätzlich.

- Mit steigender Nachfrage nach minimalinvasiven orthopädischen Verfahren, stärkeren Vertriebsnetzen und einer zunehmenden Verbreitung intelligenter Implantate dürfte der asiatisch-pazifische Raum bis 2032 die am schnellsten wachsende Region sein.

Marktanteil orthopädischer Geräte

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Zimmer Biomet (US)

- Smith+Nephew (Deutschland)

- Medtronic (Irland)

- Stryker (USA)

- B. Braun SE (Deutschland)

- NuVasive, Inc. (USA)

- Enovis Corporation (USA)

- Institut Straumann AG (Schweiz)

- OSSTEM IMPLANT CO., LTD. (Südkorea)

- Narang Medical Limited (USA)

- Globus Medical (USA)

- Arthrex, Inc. (USA)

- CONMED Corporation (USA)

- Integra LifeSciences Corporation (USA)

- RTI Surgical (USA)

- WL Gore & Associates, Inc. (USA)

- Corin Group (USA)

- Johnson & Johnson Services, Inc. (USA)

Neueste Entwicklungen auf dem globalen Markt für orthopädische Geräte

- Im März 2022 brachte Exactech, Inc., ein führender Hersteller innovativer orthopädischer Implantate, seine Equinoxe Humerus-Rekonstruktionsprothese auf den europäischen Markt. Dieses fortschrittliche Gerät, das für ein breites Spektrum an proximalem Humerusknochenverlust entwickelt wurde, ist nun in wichtigen Märkten wie Italien, Frankreich, Spanien, Deutschland und Großbritannien erhältlich und erweitert die Behandlungsmöglichkeiten für Patienten in diesen Ländern.

- Im Oktober 2020 gab Medtronic die Verfügbarkeit seines Adaptix Interbody Systems in den USA bekannt. Dieses System, das erste geführte Titanimplantat mit Titan nanoLOCK-Oberflächentechnologie, stärkte Medtronics Marktpräsenz und Nachfrage deutlich. Das innovative Produkt trug zu Umsatzsteigerungen und einer gestärkten Marktpräsenz in der Region bei.

- Im September 2020 gab Smith & Nephew plc die Markteinführung seines REDAPT-Systems für die Revisions-Totalendoprothese der Hüfte (rTHA) auf dem chinesischen Markt bekannt. Diese Einführung hat den Umsatz und die Nachfrage des Unternehmens im asiatisch-pazifischen Raum deutlich gesteigert und unterstreicht die wachsende Akzeptanz und den Erfolg der fortschrittlichen orthopädischen Lösungen von Smith & Nephew in diesem bedeutenden Markt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.