Global Liquefaction Market

Marktgröße in Milliarden USD

CAGR :

%

USD

855.15 Million

USD

1,342.54 Million

2024

2032

USD

855.15 Million

USD

1,342.54 Million

2024

2032

| 2025 –2032 | |

| USD 855.15 Million | |

| USD 1,342.54 Million | |

|

|

|

|

Globaler Verflüssigungsmarkt nach Versorgungsart (Bunker/Schiff, Pipeline, LKW und Bahn), Anwendung (Chemie und Petrochemie, Stromerzeugung, industrielle Rohstoffe und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Verflüssigung

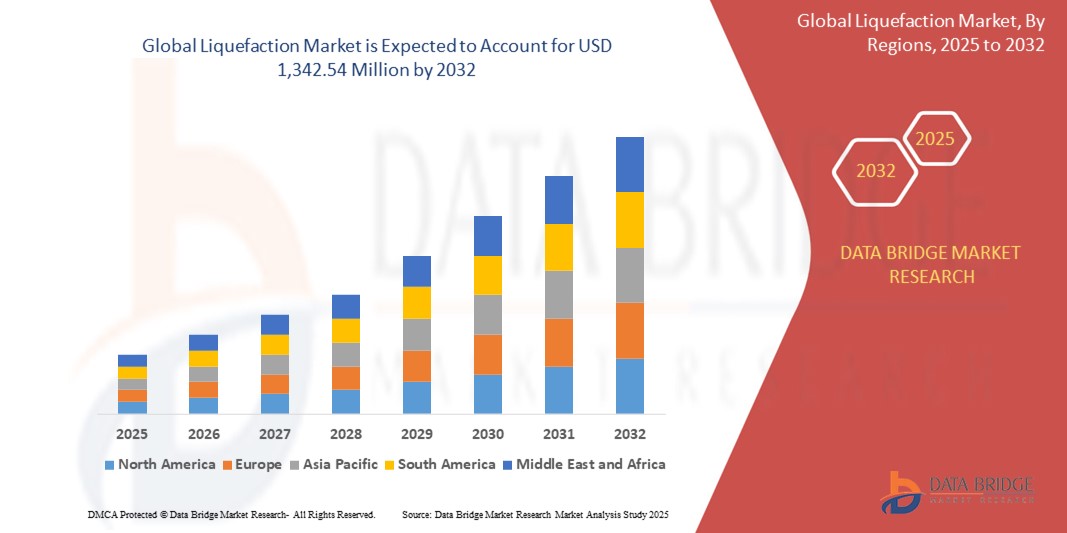

- Der globale Verflüssigungsmarkt wird im Jahr 2024 auf 855,15 Millionen US-Dollar geschätzt und soll bis 2032 einen Wert von 1.342,54 Millionen US-Dollar erreichen , was einer jährlichen Wachstumsrate (CAGR) von 5,80 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird vor allem durch die steigende Nachfrage nach sauberen Energielösungen, Fortschritte in der Verflüssigungstechnologie und den wachsenden Bedarf an effizienten Energietransport- und -speichersystemen vorangetrieben.

- Steigende Investitionen in die Energieinfrastruktur und die Umstellung auf nachhaltige Energiequellen treiben die Einführung von Verflüssigungslösungen in verschiedenen Branchen weiter voran und fördern die Marktexpansion erheblich.

Marktanalyse für Verflüssigung

- Verflüssigungstechnologien, die Gase zur einfacheren Lagerung und zum Transport in flüssige Form umwandeln, werden im Energiesektor immer wichtiger, insbesondere für Erdgas, Wasserstoff und andere Industriegase.

- Die Nachfrage nach Verflüssigung wird durch den weltweiten Vorstoß nach saubereren Energiealternativen, zunehmende Bedenken hinsichtlich der Energiesicherheit und den Bedarf an effizienten Lieferketten in abgelegenen und städtischen Gebieten angeheizt.

- Der asiatisch-pazifische Raum dominierte den Verflüssigungsmarkt mit dem größten Umsatzanteil von 42,5 % im Jahr 2024, angetrieben durch die schnelle Industrialisierung, den hohen Energiebedarf und erhebliche Investitionen in die Energieinfrastruktur, insbesondere in Ländern wie China und Indien

- Nordamerika dürfte im Prognosezeitraum die am schnellsten wachsende Region sein, angetrieben von technologischen Innovationen, der zunehmenden Nutzung erneuerbarer Energiequellen und der starken staatlichen Unterstützung von Initiativen für saubere Energie.

- Das Bunker-/Schiffssegment dominierte den größten Marktumsatzanteil von 45 % im Jahr 2024, angetrieben durch die zunehmende Nutzung von LNG als Schiffskraftstoff, um strengere Umweltvorschriften einzuhalten und die Emissionen des Seeverkehrs zu reduzieren.

Berichtsumfang und Marktsegmentierung für Verflüssigung

|

Eigenschaften |

Wichtige Markteinblicke zur Verflüssigung |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Verflüssigung

„Zunehmende Nutzung fortschrittlicher Verflüssigungstechnologien“

- Auf dem globalen Verflüssigungsmarkt ist ein deutlicher Trend zur Integration fortschrittlicher Technologien zu beobachten, um die Effizienz der Produktion von Flüssigerdgas (LNG) zu steigern und die Kosten zu senken.

- Innovationen bei Verflüssigungsprozessen, wie etwa kryogenen und gemischten Kältemitteltechnologien, ermöglichen höhere Produktionskapazitäten und eine verbesserte Energieeffizienz.

- Diese Technologien ermöglichen eine präzisere Steuerung des Verflüssigungsprozesses, optimieren die Gaskühlung und senken die Betriebskosten.

- Beispielsweise entwickeln Unternehmen modulare Verflüssigungsanlagen, die in entlegenen Gebieten eingesetzt werden können und die Produktion von Flüssigerdgas im kleinen Maßstab für Nischenanwendungen wie die Bunkerung auf See und die netzunabhängige Stromversorgung ermöglichen.

- Dieser Trend macht LNG zugänglicher und kostengünstiger und fördert seine Verbreitung in verschiedenen Anwendungsbereichen, darunter Stromerzeugung und industrielle Rohstoffe.

- Darüber hinaus werden erweiterte Analyse- und Automatisierungsfunktionen eingesetzt, um den Betrieb von Verflüssigungsanlagen zu überwachen und zu optimieren, wodurch Ausfallzeiten reduziert und die Ausgabekonsistenz verbessert werden.

Marktdynamik der Verflüssigung

Treiber

„Steigende Nachfrage nach sauberer Energie und Energiesicherheit“

- Die weltweit wachsende Nachfrage nach saubereren Energiealternativen, insbesondere nach Flüssigerdgas (LNG) als Ersatz für Kohle und Öl, ist ein wichtiger Treiber für den globalen Verflüssigungsmarkt.

- LNG bietet geringere Kohlendioxidemissionen und eine höhere Energiesicherheit und ist daher die bevorzugte Wahl für die Stromerzeugung, industrielle Prozesse und als Kraftstoff für den Transport.

- Regierungsrichtlinien und -vorschriften, insbesondere im asiatisch-pazifischen Raum, fördern die Einführung von LNG, um die Ziele der CO2-Neutralität zu erreichen und die Umweltbelastung zu reduzieren.

- Der Ausbau der 5G- und IoT-Technologien ermöglicht eine schnellere und zuverlässigere Datenübertragung zur Echtzeitüberwachung der LNG-Lieferketten und ermöglicht so eine effizientere Verteilung über Transportwege wie Bunkerung/Schiff, Pipeline, Lkw und Bahn.

- Energieunternehmen investieren zunehmend in Verflüssigungsinfrastruktur, um die steigende Nachfrage nach Flüssigerdgas (LNG) in Anwendungsbereichen wie Chemie und Petrochemie, Stromerzeugung und als industrielle Rohstoffe zu decken.

Einschränkung/Herausforderung

„Hoher Kapitaleinsatz und regulatorische Komplexität“

- Die hohen Anfangskosten für die Entwicklung von Verflüssigungsanlagen, einschließlich Ausrüstung, Infrastruktur und Integration, stellen insbesondere in Schwellenländern ein erhebliches Hindernis für das Marktwachstum dar.

- Die Nachrüstung vorhandener Infrastruktur für die Produktion oder Verteilung von Flüssigerdgas kann technisch komplex und teuer sein, was die Skalierbarkeit einschränkt.

- Auch die Datensicherheit und die Einhaltung von Umweltschutzvorschriften stellen eine Herausforderung dar, da bei Verflüssigungsprozessen große Mengen sensibler Betriebsdaten verarbeitet und die Auswirkungen auf die Umwelt kontrolliert werden müssen.

- Die globale Regulierungslandschaft für die Produktion, Lagerung und den Transport von Flüssigerdgas (LNG) ist fragmentiert und weist in den einzelnen Ländern unterschiedliche Standards auf, was die Geschäftstätigkeit internationaler Akteure erschwert.

- Diese Faktoren können Investitionen verhindern und die Marktexpansion verlangsamen, insbesondere in Regionen mit strengen Umweltauflagen oder begrenzten finanziellen

Verflüssigungsmarkt Umfang

Der Markt ist nach Lieferart und Anwendung segmentiert.

- Nach Lieferart

Der globale Verflüssigungsmarkt ist nach Versorgungsart in die Segmente Bunker/Schiff, Pipeline, Lkw und Bahn unterteilt. Das Segment Bunker/Schiff hatte 2024 mit 45 % den größten Marktanteil, getrieben durch die zunehmende Nutzung von LNG als Schiffskraftstoff zur Einhaltung strengerer Umweltvorschriften und zur Reduzierung der Emissionen im Seeverkehr. Die inhärente Flexibilität und globale Reichweite der Schiffsversorgung tragen zusätzlich zu ihrer Dominanz bei.

Der Schienenverkehr wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen. Dies ist auf den Ausbau der Schieneninfrastruktur in verschiedenen Regionen und die zunehmende Nutzung von Flüssigerdgas (LNG) als sauberer und kostengünstigerer Treibstoff für Lokomotiven zurückzuführen. Dieses Wachstum wird durch die steigende Nachfrage nach effizientem und umweltfreundlichem Gütertransport über lange Strecken zusätzlich vorangetrieben.

- Nach Anwendung

Der globale Verflüssigungsmarkt ist nach Anwendungsbereichen in Chemie und Petrochemie, Stromerzeugung, industrielle Rohstoffe und andere segmentiert. Das Segment Stromerzeugung wird voraussichtlich im Jahr 2024 mit 47,9 % den größten Marktanteil halten, vor allem aufgrund der globalen Umstellung auf sauberere Energiequellen und der steigenden Nachfrage nach Erdgas als Übergangsbrennstoff in der Stromerzeugung. LNG bietet eine umweltfreundlichere Alternative zu Kohle und Öl, was zu erheblichen Investitionen in Gaskraftwerke führt.

Für den Bereich der industriellen Rohstoffe wird von 2025 bis 2032 ein starkes Wachstum erwartet. Dieses Wachstum wird durch die zunehmende Nutzung von LNG als Rohstoff und Energiequelle in verschiedenen industriellen Prozessen, einschließlich der Herstellung von Chemikalien und Petrochemikalien, vorangetrieben, da es sauberere Verbrennungseigenschaften und eine stabile Versorgung aufweist und so die Bemühungen zur Dekarbonisierung der Industrie unterstützt.

Regionale Analyse des Verflüssigungsmarktes

- Der asiatisch-pazifische Raum dominierte den Verflüssigungsmarkt mit dem größten Umsatzanteil von 42,5 % im Jahr 2024, angetrieben durch die schnelle Industrialisierung, den hohen Energiebedarf und erhebliche Investitionen in die Energieinfrastruktur, insbesondere in Ländern wie China und Indien

- Nordamerika dürfte im Prognosezeitraum die am schnellsten wachsende Region sein, angetrieben von technologischen Innovationen, der zunehmenden Nutzung erneuerbarer Energiequellen und der starken staatlichen Unterstützung von Initiativen für saubere Energie.

Einblicke in den japanischen Verflüssigungsmarkt

Der japanische Verflüssigungsmarkt verzeichnet ein robustes Wachstum, angetrieben von der starken Nachfrage nach Flüssigerdgas (LNG) in der Stromerzeugung und für industrielle Anwendungen. Die Abhängigkeit des Landes von importiertem Flüssigerdgas, unterstützt durch Bunkerung, Schiffs- und Pipeline-Versorgung, unterstützt seine Energiesicherheitsziele. Japanische Verbraucher setzen auf hocheffiziente Verflüssigungstechnologien, um Emissionen zu reduzieren und die Energieeffizienz zu steigern. Die Integration von LNG in OEM-Fahrzeuge und Aftermarket-Lösungen, gepaart mit der staatlichen Förderung sauberer Energien, beschleunigt die Marktdurchdringung.

Einblicke in den chinesischen Verflüssigungsmarkt

China hält den größten Anteil am Verflüssigungsmarkt im asiatisch-pazifischen Raum. Grund hierfür sind die rasante Urbanisierung, der steigende Fahrzeugbestand und die starke Nachfrage nach Flüssigerdgas (LNG) in der Stromerzeugung und als industrieller Rohstoff. Die wachsende Mittelschicht des Landes und der Fokus auf die Reduzierung der Luftverschmutzung fördern die Nutzung von Bunker-, Schiffs- und LKW-basierter LNG-Versorgung. Starke inländische Produktionskapazitäten und wettbewerbsfähige Preise verbessern die Marktzugänglichkeit, während staatliche Initiativen zur Energieeffizienz und Emissionsreduzierung das Wachstum zusätzlich ankurbeln.

Einblicke in den nordamerikanischen Verflüssigungsmarkt

Nordamerika wird sich im Prognosezeitraum voraussichtlich zur am schnellsten wachsenden Region entwickeln, angetrieben durch eine dynamische Kombination aus technologischem Fortschritt, der schnellen Einführung erneuerbarer Energielösungen und soliden politischen Rahmenbedingungen. Die Region erlebt einen starken Anstieg der Investitionen in saubere Energien, insbesondere in Solar-, Wind- und grüne Wasserstofftechnologien. Die Regierungen der USA und Kanadas fördern die Dekarbonisierung aktiv durch erhebliche Fördermittel, Steueranreize und regulatorische Vorgaben zur Reduzierung der Treibhausgasemissionen. Darüber hinaus beschleunigen ein etabliertes Forschungs- und Entwicklungsökosystem sowie strategische Partnerschaften zwischen privaten Akteuren und öffentlichen Einrichtungen Innovationen in den Bereichen Energiespeicherung, Smart-Grid-Infrastruktur und Stromsysteme der nächsten Generation.

Einblicke in den US - Verflüssigungsmarkt

Der US-Verflüssigungsmarkt wird voraussichtlich deutlich wachsen, angetrieben durch die starke Nachfrage nach LNG für Bunkeranwendungen, die Stromerzeugung und industrielle Rohstoffe. Die umfangreichen Schiefergasreserven des Landes und die wachsenden Verflüssigungskapazitäten, unter anderem in Texas und Louisiana, stärken die Position des Landes als weltweit führender LNG-Exporteur. Das Bewusstsein der Verbraucher für die Umweltvorteile und die zunehmende Nutzung von LNG im Transportwesen, unterstützt durch Bunker-, Schiffs- und Lkw-Versorgung, stärken sowohl den OEM- als auch den Aftermarket-Bereich.

Einblicke in den europäischen Verflüssigungsmarkt

Der europäische Verflüssigungsmarkt verzeichnet ein stetiges Wachstum, angetrieben durch den Fokus der Region auf Energiesicherheit und den Übergang von Kohle zu saubererem LNG für die Stromerzeugung und industrielle Anwendungen. Länder wie Norwegen und Russland tragen zu LNG-Exporten bei, wobei die Versorgung über Pipelines, Bunker und Schiffe an Bedeutung gewinnt. Der Markt profitiert von strengen Umweltvorschriften und steigenden Regasifizierungskapazitäten, insbesondere als Reaktion auf reduzierte russische Pipeline-Gaslieferungen. Sowohl bei großen als auch bei kleinen LNG-Projekten ist ein Wachstum zu verzeichnen.

Einblicke in den britischen Verflüssigungsmarkt

Der britische Markt für Verflüssigung verzeichnet moderates Wachstum, angetrieben durch die steigende Nachfrage nach LNG in der Stromerzeugung und im Schiffsbunker. Die Umstellung auf sauberere Kraftstoffe, unterstützt durch Bunker-, Schiffs- und Pipeline-Versorgung, steht im Einklang mit den britischen Dekarbonisierungszielen. Das wachsende Bewusstsein für die Umweltvorteile von LNG und seine Rolle bei der Emissionsreduzierung in städtischen und industriellen Umgebungen fördert die Akzeptanz. Regulatorische Rahmenbedingungen zur Förderung der Energieeffizienz unterstützen das Marktwachstum sowohl bei Neu- als auch bei Nachrüstanwendungen zusätzlich.

Einblicke in den deutschen Verflüssigungsmarkt

Der deutsche Verflüssigungsmarkt wächst stetig, angetrieben durch die Fokussierung auf die Energiewende und die Nutzung von LNG zur Stromerzeugung und als industrieller Rohstoff. Der fortschrittliche Industriesektor des Landes und das Engagement zur Reduzierung der CO2-Emissionen fördern die Nutzung von Pipelines und LKW-basierter LNG-Versorgung. Deutsche Verbraucher und Industrie bevorzugen LNG aufgrund seiner Effizienz und geringeren Umweltbelastung. Sowohl bei OEM-Integrationen als auch bei Aftermarket-Lösungen ist die Nutzung stark gestiegen, unterstützt durch Investitionen in kleine LNG-Infrastrukturen.

Marktanteil der Verflüssigung

Die Verflüssigungsindustrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Linde plc (Großbritannien)

- Air Products and Chemicals, Inc. (USA)

- Baker Hughes Company (USA)

- Shell plc (Großbritannien)

- Honeywell International Inc. (USA)

- Siemens Gas and Power GmbH & Co. KG (Deutschland)

- ENGIE (Frankreich)

- Excelerate Energy, Inc. (USA)

- Eni SpA (Italien)

- Kunlun Energy Company Limited (China)

- Bechtel Corporation (USA)

- TechnipFMC (Großbritannien)

- Chiyoda Corporation (Japan)

- Hyundai Heavy Industries (Südkorea)

- JGC Corporation (Japan)

Was sind die jüngsten Entwicklungen auf dem globalen Verflüssigungsmarkt?

- Im Juni 2025 startete die Internationale Energieagentur (IEA) den Global LNG Capacity Tracker, ein dynamisches Online-Tool zur Verbesserung der Transparenz im Flüssigerdgassektor (LNG). Diese öffentlich zugängliche Plattform bietet detaillierte Daten zum Kapazitätsausbau im Bereich LNG-Verflüssigung bis 2030 und verfolgt finale Investitionsentscheidungen (FIDs) sowie Projekthochlaufpläne. Durch Echtzeit-Einblicke in laufende und kommende LNG-Exportprojekte ermöglicht der Tracker Regierungen, Investoren und Branchenvertretern, sich in der sich schnell entwickelnden globalen Gasversorgungslandschaft besser zurechtzufinden. Er stellt einen wichtigen Schritt zur Verbesserung der Markttransparenz und zur Unterstützung der strategischen Energieplanung dar.

- Im Mai 2025 stellte Honeywell International Inc. eine umfassende Strategie zur Portfolioneuausrichtung vor, um sich an globalen Megatrends, insbesondere der Energiewende, auszurichten. Das Unternehmen kündigte Pläne an, seinen Geschäftsbereich Aerospace Technologies vollständig abzuspalten und seinen Geschäftsbereich Advanced Materials in ein neues Unternehmen namens Solstice Advanced Materials auszugliedern. Dieser Schritt soll Honeywells strategischen Fokus schärfen und Innovationen im Bereich sauberer Energietechnologien, einschließlich Lösungen für Flüssigerdgas (LNG), beschleunigen. Durch die Straffung seiner Betriebsabläufe will Honeywell die wachsende Nachfrage nach nachhaltigen Energiesystemen besser nutzen und langfristigen Wert für seine Stakeholder schaffen.

- Im Oktober 2024 schloss die Copelouzos Group eine strategische Allianz mit der Egyptian Natural Gas Holding Company (EGAS), um den LNG-Betrieb über ein neu in Betrieb genommenes Terminal mit schwimmender Speicher- und Regasifizierungseinheit (FSRU) in Griechenland zu verbessern. Ziel dieses Joint Ventures ist es, den Transport, die Versorgung und die Regasifizierung von Flüssigerdgas in Griechenland und Osteuropa zu erleichtern. Die Partnerschaft unterstreicht die wachsende Bedeutung anpassungsfähiger Infrastruktur wie FSRUs für den Ausbau von LNG-Handelsrouten und die Verbesserung der Energieversorgung. Sie spiegelt zudem Ägyptens Bestreben wider, seine Rolle als regionale Energiedrehscheibe zu stärken und gleichzeitig die bilaterale Zusammenarbeit mit Griechenland im Energiesektor zu vertiefen.

- Im Juli 2024 gab Woodside Energy die Übernahme von Tellurian Inc. bekannt und sicherte sich damit das vollständige Eigentum am Driftwood LNG-Projekt in Calcasieu Parish, Louisiana. Dieser strategische Schritt verschafft Woodside Zugang zu einem vollständig genehmigten, groß angelegten LNG-Exportterminal mit einer geplanten Kapazität von 27,6 Millionen Tonnen pro Jahr, das voraussichtlich 2029 in Betrieb gehen wird. Die Übernahme unterstreicht Woodsides Ambitionen, seine globale LNG-Präsenz auszubauen, und spiegelt die allgemeinen Branchentrends der Konsolidierung und langfristiger Investitionen in die Verflüssigungsinfrastruktur wider, um den steigenden globalen Energiebedarf zu decken.

- Im Mai 2024 unterzeichnete die NextDecade Corporation einen 20-jährigen Kaufvertrag über Flüssigerdgas (LNG) mit Japans größtem Stromerzeuger JERA. Der Vertrag umfasst die Lieferung von 2 Millionen Tonnen LNG pro Jahr (MTPA) aus Train 5 des Rio Grande LNG-Projekts von NextDecade in Brownsville, Texas. Die Vereinbarung steht unter dem Vorbehalt einer positiven endgültigen Investitionsentscheidung (FID) für Train 5. Dieser langfristige Vertrag spiegelt nicht nur Japans anhaltenden Bedarf an US-LNG wider, sondern spielt auch eine zentrale Rolle bei der Projektfinanzierung und der Kommerzialisierung neuer Verflüssigungsinfrastruktur.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.