Global Laboratory Centrifuge Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.06 Billion

USD

2.90 Billion

2024

2032

USD

2.06 Billion

USD

2.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 2.90 Billion | |

|

|

|

|

Globale Marktsegmentierung für Laborzentrifugen nach Produkttyp (Geräte und Zubehör), Modelltyp (Tischzentrifugen und Standzentrifugen), Rotordesign (Festwinkelrotoren und Ausschwingrotoren), Verwendungszweck (Allzweckzentrifugen und klinische Zentrifugen), Anwendung (Diagnostik, Mikrobiologie und Cellomics), Endbenutzer (Krankenhaus und Biotechnologie) – Branchentrends und Prognose bis 2032

Marktgröße für Laborzentrifugen

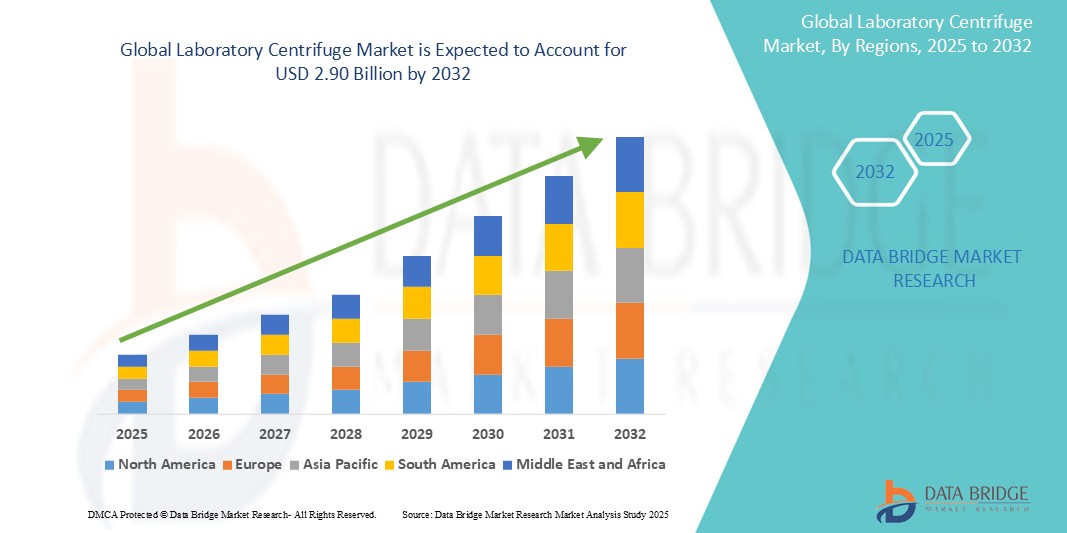

- Der globale Markt für Laborzentrifugen wird im Jahr 2024 auf 2,06 Milliarden US-Dollar geschätzt und soll bis 2032 2,90 Milliarden US-Dollar erreichen , bei einer CAGR von 4,36 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie die steigende Nachfrage nach fortschrittlichen Diagnosetechniken, steigende Investitionen in Biotechnologie und Pharmaforschung vorangetrieben.

Marktanalyse für Laborzentrifugen

- Eine Laborzentrifuge ist ein Gerät, mit dem die Bestandteile einer Mischung anhand ihrer Dichte getrennt werden, indem die Mischung mit hoher Geschwindigkeit gedreht wird. Die Zentrifuge arbeitet nach dem Prinzip der Zentrifugalkraft, die schwerere Materialien an den äußeren Rand des rotierenden Behälters drückt und so die Trennung verschiedener Substanzen in der Probe ermöglicht.

- Laborzentrifugen werden häufig in der wissenschaftlichen Forschung, in klinischen Laboren und in industriellen Anwendungen eingesetzt, um Zellen, Viren, subzelluläre Organellen, Proteine, Nukleinsäuren und andere biologische Moleküle zu isolieren und zu reinigen.

- Es wird erwartet, dass Nordamerika den Markt für Laborzentrifugen mit 35,60 % dominieren wird, aufgrund der fortschrittlichen Gesundheitsinfrastruktur, hoher Investitionen in Forschung und Entwicklung (F&E)

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund erheblicher Investitionen in die Biotechnologie und die pharmazeutische Forschung die am schnellsten wachsende Region auf dem Markt für Laborzentrifugen sein.

- Das Segment der Standzentrifugen wird voraussichtlich den Markt mit einem Marktanteil von 55,33 % dominieren, da es technologische Fortschritte und kontinuierliche Innovationen aufweist. Aufgrund der gestiegenen Nachfrage nach Hochleistungs- und Hochgeschwindigkeitszentrifugen in Forschungs- und klinischen Laboren

Berichtsumfang und Marktsegmentierung für Laborzentrifugen

|

Eigenschaften |

Wichtige Markteinblicke für Laborzentrifugen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Markttrends für Laborzentrifugen

„Steigende Nachfrage im Gesundheitswesen und in den Biowissenschaften“

- Der weltweite Anstieg chronischer Krankheiten wie Krebs, Diabetes und Herz-Kreislauf-Erkrankungen treibt die Nachfrage nach Laborzentrifugen erheblich an

- Innovationen in der Zentrifugentechnologie, wie Hochgeschwindigkeits- und Ultrageschwindigkeitsmodelle, verbesserte Rotordesigns und die Integration von Automatisierung und Digitalisierung, steigern die Effizienz und Genauigkeit von Laborprozessen

- Diese Fortschritte ermöglichen eine schnellere Probenverarbeitung und -analyse und erfüllen die wachsenden Anforderungen des Gesundheitswesens und der Biowissenschaften.

- Das Wachstum der Biotechnologie- und Pharmabranche, insbesondere in den Schwellenländern, führt zu einer höheren Nachfrage nach Laborzentrifugen für Forschungs-, Entwicklungs- und Qualitätskontrollzwecke.

- So tragen Investitionen in Forschungs- und Entwicklungsaktivitäten, wie das Programm der indischen Regierung zur Förderung von Forschung und Innovation im Pharma- und Medizintechniksektor (PRIP), zusätzlich zu dieser Nachfrage bei.

- Fortschritte bei digitalen Schnittstellen und der Integration mit LIMS haben die Abläufe in Laboren rationalisiert und die Produktivität sowie das Datenmanagement verbessert.

- So verfügt beispielsweise die Corning LSE Mini-Mikrozentrifuge über eine digitale Steuerschnittstelle und Hochgeschwindigkeitsleistung für schnelle Nukleinsäure- und Proteintrennungen und verdeutlicht damit den Trend zu effizienteren und benutzerfreundlicheren Laborgeräten.

- Staatliche Initiativen zur Förderung von Forschung und Entwicklung in den Biowissenschaften sowie die finanzielle Unterstützung der Laborinfrastruktur tragen zur Marktexpansion bei

Marktdynamik für Laborzentrifugen

Treiber

„Technologische Fortschritte im Zentrifugendesign“

- Die Entwicklung von Hochgeschwindigkeits- und Ultrageschwindigkeitszentrifugen hat die Effizienz und Genauigkeit von Laborprozessen verbessert und ermöglicht eine schnellere Probenverarbeitung und -analyse

- Innovationen im Rotordesign haben die Leistung von Zentrifugen verbessert und ermöglichen eine bessere Trennung der Komponenten und einen höheren Durchsatz.

- Die Integration von Automatisierung und Digitalisierung in Zentrifugensysteme hat die Arbeitsabläufe im Labor optimiert, menschliche Fehler reduziert und die Produktivität gesteigert.

- Die Entwicklung kompakter und benutzerfreundlicher Zentrifugenmodelle hat diese Geräte für kleinere Labore und Forschungseinrichtungen zugänglicher gemacht und ihre Akzeptanz erhöht.

- Fortschritte bei Sicherheitsfunktionen wie versiegelten Rotoren und fortschrittlichen Eindämmungssystemen haben das Risiko einer Exposition gegenüber gefährlichen Stoffen verringert und so eine sicherere Arbeitsumgebung für das Laborpersonal geschaffen.

Gelegenheit

„Integration von Automatisierung und erweiterten Funktionen“

- Die Integration der Automatisierung in Laborabläufe ermöglicht effizientere und reproduzierbarere Prozesse, reduziert manuelle Eingriffe und erhöht den Durchsatz

- Durch die Integration erweiterter Funktionen wie Temperaturregelung und programmierbarer Einstellungen können Zentrifugen spezielle Anwendungen bewältigen, einschließlich der Verarbeitung empfindlicher biologischer Proben

- Die Möglichkeit, den Zentrifugenbetrieb aus der Ferne zu überwachen und zu steuern, erhöht die Flexibilität und den Komfort und ermöglicht Anpassungen und Kontrolle in Echtzeit.

- Die Integration von Zentrifugen in LIMS ermöglicht nahtloses Datenmanagement und Rückverfolgbarkeit und verbessert so die Gesamteffizienz des Labors.

- Die Entwicklung anpassbarer Zentrifugenmodelle, die auf spezifische Anwendungen wie Genomik oder Proteomik zugeschnitten sind, eröffnet neue Wege für Marktwachstum und Diversifizierung

Einschränkung/Herausforderung

„Hohe Ausrüstungskosten“

- Die hohe Anfangsinvestition für den Kauf moderner Zentrifugenmodelle kann für kleinere Labore und Forschungseinrichtungen mit begrenztem Budget ein Hindernis darstellen.

- Die laufenden Wartungs- und Betriebskosten für Zentrifugenanlagen, einschließlich des Austauschs von Verbrauchsmaterialien und der Wartung, können die finanzielle Belastung zusätzlich erhöhen.

- Die Kosten für Zubehör wie spezielle Rotoren und Röhrchen können beträchtlich sein, insbesondere bei Hochgeschwindigkeits- und Ultrageschwindigkeitszentrifugen, was sie für kostenbewusste Institutionen weniger erschwinglich macht.

- Der intensive Wettbewerb zwischen den Herstellern kann einen Abwärtsdruck auf die Preise ausüben und so möglicherweise die Rentabilität der Unternehmen auf dem Markt beeinträchtigen.

- Wirtschaftliche Zwänge in Schwellenländern können die Einführung fortschrittlicher Zentrifugentechnologien einschränken und so das Marktwachstum in diesen Regionen behindern.

Marktumfang für Laborzentrifugen

Der Markt ist nach Produkttyp, Modelltyp, Rotordesign, Verwendungszweck, Anwendung und Endbenutzer segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkttyp |

|

|

Nach Modelltyp |

|

|

Von Rotor Design |

|

|

Nach Verwendungszweck |

|

|

Nach Anwendung |

|

|

Nach Endbenutzer |

|

Im Jahr 2025 wird die Standzentrifuge voraussichtlich den Markt dominieren und den größten Anteil im Modelltypsegment haben.

Das Segment der Standzentrifugen wird voraussichtlich im Jahr 2025 den Markt für Laborzentrifugen mit einem Marktanteil von 55,33 % dominieren. Dies ist auf den technologischen Fortschritt und die kontinuierliche Innovation zurückzuführen. Grund dafür ist die steigende Nachfrage nach Hochleistungs- und Hochgeschwindigkeitszentrifugen in Forschungs- und klinischen Laboren. Diese Zentrifugen sind beliebt, um größere Probenvolumina zu verarbeiten und präzise Ergebnisse zu liefern.

Es wird erwartet, dass die klinische Zentrifuge im Prognosezeitraum den größten Anteil am Markt für bestimmungsgemäße Verwendung ausmachen wird

Im Jahr 2025 wird das Segment der klinischen Zentrifugen voraussichtlich den Markt mit einem Marktanteil von 45,28 % dominieren, da die Nachfrage nach präzisen und effizienten diagnostischen Tests in Krankenhäusern, Forschungslaboren und klinischen Einrichtungen steigt. Klinische Zentrifugen sind unverzichtbare Geräte im medizinischen Bereich, da sie eine entscheidende Rolle bei der Trennung verschiedener Komponenten biologischer Proben spielen.

Regionale Analyse des Marktes für Laborzentrifugen

„Nordamerika hält den größten Anteil am Markt für Laborzentrifugen“

- Nordamerika hielt mit 35,60 % den größten Anteil am globalen Markt für Laborzentrifugen. Diese Dominanz ist vor allem auf die fortschrittliche Gesundheitsinfrastruktur der Region, hohe Investitionen in Forschung und Entwicklung (F&E) und die Präsenz wichtiger Märkte zurückzuführen.

- Die Region ist führend bei technologischen Innovationen im Bereich Laborzentrifugen.

- Thermo Fisher Scientific hat beispielsweise das DynaSpin Single-Use-Zentrifugensystem eingeführt, das auf die effiziente Ernte von Zellkulturen im großen Maßstab zugeschnitten ist.

- Die zunehmende Zahl von Krankheiten wie Tuberkulose und HIV in Nordamerika treibt die Nachfrage nach Laborzentrifugen an.

- So wurden in Kanada beispielsweise 77 aktive Tuberkulosefälle gemeldet, mehr als doppelt so viele wie im Vorjahr, was den Bedarf an Diagnoseinstrumenten unterstreicht.

- Unternehmen wie Thermo Fisher Scientific, Beckman Coulter und PerkinElmer tragen maßgeblich zum Wachstum des Marktes bei und bieten eine breite Palette an Zentrifugenprodukten und -dienstleistungen an.

- Umfangreiche staatliche Förderung von Gesundheits- und Forschungsinitiativen unterstützt das Wachstum des Laborzentrifugenmarktes in Nordamerika weiter

„Im asiatisch-pazifischen Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem Markt für Laborzentrifugen verzeichnet“

- Der asiatisch-pazifische Raum wird voraussichtlich das schnellste Wachstum im Markt für Laborzentrifugen erleben

- Länder wie China, Indien und Japan investieren massiv in die Gesundheitsinfrastruktur, was zu einer erhöhten Nachfrage nach Laborgeräten, einschließlich Zentrifugen, führt.

- Erhebliche Investitionen in Biotechnologie und Pharmaforschung treiben den Bedarf an fortschrittlichen Labortechnologien in der Region voran

- Regierungsinitiativen zur Verbesserung des Zugangs und der Qualität der Gesundheitsversorgung tragen zum Wachstum des Marktes für Laborzentrifugen im asiatisch-pazifischen Raum bei

- Kooperationen zwischen Unternehmen und Forschungseinrichtungen verbessern die Verfügbarkeit und Nutzung fortschrittlicher Zentrifugentechnologien in der Region

Marktanteil von Laborzentrifugen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Thermo Fisher Scientific Inc. (USA)

- Andreas Hettich GmbH & Co. KG (Deutschland)

- Eppendorf SE (Deutschland)

- NuAire, Inc. (USA)

- Danaher Corporation (USA)

- Lepu Medical Technology (Beijing) Co., Ltd (China)

- Sartorius AG (Deutschland)

- Becton, Dickinson and Company (USA)

- Kubota Corporation (Japan)

- Agilent Technologies, Inc. (USA)

Neueste Entwicklungen auf dem globalen Markt für Laborzentrifugen

- Im Juli 2024 ging die Hettich Gruppe, ein führender Anbieter von Laborzentrifugen, eine Wachstumspartnerschaft mit Bregal Unternehmerkapital ein. Im Rahmen dieser Partnerschaft wird Bregal Unternehmerkapital sein internationales Netzwerk nutzen, um die organische und anorganische Expansion der Hettich Gruppe, insbesondere in Asien und den USA, zu unterstützen.

- Im Januar 2024 übernahm die Hettich Gruppe Kirsch Medical, Hersteller von Kühl- und Gefrierlösungen für Labore und das Gesundheitswesen. Diese strategische Akquisition soll die Entwicklung neuartiger Laborzentrifugen durch die Hettich Gruppe unterstützen.

- Im April 2023 brachte Eppendorf die Centrifuge 5427 R auf den Markt, seine erste Mikrozentrifuge mit Kohlenwasserstoffkühlung, um eine nachhaltigere Laborumgebung zu fördern. Dieses gekühlte Gerät nutzt ein natürliches Kühlmittel mit nahezu null Treibhauspotenzial (GWP). So können Kunden verschiedene molekular- und zellbiologische Anwendungen durchführen und gleichzeitig die Umweltbelastung minimieren.

- Im August 2023 brachte Boekel Scientific eine neue Produktlinie mit vier Zentrifugenfamilien auf den Markt: Allzweck-, Notfall-, Economy- und Blutbank-Zentrifugen. Diese Linie umfasst insgesamt elf Zentrifugenmodelle, die alle Langlebigkeit und Reproduzierbarkeit vereinen und gleichzeitig Vielseitigkeit bei der präanalytischen Probenvorbereitung bieten. Diese Zentrifugen sind für Labore jeder Größe geeignet und in verschiedenen Kapazitäten mit 6, 12 und 24 Plätzen erhältlich. Alle sind mit abnehmbaren Rotoren ausgestattet, um den unterschiedlichen Betriebsanforderungen gerecht zu werden.

- Im Oktober 2022 stellte Genfolllower eine neue Mini-Mikrozentrifuge für den persönlichen Gebrauch vor. Dieses kompakte Gerät ist flexibel und kostengünstig konzipiert und eignet sich für jeden Arbeitsplatz, der eine „persönliche“ Minizentrifuge benötigt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.