Global Naphtha Market

Marktgröße in Milliarden USD

CAGR :

%

USD

177.67 Billion

USD

242.04 Billion

2024

2032

USD

177.67 Billion

USD

242.04 Billion

2024

2032

| 2025 –2032 | |

| USD 177.67 Billion | |

| USD 242.04 Billion | |

|

|

|

|

Globale Naphtha-Marktsegmentierung nach Typ (leichtes Naphtha und schweres Naphtha), Verfahren (Benzinmischung, Naphtha-Reformierung, Dampfcracken und andere), Anwendung (Chemikalien, Energie und Kraftstoffe und andere), Endverbraucherindustrie (Petrochemie, Landwirtschaft, Farben und Beschichtungen, Luft- und Raumfahrt und andere) – Branchentrends und Prognose bis 2032

Wie groß ist der globale Naphtha-Markt und wie hoch ist seine Wachstumsrate?

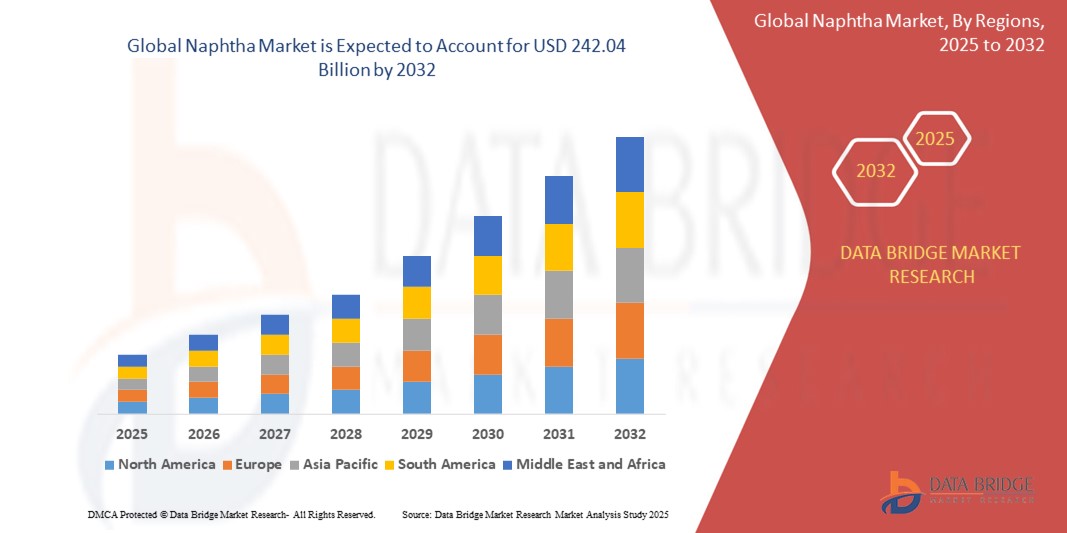

- Der globale Naphtha-Markt wird im Jahr 2024 auf 177,67 Milliarden US-Dollar geschätzt und soll bis 2032 242,04 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 3,94 % im Prognosezeitraum entspricht.

- In der petrochemischen Industrie spielt Naphtha eine entscheidende Rolle als Rohstoff für die Herstellung von Ethylen und anderen Olefinen durch Steamcracken. Ethylen ist ein grundlegender Baustein für eine Vielzahl chemischer Produkte, darunter Kunststoffe, Harze und synthetische Fasern.

- Aufgrund seiner Zusammensetzung, die reich an Kohlenwasserstoffen ist , ist Naphtha ein idealer Vorläufer für das Steamcracken, bei dem hohe Temperaturen und Dampf verwendet werden, um die Moleküle in kleinere, wertvollere Komponenten wie Ethylen zu zerlegen.

Was sind die wichtigsten Erkenntnisse des Naphtha-Marktes?

- Die Kapazität und Konfiguration der Raffinerien bestimmen die Naphtha-Produktionsmengen. Raffinerien mit hohen Naphtha-Erträgen tragen zu einem ausreichenden Angebot bei, während Raffinerien mit niedrigeren Erträgen mit Lieferengpässen konfrontiert sein können. Darüber hinaus wirken sich Schwankungen der Rohölpreise und der Verfügbarkeit auf die Wirtschaftlichkeit der Raffination aus und beeinflussen die Naphtha-Produktion und -Preisgestaltung.

- Daher ist es für die Beteiligten am Naphtha-Markt unerlässlich, die Dynamik der Raffinerieindustrie zu verstehen und darauf zu reagieren, um Angebotsschwankungen und Preistrends vorherzusehen.

- Der asiatisch-pazifische Raum dominierte den Naphtha-Markt mit dem größten Umsatzanteil von 44,3 % im Jahr 2024, angetrieben durch die starke petrochemische Industrie der Region, die schnelle industrielle Expansion und die steigende Nachfrage nach Kunststoff- und Chemieprodukten.

- Der europäische Naphtha-Markt wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 11,8 % wachsen, was auf steigende Investitionen in die Modernisierung der Petrochemie, Recyclingtechnologien und den Übergang zu kohlenstoffarmen und zirkulären Wirtschaftspraktiken zurückzuführen ist.

- Das Segment Leichtnaphtha dominierte den Naphtha-Markt mit dem größten Umsatzanteil von 58,3 % im Jahr 2024, was auf seine weit verbreitete Verwendung als primärer Rohstoff in der petrochemischen Produktion zurückzuführen ist, insbesondere für die Herstellung von Ethylen, Propylen und Aromaten.

Berichtsumfang und Naphtha-Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke für Naphtha |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Was ist der wichtigste Trend auf dem Naphtha-Markt?

„ Verlagerung hin zur Naphtha-Integration in petrochemische und energiewirtschaftliche Prozesse “

- Ein wichtiger Trend, der den globalen Naphtha-Markt prägt, ist die zunehmende Integration in die petrochemische Produktion, insbesondere bei der Herstellung von Ethylen, Propylen und anderen wichtigen Olefinen, die für die Kunststoff- und Chemieindustrie von entscheidender Bedeutung sind.

- Der zunehmende Fokus auf Strategien zur Energiewende hat Naphtha auch als Übergangsrohstoff positioniert, da Raffinerien und Chemieunternehmen nach emissionsarmen Alternativen und erhöhter betrieblicher Flexibilität suchen.

- So kündigte TotalEnergies im Januar 2024 Investitionen zur Steigerung der Naphtha-Crackkapazität in seinem Werk in Antwerpen an und unterstützte damit die Produktion von biobasierten und recycelten Polymeren im Einklang mit den Nachhaltigkeitszielen.

- Darüber hinaus erlebt der Markt technologische Verbesserungen bei Steamcrackern und Raffinationsprozessen, um die Naphtha-Nutzung zu optimieren, die Effizienz zu verbessern und die Kohlenstoffemissionen in petrochemischen Großbetrieben zu reduzieren.

- Dieser Trend steht im Einklang mit den weltweiten Bemühungen, die Abhängigkeit von traditionellen fossilen Brennstoffen zu verringern und gleichzeitig der steigenden Nachfrage nach Kunststoffen, Verpackungen und Spezialchemikalien in verschiedenen Sektoren wie der Automobil-, Bau- und Konsumgüterindustrie gerecht zu werden.

Was sind die Haupttreiber des Naphtha-Marktes?

- Die steigende Nachfrage nach Ethylen, Propylen, Aromaten und anderen petrochemischen Derivaten, die vor allem durch das Wachstum in der Kunststoff-, Verpackungs-, Automobil- und Bauindustrie getrieben wird, ist ein wesentlicher Treiber des Naphtha-Verbrauchs.

- So erweiterte SABIC im März 2024 seine integrierten petrochemischen Betriebe in Saudi-Arabien, um die Produktion von Olefinen und Polymeren auf Naphtha-Basis zu steigern und so der steigenden weltweiten Nachfrage nach leichten und nachhaltigen Materialien gerecht zu werden.

- Der Markt wird auch durch wachsende Investitionen in die Raffination und petrochemische Integration vorangetrieben, wodurch Unternehmen ihre Rentabilität, Rohstoffflexibilität und Widerstandsfähigkeit in volatilen Energiemärkten verbessern können.

- In den Schwellenländern, insbesondere im asiatisch-pazifischen Raum, kommt es zu einer rasanten Urbanisierung und Industrialisierung, was den Verbrauch von Naphtha sowohl für Kraftstoffmischungen als auch für petrochemische Anwendungen steigert.

- Darüber hinaus fördern politische Initiativen zur Förderung von Bio-Naphtha und Kreislaufwirtschaftspraktiken die Forschung und Entwicklung erneuerbarer Naphtha-Alternativen aus Biomasse oder recycelten Abfällen und unterstützen so Nachhaltigkeitsziele.

Welcher Faktor behindert das Wachstum des Naphtha-Marktes?

- Eine zentrale Herausforderung, die das Wachstum des Naphtha-Marktes begrenzt, ist die zunehmende Konkurrenz durch alternative Rohstoffe wie Ethan, Propan und biobasierte Materialien, die insbesondere in Nordamerika Kosten- und Umweltvorteile bieten.

- Die hohe Preisvolatilität von Rohöl, die sich direkt auf die Naphtha-Kosten auswirkt, führt zu betrieblichen Unsicherheiten für petrochemische Hersteller, die auf Naphtha als primären Rohstoff angewiesen sind.

- Darüber hinaus zwingen die weltweit verschärften Vorschriften zu Kohlenstoffemissionen und der Nutzung fossiler Brennstoffe die Industrie dazu, sich vom traditionellen Naphtha auf Kohlenwasserstoffbasis abzuwenden, was kostspielige Prozessänderungen oder eine Umstellung der Rohstoffe erfordert.

- So führte die Europäische Union im Rahmen des Green Deal im Jahr 2024 strengere Klimarichtlinien ein und zwang die Chemiehersteller, kohlenstoffarme Alternativen zu erforschen, was sich auf die langfristige Nachfrage nach Naphtha auswirkte.

- Die technischen und wirtschaftlichen Herausforderungen im Zusammenhang mit der Ausweitung der Bio-Naphtha-Produktion sowie die begrenzten Lieferketten in Entwicklungsregionen bremsen die Marktexpansion zusätzlich.

- Um diese Hindernisse zu überwinden, bedarf es verstärkter Forschung und Entwicklung für alternative Rohstoffe, energieeffizienter Produktionstechnologien und politischer Unterstützung, um sicherzustellen, dass Naphtha in der sich entwickelnden Energie- und Petrochemielandschaft weiterhin relevant bleibt.

Wie ist der Naphtha-Markt segmentiert?

Der Markt ist nach Typ, Prozess, Anwendung und Endverbraucherbranche segmentiert.

• Nach Typ

Der Naphtha-Markt wird nach Typ in leichtes und schweres Naphtha unterteilt. Das Segment leichtes Naphtha dominierte den Naphtha-Markt mit dem größten Umsatzanteil von 58,3 % im Jahr 2024, was auf seine weit verbreitete Verwendung als Primärrohstoff in der petrochemischen Produktion zurückzuführen ist, insbesondere zur Herstellung von Ethylen, Propylen und Aromaten. Der niedrigere Siedebereich von leichtem Naphtha macht es ideal für das Steamcracken und treibt die Nachfrage in der Kunststoff- und Chemieindustrie an.

Im Segment Schwerbenzin wird zwischen 2025 und 2032 ein deutliches Wachstum erwartet, das auf die entscheidende Rolle des Segments bei Reformierungsprozessen zur Herstellung von hochoktanigem Benzin und aromatischen Verbindungen zurückzuführen ist, die für Kraftstoffe und industrielle Anwendungen unverzichtbar sind.

• Nach Prozess

Der Naphtha-Markt ist prozessbezogen in Benzinmischung, Naphtha-Reformierung, Dampfcracken und Sonstiges unterteilt. Das Segment Dampfcracken erzielte 2024 mit 46,7 % den größten Marktanteil. Dies ist auf seine dominierende Rolle bei der Produktion wichtiger petrochemischer Bausteine wie Ethylen, Propylen und Butadien zurückzuführen, die für die Herstellung von Kunststoffen, Verpackungen und synthetischem Kautschuk unerlässlich sind.

Das Segment Naphtha-Reformierung dürfte zwischen 2025 und 2032 aufgrund der steigenden Nachfrage nach hochoktanigen Reformaten, die bei der Benzinmischung und der Herstellung aromatischer Chemikalien zum Einsatz kommen, deutlich wachsen.

• Nach Anwendung

Der Naphtha-Markt ist nach Anwendung in die Bereiche Chemikalien, Energie und Kraftstoffe sowie Sonstiges unterteilt. Das Segment Chemikalien dominierte den Markt mit dem größten Umsatzanteil von 61,5 % im Jahr 2024, da Naphtha ein wichtiger Rohstoff für die Herstellung von Olefinen, Aromaten und anderen petrochemischen Derivaten ist, die die Grundlage für Kunststoffe, synthetische Fasern und Harze bilden.

Für das Segment Energie und Kraftstoffe wird von 2025 bis 2032 ein starkes Wachstum erwartet, das durch die Verwendung von Naphtha als Beimischungskomponente in Benzin und als Übergangsenergiequelle in sich entwickelnden Kraftstoffmärkten vorangetrieben wird.

• Nach Endverbraucherbranche

Der Naphtha-Markt ist nach Endverbraucherbranchen in die Branchen Petrochemie, Landwirtschaft, Farben und Lacke, Luft- und Raumfahrt sowie Sonstige unterteilt. Das Petrochemie-Segment dominierte den Markt mit dem größten Umsatzanteil von 68,9 % im Jahr 2024. Dies ist auf den hohen Naphtha-Verbrauch des Sektors für die Produktion von Ethylen, Propylen, Aromaten und anderen Derivaten zurückzuführen, die für die Kunststoff-, Verpackungs- und Chemieindustrie von entscheidender Bedeutung sind.

Das Segment Luft- und Raumfahrt wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, unterstützt durch die steigende Nachfrage nach Hochleistungsmaterialien und Spezialchemikalien auf Naphtha-Basis, die für die Herstellung und Wartung von Luft- und Raumfahrtprodukten unverzichtbar sind.

Welche Region hält den größten Anteil am Naphtha-Markt?

- Der asiatisch-pazifische Raum dominierte den Naphtha-Markt mit dem größten Umsatzanteil von 44,3 % im Jahr 2024, angetrieben durch die starke petrochemische Industrie der Region, die schnelle industrielle Expansion und die steigende Nachfrage nach Kunststoff- und Chemieprodukten.

- Die erheblichen Investitionen der Region in Raffineriekapazitäten, Steamcracker und integrierte petrochemische Komplexe beschleunigen den Naphtha-Verbrauch, insbesondere in Ländern wie China, Indien, Japan und Südkorea.

- Die zunehmende Verwendung von Naphtha zur Herstellung von Ethylen, Propylen und Aromaten, gepaart mit einer günstigen Regierungspolitik, die das industrielle Wachstum und die exportorientierte Produktion unterstützt, stärkt die Führungsrolle des asiatisch-pazifischen Raums auf dem Weltmarkt.

Einblicke in den chinesischen Naphtha-Markt

Der chinesische Naphtha-Markt erwirtschaftete 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf die robuste Petrochemiebranche des Landes, umfangreiche Raffinerieerweiterungen und die wachsende Kunststoffproduktion zurückzuführen. Chinas Fokus auf Energiesicherheit, Autarkie bei chemischen Rohstoffen und Investitionen in moderne Steamcracking-Technologien steigern die Naphtha-Nachfrage sowohl für den Inlandsverbrauch als auch für exportorientierte Industrien weiter.

Einblicke in den indischen Naphtha-Markt

Der indische Naphtha-Markt verzeichnet ein starkes Wachstum. Dies wird durch den Ausbau der Raffineriekapazitäten, die steigende Nachfrage nach Petrochemikalien und das Bestreben der Regierung, die Importabhängigkeit wichtiger chemischer Produkte zu reduzieren, vorangetrieben. Laufende Infrastrukturprojekte, Urbanisierung und Industrialisierung sowie der steigende Verbrauch von Kunststoffen und synthetischen Materialien schaffen landesweit erhebliche Chancen für die Naphtha-Nutzung.

Welche Region ist die am schnellsten wachsende Region im Naphtha-Markt?

Der europäische Naphtha-Markt wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 11,8 % wachsen. Dies ist auf steigende Investitionen in die Modernisierung der Petrochemie, Recyclingtechnologien und den Übergang zu einer kohlenstoffarmen Kreislaufwirtschaft zurückzuführen. Der zunehmende Fokus der Region auf die Produktion nachhaltiger Polymere, biobasierter Chemikalien und recycelter Kunststoffe steigert die Nachfrage nach traditionellem und erneuerbarem Naphtha als wichtigem Rohstoff. Wichtige Entwicklungen wie Projekte für grünen Wasserstoff, Raffineriemodernisierungen und politische Anreize im Rahmen des europäischen Green Deals verändern die petrochemische Wertschöpfungskette und kurbeln die Nachfrage nach Naphtha in Anwendungen an, die mit Energieeffizienz und Umweltzielen im Einklang stehen.

Einblicke in den deutschen Naphtha-Markt

Der deutsche Naphtha-Markt wächst rasant, unterstützt durch Investitionen in fortschrittliche Chemieproduktion, Recyclinginitiativen und Raffinerieintegrationsprojekte. Als wichtiger Akteur in der europäischen Industrie- und Chemiebranche beschleunigt Deutschlands Fokus auf Nachhaltigkeit, Innovation und Ressourceneffizienz die Nutzung von Naphtha sowohl in der konventionellen als auch in der biobasierten petrochemischen Produktion.

Welches sind die Top-Unternehmen auf dem Naphtha-Markt?

Die Naphtha-Industrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Chevron Corporation (USA)

- Reliance Industries Limited (Indien)

- Shell Chemicals (USA)

- SABIC (Saudi-Arabien)

- BP PLC (Großbritannien)

- Exxon Mobil Corporation (USA)

- China Petrochemical Corporation (China)

- Indian Oil Corporation Ltd (Indien)

- Novatek (Russland)

- Mitsubishi Chemical Corporation (Japan)

- Lotte Chemical Corporation (Südkorea)

- Mangalore Refinery & Petrochemicals Ltd. (Indien)

- NOVA Chemicals Corporate (Kanada)

- Formosa Plastics Corporation (Taiwan)

- LG Chem (Südkorea)

- Petróleos Mexicanos (Mexiko)

- Vitol (Niederlande)

Was sind die jüngsten Entwicklungen auf dem globalen Naphtha-Markt?

- Im Juli 2023 gab die Exxon Mobil Corporation die Übernahme von Denbury Inc. bekannt, einem Unternehmen, das für seine Expertise in den Bereichen Kohlenstoffabscheidung, -nutzung und -speicherung (CCS) sowie verbesserte Ölrückgewinnungstechnologien bekannt ist. Dieser strategische Schritt stärkt die Kapazitäten von Exxon Mobil zur Emissionsreduzierung und unterstützt das langfristige Engagement für die Förderung kohlenstoffarmer Technologien. Die Übernahme stärkt Exxon Mobils Position als Vorreiter der globalen Energiewende.

- Im Mai 2023 nahm die Chevron Corporation ihre Ölaktivitäten in Venezuela wieder auf. Ziel war es, die Produktion zu steigern und die Rückführung ausstehender Schulden zu beschleunigen. Natixis geht davon aus, dass diese bis Ende 2025 vollständig beglichen sein werden. Diese Entwicklung stellt einen wichtigen Schritt zur Stabilisierung der Energieversorgung und zur Wiederherstellung der operativen Präsenz in der Region dar. Die Wiederaufnahme der Aktivitäten von Chevron spiegelt den Fokus auf die Erschließung neuer Wachstumschancen in Lateinamerika wider.

- Im Oktober 2022 führte LG Chem eine vorübergehende siebenwöchige Stilllegung seiner Naphtha-Cracker in Südkorea durch, um notwendige Wartungsarbeiten durchzuführen. Obwohl dieser Schritt die petrochemische Versorgung vorübergehend beeinträchtigte, unterstreicht er das Engagement des Unternehmens für die Gewährleistung der Anlagenzuverlässigkeit, Betriebssicherheit und langfristigen Produktionseffizienz. Dieser proaktive Ansatz stärkt den Ruf von LG Chem für Produktqualität und nachhaltige Betriebsführung.

- Im Mai 2022 schloss BP PLC einen 10-jährigen Abnahmevertrag mit dem britischen Unternehmen Clean Planet Energy ab, um den Bau von Anlagen zu unterstützen, die schwer recycelbare Kunststoffabfälle in kreislauffähige petrochemische Rohstoffe und schwefelarmen Diesel (ULSD) umwandeln können. Die Initiative steht im Einklang mit den umfassenderen Nachhaltigkeitszielen von BP und fördert Innovationen im Abfallmanagement und in der Produktion sauberer Kraftstoffe. Diese Vereinbarung unterstreicht das Engagement von BP für die Förderung kreislaufwirtschaftlicher Lösungen im Energiesektor.

- Im November 2021 gab Exxon Mobil seine Investition in einen milliardenschweren Chemiekomplex in der chinesischen Provinz Guangdong bekannt. Ziel ist es, die Produktionskapazität um 1,6 Millionen Tonnen pro Jahr zu erhöhen. Die Erweiterung soll die steigende Nachfrage nach Petrochemikalien in Chinas schnell wachsendem Industriesektor bedienen. Diese Investition unterstreicht Exxon Mobils strategischen Fokus auf die Stärkung seiner Präsenz in wichtigen asiatischen Märkten.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NAPHTHA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NAPHTHA MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL NAPHTHA MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL NAPHTHA MARKET, BY PRODUCT, 2022-2031, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 LIGHT NAPHTHA

10.2.1 LIGHT NAPHTHA, BY CATEGORY

10.2.1.1. NATURAL GASOLINE

10.2.1.2. CONDENSATE SPLITTING

10.2.1.3. CRUDE DISTILLATION

10.2.1.4. HYDROCRACKING

10.2.1.5. HYDROTREATING

10.3 HEAVY NAPHTHA

10.3.1 HEAVY NAPHTHA, BY CATEGORY

10.3.1.1. CONDENSATE SPLITTING

10.3.1.2. CRUDE DISTILLATION

10.3.1.3. HYDROCRACKING

10.3.1.4. HYDROTREATING

11 GLOBAL NAPHTHA MARKET, BY PROCESS, 2022-2031, (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 GASOLINE BLENDING

11.3 NAPHTHA REFORMING

11.4 PETROCHEMICAL FEEDSTOCK

11.5 STEAM CRACKING

11.6 OTHERS

12 GLOBAL NAPHTHA MARKET, BY APPLICATION, 2022-2031, (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 CHEMICALS PROCESSING

12.3 FUEL

12.3.1 POWER DISTRIBUTION

12.3.2 FERTILIZERS

12.3.3 OTHERS

12.4 DRY-CLEANING SOLVENTS

12.5 PAINTS SOLVENTS

12.6 OTHERS

13 GLOBAL NAPHTHA MARKET, BY END-USE, 2022-2031, (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 PETROCHEMICALS

13.2.1 BY PRODUCT

13.2.1.1. LIGHT NAPHTHA

13.2.1.2. HEAVY NAPHTHA

13.3 AUTOMOTIVE

13.3.1 BY PRODUCT

13.3.1.1. LIGHT NAPHTHA

13.3.1.2. HEAVY NAPHTHA

13.4 AGRICULTURE

13.4.1 BY PRODUCT

13.4.1.1. LIGHT NAPHTHA

13.4.1.2. HEAVY NAPHTHA

13.5 PAINTS AND COATINGS

13.5.1 BY PRODUCT

13.5.1.1. LIGHT NAPHTHA

13.5.1.2. HEAVY NAPHTHA

13.6 AEROSPACE AND DEFENSE

13.6.1 BY PRODUCT

13.6.1.1. LIGHT NAPHTHA

13.6.1.2. HEAVY NAPHTHA

13.7 CONSTRUCTION

13.7.1 BY PRODUCT

13.7.1.1. LIGHT NAPHTHA

13.7.1.2. HEAVY NAPHTHA

13.8 CONSUMER GOODS

13.8.1 BY PRODUCT

13.8.1.1. LIGHT NAPHTHA

13.8.1.2. HEAVY NAPHTHA

13.9 ENGINEERING

13.9.1 BY PRODUCT

13.9.1.1. LIGHT NAPHTHA

13.9.1.2. HEAVY NAPHTHA

13.1 OTHERS

13.10.1 BY PRODUCT

13.10.1.1. LIGHT NAPHTHA

13.10.1.2. HEAVY NAPHTHA

14 GLOBAL NAPHTHA MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

GLOBAL NAPHTHA MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 SWITZERLAND

14.2.7 RUSSIA

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA AND NEW ZEALAND

14.3.11 HONG KONG

14.3.12 TAIWAN

14.3.13 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 UNITED ARAB EMIRATES

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AMERICA

15 GLOBAL NAPHTHA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL NAPHTHA MARKET COMPANY PROFILES

17.1 PAO NOVATEK

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 MANGALORE REFINERY & PETROCHEMICALS LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 EXXONMOBIL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 LOTTE CHEMICAL CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT UPDATES

17.5 SAUDI ARABIAN OIL CO.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT UPDATES

17.6 MITSUBISHI CHEMICAL CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SABIC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 SHELL

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 INDIA OIL CORPORATION LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 CHINA NATIONAL PETROLEUM CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 CHEVRON

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 ENEOS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 MARATHON PETROLEUM CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 HALDIA PETROCHEMICALS LIMITED (HPL)

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

17.15 FORMOSA PETROCHEMICAL CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT UPDATES

17.16 OBEROI REFINING INDUSTRY PVT.LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT UPDATES

17.17 OPAC REFINERIES

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATES

17.18 DAKOTA GASIFICATION COMPANY

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT UPDATES

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.