Global Finance Cloud Market

Marktgröße in Milliarden USD

CAGR :

%

USD

155.40 Billion

USD

462.30 Billion

2024

2032

USD

155.40 Billion

USD

462.30 Billion

2024

2032

| 2025 –2032 | |

| USD 155.40 Billion | |

| USD 462.30 Billion | |

|

|

|

|

Globaler Finanz-Cloud-Markt, nach Typ (Lösung, Service), Anwendung (Umsatzmanagement, Vermögensverwaltungssystem, Kontoverwaltung, Kundenmanagement, Sonstiges), Bereitstellungsmodell (Public Cloud, Private Cloud, Hybrid Cloud), Unterbranche (Bank- und Finanzdienstleistungen, Versicherungen), Unternehmensgröße (Kleinunternehmen und mittlere Unternehmen, Großunternehmen) – Branchentrends und Prognose bis 2032

Finanz-Cloud-Marktgröße

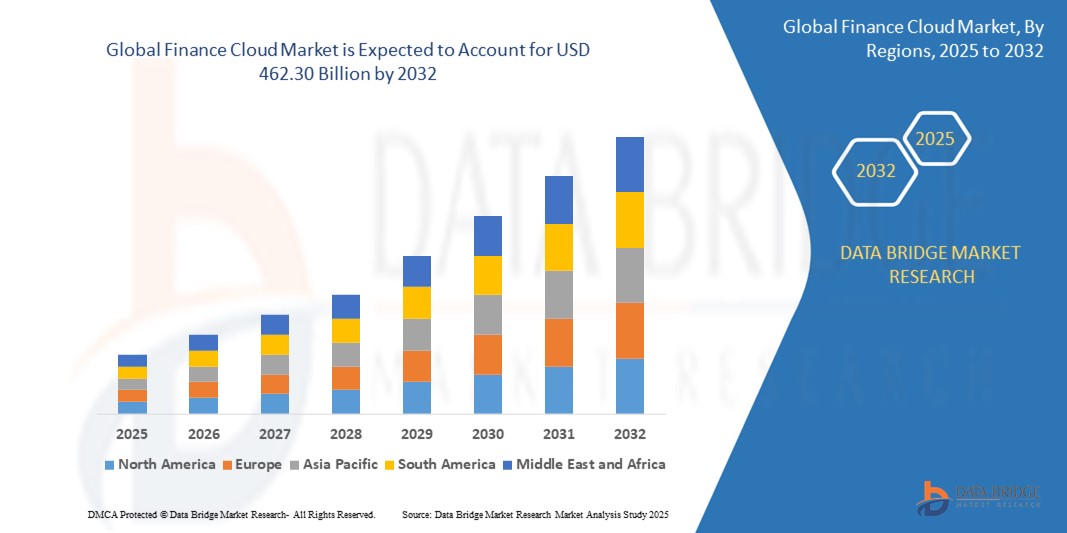

- Der globale Finanz-Cloud-Markt wird im Jahr 2024 auf 155,40 Milliarden US-Dollar geschätzt und soll bis 2032 462,30 Milliarden US-Dollar erreichen , bei einer CAGR von 14,60 % im Prognosezeitraum.

- Der Finanz-Cloud-Markt wächst rasant, da Finanzinstitute Cloud-Lösungen einsetzen, um ihre Agilität, Skalierbarkeit und Compliance zu verbessern. Wichtige Treiber sind die steigende Nachfrage nach Echtzeit-Datenanalyse, sicherem Digital Banking und kostengünstiger Infrastruktur. Cloud-Plattformen ermöglichen die nahtlose Integration von KI und Automatisierung und verbessern so das Kundenerlebnis und die betriebliche Effizienz. All diese Faktoren treiben das Marktwachstum im Prognosezeitraum voran.

Finanz-Cloud-Marktanalyse

- Der Finanz-Cloud-Markt umfasst cloudbasierte Finanzdienstleistungsplattformen, die es Institutionen ermöglichen, Abläufe, Daten und Kundeninteraktionen effizienter zu verwalten als herkömmliche On-Premise-Systeme. Diese Plattformen verändern die Art und Weise, wie Banken, Versicherungen und Fintech-Unternehmen personalisierte Dienstleistungen anbieten, die Compliance verbessern und ihre Abläufe sicher und kostengünstig skalieren. Ihre Flexibilität – im Gegensatz zu starren Legacy-Infrastrukturen – beschleunigt die digitale Transformation im gesamten Finanzsektor.

- Zu den wichtigsten Faktoren, die das Wachstum des Finanz-Cloud-Marktes im Prognosezeitraum voraussichtlich ankurbeln werden, gehören die steigende Nachfrage nach Echtzeit-Datenverarbeitung, die Automatisierung der Einhaltung gesetzlicher Vorschriften und die zunehmende Verlagerung hin zu digitalen Bankdienstleistungen. Der zunehmende Einsatz von KI und maschinellem Lernen zur Risikobewertung, Betrugserkennung und Kundenanalyse sowie der Bedarf an Remote-Finanzdienstleistungen dürften das Marktwachstum weiter vorantreiben.

- Der asiatisch-pazifische Raum wird voraussichtlich den Finanz-Cloud-Markt dominieren. Grund dafür sind die rasante Digitalisierung des Bankensektors, die staatliche Förderung der Fintech-Infrastruktur und die hohe Verbreitung mobiler Finanzplattformen. Die zunehmende Internetdurchdringung und die wachsende Zahl technisch versierter Verbraucher in der Region werden das Marktwachstum im Prognosezeitraum weiter unterstützen.

- Nordamerika wird voraussichtlich die am schnellsten wachsende Region im Finanz-Cloud-Markt sein, da dort fortschrittliche Technologien frühzeitig eingesetzt werden, starke Cybersicherheitsrahmen bestehen und Finanzinstitute zunehmend in die Cloud-Infrastruktur investieren. Darüber hinaus führt die Nachfrage nach skalierbaren, agilen und kostengünstigen Lösungen zu einer Abkehr von traditionellen IT-Modellen hin zu finanzspezifischen Cloud-Plattformen.

- Das Lösungssegment wird voraussichtlich den Finanz-Cloud-Markt mit einem prognostizierten Marktanteil von rund 59,9 % im Prognosezeitraum anführen. Diese Dominanz ist auf die zunehmende Nutzung Cloud-nativer Anwendungen für Risikomanagement, Kernbankengeschäfte, Compliance-Reporting und Kundenanalyse zurückzuführen. Verbesserte Sicherheit, Integrationsmöglichkeiten und kontinuierliche Innovationen fördern die Verbreitung von Finanz-Cloud-Lösungen auf dem globalen Markt zusätzlich.

Berichtsumfang und Marktsegmentierung für Finanz-Clouds

|

Eigenschaften |

Wichtige Markteinblicke in die Finanz-Cloud |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Trends im Finanz-Cloud-Markt

„Ausbau KI-gestützter, Cloud-nativer Finanzplattformen“

- Finanz-Cloud-Technologien entwickeln sich hin zu hochgradig skalierbaren, KI-gesteuerten Lösungen, die Einblicke in Echtzeit liefern, Routineprozesse automatisieren und die Kundenbindung über Bank-, Versicherungs- und Vermögensverwaltungsplattformen hinweg verbessern.

- Innovationen in der Verarbeitung natürlicher Sprache (NLP), der robotergestützten Prozessautomatisierung (RPA) und der prädiktiven Analytik ermöglichen es Institutionen, Altsysteme zu modernisieren und gleichzeitig die Betriebskosten zu senken und die Compliance-Effizienz zu verbessern.

- So meldeten beispielsweise mehrere globale Banken im Jahr 2025 einen deutlichen Rückgang der Fälle operationeller Risiken, nachdem sie intelligente Risiko-Engines in ihre Finanz-Cloud-Infrastruktur integriert hatten, was zu schnelleren Kreditentscheidungen und einer besseren Betrugserkennung führte.

- Der Trend wird durch die steigende Nachfrage nach agiler digitaler Infrastruktur, papierlosem Onboarding und proaktiven Finanzdienstleistungen vorangetrieben, die den steigenden Kundenerwartungen nach personalisierten On-Demand-Erlebnissen entsprechen.

Marktdynamik im Finanz-Cloud-Bereich

Treiber

„Wachsende Nachfrage nach sicherer, skalierbarer und konformer Finanzinfrastruktur“

- Finanzinstitute wechseln von lokalen Systemen zu Cloud-basierten Umgebungen, um die Skalierbarkeit zu unterstützen, die IT-Kosten zu senken und die Datenverfügbarkeit bei schwankenden Marktbedingungen sicherzustellen.

- Aufgrund des zunehmenden Drucks durch globale Regulierungsbehörden sind in Finanz-Cloud-Plattformen mittlerweile Compliance-Tools, prüfungsfähige Berichte und verschlüsselter Datenaustausch integriert, was sie für die Aufrechterhaltung der Betriebsintegrität von entscheidender Bedeutung macht.

- Die Möglichkeit, Echtzeit-Datenfeeds, Risikoanalysen und Kundendienste in einem einzigen digitalen Rahmen zu integrieren, verändert die Arbeitsweise von Institutionen und steigert ihre Reaktionsfähigkeit und Agilität.

Zum Beispiel,

- Im März 2025 meldeten Finanzorganisationen eine deutliche Steigerung der Betriebszeit und Servicekontinuität, nachdem sie ihre Kerngeschäfte in Multi-Cloud-Umgebungen migriert hatten – insbesondere in wirtschaftlich volatilen Zeiten.

- Der Anstieg von Remote-Beratungsdiensten, digitalen Geldbörsen und dezentralisierten Finanzplattformen (DeFi) unterstreicht den Bedarf an robusten Cloud-First-Lösungen im Finanzökosystem.

Gelegenheit

„Digitalisierung von Finanzdienstleistungen in Schwellenländern“

- In den Schwellenländern nimmt die Einführung des digitalen Bankings rapide zu. Gründe hierfür sind die zunehmende Verbreitung mobiler Endgeräte, unterstützende Fintech-Richtlinien und die Nachfrage unterversorgter Bevölkerungsgruppen nach zugänglichen Finanzdienstleistungen.

- Finance Cloud-Lösungen bieten Finanzinstituten und Startups eine kostengünstige, modulare Infrastruktur zur Einführung digitaler Produkte ohne große Kapitalinvestitionen.

- Cloudnative Finanzplattformen können innerhalb weniger Wochen bereitgestellt werden, unterstützen mehrere Währungen und Sprachen und lassen sich dynamisch skalieren, um den steigenden Anforderungen der Verbraucher gerecht zu werden.

Zum Beispiel,

- Im März 2025 begannen mehrere Zentralbanken in Entwicklungsregionen mit Pilottests der digitalen Währungsinfrastruktur auf sicheren Finanz-Cloud-Plattformen, um eine breitere finanzielle Inklusion und bargeldlose Wirtschaftsinitiativen zu ermöglichen.

- Dieser Trend bietet Cloud-Service-Anbietern eine enorme Chance, die nächste Welle finanzieller Innovation und wirtschaftlicher Inklusion in Asien, Afrika und Lateinamerika zu unterstützen.

Einschränkung/Herausforderung

„Komplexe regulatorische Landschaft und Bedenken hinsichtlich der Datensouveränität“

- Der Finanz-Cloud-Markt steht aufgrund fragmentierter globaler Vorschriften vor Herausforderungen, insbesondere in Bezug auf grenzüberschreitende Datenübertragungen, Standards der Finanzberichterstattung und den Datenschutz der Verbraucher.

- Finanzinstitute müssen sich an überlappende Regeln mehrerer Rechtsräume halten, was die Komplexität der Cloud-Bereitstellung erhöht und oft regionsspezifische Konfigurationen erfordert.

- Bedenken hinsichtlich der Datensouveränität, insbesondere in Regionen mit strengen Lokalisierungsgesetzen, behindern die umfassende Einführung der Cloud und können die Flexibilität von Multi-Cloud- oder Hybrid-Cloud-Systemen einschränken.

Zum Beispiel,

- Im Juni 2024 kam es bei mehreren Finanzinstituten zu Verzögerungen bei ihren Cloud-Rollout-Plänen aufgrund neuer Vorschriften, die lokale Datenspeicherung und die Erfassung von Prüfprotokollen durch Dritte vorschreiben. Diese aktualisierten regulatorischen Maßnahmen zur Gewährleistung von Datensouveränität und -sicherheit stellten Cloud-Dienstanbieter vor Herausforderungen. Infolgedessen mussten viele Unternehmen ihre Cloud-Infrastruktur neu konfigurieren, um Compliance-Standards zu erfüllen. Dieser regulatorische Wandel hat die Geschwindigkeit der digitalen Transformation im Finanzsektor beeinflusst.

- Für Anwender der Finanz-Cloud bleibt die Bewältigung von Zertifizierungsanforderungen (z. B. ISO, SOC, PCI-DSS) und die Einhaltung der Echtzeit-Konformität mit sich ändernden Finanzrichtlinien eine betriebliche und rechtliche Herausforderung.

Finanz-Cloud-Marktumfang

Der Markt ist nach Typ, Anwendung, Bereitstellungsmodell, Unterbranche und Unternehmensgröße segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Typ |

|

|

Nach Anwendung |

|

|

Nach Bereitstellungsmodell |

|

|

Nach Unterbranche |

|

|

Nach Organisationsgröße |

|

Im Jahr 2025 wird die Lösung voraussichtlich den Markt dominieren und den größten Anteil nach Typsegment haben.

Das Lösungssegment wird voraussichtlich den Finanz-Cloud-Markt mit einem Marktanteil von 59,9 % im Prognosezeitraum dominieren. Die Nachfrage nach skalierbaren, sicheren und agilen Cloud-Plattformen steigt. Finanzinstitute setzen Cloud-Lösungen ein, um die Betriebseffizienz zu steigern, die Datenanalyse zu verbessern, die Compliance sicherzustellen und personalisierte Services anzubieten. Diese Lösungen transformieren traditionelle Finanzgeschäfte und ermöglichen Echtzeit-Entscheidungen, Automatisierung und ein nahtloses Kundenerlebnis.

Das Umsatzmanagement wird voraussichtlich im Prognosezeitraum den größten Anteil am Finanz-Cloud-Markt ausmachen

Im Jahr 2025 wird das Revenue-Management-Segment im Finanz-Cloud-Markt voraussichtlich mit rund 41,1 % den größten Anteil einnehmen. Der Finanz-Cloud-Markt gewinnt an Dynamik, da Unternehmen nach fortschrittlichen Tools für die Preisgestaltung, Abrechnung und Monetarisierung von Finanzprodukten und -dienstleistungen suchen. Cloudbasierte Revenue-Management-Lösungen ermöglichen dynamische Preisgestaltung, effizientes Vertragsmanagement und Umsatzrealisierung in Echtzeit. So können Finanzinstitute ihre Einnahmequellen optimieren und eine präzise und konforme Finanzberichterstattung gewährleisten.

Regionale Analyse des Finanz-Cloud-Marktes

„Asien-Pazifik hält den größten Anteil am Finanz-Cloud-Markt“

- Der asiatisch-pazifische Raum dominiert den Finanz-Cloud-Markt, angetrieben durch die schnelle digitale Transformation im Finanzdienstleistungsbereich, die zunehmende Nutzung des mobilen Bankings und die wachsende Nachfrage nach Cloud-nativen Lösungen in Ländern wie China, Indien und Japan.

- China und Indien leisten aufgrund ihrer großen, schnell wachsenden Fintech-Ökosysteme, ihrer hohen Investitionen in die digitale Infrastruktur und der zunehmenden Verbreitung von Smartphones, die Cloud-basierte Finanzdienstleistungen vorantreibt, einen bedeutenden Beitrag.

- Japan spielt mit seiner starken technologischen Basis und der frühen Einführung von Cloud-Lösungen eine zentrale Rolle bei der Förderung von Innovationen im Finanzdienstleistungsbereich, darunter KI-gestützte Analytik, Risikomanagement und digitale Zahlungssysteme.

- Die Dominanz der Region wird zusätzlich durch Regierungsinitiativen zur Förderung des digitalen Bankwesens und elektronischer Geldbörsen sowie landesweite Bemühungen zur Verbesserung der finanziellen Inklusion und zur Modernisierung bestehender Systeme im privaten und öffentlichen Sektor unterstützt.

„Nordamerika wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate im Finanz-Cloud-Markt verzeichnen“

- In Nordamerika wird das schnellste Wachstum im Finanz-Cloud-Markt erwartet, angetrieben durch die steigende Nachfrage nach sicheren, skalierbaren Finanzlösungen, Cloud-basierten Tools zur Einhaltung gesetzlicher Vorschriften und Datenanalyseplattformen.

- Die USA sind aufgrund ihrer fortschrittlichen Finanzinfrastruktur, der hohen Akzeptanz von Cloud-Technologien und einer deutlichen Verlagerung hin zu digitalem Banking, KI-gesteuerten Finanzdienstleistungen und Blockchain-Innovationen führend in der Region.

- Die Integration von Cloud-Lösungen in Vermögensverwaltung, digitale Zahlungssysteme und Echtzeit-Finanzdatenanalyse beschleunigt die Nachfrage in der gesamten Region.

- Darüber hinaus profitiert die Region von einem robusten Startup-Ökosystem, Investitionen in Fintech-Forschung und -Entwicklung und einem starken Schwerpunkt auf Cybersicherheit, was das langfristige Wachstum cloudbasierter Finanzlösungen unterstützt.

Marktanteile der Finanz-Cloud

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- AWS (USA)

- Microsoft (US)

- Google (USA)

- IBM (USA)

- Salesforce (USA)

- Tencent (China)

- Oracle (USA)

- Alibaba (China)

- Arbeitstag (USA)

- SAP (Deutschland)

- HPE (USA)

- VMware (USA)

- Cisco (USA)

- Huawei (China)

- ServiceNow (USA)

- DXC-Technologie (USA)

- SAGE Group (Großbritannien)

- Schneeflocke (USA)

- Nutanix (USA)

- Acumatica (USA)

- RapidScale (USA)

- AtemisCloud (USA)

- Rambase (Norwegen)

- OVHcloud (Frankreich)

Neueste Entwicklungen im globalen Finanz-Cloud-Markt

- Im Januar 2025 kündigte JP Morgan Chase seinen ehrgeizigen Plan an, bis 2026 75 % seiner Infrastruktur in die Cloud zu verlagern. Der Schwerpunkt liegt dabei auf der Verbesserung seiner Finanzdienstleistungen durch Echtzeit-Datenverarbeitung, KI-gestützte Erkenntnisse und ein verbessertes Kundenerlebnis. Das Unternehmen arbeitet mit führenden Cloud-Anbietern zusammen, um sein digitales Bankgeschäft zu stärken und die Datensicherheit aller seiner Dienste zu verbessern.

- Im März 2025 stellte Goldman Sachs seine cloudbasierte Risikomanagementplattform vor, die Echtzeit-Risikoanalysen und prädiktive Modellierung für Anlageportfolios ermöglicht. Die Plattform nutzt KI und maschinelles Lernen, um Finanzentscheidungen zu verbessern, Compliance-Workflows zu optimieren und operative Risiken im Handel und in der Vermögensverwaltung zu reduzieren.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.