Global Food Processing Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

61.90 Billion

USD

81.51 Billion

2024

2032

USD

61.90 Billion

USD

81.51 Billion

2024

2032

| 2025 –2032 | |

| USD 61.90 Billion | |

| USD 81.51 Billion | |

|

|

|

|

Globale Marktsegmentierung für Lebensmittelverarbeitungsgeräte nach Gerätetyp (Kühl- und Gefriergeräte, Koch- und Heizgeräte, Füll- und Versiegelungsgeräte, Mischer, Mühlen und Mühlen, Schneide- und Schneidemaschinen, Trocknungs- und Dehydrationsgeräte, Schäler, Separatoren und andere), Automatisierungstyp (automatisch, halbautomatisch und manuell), Branche (Fleisch, Geflügel und Meeresfrüchte, Milchprodukte, Backwaren, verarbeitetes Obst und Gemüse, Süßwaren, Getreidemühlenprodukte und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Lebensmittelverarbeitungsgeräte

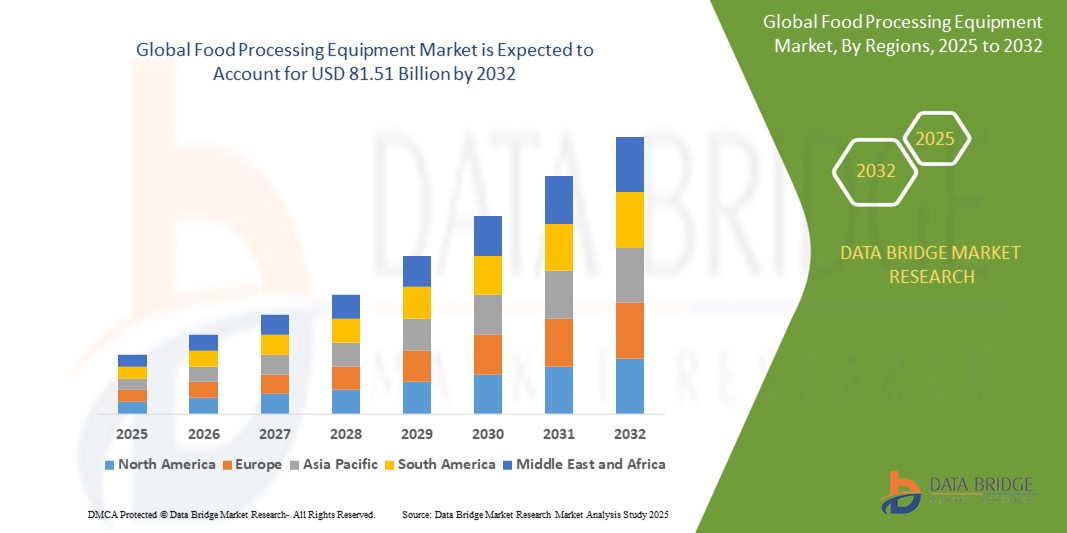

- Der globale Markt für Lebensmittelverarbeitungsgeräte wurde im Jahr 2024 auf 61,90 Milliarden US-Dollar geschätzt und dürfte bis 2032 81,51 Milliarden US-Dollar erreichen , bei einer CAGR von 3,50 % im Prognosezeitraum.

- Das Marktwachstum wird größtenteils durch die steigende Verbrauchernachfrage nach verarbeiteten Lebensmitteln und Fertiggerichten aufgrund veränderter Lebensstile und steigender verfügbarer Einkommen, den wachsenden Bedarf an effizienten und hygienischen Lebensmittelverarbeitungsmethoden, die Einführung fortschrittlicher Technologien wie Automatisierung und KI in der Lebensmittelverarbeitung und den wachsenden weltweiten Handel mit verarbeiteten Lebensmitteln vorangetrieben.

- Darüber hinaus zwingen strenge Vorschriften zur Lebensmittelsicherheit und -qualität weltweit Lebensmittelhersteller dazu, in moderne Verarbeitungsanlagen zu investieren, um die Einhaltung der Vorschriften zu gewährleisten und die Produktintegrität zu wahren.

Marktanalyse für Lebensmittelverarbeitungsgeräte

- Der Markt für Lebensmittelverarbeitungsgeräte befindet sich derzeit in einer Phase kontinuierlichen technologischen Fortschritts, wobei der Schwerpunkt stark auf der Automatisierung liegt, um die Effizienz zu steigern und die Arbeitskosten zu senken.

- Hersteller konzentrieren sich zunehmend auf die Entwicklung von Geräten, die strenge Standards für Lebensmittelsicherheit und Hygiene erfüllen, sowie auf Lösungen, die mehr Flexibilität und Anpassungsmöglichkeiten für unterschiedliche Anforderungen der Lebensmittelproduktion bieten.

- Nordamerika dominierte den Markt für Lebensmittelverarbeitungsgeräte mit dem größten Umsatzanteil von 38,6 % im Jahr 2024, angetrieben durch eine starke Präsenz von Lebensmittelherstellern und eine steigende Nachfrage nach verarbeiteten und verpackten Lebensmitteln

- Der asiatisch-pazifische Raum wird voraussichtlich die höchste Wachstumsrate auf dem globalen Markt für Lebensmittelverarbeitungsgeräte verzeichnen, angetrieben durch die schnelle Industrialisierung, die wachsende städtische Bevölkerung, steigende verfügbare Einkommen und die wachsende Nachfrage nach verpackten Lebensmitteln und Fertiggerichten in Schwellenländern wie China, Indien und den südostasiatischen Ländern.

- Das Segment Fleisch, Geflügel und Meeresfrüchte hatte im Jahr 2024 den größten Marktanteil, bedingt durch den weltweit steigenden Konsum proteinreicher Nahrungsmittel und die Notwendigkeit hygienischer und effizienter Verarbeitungssysteme.

Berichtsumfang und Marktsegmentierung für Lebensmittelverarbeitungsgeräte

|

Eigenschaften |

Wichtige Markteinblicke für Lebensmittelverarbeitungsgeräte |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Lebensmittelverarbeitungsgeräte

„Zunehmende Nutzung von Automatisierung und Robotik“

- In der Lebensmittelverarbeitung werden zunehmend Roboterarme für Aufgaben wie Sortieren und Verpacken eingesetzt, um den Durchsatz zu steigern und Hygienestandards einzuhalten.

- Fahrerlose Transportfahrzeuge (AGVs) und autonome mobile Roboter (AMRs) werden in Lebensmittelverarbeitungsanlagen für Materialhandhabung und -transport immer häufiger eingesetzt.

- Die Implementierung automatisierter Reinigungs- und Hygienesysteme gewinnt an Bedeutung, um die Lebensmittelsicherheit und die Einhaltung strenger Vorschriften zu gewährleisten

- Datenanalyse und IoT (Internet der Dinge) werden in automatisierte Lebensmittelverarbeitungsanlagen integriert, um Echtzeitüberwachung und vorausschauende Wartung zu ermöglichen

- Kollaborative Roboter (Cobots) werden in der Lebensmittelverarbeitung eingesetzt, um gemeinsam mit menschlichen Mitarbeitern Aufgaben zu erledigen, die sowohl Präzision als auch Flexibilität erfordern.

Marktdynamik für Lebensmittelverarbeitungsgeräte

Treiber

„Nachfrage nach verarbeiteten und verpackten Lebensmitteln“

- Die wachsende Weltbevölkerung erfordert eine groß angelegte Nahrungsmittelproduktion, um den Nährstoffbedarf einer wachsenden Zahl von Verbrauchern zu decken.

- In Ländern mit schnell wachsender Bevölkerung besteht beispielsweise eine erhöhte Nachfrage nach Hochleistungsanlagen zur Getreideverarbeitung, um eine ausreichende Nahrungsmittelversorgung sicherzustellen.

- Die Nachfrage nach verarbeiteten und verpackten Lebensmitteln steigt aufgrund veränderter Lebensstile und steigender verfügbarer Einkommen, insbesondere in städtischen und Entwicklungsregionen.

- Urbanisierung und veränderte Lebensstile haben zu einer stärkeren Abhängigkeit von bequemen Nahrungsmitteln geführt und den Bedarf an modernen Geräten zur Lebensmittelverarbeitung weiter erhöht.

- Lebensmittelhersteller sind gezwungen, in hochentwickelte Maschinen zu investieren, die große Mengen an Rohstoffen verarbeiten können und gleichzeitig eine gleichbleibende Produktqualität gewährleisten und strenge Hygiene- und Sicherheitsstandards einhalten.

- Die Globalisierung des Lebensmittelhandels erfordert fortschrittliche Verarbeitungs- und Verpackungstechnologien, um die sichere und effiziente Verteilung von Lebensmitteln über geografische Grenzen hinweg zu ermöglichen

Einschränkung/Herausforderung

„Erhebliche anfängliche Investitionskosten im Zusammenhang mit der Anschaffung und Implementierung fortschrittlicher Verarbeitungstechnologien“

- Die erheblichen anfänglichen Investitionskosten für moderne Lebensmittelverarbeitungsanlagen, insbesondere für Maschinen mit Automatisierung und Robotik, stellen eine erhebliche finanzielle Hürde dar.

- Beispielsweise könnte ein kleines Fleischverarbeitungsunternehmen die Anschaffungskosten für automatisierte Schneide- und Verpackungssysteme als zu hoch empfinden.

- Moderne Lebensmittelverarbeitungsanlagen mit hochentwickelten Steuerungssystemen erfordern oft erhebliche Investitionen und stellen für viele eine Eintrittsbarriere dar

- Diese hohen Kosten stellen eine erhebliche Herausforderung für kleine und mittlere Unternehmen (KMU) im Lebensmittelverarbeitungssektor mit begrenzten finanziellen Mitteln dar.

- Die Implementierung komplexer Maschinen erfordert zusätzliche Investitionen in Bereichen wie Infrastrukturverbesserungen, Schulungen für spezialisiertes Personal sowie laufende Wartung und technischen Support

- Das wahrgenommene Risiko und die Unsicherheiten in Bezug auf die Marktnachfrage und die Kapitalrendite können Unternehmen zusätzlich davon abhalten, hochmoderne, aber teure Technologien zur Lebensmittelverarbeitung einzuführen.

Marktumfang für Lebensmittelverarbeitungsgeräte

Der Markt ist nach Gerätetyp, Automatisierungstyp und Branche segmentiert.

- Nach Gerätetyp

Der Markt für Lebensmittelverarbeitungsgeräte ist nach Gerätetyp in Kühl- und Gefriergeräte, Koch- und Heizgeräte, Füll- und Versiegelungsgeräte, Mischer, Mühlen, Schneide- und Schneidemaschinen, Trocknungs- und Dehydrationsgeräte, Schäler, Separatoren und weitere Geräte unterteilt. Das Segment Kühl- und Gefriergeräte dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch die steigende Nachfrage nach Tiefkühlkost und die Notwendigkeit, verderbliche Produkte über lange Lieferketten hinweg haltbar zu machen. Diese Geräte gewährleisten Lebensmittelsicherheit und -qualität und sind daher sowohl in Großproduktions- als auch in Lageranlagen unverzichtbar.

Das Segment der Mischer wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen, da sie eine entscheidende Rolle bei der Mischung von Zutaten in verschiedenen Lebensmittelkategorien spielen. Mischer gewährleisten Chargenkonsistenz und Effizienz, und Fortschritte im Hygienedesign und in der Automatisierung fördern ihre Verbreitung in modernen Lebensmittelverarbeitungsanlagen.

- Nach Automatisierungstyp

Der Markt für Lebensmittelverarbeitungsanlagen wird nach Automatisierungsart in automatische, halbautomatische und manuelle Anlagen unterteilt. Das automatische Segment hatte 2024 den größten Marktanteil, angetrieben durch die steigende Nachfrage nach hocheffizienten, arbeitssparenden Anlagen, die eine gleichbleibende Produktqualität gewährleisten. Automatisierung minimiert menschliche Fehler, erhöht den Durchsatz und senkt die Betriebskosten, was sie bei großen Lebensmittelherstellern immer beliebter macht.

Das halbautomatische Segment dürfte zwischen 2025 und 2032 das höchste Wachstum verzeichnen, was durch die Flexibilität in kleinen und mittleren Unternehmen (KMU) unterstützt wird. Es bietet ein ausgewogenes Verhältnis zwischen Kosteneffizienz und manueller Steuerung, was insbesondere für kundenspezifische Verarbeitungsanforderungen oder Nischenprodukte von Vorteil ist.

- Nach Branche

Der Markt für Lebensmittelverarbeitungsanlagen ist branchenbezogen in die Bereiche Fleisch, Geflügel und Meeresfrüchte, Milchprodukte, Backwaren, verarbeitetes Obst und Gemüse, Süßwaren, Getreidemühlenprodukte und weitere unterteilt. Das Segment Fleisch, Geflügel und Meeresfrüchte erzielte 2024 den größten Marktanteil, getrieben durch den weltweit steigenden Konsum proteinreicher Nahrungsmittel und den Bedarf an hygienischen und effizienten Verarbeitungssystemen. Die Komplexität der Fleischverarbeitung erfordert zudem spezielle Geräte zum Schneiden, Mahlen, Kochen und Verpacken.

Das Segment verarbeitetes Obst und Gemüse wird voraussichtlich von 2025 bis 2032 das höchste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach Fertiggerichten und das wachsende Gesundheitsbewusstsein. Verbraucher suchen zunehmend nach verzehrfertigen, nährstoffhaltigen verarbeiteten Produkten, was Innovationen und Investitionen in moderne Verarbeitungsanlagen für dieses Segment vorantreibt.

Regionale Analyse des Marktes für Lebensmittelverarbeitungsgeräte

- Nordamerika dominierte den Markt für Lebensmittelverarbeitungsgeräte mit dem größten Umsatzanteil von 38,6 % im Jahr 2024, angetrieben durch eine starke Präsenz von Lebensmittelherstellern und eine steigende Nachfrage nach verarbeiteten und verpackten Lebensmitteln

- Die Region profitiert von einer fortschrittlichen Fertigungsinfrastruktur, hohen Verbraucherausgaben für Fertiggerichte und der Einführung von Automatisierung und hygienegerechter Ausrüstung in Lebensmittelbetrieben.

- Kontinuierliche technologische Fortschritte und strenge Vorschriften zur Lebensmittelsicherheit unterstützen das Marktwachstum. Hersteller investieren in effiziente, automatisierte Lösungen zur Verbesserung der Produktivität und Produktqualität.

Einblicke in den US-Markt für Lebensmittelverarbeitungsgeräte

Der US-Markt für Lebensmittelverarbeitungsanlagen erzielte 2024 mit 80,4 % den größten Umsatzanteil in Nordamerika. Dies ist auf die großflächige Lebensmittelproduktion, technologische Innovationen und die steigende Nachfrage nach Clean-Label- und verzehrfertigen Lebensmitteln zurückzuführen. Der Bedarf an fortschrittlichen Geräten, die Lebensmittelsicherheit, Energieeffizienz und Automatisierung unterstützen, ist ein wichtiger Treiber. Darüber hinaus fördert der wachsende Trend zur Verarbeitung pflanzlicher und biologischer Lebensmittel die Einführung vielseitiger, leistungsstarker Geräte auf dem gesamten US-Markt.

Einblicke in den europäischen Markt für Lebensmittelverarbeitungsgeräte

Der europäische Markt für Lebensmittelverarbeitungsanlagen wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen, angetrieben von einer reifen Lebensmittel- und Getränkeindustrie und strengen EU-Vorschriften zur Lebensmittelsicherheit und -hygiene. Die Umstellung auf nachhaltige und energieeffiziente Verarbeitungssysteme ist ein wichtiger Faktor für die Einführung moderner Anlagen. Die steigende Nachfrage nach verarbeiteten Milchprodukten, Backwaren und Süßwaren unterstützt die regionale Marktexpansion zusätzlich, insbesondere in Ländern mit hohem Exportpotenzial.

Einblicke in den britischen Markt für Lebensmittelverarbeitungsgeräte

Der britische Markt für Lebensmittelverarbeitungsanlagen wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, was auf steigende Investitionen in Lebensmittelinnovation, Automatisierung und Anlagenmodernisierung zurückzuführen ist. Die Nachfrage nach gesünderen Lebensmitteln, darunter auch zuckerarme und pflanzliche Alternativen, veranlasst Lebensmittelhersteller, flexiblere und präzisere Anlagen einzusetzen. Darüber hinaus veranlassen regulatorische Anpassungen nach dem Brexit Unternehmen dazu, ihre Verarbeitungssysteme zu modernisieren, um sowohl nationale als auch internationale Qualitätsstandards zu erfüllen.

Markteinblick in Lebensmittelverarbeitungsgeräte in Deutschland

Der deutsche Markt für Lebensmittelverarbeitungsanlagen wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen. Dies ist auf die starke Ingenieursbasis des Landes, den Fokus auf Lebensmittelqualität und die steigende Nachfrage nach nachhaltigen Verarbeitungstechnologien zurückzuführen. Deutsche Hersteller sind führend bei der Integration von Industrie-4.0-Technologien wie KI, Robotik und IoT in Lebensmittelverarbeitungssysteme. Der Fokus auf die Reduzierung von Lebensmittelabfällen und Energieverbrauch trägt ebenfalls zur Einführung moderner, umweltfreundlicher Anlagen bei.

Markteinblicke für Lebensmittelverarbeitungsgeräte im asiatisch-pazifischen Raum

Der Markt für Lebensmittelverarbeitungsanlagen im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen. Grund hierfür sind die rasante Urbanisierung, steigende verfügbare Einkommen und die wachsende Mittelschicht in Ländern wie China, Indien und Südostasien. Regierungsinitiativen zur Verbesserung der Lebensmittelsicherheit, der Ausbau der Infrastruktur und die Entstehung von Zentren der Lebensmittelproduktion kurbeln das Marktwachstum deutlich an. Der wachsende Bedarf der Region an verarbeiteten, verpackten und Fertiggerichten beschleunigt die Nachfrage nach Anlagen zusätzlich.

Einblicke in den Markt für Lebensmittelverarbeitungsgeräte in Japan

Der japanische Markt für Lebensmittelverarbeitungsanlagen wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch die Vorliebe des Landes für Automatisierung, kompakte Maschinen und hygienische Verarbeitungsstandards. Die alternde Bevölkerung und die schrumpfende Belegschaft zwingen Hersteller dazu, in arbeitssparende Technologien und hocheffiziente Anlagen zu investieren. Japans starke Tradition des Konsums von Fertiggerichten und Fertiggerichten sowie sein Ruf für Qualität und Innovation unterstützen das anhaltende Wachstum im Bereich der Lebensmittelverarbeitungsanlagen.

Einblicke in den Markt für Lebensmittelverarbeitungsgeräte in China

Der chinesische Markt für Lebensmittelverarbeitungsanlagen wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen. Dies ist auf den expandierenden Lebensmittelsektor des Landes und die steigende Verbrauchernachfrage nach verarbeiteten und verpackten Lebensmitteln zurückzuführen. Die rasante Urbanisierung, steigende verfügbare Einkommen und sich wandelnde Ernährungsgewohnheiten tragen zum Anstieg der Nachfrage nach modernen Lebensmittelverarbeitungslösungen bei. Darüber hinaus fördern staatliche Maßnahmen zur Lebensmittelsicherheit, technologischen Innovation und Automatisierung den Einsatz moderner Anlagen. In- und ausländische Hersteller investieren massiv in den chinesischen Markt, um den wachsenden Bedarf an effizienten, leistungsstarken und konformen Verarbeitungssystemen in Branchen wie der Fleisch-, Milch-, Back- und Getränkeindustrie zu decken.

Marktanteil von Lebensmittelverarbeitungsgeräten

Die Branche der Lebensmittelverarbeitungsgeräte wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- JBT (USA)

- ALFA LAVAL (Schweden)

- Marel (Island)

- Die Middleby Corporation (USA)

- Bühler AG (Schweiz)

- GEA Group Aktiengesellschaft (Deutschland)

- SPX FLOW (USA)

- Tetra Pak Gruppe (Schweiz)

- Bigtem Makine AS (Türkei)

- TNA Australia Pty Limited (Australien)

- Schaaf Technologie GmbH (Deutschland)

- ANKO FOOD MACHINE CO., LTD. (Taiwan)

- Bettcher Industries, Inc. (USA)

- Baker Perkins (Großbritannien)

- Heat and Control, Inc. (USA)

- Schlüsseltechnologie (USA)

- Provisur Technologies, Inc. (USA)

- PROXES GMBH (Deutschland)

- FME Food Machinery Europe Sp. z oo (Polen)

- Alto-Shaam, Inc. (USA)

Neueste Entwicklungen auf dem globalen Markt für Lebensmittelverarbeitungsgeräte

- Im Mai 2024 stellte die Tetra Pak Gruppe ihr Angebot „Factory Sustainable Solutions“ vor, einen neuen, umfassenden Ansatz zur Fabrikoptimierung. Diese Initiative zielt darauf ab, Energie-, Wasser- und CIP-Prozesse in Lebensmittel- und Getränkeproduktionsanlagen zu verbessern. Sie bietet Herstellern eine maßgeschneiderte Kombination aus fortschrittlichen Technologien und überlegenen Anlagenintegrationsmöglichkeiten. Sie unterstützt sie dabei, ihre Nachhaltigkeitsziele durch Steigerung der Energie- und Ressourceneffizienz zu erreichen und so letztlich die Betriebskosten zu senken. Dies stärkt das gesamte Nachhaltigkeitsportfolio von Tetra Pak.

- Im Januar 2024 gab die Tetra Pak Gruppe eine strategische Zusammenarbeit mit Absolicon, einem schwedischen Solarthermieunternehmen, bekannt. Ziel dieser Partnerschaft ist die Bereitstellung einer standardisierten Lösung für Industrieanlagen, die mit erneuerbarer Wärmeenergie betrieben werden. Das Unternehmen wird skalierbare Solarthermiemodule in bestehende und neue UHT-Anlagen integrieren und so verschiedene Dekarbonisierungsoptionen anbieten, darunter eine deutliche Reduzierung der Treibhausgasemissionen, die auf die Kundenbedürfnisse zugeschnitten ist. Die Zusammenarbeit unterstützt Tetra Pak dabei, seine Nachhaltigkeitsziele zu erreichen, die Betriebseffizienz zu steigern und seinen Wettbewerbsvorteil im Markt zu sichern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.