Global Liquid Bioinsecticides Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.31 Billion

USD

4.78 Billion

2024

2032

USD

1.31 Billion

USD

4.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.31 Billion | |

| USD 4.78 Billion | |

|

|

|

|

Globale Marktsegmentierung für flüssige Bioinsektizide nach Organismentyp (Bacteria Thuringiensis, Beauveria Bassiana und Metarhizium Anisopliae), Typ (natürliche Insektizide, Krankheitserreger und Parasiten), Pflanzenart (Ölsaaten und Hülsenfrüchte, Obst und Gemüse sowie Getreide und Getreide), Anwendung (Saatgutbehandlung, Bodenbehandlung und Blattspray), Insekten (Insekten und Milben, Raupen und Bodeninsekten) – Branchentrends und Prognose bis 2032

Marktgröße für flüssige Bioinsektizide

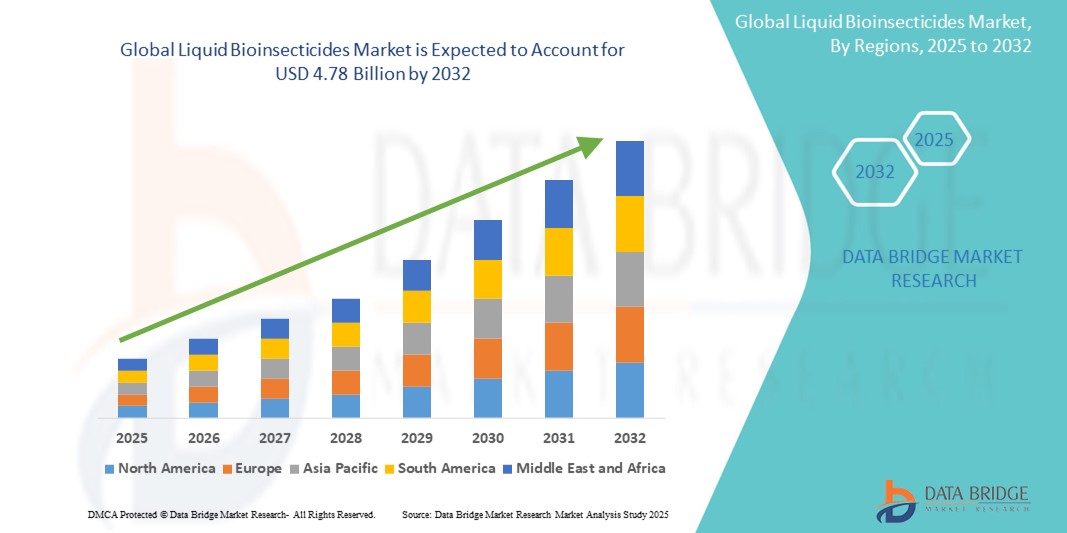

- Der globale Markt für flüssige Bioinsektizide wurde im Jahr 2024 auf 1,31 Milliarden US-Dollar geschätzt und dürfte bis 2032 4,78 Milliarden US-Dollar erreichen , bei einer CAGR von 17,50 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Umstellung auf biologische und nachhaltige Landwirtschaft sowie durch wachsende Bedenken hinsichtlich der Auswirkungen synthetischer Pestizide auf Umwelt und Gesundheit vorangetrieben. Diese Bedenken veranlassen die Regulierungsbehörden dazu, den Einsatz chemischer Pestizide strenger zu beschränken, was die Nachfrage nach umweltfreundlichen Alternativen wie flüssigen Bioinsektiziden steigert.

- Darüber hinaus beschleunigen staatliche Unterstützung durch Subventionen und Aufklärungskampagnen sowie Fortschritte bei der mikrobiellen Formulierung und Verabreichungstechnologien die Einführung flüssiger Bioinsektizide bei verschiedenen Nutzpflanzenarten und tragen erheblich zur Marktexpansion bei.

Marktanalyse für flüssige Bioinsektizide

- Flüssige Bioinsektizide sind biologisch gewonnene Formulierungen – typischerweise basierend auf Bakterien, Pilzen oder Pflanzenextrakten –, die gezielt gegen bestimmte Insektenschädlinge wirken und gleichzeitig nützliche Organismen schützen. Diese Produkte werden als Blattsprays, Saatgutbehandlungen oder Bodenbewässerungen angewendet, um eine nachhaltige und rückstandsfreie Schädlingsbekämpfung zu gewährleisten.

- Die steigende Nachfrage nach flüssigen Bioinsektiziden ist vor allem auf die weltweit zunehmende Bedeutung der biologischen Lebensmittelproduktion, die regulatorische Unterstützung für Biopestizide und das zunehmende Bewusstsein der Landwirte für die langfristigen Vorteile nachhaltiger Schädlingsbekämpfungslösungen zurückzuführen.

- Nordamerika dominierte den Markt für flüssige Bioinsektizide mit einem Anteil von 37,09 % im Jahr 2024, was auf die zunehmende Verlagerung der Verbraucher hin zur Bio-Lebensmittelproduktion und die zunehmende Nutzung nachhaltiger landwirtschaftlicher Betriebsmittel zurückzuführen ist.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für flüssige Bioinsektizide sein, da dort der ökologische Landbau zunimmt, das Bewusstsein für die schädlichen Auswirkungen synthetischer Chemikalien zunimmt und die Regierungen dies unterstützen.

- Das Segment Blattspray dominierte den Markt mit einem Marktanteil von 50,2 % im Jahr 2024 aufgrund seines direkten Kontaktmechanismus, seiner schnellen Wirkung und der einfachen Anwendung bei verschiedenen Kulturarten. Die Blattanwendung ermöglicht eine präzise Bekämpfung von Insektenschädlingen bei Ausbrüchen und liefert sichtbare Ergebnisse bei minimaler Nachbehandlungshäufigkeit, was die Akzeptanz sowohl bei Kleinbauern als auch bei kommerziellen Betrieben fördert.

Berichtsumfang und Marktsegmentierung für flüssige Bioinsektizide

|

Eigenschaften |

Wichtige Markteinblicke zu flüssigen Bioinsektiziden |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für flüssige Bioinsektizide

„Steigende Nachfrage nach ökologischer Landwirtschaft“

- Ein bedeutender und sich beschleunigender Trend auf dem Markt für flüssige Bioinsektizide ist die steigende Nachfrage nach biologischen Anbaumethoden, da Verbraucher, Regulierungsbehörden und Hersteller nach sichereren und nachhaltigeren Alternativen zu synthetischen Agrochemikalien suchen.

- So erweitern Unternehmen wie Certis Biologicals, Koppert Biological Systems und Marrone Bio Innovations beispielsweise ihr Portfolio an flüssigen Bioinsektiziden, um den Bedürfnissen der Biobauern gerecht zu werden. Sie bieten Produkte an, die OMRI-gelistet sind und den internationalen Bio-Standards entsprechen.

- Der Übergang zu biologischer und regenerativer Landwirtschaft wird durch das steigende Bewusstsein der Verbraucher für Lebensmittelsicherheit, Umweltgesundheit und die negativen Auswirkungen chemischer Pestizidrückstände auf Ökosysteme vorangetrieben.

- Staatliche Initiativen und Subventionen zur Förderung des ökologischen Landbaus, insbesondere in Regionen wie Europa, Nordamerika und dem asiatisch-pazifischen Raum, fördern die Einführung von Bioinsektiziden als wesentliche Instrumente für den integrierten Schädlingsschutz.

- Dieser Trend wird auch durch die wachsende Popularität von „Farm-to-Table“-Bewegungen, Bio-Lebensmittelzertifizierungen und das Engagement des Einzelhandels für nachhaltige Beschaffung unterstützt. All dies führt zu einer steigenden Nachfrage nach Pflanzenschutzlösungen, die mit Clean-Label- und umweltfreundlichen Werten im Einklang stehen.

- Unternehmen investieren in die Forschung, um wirksamere, breitbandige flüssige Bioinsektizide und innovative Anwendungstechnologien zu entwickeln, die es Landwirten ermöglichen, eine zuverlässige Schädlingsbekämpfung zu erreichen und gleichzeitig die Bio-Zertifizierung und den Marktzugang aufrechtzuerhalten.

Marktdynamik für flüssige Bioinsektizide

Treiber

„Wachsende Resistenz gegen chemische Pestizide“

- Die zunehmende Resistenz von Schädlingen gegen herkömmliche chemische Pestizide ist ein wichtiger Treiber für den Markt für flüssige Bioinsektizide, da Landwirte nach alternativen Lösungen suchen, um die sich entwickelnden Schädlingspopulationen unter Kontrolle zu halten und die Ernteerträge aufrechtzuerhalten.

- So entwickeln und fördern Unternehmen wie Bayer Crop Science, Syngenta Biologicals und Valent BioSciences flüssige Bioinsektizide auf Basis natürlich vorkommender Bakterien, Pilze und Pflanzenextrakte, die neuartige Wirkungsweisen bieten und das Risiko der Resistenzentwicklung verringern.

- Der weitverbreitete Einsatz chemischer Insektizide hat zur Entstehung resistenter Schädlingsarten geführt, was die Regulierungsbehörden dazu veranlasst hat, bestimmte Wirkstoffe einzuschränken oder zu verbieten und die Einführung biologischer Alternativen zu fördern.

- Flüssige Bioinsektizide ermöglichen eine gezielte Bekämpfung mit minimalen Auswirkungen auf nützliche Insekten und Nichtzielorganismen und sind daher wertvolle Bestandteile integrierter Schädlingsbekämpfungsprogramme.

- Der Markt profitiert zudem von Fortschritten in der Formulierungswissenschaft, die die Stabilität, Haltbarkeit und Wirksamkeit flüssiger Bioinsektizide verbessern und so deren breitere Anwendung bei verschiedenen Kulturen und unter verschiedenen Klimabedingungen unterstützen. Da das Resistenzmanagement sowohl für Landwirte als auch für Regulierungsbehörden oberste Priorität hat, wird die Nachfrage nach innovativen Bioinsektizidlösungen voraussichtlich weiter steigen.

Einschränkung/Herausforderung

„Hohe Produktionskosten“

- Hohe Produktionskosten stellen weiterhin eine erhebliche Herausforderung auf dem Markt für flüssige Bioinsektizide dar und beeinträchtigen die Preiswettbewerbsfähigkeit und die großflächige Einführung, insbesondere in kostensensiblen Regionen.

- So erfordert die Herstellung flüssiger Bioinsektizide oft komplexe Fermentationsprozesse, strenge Qualitätskontrollen und spezielle Lageranforderungen, was die Kosten für Hersteller wie Marrone Bio Innovations und Certis Biologicals in die Höhe treiben kann.

- Der Bedarf an Kühlkettenlogistik, die kürzere Haltbarkeit im Vergleich zu chemischen Alternativen und die Einhaltung gesetzlicher Vorschriften erhöhen die Betriebskosten zusätzlich, sodass es für einige Erzeuger trotz der Umweltvorteile schwierig ist, die Umstellung zu rechtfertigen.

- Die Ausweitung der Produktion bei gleichzeitiger Wahrung der Produktwirksamkeit und -konsistenz stellt eine weitere Hürde dar, insbesondere für kleine und mittelständische Hersteller. Unternehmen reagieren darauf mit Investitionen in Prozessoptimierung, Skaleneffekte und Partnerschaften mit Auftragsherstellern, um Kosten zu senken und die Marktpräsenz zu erweitern.

- Um diese Herausforderung zu meistern, sind kontinuierliche Innovationen in den Produktionstechnologien, verbesserte Vertriebsnetze und eine stärkere Aufklärung über den langfristigen Wert und die Nachhaltigkeitsvorteile flüssiger Bioinsektizide sowohl für die Landwirte als auch für die Umwelt erforderlich.

Marktumfang für flüssige Bioinsektizide

Der Markt ist nach Organismentyp, Art, Pflanzenart, Anwendung und Insekten segmentiert.

- Nach Organismustyp

Der Markt für flüssige Bioinsektizide ist nach Organismustyp in Bacillus thuringiensis, Beauveria bassiana und Metarhizium anisopliae unterteilt. Das Segment Bacillus thuringiensis erzielte 2024 den größten Marktanteil, da es sich durch seine nachgewiesene Wirksamkeit gegen ein breites Spektrum von Insektenlarven und seine langjährige Akzeptanz im ökologischen und konventionellen Landbau auszeichnet. Es wird aufgrund seines Sicherheitsprofils, seiner Ungiftigkeit für Mensch und Tier und seiner Integrationsfähigkeit in integrierte Schädlingsbekämpfungsprogramme (IPM) weithin geschätzt. Seine Kompatibilität mit anderen biologischen und chemischen Wirkstoffen stärkt seine Dominanz in verschiedenen Anbausystemen zusätzlich.

Das Segment Metarhizium anisopliae wird voraussichtlich von 2025 bis 2032 das höchste Wachstum verzeichnen. Dies ist auf den zunehmenden Einsatz zur Bekämpfung von Bodeninsekten und die zunehmende Wirksamkeit gegen schwer zu bekämpfende Schädlinge wie Termiten und Käfer zurückzuführen. Seine einzigartige Wirkungsweise, die auf Pilzinfektionen und der Besiedlung von Insektenwirten beruht, macht es für nachhaltige Landwirtschaftspraktiken, die nach chemiefreien Alternativen suchen, äußerst attraktiv.

- Nach Typ

Der Markt ist nach Typ in natürliche Insektizide, Krankheitserreger und Parasiten unterteilt. Das Segment der natürlichen Insektizide hatte 2024 den größten Marktanteil, unterstützt durch die steigende Verbrauchernachfrage nach chemiefreien landwirtschaftlichen Betriebsmitteln und strengere Rückstandsvorschriften für synthetische Pestizide. Natürliche Insektizide werden aufgrund ihrer Umweltfreundlichkeit und schnellen biologischen Abbaubarkeit bevorzugt, was gut zu den Wachstums- und Nachhaltigkeitszielen des ökologischen Landbaus passt.

Das Segment der Krankheitserreger wird voraussichtlich von 2025 bis 2032 aufgrund der zunehmenden Forschung und des Einsatzes mikrobieller Lösungen zur gezielten Schädlingsbekämpfung das höchste CAGR-Wachstum verzeichnen. Krankheitserreger, insbesondere entomopathogene Pilze und Bakterien, gewinnen aufgrund ihrer Spezifität, ihrer minimalen Auswirkungen auf Nicht-Zielorganismen und ihrer Fähigkeit, sich unter unterschiedlichen Umweltbedingungen zu etablieren, an Bedeutung, was ihr langfristiges Potenzial zur Schädlingsbekämpfung erhöht.

- Nach Pflanzenart

Der Markt ist nach Anbauart in Ölsaaten und Hülsenfrüchte, Obst und Gemüse sowie Getreide und Getreide unterteilt. Das Obst- und Gemüsesegment dominierte den Markt im Jahr 2024 aufgrund des hohen Wertes dieser Pflanzen und ihrer Anfälligkeit für Schädlingsbefall während der gesamten Vegetationsperiode. Landwirte in diesem Segment bevorzugen zunehmend flüssige Bioinsektizide aufgrund ihrer kurzen Erntezeiten, minimalen Rückstände und der Einhaltung internationaler Exportstandards.

Das Segment Ölsaaten und Hülsenfrüchte dürfte im Prognosezeitraum das stärkste Wachstum verzeichnen. Dies ist auf staatliche Initiativen zur Förderung des Einsatzes von Bioinput im Leguminosenanbau und das zunehmende Bewusstsein der Landwirte für Bodengesundheit und Bestäuberschutz zurückzuführen. Die Fähigkeit von Bioinsektiziden, sowohl Schädlinge zu unterdrücken als auch die Bodenmikroben anzureichern, steigert den Wert ölsaatenbasierter Anbausysteme zusätzlich.

- Nach Anwendung

Der Markt ist nach Anwendungsgebieten in Saatgutbehandlung, Bodenbehandlung und Blattspray unterteilt. Das Segment Blattspray erzielte 2024 mit 50,2 % den größten Umsatzanteil aufgrund seines direkten Kontaktmechanismus, seiner schnellen Wirkung und der einfachen Anwendung bei verschiedenen Kulturpflanzenarten. Die Blattspray-Anwendung ermöglicht eine präzise Bekämpfung von Schadinsekten bei Ausbrüchen und liefert sichtbare Ergebnisse bei minimaler Nachbehandlungshäufigkeit, was die Akzeptanz sowohl bei Kleinbauern als auch bei kommerziellen Betrieben fördert.

Das Segment der Saatgutbehandlung dürfte zwischen 2025 und 2032 das höchste Wachstum verzeichnen, da der frühzeitige Schädlingsschutz in der Präzisionslandwirtschaft und integrierten Schädlingsbekämpfungsstrategien an Bedeutung gewinnt. Die Saatgutbehandlung mit Bioinsektiziden bietet eine langfristige Kontrolle bereits in den ersten Wachstumsphasen, reduziert den Bedarf an wiederholten Feldanwendungen und trägt zu niedrigeren Inputkosten und verbesserten Erträgen bei.

- Von Insekten

Der Markt ist nach Zielschädlingen in Insekten und Milben, Raupen und Bodeninsekten segmentiert. Das Raupensegment dominierte den Markt im Jahr 2024 aufgrund des weit verbreiteten Befalls mit Schmetterlingslarven in wichtigen Nahrungspflanzen, insbesondere in tropischen und subtropischen Regionen. Flüssige Bioinsektizide gegen Raupen, insbesondere solche auf Basis von Bacillus thuringiensis, werden aufgrund ihrer hohen Spezifität und geringen Umweltpersistenz häufig eingesetzt.

Das Segment Bodeninsekten wird voraussichtlich zwischen 2025 und 2032 die höchste jährliche Wachstumsrate verzeichnen, bedingt durch die zunehmenden Herausforderungen bei der Bekämpfung von Schädlingen im Wurzelbereich mit herkömmlichen Chemikalien. Die zunehmende Betonung der Bodengesundheit, kombiniert mit Fortschritten in Formulierungstechnologien, die die mikrobielle Überlebensfähigkeit in der Rhizosphäre verbessern, unterstützt die beschleunigte Einführung von Bioinsektiziden zur unterirdischen Insektenbekämpfung.

Regionale Analyse des Marktes für flüssige Bioinsektizide

- Nordamerika dominierte den Markt für flüssige Bioinsektizide mit dem größten Umsatzanteil von 37,09 % im Jahr 2024, bedingt durch die zunehmende Verlagerung der Verbraucher hin zur Bio-Lebensmittelproduktion und die zunehmende Nutzung nachhaltiger landwirtschaftlicher Betriebsmittel.

- In der Region wird eine starke Präferenz für umweltfreundliche Schädlingsbekämpfungslösungen gezeigt, unterstützt durch strenge Pestizidvorschriften und ein zunehmendes Bewusstsein für die schädlichen Auswirkungen synthetischer Chemikalien.

- Robuste Investitionen in die Forschung und eine großzügige staatliche Förderung biologischer Pflanzenschutzprogramme tragen zur weiteren Marktexpansion sowohl bei Reihenkulturen als auch bei Spezialkulturen bei.

Markteinblick für flüssige Bioinsektizide in den USA

Der US-Markt für flüssige Bioinsektizide erzielte 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch den rasanten Ausbau des ökologischen Landbaus und die verstärkte behördliche Kontrolle chemischer Pflanzenschutzmittel. Landwirte setzen zunehmend mikrobielle und pilzliche Bioinsektizide ein, um die steigende Nachfrage der Verbraucher nach sicheren und nachhaltig angebauten Lebensmitteln zu decken. Die Präsenz großer Biokontrollunternehmen sowie unterstützende Programme des US-Landwirtschaftsministeriums (USDA) und der US-Umweltschutzbehörde (EPA) treiben das Marktwachstum für verschiedene Nutzpflanzenarten weiter voran.

Markteinblick für flüssige Bioinsektizide in Europa

Der europäische Markt für flüssige Bioinsektizide wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen, vor allem aufgrund der strengen EU-Pestizidvorschriften und der zunehmenden Fokussierung auf ökologische Landwirtschaftssysteme. Die zunehmende Beliebtheit des integrierten Schädlingsmanagements (IPM) sowie das steigende Verbraucherbewusstsein für Lebensmittelsicherheit und Nachhaltigkeit fördern die Einführung biologischer Insektenbekämpfungsmittel. Die Region verzeichnet ein deutliches Wachstum im Gartenbau, Weinbau und geschützten Anbau, wo die Einhaltung gesetzlicher Vorschriften und Exportanforderungen den Ersatz chemischer Insektizide durch Bioinsektizide vorantreiben.

Markteinblick in flüssige Bioinsektizide in Großbritannien

Der britische Markt für flüssige Bioinsektizide wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen. Dies ist auf die politisch motivierte Umstellung auf eine nachhaltige Landwirtschaft und die steigende Nachfrage nach chemiefreien Lebensmitteln zurückzuführen. Der starke Bio-Einzelhandel des Landes und die öffentliche Besorgnis über den Verlust der Artenvielfalt ermutigen Landwirte, Bioinsektizide in ihre Pflanzenschutzstrategien zu integrieren, insbesondere bei Obst, Gemüse und Hülsenfrüchten.

Markteinblick für flüssige Bioinsektizide in Deutschland

Der deutsche Markt für flüssige Bioinsektizide wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies ist auf die führende Rolle Deutschlands im ökologischen Landbau und den Fokus auf umweltfreundliche landwirtschaftliche Betriebsmittel zurückzuführen. Deutschlands strenge regulatorische Rahmenbedingungen und der innovationsorientierte Ansatz in der Agrarbiotechnologie fördern die Einführung flüssiger Bioinsektizide sowohl in der konventionellen als auch in der ökologischen Landwirtschaft.

Markteinblicke für flüssige Bioinsektizide im asiatisch-pazifischen Raum

Der Markt für flüssige Bioinsektizide im asiatisch-pazifischen Raum dürfte im Prognosezeitraum von 2025 bis 2032 mit der höchsten jährlichen Wachstumsrate wachsen. Dies ist auf den Ausbau der biologischen Landwirtschaft, das zunehmende Bewusstsein für die schädlichen Auswirkungen synthetischer Chemikalien und eine unterstützende Regierungspolitik zurückzuführen. Der steigende Nahrungsmittelbedarf der Region sowie Initiativen zur Förderung einer nachhaltigen und rückstandsfreien Landwirtschaft treiben die Einführung biologischer Schädlingsbekämpfungslösungen voran. Da sich der asiatisch-pazifische Raum zu einem Zentrum mit hoher Nachfrage und hohem Angebot für biobasierte landwirtschaftliche Betriebsmittel entwickelt, erweitern steigende Investitionen und inländische Produktionskapazitäten die Marktreichweite sowohl für kleine als auch für große landwirtschaftliche Betriebe.

Markteinblick für flüssige Bioinsektizide in Indien

Der indische Markt für flüssige Bioinsektizide gewinnt an Dynamik, da Landwirte zunehmend auf Bodengesundheit, Umweltverträglichkeit und die wirtschaftlichen Vorteile biobasierter Produkte achten. Staatliche Programme wie die Nationale Mission für nachhaltige Landwirtschaft und Subventionen für Biopestizide beschleunigen die Verbreitung, insbesondere im Obst-, Gemüse- und Hülsenfruchtanbau.

Markteinblick in China für flüssige Bioinsektizide

Der chinesische Markt für flüssige Bioinsektizide erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf politisch motivierte Reduzierungen des Einsatzes synthetischer Pestizide und die zunehmende Betonung umweltfreundlicher landwirtschaftlicher Praktiken zurückzuführen. Chinas starke inländische Produktionsbasis, der Ausbau zertifizierter Bio-Anbauflächen und die steigende Verbraucherpräferenz für Clean-Label-Produkte tragen maßgeblich zum Marktwachstum in wichtigen Anbausegmenten bei.

Marktanteil flüssiger Bioinsektizide

Die Branche der flüssigen Bioinsektizide wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- BASF (Deutschland)

- Bayer AG (Deutschland)

- BIOBEST GROUP NV (Belgien)

- Certis USA LLC (USA)

- Novozymes (Dänemark)

- Marrone Bio Innovations (USA)

- Syngenta (Schweiz)

- Nufarm (Australien)

- Som Phytopharma India Ltd. (Indien)

- Valent BioSciences LLC (USA)

- BioWorks Inc. (USA)

- Camson Biotechnologies Ltd (Indien)

- Andermatt Biocontrol AG (Schweiz)

- Kan Biosys Pvt. Ltd. (Indien)

- Futureco Bioscience SA (Spanien)

- Kilpest India Ltd (Indien)

- BioSafe Systems, LLC. (USA)

- Vestaron Corporation (USA)

- SDS Biotech KK (Japan)

Neueste Entwicklungen auf dem globalen Markt für flüssige Bioinsektizide

- Im April 2024 ging Syngenta eine strategische Zusammenarbeit mit Lavie Bio aus Israel ein, die sich auf die Erforschung und Entwicklung innovativer Biopestizide konzentriert. Ziel dieser Partnerschaft ist es, die Entwicklung von Biologika zu beschleunigen, ein dringender Bedarf im Agrarsektor. Mithilfe der von Evogene bereitgestellten computerbiologischen Infrastruktur will Lavie Bio mikrobielle Stämme identifizieren, die den Anforderungen des Pflanzenschutzes gerecht werden. Dadurch erweitert Lavie Bio seine Marktreichweite und seine Kapazitäten durch das umfangreiche Netzwerk von Syngenta deutlich.

- Im November 2023 stellte FMC Ethos Elite LFR vor, ein neues Pflanzenschutzmittel aus Insektizid und Biofungizid, das 2024 auf den US-Markt kommen soll. Diese Formulierung kombiniert die bewährte Wirksamkeit des Pyrethroid-Insektizids Bifenthrin mit zwei proprietären biologischen Stämmen von FMC – Bacillus velezensis Stamm RTI301 und Bacillus subtilis Stamm RTI477 – und bietet so ein breites Spektrum an Bekämpfungsmaßnahmen gegen Frühsaisonkrankheiten und bodenbürtige Schädlinge.

- Im Februar 2023 brachte Vestaron, ein führender Hersteller peptidbasierter Bioinsektizide, Spear RC auf den Markt, eine neue Ergänzung seiner Spear-Serie. Dieses innovative Insektizid wurde entwickelt, um Schmetterlingsschädlinge wie den Baumwollkapselwurm, den Sojabohnenspanner und den Heerwurm in Nutzpflanzen wie Baumwolle, Sojabohnen und Reis zu bekämpfen. Feldversuche haben gezeigt, dass Spear® RC eine mit herkömmlichen chemischen Insektiziden vergleichbare Schädlingsbekämpfungsleistung bietet.

- Im März 2022 gaben Marrone Bio Innovations Inc. und Bioceres Crop Solutions Corp. eine endgültige Vereinbarung zur Fusion im Rahmen einer reinen Aktientransaktion bekannt. Ziel ist die Schaffung eines weltweit führenden Anbieters nachhaltiger Agrarlösungen. Die Fusion vereint die Expertise von Bioceres in den Bereichen Bio-Ernährung und Saatgutpflege mit den Innovationen von Marrone Bio im Bereich biologischer Pflanzenschutz. Gemeinsam werden sie ihre Fähigkeiten in der Entwicklung und Vermarktung umweltfreundlicher Agrarprodukte stärken und so weltweit nachhaltige landwirtschaftliche Praktiken unterstützen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.