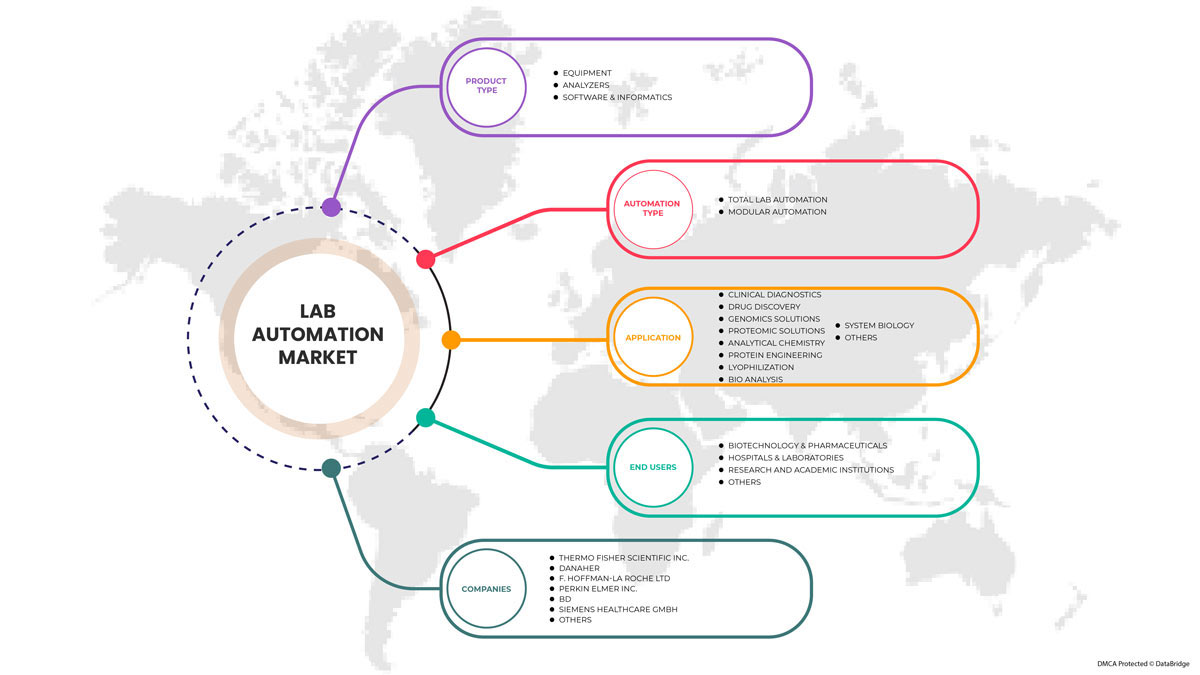

Globaler Markt für Laborautomatisierung, nach Produkttyp (Geräte, Software & Informatik und Analysatoren), Automatisierungstyp (Modulare Automatisierung und vollständige Laborautomatisierung), Anwendung (Arzneimittelentdeckung, Klinische Diagnostik, Genomiklösungen , Proteomiklösungen, Bioanalyse, Protein-Engineering, Gefriertrocknung, Systembiologie, Analytische Chemie und andere), Endbenutzer (Biotechnologie & Pharmazeutika, Krankenhäuser & Labore, Forschungs- und akademische Einrichtungen und andere) – Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke in die Laborautomatisierung

Die Nachfrage auf dem Markt für Laborautomatisierung steigt aufgrund des technologischen Fortschritts auf der ganzen Welt. Im Gesundheitssektor werden Laborautomatisierungsgeräte und -werkzeuge eingesetzt. Da die Gesundheitsausgaben aufgrund verschiedener Faktoren gestiegen sind, müssen die führenden Pharma- und Gesundheitsunternehmen die Labore automatisieren, um fortschrittliche Gesundheitsdienstleistungen in kürzerer Zeit direkt vor der Haustür anbieten zu können.

Die wachsende Nachfrage nach Gesundheitsprodukten auf dem Markt ist der Hauptgrund für den Wettbewerb zwischen den führenden Gesundheits- und Pharmaunternehmen bei der Verbesserung der Laborautomatisierung weltweit. Der Anstieg der Nutzung von Geräten, Analysegeräten und Software für das Labor wurde genutzt. Der Schwerpunkt der Marktteilnehmer liegt darauf, eine Vielfalt an Werkzeugen, Geräten, Maschinen und Techniken bereitzustellen, um die Entwicklung und Herstellung einer automatisierten Laborinfrastruktur zu unterstützen. Die Marktteilnehmer investieren mehr und finanzieren mehr, um fortschrittliche Technologien und Methoden zu entwickeln.

Die Gesundheitsausgaben sind aufgrund verschiedener Faktoren gestiegen, wie beispielsweise der alternden Bevölkerung, der Häufigkeit chronischer Krankheiten, steigender Medikamentenpreise, Kosten für Gesundheitsdienstleistungen und Verwaltungskosten. Darüber hinaus gibt es immer mehr Krankenhäuser, private Labore, Zentren für klinische Forschung und Diagnostik, was die Nachfrage nach Laborautomatisierung erhöht.

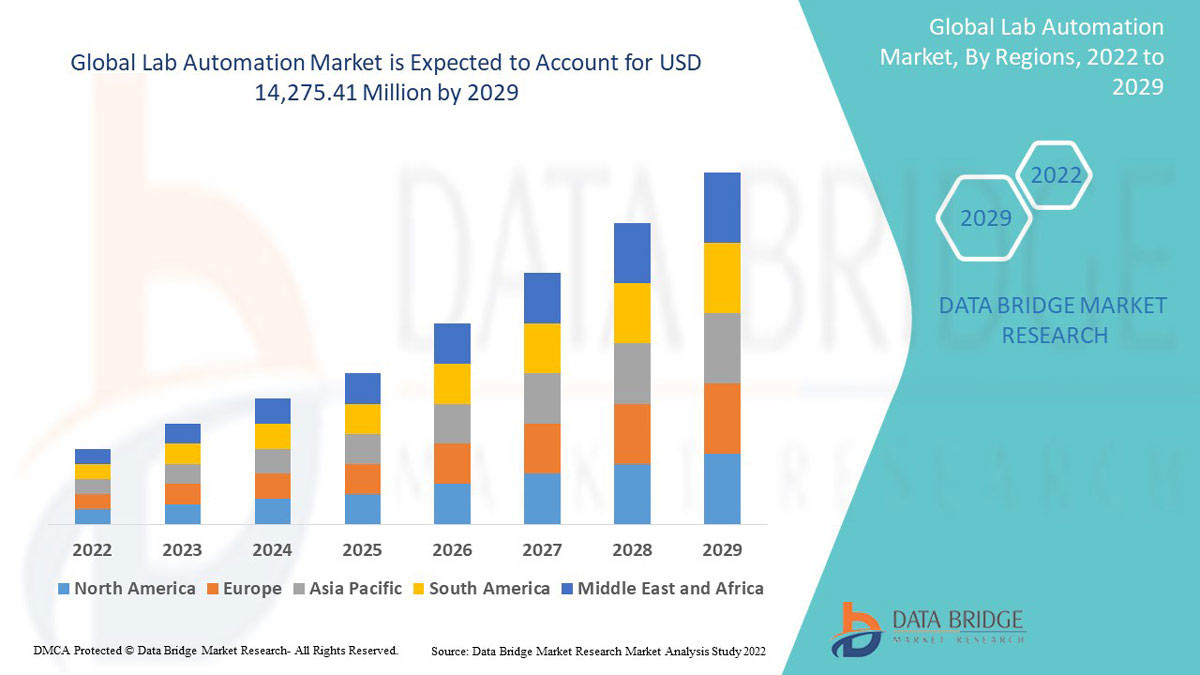

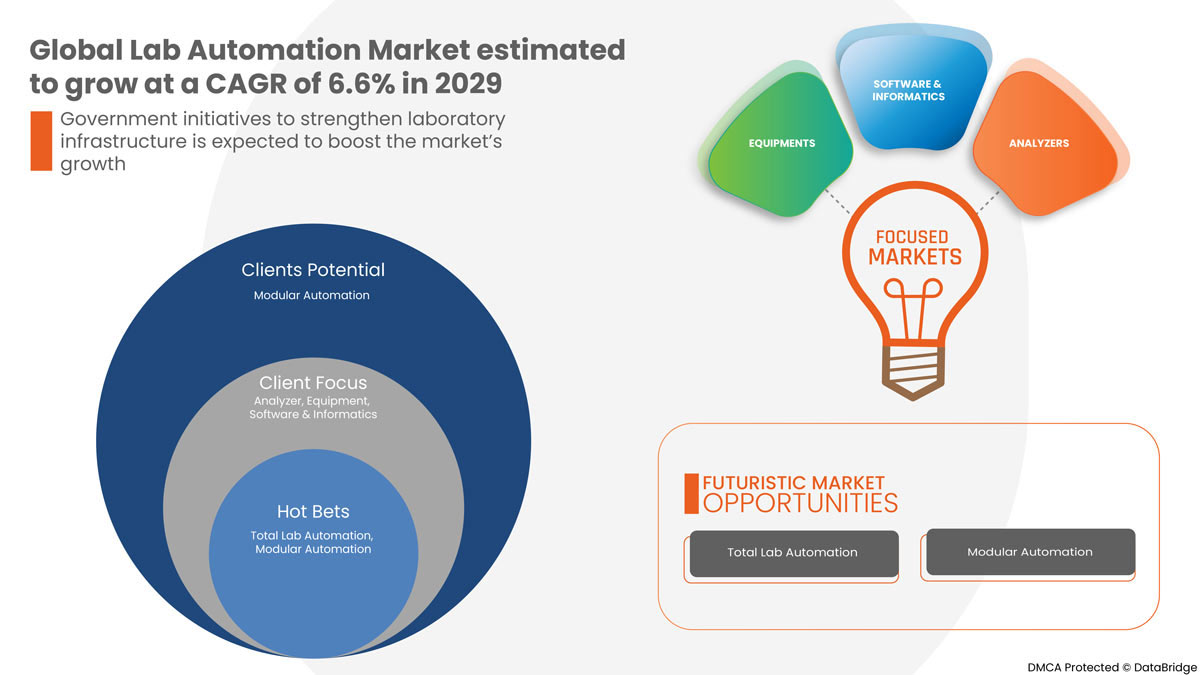

Der globale Markt für Laborautomatisierung dürfte im Prognosezeitraum von 2022 bis 2029 ein Marktwachstum verzeichnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,6 % wächst und bis 2029 voraussichtlich 14.275,41 Millionen USD erreichen wird.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 (anpassbar auf 2019–2014) |

|

Quantitative Einheiten |

Umsatz in Mio. USD |

|

Abgedeckte Segmente |

Nach Produkttyp (Geräte, Software & Informatik und Analysator), Automatisierungstyp (Modulare Automatisierung und vollständige Laborautomatisierung), Anwendung (Arzneimittelentdeckung, Klinische Diagnostik, Genomiklösungen, Proteomiklösungen, Bioanalyse, Protein-Engineering, Gefriertrocknung, Systembiologie, Analytische Chemie und andere), Endnutzer (Biotechnologie & Pharmazeutika, Krankenhäuser & Labore, Forschungs- und akademische Einrichtungen und andere) |

|

Abgedeckte Länder |

USA, Kanada, Mexiko, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Niederlande, Russland, Belgien, Schweiz, Türkei, Restliches Europa, China, Japan, Indien, Südkorea, Australien, Singapur, Thailand, Malaysia, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Brasilien, Argentinien, Restliches Südamerika, Südafrika, Saudi-Arabien, Vereinigte Arabische Emirate und Restlicher Naher Osten und Afrika |

|

Abgedeckte Marktteilnehmer |

QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE und Labware unter anderem |

Marktdefinition

Laborautomatisierung ist die Kombination automatisierter Technologien im Labor, um neue und verbesserte Prozesse zu ermöglichen. Sie wird als Strategie zur Erforschung, Entwicklung, Optimierung und Nutzung von Technologien im Labor eingesetzt. Sie wird speziell zur Automatisierung von Laborprozessen verwendet, die nur minimalen menschlichen Aufwand erfordern und menschliche Fehler ausschließen. Laborautomatisierung wird mit dem Ziel eingesetzt, effizientere Tests und Diagnosen bereitzustellen.

Durch Laborautomatisierung können Forscher und Techniker in kürzerer Zeit effizient und effektiv Ergebnisse erzielen, was den Markt für Laborautomatisierung voraussichtlich ankurbeln wird. Darüber hinaus lässt die schnelle Verbreitung von Krankheiten sowie neue Erkenntnisse im Gesundheitsbereich die Nachfrage nach Diagnosen und Behandlungen steigen, was den Markt für Laborautomatisierung voraussichtlich ankurbeln wird. Hohe staatliche und private Mittel für Forschung und Entdeckungsforschung sowie die Präsenz wichtiger Marktteilnehmer tragen ebenfalls zum Marktwachstum bei.

Globale Marktdynamik für Laborautomatisierung

Treiber

- Steigende Investitionen und strategische Initiativen der Marktteilnehmer

Der Markt für Laborautomatisierung wächst, da eine hohe Nachfrage nach spezialisierten, fortschrittlichen Automatisierungsdiensten besteht, die menschliche Fehler ausschließen. Der Schwerpunkt der Marktteilnehmer und Unternehmen liegt darauf, eine Vielfalt an Werkzeugen, Geräten, Maschinen und Techniken bereitzustellen, um die Entwicklung und Herstellung automatisierter Laborinfrastruktur zu unterstützen. Der Markt für Laborautomatisierung wächst, da eine hohe Nachfrage nach spezialisierten, fortschrittlichen Automatisierungsdiensten besteht, die menschliche Fehler ausschließen. Um den globalen Marktanteil zu erobern, investieren die Marktteilnehmer mehr und finanzieren die Entwicklung fortschrittlicher Technologien und Methoden. Diese Akteure konzentrieren sich stärker darauf, den manuellen Aufwand und die Arbeitszeit für den traditionell arbeitsintensiven Prozess zu reduzieren. Dies dürfte das Marktwachstum vorantreiben.

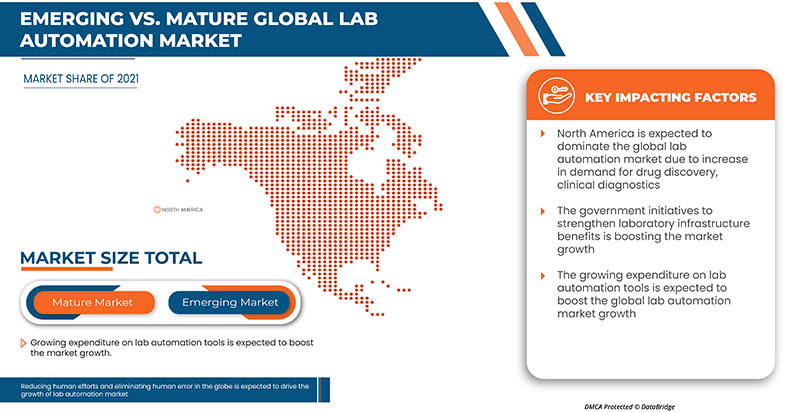

- Regierungsinitiativen zur Stärkung der Laborinfrastruktur

Um den Gesundheitssektor und die Laborinfrastruktur weiter zu stärken, spielen Regierungsorganisationen eine wichtige Rolle. Die staatliche Finanzierung und Initiative zur Ausweitung der Laborautomatisierung wird das Marktwachstum fördern und die Zahl der Marktteilnehmer erhöhen. Die Zusammenarbeit und Vereinbarungen der Regierung mit den wichtigsten Marktteilnehmern werden die Laborinfrastruktur weiter stärken.

- Steigende Ausgaben für Werkzeuge und Geräte zur Laborautomatisierung

Die Ausgaben für Werkzeuge und Geräte zur Laborautomatisierung steigen. Dies liegt vor allem daran, dass die Nachfrage nach Laboruntersuchungen aus verschiedenen Gründen rapide zunimmt, beispielsweise aufgrund der alternden Bevölkerung, der Zunahme chronischer Krankheiten, der Entdeckung neuer und wirksamerer Biomarker und der Zunahme allgemeiner Anforderungen an die Gesundheit oder Diagnostik.

- Reduzierung des menschlichen Aufwands und Beseitigung menschlicher Fehler

Es gibt mehrere traditionelle Möglichkeiten, menschliche Fehler zu reduzieren, aber die Entwicklung eines Systems zur Minimierung des Risikos menschlicher Fehler wird dazu beitragen, dass Sie dieselben Fehler nicht noch einmal wiederholen. Produktionsstätten konzentrieren sich auf den Aufbau fortschrittlicher Systeme, um mithilfe künstlicher Intelligenz Probleme zu erkennen und zu beheben, bevor sie auftreten.

Gelegenheiten

-

Steigende Gesundheitsausgaben

Die Gesundheitsausgaben sind aufgrund verschiedener Faktoren gestiegen, darunter die alternde Bevölkerung, die Prävalenz chronischer Krankheiten, steigende Medikamentenpreise, Kosten für Gesundheitsdienstleistungen und Verwaltungskosten. Der Wendepunkt war jedoch das Jahr 2020, in dem die Ausgaben aufgrund der COVID-19-Pandemie am höchsten waren. Es wurde festgestellt, dass die Gesundheitsausgaben im Jahr 2020 aufgrund der Pandemie mit der höchsten Wachstumsrate seit 2002 wuchsen .

-

Strategische Initiativen wichtiger Akteure

Die führenden Pharma- und Gesundheitsunternehmen haben verschiedene Initiativen ergriffen, um die Labore zu automatisieren und so fortschrittliche Gesundheitsdienstleistungen in kürzerer Zeit direkt an die Haustür zu liefern. Die wachsende Nachfrage nach Gesundheitsdienstleistungen auf dem Markt ist der Hauptgrund für den Wettbewerb zwischen den führenden Gesundheits- und Pharmaunternehmen bei der Verbesserung der Laborautomatisierung weltweit. Daher wird erwartet, dass die strategischen Initiativen der Marktteilnehmer eine Chance für das Wachstum des Laborautomatisierungsmarktes darstellen.

-

Anstieg der Zahl der Pharmaunternehmen

Die Pharmaindustrie hat in den letzten zwei Jahrzehnten ein starkes Wachstum erlebt. Steigende verfügbare Einkommen, verbesserter Zugang zu Gesundheitseinrichtungen, wachsendes Gesundheitsbewusstsein in der Bevölkerung und eine zunehmende Verbreitung medizinischer Dienstleistungen führen dazu, dass die Zahl der Pharmaunternehmen steigt, um die Nachfrage zu decken.

Die COVID-19-Pandemie hatte große Auswirkungen auf die Pharmaindustrie, da die Nachfrage nach medizinischen Dienstleistungen und Medikamentenlieferungen gestiegen ist. Die Pharmaindustrie wächst weltweit schnell, um die hohe Nachfrage der Menschheit zu decken, und daher müssen die Dienstleistungen so schnell wie möglich erbracht werden. Um also eine fehlerfreie, schnelle Versorgung moderner Gesundheitseinrichtungen in kürzerer Zeit zu erreichen, ist eine Laborautomatisierung erforderlich. Daher wird erwartet, dass der Anstieg der Zahl der Pharmaunternehmen eine Chance für das Wachstum des Marktes für Laborautomatisierung darstellt.

Einschränkungen/Herausforderungen

- Einschränkung bei der Analyse neuartiger komplexer Produkte

Es gibt verschiedene Faktoren, die zur Komplexität neuartiger Produkte beitragen, die in automatisierten Laboren verwendet werden. Die kontinuierliche Zusammenarbeit zwischen Mitarbeitern und Geräteherstellern zu Beginn des Entwicklungsprozesses ist dringend erforderlich und wird zum Verständnis zwingend erforderlich, um das Teil oder das Gesamtsystem zu betreiben. Einschränkungen bei der Erkennung und Analyse neuartiger komplexer Produkte wie Maschinen, Werkzeuge und Geräte erschweren die Installation und den Betrieb automatisierter Labore auf dem Markt.

- Hohe Kosten für Installation und Einrichtung

Die Installation und Einrichtung von Laborautomatisierungssystemen sind wesentlich arbeitsintensivere und komplexere Verfahren. Die Einrichtung automatisierter Labors erfordert viel Zeit, Aufwand, Planung, Umsetzung und Genehmigungen verschiedener Regierungsbehörden. Darüber hinaus ist für die Einrichtung eines neuen Labors aufgrund der hohen Kosten für moderne Maschinen, Werkzeuge und Geräte eine erhebliche Investition in die Infrastruktur erforderlich.

- Upgrade, Wartung und regelmäßige Überprüfungen

Nach der Einrichtung ist der effiziente Betrieb von Laboren das Hauptanliegen. Für den Betrieb sind Wartung, Aufrüstung und regelmäßige Überprüfung der Geräte erforderlich. Die dafür erforderlichen Kosten sind einer der Haupthemmfaktoren für die Marktteilnehmer. Die Laborinhaber sind durch Vorschriften oder Qualitätskontrollen verpflichtet, ihre Produkte unabhängig von den Herstellerfirmen zu testen, um einen reibungslosen Betrieb zu gewährleisten und Umstände zu vermeiden. Dies kann das Marktwachstum hemmen.

Auswirkungen von COVID-19 auf den globalen Markt für Laborautomatisierung

COVID-19 hat sich positiv auf den Automatisierungsmarkt ausgewirkt. Aufgrund der Pandemie wurde die Gesundheit der Menschen beeinträchtigt, wodurch viele Diagnosetests durchgeführt wurden und die Nachfrage stieg. Private Labore, Krankenhäuser und klinische Forschung nahmen aufgrund der Pandemie zu. Somit hat COVID-19 den Markt für Laborautomatisierung positiv beeinflusst.

Jüngste Entwicklungen

- Im Juni 2022 gab BD bekannt, dass die Übernahme der Straub Medical AG, eines Privatunternehmens, abgeschlossen wurde. Mit dieser Übernahme hat das Unternehmen das wertvolle Know-how und die Erfahrung der Straub Medical AG hinzugefügt und sein Produktportfolio erweitert

- Im Januar 2022 gab QIAGEN bekannt, dass es neue Kooperationen mit Atlia Biosystems eingegangen ist, um nicht-invasive pränatale Testlösungen anzubieten.

Globaler Marktumfang für Laborautomatisierung

Der globale Markt für Laborautomatisierung ist segmentiert in Produkttyp, Produktkategorie, automatisierte Systeme, Anwendung und Endbenutzer. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Produkttyp

- Ausrüstung

- Analysator

- Software & Informatik

Basierend auf dem Produkttyp ist der globale Markt für Laborautomatisierung in Geräte, Analysegeräte sowie Software und Informatik segmentiert.

Automatisierte Systeme

- Vollständige Laborautomatisierung

- Modulare Laborautomatisierung

Basierend auf automatisierten Systemen ist der globale Markt für Laborautomatisierung in die Bereiche Gesamtlaborautomatisierung und modulare Laborautomatisierung segmentiert.

Anwendung

- Klinische Diagnostik

- Arzneimittelforschung

- Genomik-Lösungen

- Proteomische Lösungen

- Analytische Chemie

- Protein-Engineering

- Gefriertrocknung

- Bioanalyse

- Systembiologie

- Sonstiges

Basierend auf der Anwendung ist der globale Markt für Laborautomatisierung in Arzneimittelforschung, klinische Diagnostik, Genomlösungen, Proteomlösungen, Bioanalyse, Protein-Engineering, Gefriertrocknung, Systembiologie, analytische Chemie und andere unterteilt.

Endbenutzer

- Biotechnologie und Pharmazeutik

- Krankenhäuser und Labore

- Forschungs- und akademische Institute

- Sonstiges

Basierend auf dem Endbenutzer ist der globale Markt für Laborautomatisierung in die Bereiche Biotechnologie und Pharmazeutik, Krankenhäuser und Labore, Forschungs- und akademische Einrichtungen und andere unterteilt.

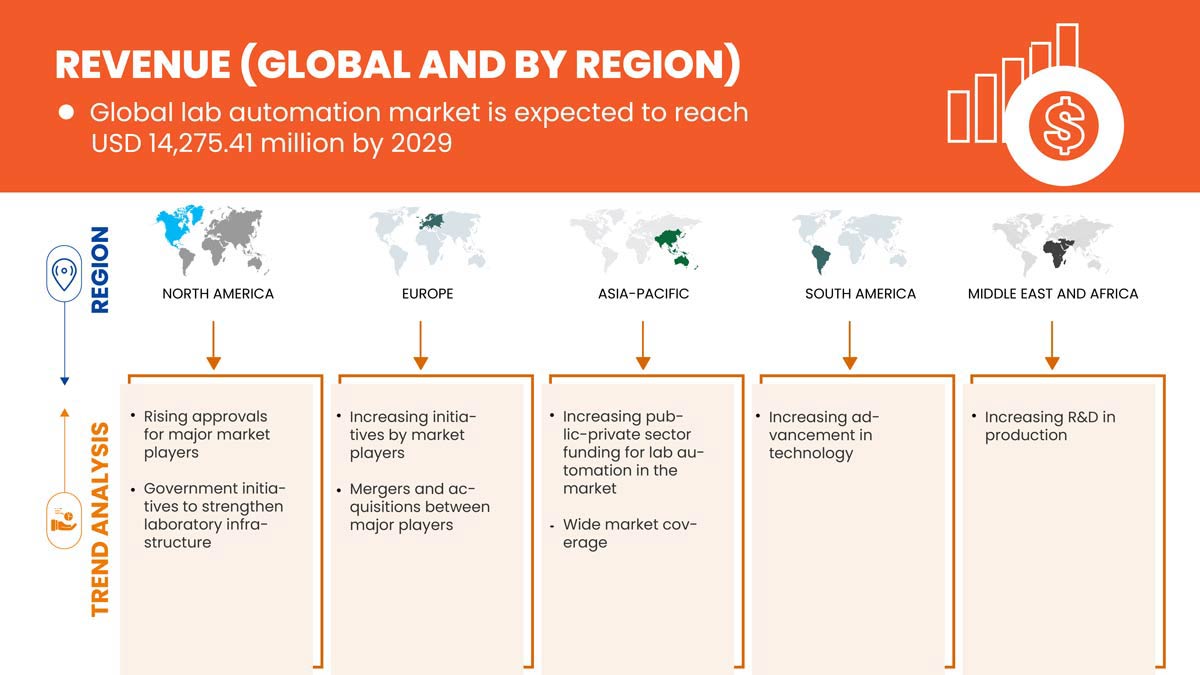

Globaler Markt für Laborautomatisierung – regionale Analyse/Einblicke

Der globale Markt für Laborautomatisierung wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkttyp, automatisierten Systemen, Anwendung und Endbenutzer bereitgestellt.

Die vom Markt abgedeckten Länder sind die USA, Kanada, Mexiko, Deutschland, Frankreich, Großbritannien, Italien, Spanien, die Niederlande, Russland, Belgien, die Schweiz, die Türkei, das übrige Europa, China, Japan, Indien, Südkorea, Australien, Singapur, Thailand, Malaysia, Indonesien, die Philippinen, der übrige asiatisch-pazifische Raum, Brasilien, Argentinien, der übrige Teil Südamerikas, Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate und der übrige Nahe Osten und Afrika.

Aufgrund der wachsenden Zahl an Forschungsaktivitäten wird der asiatisch-pazifische Raum voraussichtlich den globalen Markt für Laborautomatisierung dominieren. Eine steigende Nachfrage nach Geräten, Analysegeräten und Software dürfte im Prognosezeitraum das Marktwachstum ankurbeln.

Der regionale Abschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Marktvorschriften, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neu- und Ersatzverkäufe, demografische Daten des Landes, Krankheitsepidemiologie und Import- und Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Darüber hinaus werden bei der Prognoseanalyse der Länderdaten die Präsenz und Verfügbarkeit zentralamerikanischer Marken und ihre Herausforderungen aufgrund der hohen Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und globale Analyse der Marktanteile im Bereich Laborautomatisierung

Die Wettbewerbslandschaft des globalen Marktes für Laborautomatisierung liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Details gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -einrichtungen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang und Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen auf den globalen Markt für Laborautomatisierung.

Zu den wichtigsten Akteuren auf dem globalen Markt für Laborautomatisierung zählen unter anderem QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE und Labware.

Forschungsmethodik

Die Datenerfassung und die Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Die wichtigste Forschungsmethode, die das DBMR-Forschungsteam verwendet, ist die Datentriangulation, die Data Mining, Analyse der Auswirkungen von Datenvariablen auf den Markt und primäre (Branchenexperten-)Validierung umfasst. Abgesehen davon umfassen die Datenmodelle ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, einen Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Firmenmarktanteilsanalyse, Messstandards, globale vs. regionale und Lieferantenanteilsanalyse. Bitte fordern Sie bei weiteren Fragen einen Analystenanruf an.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 GLOBAL LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 GLOBAL LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 GLOBAL LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 GLOBAL LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 GLOBAL LAB AUTOMATION MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 FRANCE

11.3.3 U.K.

11.3.4 ITALY

11.3.5 RUSSIA

11.3.6 SPAIN

11.3.7 NETHERLANDS

11.3.8 SWITZERLAND

11.3.9 TURKEY

11.3.10 BELGIUM

11.3.11 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 AUSTRALIA

11.4.6 SINGAPORE

11.4.7 THAILAND

11.4.8 MALAYSIA

11.4.9 INDONESIA

11.4.10 PHILIPPINES

11.4.11 REST OF ASIA-PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 SOUTH AFRICA

11.6.2 SAUDI ARABIA

11.6.3 U.A.E.

11.6.4 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 GLOBAL LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 U.S. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 46 U.S. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 U.S. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 56 CANADA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 MEXICO LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 66 MEXICO SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 MEXICO LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 EUROPE LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 71 EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 EUROPE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 EUROPE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 EUROPE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 77 EUROPE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 EUROPE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 GERMANY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 GERMANY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 87 GERMANY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 GERMANY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 FRANCE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 FRANCE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 FRANCE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 FRANCE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 FRANCE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 FRANCE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 101 U.K. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.K. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.K. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.K. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.K. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.K. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.K. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 U.K. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 ITALY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 ITALY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 ITALY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 ITALY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 117 ITALY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 ITALY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 ITALY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 127 RUSSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 SPAIN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 SPAIN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 SPAIN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 SPAIN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SPAIN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 137 SPAIN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 SPAIN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 139 SPAIN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 SPAIN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 NETHERLANDS LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 NETHERLANDS EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 NETHERLANDS AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 NETHERLANDS MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 NETHERLANDS ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 151 SWITZERLAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 153 SWITZERLAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 TURKEY LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 TURKEY EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 TURKEY AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 167 TURKEY SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 TURKEY LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 177 BELGIUM SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 181 REST OF EUROPE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 182 ASIA-PACIFIC LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 183 ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 ASIA-PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 ASIA-PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 ASIA-PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 ASIA-PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 ASIA-PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 189 ASIA-PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 190 ASIA-PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 191 ASIA-PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 ASIA-PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 193 CHINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 194 CHINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 CHINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 CHINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 CHINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 CHINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 199 CHINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 CHINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 201 CHINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 CHINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 203 JAPAN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 204 JAPAN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 206 JAPAN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 207 JAPAN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 208 JAPAN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 209 JAPAN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 210 JAPAN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 211 JAPAN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 212 JAPAN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 213 SOUTH KOREA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 214 SOUTH KOREA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 215 SOUTH KOREA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 223 INDIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 224 INDIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 225 INDIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 226 INDIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 227 INDIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 228 INDIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 229 INDIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 230 INDIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 231 INDIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 232 INDIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 233 AUSTRALIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 234 AUSTRALIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 235 AUSTRALIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 236 AUSTRALIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 237 AUSTRALIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 238 AUSTRALIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 239 AUSTRALIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 240 AUSTRALIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 241 AUSTRALIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 AUSTRALIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 SINGAPORE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 244 SINGAPORE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 245 SINGAPORE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 246 SINGAPORE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 247 SINGAPORE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 248 SINGAPORE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 249 SINGAPORE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 250 SINGAPORE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 251 SINGAPORE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 252 SINGAPORE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 253 THAILAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 254 THAILAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 255 THAILAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 256 THAILAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 257 THAILAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 258 THAILAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 259 THAILAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 260 THAILAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 261 THAILAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 262 THAILAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 268 MALAYSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 269 MALAYSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 270 MALAYSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 271 MALAYSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 MALAYSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 273 INDONESIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 274 INDONESIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 275 INDONESIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 276 INDONESIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 277 INDONESIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 278 INDONESIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 279 INDONESIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 280 INDONESIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDONESIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 INDONESIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 283 PHILIPPINES LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 284 PHILIPPINES EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 285 PHILIPPINES AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 286 PHILIPPINES MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 287 PHILIPPINES ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 288 PHILIPPINES ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 289 PHILIPPINES SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 290 PHILIPPINES LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 291 PHILIPPINES LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 292 PHILIPPINES LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 293 REST OF ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 SOUTH AMERICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 295 SOUTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 296 SOUTH AMERICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 297 SOUTH AMERICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 298 SOUTH AMERICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 299 SOUTH AMERICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 300 SOUTH AMERICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 301 SOUTH AMERICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 302 SOUTH AMERICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 303 SOUTH AMERICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 304 SOUTH AMERICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 305 BRAZIL LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 306 BRAZIL EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 307 BRAZIL AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 308 BRAZIL MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 309 BRAZIL ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 310 BRAZIL ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 311 BRAZIL SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 312 BRAZIL LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 313 BRAZIL LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 BRAZIL LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 315 ARGENTINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 316 ARGENTINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 317 ARGENTINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 318 ARGENTINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 319 ARGENTINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 320 ARGENTINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 321 ARGENTINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 322 ARGENTINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 323 ARGENTINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 324 ARGENTINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 325 REST OF SOUTH AMERICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 326 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 327 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 328 MIDDLE EAST AND AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 329 MIDDLE EAST AND AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 330 MIDDLE EAST AND AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 331 MIDDLE EAST AND AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 332 MIDDLE EAST AND AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 333 MIDDLE EAST AND AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 334 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 335 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 336 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 337 SOUTH AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 338 SOUTH AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 339 SOUTH AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 340 SOUTH AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 341 SOUTH AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 342 SOUTH AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 343 SOUTH AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 344 SOUTH AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 345 SOUTH AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 346 SOUTH AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 347 SAUDI ARABIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 348 SAUDI ARABIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 349 SAUDI ARABIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 350 SAUDI ARABIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 351 SAUDI ARABIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 352 SAUDI ARABIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 353 SAUDI ARABIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 354 SAUDI ARABIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 355 SAUDI ARABIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 356 SAUDI ARABIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 357 U.A.E. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 358 U.A.E. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 359 U.A.E. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 360 U.A.E. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 361 U.A.E. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 362 U.A.E. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 363 U.A.E. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 364 U.A.E. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 365 U.A.E. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 366 U.A.E. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 367 REST OF MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 GLOBAL LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 GLOBAL LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LAB AUTOMATION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE GLOBAL LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL LAB AUTOMATION MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR LAB AUTOMATION MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LAB AUTOMATION MARKET

FIGURE 16 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 18 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 22 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 23 GLOBAL LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 25 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 26 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 GLOBAL LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 29 GLOBAL LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 30 GLOBAL LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 31 GLOBAL LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 GLOBAL LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 33 GLOBAL LAB AUTOMATION MARKET: BY REGION (2021)

FIGURE 34 GLOBAL LAB AUTOMATION MARKET: BY REGION (2022 & 2029)

FIGURE 35 GLOBAL LAB AUTOMATION MARKET: BY REGION (2021 & 2029)

FIGURE 36 GLOBAL LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 37 NORTH AMERICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 38 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 39 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 NORTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 NORTH AMERICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 42 EUROPE LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 47 ASIA-PACIFIC LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 48 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 49 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 ASIA-PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 52 SOUTH AMERICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 53 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 54 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 55 SOUTH AMERICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 56 SOUTH AMERICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 57 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 58 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 59 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 60 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 61 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 62 GLOBAL LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 63 NORTH AMERICA LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 64 EUROPE LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 65 ASIA-PACIFIC LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.