Global Dental Implants And Prosthetics Market

Marktgröße in Milliarden USD

CAGR :

%

USD

13.33 Billion

USD

22.90 Billion

2023

2031

USD

13.33 Billion

USD

22.90 Billion

2023

2031

| 2024 –2031 | |

| USD 13.33 Billion | |

| USD 22.90 Billion | |

|

|

|

|

Global Dental Implants and Prosthetics Market Segmentation, By Type (Denture, Crown, Bridges, Veneer, Abutment, and Inlays), Type of Material (Zirconium, Metal, Ceramic, Titanium Dental Implants, and Porcelain Fused to Metal), End User (Dental Hospitals and Clinics and Dental Research Laboratories), Procedures (Root-form Dental Implants, Plate-form Dental Implants, Subperiosteal Dental Implants, and Transosteal Dental Implants) - Industry Trends and Forecast to 2032

Dental Implants and Prosthetics Market Size

-

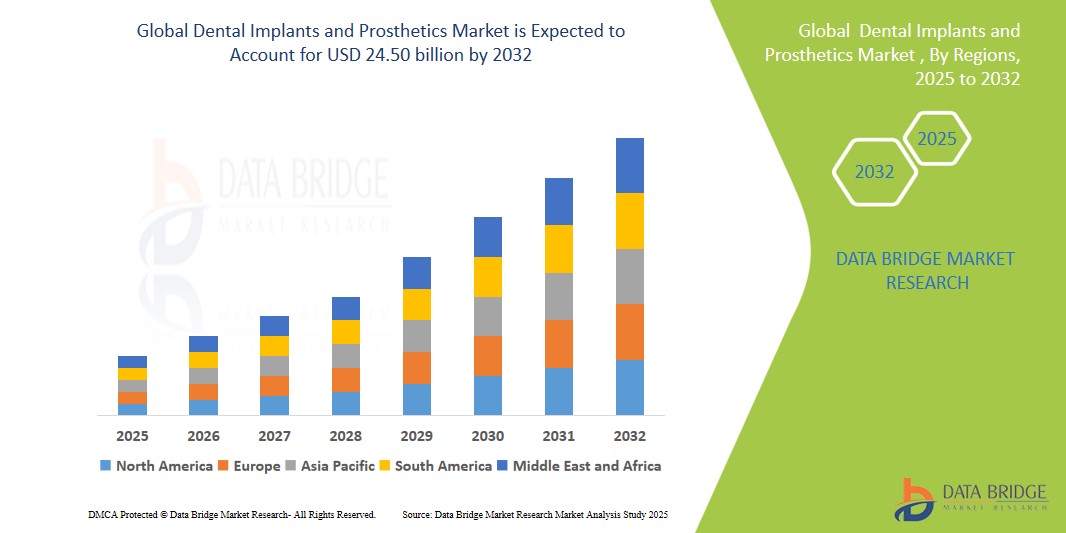

The global dental implants and prosthetics market size was valued atUSD 14.26 billion in 2024 and is expected to reachUSD 24.50 billion by 2032, at aCAGR of 7.00%during the forecast period

- This growth is driven by growing Incidence of dental diseases

Dental Implants and Prosthetics Market Analysis

- Dental Implants and Prosthetics systems are vital medical devices used in restorative and reconstructive dental procedures to replace missing teeth and restore functionality

- The growing demand for dental implants and prosthetics is largely driven by the increasing prevalence of dental diseases, rising awareness of aesthetic treatments, advancements in implant materials such astitanium andceramics

- North America is expected to dominate the dental implants and prosthetics market with the largest market share of 35.94%, driven by its well-established healthcare infrastructure, high adoption rate of advanced implant technologies, and strong presence of key industry players in the region

- Asia-Pacific is projected to register the highest growth rate in the dental implants and prosthetics market during the forecast period, driven by the rapid adoption of advanced dental technologies, increasing investments in dental care, rising disposable incomes, and growing awareness about cosmetic dentistry in countries such as China, India, and Japan

- The titanium segment is expected to dominate the type of material segment with the largest market share of 92.55%, due to its widespread use of dental implants made from titanium is primarily due to its biocompatible nature, which is a key advantage. The raw form of titanium contains various metals, includingilmenite, iron,vanadium, zirconium, silicon, and magnesium

Report Scope and Dental Implants and Prosthetics Market Segmentation

|

Attributes |

Dental Implants and Prosthetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Implants and Prosthetics Market Trends

“Shift Towards Digital Dentistry and 3D Printing in Dental Implants”

- A significant trend in the dental implants and prosthetics market is the increasing use of digital dentistry technologies and3D printing. These technologies allow for the rapid production of custom implants and prosthetics, reducing the time required for treatment and improving the precision of dental restorations

- Digital workflows, including computer-aided design (CAD) and computer-aided manufacturing (CAM), enable dental professionals to create highly accurate prosthetics tailored to the patient's unique anatomy. This shift is enhancing patient satisfaction and reducing the risk of post-operative complications

- The trend is further supported by the growing availability of affordable 3D printers, which allow dental clinics to produce high-quality implants and prosthetics in-house, providing greater control over quality and turnaround times

- For instance, in 2023, Stratasys introduced a new 3D printing technology for dental implants, allowing faster production and precise fitting of prosthetics in dental surgeries

- The increased use of 3D printing and digital solutions is revolutionizing the dental implant process, making it faster, more cost-effective, and more accurate, thus driving industry growth

Dental Implants and Prosthetics Market Dynamics

Driver

“Rising Demand for Aesthetic Dentistry and Cosmetic Implant Procedures”

- A key driver in the dental implants and prosthetics market is the rising demand for aesthetic dentistry, as patients increasingly seek solutions for restoring the appearance and function of their teeth

- Dental implants offer a highly effective solution for tooth replacement, with advancements in materials and techniques ensuring that implants resemble natural teeth, meeting both functional and aesthetic needs

- The growing popularity of cosmetic dentistry procedures, such as smile makeovers and full mouth reconstructions, is contributing significantly to the demand for dental implants and prosthetics

- For instance, a 2023 report by American Dental Association highlighted a 20% increase in cosmetic dental procedures over the past five years, reflecting the rising demand for aesthetically pleasing dental implants

- The demand for aesthetic solutions is expected to continue driving the growth of the market, as patients increasingly prioritize appearance alongside functionality

Opportunity

“Advancements in Biomaterials for Dental Implants”

- A significant opportunity in the dental implants and prosthetics market is the development of advanced biomaterials that improve the longevity, biocompatibility, and aesthetic outcomes of implants

- Innovations in materials such as zirconia and titanium alloys are allowing for more durable, lightweight, and visually appealing implants that are also better suited to integrating with bone tissue

- The ongoing research and development of next-generation biomaterials, such as biodegradable polymers and 3D-printed materials, presents an exciting opportunity for companies to expand their offerings and cater to the evolving needs of patients

- For instance, in 2023, Zimmer Biomet launched a new line of titanium-zirconia hybrid implants designed for enhanced strength and better aesthetic outcomes, catering to a broader patient base

- The development of these advanced biomaterials is expected to significantly enhance the quality and acceptance of dental implants, providing new growth avenues for the market

Restraint/Challenge

“High Cost of Dental Implants and Prosthetics Limiting Market Accessibility”

- One of the major challenges in the dental implants and prosthetics market is the high cost associated with the procedures, which can limit accessibility, especially in emerging markets

- The cost of dental implants includes the materials and the surgical procedures and follow-up care, which can be prohibitive for many patients. This challenge is further compounded by the limited availability of affordable financing options for patients in low and middle-income countries

- High costs also discourage some healthcare providers from adopting advanced implant technologies, as the initial investment in equipment and materials can be substantial

- For instance, in 2023, a dental clinic in Brazil faced significant challenges in adopting new implant technologies due to the high upfront costs, affecting its ability to offer competitive pricing to patients

- The high cost of dental implants remains a barrier to widespread adoption and market growth, particularly in price-sensitive regions where patients may opt for lower-cost alternatives

Dental Implants and Prosthetics Market Scope

The market is segmented on the basis of type, type of material, end user, and procedures.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Type of Material |

|

|

By End User |

|

|

By Procedures |

|

In 2025, the titanium dental implants is projected to dominate the market with a largest share in type of material segment

The titanium dental implants segment is expected to dominate the dental implants and prosthetics market with the largest market share of 92.55% in 2025 due to its widespread use of dental implants made from titanium is primarily due to its biocompatible nature, which is a key advantage. The raw form of titanium contains various metals, including ilmenite, iron, vanadium, zirconium, silicon, and magnesium.

The crown is expected to account for the largest share during the forecast period in type segment

In 2025, the crown segment is expected to dominate the market with the largest market share of 42.25% due to its widespread use in restorative dentistry and the growing demand for dental restoration procedures.

Dental Implants and Prosthetics Market Regional Analysis

“North America Holds the Largest Share in the Dental Implants and Prosthetics Market”

- North America is expected to dominate the dental implants and prosthetics market with the largest market share of 35.94%, driven by a strong presence of industry leaders, highly advanced healthcare infrastructure, rising demand for surgical imaging technologies, and supportive reimbursement policies for dental procedures

- The U.S. maintains the dominant position within the region due to widespread adoption of 3D imaging and CAD/CAM technologies in implant dentistry, as well as high rates of dental procedures among the aging population

- Increasing demand for minimally invasive procedures, combined with advancements in implant materials and precision dentistry, is expected to continue solidifying North America's position in the global dental implants and prosthetics market

“Asia-Pacific is Projected to Register the Highest CAGR in the Dental Implants and Prosthetics Market”

- Asia-Pacific is expected to witness the highest growth rate in the dental implants and prosthetics market, fueled by rapid improvements in healthcare infrastructure, rising surgical volumes, growing awareness of advanced surgical imaging technologies, and expanding access to healthcare services in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives for healthcare modernization, increasing investments in hospital facilities, and the growing burden of chronic diseases requiring surgical intervention

- Japan, known for its technological leadership and high healthcare standards, is actively adopting cutting-edge dental implants and prosthetics solutions, while China and India are witnessing a surge in demand due to healthcare reforms, public-private partnerships, and increased training of medical professionals in image-guided surgeries

Dental Implants and Prosthetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Institut Straumann AG (Germany)

- Nobel Biocare Services AG (Switzerland)

- Danaher (U.S.)

- Ivoclar Vivadent (Switzerland)

- TBR Dental (France)

- Dentsply Sirona (U.S.)

- Avinent Science and Technology (Spain)

- CAMLOG Biotechnologies GmbH (Switzerland)

- Zimmer Biomet (U.S.)

- DENTAURUM GmbH & Co. KG (Germany)

- Ultradent Products Inc. (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Dental Wings Inc. (Canada)

- Bicon (U.S.)

- OSSTEM IMPLANT.CO., LTD. (South Korea)

- Align Technology, Inc. (U.S.)

Latest Developments in Global Dental Implants and Prosthetics Market

- In February 2025, Dentsply Sirona launched the MIS LYNX in the U.S. market as a premium, cost-effective, all-in-one dental implant solution. This move highlights the company’s commitment to providing accessible, high-quality dental solutions

- In October 2024, Thommen Medical AG introduced NEVO, the world’s first Gentle Implant, designed for optimal bone engagement, precise insertion, and high primary stability. NEVO’s unique features, such as apically pronounced self-cutting threads and long spiral flutes, ensure controlled placement and exceptional performance

- In May 2024, Osstem Implant Co., Ltd entered into an agreement to acquire Implacil de Bortoli, Brazil’s third-largest dental implant firm, marking its expansion into the rapidly growing Latin American dental market. This strategic move is aimed at strengthening Osstem's global presence and tapping into new growth opportunities

- In June 2024, BioHorizons introduced the Tapered Pro Conical, its first dental implant featuring a deep conical connection. This launch underscores BioHorizons’ ongoing commitment to innovation, enhancing clinical performance, and improving workflow efficiency

- In August 2023, MBK Partners and UCK Partners acquired Osstem Implant Co., Ltd. for an enterprise value of USD 2.70 billion (KRW 3.64 trillion). This acquisition significantly strengthens Osstem's market position in the global dental implant industry

- In February 2022, Envista entered into a partnership with Vitaldent Group (Spain) for the supply of implants (Nobel Biocare) and clear aligners (Spark). This partnership is a step forward in expanding Envista’s footprint in the European dental market

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.