Global Mid And High Level Precision Global Positioning System Receiver Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.93 Billion

USD

10.08 Billion

2021

2029

USD

2.93 Billion

USD

10.08 Billion

2021

2029

| 2022 –2029 | |

| USD 2.93 Billion | |

| USD 10.08 Billion | |

|

|

|

|

Globaler Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision, nach Frequenztyp (Einzelfrequenz, Doppelfrequenz), Typ (Differentialqualität, Vermessungsqualität), Branche (Landwirtschaft, Bergbau, Bauwesen, Öl und Gas, Sonstige) – Branchentrends und Prognose bis 2029

Marktanalyse und Größe

Die Vermessungsqualität wird zunehmend in Branchen wie dem Bauwesen und der Landwirtschaft eingesetzt, da sie unter anderem eine genaue Positionierung ermöglicht. GPS-Empfänger mit mittlerer und hoher Präzision werden häufig zur Vermessung von Markierungen und Gebäuden sowie zur Positionierung im Straßenbau eingesetzt. Sie sind effektiv, um im statischen Modus oder in Echtzeit eine konstante Netzwerkgenauigkeit zu erreichen.

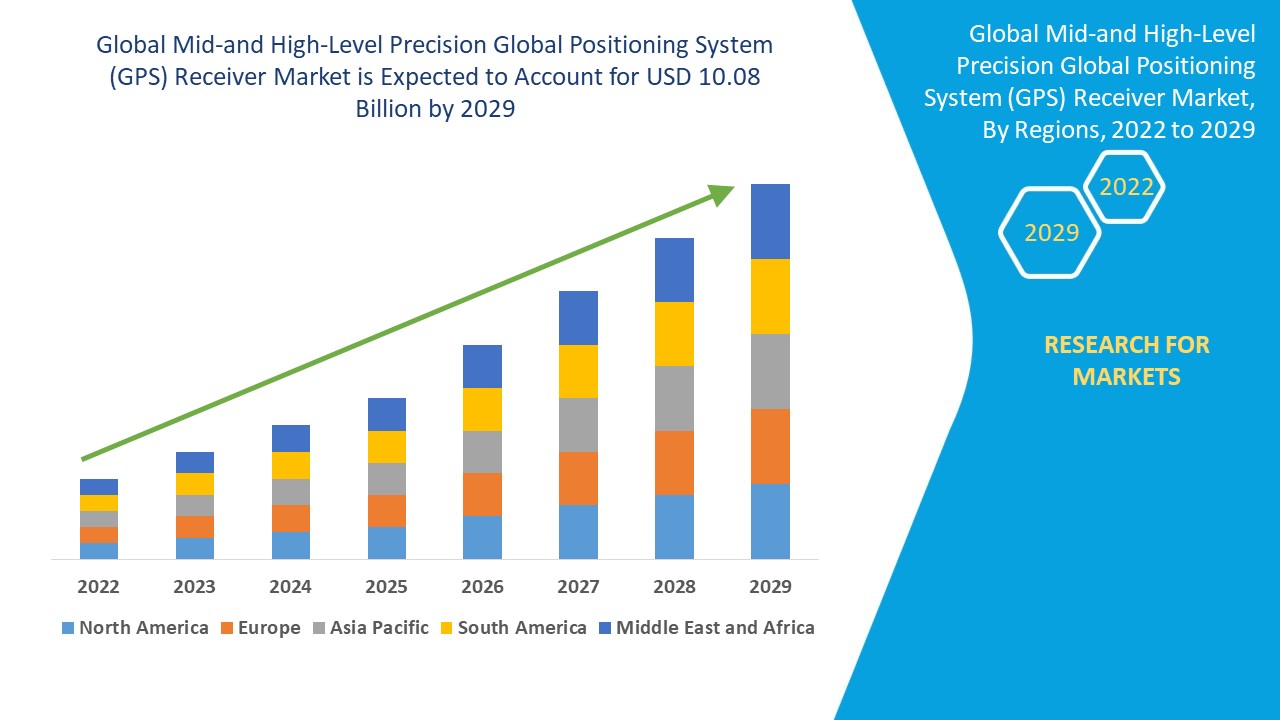

Der globale Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision wurde im Jahr 2021 auf 2,93 Milliarden USD geschätzt und soll bis 2029 10,08 Milliarden USD erreichen, was einer CAGR von 16,70 % im Prognosezeitraum von 2022 bis 2029 entspricht. Survey Grade stellt das größte Anwendungssegment im jeweiligen Markt dar, da es von professionellen Vermessern zur Durchführung von Genauigkeitsmessungen fester Standorte verwendet wird. Neben Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht auch eingehende Expertenanalysen, Import-/Exportanalysen, Preisanalysen, Produktionsverbrauchsanalysen und PESTLE-Analysen.

Marktdefinition

Ein GPS-Empfänger ist ein L-Band-Funkprozessor, der Navigationsgleichungen zur Bestimmung von Benutzerstandort, Geschwindigkeit, präziser Zeit (PVT) und Tempo lösen kann, indem er das von GPS-Satelliten gesendete Signal verarbeitet. GPS-Empfänger mittlerer und hoher Präzision werden in zahlreichen Branchen eingesetzt, unter anderem im Bergbau, Bauwesen, in der Landwirtschaft sowie in der Öl- und Gasindustrie.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 (Anpassbar auf 2019 – 2014) |

|

Quantitative Einheiten |

Umsatz in Mrd. USD, Volumen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Frequenztyp (Einzelfrequenz, Doppelfrequenz), Typ (Differentialqualität, Vermessungsqualität), Branche (Landwirtschaft, Bergbau, Bauwesen, Öl und Gas, Sonstige) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) im Asien-Pazifik-Raum (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika. |

|

Abgedeckte Marktteilnehmer |

AG Leader Technology Inc. (USA), AGCO Corporation (USA), AgJunction Inc. (Kanada), AgEagle Aerial Systems, Inc. (USA), Valmont Industries Inc. (USA), Agsmart Pty Ltd (Australien), BouMatic (USA), CROPMETRICS (USA), Trimble Inc. (USA), CropX Inc. (Israel), Deere & Company (USA), Farmers Edge Inc. (Kanada), GEA Group Aktiengesellschaft (Deutschland), Monsanto Company (USA), Taranis (USA), Precision Planting LLC (USA), Raven Industries Inc. (USA), Topcon (Japan), Tetra Laval International SA (Schweiz) und Trimble Inc. (USA) unter anderem |

|

Marktchancen |

|

Marktdynamik für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Chancen, Beschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Anstieg in der Bauindustrie

Der Anstieg der Verwendung von GPS-Empfängern mittlerer und hoher Präzision in der Bauindustrie ist einer der Hauptfaktoren für das Wachstum des Marktes für GPS-Empfänger mittlerer und hoher Präzision. Die GPS-Technologie wird in großen Bauprojekten wie Megaprojekten zur Geräteverfolgung und auf zivilen Baustellen weithin eingesetzt.

- Verfügbarkeit kostengünstiger Sensoren

Die Verfügbarkeit verschiedener Sensoren wie Last-, Temperatur- und Vibrationssensoren beschleunigt das Marktwachstum. Die laufenden technologischen Fortschritte in der Halbleiterindustrie und der intensive Wettbewerb zwischen verschiedenen Herstellern treiben das Marktwachstum ebenfalls voran.

- Einsatz moderner Technologien in landwirtschaftlichen Produkten

Der Einsatz moderner Technologien wie Variable Rate Technology (VRT), Datenmanagementsoftware, Kartierungssoftware, Ertragskartierungssoftware und GPS in landwirtschaftlichen Produkten beeinflusst den Markt zusätzlich. Diese Technologien verbessern die Bodenfruchtbarkeit und Rentabilität, maximieren die Produktivität, senken die landwirtschaftlichen Kosten und ermöglichen eine nachhaltige Landwirtschaft.

Darüber hinaus wirken sich die schnelle Urbanisierung, veränderte Lebensstile, ein Anstieg der Investitionen und erhöhte Verbraucherausgaben positiv auf den Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision aus.

Gelegenheiten

Darüber hinaus eröffnen die kommerzielle Nutzung unbemannter Luftfahrzeuge (UAVs) sowie technologische Fortschritte und GPS-Erweiterungssysteme den Marktakteuren im Prognosezeitraum von 2022 bis 2029 lukrative Möglichkeiten. Darüber hinaus werden kontinuierliche Entwicklungen zur Verbesserung der gesamten GPS-Infrastruktur den Markt weiter ausbauen.

Einschränkungen/Herausforderungen

Andererseits dürften die geringe Akzeptanz neuer Technologien und die starke Abhängigkeit von der Verfügbarkeit von Satelliten das Marktwachstum behindern. Darüber hinaus dürften Probleme bei der Verbindung von GPS-Signalen mit Lichtquadratsignalen und die geringe Nachfrage nach GPS-Empfängern aufgrund von COVID-19 den Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision im Prognosezeitraum 2022–2029 vor Herausforderungen stellen.

Dieser Marktbericht für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision enthält Details zu aktuellen Entwicklungen, Handelsvorschriften, Import-/Exportanalysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analyst Brief zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von COVID-19 auf den Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision

COVID-19 hatte aufgrund der strengen Ausgangssperren und der sozialen Distanzierung zur Eindämmung der Ausbreitung des Virus negative Auswirkungen auf den Markt für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision. Die wirtschaftliche Unsicherheit, die teilweise Schließung von Unternehmen und das geringe Verbrauchervertrauen wirkten sich auf die Nachfrage im Markt für Industriedienstleistungen aus. Die Lieferkette wurde während der Pandemie beeinträchtigt und es kam zu Verzögerungen bei den Logistikaktivitäten. Es wird jedoch erwartet, dass der Markt für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision nach der Pandemie aufgrund der Lockerung der Beschränkungen wieder an Fahrt gewinnen wird.

Jüngste Entwicklungen

- Hexagon AB | NovAtel hat im Dezember 2020 MarinePak 7 auf den Markt gebracht, einen neuen, für den Seeverkehr zertifizierten GNSS-Empfänger. Er ist speziell für den Einsatz in Küstennähe konzipiert. Der Empfänger unterstützt die SPAN GNSS+INS-Technologie und den Oceanix-Korrekturdienst.

- Trimble, Inc. stellte im September 2020 den Trimble R12i GNSS-Empfänger vor, eine neue Ergänzung des GNSS-Portfolios. Die Technologie besteht aus einer auf einer Trägheitsmesseinheit (IMU) basierenden Neigungskompensation, die die Trimble TIP-Technologie nutzt. Sie ermöglicht das Messen oder Abstecken von Punkten, während die Vermessungslatte geneigt ist.

Globaler Marktumfang und Marktgröße für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision

Der Markt für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision ist nach Frequenztyp, Typ und Branche segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Frequenztyp

- Einzelfrequenz

- Duale Frequenz

Typ

- Differenzielle Note

- Umfragequalität

Industrie

- Landwirtschaft

- Bergbau

- Konstruktion

- Öl und Gas

- Sonstiges

Regionale Analyse/Einblicke zum Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision

Der Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Frequenztyp, Typ und Branche bereitgestellt.

Die im Marktbericht für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika dominiert den Markt für GPS-Empfänger (Global Positioning System) mittlerer und hoher Präzision aufgrund der schrittweisen Einführung intelligenter Dienste für die Landwirtschaft in der Region.

Im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2022 bis 2029 aufgrund der Einführung von Technologien mit variabler Bewässerungsrate, intelligenten Bewässerungssteuerungen und KI-basierten Farmanalysediensten in der Region ein erhebliches Wachstum erwartet.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision

Die Wettbewerbslandschaft auf dem Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision.

Einige der wichtigsten Akteure auf dem Markt für GPS-Empfänger (Global Positioning System) mit mittlerer und hoher Präzision sind

- AG Leader Technology Inc. (USA)

- AGCO Corporation (USA)

- AgJunction Inc. (Kanada)

- AgEagle Aerial Systems, Inc. (USA)

- Valmont Industries Inc. (USA)

- Agsmart Pty Ltd (Australien)

- BouMatic (USA)

- CROPMETRICS (USA)

- Trimble Inc. (USA)

- CropX Inc. (Israel)

- Deere & Company (USA)

- Farmers Edge Inc. (Kanada)

- GEA Group Aktiengesellschaft (Deutschland)

- Monsanto Company (USA)

- Taranis (USA)

- Precision Planting LLC (USA)

- Raven Industries Inc. (USA)

- Topcon (Japan)

- Tetra Laval International SA (Schweiz)

- Trimble Inc. (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.