Global Hemostats Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.34 Billion

USD

5.67 Billion

2024

2032

USD

3.34 Billion

USD

5.67 Billion

2024

2032

| 2025 –2032 | |

| USD 3.34 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Globale Marktsegmentierung für Hämostatika nach Produkttyp (Hämostat auf Thrombinbasis, Kombinations-Hämostat, Hämostat auf Basis oxidierter regenerierter Zellulose, Gelatine- und Kollagenbasis), Formulierung (Matrix- und Gel-Hämostatika, Blatt- und Pad-Hämostatika, Schwamm-Hämostatika und Pulver-Hämostatika), Anwendung (Orthopädie, Allgemeinchirurgie, Neurochirurgie, Herz-Kreislauf-Chirurgie, Rekonstruktive Chirurgie und Gynäkologische Chirurgie), Indikation (Wundverschluss und Chirurgie), Endverbraucher (Krankenhäuser, Kliniken, Ambulanzen, kommunale Gesundheitsversorgung und andere) – Branchentrends und Prognose bis 2032

Hämostatika Marktgröße

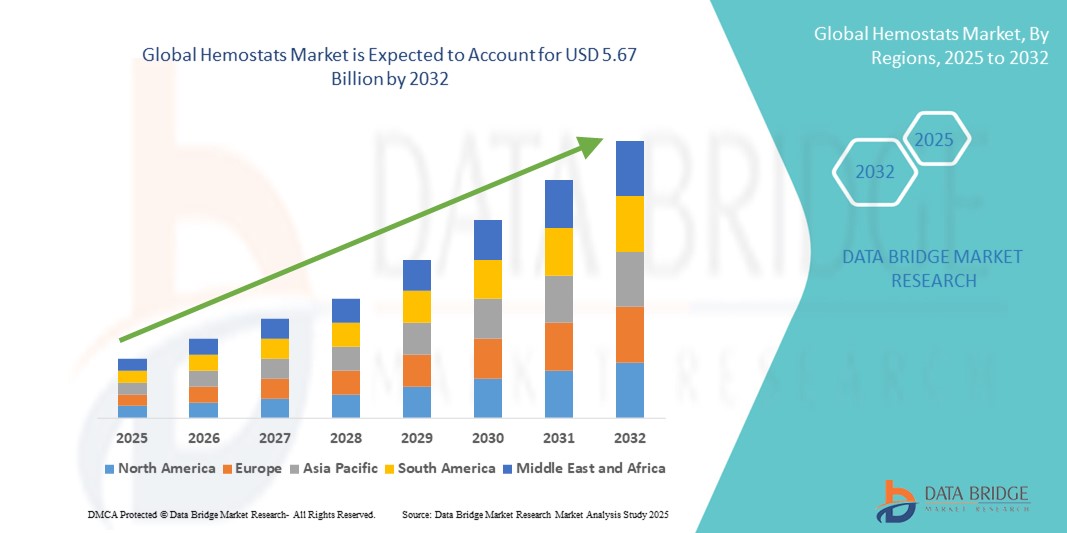

- Der globale Markt für Hämostatika wurde im Jahr 2024 auf 3,34 Milliarden US-Dollar geschätzt und soll bis 2032 5,67 Milliarden US-Dollar erreichen , bei einer CAGR von 6,85 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die weltweit steigende Zahl chirurgischer Eingriffe und den wachsenden Bedarf an einem effektiven Blutverlustmanagement, insbesondere in der Trauma- und Notfallversorgung, vorangetrieben. Hämostatika spielen eine entscheidende Rolle bei der Verbesserung der chirurgischen Effizienz, indem sie eine schnelle und lokalisierte Blutungskontrolle ermöglichen und so intraoperative Komplikationen reduzieren und die Behandlungsergebnisse verbessern.

- Darüber hinaus beschleunigen Fortschritte in der Hämostatiktechnologie – darunter bioresorbierbare Materialien, thrombinbasierte Wirkstoffe und Kombinationsprodukte – die Einführung von Hämostatika in der Allgemeinchirurgie, bei kardiovaskulären Eingriffen und bei orthopädischen Eingriffen. Diese Innovationen verbessern nicht nur die Wirksamkeit, sondern ermöglichen auch eine breitere Anwendung in der minimalinvasiven und laparoskopischen Chirurgie und fördern so das Marktwachstum erheblich.

Hämostatika-Marktanalyse

- Hämostatika, lebenswichtige chirurgische Mittel zur Blutstillung und zur Förderung der Blutgerinnung während Operationen, sind in der Traumaversorgung, bei orthopädischen Eingriffen, in der Herz-Kreislauf-Chirurgie und bei minimalinvasiven Eingriffen zunehmend unverzichtbar, da sie eine schnelle Blutstillung gewährleisten und die Operationsergebnisse verbessern.

- Die steigende Nachfrage nach Hämostatika ist vor allem auf die weltweit zunehmende Zahl chirurgischer Eingriffe, die zunehmende Zahl von Traumata und Unfällen sowie die wachsende ältere Bevölkerung zurückzuführen, die anfällig für chronische Krankheiten ist, die eine operative Versorgung erfordern.

- Nordamerika dominierte den Hämostatika-Markt mit dem größten Umsatzanteil von 39,8 % im Jahr 2024, was auf die fortschrittliche Gesundheitsinfrastruktur, die hohen Gesundheitsausgaben pro Kopf und die starke Präsenz führender Marktteilnehmer zurückzuführen ist. Insbesondere in den USA ist die Verbreitung passiver und aktiver Hämostatika in Krankenhäusern und ambulanten Operationszentren stark ausgeprägt.

- Der asiatisch-pazifische Raum wird im Prognosezeitraum von 2025 bis 2032 voraussichtlich die am schnellsten wachsende Region auf dem Hämostatika-Markt sein. Dies ist auf die schnelle Urbanisierung, steigende Investitionen im Gesundheitswesen, den verbesserten Zugang zur chirurgischen Versorgung in Ländern wie China und Indien und das zunehmende Bewusstsein für ein wirksames Blutverlustmanagement bei Eingriffen zurückzuführen.

- Das Segment Chirurgie dominierte den Hämostatikamarkt mit einem Marktanteil von 65,4 % im Jahr 2024, was auf die wachsende Zahl komplexer chirurgischer Eingriffe zurückzuführen ist, die eine sofortige und effiziente Blutungskontrolle erfordern, um Komplikationen zu minimieren.

Berichtsumfang und Hämostatika-Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke für Hämostatika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Hämostatika-Markttrends

Steigende Nachfrage nach fortschrittlichen Hämostatika in der modernen Chirurgie

- Ein bedeutender und sich beschleunigender Trend auf dem globalen Hämostatikamarkt ist die zunehmende Verwendung fortschrittlicher Hämostatika in verschiedenen chirurgischen Bereichen, darunter Orthopädie, Herz-Kreislauf-, Trauma- und Neurochirurgie. Die Weiterentwicklung chirurgischer Techniken hat zu einer erhöhten Nachfrage nach zuverlässigen, schnell wirkenden Lösungen zur effizienten Behandlung intraoperativer Blutungen geführt.

- Moderne Hämostatika, einschließlich Wirkstoffen wie Thrombin und Fibrinkleber, erfreuen sich aufgrund ihrer überlegenen Wirksamkeit zunehmender Beliebtheit, insbesondere bei komplexen oder minimalinvasiven Eingriffen, bei denen herkömmliche mechanische Methoden (wie Nähte oder Ligaturen) nicht ausreichen.

- Krankenhäuser und ambulante Operationszentren bevorzugen zunehmend kombinierte Hämostatika, die Blutungen sowohl physikalisch als auch biochemisch stillen. Dieser Trend spiegelt eine zunehmende Präferenz für vielseitige Wirkstoffe wider, die in verschiedenen Operationssituationen und bei verschiedenen Wundtypen eingesetzt werden können.

- Darüber hinaus hat der weltweite Anstieg der geriatrischen Bevölkerung – die anfälliger für chronische Krankheiten ist, die einen chirurgischen Eingriff erfordern – einen direkten Einfluss auf den erhöhten Verbrauch hämostatischer Produkte in der operativen Versorgung und in der postoperativen Genesung.

- Führende Hersteller konzentrieren sich auf die Entwicklung von Hämostatika der nächsten Generation mit verbesserter Biokompatibilität, minimaler immunogener Reaktion und schnelleren Anwendungszeiten, die dem zunehmenden Trend zur Verkürzung der Operationsdauer und zur Verbesserung der Patientenergebnisse entsprechen.

- Mit zunehmenden Investitionen in die Gesundheitsinfrastruktur und chirurgische Innovationen, insbesondere in Schwellenländern, ist der globale Markt für Hämostatika auf anhaltendes Wachstum eingestellt – angetrieben von klinischer Wirksamkeit, Patientensicherheit und dem wachsenden Umfang chirurgischer Eingriffe, die eine präzise Kontrolle des Blutverlusts erfordern

Hämostatika-Marktdynamik

Treiber

Steigende Nachfrage nach Blutverlustmanagement in allen chirurgischen Fachgebieten

- Das weltweit wachsende Operationsaufkommen – insbesondere in den Bereichen Herz-Kreislauf-, Orthopädie-, Trauma- und Neurochirurgie – treibt die Nachfrage nach effizienten Hämostatika deutlich an.

- Krankenhäuser und chirurgische Zentren setzen verstärkt auf den Einsatz moderner Hämostate, um intra- und postoperative Blutungen effektiver zu behandeln und so die Komplikationsrate zu senken und die Behandlungsergebnisse der Patienten zu verbessern.

- So hat beispielsweise die zunehmende Anwendung minimalinvasiver Operationstechniken, bei denen Sichtbarkeit und Präzision von größter Bedeutung sind, den Bedarf an schnell wirkenden topischen Hämostatika verstärkt.

- Dies ermutigt Hersteller, innovative Lösungen zu entwickeln, die eine schnelle Gerinnung ermöglichen, ohne das Operationsfeld zu beeinträchtigen.

- Chronische Erkrankungen wie Diabetes, Lebererkrankungen und Koagulopathien, die das Blutungsrisiko während der Operation erhöhen, treiben die Nachfrage nach zuverlässigen hämostatischen Lösungen sowohl bei Wahl- als auch bei Notfalleingriffen weiter voran

- Die Verwendung zusätzlicher Hämostatika wird bei vielen Hochrisikooperationen zur Standardpraxis

Einschränkung/Herausforderung

Hohe Kosten und regulatorische Einschränkungen

- Trotz ihrer klinischen Wirksamkeit bleiben die hohen Kosten für fortschrittliche biologische und aktive Hämostatika, wie z. B. Thrombin- oder Fibrin-basierte Produkte, ein wesentliches Hindernis in ressourcenarmen Gesundheitseinrichtungen. Viele öffentliche Krankenhäuser und kleine chirurgische Zentren, insbesondere in Entwicklungsländern, verlassen sich aus Kostengründen immer noch auf einfache mechanische Methoden.

- Darüber hinaus erhöhen die strengen regulatorischen Rahmenbedingungen für die Zulassung biologisch gewonnener Hämostatika den Markteintritt und erhöhen die Kosten. Hersteller müssen hohe Investitionen in die klinische Validierung tätigen und strenge Compliance-Anforderungen erfüllen, was Innovation und Marktverfügbarkeit verlangsamen kann.

- Eine weitere Herausforderung liegt in der Produktkompatibilität und Benutzerfreundlichkeit. Einige Hämostatika erfordern eine spezielle Lagerung oder Zubereitung, was sie in Notfällen oder in ländlichen Gebieten weniger praktisch macht. Daher steigt die Nachfrage nach gebrauchsfertigen, haltbaren Produkten mit breitem Anwendungsspektrum für verschiedene Eingriffe.

- Das mangelnde Bewusstsein für die Vorteile moderner Hämostate in bestimmten Entwicklungsmärkten schränkt deren Einsatz ein. Chirurgen und Beschaffungsabteilungen sind möglicherweise weiterhin auf traditionelle Techniken angewiesen, da sie nicht ausreichend geschult sind oder mit neuen Technologien vertraut sind.

- Auch die Herausforderungen bei der Kostenerstattung in mehreren Regionen bremsen das Marktwachstum. Viele Gesundheitssysteme bieten keine vollständige Kostenerstattung für teure Hämostatika an, was sowohl für Anbieter als auch für Patienten eine finanzielle Belastung darstellt.

- Unterbrechungen der Lieferkette, insbesondere während globaler Ereignisse wie der COVID-19-Pandemie, können die durchgängige Verfügbarkeit wichtiger Hämostatika in Krankenhäusern und chirurgischen Zentren beeinträchtigen und sich auf Behandlungsprotokolle und Bestandsentscheidungen auswirken.

- Produktrückrufe und Bedenken hinsichtlich Sicherheit oder Kontamination können das Markenvertrauen und die Markenakzeptanz erheblich beeinträchtigen. Beispielsweise können biologische Produkte bei unsachgemäßer Handhabung oder Verarbeitung das Risiko immunogener Reaktionen oder Virusübertragungen bergen.

- Darüber hinaus gibt es wachsende Bedenken hinsichtlich der Umweltauswirkungen und der Abfallerzeugung durch hämostatische Einwegprodukte. Dies veranlasst Aufsichtsbehörden und Krankenhäuser dazu, nach nachhaltigeren Alternativen zu suchen – etwas, das derzeit nicht alle Unternehmen anbieten können.

Hämostatika-Marktumfang

Der Markt ist nach Produkttyp, Formulierung, Anwendung, Indikation und Endbenutzer segmentiert.

- Nach Produkttyp

Der Markt für Hämostatika ist nach Produkttyp in Hämostatika auf Thrombinbasis, Kombinationspräparate, Hämostatika auf Basis oxidierter regenerierter Zellulose, Gelatinepräparate und Kollagenpräparate unterteilt. Das Segment der Hämostatika auf Thrombinbasis dominierte den Markt mit einem Umsatzanteil von 31,8 % im Jahr 2024 aufgrund seiner schnellen Gerinnungsfähigkeit und Kompatibilität mit verschiedenen chirurgischen Eingriffen. Diese Produkte sind hochwirksam bei der Kontrolle kleiner und großer Blutungen und werden daher von Chirurgen weltweit bevorzugt.

Gleichzeitig wird für das Segment der kombinierten Hämostate aufgrund seiner Doppelwirkungsmechanismen und der verbesserten Wirksamkeit in komplexen chirurgischen Umgebungen wie Herz- und orthopädischen Eingriffen von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 6,9 % gerechnet.

- Nach Formulierung

Der Markt für Hämostatika ist nach Formulierung in Matrix- und Gelhämostate, Folien- und Padhämostate, Schwammhämostate und Pulverhämostate unterteilt. Das Segment Matrix- und Gelhämostate erzielte im Jahr 2024 mit 34,2 % den größten Umsatzanteil, da sie sich hervorragend an unregelmäßige Wundoberflächen anpassen und bei minimalinvasiven Operationen schnell wirken. Ihre einfache Anwendung und die reduzierte Gewebeschädigung machen sie zur bevorzugten Wahl für Chirurgen bei hochpräzisen Operationen.

Für das Segment der Hämostatika in Pulverform wird von 2025 bis 2032 mit 7,3 % die höchste durchschnittliche jährliche Wachstumsrate erwartet. Grund hierfür sind ihre Vielseitigkeit, einfache Lagerung und die zunehmende Verwendung bei Notfalltraumata und laparoskopischen Eingriffen.

- Nach Anwendung

Der Markt für Hämostatika ist nach Anwendungsgebieten in die Bereiche Orthopädie, Allgemeinchirurgie, Neurochirurgie, Herz-Kreislauf-Chirurgie, Rekonstruktive Chirurgie und Gynäkologie unterteilt. Die Allgemeinchirurgie führte das Segment mit einem Umsatzanteil von 28,6 % im Jahr 2024 an, was auf den weit verbreiteten Einsatz von Hämostatika bei Bauch-, Trauma- und Hernienoperationen zurückzuführen ist, bei denen eine wirksame Kontrolle des Blutverlusts entscheidend ist.

Das Segment der neurologischen Chirurgie wird voraussichtlich zwischen 2025 und 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 7,5 % am schnellsten wachsen, da für diese Verfahren hochpräzise hämostatische Instrumente zur Behandlung leichter Blutungen in der Nähe von Hirn- und Rückenmarksgewebe erforderlich sind.

- Nach Indikation

Der Markt für Hämostatika ist in die Bereiche Wundverschluss und Chirurgie unterteilt. Das Segment Chirurgie erreichte im Jahr 2024 mit 65,4 % den größten Marktanteil. Dies ist auf die steigende Zahl komplexer chirurgischer Eingriffe zurückzuführen, die eine sofortige und effiziente Blutungskontrolle erfordern, um Komplikationen zu minimieren.

Das Segment Wundverschluss wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen, da in der Notfallversorgung und postoperativen Genesung zunehmend topische Hämostatika eingesetzt werden, um die Heilungszeit zu verkürzen und das Infektionsrisiko zu senken.

- Nach Endbenutzer

Der Markt für Hämostatika ist nach Endverbrauchern in Krankenhäuser, Kliniken, ambulante Zentren, kommunale Gesundheitsversorgung und andere Bereiche unterteilt. Krankenhäuser hatten im Jahr 2024 mit 58,1 % den größten Marktanteil, was auf das hohe Operationsaufkommen und die Verfügbarkeit spezialisierter Operationsteams und Infrastruktur zurückzuführen ist. Krankenhäuser sind die wichtigsten Standorte für komplexe Eingriffe, die eine fortschrittliche Blutungskontrolle erfordern.

Für ambulante Zentren wird von 2025 bis 2032 mit 8,1 % die höchste durchschnittliche jährliche Wachstumsrate prognostiziert. Grund hierfür ist die Zunahme ambulanter Operationen und die zunehmende Einführung kostengünstiger, ambulanter Verfahren, die zuverlässige, schnell wirkende Hämostatika erfordern.

Regionale Analyse des Hämostatikummarktes

- Nordamerika dominierte den Hämostatika-Markt mit dem größten Umsatzanteil von 39,8 % im Jahr 2024, getrieben durch die zunehmende Zahl chirurgischer Eingriffe, die hohe Akzeptanz fortschrittlicher Hämostatika und eine starke Gesundheitsinfrastruktur.

- Die Präsenz wichtiger Marktteilnehmer, gepaart mit günstigen Erstattungsrichtlinien und einem zunehmenden Fokus auf die Minimierung chirurgischer Komplikationen, hat weiter zur Dominanz der Region beigetragen.

- Die Nachfrage nach Hämostatika in Nordamerika wird auch durch die steigende Zahl älterer Menschen, chronischer Erkrankungen und die steigende Zahl von Trauma- und Herz-Kreislauf-Operationen gefördert. Krankenhäuser und chirurgische Zentren investieren zunehmend in moderne, effiziente Hämostatika-Lösungen, um intraoperative Blutungen zu reduzieren und die Behandlungsergebnisse zu verbessern.

Einblicke in den US-Markt für Hämostatika

Der US-Markt für Hämostatika erzielte 2024 mit 64 % den größten Umsatzanteil innerhalb Nordamerikas. Dies ist auf die zunehmende Beliebtheit minimalinvasiver Operationen, das steigende Bewusstsein für das Management von Blutverlust und den technologischen Fortschritt bei Hämostatikaprodukten zurückzuführen. Das Land profitiert zudem von einem gut etablierten regulatorischen Rahmen, der weit verbreiteten klinischen Anwendung kombinierter Hämostatika und strategischen Kooperationen zwischen Krankenhäusern und Medizintechnikunternehmen. Staatliche Förderung und die Präsenz führender akademischer Einrichtungen, die im Bereich der chirurgischen Hämostase forschen, unterstützen das Marktwachstum zusätzlich.

Einblicke in den europäischen Hämostatika-Markt

Der europäische Markt für Hämostatika wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies ist vor allem auf die steigende Zahl elektiver und notfallmäßiger Eingriffe, die zunehmende Fokussierung auf postoperative Ergebnisse und eine günstige Finanzierung des öffentlichen Gesundheitswesens zurückzuführen. In Ländern wie Deutschland, Frankreich und Großbritannien werden fortschrittliche biologische und aktive Hämostatika zunehmend in der orthopädischen, kardiovaskulären und Traumachirurgie eingesetzt. Darüber hinaus fördern zunehmende Bemühungen um eine verbesserte Chirurgenausbildung, Innovationen bei Medizinprodukten und die Verbesserung der Operationssicherheit die Akzeptanz in öffentlichen und privaten Gesundheitseinrichtungen.

Einblicke in den britischen Hämostatika-Markt

Der britische Markt für Hämostatika wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen. Dies ist auf die zunehmende Verbreitung chronischer Erkrankungen, die chirurgische Eingriffe erfordern, und den starken Fokus auf die Verbesserung der Operationsergebnisse durch fortschrittliche intraoperative Instrumente zurückzuführen. Investitionen des National Health Service (NHS) in moderne chirurgische Ausrüstung und die wachsende Bedeutung ambulanter Operationszentren (ASCs) tragen zur steigenden Nachfrage bei. Darüber hinaus erhöht die Zunahme ambulanter Operationen und laparoskopischer Eingriffe den Bedarf an schnell wirkenden, resorbierbaren Hämostatika.

Markteinblick in Deutschland für Hämostatika

Der deutsche Markt für Hämostatika wird im Prognosezeitraum voraussichtlich mit einer beträchtlichen jährlichen Wachstumsrate wachsen. Begünstigt werden diese durch ein technologisch fortschrittliches Gesundheitssystem, den Schwerpunkt auf qualitativ hochwertige Pflege und die steigende Zahl älterer Patienten, die sich chirurgischen Eingriffen unterziehen. Krankenhäuser in ganz Deutschland setzen aufgrund ihrer Wirksamkeit bei komplexen Operationen kombinierte und fibrinversiegelnde Hämostatika ein. Regulatorische Anreize und lokale Innovationen bei chirurgischen Materialien unterstützen das Marktwachstum in Deutschland zusätzlich.

Markteinblicke für Hämostatika im asiatisch-pazifischen Raum

Der Markt für Hämostatika im asiatisch-pazifischen Raum wird im Prognosezeitraum 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Grund hierfür sind steigende Investitionen im Gesundheitswesen, die zunehmende Nutzung moderner chirurgischer Verfahren und ein starker Anstieg der Operationsvolumina in Schwellenländern. Länder wie China, Japan und Indien erleben einen rasanten Ausbau ihrer Krankenhausinfrastruktur, gepaart mit staatlich geförderten Bemühungen zur Verbesserung der Operationsergebnisse. Die steigende Nachfrage nach kostengünstigen und effizienten Hämostatikalösungen in öffentlichen und privaten Krankenhäusern dürfte das Wachstum in der Region deutlich vorantreiben.

Markteinblick in Japan für Hämostatika

Der japanische Markt für Hämostatika gewinnt an Dynamik. Dies wird durch eine hohe Anzahl an Operationen, einen Anstieg der geriatrischen Bevölkerung und einen zunehmenden Fokus auf Infektionsprävention und verbesserte postoperative Heilung unterstützt. Japanische Gesundheitseinrichtungen legen Wert auf hochwertige Hämostatika mit nachgewiesener klinischer Sicherheit und Wirksamkeit. Moderne Krankenhäuser setzen kombinierte und synthetische Hämostatika ein, um Operationszeiten und den Bedarf an Bluttransfusionen zu reduzieren. Darüber hinaus beschleunigen inländische Innovationen und strenge regulatorische Vorgaben die Einführung neuer Produkte.

Markteinblick in China für Hämostatika

Der chinesische Markt für Hämostatika erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf die rasche Modernisierung der Gesundheitsinfrastruktur des Landes, den Ausbau der Tertiärkrankenhäuser und die steigende Zahl jährlich durchgeführter chirurgischer Eingriffe zurückzuführen. Starke lokale Fertigungskapazitäten und staatliche Unterstützung für inländische Medizintechnikunternehmen erhöhen die Verfügbarkeit und Erschwinglichkeit von Hämostatika im Land zusätzlich. Die wachsende Mittelschicht und die zunehmende Krankenversicherungsdichte verbessern den Zugang zu chirurgischer Versorgung und steigern die Nachfrage nach wirksamen Hämostatika.

Hämostatika Marktanteil

Die Hämostatika-Industrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- CR Bard, Inc. (USA)

- B. Braun SE (Deutschland)

- Baxter International, Inc. (USA)

- Integra LifeSciences (USA)

- Marine Polymer Technologies, Inc. (USA)

- Teleflex (USA)

- Ethicon, Inc. (USA)

- Pfizer, Inc. (USA)

- Z-Medica LLC (USA)

- Gelita Medical GmbH (Deutschland)

- Anika Therapeutics, Inc. (USA)

- Stryker (USA)

- Integra LifeSciences Corporation (USA)

Neueste Entwicklungen auf dem globalen Hämostatikamarkt

- Im April 2023 stellte Olympus drei neue hämostatische Produkte vor: EndoClot Adhesive (ECA), EndoClot Polysaccharide Hemostatic Spray (PHS) und EndoClot Submucosal Injection – entwickelt für die schnelle Blutstillung bei endoskopischen Eingriffen. Diese Innovationen spiegeln das anhaltende Wachstum im Bereich der minimalinvasiven chirurgischen Hilfsmittel wider.

- Im März 2023 erhielt Axio Biosolutions die 510(k)-Zulassung der US-amerikanischen FDA für sein Ax-Surgi Surgical Hemostat, ein auf Chitosan basierendes Produkt zur Behandlung schwerer chirurgischer Blutungen. Diese Zulassung unterstreicht die regulatorische Dynamik in der Entwicklung von Hämostatika

- Im Januar 2024 erwarb Baxter International Inc. PerClot, ein pulverförmiges Hämostatikum auf Pflanzenstärkebasis, und erweiterte damit sein Angebot im Bereich der ergänzenden Hämostase. Dies unterstreicht die strategische Konsolidierung in der Branche.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.