Global Immunoassay Reagents And Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4,689.40 Billion

USD

7,142.30 Billion

2024

2032

USD

4,689.40 Billion

USD

7,142.30 Billion

2024

2032

| 2025 –2032 | |

| USD 4,689.40 Billion | |

| USD 7,142.30 Billion | |

|

|

|

|

Global Immunoassay Reagents and Devices Market Segmentation, By Product (Reagents and Kits and Analyzers), Platform (Chemiluminescence Immunoassays, Fluorescence Immunoassays, Enzyme Immunoassay, Radio Immunoassays, and Others), Technique (Enzyme-Linked Immunosorbent Assays, Rapid Tests, Enzyme-Linked Immunospot, Western Blotting, Immuno-PCR, and Other Techniques), Specimen Type (Blood, Urine, Saliva, and Others), Application (Infectious Diseases, Oncology and Endocrinology, Bone and Mineral Disorders, Cardiology, Hematology and Blood Screening, Autoimmune Disorders, Toxicology, Neonatal Screening, and Other Applications), End User (Hospitals, Clinical Laboratories, Pharmaceutical and Biotechnology Companies, Blood Banks, Research and Academic Laboratories, and Others) - Industry Trends and Forecast to 2032

Immunoassay Reagents and Devices Market Size

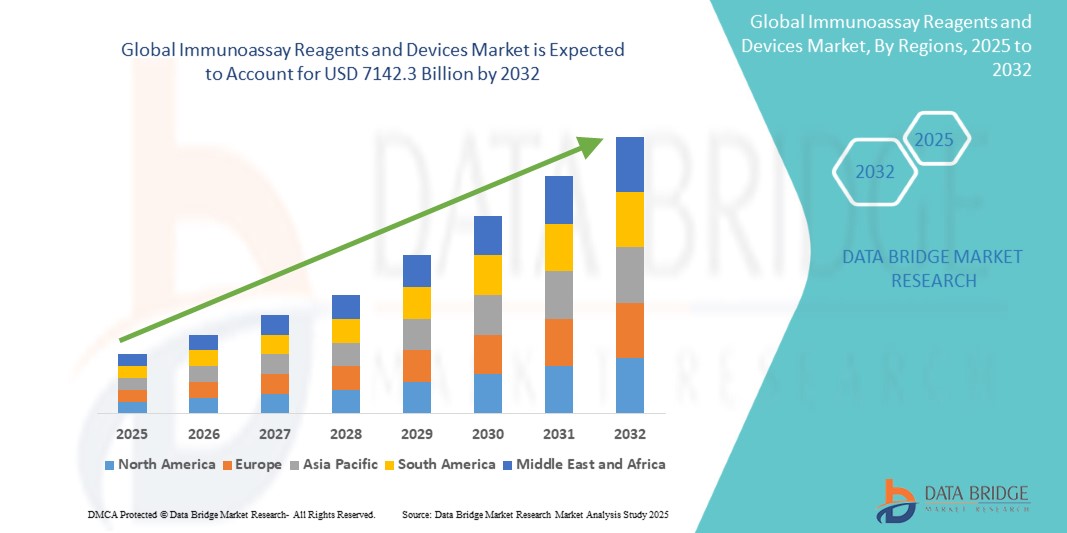

- The global immunoassay reagents and devices market size was valued atUSD 4689.4 billion in 2024and is expected to reachUSD 7142.3 billion by 2032, at aCAGR of 5.40%during the forecast period

- This growth is driven by factors such as rising cases of chronic and infectious diseases, growing demand for early and accurate diagnostics, advancements in automated and point-of-care technologies, a growing elderly population, increased healthcare spending, and supportive regulatory and reimbursement policies

Immunoassay Reagents and Devices Market Analysis

- Immunoassay reagents and devices are vital tools in clinical diagnostics, used to detect and quantify specific proteins, hormones, and pathogens in biological samples. They are widely applied in disease screening, therapeutic monitoring, and drug testing, supporting accurate diagnosis and effective treatment decisions

- The immunoassay reagents and devices market is witnessing strong growth, driven by the rising burden of chronic and infectious diseases, technological advancements in assay platforms, and the growing demand for early and precise diagnostics. In addition, expanding healthcare infrastructure and increased adoption of automated and point-of-care systems are accelerating market expansion

- North America is expected to dominate the immunoassay reagents and devices market with a share of 47.93, due to the significant investments in research and development, robust government support, and a highly developed healthcare infrastructure

- Asia-Pacific is expected to be the fastest growing region in the immunoassay reagents and devices market during the forecast period due to increasing healthcare investments, rapid urbanization, and a growing demand for advanced diagnostic solutions across the region

- Reagents and kits segment is expected to dominate the market with a market share of 66.60% due to their recurring use in diagnostic procedures, increasing demand for high-throughput testing, and the rising prevalence of chronic and infectious diseases requiring continuous monitoring and rapid diagnostics

Report Scope andImmunoassay Reagents and DevicesMarket Segmentation

|

Attributes |

Immunoassay Reagents and DevicesKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Immunoassay Reagents and DevicesMarket Trends

“Growing Shift to Automated and Multiplex Platforms”

- One prominent trend in the global immunoassay reagents and devices market is the growing shift to automated and multiplex platforms

- This trend is driven by the rising demand for high-throughput, accurate, and efficient diagnostic solutions, especially in managing large testing volumes in hospitals and laboratories

- For instance, companies such as Roche and Abbott are introducing advanced immunoassay systems with automation and multiplexing capabilities, allowing simultaneous detection of multiple biomarkers with minimal hands-on time

- The increasing focus on streamlining lab workflows and reducing turnaround times is also driving the adoption of these next-gen platforms

- As healthcare systems prioritize precision diagnostics and operational efficiency, the shift to automated and multiplex immunoassay platforms is expected to play a key role in market growth

Immunoassay Reagents and DevicesMarket Dynamics

Driver

“Increasing Demand for Diagnostics”

- The growing emphasis on diagnostics is a key driver for the immunoassay reagents and devices market, as these tools are essential for detecting and monitoring various diseases, from infectious diseases to chronic conditions

- This shift is particularly significant in healthcare sectors focused on early disease detection and personalized treatment, where accurate and timely diagnostics are critical for improving patient outcomes

- With rising healthcare awareness and the global push for preventive healthcare, the demand for immunoassay reagents and devices is increasing, as they enable accurate, rapid, and cost-effective diagnostic testing

- Manufacturers are advancing immunoassay technologies to include features such as automated sample processing, higher sensitivity, and multiplexing capabilities, which improve diagnostic accuracy and throughput

- The increasing focus on improving patient care and ensuring quick, reliable diagnostic results is driving the growth of immunoassay reagents and devices across laboratories, clinics, and hospitals

For instance,

- Abbott's ARCHITECT system offers a range of immunoassay reagents and devices, enabling rapid and precise diagnostic testing in clinical settings

- Siemens Healthineers provides advanced immunoassay solutions with enhanced efficiency, helping healthcare providers achieve quicker and more reliable results for patient management

- The immunoassay reagents and devices market is expected to experience significant growth, driven by the rising demand for diagnostics, continuous innovations in immunoassay technologies, and the global shift toward more effective disease management

Opportunity

“Increasing Focus on Biomarker Discovery”

- The increasing focus on biomarker discovery presents a significant opportunity for the immunoassay reagents and devices market, driven by the growing need for more accurate and specificbiomarkersfor disease detection, prognosis, and personalized treatment

- Healthcare sectors are prioritizing advanced immunoassay solutions to facilitate the discovery of novel biomarkers, which helps identify new therapeutic targets and improves disease management. This shift is fueling demand for highly sensitive and versatile immunoassay reagents and devices

- This opportunity aligns with the broader trend toward precision medicine, where biomarkers play a critical role in tailoring treatments to individual patients, ultimately improving clinical outcomes and reducing adverse effects

For instance,

- Bio-Rad Laboratories offers immunoassay platforms that aid in biomarker research, enabling high-throughput analysis of potential biomarkers for disease diagnostics and therapy development

- Roche Diagnostics has developed immunoassay technologies that support biomarker discovery in oncology and other therapeutic areas, providing healthcare providers with insights into more effective treatment strategies

- As the global focus on biomarker discovery intensifies, the immunoassay reagents and devices market is set to see robust growth, driven by continuous technological advancements and the expanding role of biomarkers in personalized medicine

Restraint/Challenge

“Regulatory Challenges”

- Regulatory challenges represent a significant hurdle for the immunoassay reagents and devices market, particularly with the growing demand fordiagnostic toolsthat comply with stringent standards for safety and efficacy

- The need to meet various regulatory requirements, such as FDA approvals and CE certifications, often results in lengthy and costly approval processes. This increases time-to-market and places financial strain on manufacturers, especially smaller companies

- This challenge is especially notable in regions with strict regulatory frameworks, where manufacturers must ensure that their products meet extensive validation, testing, and documentation requirements before they can be introduced into the market

For instance,

- Thermo Fisher Scientific adheres to strict regulatory standards when developing immunoassay reagents, ensuring compliance with global guidelines to guarantee product reliability and safety

- The complexity of regulatory approval processes and the associated costs may slow down innovation and increase market entry barriers, particularly for new or emerging players in the immunoassay reagents and devices sector

Immunoassay Reagents and Devices Market Scope

The market is segmented on the basis of product, platform, technique, specimen type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

ByProduct |

|

|

ByPlatform |

|

|

ByTechnique |

|

|

BySpecimen Type

|

|

|

By Application |

|

|

By End User |

|

In 2025, the reagents and kits is projected to dominate the market with a largest share in product segment

The reagents and kits segment is expected to dominate the immunoassay reagents and devices market with the largest share of 66.60% in 2025 due to their recurring use in diagnostic procedures, increasing demand for high-throughput testing, and the rising prevalence of chronic and infectious diseases requiring continuous monitoring and rapid diagnostics.

The enzyme immunoassay is expected to account for the largest share during the forecast period in platform market

In 2025, the enzyme immunoassay segment is expected to dominate the market with the largest market share of 64.40% due to its high sensitivity, specificity, and cost-effectiveness, which make it a preferred choice for clinical diagnostics. Its ability to be easily automated supports high-throughput screening, essential for large-scale testing in hospitals and laboratories. In addition, its broad application in detecting infectious diseases, hormone levels, and cancer biomarkers further drives its widespread adoption across both developed and emerging healthcare markets.

Immunoassay Reagents and Devices Market Regional Analysis

“North America Holds the Largest Share in the Immunoassay reagents and devices Market”

- North America dominates the immunoassay reagents and devicesmarketwith a share of 47.93, driven by the significant investments in research and development, robust government support, and a highly developed healthcare infrastructure

- U.S.holds a significant share due to its extensive healthcare system, advanced medical device industry, and high adoption of immunoassay technologies across various healthcare settings, from hospitals to specialized clinics

- The region's focus on research-driven innovation, along with government initiatives aimed at enhancing diagnostic capabilities and improving healthcare delivery, further strengthens its leadership in the market. In addition, the rising demand for personalized medicine and early disease detection fuels the need for advanced immunoassay devices and reagents

- As North America continues to prioritize healthcare advancements, including the integration of cutting-edge diagnostics and precision medicine, it is expected to maintain its market dominance through 2032, supported by ongoing technological breakthroughs and favorable healthcare policies

“Asia-Pacific is Projected to Register the HighestCAGR in the Immunoassay reagents and devices Market”

- Asia-Pacificis expected to witness the highest growth rate in the immunoassay reagents and devicesmarket, driven by increasing healthcare investments, rapid urbanization, and a growing demand for advanced diagnostic solutions across the region

- China holds a significant share due to substantial healthcare infrastructure investments, improving access to diagnostic technologies, and an increasing focus on precision medicine and disease detection

- The rising burden of infectious diseases, along with a growing aging population and the increasing prevalence of chronic conditions such as cancer and diabetes, is expected to drive significant demand for immunoassay reagents and devices in clinical settings and for personalized diagnostics

- Local manufacturers in the region are also enhancing their offerings by providing affordable and effective immunoassay solutions, which are accelerating adoption in both developed and developing markets within Asia-Pacific. With continued healthcare improvements, infrastructure expansion, and rapid technological advancements, Asia-Pacific is poised to become the fastest-growing region in the immunoassay reagents and devices market through 2032

Immunoassay Reagents and Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd(Switzerland)

- Siemens(Germany)

- Randox Laboratories Ltd. (U.K.)

- Abbott(U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- Beckman Coulter, Inc.(U.S.)

- BIOMÉRIEUX (France)

- Thermo Fisher Scientific Inc.(U.S.)

- BD (U.S.)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

- DiaSorin S.p.A (Italy)

- Ortho Clinical Diagnostics (U.S.)

- QIAGEN (Germany)

- QuidelOrtho Corporation (U.S.)

- BioCheck (U.S.)

- Bio-Techne (U.S.)

- PerkinElmer Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- MESO SCALE DIAGNOSTICS, LLC (U.S.)

Latest Developments in Global Immunoassay Reagents and Devices Market

- In November 2022, Getein unveiled the MAGICL 6000 CLIA analyzer at MEDICA 2022, catering to mid to high-workflow laboratories with its compact design. This innovative one-step CLIA solution provides optimal efficiency for such laboratory settings

- In November 2022, LumiraDx launched a rapid microfluidic immunoassay HbA1c test across Europe, parts of the Middle East, Asia, Latin America, and Africa. This expansion signifies a strategic move to make this diagnostic tool widely available in diverse regions

- In April 2022, Bio-Techne Corporation and Cygnus Technologies introduced the Simple Plex HEK 293 HCP 3G assay for automated process impurity detection on the Ella immunoassay platform. Addressing the vital need for impurity clearance in Gene and Cell Therapy applications, this assay facilitates accurate quantification of host cell proteins (HCP) throughout viral production phases, aligning with regulatory criteria for ensuring product purity

- In February 2022, Hycor Biomedical Inc secured additional FDA 510(k) clearance for the NOVEOS Immunoassay Analyzer, a chemiluminescent diagnostic tool designed to measure analyte concentrations in human samples. The device, specializing in allergy diagnosis, enhances the capabilities of in-vitro diagnostic equipment

- In January 2021, Abbott's Panbio COVID-19 Ag Rapid Test Device received the CE Mark for asymptomatic SARS-CoV-2 virus diagnosis. This test, equipped with self-swabbing capabilities, offers an efficient and accessible solution for detecting the virus in diverse settings

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.