Global Homologation Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.53 Billion

USD

2.28 Billion

2024

2032

USD

1.53 Billion

USD

2.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 2.28 Billion | |

|

|

|

|

Globale Homologationsmarktsegmentierung nach Servicetyp (vollständige Fahrzeughomologation sowie Komponenten- und Systemhomologation), Anwendung (inländische Homologation und exportorientierte Homologation), Fahrzeugtyp (Motorräder, Personenkraftwagen, Nutzfahrzeuge, Anhänger und landwirtschaftliche Geräte) – Branchentrends und Prognose bis 2032

Homologation Marktgröße

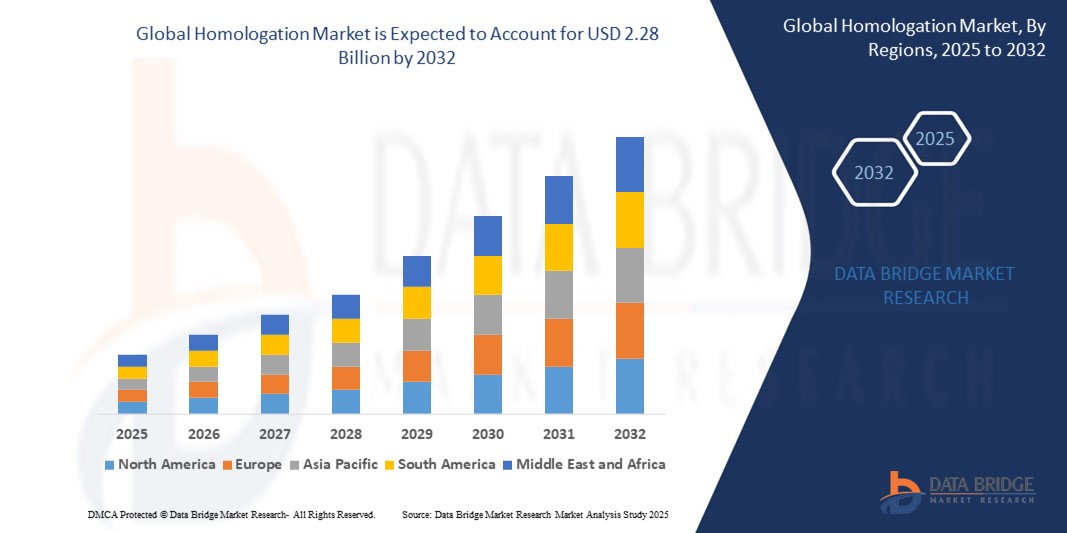

- Der globale Homologationsmarkt hatte im Jahr 2024 einen Wert von 1,53 Milliarden US-Dollar und dürfte bis 2032 einen Wert von 2,28 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 5,10 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Globalisierung des Automobilhandels, die steigende Nachfrage nach Fahrzeugexporten und strenge staatliche Vorschriften in Bezug auf Sicherheit, Emissionen und Umweltschutz in den wichtigsten Volkswirtschaften vorangetrieben.

- Darüber hinaus treiben technologische Fortschritte bei Prüf- und Zertifizierungsdiensten sowie wachsende Märkte für Elektro- und autonome Fahrzeuge die Nachfrage nach Homologationsdienstleistungen weltweit weiter an.

Homologationsmarktanalyse

- Der globale Homologationsmarkt verzeichnet ein stetiges Wachstum, da die regulatorischen Standards in den Bereichen Automobil, Luft- und Raumfahrt sowie Maschinenbau immer einheitlicher und strenger werden, insbesondere in Regionen wie Europa, Nordamerika und im asiatisch-pazifischen Raum.

- Unternehmen, die Fahrzeuge und Komponenten herstellen und exportieren, müssen die Einhaltung bestimmter lokaler Normen sicherstellen, wodurch ein anhaltender Bedarf an Zertifizierungs-, Prüf- und Zulassungsdiensten entsteht.

- Europa dominierte den Homologationsmarkt mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch strenge regulatorische Rahmenbedingungen wie UNECE-Standards und hohe grenzüberschreitende Fahrzeugexportmengen

- Im asiatisch-pazifischen Raum wird voraussichtlich die höchste Wachstumsrate auf dem globalen Homologationsmarkt verzeichnet, angetrieben durch die wachsende Automobilproduktion, steigende Fahrzeugexporte und die zunehmende Angleichung nationaler Vorschriften an internationale Standards.

- Das Segment der vollständigen Fahrzeughomologation erwirtschaftete 2024 den größten Umsatzanteil. Dies ist auf den zunehmenden internationalen Automobilhandel und die steigenden regulatorischen Anforderungen an die vollständige Fahrzeugzertifizierung in allen Regionen zurückzuführen. Automobilhersteller sind beim Export von Fahrzeugen gezwungen, sich an die sich entwickelnden Emissions-, Sicherheits- und Umweltstandards anzupassen, was die Nachfrage nach umfassenden Homologationsdienstleistungen erhöht. OEMs bevorzugen vollständige Fahrzeugzulassungen, um den globalen Markteintritt zu vereinfachen und redundante Tests zu reduzieren.

Berichtsumfang und Homologationsmarktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke zur Homologation |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Homologationsmarkttrends

„Integration digitaler Tools und Automatisierung in Testprozesse“

- Digitale Plattformen werden zunehmend eingesetzt, um das Compliance-Management zu optimieren, Dokumentationsfehler zu reduzieren und die Auditbereitschaft zu verbessern.

- Die Automatisierung von Testprozessen verbessert die Geschwindigkeit und Genauigkeit von Bewertungen und ermöglicht es Herstellern, die Zeiträume für die Produkteinführung zu verkürzen.

- KI und maschinelles Lernen werden zur Analyse großer Mengen von Testdaten eingesetzt und ermöglichen so eine vorausschauende Compliance- und Risikobewertung.

- Die Digital-Twin-Technologie ermöglicht es Unternehmen, virtuelle Homologationssimulationen durchzuführen, wodurch der Bedarf an wiederholten physischen Tests reduziert wird

- Cloudbasierte Systeme ermöglichen Echtzeit-Updates zu sich entwickelnden Standards und eine nahtlose Koordination zwischen OEMs und Zertifizierern

- So führte TÜV SÜD beispielsweise KI-gestützte automatisierte Testlabore ein, die die Bearbeitungszeit für Zertifizierungen um fast 30 % verkürzten und so die Produktivität mehrerer Automobilkunden steigerten.

Dynamik des Homologationsmarktes

Treiber

„Steigende globale Fahrzeugexporte und sich entwickelnde Regulierungsstandards“

- Der zunehmende internationale Fahrzeughandel veranlasst OEMs, Zertifizierungen in mehreren Rechtsräumen anzustreben, um wettbewerbsfähig zu bleiben

- Strenge Emissions- und Sicherheitsvorschriften in Regionen wie Europa und den USA erhöhen die Nachfrage nach fachkundigen Homologationsdienstleistungen

- Der Aufstieg von Elektrofahrzeugen und ADAS-Technologien führt zu neuen Testparametern, die eine erweiterte Konformitätsbewertung erfordern

- Internationale Organisationen wie die UNECE fördern harmonisierte Rahmenbedingungen, obwohl regionale Unterschiede weiterhin lokale Genehmigungen erfordern.

- Die zunehmende Komplexität von Fahrzeugkomponenten, Software und Elektronik hat die Zertifizierung technischer und wiederkehrender gemacht

- So führte beispielsweise die Einführung des Worldwide Harmonized Light Vehicles Test Procedure (WLTP) in der EU zu verstärkten Homologationsbemühungen bei den nach Europa exportierenden Automobilherstellern.

Einschränkung/Herausforderung

„Kosten- und zeitintensiver Genehmigungsprozess“

- Die Homologation erfordert erhebliche Investitionen in Testinfrastruktur, Zertifizierungen und Fachpersonal

- Genehmigungszeiträume können langwierig sein, was die Markteinführungszeit verzögert und die Opportunitätskosten für OEMs erhöht

- Mangelnde Harmonisierung zwischen den Ländern führt zu doppelten Testanstrengungen und erhöht die finanzielle Belastung

- Kleinere Unternehmen und Startups haben oft Schwierigkeiten, die wiederkehrenden Kosten für Tests und Dokumentation zu tragen, die für jeden neuen Markt erforderlich sind

- Kontinuierliche Aktualisierungen der regulatorischen Rahmenbedingungen erfordern zusätzliche Testrunden, die oft die begrenzten Budgets und Ressourcen belasten.

- So haben beispielsweise mehrere Hersteller von Elektro-Zweirädern in Südostasien den Markteintritt in Europa verschoben, da die Homologation von Batteriesystemen nach den strengen EU-Sicherheitsnormen zu teuer und zu zeitaufwändig war.

Homologationsmarktumfang

Der Markt ist nach Servicetyp, Anwendung und Fahrzeugtyp segmentiert.

• Nach Servicetyp

Der Homologationsmarkt ist nach Dienstleistungsart in die Homologation von Gesamtfahrzeugen sowie die Homologation von Komponenten und Systemen segmentiert. Das Segment der Gesamtfahrzeughomologation erzielte 2024 den größten Umsatzanteil, getrieben durch den zunehmenden internationalen Automobilhandel und die steigenden regulatorischen Anforderungen an die Zertifizierung von Gesamtfahrzeugen in allen Regionen. Automobilhersteller sind gezwungen, beim Export von Fahrzeugen die sich entwickelnden Emissions-, Sicherheits- und Umweltstandards einzuhalten, was die Nachfrage nach umfassenden Homologationsdienstleistungen steigert. OEMs bevorzugen Gesamtfahrzeugzulassungen, um den globalen Markteintritt zu vereinfachen und redundante Tests zu reduzieren.

Das Segment Komponenten- und Systemhomologation wird voraussichtlich zwischen 2025 und 2032 aufgrund der zunehmenden Komplexität von Fahrzeugsubsystemen und der Integration elektronischer Komponenten das höchste Wachstum verzeichnen. Mit dem Aufkommen von Elektro- und autonomen Fahrzeugen ist die Nachfrage nach Tests auf Komponentenebene – beispielsweise für Batteriesysteme, ADAS-Module und Antriebsstränge – stark gestiegen. Tier-1- und Tier-2-Zulieferer führen zunehmend spezialisierte Homologationen durch, um die Konformität einzelner Teile über verschiedene Regionen hinweg sicherzustellen.

• Nach Anwendung

Der Homologationsmarkt wird je nach Anwendung in die nationale und die exportorientierte Homologation unterteilt. Das exportorientierte Homologationssegment dominierte den Markt im Jahr 2024 aufgrund eines starken Anstiegs der grenzüberschreitenden Fahrzeugverkäufe, insbesondere in Europa, im asiatisch-pazifischen Raum und in Nordamerika. Globale Automobilhersteller sind auf Exportgenehmigungen angewiesen, um unterschiedliche regionale Anforderungen zu erfüllen. Dies ist besonders wichtig für Unternehmen, die in stark regulierte Märkte wie die USA und die EU eintreten.

Das Segment der nationalen Homologation dürfte zwischen 2025 und 2032 das höchste Wachstum verzeichnen, unterstützt durch nationale Regulierungsreformen und eine strengere Einhaltung der Vorschriften in Schwellenländern. Da Länder ihre Standards an globale Rahmenbedingungen anpassen, müssen lokale Hersteller zunehmend Zertifizierungen einholen, auch für im Inland verkaufte Fahrzeuge.

• Nach Fahrzeugtyp

Der Markt ist nach Fahrzeugtyp in Motorräder, Personenkraftwagen, Nutzfahrzeuge, Anhänger und landwirtschaftliche Geräte segmentiert. Das Segment Personenkraftwagen hatte 2024 den größten Umsatzanteil, was auf die Dominanz der Pkw-Exporte und die zunehmende Integration fortschrittlicher Sicherheits- und Infotainmenttechnologien zurückzuführen ist. Die Notwendigkeit, eine breite Palette von Merkmalen – wie Emissionen, Beleuchtung, Crashsicherheit und Elektronik – zu zertifizieren, macht die Homologation für Personenkraftwagen unerlässlich.

Das Motorradsegment dürfte zwischen 2025 und 2032 das höchste Wachstum verzeichnen, insbesondere aufgrund steigender Zweiradexporte aus asiatisch-pazifischen Ländern wie Indien und China. Neue Emissionsnormen wie Euro 5 und die sich entwickelnden Vorschriften für die Elektromobilität veranlassen Hersteller dazu, schnelle und kostengünstige Homologationsdienste in Anspruch zu nehmen, um ihre Wettbewerbsfähigkeit auf dem Markt zu erhalten.

Regionale Analyse des Homologationsmarktes

• Europa dominierte den Homologationsmarkt mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch strenge regulatorische Rahmenbedingungen wie UNECE-Standards und hohe grenzüberschreitende Fahrzeugexportmengen

• OEMs und Komponentenhersteller in der Region sind stark auf Typgenehmigungsverfahren angewiesen, wobei Länder wie Deutschland, Frankreich und Italien bei den Zertifizierungsverfahren eine zentrale Rolle spielen.

• Der wachsende Fokus auf Sicherheit, Emissionskontrolle und nachhaltige Mobilität sowie die zunehmende Komplexität der Automobiltechnologien haben die Bedeutung einer einheitlichen Homologation auf den nationalen und internationalen Märkten verstärkt

Einblicke in den deutschen Homologationsmarkt

Der deutsche Homologationsmarkt erzielte 2024 den höchsten Umsatzanteil in Europa, was auf die Position des Landes als globaler Automobilstandort zurückzuführen ist. Die Notwendigkeit, sowohl EU- als auch globale Vorschriften einzuhalten, hat die Homologationsaktivitäten intensiviert. Mit seiner fortschrittlichen Prüfinfrastruktur und seiner regulatorischen Führungsrolle setzt Deutschland weiterhin Maßstäbe für die Typgenehmigung, insbesondere in aufstrebenden Segmenten wie Elektro- und autonomen Fahrzeugen. Die Präsenz großer OEMs und Tier-1-Zulieferer beschleunigt die Nachfrage nach System- und Gesamtfahrzeugzertifizierungen zusätzlich.

Einblicke in den britischen Homologationsmarkt

Der britische Homologationsmarkt wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, unterstützt durch die Einhaltung strenger Sicherheits- und Umweltstandards. Nach dem Brexit hat Großbritannien ein eigenes Fahrzeugtypgenehmigungssystem (UKTA) eingeführt, was Hersteller dazu veranlasst, separate Zertifizierungsverfahren für den britischen und den EU-Markt zu durchlaufen. Diese doppelte Konformitätsanforderung hat die Nachfrage nach lokalen Homologationsdienstleistungen erhöht. Darüber hinaus tragen die starken Forschungs- und Entwicklungskapazitäten des Landes im Automobilbereich und der wachsende Elektrofahrzeugsektor zum Anstieg der Komponenten- und Systemzulassungen bei.

Einblicke in den Homologationsmarkt im Asien-Pazifik-Raum

Der Homologationsmarkt im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen. Grund hierfür sind die steigende Fahrzeugproduktion, steigende Exporte und die Übernahme globaler Standards durch Länder wie Indien, China und Japan. Die Regierungen der Region orientieren sich zunehmend an internationalen Zertifizierungsprotokollen, was die Rolle der Homologationsdienstleister stärkt. Darüber hinaus schaffen das Wachstum der Elektromobilität und der grenzüberschreitende Handel günstige Rahmenbedingungen für die Zulassung von Komponenten und Gesamtfahrzeugen.

Einblicke in den chinesischen Homologationsmarkt

China eroberte 2024 den größten Marktanteil im Homologationsmarkt im asiatisch-pazifischen Raum, was auf seine enorme Fahrzeugproduktionsbasis und steigende Exporte nach Europa, Südostasien und Lateinamerika zurückzuführen ist. Die Bemühungen der Regierung, lokale Standards mit internationalen Rahmenbedingungen zu harmonisieren, sowie Chinas führende Rolle in der Elektrofahrzeugproduktion haben den Bedarf an nationalen und exportorientierten Zertifizierungen erhöht. Die wachsende Bedeutung digitaler Tools und automatisierter Testplattformen modernisiert zudem den Homologationsprozess im ganzen Land.

Einblicke in den Homologationsmarkt Nordamerika

Nordamerika hält einen bedeutenden Anteil am globalen Homologationsmarkt, angetrieben durch die Regulierung durch Behörden wie die US-amerikanische National Highway Traffic Safety Administration (NHTSA) und die Environmental Protection Agency (EPA). Automobilhersteller müssen komplexe Vorschriften einhalten, um sowohl inländische als auch ausländische Märkte zu erschließen. Der starke Fokus der Region auf Sicherheit, Emissionsstandards und Fahrzeugkonnektivität erweitert den Umfang der Homologation kontinuierlich.

Einblicke in den US-Homologationsmarkt

Der US-Homologationsmarkt dominierte 2024 Nordamerika, was auf die starke Fahrzeugexportbasis des Landes und die robuste Automobilinnovation zurückzuführen ist. US-amerikanische Zulassungsvorschriften wie FMVSS und CARB führen zu einer hohen Nachfrage nach Zertifizierungen für eine breite Palette von Fahrzeugen und Komponenten. Die wachsende Präsenz von Startups für Elektro- und autonome Fahrzeuge verstärkt den Bedarf an spezialisierten und flexiblen Homologationsdienstleistungen zusätzlich.

Marktanteile im Bereich Homologation

Die Homologationsbranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Applus+ (Spanien)

- Lloyd's Register Group Services Limited (Großbritannien)

- TÜV SÜD (Deutschland)

- Eurofins Scientific (Luxemburg)

- Formel D (Deutschland)

- Bureau Veritas (Frankreich)

- DEKRA India Private Limited (Deutschland)

- MISTRAS Group (USA)

- SGS SA (Schweiz)

- Intertek Group plc (Großbritannien)

- CIRT (Indien)

- Splan Corporate Solutions LLP (Indien)

- TASS International (Niederlande)

- Eleos Compliance (USA)

Neueste Entwicklungen auf dem globalen Homologationsmarkt

- Im Juli 2023 intensivieren UTAC und SMVIC ihre Zusammenarbeit. Das Testzentrum von SMVIC erhält in China die Euro NCAP-Zulassung und unterstreicht damit einen großen Fortschritt in der globalen Fahrzeugsicherheit. Die Unterzeichnung einer Absichtserklärung bekräftigt das Engagement von UTAC, die Test-, Typgenehmigungs- und Zertifizierungsbemühungen zu stärken und seine Rolle als Behörde für Mobilitätssicherheit zu festigen.

- Im Juli 2023 erhält UL LLC. den Status eines Zertifizierungsprüflabors für Batterie- und Elektrofahrzeug-Ladedienste in Taiwan und bietet umfassende Testlösungen für Hersteller aus dem E-Mobilitäts- und Energiesektor an, um die Produktsicherheit und -konformität in sich entwickelnden Märkten zu stärken.

- Im Mai 2023 erhält der FORVIA CLD die wichtige Tankzertifizierung Typ IV von der chinesischen Regierung und stärkt damit Faurecias Position im Bereich der Wasserstoffmobilität. Mit dem Leichtbaukonzept und den Wachstumsaussichten des CLD ist Faurecia bestens aufgestellt, die Wasserstoffmobilität in China voranzutreiben und seine Marktpräsenz und seinen Einfluss zu festigen.

- Im März 2023 investierte die SGS Société Générale de Surveillance SA erheblich in eine hochmoderne bioanalytische Testanlage in Pudong, Shanghai, und verstärkte damit die Unterstützung des Biopharma-Sektors. Diese Initiative verspricht optimierte IND- und NDA-Prozesse und unterstreicht das Engagement von SGS, die Arzneimittelforschung und -entwicklung sowie die Qualitätsstandards in Zusammenarbeit mit Branchenführern voranzutreiben.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.