Global Fatty Esters Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.48 Billion

USD

3.78 Billion

2024

2032

USD

2.48 Billion

USD

3.78 Billion

2024

2032

| 2025 –2032 | |

| USD 2.48 Billion | |

| USD 3.78 Billion | |

|

|

|

|

Globale Marktsegmentierung für Fettsäureester nach Typ (Polyester, Acrylsäureester, Fettsäureester, Phosphatester, Sonstige), Anwendung (Textil, Schmiermittel, Verpackung, Farben und Beschichtungen, Körperpflege und Kosmetik, Tenside, Lebensmittel und Getränke, Sonstige) – Branchentrends und Prognose bis 2032

Fettsäureester Marktanalyse

Die Fettsäureester erfreuen sich aufgrund ihrer Verwendung als Feinchemikalien in der chemischen Industrie zunehmender Beliebtheit, da sie vorteilhafte Eigenschaften wie gute Stabilisierungs- und Konditionierungseigenschaften, Schmiereigenschaften, Lösevermögen und Oxidationsbeständigkeit aufweisen. Daher wird die zunehmende Verwendung von Fettsäureestern in der chemischen Industrie dazu beitragen, dass der Markt im Prognosezeitraum stark floriert.

Fettsäureester Marktgröße

Der weltweite Markt für Fettsäureester hatte im Jahr 2024 einen Wert von 2,48 Milliarden US-Dollar und soll bis 2032 einen Wert von 3,78 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 5,8 % im Prognosezeitraum von 2025 bis 2032.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke zu Fettsäureestern |

|

Segmentierung |

|

|

Abgedeckte Länder |

USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Deutschland, Frankreich, Italien, Großbritannien, Belgien, Spanien, Russland, Türkei, Niederlande, Schweiz, Restliches Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Vereinigte Arabische Emirate, Saudi-Arabien, Ägypten, Südafrika, Israel, Restlicher Naher Osten und Afrika |

|

Wichtige Marktteilnehmer |

Dupont (USA), SOLVAY (Belgien), DAIKIN (Japan), Dow (USA), Sumitomo Chemical Co., Ltd. (Japan), ABITEC (USA), ADM (USA), BASF SE (Deutschland), IFFCO (Türkei), AkzoNobel NV (Niederlande), Biotage (Schweden), Stepan Company (USA), DSM (Niederlande), CEM Corporation (USA), Fine Organics (Indien), Subhash Chemicals (Indien), Gattefosse (Frankreich) und Croda International (Großbritannien) |

|

Marktchancen |

|

Fettsäureester Marktdefinition

Ester sind im Grunde genommen chemische Verbindungen, die Carbonsäure und Alkohol enthalten und zwischen denen eine kontinuierliche Etherbindung besteht. Sie werden normalerweise aus anorganischen oder natürlichen Säuren assimiliert, indem die Hydratisierung mit Alkohol vermieden wird. Sie bilden Alkohole und andere Chemikalien , wenn sie mit Wasser reagieren. Öle, Fette und Triglyceride sind alle in natürlich vorkommenden Estern enthalten. Natürliche Ester umfassen ungesättigte Glycerinfettester, Polyester, Nitratester und andere mit einer Alkyl- oder wohlriechenden Gruppe. Fett, Kunststoffe, Teer, Tenside, Sprengstoffe, Kosmetika, Biokraftstoff und die Verbindung verschiedener mechanisch-synthetischer Gebräue erfordern alle Ester. Ester mit niedrigem Molekulargewicht werden oft als Parfüme verwendet. Farben, Lacke und Firnisse können alle von der Verwendung flüchtiger Ester als Lösungsmittel profitieren.

Marktdynamik für Fettsäureester

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Hohe Nachfrage bei Endbenutzern

Die zunehmende Verwendung in Körperpflegeprodukten wie Kosmetika, Schmiermitteln, Papier und Lebensmitteln sowie in industriellen Anwendungen aufgrund ihrer Umweltfreundlichkeit wird voraussichtlich dazu beitragen, dass der Markt für Fettsäureester schnell wächst. Darüber hinaus wird im Prognosezeitraum die steigende Verbraucherpräferenz für natürliche und spezielle Ester in Körperpflegeprodukten voraussichtlich das Marktwachstum ankurbeln. Fettsäureester werden immer häufiger in Biodieseln verwendet. Der Markt wird voraussichtlich auch durch die steigende Nachfrage nach Isopropylpalmitat in der Kosmetikindustrie angekurbelt.

Die wachsende Vorliebe der Verbraucher für natürliche und spezielle Ester wird zusammen mit der damit verbundenen Wachstumsrate des Fettsäureestermarktes weiter ankurbeln. Darüber hinaus wird die steigende Nachfrage nach Biodiesel aufgrund der vorhandenen unterstützenden Vorschriften ebenfalls das Marktwertwachstum vorantreiben. Die steigende Zahl berufstätiger Frauen, das wachsende Bewusstsein für einen gesunden Lebensstil, die steigende Nachfrage nach Pflegeprodukten für Männer sowie die zunehmende Bedeutung der vorbeugenden Gesundheitsfürsorge werden voraussichtlich das Wachstum des Marktes fördern.

Gelegenheiten

- Bewusstsein und Entwicklung

Darüber hinaus eröffnet das zunehmende Bewusstsein der Endverbraucher hinsichtlich der Vorteile natürlicher Ester den Marktakteuren im Prognosezeitraum von 2025 bis 2032 lukrative Möglichkeiten. Darüber hinaus werden die technologischen Fortschritte sowie die Produktentwicklung das zukünftige Wachstum des Marktes für Fettsäureester weiter vorantreiben.

Einschränkungen/Herausforderungen

- Strenge Vorschriften

Die strengen Umweltschutzbestimmungen werden das Wachstum des Fettsäureestermarktes behindern.

- Unsichere globale Wirtschaftsbedingungen

Darüber hinaus werden sich die unsicheren globalen Wirtschaftsbedingungen als Nachteil für den Markt für Fettsäureester erweisen. Dies wird daher die Wachstumsrate des Marktes für Fettsäureester beeinträchtigen.

Dieser Bericht zum Markt für Fettsäureester enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Fettsäureester zu erhalten, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für Fettsäureester

Der Markt für Fettsäureester ist nach Typ und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Polyester

- Acrylsäureester

- Fettsäureester

- Phosphatester

- Sonstiges

Anwendung

- Textil

- Schmiermittel

- Verpackung

- Farben und Lacke

- Körperpflege und Kosmetik

- Tenside

- Essen und Trinken

- Sonstiges

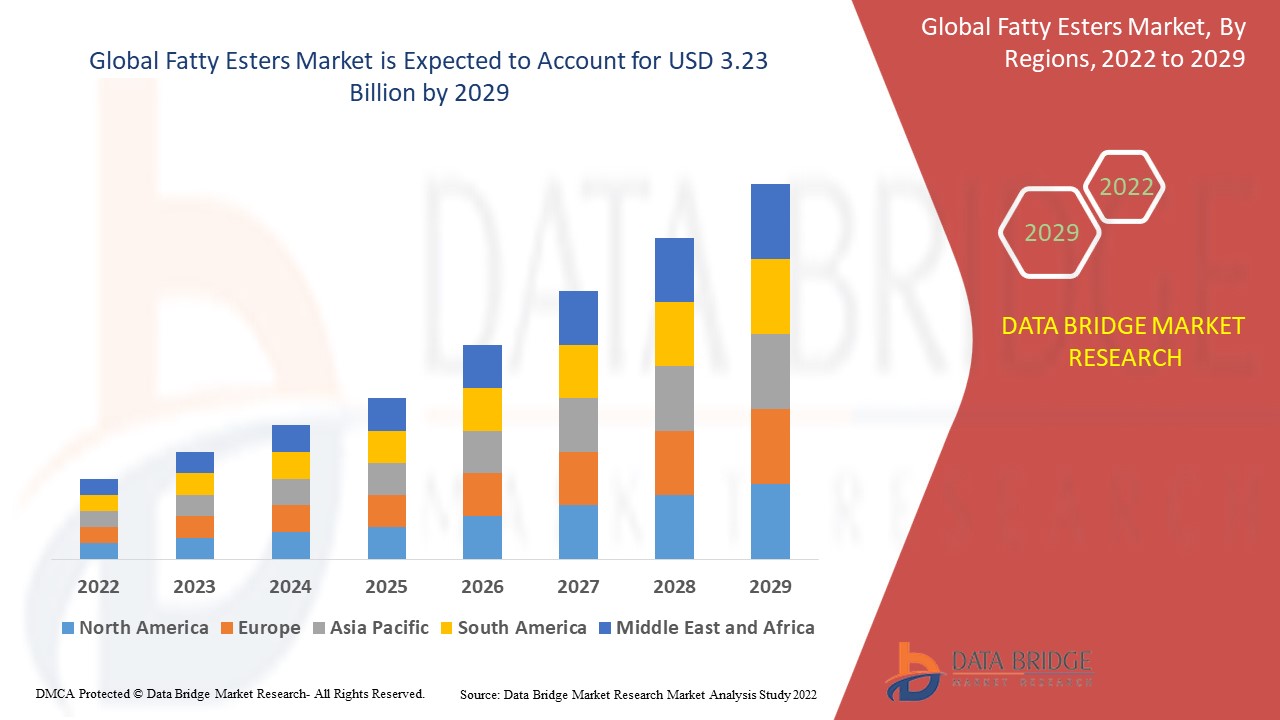

Regionale Analyse des Fettsäureestermarktes

Der Markt für Fettsäureester wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht für Fettsäureester abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika dominiert den Markt für Fettsäureester, da dort die Verwendung von Fettsäureestern in Körper- und Kosmetikanwendungen zunimmt. Grund dafür ist der hohe Lebensstandard und die zunehmende Betonung von Schönheit und Aussehen aufgrund des wachsenden Einflusses der sozialen Medien in der Region.

Andererseits wird für den asiatisch-pazifischen Raum im Prognosezeitraum 2025 bis 2032 ein lukratives Wachstum erwartet, da die Industrie dort wächst und die Bevölkerung vor allem in China und Indien zunimmt.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil von Fettsäureestern

Die Wettbewerbslandschaft des Marktes für Fettsäureester liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Fettsäureester.

Die Marktführer im Bereich Fettsäureester sind:

- Dupont (USA)

- SOLVAY (Belgien)

- DAIKIN (Japan)

- Dow (USA)

- (Japan)

- ABITEC (USA)

- ADM (USA)

- BASF SE (Deutschland)

- IFFCO (Türkei)

- AkzoNobel NV (Niederlande)

- Biotage (Schweden)

- Stepan Company (USA)

- DSM (Niederlande)

- CEM Corporation (USA)

- Feine organische Stoffe (Indien)

- Subhash Chemicals (Indien)

- Gattefosse (Frankreich)

- Croda International (Großbritannien)

Neueste Entwicklungen auf dem Fettsäureestermarkt

- Im Juli 2021 unterzeichneten Indian Oil Corporation Ltd und Verbio AG eine Absichtserklärung (Memorandum of Understanding, MoU). Das MoU soll die Möglichkeiten prüfen, mit Verbio ein Joint Venture zur Herstellung von Biokraftstoffen (Biomethan (CBG/BioCNG), Bioethanol und Biodiesel) zu gründen und über das Netzwerk von Indian Oil zu vermarkten.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.