Global Frozen Food Market

Marktgröße in Milliarden USD

CAGR :

%

USD

280.56 Billion

USD

403.59 Billion

2024

2032

USD

280.56 Billion

USD

403.59 Billion

2024

2032

| 2025 –2032 | |

| USD 280.56 Billion | |

| USD 403.59 Billion | |

|

|

|

|

Globale Marktsegmentierung für Tiefkühlkost nach Produkttyp (Obst und Gemüse, Backwaren, tiefgekühlte Milchprodukte, Fleisch- und Meeresfrüchteprodukte, Convenience Food und Fertiggerichte, Sonstiges), Typ (halbgegart, Rohmaterial, verzehrfertig), Gefriertechnik (individuelles Schnellgefrieren (IQF), Schockfrosten, Bandgefrieren, Sonstiges), Verbrauch (Lebensmittelservice, Einzelhandel), Vertriebskanal (Supermärkte und Hypermärkte, Convenience Stores, Online-Kanäle, Sonstiges), – Branchentrends und Prognose bis 2031.

Marktanalyse für Tiefkühlkost

Aufgrund der Urbanisierung und eines schnelleren Lebensstils haben sich viele Markttrends verschoben. Wir leben in einer schnelllebigen Welt, in der jeder in kürzerer Zeit mehr erledigen möchte. Tiefkühlkost erfüllt diese Kriterien perfekt und hat die Art und Weise, wie wir nährstoffreiche Lebensmittel konsumieren, völlig verändert.

Marktgröße für Tiefkühlkost

Der weltweite Markt für Tiefkühlkost hatte im Jahr 2023 einen Wert von 268,10 Milliarden US-Dollar und soll bis 2031 einen Wert von 385,66 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 4,65 % im Prognosezeitraum von 2024 bis 2031.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke für Tiefkühlkost |

|

Segmentierung |

|

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Schweden, Polen, Dänemark, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Wichtige Marktteilnehmer |

The Hain Celestial Company (USA), AGRARFROST GMBH & CO. KG (Deutschland), Agristo (Belgien), Bart's Potato Company bvba (Belgien), Royal Cosun (Niederlande), Farm Frites (Niederlande), Greenyard (Belgien), Himalaya Food International Ltd. (Indien), JR Simplot Company (USA), McCain Foods Ltd. (Großbritannien), Lamb Weston Holdings, Inc. (Großbritannien), General Mills, Inc. (USA), Mondelez International, Inc. (USA) und THE KRAFT HEINZ COMPANY (USA) |

|

Marktchancen |

|

Marktdefinition für Tiefkühlkost

Tiefkühlkost ist ein Lebensmittel, das bei einer bestimmten Temperatur aufbewahrt wird, dem die gesamte Feuchtigkeit entzogen und das in fester Form gelagert wird. Der Hauptzweck dieser Tiefkühlkost besteht darin, den Verbrauchern den Kochvorgang zu erleichtern und eine längere Haltbarkeit zu gewährleisten.

Marktdynamik für Tiefkühlkost

Treiber

- Steigende Urbanisierung und wachsender Trend zu Convenience Food auf der ganzen Welt

Die wachsende Vorliebe der Verbraucher für Fertiggerichte kommt indirekt der steigenden Nachfrage nach Tiefkühlkost zugute, da ihre Zubereitung weniger Zeit und Aufwand erfordert als das Kochen von Grund auf. Aufgrund des hektischen Lebensstils der Verbraucher wird der Markt für verarbeitete Lebensmittel von einem größeren Bedürfnis nach Bequemlichkeit angetrieben. Infolgedessen steigt die Nachfrage nach Tiefkühlprodukten. Das steigende verfügbare Einkommen ist ein weiterer Faktor, der einen erheblichen Einfluss auf das Wachstum des Tiefkühlkostmarktes hat, da es die Kaufkraft der Verbraucher erhöht.

- Expansion von Convenience Stores sowie wachsende Arbeiterbevölkerung

Tiefgekühlte Fertiggerichte, die von Unternehmen der Lebensmittelversorgungskette verkauft werden, tragen weiterhin erheblich zum Umsatz bei. Weitere Umsatzanteile werden in Kürze erwartet, da Convenience-Stores ihr Angebot an tiefgekühlten Fertiggerichten erweitern und der Internetverkauf bisher ungenutzte Marktchancen erschließt.

Tiefkühlkost erfreut sich in Industrieländern zunehmender Beliebtheit. Dort ist der Verbrauch höher als in Entwicklungsländern. Die steigende Zahl der Erwerbstätigen in Schwellenländern wie China und Indien sowie der Trend zu längeren und flexibleren Arbeitszeiten haben zu einer fortschreitenden Abkehr vom traditionellen Paradigma des täglichen Kochens geführt.

Gelegenheit

Der unerwartete Ausbruch von COVID-19 auf der ganzen Welt hat die Nachfrage nach Tiefkühlkost deutlich erhöht, da diese die Nährstoffe länger behält und länger haltbar ist als anderes frisches Obst, Gemüse und Fleisch, was ebenfalls das Marktwachstum ankurbeln dürfte. Darüber hinaus werden die zunehmende Digitalisierung im Einzelhandel und der schnell wachsende Handel mit verarbeiteten Lebensmitteln im Prognosezeitraum neue Möglichkeiten für den Markt für Tiefkühlkost schaffen.

Beschränkungen

Allerdings dürften die zunehmende Vorliebe für frische und natürliche Lebensmittel sowie der steigende Bedarf an ständiger Temperaturüberwachung das Wachstum des Marktes für Tiefkühlkost bremsen, während die fehlende Kühlketteninfrastruktur in den Entwicklungsländern im Prognosezeitraum eine Marktherausforderung für Tiefkühlkost darstellen wird.

Dieser Marktbericht für Tiefkühlkost enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Tiefkühlkost zu erhalten, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von COVID-19 auf den Markt für Tiefkühlkost

Der COVID-19-Ausbruch hat die Nachfrage nach Fertiggerichten erhöht. Während der Pandemie kauften die Verbraucher ständig Fertiggerichte oder Fertiggerichte zum Kochen, da diese zu niedrigen Preisen erhältlich waren. In allen Restaurants, Hotels und Einkaufszentren wurden strenge Lockdown-Maßnahmen verhängt, die sich aufgrund der Lockdown- und Sicherheitsmaßnahmen weltweit auf die Essgewohnheiten ausgewirkt haben. Dieser Faktor hat auch viele Menschen dazu veranlasst, auf selbst gekochte Mahlzeiten und abgepackte Fertiggerichte umzusteigen, die über mehrere Supermärkte oder Hypermärkte und E-Commerce- Lebensmittelgeschäfte nach Hause geliefert werden können, da die Möglichkeiten, auswärts zu essen, begrenzt waren. Die Angst vor einer Verbreitung des Virus an öffentlichen Orten hat dazu geführt, dass abgepackte und haltbare Lebensmittel anstelle von frischen Lebensmitteln gekauft werden.

Marktumfang für Tiefkühlkost

Der Markt für Tiefkühlkost ist nach Produkttyp, Art, Gefriertechnik, Verbrauch und Vertriebskanal segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkttyp

- Obst und Gemüse

- Gefrorene Früchte

- Tiefkühlgemüse

- Backwaren

- Brot

- Pizzaboden

- Sonstiges

- Gefrorene Milchprodukte

- Fleisch- und Meeresfrüchteprodukte

- Fertiggerichte

- Fertiggerichte

- Sonstiges

Typ

- Halb gekocht

- Rohstoff

- Verzehrfertig

Vertriebskanal

- Supermärkte und Hypermärkte

- Convenience-Stores

- Online-Kanäle

- Sonstiges

Gefriertechnik

- Individuelles Schnellgefrieren (IQF)

- Schockfrosten

- Bandgefrieren

- Andere

Verbrauch

- Gastronomie

- Einzelhandel

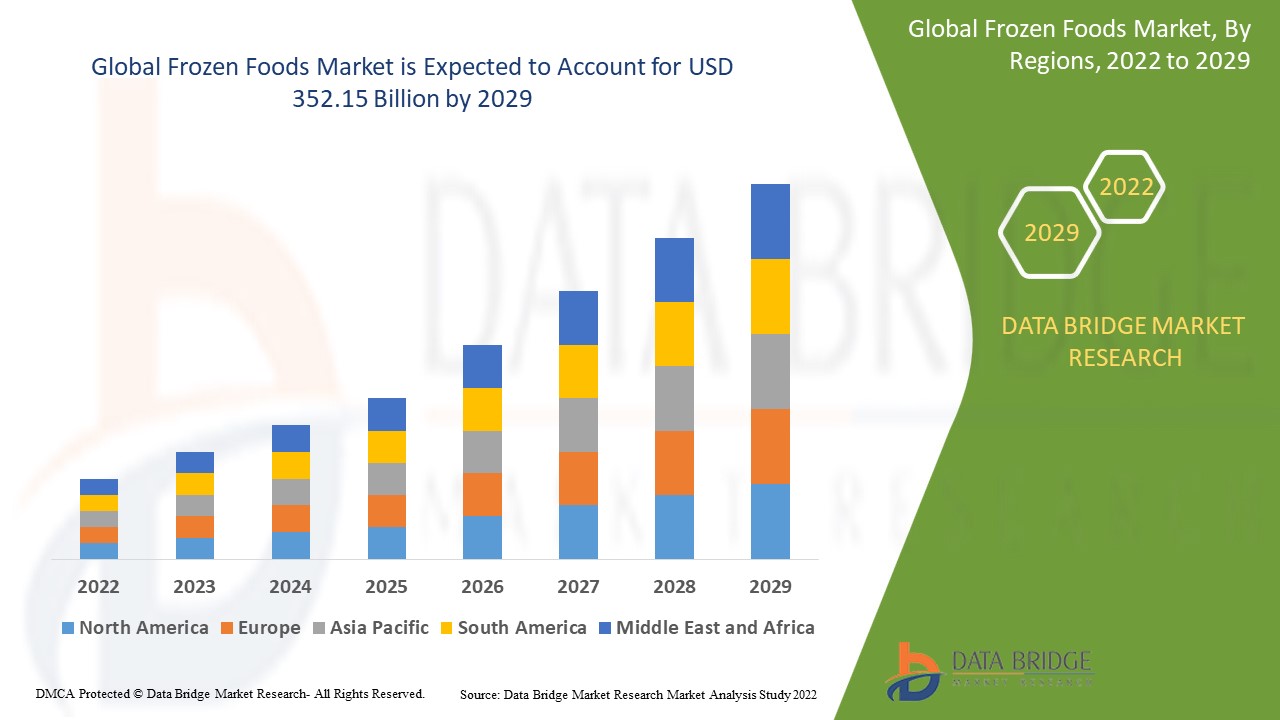

Regionale Analyse des Marktes für Tiefkühlkost

Der Markt für Tiefkühlkost wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkttyp, Gefriertechnik, Verbrauch und Vertriebskanal wie oben angegeben bereitgestellt.

Die im Marktbericht für Tiefkühlkost abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Schweden, Polen, Dänemark, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Europa dominiert den Markt für Tiefkühlkost aufgrund der gestiegenen Nachfrage nach Tiefkühlkost aufgrund der COVID-19-Pandemie, von der mehrere Länder betroffen sind. Darüber hinaus werden das Bevölkerungswachstum der Region, die rasche Urbanisierung und das gestiegene Bewusstsein der Verbraucher für die Vorteile von Tiefkühlkost das Wachstum des Marktes für Tiefkühlkost im Prognosezeitraum vorantreiben.

Im asiatisch-pazifischen Raum wird ein deutliches Wachstum des Marktes für Tiefkühlkost erwartet, da der Trend zu verzehrfertigen Lebensmitteln unter der Arbeiterschicht zunimmt. Darüber hinaus wird erwartet, dass die deutlich steigende Nachfrage nach Tiefkühlkost aufgrund der kürzeren Zeit für die Zubereitung und das Kochen das Marktwachstum in der Region weiter vorantreiben wird.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil Tiefkühlkost

Die Wettbewerbslandschaft des Marktes für Tiefkühlkost liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Tiefkühlkost.

Die Marktführer für Tiefkühlkost sind:

- The Hain Celestial Company (USA)

- AGRARFROST GMBH & CO. KG (Deutschland)

- Agristo (Belgien)

- Bart's Potato Company bvba (Belgien)

- Royal Cosun (Niederlande)

- Farm Frites (Niederlande)

- Greenyard (Belgien)

- Himalaya Food International Ltd. (Indien)

- JR Simplot Company (USA)

- McCain Foods Ltd. (Großbritannien)

- Lamb Weston Holdings, Inc. (Großbritannien)

- General Mills, Inc. (USA)

- Mondelez International, Inc. (USA)

- THE KRAFT HEINZ COMPANY (USA)

Latest Developments in Frozen Foods Market

- In 2021, Nomad Foods announced an agreement with Fortenova Grupa d. d. to acquire Fortenova's Frozen Food Business Group (FFBG) in cash for USD 724 million in order to expand its product portfolio, as FFBG offers a wide range of frozen meals and has a large distribution channel in Eastern Europe

- Conagra Brands Inc. launched its extensive summer line products in 2021 to provide manufacturers inside single-serve frozen meals and collect brands with new Banquet®, Marie Callender's, Wholesome Alternative, and Hungry Man dishes. Conagra's mission is to please customers by providing nutritious frozen foods

- In 2020, the Dutch start-up Lazy Vegan released its latest frozen ready meal, "Thai Green Curry," which is gluten-free and soy-free. It also launched vegan frozen meals with plant-based chicken and Foods in order to establish a strong presence in the European market

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.