Global Genetic Testing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

21.49 Billion

USD

72.93 Billion

2024

2032

USD

21.49 Billion

USD

72.93 Billion

2024

2032

| 2025 –2032 | |

| USD 21.49 Billion | |

| USD 72.93 Billion | |

|

|

|

|

Globale Marktsegmentierung für Gentests nach Typ (Trägertests, Diagnosetests, Neugeborenen-Screening, prädiktive Tests, präsymptomatische Tests und andere), Technologie (DNA-Sequenzierung (NGS-basierte Tests), Polymerase-Kettenreaktion, Microarrays, Gesamtgenomsequenzierung, Fluoreszenz-in-situ-Hybridisierung (FISH) und andere), Krankheiten (seltene genetische Störung, Krebs, Mukoviszidose, Sichelzellenanämie, Muskeldystrophie Duchenne, Thalassämie, Huntington-Krankheit, Fragiles-X-Syndrom und andere) und Endbenutzer (Krankenhäuser, Kliniken, Diagnosezentren, Privatkliniken, Labordienstleister und private Labore) – Branchentrends und Prognose bis 2032

Marktgröße für Gentests

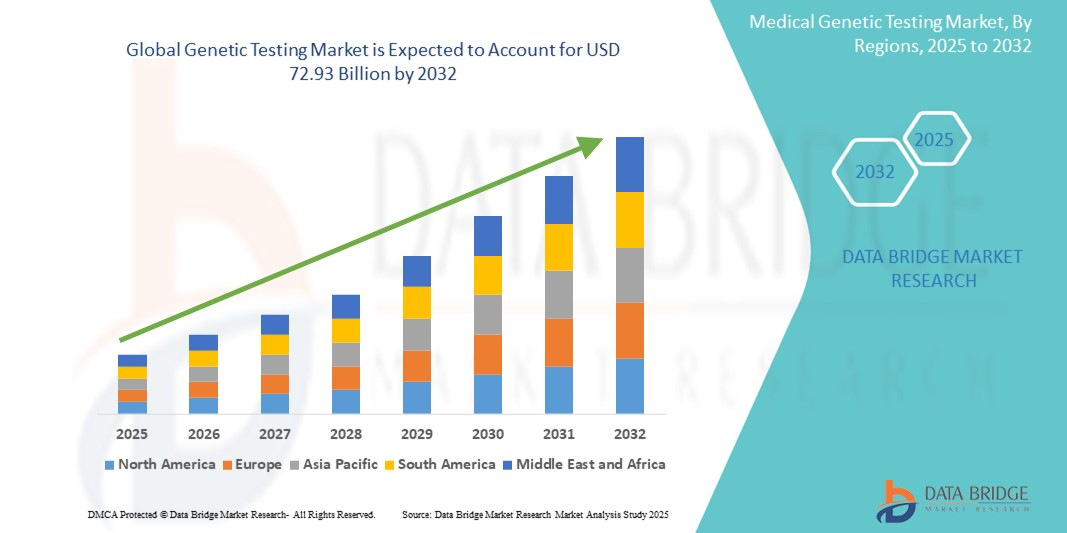

- Der globale Markt für genetische Tests wurde im Jahr 2024 auf 21,49 Milliarden US-Dollar geschätzt und dürfte bis 2032 72,93 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 16,5 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung genetischer Störungen, Krebs und chronischer Krankheiten sowie das wachsende Bewusstsein und die Verfügbarkeit personalisierter Medizin und Methoden zur Früherkennung von Krankheiten vorangetrieben.

- Darüber hinaus etablieren die steigende Verbrauchernachfrage nach prädiktiven Tests, verbesserte Sequenzierungstechnologien und eine bessere Verfügbarkeit über Direktvertriebskanäle Gentests als Eckpfeiler der präventiven Gesundheitsfürsorge. Diese konvergierenden Faktoren beschleunigen die Verbreitung von Gentests und fördern damit die Marktexpansion erheblich.

Marktanalyse für genetische Tests

- Genetische Tests, die die Identifizierung genetischer Störungen, Krankheitsprädispositionen und der Abstammung ermöglichen, werden aufgrund ihrer diagnostischen Genauigkeit, des schnellen technologischen Fortschritts und der zunehmenden Erschwinglichkeit zu einem wesentlichen Bestandteil der personalisierten Medizin und der präventiven Gesundheitsfürsorge sowohl in klinischen als auch in direkt an den Verbraucher gerichteten Anwendungen.

- Die steigende Nachfrage nach genetischen Tests wird vor allem durch die zunehmende Verbreitung chronischer und erblicher Krankheiten, das steigende Bewusstsein für die Früherkennung von Krankheiten und die zunehmende Nutzung der Genomik in der Onkologie, im pränatalen Screening und in der Pharmakogenomik angetrieben.

- Nordamerika dominierte den Markt für Gentests mit dem größten Umsatzanteil von 48,1 % im Jahr 2024, angetrieben von einer gut etablierten Gesundheitsinfrastruktur, günstigen Erstattungsrichtlinien und der Präsenz führender Unternehmen für Gentests, wobei die USA aufgrund hoher Testvolumina und der Einführung von Sequenzierungstechnologien der nächsten Generation an der Spitze standen.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für Gentests sein, da die Gesundheitsausgaben steigen, das Bewusstsein für genetische Erkrankungen zunimmt und die staatlichen Initiativen zur Förderung der Genomforschung zunehmen.

- Das Segment der prädiktiven Tests dominierte den Markt für genetische Tests mit einem Marktanteil von 37,3 % im Jahr 2024, was auf seine entscheidende Rolle bei der Frühdiagnose, Risikobewertung und personalisierten Behandlungsplanung in verschiedenen Krankheitsbereichen zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für genetische Tests

|

Eigenschaften |

Wichtige Markteinblicke im Bereich Gentests |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Gentests

„Zunehmende Integration von KI und Big Data für die personalisierte Medizin“

- Ein bedeutender und sich beschleunigender Trend auf dem globalen Markt für genetische Tests ist die zunehmende Integration von künstlicher Intelligenz (KI), maschinellem Lernen und Big Data-Analysen, um die diagnostische Genauigkeit zu verbessern, die Testinterpretation zu optimieren und personalisierte Behandlungsempfehlungen auf der Grundlage genetischer Profile zu ermöglichen.

- Unternehmen wie Tempus und PathAI nutzen beispielsweise KI-gestützte Plattformen zur Interpretation komplexer Genomdaten und unterstützen Ärzte bei der Entwicklung maßgeschneiderter Therapien, insbesondere in der Onkologie. KI-Tools helfen bei der Identifizierung seltener Mutationen und der Zuordnung von Patienten zu gezielten Behandlungen oder klinischen Studien.

- Die Integration von KI in genetische Tests ermöglicht eine schnellere Verarbeitung umfangreicher genomischer Datensätze, verbessert die Variantenklassifizierung und reduziert die Wahrscheinlichkeit von Diagnosefehlern. Sie unterstützt zudem die Entwicklung polygener Risikoscores, die zunehmend hilfreich für die Vorhersage der Wahrscheinlichkeit häufiger Krankheiten wie Diabetes und Herz-Kreislauf-Erkrankungen sind.

- Darüber hinaus bieten Cloud-basierte Plattformen wie Illumina Connected Analytics und die Datenplattform von Invitae eine skalierbare Infrastruktur für die Speicherung und Analyse genetischer Daten und ermöglichen so eine nahtlose Zusammenarbeit zwischen Laboren, Klinikern und Forschern.

- Die Möglichkeit, genetische Tests in elektronische Gesundheitsakten (EHRs) und andere Gesundheitsplattformen zu integrieren, ermöglicht eine klinische Entscheidungsunterstützung in Echtzeit und erhöht so den Nutzen genetischer Daten in der alltäglichen medizinischen Praxis.

- Dieser Wandel hin zu intelligenteren, datengesteuerten und vernetzten genetischen Testlösungen verändert die Nutzung genetischer Informationen im Gesundheitswesen. Unternehmen wie 23andMe und Fulgent Genetics investieren daher zunehmend in KI-gestützte Genomplattformen, um ihre Fähigkeiten in der Krankheitsvorhersage und personalisierten Medizin zu erweitern.

- Die Nachfrage nach genetischen Testlösungen, die Präzision, Skalierbarkeit und umsetzbare Erkenntnisse bieten, wächst in den Bereichen klinische Diagnostik, Forschung und Verbraucher rasant, da die Beteiligten nach gezielteren und wirksameren Lösungen im Gesundheitswesen suchen.

Marktdynamik für Gentests

Treiber

„Steigende Nachfrage nach Früherkennung und personalisierter Gesundheitsversorgung“

- Die zunehmende Belastung durch genetische und chronische Krankheiten, gepaart mit einem verstärkten Fokus auf Frühdiagnose und präventive Gesundheitsfürsorge, ist ein wichtiger Wachstumstreiber auf dem globalen Markt für Gentests

- So ging Illumina im Januar 2024 eine Partnerschaft mit Janssen ein, um den Einsatz der Gesamtgenomsequenzierung bei der Identifizierung seltener genetischer Erkrankungen zu beschleunigen, was einen breiteren Schritt hin zur Integration der Genomik in die allgemeine Gesundheitsversorgung signalisiert.

- Während sich Gesundheitssysteme weltweit auf eine wertorientierte Versorgung umstellen, bieten genetische Tests umsetzbare Erkenntnisse, die das Fortschreiten von Krankheiten verhindern, die Auswahl der Behandlung optimieren und die Gesamtkosten des Gesundheitswesens senken können.

- Auch die zunehmende Beliebtheit der personalisierten Medizin treibt die Nachfrage an, da Ärzte zunehmend auf genetische Informationen zurückgreifen, um Arzneimitteltherapien individuell anzupassen – insbesondere in der Onkologie, Kardiologie und bei der Behandlung seltener Krankheiten.

- Darüber hinaus steigert die zunehmende Verfügbarkeit von Gentests direkt für Verbraucher von Unternehmen wie 23andMe und AncestryDNA das Bewusstsein und die Akzeptanz der Verbraucher und trägt zur Markterweiterung über traditionelle klinische Umgebungen hinaus bei

Einschränkung/Herausforderung

„Ethische, regulatorische und datenschutzbezogene Bedenken“

- Ethische und regulatorische Herausforderungen im Zusammenhang mit Datenschutz, informierter Einwilligung und potenziellem Missbrauch genetischer Informationen stellen erhebliche Hindernisse für die breitere Einführung genetischer Tests dar

- So haben beispielsweise Ängste vor genetischer Diskriminierung bei der Beschäftigung oder im Versicherungswesen in einigen Ländern zu gesetzlichen Maßnahmen geführt, wie etwa dem Genetic Information Nondiscrimination Act (GINA) in den USA. Dennoch bestehen weiterhin Lücken in den globalen Regulierungsrahmen.

- Der sichere Umgang mit sensiblen genetischen Daten ist ein wichtiges Anliegen, insbesondere angesichts der jüngsten Datenschutzverletzungen im Gesundheitswesen. Unternehmen müssen robuste Cybersicherheitsmaßnahmen und eine transparente Datenverwaltung implementieren, um das Vertrauen der Öffentlichkeit zu stärken.

- Darüber hinaus kann die Komplexität der Interpretation genetischer Ergebnisse zu Ängsten oder Fehlentscheidungen führen, wenn sie nicht ausreichend erklärt werden. Dies unterstreicht die Notwendigkeit einer genetischen Beratung und der Schulung von Ärzten im Rahmen des Testprozesses.

- Die hohen Kosten einiger fortgeschrittener genetischer Tests, insbesondere in Ländern mit niedrigem und mittlerem Einkommen, schränken die Zugänglichkeit ebenfalls ein, obwohl die Preise mit dem Aufkommen von Hochdurchsatztechnologien wie der Sequenzierung der nächsten Generation allmählich sinken.

Marktumfang für genetische Tests

Der Markt ist nach Typ, Technologie, Krankheit und Endbenutzer segmentiert.

- Nach Typ

Der Markt für Gentests ist nach Typ segmentiert in Trägertests, diagnostische Tests, Neugeborenen-Screening, prädiktive Tests, präsymptomatische Tests und weitere. Das Segment der prädiktiven Tests dominierte den Markt mit dem größten Umsatzanteil von 37,3 % im Jahr 2024, angetrieben durch die steigende Nachfrage nach frühzeitiger Risikobewertung und proaktivem Krankheitsmanagement. Prädiktive Tests werden häufig eingesetzt, um die Wahrscheinlichkeit der Entwicklung von Erbkrankheiten wie Brustkrebs, Alzheimer und Herz-Kreislauf-Erkrankungen zu beurteilen.

Es wird erwartet, dass das Segment der diagnostischen Tests von 2025 bis 2032 stetig wächst. Dies wird durch den technologischen Fortschritt und die steigende Nachfrage nach präziser Identifizierung genetischer Anomalien zur Unterstützung von Behandlungsentscheidungen unterstützt. Diagnostische Tests bleiben für die Identifizierung seltener Krankheiten, Onkologie und neurologischer Erkrankungen von entscheidender Bedeutung und bieten Gesundheitsdienstleistern wertvolle Erkenntnisse für eine personalisierte Behandlungsplanung.

- Nach Technologie

Der Markt für Gentests ist technologisch in DNA-Sequenzierung, Polymerase-Kettenreaktion, Microarrays, Gesamtgenomsequenzierung, Fluoreszenz-in-situ-Hybridisierung (FISH) und weitere Verfahren unterteilt. Das Segment DNA-Sequenzierung, insbesondere NGS-basierte Tests, hatte 2024 aufgrund seiner hohen Genauigkeit, Skalierbarkeit und der Fähigkeit, große Mengen genetischer Daten schnell zu verarbeiten, den größten Marktanteil. NGS wird häufig in der Onkologie, der Diagnostik seltener Krankheiten und der Pharmakogenomik eingesetzt und bietet umfassende Einblicke in genetische Varianten und Mutationen.

Die Gesamtgenomsequenzierung wird im Prognosezeitraum voraussichtlich die höchste jährliche Wachstumsrate verzeichnen, angetrieben durch Fortschritte bei Sequenzierungsgeschwindigkeit und Kosteneffizienz. Sie bietet einen vollständigen Überblick über die genetische Ausstattung eines Menschen und wird dadurch für personalisierte Medizin und Forschungsanwendungen immer wertvoller. Die zunehmende Nutzung in Populationsgenomikprojekten und groß angelegten klinischen Studien treibt ihr Wachstum weiter voran.

- Durch Krankheit

Der Markt für Gentests ist nach Krankheitsbildern segmentiert in seltene genetische Erkrankungen, Krebs, Mukoviszidose, Sichelzellenanämie, Muskeldystrophie Duchenne, Thalassämie, Morbus Huntington, Fragiles-X-Syndrom und weitere. Das Krebssegment dominierte den Markt im Jahr 2024 aufgrund der weit verbreiteten Anwendung von Gentests in der Onkologie zur Früherkennung, Risikostratifizierung und Behandlungsauswahl. Gentests auf BRCA-Mutationen, Lynch-Syndrom und Begleitdiagnostik für zielgerichtete Therapien werden in der klinischen Praxis zunehmend eingesetzt.

Das Segment der seltenen genetischen Erkrankungen wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen. Dies ist auf Fortschritte in der Diagnosetechnologie und ein wachsendes Bewusstsein im Gesundheitswesen zurückzuführen. Eine frühzeitige Erkennung durch genetische Tests ermöglicht rechtzeitige Interventionen bei Erkrankungen, die sonst möglicherweise nicht diagnostiziert werden. Globale Initiativen zur Förderung der Erforschung seltener Krankheiten und Neugeborenen-Screening-Programme tragen ebenfalls zum Wachstum dieses Segments bei.

- Nach Endbenutzer

Der Markt für Gentests ist nach Endnutzern in Krankenhäuser, Kliniken, Diagnosezentren, Privatkliniken, Labordienstleister und private Labore segmentiert. Das Segment der Labordienstleister erzielte 2024 den größten Umsatzanteil aufgrund des hohen Testvolumens, der modernen Infrastruktur und der Partnerschaften mit Gesundheitseinrichtungen für ausgelagerte Gentests. Wichtige Akteure wie Quest Diagnostics und LabCorp bauen ihr Angebot an Genomik-Dienstleistungen kontinuierlich aus und stärken so die Dominanz dieses Segments.

Das Segment der privaten Labore dürfte bis 2032 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach flexiblen, dezentralen Testlösungen, insbesondere in städtischen und halbstädtischen Gebieten. Der Anstieg von DTC-Gentests und personalisierten Wellness-Dienstleistungen privater Labore verändert die Verbrauchergenetiklandschaft und zieht gesundheitsbewusste Menschen an, die nach maßgeschneiderten Gesundheitsinformationen suchen.

Regionale Analyse des Marktes für genetische Tests

- Nordamerika dominierte den Markt für Gentests mit dem größten Umsatzanteil von 48,1 % im Jahr 2024, angetrieben von einer gut etablierten Gesundheitsinfrastruktur, günstigen Erstattungsrichtlinien und der Präsenz führender Unternehmen für Gentests, wobei die USA aufgrund hoher Testvolumina und der Einführung von Sequenzierungstechnologien der nächsten Generation an der Spitze standen.

- Verbraucher und Gesundheitsdienstleister in der Region legen großen Wert auf eine frühzeitige Diagnose, maßgeschneiderte Behandlungspläne und ein proaktives Gesundheitsmanagement. All dies wird durch fortschrittliche genetische Testlösungen ermöglicht.

- Diese starke Marktposition wird durch günstige Erstattungsrichtlinien, erhebliche Investitionen in die Genomforschung und die Präsenz führender Branchenakteure, die sowohl klinische als auch direkt an den Verbraucher gerichtete Testdienstleistungen anbieten, weiter unterstützt.

Einblicke in den US-amerikanischen Gentestmarkt

Der US-Markt für Gentests erzielte 2024 mit 89 % den größten Umsatzanteil innerhalb Nordamerikas. Dies ist auf die weit verbreitete Anwendung der Präzisionsmedizin, hohe Testvolumina und eine robuste Gesundheitsinfrastruktur zurückzuführen. Verbraucher und Gesundheitsdienstleister nutzen Gentests zunehmend zur Risikobewertung von Krankheiten, zur Frühdiagnose und zur Personalisierung der Behandlung. Staatliche Unterstützung der Genomforschung, starke Erstattungsrahmen und die Präsenz führender Akteure wie Invitae, Myriad Genetics und LabCorp beschleunigen das Marktwachstum zusätzlich. Auch Direkttests für Verbraucher gewinnen weiter an Bedeutung, insbesondere in den Bereichen Wellness und Abstammung.

Einblicke in den europäischen Markt für Gentests

Der europäische Markt für Gentests wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies ist auf eine unterstützende Gesundheitspolitik, ein zunehmendes Bewusstsein für genetische Erkrankungen und die steigende Nachfrage nach personalisierten Behandlungsmöglichkeiten zurückzuführen. Staatlich geförderte Initiativen und europaweite Genomikprogramme fördern die Verfügbarkeit von Tests. Besonders stark ist die Akzeptanz in der Onkologie und der Diagnostik seltener Krankheiten. Darüber hinaus legen Vorschriften wie die DSGVO Wert auf Datenschutz und ethische Tests und fördern so ein verantwortungsvolles Wachstum in klinischen und Forschungsanwendungen in der Region.

Markteinblicke für Gentests in Großbritannien

Der britische Markt für Gentests wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen, angetrieben durch die kontinuierlichen Investitionen des National Health Service (NHS) in Genomik und Früherkennung. Der Genomic Medicine Service des Landes ist ein wichtiger Wegbereiter für die Integration genetischer Tests in die Routineversorgung. Öffentliche Aufklärungskampagnen und eine enge Zusammenarbeit zwischen Wissenschaft und Industrie treiben die Akzeptanz in der Onkologie, im Herz-Kreislauf-System und in der pränatalen Früherkennung weiter voran. Darüber hinaus unterstützt das robuste Forschungsumfeld Großbritanniens Fortschritte in den Bereichen Sequenzierungstechnologien und Bevölkerungsgesundheitsgenomik.

Markteinblicke für Gentests in Deutschland

Der deutsche Markt für Gentests wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies wird durch die hohe Nachfrage nach fortschrittlicher Diagnostik, ein gut finanziertes Gesundheitssystem und einen zunehmenden Fokus auf die Erkennung seltener Krankheiten und die Pharmakogenomik unterstützt. Deutschland ist ein wichtiger Akteur in der europäischen Biotechnologie- und Diagnostikbranche und verfügt über eine starke akademische und kommerzielle Forschungs- und Entwicklungsinfrastruktur. Die Akzeptanz von Gentests in Krankenhäusern und Fachkliniken nimmt zu, wobei der Schwerpunkt auf datenschutzkonformen und ethisch vertretbaren Lösungen liegt, die den lokalen Vorschriften entsprechen.

Markteinblicke für Gentests im asiatisch-pazifischen Raum

Der Markt für Gentests im asiatisch-pazifischen Raum dürfte im Prognosezeitraum von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 22,3 % wachsen. Dies ist auf den verbesserten Zugang zur Gesundheitsversorgung, das steigende Bewusstsein für genetische Erkrankungen und staatliche Initiativen im Bereich digitale Gesundheit zurückzuführen. Länder wie China, Japan und Indien verzeichnen ein rasantes Wachstum der Nachfrage nach pränatalen Tests, Krebsvorsorgeuntersuchungen und Abstammungsuntersuchungen. Niedrigere Sequenzierungskosten, steigende Investitionen in die Genomik und das Aufkommen inländischer Akteure machen Gentests in der gesamten Region erschwinglicher und zugänglicher.

Markteinblicke für Gentests in Japan

Der japanische Markt für Gentests gewinnt an Dynamik, angetrieben von der alternden Bevölkerung, der fortschrittlichen Gesundheitsinfrastruktur und der kulturellen Betonung der Präventivmedizin. Genomische Tests werden zunehmend zur Krebsdiagnose, Pharmakogenomik und zur Erkennung seltener Krankheiten eingesetzt. Regierungsinitiativen wie die „Genome Medical Care“-Strategie zielen darauf ab, Präzisionsmedizin in das nationale Gesundheitssystem zu integrieren. Japans Fokus auf Innovation und klinische Qualität fördert das Wachstum sowohl in der klinischen Diagnostik als auch in forschungsbasierten Tests.

Markteinblicke für Gentests in Indien

Der indische Markt für Gentests erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf die rasante Urbanisierung, eine wachsende Mittelschicht und ein gestiegenes Bewusstsein für genetische Erkrankungen zurückzuführen. Das Land verzeichnet einen starken Anstieg der Nachfrage nach kostengünstigen genetischen Screenings in der Schwangerschaftsvorsorge, Onkologie und bei Stoffwechselerkrankungen. Regierungsinitiativen zur Förderung digitaler Gesundheitsversorgung und Bevölkerungsscreenings sowie die Präsenz lokaler Gentest-Startups beschleunigen die Marktdurchdringung. Indiens robuste IT-Infrastruktur und die Nutzung der Telemedizin unterstützen den Zugang zu genetischen Dienstleistungen in städtischen und ländlichen Gebieten zusätzlich.

Marktanteile genetischer Tests

Die Gentestbranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Thermo Fisher Scientific Inc. (USA)

- Invitae Corporation (USA)

- Bio-Rad Laboratories, Inc. (USA)

- PerkinElmer (USA)

- Illumina, Inc. (USA)

- QIAGEN (Deutschland)

- F. Hoffmann-La Roche Ltd. (Schweiz)

- Fulgent Genetics (USA)

- Myriad Genetics, Inc. (USA)

- Abbott (USA)

- Eurofins Scientific (Luxemburg)

- Sorenson Genomics (USA)

- BIO-HELIX (USA)

- Biocartis (Belgien)

- Cepheid (USA)

- PacBio (USA)

- ELITechGroup (Frankreich)

- Genes2Me (Indien)

- Eugene Labs (USA)

- Otogenetik (USA)

- Mapmygenome (Indien)

- MedGenome (Indien)

- BioReference Health, LLC (USA)

- Natera, Inc. (USA)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für Gentests?

- Im April 2023 ging Illumina Inc., ein weltweit führendes Unternehmen für DNA-Sequenzierung und Array-basierte Technologien, eine Partnerschaft mit Janssen Biotech Inc. ein, um die Anwendung der Gesamtgenomsequenzierung (WGS) zur Identifizierung seltener und nicht diagnostizierter genetischer Erkrankungen zu erweitern. Diese strategische Zusammenarbeit zielt darauf ab, die Forschung zu beschleunigen und die Möglichkeiten der Frühdiagnose zu verbessern. Sie unterstreicht Illuminas Engagement für die Weiterentwicklung der Genommedizin und die Erweiterung der Reichweite genetischer Tests in komplexen Krankheitsbereichen.

- Im März 2023 veröffentlichte die 23andMe Holding Co., ein führender Anbieter von Gentests für den Direktvertrieb, einen neuen Pharmakogenetik-Bericht als Teil ihres Gesundheitsdienstleistungsangebots. Dieser Bericht hilft Verbrauchern zu verstehen, wie sich ihr genetisches Profil auf ihre Reaktion auf bestimmte Medikamente auswirken kann. Dieser Schritt unterstreicht die wachsende Nachfrage nach personalisierten Gesundheitsinformationen und spiegelt die kontinuierlichen Bemühungen von 23andMe wider, klinisch relevante Tests in verbraucherfreundliche Plattformen zu integrieren.

- Im Februar 2023 gab Myriad Genetics Inc. die Veröffentlichung seines aktualisierten MyRisk Hereditary Cancer Tests bekannt. Dieser Test bietet ein neues Panel mit erweiterter Genabdeckung und verbesserter Vorhersagegenauigkeit. Diese Entwicklung zielt darauf ab, Personen mit einem Risiko für erbliche Krebserkrankungen wie Brust-, Eierstock- und Darmkrebs umfassendere Einblicke zu bieten. Die Innovation von Myriad unterstreicht die Rolle genetischer Tests bei der Krebsfrüherkennung und Risikobewertung und unterstützt personalisierte Präventionsstrategien.

- Im Februar 2023 brachte Thermo Fisher Scientific Inc. seinen Ion Torrent Genexus Dx Integrated Sequencer auf den Markt, eine vollautomatische Next-Generation-Sequencing-Plattform (NGS) für die klinische Diagnostik. Dieses System ermöglicht Ergebnisse noch am selben Tag bei minimalem Zeitaufwand und stellt damit einen deutlichen Fortschritt in der Arbeitseffizienz und der klinischen Entscheidungsfindung dar. Die Markteinführung unterstreicht den Fokus von Thermo Fisher auf die Ermöglichung von Präzisionsmedizin durch zugängliche, durchsatzstarke genetische Testlösungen.

- Im Januar 2023 ging die Invitae Corporation eine strategische Partnerschaft mit NTT DATA ein, um den Zugang zu ihrer Gentestplattform in Schwellenländern zu erweitern. Ziel dieser Zusammenarbeit ist es, die globale Reichweite zu erhöhen und Hürden für die genetische Diagnostik durch die Nutzung digitaler Gesundheitsinfrastrukturen abzubauen. Die Partnerschaft spiegelt Invitaes Mission wider, umfassende genetische Informationen für alle Patienten, insbesondere in unterrepräsentierten Regionen, zugänglich und nutzbar zu machen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.