Global Intravenous Access Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

7.28 Billion

USD

11.42 Billion

2024

2032

USD

7.28 Billion

USD

11.42 Billion

2024

2032

| 2025 –2032 | |

| USD 7.28 Billion | |

| USD 11.42 Billion | |

|

|

|

|

Global Intravenous Access Devices Market Segmentation, By Product (Intravenous Catheters, Intravenous Infusion Pumps, and Intravenous Needles), End User (Hospitals and Clinics, Ambulatory Surgery Centers, Dialysis Centers, Home Care, and Others), Application (Medication Administration, Administration of Fluid and Nutrition, Transfusion of Blood Products, and Diagnostic Testing) – Industry Trends and Forecast to 2032

Intravenous Access Devices Market Analysis

The intravenous access devices market is expanding due to the increasing demand for efficient and safe intravenous (IV) therapies across various healthcare settings. Intravenous devices are essential for administering fluids, medications, blood products, and nutrition, especially for patients in critical care, hospitals, and ambulatory surgery centers. The market is driven by the rising prevalence of chronic diseases, an aging population, and a surge in the need for surgical procedures requiring IV access. In addition, advancements in technology are significantly improving the design and safety features of IV devices. For instance, the development of needle-free blood collection systems such as BD's PIVO Pro and innovations in safety IV catheters, such as B. Braun's Introcan Safety 2, help minimize the risk of needle-stick injuries and prevent exposure to bloodborne pathogens. Furthermore, companies are focusing on improving the functionality of IV catheters, with features such as multi-access blood control and dual-lumen catheters. The integration of smart technologies, such as connected infusion pumps, is enhancing patient safety and reducing medical errors. As healthcare infrastructure improves globally, especially in emerging regions, the intravenous access devices market is expected to see substantial growth in the coming years.

Intravenous Access Devices Market Size

The global intravenous access devices market size was valued at USD 7.28 billion in 2024 and is projected to reach USD 11.42 billion by 2032, with a CAGR of 5.78% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Intravenous Access Devices Market Trends

“Increasing Adoption of Safety Features”

Ein wichtiger Trend auf dem Markt für intravenöse Zugangsgeräte ist die zunehmende Einführung von Sicherheitsfunktionen, die das Risiko von Nadelstichverletzungen verringern und die Behandlungsergebnisse verbessern sollen. Geräte wie der BD PIVO Pro, ein nadelfreies Blutentnahmegerät, und der Introcan Safety 2 IV-Katheter von B. Braun gewinnen aufgrund ihrer verbesserten Sicherheitsfunktionen zunehmend an Bedeutung. Diese Innovationen tragen dazu bei, das Gesundheitspersonal vor einer möglichen Exposition gegenüber durch Blut übertragbaren Krankheitserregern zu schützen und das Risiko von Komplikationen wie Infektionen zu verringern. Darüber hinaus tragen Fortschritte bei intelligenten Infusionspumpen, die Echtzeitüberwachung und automatische Medikamentenverabreichung bieten, zu einem besseren Management intravenöser Therapien bei, insbesondere in der Intensivpflege. Beispielsweise integrieren Unternehmen wie Medtronic und Teleflex digitale Lösungen in ihre Infusionsgeräte, was präzisere und effizientere Behandlungen ermöglicht. Da sich die Gesundheitssysteme auf die Verbesserung der Patienten- und Anbietersicherheit konzentrieren, wächst der Markt für intravenöse Zugangsgeräte dank dieser technologischen Innovationen weiter.

Berichtsumfang und Marktsegmentierung für intravenöse Zugangsgeräte

|

Eigenschaften |

Wichtige Markteinblicke zu intravenösen Zugangsgeräten |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Wichtige Marktteilnehmer |

BD (USA), B. Braun SE (Deutschland), Teleflex Incorporated (USA), Medtronic (Irland), Smiths Group plc (Großbritannien), Pfizer Inc. (USA), Fresenius Medical Care AG (Deutschland), Baxter (USA), Siemens Healthineers AG (Deutschland), Terumo Corporation (Japan), Nipro Europe Group Companies (Belgien), Edwards Lifesciences Corporation (USA), General Electric Company (USA), AngioDynamics (USA), Cook (USA), Deltamed (Belgien), Galt Medical Corp. (USA), ICU Medical, Inc. (USA) und Retractable Technologies, Inc (USA) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Marktdefinition für intravenöse Zugangsgeräte

Intravenöse Zugangsgeräte sind medizinische Instrumente, die über eine Vene direkten Zugang zum Blutkreislauf eines Patienten bieten. Diese Geräte erleichtern die Verabreichung von Flüssigkeiten, Medikamenten, Blutprodukten und Nährstoffen und sind in verschiedenen medizinischen Einrichtungen, darunter Krankenhäusern, Kliniken und der häuslichen Krankenpflege , unverzichtbar .

Marktdynamik für intravenöse Zugangsgeräte

Treiber

- Zunehmende Verbreitung chronischer Krankheiten

Die zunehmende Verbreitung chronischer Krankheiten wie Diabetes, Krebs und Herz-Kreislauf-Erkrankungen treibt die Nachfrage nach intravenösen Zugangsgeräten erheblich an. Laut der Weltgesundheitsorganisation (WHO) sind chronische Krankheiten für etwa 70 % aller Todesfälle weltweit verantwortlich, wobei Herz-Kreislauf-Erkrankungen die häufigste Ursache sind, gefolgt von Krebs und Diabetes. Diese Krankheiten erfordern oft langfristige intravenöse Therapien , darunter Chemotherapie, Insulininfusionen und Schmerzbehandlungen. Krebspatienten beispielsweise, die sich einer Chemotherapie unterziehen, sind für die Verabreichung von Medikamenten auf einen intravenösen Zugang angewiesen und Diabetiker benötigen in Krankenhäusern während akuter Episoden möglicherweise intravenöses Insulin. Da die Zahl der Personen, bei denen diese Krankheiten diagnostiziert werden, weiter steigt, insbesondere bei alternden Bevölkerungen, wächst der Bedarf an zuverlässigen und effizienten intravenösen Zugangsgeräten schnell. Dieser Trend unterstreicht die Bedeutung intravenöser Geräte bei der Behandlung chronischer Krankheiten und trägt zur Expansion des Marktes für intravenöse Zugangsgeräte bei.

- Weltweit steigende Zahl chirurgischer Eingriffe

Die steigende Zahl chirurgischer Eingriffe weltweit treibt die Nachfrage nach intravenösen Zugangsgeräten an, da diese für die Verabreichung von Anästhetika, Medikamenten und Flüssigkeiten während und nach Operationen unerlässlich sind. Laut der Weltgesundheitsorganisation (WHO) werden weltweit jedes Jahr über 230 Millionen Operationen durchgeführt, und diese Zahl steigt weiter an, da die Bevölkerung altert und die Medizintechnik voranschreitet. Intravenöse Zugangsgeräte wie Katheter und Infusionspumpen sind in diesen Situationen für die sichere Verabreichung von Anästhetika und die postoperative Versorgung von entscheidender Bedeutung. Beispielsweise werden intravenöse Katheter zur Verabreichung von Anästhetika während Operationen verwendet und sind für das Flüssigkeitsmanagement, die Schmerzlinderung und die Verabreichung von Antibiotika nach Operationen unerlässlich. Da die Zahl der geplanten und Notfalloperationen zunimmt, insbesondere in Regionen wie Nordamerika und Europa, wird erwartet, dass die Nachfrage nach effizienten intravenösen Zugangsgeräten steigt und das Marktwachstum weiter ankurbelt. Dieser Anstieg der chirurgischen Eingriffe ist ein wichtiger Markttreiber und trägt zur weltweiten Nachfrage nach fortschrittlichen intravenösen Zugangsgeräten bei.

Gelegenheiten

- Zunehmender technologischer Fortschritt

Technologische Fortschritte treiben den Markt für intravenöse Zugangsgeräte erheblich voran. Innovationen wie nadelfreie Systeme, intelligente Infusionspumpen und sicherere IV-Katheter bieten eine verbesserte Patientensicherheit und bessere Behandlungsergebnisse. Nadelfreie Systeme wie PIVO Pro von BD ermöglichen beispielsweise die Blutentnahme ohne herkömmliche Nadeln und verringern so das Risiko von Nadelstichverletzungen, ein großes Problem im Gesundheitswesen. Darüber hinaus ermöglichen intelligente Infusionspumpen, wie sie von Unternehmen wie Medtronic entwickelt werden, eine automatisierte Medikamentenverabreichung mit präziser Dosierung und kontinuierlicher Überwachung, wodurch menschliche Fehler reduziert und die Behandlungswirksamkeit verbessert werden. Die Entwicklung von IV-Kathetern mit integrierten Sicherheitsmechanismen wie Introcan Safety 2 von B. Braun trägt dazu bei, Nadelstichverletzungen zu verhindern und die Exposition gegenüber durch Blut übertragbaren Krankheitserregern zu minimieren. Diese Innovationen machen intravenöse Zugangsgeräte sicherer und effizienter und eröffnen neue Marktchancen, insbesondere in Umgebungen, die hohe Pflegestandards erfordern, wie Krankenhäuser und chirurgische Zentren. Da diese Technologien immer zugänglicher werden, werden sie den globalen Markt für intravenöse Zugangsgeräte weiter ausbauen.

- Ausbau der Gesundheitsversorgung in Entwicklungsregionen

Der Ausbau der Gesundheitseinrichtungen in Entwicklungsregionen, kombiniert mit Fortschritten in der Medizintechnik, schafft erhebliche Wachstumschancen auf dem Markt für intravenöse Zugangsgeräte. So investieren Länder im asiatisch-pazifischen Raum und in Afrika zunehmend in die Gesundheitsinfrastruktur und bauen neue Krankenhäuser, Kliniken und chirurgische Zentren, um ihrer wachsenden Bevölkerung und den steigenden Anforderungen an die Gesundheitsversorgung gerecht zu werden. Dies geht mit der Einführung fortschrittlicher Medizintechnologien wie intelligenter Infusionspumpen und sichererer, effizienterer IV-Katheter einher. In Ländern wie Indien und China, wo sich der Zugang zur Gesundheitsversorgung rasch verbessert, steigt die Nachfrage nach zuverlässigen intravenösen Zugangsgeräten, da mehr Operationen, Krebsbehandlungen und Langzeittherapien durchgeführt werden. So werden beispielsweise die Infusionssysteme von Medtronic, die eine höhere Präzision und Sicherheit bieten, in diesen Regionen zu einem integralen Bestandteil der Patientenversorgung. Während die Gesundheitssysteme modernisiert und erweitert werden, treiben diese Innovationen die Nachfrage nach fortschrittlichen intravenösen Zugangslösungen an, was sie zu einer bedeutenden Marktchance in Entwicklungsländern macht.

Einschränkungen/Herausforderungen

- Komplikationen und Infektionsrisiko

Komplikationen und Infektionsrisiken bleiben große Herausforderungen auf dem Markt für intravenöse (IV) Zugangsgeräte, da diese Geräte anfällig für schwere Gesundheitsprobleme sind, darunter katheterassoziierte Blutbahninfektionen (CABSI). Wenn IV-Katheter beispielsweise nicht richtig gewartet werden oder über längere Zeiträume an Ort und Stelle bleiben, können Bakterien in den Blutkreislauf gelangen und zu potenziell lebensbedrohlichen Infektionen führen. Dieses Risiko ist besonders hoch bei schwerkranken Patienten oder solchen, die eine langfristige IV-Therapie benötigen, wie Krebspatienten, die sich einer Chemotherapie unterziehen, oder Patienten auf Intensivstationen. Infektionen können zu längeren Krankenhausaufenthalten, höheren medizinischen Kosten und höheren Sterblichkeitsraten führen. Darüber hinaus erfordert die Behandlung dieser Infektionen oft den Einsatz stärkerer, teurerer Antibiotika und zusätzlicher medizinischer Verfahren, was die finanzielle Belastung erhöht. Das Vorhandensein von Infektionen wirkt sich auf die Patientenergebnisse aus und stellt die Gesundheitsdienstleister vor erhebliche betriebliche Herausforderungen, da sie in bessere Infektionskontrollpraktiken, Sterilisationstechniken und Überwachungssysteme investieren müssen, um diese Risiken zu verringern. Infolgedessen schränkt das mit IV-Zugangsgeräten verbundene hohe Infektionsrisiko ihre weite Verbreitung und Wirksamkeit ein und stellt somit eine zentrale Herausforderung für das Wachstum dieses Marktes dar.

- Hohe Kosten und Probleme bei der Erstattung

Hohe Kosten und Erstattungsprobleme stellen eine erhebliche Herausforderung auf dem Markt für intravenöse (IV) Zugangsgeräte dar, da fortschrittliche IV-Technologien oft mit erheblichen finanziellen Belastungen verbunden sind, die ihre Zugänglichkeit und breite Akzeptanz einschränken können. Beispielsweise sind Geräte mit antimikrobiellen Beschichtungen oder solche, die für den Langzeitgebrauch konzipiert sind, wie peripher eingeführte zentrale Katheter (PICC), aufgrund ihrer fortschrittlichen Materialien und ihres Designs oft teurer als herkömmliche Geräte. Diese höheren Kosten sind eine besondere Belastung für Krankenhäuser, vor allem in Regionen mit begrenzten Gesundheitsbudgets oder niedrigen Erstattungssätzen. In vielen Fällen übernehmen die Versicherungsgesellschaften die Kosten dieser fortschrittlichen IV-Geräte nicht vollständig, sodass Gesundheitsdienstleister und Patienten die finanzielle Belastung tragen müssen. Infolgedessen entscheiden sich Krankenhäuser möglicherweise für billigere, weniger wirksame Alternativen, obwohl fortschrittlichere Optionen möglicherweise bessere Patientenergebnisse erzielen. Der Mangel an angemessener Erstattung verschärft die finanziellen Herausforderungen für Gesundheitsdienstleister noch weiter, vor allem in Regionen mit hohen Eigenbeteiligungskosten für Patienten. Diese finanziellen Hürden sowie die Komplexität der Kostenerstattung erschweren die Einführung innovativer IV-Zugangsgeräte, begrenzen das Marktwachstum und schränken die Möglichkeit der Patienten ein, von verbesserten Behandlungsmöglichkeiten zu profitieren.

Dieser Marktbericht enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für intravenöse Zugangsgeräte

Der Markt ist nach Produkt, Endbenutzer und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Intravenöse Katheter

- Intravenöse Infusionspumpen

- Intravenöse Nadeln

Endbenutzer

- Krankenhäuser und Kliniken

- Ambulante Chirurgiezentren

- Dialysezentren

- Heimpflege

- Sonstiges

Anwendung

- Verabreichung von Medikamenten

- Verabreichung von Flüssigkeit und Nahrung

- Transfusion von Blutprodukten

- Diagnostische Tests

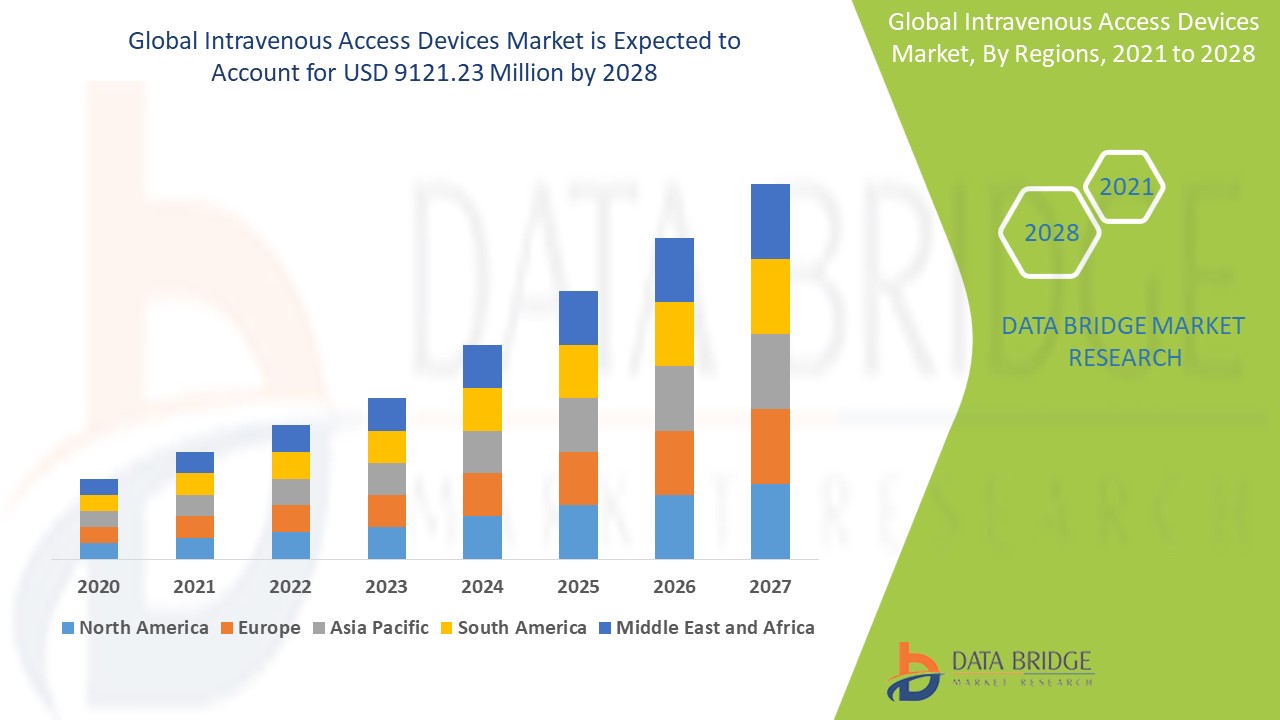

Regionale Analyse des Marktes für intravenöse Zugangsgeräte

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkt, Endbenutzer und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika dominiert den Markt für intravenöse Zugangsgeräte, was auf die wachsende ältere Bevölkerung und die steigende Zahl chronischer Krankheiten zurückzuführen ist. Die gut ausgebaute Gesundheitsinfrastruktur und die fortschrittliche Medizintechnik der Region tragen zur Nachfrage nach intravenösen Geräten bei. Darüber hinaus treibt eine höhere Zahl von Krankenhauseinweisungen und -behandlungen in Nordamerika das Marktwachstum weiter an. Diese Faktoren, gepaart mit einem steigenden Bedarf an effektiven und zuverlässigen intravenösen Zugängen, unterstützen die Dominanz des Marktes in der Region.

Der asiatisch-pazifische Raum dürfte von 2025 bis 2032 das höchste Wachstum auf dem Markt für intravenöse Zugangsgeräte verzeichnen, was auf die steigende Zahl der Zielkrankheiten und eine wachsende ältere Bevölkerung zurückzuführen ist. Die Verbesserung der Gesundheitsinfrastruktur der Region und der zunehmende Zugang zu fortschrittlichen medizinischen Technologien beschleunigen die Marktexpansion weiter. Steigende Investitionen im Gesundheitswesen und ein steigendes Bewusstsein für das Krankheitsmanagement spielen ebenfalls eine Schlüsselrolle bei der Förderung des Marktwachstums. Da sich die Gesundheitssysteme weiterentwickeln und die Nachfrage nach besseren Behandlungsmöglichkeiten steigt, wird der Markt im asiatisch-pazifischen Raum in diesem Zeitraum voraussichtlich eine erhebliche Entwicklung erleben.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil von intravenösen Zugangsgeräten

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den einzelnen Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die Marktführer für intravenöse Zugangsgeräte sind:

- BD (USA)

- B. Braun SE (Deutschland)

- Teleflex Incorporated (USA)

- Medtronic (Irland)

- Smiths Group plc (Großbritannien)

- Pfizer Inc. (USA)

- Fresenius Medical Care AG (Deutschland)

- Baxter (USA)

- Siemens Healthineers AG (Deutschland)

- Terumo Corporation (Japan)

- Unternehmen der Nipro Europe-Gruppe (Belgien)

- Edwards Lifesciences Corporation (USA)

- General Electric Company (USA)

- AngioDynamics (USA)

- Koch (USA)

- Deltamed (Belgien)

- Galt Medical Corp. (USA)

- ICU Medical, Inc. (USA)

- Retractable Technologies, Inc (USA)

Neueste Entwicklungen auf dem Markt für intravenöse Zugangsgeräte

- Im November 2023 stellte BD das PIVO Pro vor, ein bahnbrechendes nadelfreies Blutentnahmegerät. Es ist das erste, das sich nahtlos sowohl mit Langzeit- als auch mit integrierten peripheren IV-Kathetern integrieren lässt, einschließlich des Nexiva-Systems, das jetzt über den von der FDA zugelassenen NearPort IV Access verfügt

- Im Oktober 2023 brachte B. Braun Medical Inc. den Introcan Safety 2 IV-Katheter auf den Markt, der über Multi-Access Blood Control verfügt, um die passive Nadelstichprävention zu verbessern. Das Design zielt darauf ab, den Kontakt des Klinikpersonals mit Blut zu reduzieren und das Risiko der Übertragung von durch Blut übertragbaren Krankheitserregern bei intravenösen Eingriffen zu minimieren.

- Im Juni 2023 schloss Teleflex Incorporated zwei Gruppeneinkaufsverträge mit Premier, Inc. ab, die Premier-Mitgliedern exklusive Preise und Konditionen für die zentralvenösen und arteriellen Gefäßzugänge von Teleflex ermöglichen.

- Im Juli 2022 stellte B. Braun Medical Inc. seinen neuen Introcan Safety 2 IV-Katheter mit einmaliger Blutkontrolle vor. Diese Innovation soll die Sicherheit des IV-Zugangs für Ärzte verbessern, indem sie das Risiko von Nadelstichverletzungen und Blutkontakt verringert

- Im Mai 2022 erhielt Access Vascular, Inc. (AVI) die FDA 510(k)-Zulassung für seinen HydroPICC Dual-Lumen-Katheter. Er wurde aus dem gleichen proprietären hydrophilen Biomaterial wie die einlumigen HydroPICC- und HydroMID®-Katheter von AVI hergestellt und zeigte in jüngsten Studien eine signifikante Reduzierung von Komplikationen wie Verschlüssen, tiefer Venenthrombose, Phlebitis und Katheterwechseln.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.