Global Mining Lubricants Market

Marktgröße in Milliarden USD

CAGR :

%

USD

6.79 Billion

USD

7.95 Billion

2024

2032

USD

6.79 Billion

USD

7.95 Billion

2024

2032

| 2025 –2032 | |

| USD 6.79 Billion | |

| USD 7.95 Billion | |

|

|

|

|

Globale Marktsegmentierung für Bergbauschmierstoffe nach Produkt (Mineralöl-, synthetische und biobasierte Bergbauschmierstoffe), Anwendung (Kohlebergbau, Eisenerzbergbau, Bauxitbergbau, Bergbau von Seltenerdmineralien, Edelmetallbergbau und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Bergbauschmierstoffe

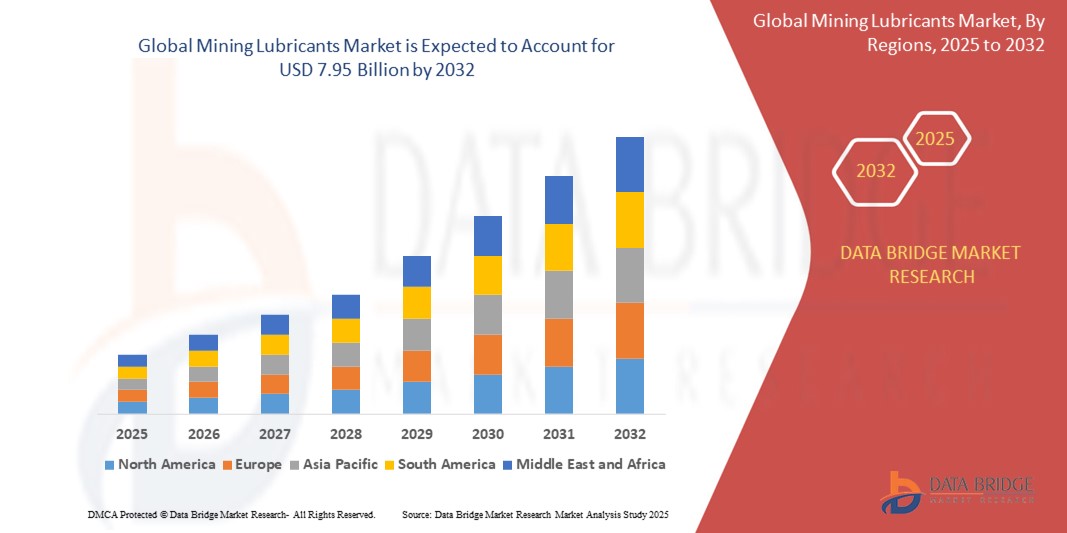

- Der globale Markt für Bergbauschmierstoffe wurde im Jahr 2024 auf 6,79 Milliarden US-Dollar geschätzt und dürfte bis 2032 7,95 Milliarden US-Dollar erreichen , bei einer CAGR von 2,00 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie die steigende Nachfrage nach Hochleistungs-Bergbaugeräten, zunehmende Mineralexplorationsaktivitäten und den Bedarf an Hochleistungsschmierstoffen vorangetrieben, die die Effizienz der Geräte steigern, Ausfallzeiten reduzieren und die Lebensdauer der Maschinen in rauen Bergbauumgebungen verlängern.

Marktanalyse für Bergbauschmierstoffe

- Der globale Markt für Bergbauschmierstoffe wächst aufgrund der steigenden Nachfrage nach Hochleistungsschmierstoffen, die extremen Temperaturen und Drücken standhalten und so den effizienten Betrieb von Bergbaumaschinen gewährleisten.

- Der Übergang zu synthetischen und biobasierten Schmierstoffen gewinnt an Dynamik, da Bergbauunternehmen nach umweltfreundlichen und nachhaltigen Lösungen suchen, um gesetzliche Anforderungen zu erfüllen und ihren ökologischen Fußabdruck zu reduzieren.

- Nordamerika wird voraussichtlich den Markt für Bergbauschmierstoffe dominieren, da dort große Bergbauunternehmen ansässig sind, eine fortschrittliche Infrastruktur besteht und ein etablierter Markt für Schmierstoffe besteht. Die hohe Nachfrage nach effizienten Bergbaubetrieben in der Region, kombiniert mit technologischen Fortschritten, dürfte die Marktdominanz vorantreiben.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für Bergbauschmierstoffe sein. Grund dafür sind die rasante Industrialisierung, der zunehmende Bergbau und die steigende Nachfrage nach Mineralien in Ländern wie China, Indien und Australien. Dieses Wachstum wird durch Investitionen in Bergbautechnologie und Infrastruktur zusätzlich vorangetrieben.

- Es wird erwartet, dass das Segment der synthetischen Bergbauschmierstoffe den Markt für Bergbauschmierstoffe mit dem größten Anteil von 53,54 % im Jahr 2025 dominieren wird. Dies ist auf seine überlegene Leistung unter extremen Betriebsbedingungen, die verlängerte Lebensdauer der Ausrüstung und den geringeren Wartungsbedarf zurückzuführen, wodurch es sich ideal für anspruchsvolle Bergbauumgebungen eignet.

Berichtsumfang und Marktsegmentierung für Bergbauschmierstoffe

|

Eigenschaften |

Wichtige Markteinblicke für Bergbauschmierstoffe |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Bergbauschmierstoffe

„ Im Bergbau nimmt der Trend zu biobasierten und synthetischen Schmierstoffen zu“

- Die Bergbauindustrie setzt zunehmend auf synthetische Schmierstoffe, da diese extremen Temperaturen standhalten und die Lebensdauer der Ausrüstung verlängern, was zu einer Reduzierung der Betriebsausfallzeiten beiträgt.

- Biobasierte Schmierstoffe gewinnen als umweltfreundliche Alternativen, die strenge Umweltvorschriften erfüllen, zunehmend an Bedeutung, insbesondere in Regionen mit fragilen Ökosystemen wie Westaustralien und Teilen Kanadas.

- So haben beispielsweise Bergbauunternehmen in Ontario begonnen, biologisch abbaubare Hydraulikflüssigkeiten zu verwenden, um die Bodenkontamination zu minimieren, während Unternehmen in Queensland in abgelegenen Bergbaugebieten auf pflanzliche Getriebeöle umgestiegen sind.

- Globale Schmierstoffhersteller wie Shell und Fuchs haben fortschrittliche Bio-Schmierstofflinien eingeführt, die speziell für Bergbaumaschinen entwickelt wurden und die Nachhaltigkeit ohne Leistungseinbußen erhöhen.

- Der Trend spiegelt einen breiteren Vorstoß der Bergbauunternehmen wider, sich an den Umweltzielen der Unternehmen und den Erwartungen der Investoren an einen umweltfreundlichen Betrieb auszurichten und so eine langfristige Markttransformation zu unterstützen.

Marktdynamik für Bergbauschmierstoffe

Treiber

„Steigende Nachfrage nach Hochleistungs-Bergbaugeräten im Tagebau und Untertagebau“

- Die weltweit steigende Nachfrage nach Mineralien wie Kupfer, Eisen, Kohle und Seltenen Erden führt zu einer Zunahme der Bergbauaktivitäten, was wiederum den Bedarf an schwererer Bergbauausrüstung erhöht.

- Bergbaumaschinen über und unter Tage arbeiten unter extremen Bedingungen wie hohem Druck, großer Hitze und ständiger Reibung und benötigen spezielle Schmierstoffe, um ihre Leistung aufrechtzuerhalten.

- Die richtige Schmierung spielt eine entscheidende Rolle bei der Minimierung des Geräteverschleißes, der Senkung der Wartungskosten und der Verbesserung der allgemeinen Betriebseffizienz und Sicherheit

- So sind beispielsweise große Bagger in chilenischen Kupferminen auf hochbelastbare Schmierfette angewiesen, um Getriebeausfälle im Dauerbetrieb zu verhindern, während Tiefbohranlagen in südafrikanischen Goldminen synthetische Getriebeöle verwenden, um den extremen Tiefendrücken standzuhalten.

- Die steigenden Investitionen der Bergbauunternehmen in hochwertige Schmierstoffe sorgen für eine höhere Betriebszeit und senken die Gesamtbetriebskosten. Dadurch wird die Schmierung zu einem Schlüsselelement der Produktivitätsstrategien im Bergbau.

Gelegenheit

„Zunehmende Nutzung von Automatisierung und Digitalisierung im Bergbau“

- Der Anstieg der Automatisierung und Digitalisierung im Bergbau führt zu einer Nachfrage nach fortschrittlichen Schmierstoffen, die den unterbrechungsfreien Betrieb autonomer und mit Sensoren ausgestatteter Maschinen unterstützen können.

- Intelligente Bergbausysteme wie Plattformen zur vorausschauenden Wartung und autonome Muldenkipper benötigen Schmierstoffe mit langer Lebensdauer, thermischer Stabilität und geringer Rückstandsbildung, um effizient zu funktionieren.

- Schmierstoffhersteller reagieren darauf mit Innovationen wie sensorkompatiblen Formulierungen und integrierten Überwachungslösungen, die auf intelligente Gerätesysteme abgestimmt sind.

- So nutzen beispielsweise einige Bergbauunternehmen in Australien IoT-fähige Schmiersysteme, die Echtzeit-Updates zum Ölzustand liefern, während nordamerikanische Zulieferer intelligente Schmierfette auf den Markt gebracht haben, die bei Leistungsabfall Alarm auslösen.

- Diese Entwicklungen bieten erhebliche Wachstumschancen, da sie es Bergbauunternehmen ermöglichen, Ausfallzeiten zu reduzieren, die Effizienz zu verbessern und durch den intelligenten Einsatz von Schmierstoffen den sich entwickelnden technologischen Standards gerecht zu werden.

Einschränkung/Herausforderung

„Volatilität der Rohstoffpreise für Schmierstoffformulierungen“

- Der Markt für Bergbauschmierstoffe steht vor einer großen Herausforderung in Form der Volatilität der Rohstoffpreise, insbesondere bei Grundölen und chemischen Additiven, die mit den Schwankungen des Rohölmarktes verbunden sind.

- Starke Erhöhungen der Rohölpreise oder Störungen der globalen Lieferkette können die Produktionskosten erheblich erhöhen und die Erschwinglichkeit und Verfügbarkeit hochwertiger Schmierstoffe beeinträchtigen.

- Kleinere Bergbauunternehmen in Schwellenländern haben oft Schwierigkeiten, diese höheren Kosten zu tragen. Manchmal müssen sie Kompromisse bei der Schmierstoffqualität eingehen oder die Wartungsintervalle verlängern, was die Effizienz der Anlagen beeinträchtigen kann.

- Umweltvorschriften zur Schmiermittelentsorgung und -kontrolle erhöhen die Betriebskosten zusätzlich und zwingen die Unternehmen, in sicherere und oft kostspieligere Handhabungspraktiken zu investieren.

- So mussten beispielsweise in Indonesien tätige Unternehmen aufgrund regionaler Versorgungsprobleme mit höheren Kosten für Schmierstoffimporte rechnen, während Bergbauunternehmen in Brasilien ihre Abfallwirtschaftssysteme modernisieren mussten, um strengere Umweltvorschriften einzuhalten. Beides erhöht den finanziellen Druck auf die Unternehmen.

Marktumfang für Bergbauschmierstoffe

Der Markt ist nach Produkt und Anwendung segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkt |

|

|

Nach Anwendung |

|

Im Jahr 2025 werden die synthetischen Bergbauschmierstoffe voraussichtlich den Markt mit dem größten Anteil im Anwendungssegment dominieren

Es wird erwartet, dass das Segment der synthetischen Bergbauschmierstoffe den Markt für Bergbauschmierstoffe mit dem größten Anteil von 53,54 % im Jahr 2025 dominieren wird. Dies ist auf seine überlegene Leistung unter extremen Betriebsbedingungen, die verlängerte Lebensdauer der Ausrüstung und den geringeren Wartungsbedarf zurückzuführen, wodurch es sich ideal für anspruchsvolle Bergbauumgebungen eignet.

Der Eisenerzbergbau wird voraussichtlich im Prognosezeitraum den größten Anteil am Technologiemarkt ausmachen

Im Jahr 2025 wird der Eisenerzbergbau voraussichtlich den Markt mit dem größten Marktanteil von 20,57 % dominieren. Dies ist auf die hohe weltweite Nachfrage nach Stahlproduktion zurückzuführen, bei der Eisenerz ein wichtiger Rohstoff ist, und auf die groß angelegten Aktivitäten in führenden Bergbauländern wie Australien, Brasilien und China.

Regionale Analyse des Marktes für Bergbauschmierstoffe

„Nordamerika hält den größten Anteil am Markt für Bergbauschmierstoffe“

- Nordamerika wird voraussichtlich den Markt für Bergbauschmierstoffe mit einem Marktanteil von rund 33 % dominieren . Diese Dominanz ist auf die hohe Nachfrage nach Bergbauausrüstung, modernen Schmierstoffen und die starke Präsenz wichtiger Marktteilnehmer in der Region zurückzuführen.

- In den USA sind führende Bergbauunternehmen ansässig, die auf fortschrittliche Schmierlösungen setzen, um die Effizienz ihrer Anlagen zu maximieren und Ausfallzeiten zu minimieren.

- Starke Investitionen in Automatisierung und Digitalisierung in der Region treiben die Nachfrage nach synthetischen und fortschrittlichen Schmierstoffen an

- Die strengen Umweltvorschriften in Nordamerika tragen ebenfalls zur steigenden Nachfrage nach umweltfreundlichen und leistungsstarken Schmierstoffen bei.

„Der asiatisch-pazifische Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate auf dem Markt für Bergbauschmierstoffe verzeichnen“

- Der asiatisch-pazifische Raum dürfte aufgrund der raschen Industrialisierung und der zunehmenden Bergbauaktivitäten die am schnellsten wachsende Region im Markt für Bergbauschmierstoffe sein.

- Schwellenländer wie China und Indien investieren massiv in die Bergbauinfrastruktur und treiben damit die Nachfrage nach Schmierstoffen im Kohle-, Eisenerz- und Seltenerdbergbau an.

- Der zunehmende Einsatz automatisierter und technologisch fortschrittlicher Bergbauausrüstung in der Region treibt den Bedarf an hochwertigen Schmierstoffen an

- Es wird erwartet, dass staatliche Initiativen und Investitionen im Bergbausektor das Marktwachstum im asiatisch-pazifischen Raum im Prognosezeitraum weiter beschleunigen werden.

Marktanteil von Bergbauschmierstoffen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Gulf Oil International Ltd (Großbritannien)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (Indien)

- Whitmore Manufacturing, LLC. (USA)

- Quaker Chemical Corporation d/b/a Quaker Houghton (USA)

- Exxon Mobil Corporation (USA)

- BP plc (Großbritannien)

- Gesamt (Frankreich)

- China Petrochemical Corporation (China)

- Shell-Unternehmensgruppe (Niederlande)

- Sinolube (China)

- Chevron Corporation (USA)

- LUKOIL Marine Lubricants DMCC (Russland)

- Eni SpA (Italien)

- Croda International Plc (Großbritannien)

- Synforce Lubricants (Australien)

- Valvoline LLC (USA)

- Lubricon (Kanada)

- PETRONAS Lubricants International (Malaysia)

- FUCHS (Deutschland)

- Idemitsu Kosan Co., Ltd. (Japan)

Neueste Entwicklungen auf dem globalen Markt für Bergbauschmierstoffe

- Im März 2024 schloss die FUCHS SE die Übernahme des Schweizer Schmierstoffunternehmens STRUB Co. AG ab. Diese strategische Entwicklung ermöglicht es FUCHS, sein Produktportfolio zu erweitern und seine Position im globalen Schmierstoffmarkt zu stärken. Die Akquisition ermöglicht es FUCHS, neue Marktsegmente zu erschließen und seine technologischen Kompetenzen, insbesondere im Bereich Hochleistungsschmierstoffe, zu erweitern. Durch die Integration der Expertise von STRUB will FUCHS Branchen wie die Automobilindustrie, den Bergbau und die Fertigungsindustrie besser bedienen. Dieser Schritt soll den Marktanteil und die Wettbewerbsfähigkeit von FUCHS, insbesondere auf den europäischen und internationalen Märkten, stärken.

- Im Mai 2024 schloss ExxonMobil die 60 Milliarden US-Dollar teure Übernahme von Pioneer Natural Resources ab – der größte Öl- und Gasdeal seit Jahrzehnten. Dieser strategische Schritt stärkt die Präsenz von ExxonMobil im Permian Basin deutlich und vereint über 1,4 Millionen Acres (ca. 6,6 Millionen Hektar) Land in den Delaware- und Midland-Becken mit geschätzten 16 Milliarden Barrel Öläquivalent. Dadurch verdoppelte sich ExxonMobils Produktionsvolumen im Permian Basin auf 1,3 Millionen Barrel Öläquivalent pro Tag und soll bis 2027 auf rund 2 Millionen Barrel pro Tag steigen. Die Fusion dürfte durch die effizientere und umweltschonendere Gewinnung höherer Ressourcen zweistellige Renditen generieren. Darüber hinaus plant ExxonMobil, Pioneers Netto-Null-Emissionsziel von 2050 bis 2035 zu beschleunigen. Dazu setzt ExxonMobil fortschrittliche Technologien zur Überwachung und Reduzierung von Methanemissionen sowie zur verstärkten Nutzung von Recyclingwasser im Betrieb ein.

- Im April 2024 gab die FUCHS SE, ein weltweit führender Anbieter von Schmierstofflösungen, die Übernahme der LUBCON Gruppe bekannt, einem deutschen Hersteller von Hochleistungs-Spezialschmierstoffen. Dieser strategische Schritt zielt darauf ab, das Produktportfolio von FUCHS, insbesondere im Bereich Industriefette und -öle, zu erweitern und die globale Wettbewerbsfähigkeit zu stärken. Die LUBCON Gruppe betreibt 13 Unternehmen und fünf Produktionsstandorte in Deutschland, Polen, den Philippinen, Indien und den USA und beschäftigt über 200 Mitarbeiter. Ihre Produkte werden in verschiedenen Branchen eingesetzt, darunter in der Bahn-, Wälzlager-, Papier-, Textil-, Lebensmittel-, Pharma- und Windenergieindustrie. Die Übernahme wird voraussichtlich im dritten Quartal 2024 abgeschlossen sein, vorbehaltlich der behördlichen Genehmigungen. Sie integriert die Expertise von LUBCON in das umfassende Netzwerk von FUCHS mit 55 Unternehmen und 33 Produktionsstätten weltweit.

- Im Dezember 2022 übernahm Shell USA über seine Tochtergesellschaft Pennzoil-Quaker State Company 100 % der TFH Reliability Group, LLC, der Muttergesellschaft von Allied Reliability Inc. Diese Übernahme stärkt Shells nordamerikanisches Schmierstoffgeschäft durch die Integration der Industrieprodukte und -dienstleistungen von Allied Reliability, einschließlich Anlagenleistungsmanagement und Zuverlässigkeitsberatung. Dadurch kann Shell ein umfassendes „Produkt-plus-Services“-Modell anbieten, das hochwertige Schmierstoffe mit Zuverlässigkeitslösungen kombiniert, um die Leistung und Sicherheit von Anlagen für Kunden verschiedener Branchen zu verbessern. Allied Reliability ist in einem breiten Branchenspektrum tätig und verbessert die Effizienz und Zuverlässigkeit von Anlagen. Die Übernahme ermöglicht Shell die Erweiterung seines Angebots an Schmierstoffprodukten und -dienstleistungen und steht im Einklang mit seiner globalen Strategie, sein Premiumproduktangebot und seine Präsenz im Industriesektor auszubauen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.