Global Lidar Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.83 Billion

USD

17.60 Billion

2024

2032

USD

3.83 Billion

USD

17.60 Billion

2024

2032

| 2025 –2032 | |

| USD 3.83 Billion | |

| USD 17.60 Billion | |

|

|

|

|

Globale LiDAR-Marktsegmentierung nach Typ (festes LiDAR und rotierendes LiDAR), Anwendung (autonome Fahrzeuge, Luftinspektion, Robotik, Vermessung und Kartierung, Forstwirtschaft und Landmanagement, erneuerbare Energien und andere) – Branchentrends und Prognose bis 2032

LiDAR-Marktanalyse

Bei der LiDAR-Analyse (Light Detection and Ranging) wird mithilfe von Laserlicht die Entfernung zur Erdoberfläche gemessen, wodurch hochpräzise 3D-Modelle von Umgebungen erstellt werden. LiDAR-Systeme senden Laserimpulse aus und messen die Zeit, die sie benötigen, um nach der Reflexion an Objekten zurückzukehren. Diese Daten helfen dabei, detaillierte topografische Karten zu erstellen, Vegetation zu identifizieren, Infrastruktur zu modellieren und Umweltveränderungen zu überwachen. LiDAR wird häufig in Anwendungen wie Forstwirtschaft, Stadtplanung, Archäologie und Katastrophenmanagement eingesetzt. Durch die Verarbeitung der reflektierten Signale erzeugt die LiDAR-Analyse hochauflösende Punktwolken, die für die Geländemodellierung, Konturkartierung und Vegetationsklassifizierung verwendet werden können.

LiDAR-Marktgröße

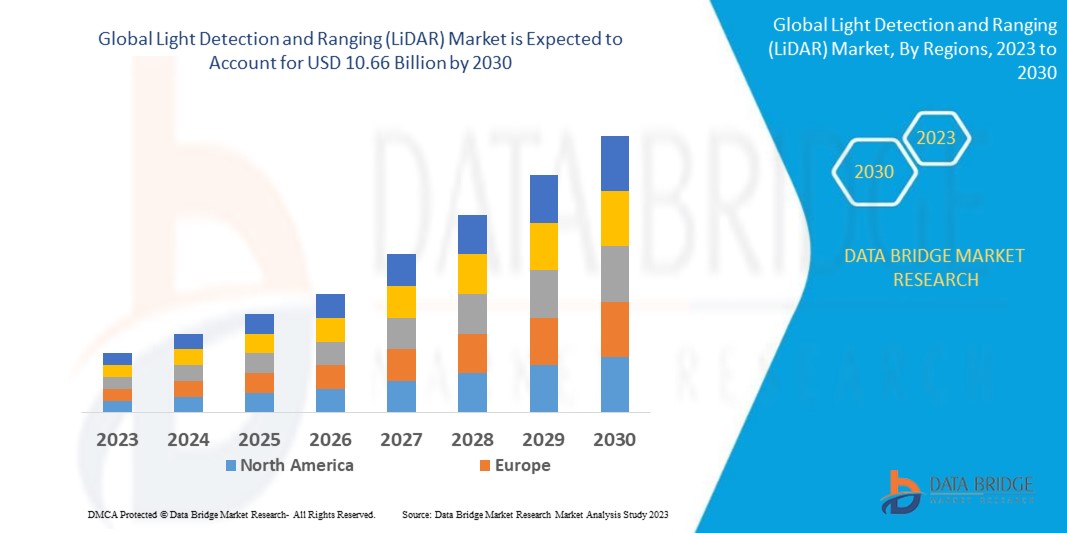

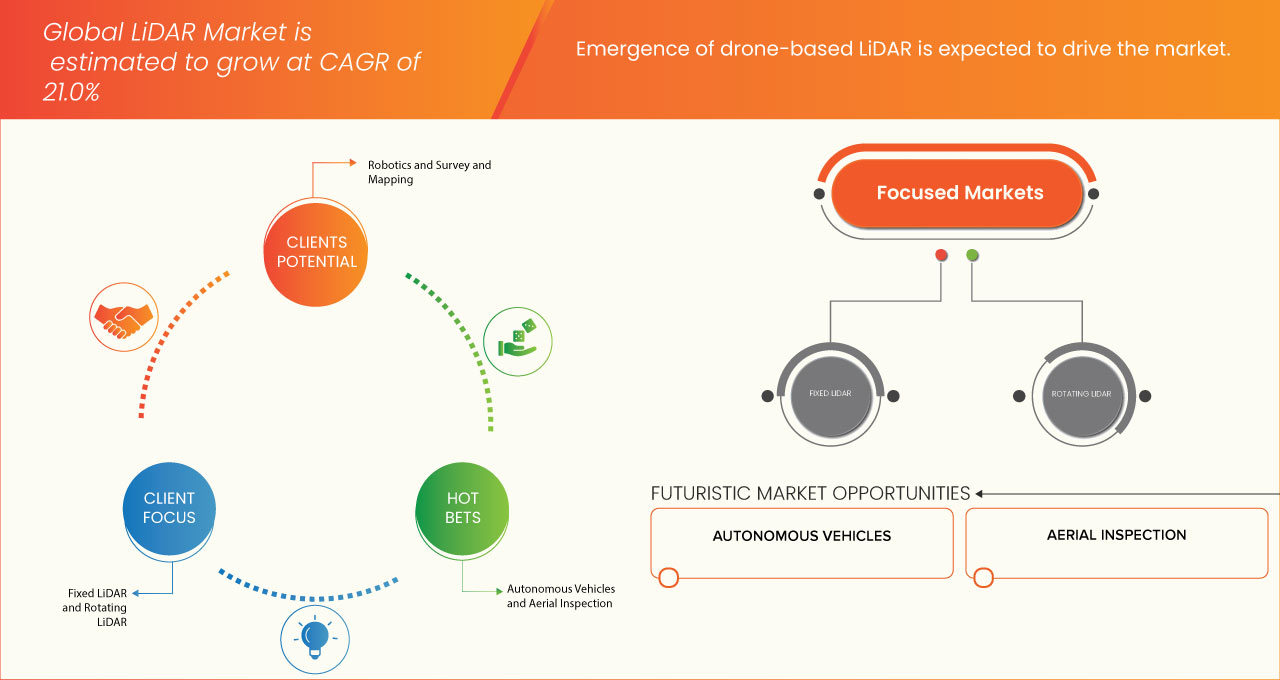

Der globale LiDAR-Markt hatte im Jahr 2024 einen Wert von 3,83 Milliarden US-Dollar und soll bis 2032 17,60 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 21,0 % im Prognosezeitraum 2025 bis 2032. Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen.

LiDAR-Markttrends

„Steigende Nachfrage nach präzisen 3D-Mapping-Technologien“

Die steigende Nachfrage nach präzisen 3D-Mapping-Technologien ist ein wichtiger Treiber auf dem globalen LiDAR-Markt. Branchen wie Stadtplanung, Bauwesen, Landwirtschaft und Umweltüberwachung benötigen präzise topografische Daten, um Entscheidungen zu treffen und die Effizienz zu verbessern. LiDAR liefert hochauflösende 3D-Modelle, die eine detaillierte Kartierung von Gelände, Infrastruktur und Vegetation ermöglichen. Dieser steigende Technologietrend ist besonders wertvoll für Anwendungen wie Hochwassermodellierung, autonome Fahrzeuge und geologische Untersuchungen, bei denen Präzision von entscheidender Bedeutung ist. Da Branchen zunehmend digitale Zwillingstechnologien und Smart-City-Initiativen einsetzen, wächst der Bedarf an genauen und effizienten 3D-Mapping-Lösungen weiter und treibt den LiDAR-Markttrend an.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke zu LiDAR |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

USA, Kanada, Mexiko, China, Japan, Südkorea, Indien, Thailand, Malaysia, Indonesien, Vietnam, Taiwan, Philippinen, Singapur, Australien, Restlicher Asien-Pazifik-Raum, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, Türkei, Niederlande, Belgien, Schweden, Polen, Schweiz, Restliches Europa. Brasilien, Argentinien, Restliches Südamerika, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel und Restlicher Naher Osten und Afrika |

|

Wichtige Marktteilnehmer |

Innoviz Technologies Ltd (Israel), SICK AG (Deutschland), Hesai Group. (China), Quanergy Solutions, Inc. (USA), Cepton, Inc. (USA), Génération Robots (Frankreich), Teledyne Optech China), Aeva Inc. (USA), AEye, Inc. (USA), Trimble Inc. (USA) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen. |

LiDAR- Marktdefinition

LiDAR (Light Detection and Ranging) ist eine Fernerkundungstechnologie, die Laserimpulse verwendet, um Entfernungen zwischen einem Sensor und Objekten auf der Erdoberfläche zu messen. Durch das Aussenden schneller Laserstrahlen und das Aufzeichnen der Zeit, die die Impulse zum Zurückreflektieren benötigen, erzeugt LiDAR hochpräzise, detaillierte 3D-Daten. Diese Daten, die als Punktwolke bezeichnet werden, liefern präzise Messungen der Oberflächentopografie, Vegetation, Infrastruktur und mehr. LiDAR wird häufig in Branchen wie Kartierung, Forstwirtschaft, Archäologie und Umweltüberwachung eingesetzt, da es hochauflösende räumliche Daten in einer Vielzahl von Umgebungen erfassen kann, darunter sowohl Land- als auch Luftvermessungen.

LiDAR- Marktdynamik

Treiber

- Wachsende Nachfrage nach autonomen Fahrzeugen

Die wachsende Nachfrage nach autonomen Fahrzeugen (AVs) ist einer der Hauptfaktoren für die zunehmende Verbreitung der LiDAR-Technologie. LiDAR spielt eine entscheidende Rolle dabei, selbstfahrenden Fahrzeugen eine genaue Wahrnehmung ihrer Umgebung zu ermöglichen, und ist somit eine wesentliche Komponente für autonome Fahrzeugsysteme. Da sich die Automobilindustrie in Richtung vollständig autonomer Transportmittel bewegt, ist die Fähigkeit von LiDAR, hochauflösende 360-Grad-3D-Karten und Echtzeit-Umgebungsdaten bereitzustellen, von entscheidender Bedeutung für die Gewährleistung von Sicherheit und Zuverlässigkeit.

LiDAR-Sensoren senden Laserimpulse aus, um Entfernungen zu messen und präzise 3D-Karten der Umgebung zu erstellen. So können autonome Fahrzeuge Hindernisse, Verkehrsschilder, Fußgänger und andere Fahrzeuge selbst unter schwierigen Bedingungen wie schlechten Lichtverhältnissen oder schlechtem Wetter erkennen. Dieses Maß an Präzision und Tiefenwahrnehmung hilft autonomen Systemen, komplexe Umgebungen sicher zu navigieren, was LiDAR zur bevorzugten Wahl für Hersteller selbstfahrender Autos macht. Im Gegensatz zu herkömmlichen kamera- oder radarbasierten Sensoren liefert LiDAR viel detailliertere und genauere räumliche Informationen, die für sekundenschnelle Entscheidungen in dynamischen Umgebungen entscheidend sind.

Die steigende Nachfrage nach autonomen Fahrzeugen treibt auch Innovationen in der LiDAR-Technologie voran. Um den Anforderungen des Automobilsektors gerecht zu werden, wurden erhebliche Fortschritte bei der Reduzierung der Größe, Kosten und Komplexität von LiDAR-Systemen erzielt. Solid-State-LiDAR beispielsweise bietet eine kostengünstigere und langlebigere Alternative zu herkömmlichen rotierenden LiDAR-Systemen, was für eine breite Einführung in Verbraucherfahrzeugen von entscheidender Bedeutung ist. Darüber hinaus ermöglichen Fortschritte bei der Integration von LiDAR mit anderen Sensoren wie Radar und Kameras eine bessere Leistung und einen reibungsloseren Betrieb in autonomen Systemen.

Während sich der weltweite Vorstoß in Richtung autonom fahrender Fahrzeuge aufgrund der Aussicht auf mehr Sicherheit, Effizienz und Komfort verstärkt, wird die LiDAR-Technologie auch weiterhin eine zentrale Rolle bei der Entwicklung selbstfahrender Autos spielen und dazu beitragen, die Realisierung einer Zukunft mit vollständig autonom fahrenden Transportmitteln zu beschleunigen.

Zum Beispiel,

- Laut einem im Oktober 2024 auf Medium veröffentlichten Artikel ist die Fähigkeit von LiDAR, genaue 3D-Karten zu erstellen und Hindernisse in Echtzeit zu erkennen, für den sicheren Betrieb selbstfahrender Fahrzeuge von entscheidender Bedeutung. Mit dem Fortschreiten der autonomen Fahrzeugtechnologie wird LiDAR für die Navigation, Entscheidungsfindung und Kollisionsvermeidung von entscheidender Bedeutung und wird damit zu einem Schlüsselfaktor für vollständig autonome Transportsysteme

Verstärkter Einsatz von LiDAR in der Umweltüberwachung und bei Umweltanwendungen

Der zunehmende Einsatz der LiDAR-Technologie in der Umweltüberwachung und in Umweltanwendungen verändert die Art und Weise, wie wir natürliche Ressourcen, Ökosysteme und Umweltrisiken verstehen und verwalten. Die Fähigkeit von LiDAR, hochdetaillierte, genaue 3D-Daten zu erfassen, macht es für eine breite Palette von Umweltanwendungen von unschätzbarem Wert, darunter Forstwirtschaftsmanagement, Hochwassermodellierung, Küstenüberwachung und Habitatkartierung.

Eine der wichtigsten Anwendungen von LiDAR in der Umweltüberwachung ist die Forstwirtschaft. Die LiDAR-Technologie ermöglicht eine präzise Kartierung von Waldkronen, Baumhöhe, -dichte und -biomasse, was Förstern hilft, den Zustand des Waldes zu beurteilen und Holzressourcen effektiver zu verwalten. LiDAR kann auch verwendet werden, um detaillierte topografische Karten von Waldgebieten zu erstellen, potenzielle Risiken wie Erdrutsche oder Erosion zu identifizieren und Naturschutzbemühungen durch die Kartierung von Lebensräumen von Wildtieren zu unterstützen.

Im Bereich Hochwasserrisikomanagement liefert LiDAR hochauflösende Daten, die bei der Erstellung präziser Hochwassermodelle helfen. Durch die Erfassung detaillierter Höhendaten ermöglicht LiDAR Wissenschaftlern, Hochwassermuster vorherzusagen, potenzielle Überschwemmungsgebiete einzuschätzen und Strategien zur Hochwasserminderung zu entwickeln. Es ist besonders in Gebieten mit komplexem Gelände nützlich, in denen es mit herkömmlichen Methoden schwierig sein könnte, genaue Daten zu erhalten.

LiDAR wird auch zunehmend in Küsten- und Meeresstudien eingesetzt. Es kann helfen, Küstenlinien zu kartieren, Küstenerosion zu überwachen und den Zustand von Meeresökosystemen wie Korallenriffen zu beurteilen. Die Fähigkeit, detaillierte Daten unter Wasser und entlang von Küstenlinien zu erfassen, ist für das Verständnis und den Schutz dieser empfindlichen Umgebungen von entscheidender Bedeutung. Darüber hinaus ist LiDAR in der Klimaforschung wertvoll und hilft dabei, Umweltveränderungen im Laufe der Zeit zu überwachen, wie etwa das Schmelzen des Eises in Polarregionen oder die Abholzung tropischer Wälder.

Angesichts der zunehmenden Umweltbedenken ist die Fähigkeit von LiDAR, genaue Echtzeitdaten bereitzustellen, von entscheidender Bedeutung für die Überwachung, Erhaltung und Bewirtschaftung der Umwelt und macht es zu einem wesentlichen Instrument für eine nachhaltige Ressourcenbewirtschaftung und den Umweltschutz.

Zum Beispiel,

- Laut einem im April 2023 von Neuvition, Inc. veröffentlichten Artikel wird der zunehmende Einsatz der LiDAR-Technologie bei der Umweltüberwachung und -verwaltung hervorgehoben. Die hochauflösende 3D-Kartierung von LiDAR ermöglicht eine detaillierte Analyse von Landschaften, Vegetation und Topographie und ist daher für die Überwachung der ökologischen Gesundheit, die Erkennung von Umweltveränderungen und die Verwaltung natürlicher Ressourcen unverzichtbar und stellt ein Schlüsselinstrument für nachhaltige Praktiken dar.

Gelegenheiten

- Zunehmende Urbanisierung und Infrastrukturentwicklung weltweit

Der beschleunigte Trend zur Urbanisierung und Infrastrukturentwicklung auf der ganzen Welt bietet eine Fülle von Möglichkeiten für den globalen LiDAR-Markt (Light Detection and Ranging). Da Städte weiter wachsen, sich weiterentwickeln und modernisieren, war der Bedarf an genauen, effizienten und skalierbaren Lösungen zur Überwachung und Verwaltung städtischer Umgebungen nie größer. Die LiDAR-Technologie mit ihrer Fähigkeit, hochauflösende, dreidimensionale Daten von Landschaften, Infrastruktur und Gebäuden zu erfassen, entwickelt sich zu einem Schlüsselfaktor in der Stadtplanung, im Bauwesen und im Infrastrukturmanagement.

Mit zunehmender Urbanisierung werden Städte komplexer und es besteht eine steigende Nachfrage nach intelligenteren, effizienteren Lösungen zur Bewältigung von Herausforderungen wie Verkehrsstaus, Abfallmanagement und Energieverbrauch. Die LiDAR-Technologie spielt eine zentrale Rolle bei der Stadtplanung, da sie hochdetaillierte und genaue 3D-Modelle von Städten liefert. Diese Modelle helfen Stadtplanern, die vorhandene Infrastruktur zu visualisieren, neue Entwicklungen zu planen und die Raumnutzung zu optimieren. Im Kontext intelligenter Städte kann LiDAR bei der Schaffung intelligenter Systeme helfen, die alles von Verkehrsströmen bis hin zu öffentlichen Versorgungseinrichtungen überwachen und so zu nachhaltigeren und lebenswerteren städtischen Umgebungen beitragen.

Die Entwicklung der Infrastruktur ist ein entscheidender Aspekt der Urbanisierung. Regierungen und private Unternehmen investieren massiv in den Bau und die Instandhaltung von Straßen, Brücken, Gebäuden und Versorgungseinrichtungen. Die LiDAR-Technologie ist in dieser Hinsicht unverzichtbar, da sie präzise, hochauflösende Daten für Standortuntersuchungen, topografische Kartierungen und Strukturinspektionen liefert. Mit LiDAR ausgestattete Drohnen können beispielsweise Baustellen schnell und genau kartieren, was eine effizientere Projektplanung ermöglicht, Kosten senkt und Fehler minimiert. Darüber hinaus ermöglicht die Fähigkeit von LiDAR, strukturelle Veränderungen und potenzielle Gefahren in der bestehenden Infrastruktur zu erkennen, proaktive Wartungs- und Reparaturarbeiten und stellt sicher, dass kritische Anlagen sicher und funktionsfähig bleiben.

Da die Nachfrage nach präzisen Echtzeitdaten steigt, wird erwartet, dass der globale LiDAR-Markt erheblich wachsen wird. Die Integration von LiDAR mit KI, maschinellem Lernen und autonomen Technologien wird seine Anwendungsmöglichkeiten weiter ausbauen und die Marktakzeptanz in Sektoren wie Transport, Bau und Energie vorantreiben. Dieser Trend bietet Unternehmen, die LiDAR-basierte Lösungen anbieten, erhebliche Chancen – von Hardwareherstellern bis hin zu Softwareentwicklern.

Zum Beispiel,

- Laut einem Artikel der ResearchGate GmbH wird LiDAR-Technologie im Juni 2024 für städtische geophysikalische Untersuchungen eingesetzt, beispielsweise zur Kartierung unterirdischer Versorgungsleitungen und zur Überwachung der strukturellen Integrität. Sie hilft bei der Erstellung detaillierter 3D-Modelle städtischer Landschaften, die bei der Infrastrukturplanung, Hochwassermodellierung und Stadtentwicklung helfen und eine genauere und effizientere Entscheidungsfindung bei der Stadtverwaltung gewährleisten.

Einführung von Drohnen-basiertem LiDAR

Das Aufkommen der Drohnen-basierten LiDAR-Technologie hat zusammen mit den sich beschleunigenden Trends der Urbanisierung und der globalen Infrastrukturentwicklung enorme Chancen für den globalen LiDAR-Markt geschaffen. Da Städte wachsen und Infrastrukturprojekte an Größe und Komplexität zunehmen, steigt die Nachfrage nach präzisen, effizienten und kostengünstigen Datenerfassungslösungen. Drohnen-basiertes LiDAR positioniert sich als transformatives Werkzeug in verschiedenen Sektoren, darunter Infrastrukturentwicklung, Vermessung, Umweltüberwachung und Landwirtschaft.

In der sich rasch entwickelnden globalen Infrastrukturlandschaft spielt drohnenbasiertes LiDAR eine zentrale Rolle, da es hochpräzise 3D-Kartierungen in Echtzeit liefert. Während der Bauphase können mit LiDAR ausgestattete Drohnen topografische Daten erfassen und so eine präzise Projektplanung gewährleisten. Dies verringert die Wahrscheinlichkeit von Fehlern während des Baus, optimiert den Materialeinsatz und hilft bei der Einhaltung strenger Zeitpläne. Darüber hinaus unterstützen LiDAR-Drohnen die Infrastrukturüberwachung, indem sie Anlagen wie Straßen, Brücken und Pipelines regelmäßig scannen. Sie können strukturelle Probleme wie Risse oder Verformungen erkennen, bevor sie kritisch werden, was eine vorbeugende Wartung ermöglicht und erhebliche Reparaturkosten spart. In Gebieten mit komplexer oder schwer zugänglicher Infrastruktur ermöglichen Drohnen eine schnelle Datenerfassung, wodurch der Bedarf an manuellen Inspektionen minimiert wird.

Mit LiDAR ausgestattete Drohnen verändern auch traditionelle Vermessungsmethoden. Landvermessungen, die früher Tage oder Wochen dauerten, können heute in einem Bruchteil der Zeit abgeschlossen werden. Drohnen können riesige Gebiete abdecken und präzise Daten sammeln, für die sonst viel Personal und teure Ausrüstung erforderlich wären. Im Bergbau oder im Bauwesen beispielsweise erstellen Drohnen genaue 3D-Modelle für die Standortplanung und Volumenmessungen und sorgen so dafür, dass Projekte im Zeitplan bleiben. Bei der Umweltüberwachung ermöglicht Drohnen-basiertes LiDAR eine effiziente Verfolgung von Landschaftsveränderungen wie Erosion, Entwaldung oder Landnutzungsänderungen. Es hilft auch bei der Bewertung von Hochwasserrisiken und Naturschutzbemühungen, indem es detaillierte Höhendaten liefert, die für das Verständnis des Wasserflusses und der Gesundheit des Ökosystems von entscheidender Bedeutung sind.

In der Landwirtschaft revolutioniert drohnenbasiertes LiDAR die Landbewirtschaftung. Mit LiDAR ausgestattete Drohnen helfen dabei, den Gesundheitszustand von Nutzpflanzen zu überwachen, den Bewässerungsbedarf zu ermitteln und frühe Anzeichen von Schädlingsbefall zu erkennen. Die Technologie liefert detaillierte, hochauflösende Daten zur Bodentopographie und zur Struktur der Pflanzenkronen, sodass Landwirte fundiertere Entscheidungen treffen und ihre landwirtschaftlichen Praktiken optimieren können. LiDAR kann auch bei der Präzisionslandwirtschaft helfen, indem es die effizienteste Nutzung von Ressourcen identifiziert, Abfall reduziert und Ernteerträge steigert.

Zum Beispiel,

- Im August 2023 wird laut einem Artikel von MDPI drohnenbasiertes LiDAR zur Kartierung und Überwachung von Waldkronen eingesetzt und liefert präzise Daten zu Baumhöhe, Kronenstruktur und Vegetationsdichte. Diese Technologie unterstützt ökologische Studien, Waldbewirtschaftung und Naturschutzbemühungen und liefert wichtige Erkenntnisse zur Artenvielfalt, Biomasseschätzung und Waldgesundheit

Einschränkungen/Herausforderungen

- Hohe Kosten für LiDAR-Systeme

Die hohen Kosten von LiDAR-Systemen (Light Detection and Ranging) sind ein erhebliches Hindernis für ihre breite Einführung, obwohl sie in zahlreichen Branchen wie autonomen Fahrzeugen, Bauwesen, Landwirtschaft und Umweltüberwachung eingesetzt werden können. Diese Systeme sind dafür bekannt, hochpräzise, hochauflösende 3D-Karten zu liefern, aber ihre Kosten bleiben für viele Unternehmen und Organisationen, die LiDAR in ihre Betriebsabläufe integrieren möchten, eine Herausforderung.

Es gibt mehrere Gründe für die hohen Kosten von LiDAR-Systemen. Erstens erfordert die Technologie selbst spezielle Komponenten wie Laserscanner, GPS-Geräte und Hochleistungssensoren, deren Herstellung teuer ist. LiDAR-Sensoren verwenden hochentwickelte Laserstrahlen, um Entfernungen zu messen und Daten zu erfassen. Die für genaue Ergebnisse erforderliche Präzision erhöht die Komplexität der Produktion. Darüber hinaus erhöht die Integration dieser Sensoren in hochentwickelte Software zur Datenverarbeitung und -analyse die Gesamtsystemkosten.

Zweitens trägt auch die zur Verbesserung der LiDAR-Technologie erforderliche Forschung und Entwicklung (F&E) zu ihrem hohen Preis bei. Unternehmen investieren massiv in die Entwicklung kompakterer, effizienterer und präziserer Systeme, was oft erhebliche Anfangsinvestitionen erfordert. Während neuere LiDAR-Technologien wie Solid-State-LiDAR die Kosten im Laufe der Zeit senken dürften, bleiben die Anfangsinvestitionen in Spitzentechnologie hoch.

Darüber hinaus erhöhen die Betriebskosten für LiDAR-Systeme, wie etwa die Schulung des Personals zur Bedienung der Geräte und die Verarbeitung der generierten großen Datenmengen, die Gesamtkosten. Ein einziger LiDAR-Scan-Auftrag kann Terabyte an Daten erzeugen, für deren Analyse spezielle Software und Rechenleistung erforderlich sind, was die Kosten weiter in die Höhe treibt.

Trotz dieser Herausforderungen sinken die Preise für LiDAR-Systeme allmählich, da der technologische Fortschritt die Komponenten erschwinglicher macht. Da der Wettbewerb auf dem Markt zunimmt und die Nachfrage steigt, ist zu erwarten, dass LiDAR zugänglicher wird und eine breitere Nutzung in verschiedenen Branchen ermöglicht.

Zum Beispiel

- Laut einem im März 2022 veröffentlichten Blog von Queensland Drones bietet LiDAR-Mapping zwar Vorteile gegenüber der Photogrammetrie, bleibt aber aufgrund der hohen Geräte- und Softwarekosten teuer. Auf UAVs montierte LiDAR-Systeme kosten etwa 2.500 USD pro Tag, verglichen mit 30.000 USD für bemannte Flugzeugsysteme.

Strenge Vorschriften für Drohnen-basierten LiDAR-Betrieb und Datenschutzbedenken

Materialeigenschaften, insbesondere Viskosität, spielen eine entscheidende Rolle bei der Bestimmung der Effizienz und Qualität des Extrusionsprozesses. Viskosität, ein Maß für den Fließwiderstand eines Materials, beeinflusst direkt, wie sich Materialien unter den für die Extrusion typischen Hochdruck- und Hochtemperaturbedingungen verhalten. Das Verständnis und die Kontrolle der Viskosität sind für die Optimierung des Extrusionsprozesses, die Gewährleistung einer gleichbleibenden Produktqualität und das Erreichen der gewünschten mechanischen Eigenschaften von entscheidender Bedeutung.

Bei der Polymerextrusion beeinflusst die Viskosität die Fließgeschwindigkeit und Gleichmäßigkeit des geschmolzenen Materials, wenn es durch die Düse gepresst wird. Materialien mit hoher Viskosität erfordern mehr Kraft, um durch die Düse gepresst zu werden, was den Energieverbrauch und den Verschleiß der Extrusionsmaschine erhöhen kann. Materialien mit niedriger Viskosität hingegen fließen leichter, bieten aber möglicherweise nicht die für bestimmte Anwendungen erforderliche strukturelle Integrität. Daher ist das Erreichen einer optimalen Viskosität entscheidend für die Balance zwischen Verarbeitungseffizienz und Produktleistung.

Das rheologische Verhalten von Materialien, zu dem auch die Viskosität gehört, wirkt sich auch auf die thermischen und mechanischen Eigenschaften der extrudierten Produkte aus. So können beispielsweise Viskositätsschwankungen zu ungleichmäßiger Wandstärke, Oberflächenfehlern und inneren Spannungen in den extrudierten Profilen führen. Diese Fehler können die Festigkeit, Haltbarkeit und Ästhetik des Endprodukts beeinträchtigen. Durch eine präzise Kontrolle der Viskosität können Hersteller die Maßgenauigkeit und Oberflächenbeschaffenheit der extrudierten Materialien verbessern und so qualitativ hochwertigere Produkte herstellen.

Darüber hinaus beeinflusst die Viskosität das Mischen und Vermengen von Additiven und Füllstoffen im Grundmaterial. Bei Anwendungen, bei denen mehrere Komponenten kombiniert werden, um bestimmte Eigenschaften zu erzielen, wie etwa verstärkte Verbundwerkstoffe oder mehrschichtige Strukturen, hängen die Kompatibilität und Dispersion dieser Komponenten von der Viskosität des Materials ab. Eine richtig eingestellte Viskosität gewährleistet eine homogene Mischung und verhindert Probleme wie Phasentrennung oder ungleichmäßige Verteilung von Füllstoffen, die die Gesamtleistung des Materials beeinträchtigen können.

Moderne Extrusionstechnologien beinhalten häufig Echtzeit-Überwachungs- und Kontrollsysteme zur Steuerung der Viskosität und anderer kritischer Parameter. Diese Systeme ermöglichen dynamische Anpassungen der Verarbeitungsbedingungen wie Temperatur und Schneckendrehzahl, um während des gesamten Extrusionsprozesses eine optimale Viskosität aufrechtzuerhalten. Dieses Maß an Kontrolle steigert die Produktivität, reduziert Materialabfall und gewährleistet gleichbleibende Qualität.

Zum Beispiel,

- Im Juli 2021 wurde in einem Artikel des Vidhi Centre über Datenschutzbedenken im Zusammenhang mit Drohneneinsätzen in Indien berichtet, die die Herausforderungen bei der Erfassung sensibler Daten durch Luftüberwachung hervorheben. Der Artikel betont die Notwendigkeit strengerer Vorschriften zum Schutz der Privatsphäre des Einzelnen und zum Ausgleich der Vorteile der Drohnentechnologie, insbesondere in Sektoren wie Kartierung, Landwirtschaft und Infrastrukturentwicklung.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

LiDAR-Marktumfang

Der Markt ist nach Typ und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Festes LiDAR

- Rotierendes LiDAR

- Andere

Anwendung

- Autonome Fahrzeuge

- Inspektion aus der Luft

- Robotik

- Vermessung und Kartierung

- Forstwirtschaft und Landmanagement

- Erneuerbare Energien

- Sonstiges

Regionale Analyse des LiDAR-Marktes

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Typ und Anwendung bereitgestellt.

Die vom Markt abgedeckten Länder sind die USA, Kanada, Mexiko, China, Japan, Südkorea, Indien, Thailand, Malaysia, Indonesien, Vietnam, Taiwan, Philippinen, Singapur, Australien, der restliche asiatisch-pazifische Raum, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, Türkei, Niederlande, Belgien, Schweden, Polen, Schweiz, der restliche Teil Europas. Brasilien, Argentinien, der restliche Teil Südamerikas, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel und der restliche Nahe Osten und Afrika.

Nordamerika dominiert den globalen LiDAR-Markt aufgrund der fortschrittlichen technologischen Infrastruktur, der hohen Akzeptanz in Branchen wie der Luft- und Raumfahrt, Verteidigung und Automobilindustrie sowie starker Investitionen in autonome Fahrzeuge und Geografische Informationssysteme (GIS).

Der asiatisch-pazifische Raum erschließt sich auf dem globalen LiDAR-Markt einen aufstrebenden Markt aufgrund der raschen Industrialisierung, steigender Investitionen in Smart Cities, autonome Fahrzeuge, Infrastrukturentwicklung und einer wachsenden Nachfrage nach präzisen Kartierungs- und Umweltüberwachungslösungen.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

LiDAR-Marktanteil

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die auf dem Markt tätigen LiDAR-Marktführer sind:

- Innoviz Technologies Ltd (Israel)

- SICK AG (Deutschland)

- Hesai-Gruppe (China).

- Quanergy Solutions, Inc. (USA)

- Cepton, Inc. (USA)

- Generation Robots (Frankreich)

- Teledyne Optech China)

- Aeva Inc. (USA)

- AEye, Inc. (USA)

- Trimble Inc. (USA)

Neueste Entwicklungen auf dem globalen LiDAR-Markt

- Im Juli 2024 gab Cepton, Inc. eine endgültige Vereinbarung zur Übernahme durch Koito Manufacturing Co., Ltd. bekannt, einem langjährigen Kooperationspartner und strategischen Partner. Nach Abschluss der Übernahme wird Cepton als private indirekte Tochtergesellschaft von Koito agieren und seinen Hauptsitz in San Jose, Kalifornien, beibehalten. Diese Partnerschaft baut auf ihrer Geschichte der Entwicklung leistungsstarker LiDAR-Lösungen für Automobil- und intelligente Infrastrukturanwendungen auf. Die Übernahme soll die Einführung von LiDAR in Massenmarktanwendungen fördern und dabei die Fertigungskapazitäten von Koito und das technologische Know-how von Cepton nutzen.

- Im Mai 2024 stellte Cepton, Inc. StudioViz vor, eine proprietäre End-to-End-LiDAR-Simulationsplattform, die die Entwicklung fortschrittlicher Fahrerassistenzsysteme (ADAS) und autonomer Fahrzeuge (AVs) beschleunigen soll. StudioViz ermöglicht es OEMs und Entwicklern, LiDAR-Integrationsszenarien zu simulieren, Sensorplatzierungen zu testen und Wahrnehmungsalgorithmen zu verfeinern, ohne dass umfangreiche physische Tests erforderlich sind. Dieses Tool bietet hochpräzise 3D-Punktwolkenvisualisierungen und Funktionen zum Erstellen von Szenarien und reduziert Kosten und Komplexität bei Tests in der realen Welt, indem es verschiedene Umgebungsbedingungen virtuell nachbildet.

- Im Juni 2021 haben eledyne Optech und Teledyne CARIS, beide Unternehmen von Teledyne Technologies, die Einführung des bathymetrischen LiDAR der nächsten Generation angekündigt, den CZMIL SuperNova. Dieses innovative System bietet eine unübertroffene Tiefenleistung und die höchste grüne Laserpunktdichte seiner Klasse. Es verfügt über die SmartSpacing-Technologie für eine effiziente Punktverteilung, Echtzeitverarbeitung zur Reduzierung der Nachbearbeitungszeit und konfigurierbare Modi, die auf verschiedene Wasserumgebungen zugeschnitten sind.

- Im November 2023 sicherte sich Aeva einen Produktionsauftrag von der Nikon Corporation zur Lieferung seiner mikrometergenauen LiDAR-on-Chip-Technologie für Nikons Produkte für industrielle Messtechnik und Qualitätskontrolle. Im Rahmen der mehrjährigen Vereinbarung wird Aevas Technologie in Nikons automatisierte Inspektionslösungen für die Bereiche Automobil, Luft- und Raumfahrt sowie erneuerbare Energien integriert. Die Produktion beginnt Ende 2024 und die Produkte sind ab 2025 verfügbar.

- Im Juni 2024 hat sich Innoviz Technologies mit einem großen OEM zusammengetan, um eine neue LiDAR-Lösung für die kurze Reichweite von autonomen Fahrzeugen der Stufe 4 (L4) zu entwickeln. Diese Zusammenarbeit konzentriert sich darauf, die Fähigkeit des Fahrzeugs zu verbessern, seine Umgebung aus nächster Nähe wahrzunehmen, was zu einer präziseren und zuverlässigeren Navigation für vollständig autonomes Fahren beiträgt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONTINUOUS INNOVATIONS AND ADVANCEMENTS IN LIDAR TECHNOLOGY

5.1.2 INCREASING ADOPTION OF SURVEYING AND MAPPING

5.1.3 GROWING DEMAND FOR AUTONOMOUS VEHICLES

5.1.4 INCREASING USAGE OF LIDAR IN ENVIRONMENTAL MONITORING AND APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF LIDAR SYSTEMS

5.2.2 STIFF COMPETITION FROM ALTERNATIVE TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 EXPANDING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT ACROSS THE GLOBE

5.3.2 EMERGENCE OF DRONE-BASED LIDAR

5.3.3 INTEGRATION OF LIDAR WITH AI AND MACHINE LEARNING

5.4 CHALLENGES

5.4.1 STRINGENT REGULATIONS FOR DRONE-BASED LIDAR OPERATIONS AND PRIVACY CONCERNS

5.4.2 DATA PROCESSING, MANAGEMENT AND COMPUTATIONAL CHALLENGES

6 GLOBAL LIDAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FIXED LIDAR

6.3 ROTATING LIDAR

7 GLOBAL LIDAR MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AUTONOMOUS VEHICLES

7.3 AERIAL INSPECTION

7.4 ROBOTICS

7.5 SURVEY AND MAPPING

7.6 FORESTRY AND LAND MANAGEMENT

7.7 RENEWABLE ENERGY

7.8 OTHERS

8 GLOBAL LIDAR MARKET, BY REGION

8.1 OVERVIEW

8.2 GLOBAL

8.3 NORTH AMERICA

8.3.1 U.S.

8.3.2 CANADA

8.3.3 MEXICO

8.4 ASIA-PACIFIC

8.4.1 CHINA

8.4.2 JAPAN

8.4.3 SOUTH KOREA

8.4.4 INDIA

8.4.5 THAILAND

8.4.6 MALAYSIA

8.4.7 INDONESIA

8.4.8 VIETNAM

8.4.9 TAIWAN

8.4.10 PHILIPPINES

8.4.11 SINGAPORE

8.4.12 AUSTRALIA

8.4.13 REST OF ASIA-PACIFIC

8.5 EUROPE

8.5.1 GERMANY

8.5.2 FRANCE

8.5.3 U.K.

8.5.4 ITALY

8.5.5 SPAIN

8.5.6 RUSSIA

8.5.7 TURKEY

8.5.8 NETHERLANDS

8.5.9 BELGIUM

8.5.10 SWEDEN

8.5.11 POLAND

8.5.12 SWITZERLAND

8.5.13 REST OF EUROPE

8.6 MIDDLE EAST AND AFRICA

8.6.1 SAUDI ARABIA

8.6.2 U.A.E.

8.6.3 SOUTH AFRICA

8.6.4 EGYPT

8.6.5 ISRAEL

8.6.6 REST OF MIDDLE EAST AND AFRICA

8.7 SOUTH AMERICA

8.7.1 BRAZIL

8.7.2 ARGENTINA

8.7.3 REST OF SOUTH AMERICA

9 GLOBAL LIDAR MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: GLOBAL

9.2 COMPANY SHARE ANALYSIS: EUROPE

9.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 TELEDYNE GEOSPATIAL

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENT

11.2 TRIMBLE INC

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENT

11.3 SICK AG

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 HESAI GROUP

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENT

11.5 AEVA INC

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 AEYE, INC.

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 CEPTON, INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 GÉNÉRATION ROBOTS

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 INNOVIZ TECHNOLOGIES LTD

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 QUSNERGY SOLUTIONS, INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 GLOBAL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL FIXED LIDAR IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL ROTATING LIDAR IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL LIDAR MARKET, BY APPLICATION, 2024, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL AUTONOMOUS VEHICLES IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL AERIAL INSPECTION IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL ROBOTICS IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL SURVEY AND MAPPING IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL FORESTRY AND LAND MANAGEMENT IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL RENEWABLE ENERGY IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL OTHERS IN LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL LIDAR MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 CANADA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 CANADA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 SOUTH KOREA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 SOUTH KOREA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 INDIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 INDIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 THAILAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 THAILAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MALAYSIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MALAYSIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 INDONESIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 INDONESIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 VIETNAM LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 VIETNAM LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 TAIWAN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 TAIWAN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 PHILIPPINES LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 PHILIPPINES LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 45 SINGAPORE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 SINGAPORE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 REST OF ASIA-PACIFIC LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 GERMANY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 FRANCE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 FRANCE LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 ITALY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ITALY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 SPAIN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SPAIN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 63 RUSSIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 RUSSIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 TURKEY LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 TURKEY LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 NETHERLANDS LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NETHERLANDS LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 BELGIUM LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 BELGIUM LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 SWEDEN LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SWEDEN LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 POLAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 POLAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SWITZERLAND LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SWITZERLAND LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 REST OF EUROPE LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 EGYPT LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 EGYPT LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 ISRAEL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ISRAEL LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 REST OF MIDDLE EAST AND AFRICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AMERICA LIDAR MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AMERICA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 BRAZIL LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 BRAZIL LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 ARGENTINA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 ARGENTINA LIDAR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 REST OF SOUTH AMERICA LIDAR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 GLOBAL LIDAR MARKET

FIGURE 2 GLOBAL LIDAR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LIDAR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LIDAR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LIDAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LIDAR MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL LIDAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL LIDAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL LIDAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL LIDAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL LIDAR MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE GLOBAL LIDAR MARKET, BY TYPE

FIGURE 13 GLOBAL LIDAR MARKET:-STRATEGIC DECISIONS

FIGURE 14 GLOBAL LIDAR MARKET EXECUTIVE SUMMARY

FIGURE 15 CONTINUOUS INNOVATIONS AND ADVANCEMENTS IN LIDAR TECHNOLOGY ARE EXPECTED TO DRIVE THE GLOBAL LIDAR MARKET IN THE FORECAST PERIOD

FIGURE 16 THE FIXED LIDAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL LIDAR MARKET IN 2025 AND 2032

FIGURE 17 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL LIDAR MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL LIDAR MARKET

FIGURE 19 GLOBAL LIDAR MARKET: BY TYPE, 2024

FIGURE 20 GLOBAL LIDAR MARKET: BY APPLICATION, 2024

FIGURE 21 GLOBAL LIDAR MARKET: SNAPSHOT (2024)

FIGURE 22 NORTH AMERICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 23 ASIA-PACIFIC LIDAR MARKET: SNAPSHOT (2024)

FIGURE 24 EUROPE LIDAR MARKET: SNAPSHOT (2024)

FIGURE 25 MIDDLE EAST AND AFRICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 26 SOUTH AMERICA LIDAR MARKET: SNAPSHOT (2024)

FIGURE 27 GLOBAL LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 28 EUROPE LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 29 ASIA-PACIFC LIDAR MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 NORTH AMERICA LIDAR MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.