Global Dairy Alternative Market

Marktgröße in Milliarden USD

CAGR :

%

USD

27.11 Billion

USD

63.15 Billion

2024

2032

USD

27.11 Billion

USD

63.15 Billion

2024

2032

| 2025 –2032 | |

| USD 27.11 Billion | |

| USD 63.15 Billion | |

|

|

|

|

Globale Marktsegmentierung für Milchalternativen nach Produkttyp (Sojamilch, Mandelmilch, Kokosmilch, Cashewmilch, Hafermilch, Reismilch), Typ (anorganisch, biologisch), Formulierung (pur und gesüßt, aromatisiert und ungesüßt, aromatisiert und gesüßt, pur und ungesüßt), Anwendung (Lebensmittel, Getränke), Nährstoffe (Protein, Vitamine, Kohlenhydrate), Vertriebskanäle (Supermärkte/Hypermärkte, Online, Fachgeschäfte) – Branchentrends und Prognose bis 2032

Marktgröße für Milchalternativen

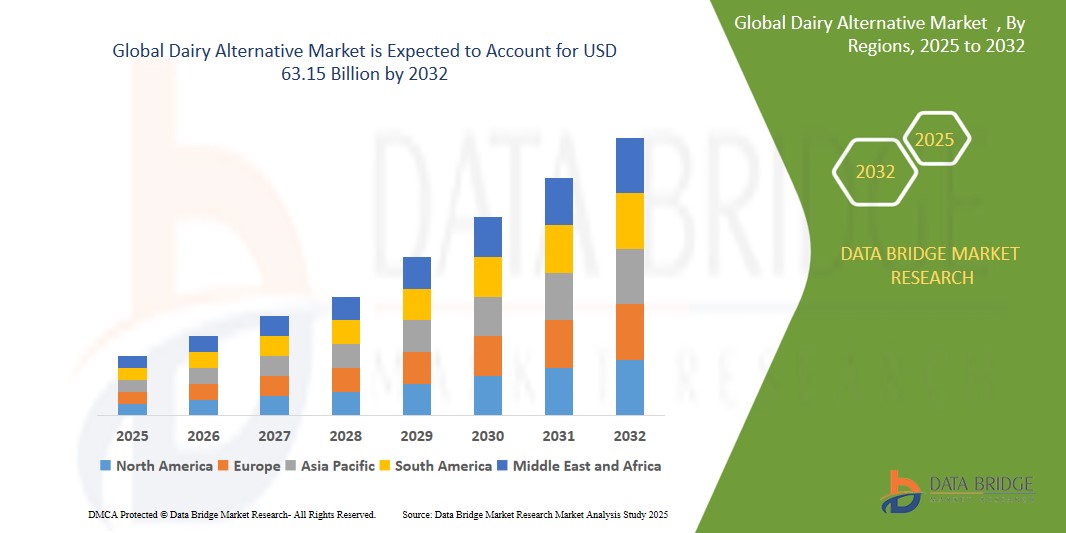

- Der globale Markt für Milchalternativen wurde im Jahr 2024 auf 27,11 Milliarden US-Dollar geschätzt und soll bis 2032 63,15 Milliarden US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,20 % wachsen, was vor allem auf die Einführung innovativer pflanzlicher Inhaltsstoffe zur Verbesserung von Nährwert und Geschmack zurückzuführen ist.

- Dieses Wachstum wird durch Faktoren wie die zunehmende Laktoseintoleranz und die Nachfrage nach pflanzlicher Ernährung sowie ein weltweit steigendes Gesundheitsbewusstsein vorangetrieben.

Marktanalyse für Milchalternativen

- Der Markt für Milchalternativen wird durch das zunehmende Gesundheitsbewusstsein der Verbraucher angetrieben, mit einer wachsenden Nachfrage nach pflanzlichen, laktosefreien und milchfreien Produkten zur Behandlung von Gesundheitsproblemen wie Cholesterin, Laktoseintoleranz und Fettleibigkeit.

- Das wachsende Bewusstsein für ökologische Nachhaltigkeit und ethische Aspekte in der Lebensmittelproduktion treibt den Wandel hin zu pflanzlichen Alternativen voran. Hersteller entwickeln innovative Produktangebote und konzentrieren sich auf verbesserte Geschmacks-, Textur- und Nährwertprofile durch die Verwendung vielfältiger Zutaten wie Hafer, Mandeln und Soja.

- Nordamerika, Europa und der asiatisch-pazifische Raum sind die Schlüsselregionen für den Markt für Milchalternativen, wobei Nordamerika und Europa die größte Nachfrage nach pflanzlichen Produkten aufweisen, während der asiatisch-pazifische Raum aufgrund des steigenden Gesundheitsbewusstseins und der zunehmenden verfügbaren Einkommen ein signifikantes Wachstum aufweist.

Berichtsumfang und Marktsegmentierung für Milchalternativen

|

Eigenschaften |

Wichtige Markteinblicke zu Milchalternativen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Milchalternativen

„Einführung innovativer pflanzlicher Inhaltsstoffe für einen verbesserten Nährwert und Geschmack“

- Ein wichtiger Trend auf dem Markt für Milchalternativen ist die schnelle Innovation bei pflanzlichen Zutaten, die darauf abzielen, sowohl das Nährwertprofil als auch das sensorische Erlebnis milchfreier Produkte zu verbessern.

- Neue Grundzutaten wie Kichererbsen, Leinsamen, Hanf und Wassermelonenkerne werden neben den traditionellen Soja-, Mandel- und Hafersorten erforscht, um einen besseren Proteingehalt, eine bessere Cremigkeit und einen höheren Mikronährstoffreichtum zu erzielen.

- Fermentationstechniken und enzymatische Verarbeitung werden zunehmend eingesetzt, um die Verdaulichkeit, Textur und den Geschmack von Milchalternativen zu verbessern und den Geschmack und das Mundgefühl herkömmlicher Milchprodukte nachzuahmen.

- So heißt es beispielsweise in einem Artikel von Guardian News & Media Limited vom April 2025, Hafermilch sei die beliebteste Pflanzenmilch in Großbritannien geworden und betrage etwa 40 % des Marktes. Marken wie Alpro, ein Unternehmen von Danone, setzen auf lokale Herkunft und verwenden in Großbritannien angebauten Hafer, der in der hochmodernen Hafermühle Navara verarbeitet wird. Dieser Schritt unterstützt die wachsende Nachfrage: Die Hafermilchverkäufe in Supermärkten stiegen im Jahr bis Februar 2025 um 7,2 %.

Marktdynamik für Milchalternativen

Treiber

„Steigende Laktoseintoleranz und Nachfrage nach pflanzlicher Ernährung“

- Die zunehmende Verbreitung von Laktoseintoleranz und Milchallergien steigert die Nachfrage nach Milchalternativen erheblich. Verbraucher suchen nach pflanzlichen Alternativen, die ihren Ernährungseinschränkungen und Gesundheitszielen gerecht werden.

- Gesundheitsbewusste Menschen greifen zunehmend auf Milchalternativen wie Mandelmilch, Sojamilch und Hafermilch zurück, die aufgrund ihres geringeren Gehalts an gesättigten Fettsäuren und des fehlenden Cholesterins als gesündere Alternative gelten.

- Insbesondere im asiatisch-pazifischen Raum steigt die Nachfrage nach Milchalternativen stark an, was auf einen deutlichen Anstieg gemeldeter Fälle von Kuhmilchallergien und Laktoseintoleranz zurückzuführen ist. Verbraucher in dieser Region stellen zunehmend auf vegane Ernährung um und greifen zu Kuhmilchalternativen.

Zum Beispiel,

- Studien haben ergeben, dass 60–90 % der indischen Bevölkerung an Laktoseintoleranz oder Milchallergien leiden. Diese hohe Prävalenz führt zu einer deutlichen Nachfrage nach pflanzlichen Milchalternativen im Land.

- Da das Bewusstsein für Laktoseintoleranz und Ernährungseinschränkungen weiter zunimmt, wird der Markt für Milchalternativen voraussichtlich weiter wachsen und den Verbrauchern eine Vielzahl von Optionen bieten, die ihren Gesundheits- und Ernährungsbedürfnissen gerecht werden.

Gelegenheit

„Weiterentwicklung pflanzlicher Milchprodukte mit funktionellen Zutaten und neuartigen Rezepturen“

- Die Integration funktioneller Inhaltsstoffe wie Probiotika, Präbiotika und pflanzlicher Proteine verbessert das Nährwertprofil von Milchalternativen und kommt gesundheitsbewussten Verbrauchern entgegen, die nach zusätzlichen gesundheitlichen Vorteilen suchen.

- Innovationen in der Fermentationstechnologie ermöglichen die Entwicklung pflanzlicher Milchprodukte mit verbessertem Geschmack, besserer Textur und höherem Nährwert, die herkömmlichen Milchprodukten sehr nahe kommen.

- Fortschritte in der Präzisionsfermentation ermöglichen es Unternehmen, Milchproteine ohne tierische Produkte herzustellen, was zur Entwicklung laktosefreier und umweltfreundlicher Milchalternativen führt.

- Die wachsende Nachfrage der Verbraucher nach Clean-Label- und nachhaltigen Produkten veranlasst die Hersteller, neue Rezepturen zu entwickeln, die diesen Vorlieben gerecht werden und gleichzeitig Geschmack und Funktionalität bieten.

Zum Beispiel,

- Im Oktober 2024 entwickelte das israelische Unternehmen DairyX Hefestämme, die durch Präzisionsfermentation Kaseinproteine produzieren können. Dadurch wird die Herstellung von dehnbarem, cremigem Käse ohne den Einsatz von Kühen ermöglicht. Diese Innovation behebt Texturprobleme, die häufig bei pflanzlichem Käse auftreten, und könnte die Umweltbelastung der Milchindustrie deutlich reduzieren.

- Da sich der Markt für pflanzliche Milchprodukte ständig weiterentwickelt, bieten diese Innovationen bedeutende Möglichkeiten zur Produktdiversifizierung und Markterweiterung und stehen im Einklang mit den allgemeineren Gesundheits- und Wellnesstrends, die die Entscheidungen der Verbraucher beeinflussen.

Einschränkung/Herausforderung

„Regulatorische Rahmenbedingungen für neuartige vegane Produkte“

- Bei der Einführung neuer Milchalternativen kommen häufig innovative pflanzliche Inhaltsstoffe zum Einsatz, die insbesondere in Märkten wie der EU, den USA und Asien strengen behördlichen Genehmigungen unterliegen müssen.

- Diese Regulierungsprozesse können zeitaufwändig sein und erfordern umfangreiche Dokumentation, klinische Studien oder Sicherheitstests, was die Markteinführung verzögert und die Reaktionsfähigkeit des Marktes beeinträchtigt.

- Um den sich entwickelnden Standards für Lebensmittelsicherheit und -kennzeichnung gerecht zu werden, müssen die Unternehmen massiv in die Einhaltung von Vorschriften, die Kennzeichnung und die Neuformulierung investieren, was zu höheren Betriebs- und Rechtskosten führt.

- Kleinere Hersteller stehen vor unverhältnismäßig großen Herausforderungen bei der Bewältigung komplexer regulatorischer Rahmenbedingungen, was ihre Fähigkeit zur Skalierung und effektiven Innovation einschränkt.

Zum Beispiel,

Laut einem Blogbeitrag von Eurofins legen die Vorschriften für vegane Produkte Wert auf die Einhaltung von Kennzeichnung, Transparenz der Inhaltsstoffe und Allergenwarnungen. Der Blogbeitrag unterstreicht die Bedeutung der Einhaltung spezifischer Standards für pflanzliche Inhaltsstoffe, um Produktsicherheit und Verbrauchervertrauen zu gewährleisten, und bietet Orientierung bei der Bewältigung der regulatorischen Anforderungen im veganen Markt.

Marktumfang für Milchalternativen

Der Markt ist nach Produkttyp, Art, Formulierung, Anwendung, Nährwert und Vertriebskanal segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkttyp |

|

|

Nach Typ |

|

|

Nach Formulierung |

|

|

Nach Anwendung |

|

|

Von Nutritive |

|

|

Nach Vertriebskanal |

|

Regionale Analyse des Marktes für Milchalternativen

„Nordamerika ist die dominierende Region auf dem Markt für Milchalternativen“

-

Nordamerika dominiert den globalen Markt für Milchalternativen, unterstützt durch die wachsende Nachfrage der Verbraucher nach pflanzlicher Ernährung, das Bewusstsein für Laktoseintoleranz und ethische Bedenken im Zusammenhang mit Tierschutz und Nachhaltigkeit.

- Die USA sind aufgrund der weit verbreiteten Verwendung von Produkten auf Hafer-, Mandel- und Sojabasis, einer starken Präsenz großer pflanzlicher Milchmarken und kontinuierlicher Innovationen bei Geschmack, Textur und Nährstoffgehalt führend auf dem regionalen Markt.

- Eine gut etablierte Einzelhandelsinfrastruktur, eine steigende Nachfrage nach Clean-Label- und gentechnikfreien Produkten sowie die Unterstützung von Risikokapitalfirmen für pflanzenbasierte Startups tragen zur anhaltenden Marktführerschaft bei

„Asien-Pazifik wird voraussichtlich die höchste Wachstumsrate verzeichnen“

-

Der asiatisch-pazifische Raum dürfte das schnellste Wachstum im Markt für Milchalternativen verzeichnen, was auf die steigenden Laktoseintoleranzraten, die Urbanisierung und veränderte Ernährungspräferenzen zurückzuführen ist.

- Länder wie China, Indien und Japan sind aufgrund der wachsenden Mittelschichtbevölkerung, des steigenden Gesundheitsbewusstseins und der zunehmenden Präferenz für cholesterinarme, pflanzliche Ernährung wichtige Märkte.

- Japans Innovationen bei Milchalternativen auf Sojabasis und Chinas schnelle Einführung von Hafer- und Mandelmilch im Einzelhandel und in der Gastronomie beschleunigen die Marktexpansion

- In Indien treiben die wachsende vegane Bevölkerung, die Verbreitung von Milchallergien und die religiöse Neigung zum pflanzlichen Konsum die Nachfrage an; lokale Startups und internationale Marken bringen zunehmend regionsspezifische milchfreie Produkte auf den Markt, um diesen Bedarf zu decken.

Marktanteil von Milchalternativen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Chobani, LLC (USA)

- Danone SA (Frankreich)

- Hain Celestial (USA)

- Daiya Foods (Kanada)

- Eden Foods (USA)

- NUTRIOPS, SL (Spanien)

- Earth's Own (Kanada)

- SunOpta (Kanada)

- Melt Organic (USA)

- Oatly AB (Schweden)

- Blue Diamond Growers (USA)

- Ripple Foods (USA)

- Vitasoy International Holdings Ltd (Hongkong)

- Organic Valley (USA)

Neueste Entwicklungen auf dem globalen Markt für Milchalternativen

- Im Juni 2023 brachte die schwedische Oatly Group AB einen veganen Frischkäse auf den Markt, der nun landesweit in den USA erhältlich ist. Diese Innovation auf Haferbasis ist in zwei Geschmacksrichtungen erhältlich: Natur und Schnittlauch & Zwiebel.

- Im April 2021 erwarb SunOpta die pflanzlichen Getränkemarken Dream und WestSoy von The Hain Celestial Group, Inc., wodurch das Produktportfolio erweitert und das weitere Wachstum im Segment der pflanzlichen Getränke vorangetrieben wurde.

- Im November 2021 brachte Blue Diamond die extra cremige Mandelmilch Almond Breeze auf den Markt. Sie wird mit Mandelöl aus hochwertigen, kalifornischen Blue Diamond-Mandeln hergestellt und bietet eine reichhaltigere, cremigere Textur. Ziel dieser Produkteinführung war es, die Attraktivität für Verbraucher zu steigern und den Kundenstamm des Unternehmens zu erweitern.

- Im Februar 2025 führte MALK Organics zwei neue Clean-Label-Produkte ein: ungesüßte Bio-Kokosnussmilch und ungesüßte Bio-Sojamilch. Diese Ergänzungen stehen im Einklang mit dem Engagement der Marke, pflanzliche Milch mit minimalen Zutaten anzubieten und so Verbraucher anzusprechen, die nach transparenten und gesünderen Optionen suchen.

- Mit Wirkung zum 5. März 2025 hat Dunkin' die Aufpreise für pflanzliche Milchprodukte wie Mandel- und Hafermilch an allen US-Standorten abgeschafft. Diese Entscheidung, die auf Kundenfeedback und Lobbyarbeit beruht, steht Dunkin' im Einklang mit anderen großen Kaffeeketten und möchte Verbrauchern Milchalternativen zugänglicher machen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.