Global Core Banking Solutions Market

Marktgröße in Milliarden USD

CAGR :

%

USD

16.71 Billion

USD

37.42 Billion

2024

2032

USD

16.71 Billion

USD

37.42 Billion

2024

2032

| 2025 –2032 | |

| USD 16.71 Billion | |

| USD 37.42 Billion | |

|

|

|

|

Globaler Markt für Kernbankenlösungen nach Typ (Unternehmenskundenlösungen, Einlagen, Kredite, Hypotheken, Überweisungen, Zahlungen und Abhebungen, Geldwechsel und andere), Angebot (Software und Dienste), Bereitstellungsmodus (Cloud und vor Ort), Unternehmensgröße (Großunternehmen und kleine und mittlere Unternehmen (KMU)), Kanal (Geldautomaten, Internetbanking, Mobile Banking, Bankfilialen und andere), Funktion (Kontoverwaltung, Transaktionsverarbeitung, Risikomanagement, Kundenbeziehungsmanagement, Berichterstellung und Analyse, Produktmanagement, Kreditverwaltung, Compliance-Management und andere) und Endbenutzer (Banken, Kreditgenossenschaften und Gemeinschaftsbanken und andere Finanzinstitute) – Branchentrends und Prognose bis 2032.

Marktgröße für Kernbankenlösungen

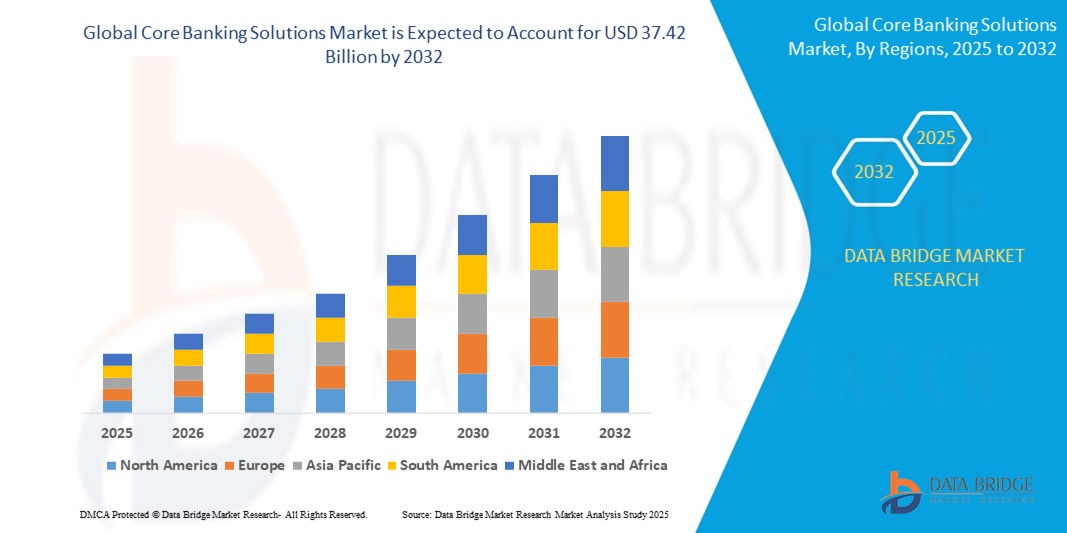

- Der globale Markt für Kernbanklösungen wurde im Jahr 2024 auf 16,71 Milliarden US-Dollar geschätzt und soll bis 2032 37,42 Milliarden US-Dollar erreichen , bei einer CAGR von 10,6 % im Prognosezeitraum.

- Das Marktwachstum wird durch die zunehmende Nutzung des digitalen Bankings, Fortschritte bei Cloud-basierten Technologien und den Bedarf an modernisierter Bankinfrastruktur zur Verbesserung der Betriebseffizienz und des Kundenerlebnisses vorangetrieben.

- Die steigende Nachfrage nach nahtlosen, sicheren und integrierten Banklösungen sowie die regulatorischen Anforderungen an Compliance und Risikomanagement machen Kernbankenlösungen zu entscheidenden Komponenten der digitalen Transformationsstrategien von Finanzinstituten.

Marktanalyse für Kernbankenlösungen

- Kernbankenlösungen, die Software und Dienstleistungen zur Verwaltung kritischer Bankgeschäfte wie Einlagen, Kredite und Zahlungen umfassen, sind für die Modernisierung von Finanzinstituten von entscheidender Bedeutung, da sie die Verarbeitung von Transaktionen in Echtzeit, einen verbesserten Kundenservice und die Integration mit digitalen Bankkanälen ermöglichen.

- Der Nachfrageanstieg wird durch die zunehmende Nutzung von Mobile- und Internet-Banking, den zunehmenden regulatorischen Druck und den Bedarf an skalierbaren, flexiblen Systemen zur Erfüllung der sich wandelnden Kundenerwartungen vorangetrieben.

- Nordamerika dominierte den Markt für Kernbanklösungen mit dem größten Umsatzanteil von 42,5 % im Jahr 2024, was auf die frühe Einführung digitaler Banktechnologien, hohe Investitionen in die IT-Infrastruktur und die Präsenz wichtiger Marktteilnehmer zurückzuführen ist.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region sein, angetrieben durch die schnelle Digitalisierung, die zunehmende finanzielle Inklusion und die zunehmende Nutzung des Mobile Banking in Ländern wie Indien und China.

- Das Segment Unternehmenskundenlösungen dominierte im Jahr 2024 den größten Marktumsatzanteil von 38 %, angetrieben durch die steigende Nachfrage nach integrierten Plattformen, die das Kundenmanagement, Kontodienstleistungen und personalisierte Bankerlebnisse für große Finanzinstitute optimieren.

Berichtsumfang und Marktsegmentierung für Kernbankenlösungen

|

Eigenschaften |

Wichtige Markteinblicke für Kernbankenlösungen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Markttrends für Kernbankenlösungen

„Zunehmende Integration von KI und Advanced Analytics“

- Der globale Markt für Kernbankenlösungen erlebt einen deutlichen Trend zur Integration von künstlicher Intelligenz (KI) und fortschrittlicher Analytik

- Diese Technologien ermöglichen eine anspruchsvolle Datenverarbeitung und bieten tiefere Einblicke in das Kundenverhalten, Transaktionsmuster und die Betriebseffizienz

- KI-gestützte Kernbankenlösungen erleichtern proaktive Entscheidungen, beispielsweise bei der Erkennung potenziellen Betrugs, der Optimierung von Kreditgenehmigungen und der Vorhersage von Kundenbedürfnissen.

- Beispielsweise entwickeln mehrere Anbieter KI-gesteuerte Plattformen, die Finanzprodukte personalisieren, Compliance-Prozesse optimieren und das Risikomanagement auf der Grundlage von Echtzeit-Datenanalysen verbessern.

- Dieser Trend steigert die Attraktivität von Kernbankenlösungen für Finanzinstitute und verbessert die Kundenzufriedenheit sowie die operative Flexibilität.

- KI-Algorithmen analysieren riesige Datensätze, darunter Transaktionshistorien, Kundeninteraktionen und Markttrends, um maßgeschneiderte Dienste und prädiktive Erkenntnisse bereitzustellen.

Marktdynamik für Kernbankenlösungen

Treiber

„Steigende Nachfrage nach digitalem Banking und verbessertem Kundenerlebnis“

- Die wachsende Nachfrage der Verbraucher nach nahtlosen digitalen Bankdienstleistungen wie Mobile Banking, Echtzeitzahlungen und personalisierten Finanzprodukten ist ein wichtiger Treiber für den globalen Markt für Kernbankenlösungen

- Kernbankensysteme verbessern das Kundenerlebnis durch Funktionen wie sofortige Transaktionsverarbeitung, 24/7-Kontozugriff und integrierte Finanzmanagement-Tools

- Regulatorische Vorgaben in Regionen wie Nordamerika, das den Markt dominiert, zwingen Banken dazu, fortschrittliche Kernbankenlösungen einzuführen, um die Standards für Transparenz und Sicherheit zu erfüllen.

- Die Verbreitung von Cloud Computing und 5G-Technologie ermöglicht eine schnellere Datenverarbeitung und geringere Latenzzeiten und unterstützt innovative Bankdienstleistungen wie den Echtzeit-Geldwechsel und Mobile-First-Banking.

- Finanzinstitute übernehmen zunehmend moderne Kernbankenplattformen als Standardangebote, um die Erwartungen ihrer Kunden zu erfüllen und wettbewerbsfähig zu bleiben.

Einschränkung/Herausforderung

„Hohe Implementierungskosten und Bedenken hinsichtlich der Datensicherheit“

- Die erheblichen Anfangsinvestitionen, die für die Bereitstellung eines Kernbankensystems erforderlich sind, einschließlich Hardware, Software und Integration, stellen ein Hindernis für die Einführung dar, insbesondere für kleine und mittlere Unternehmen (KMU) und Institutionen in Schwellenländern.

- Die Integration moderner Kernbankenlösungen in Altsysteme kann komplex und kostspielig sein und erfordert umfangreiche Anpassungen und Tests

- Datensicherheit und Datenschutz stellen große Herausforderungen dar, da Kernbankensysteme sensible Kunden- und Transaktionsdaten verarbeiten, was das Risiko von Verstößen, Missbrauch oder der Nichteinhaltung von Vorschriften wie der DSGVO und dem CCPA erhöht.

- Die fragmentierte Regulierungslandschaft in den einzelnen Ländern, insbesondere im schnell wachsenden Asien-Pazifik-Raum, erschwert die Einhaltung der Vorschriften für globale Anbieter und stellt zusätzliche operative Herausforderungen dar.

- Diese Faktoren können die Einführung behindern, insbesondere in Regionen mit hoher Kostensensibilität oder strengem Datenschutzbewusstsein

Marktumfang für Kernbankenlösungen

Der Markt ist nach Typ, Angebot, Bereitstellungsmodus, Unternehmensgröße, Kanal, Funktion und Endbenutzer segmentiert.

- Nach Typ

Der globale Markt für Kernbanklösungen ist nach Typ in Unternehmenskundenlösungen, Einlagen, Kredite, Hypotheken, Überweisungen, Zahlungen und Abhebungen, Geldwechsel und weitere segmentiert. Das Segment Unternehmenskundenlösungen hatte im Jahr 2024 mit 38 % den größten Marktanteil, angetrieben durch die steigende Nachfrage nach integrierten Plattformen, die das Kundenmanagement, Kontodienstleistungen und personalisierte Bankerlebnisse für große Finanzinstitute optimieren.

Das Segment Zahlungen und Abhebungen wird voraussichtlich von 2025 bis 2032 das höchste Wachstum verzeichnen. Dies ist auf die zunehmende Verbreitung digitaler Zahlungssysteme, Echtzeit-Transaktionsverarbeitung und die Nachfrage der Verbraucher nach nahtlosen, sicheren und sofortigen Zahlungslösungen zurückzuführen. Fortschritte in den Bereichen Fintech und Mobile Banking beschleunigen dieses Wachstum zusätzlich.

- Durch das Angebot

Der globale Markt für Kernbankenlösungen ist nach Angebot in Software und Dienstleistungen unterteilt. Das Softwaresegment wird voraussichtlich im Jahr 2024 mit 62 % den größten Marktanteil halten. Dies ist auf die entscheidende Rolle von Kernbankensoftware für die effiziente Transaktionsabwicklung, Kontoverwaltung und Einhaltung regulatorischer Anforderungen zurückzuführen. Finanzinstitute setzen zunehmend auf skalierbare Softwarelösungen zur Modernisierung ihrer Altsysteme.

Das Dienstleistungssegment wird voraussichtlich von 2025 bis 2032 mit 18,5 % das höchste Wachstum verzeichnen. Grund dafür ist der steigende Bedarf an Implementierungs-, Beratungs- und Wartungsdienstleistungen zur Unterstützung komplexer Kernbankensoftware. Die Nachfrage nach maßgeschneiderten Lösungen und kontinuierlichem Support steigert die Akzeptanz.

- Nach Bereitstellungsmodus

Der globale Markt für Kernbankenlösungen wird anhand der Bereitstellungsmethode in Cloud- und On-Premise-Lösungen unterteilt. Das Cloud-Segment wird voraussichtlich im Jahr 2024 mit 58 % den größten Marktanteil halten. Dies ist auf seine Flexibilität, Skalierbarkeit und Kosteneffizienz zurückzuführen, die es Finanzinstituten ermöglichen, sich an veränderte Marktanforderungen anzupassen und Infrastrukturkosten zu senken.

Es wird außerdem erwartet, dass das Cloud-Segment zwischen 2025 und 2032 das schnellste Wachstum verzeichnen wird. Grund hierfür ist die zunehmende Verbreitung cloudbasierter Lösungen im Asien-Pazifik-Raum und anderen Regionen, wo Banken versuchen, fortschrittliche Technologien wie KI und maschinelles Lernen zu nutzen, um die Betriebseffizienz und das Kundenerlebnis zu verbessern.

- Nach Unternehmensgröße

Der globale Markt für Kernbankenlösungen ist nach Unternehmensgröße in Großunternehmen sowie kleine und mittlere Unternehmen (KMU) segmentiert. Das Segment der Großunternehmen dominierte 2024 mit einem Marktanteil von 70 %. Grund hierfür ist der Bedarf an robusten, skalierbaren und sicheren Kernbankensystemen zur Bewältigung hoher Transaktionsvolumina und komplexer Abläufe in großen Finanzinstituten.

Für das KMU-Segment wird zwischen 2025 und 2032 ein rasantes Wachstum von 20,2 % erwartet. Dieser Anstieg wird durch die zunehmende Digitalisierung und die Einführung kostengünstiger, cloudbasierter Kernbankenlösungen vorangetrieben, die auf die Bedürfnisse kleinerer Institute zugeschnitten sind, insbesondere in Schwellenmärkten wie dem asiatisch-pazifischen Raum.

- Nach Kanal

Der globale Markt für Kernbankenlösungen ist nach Kanälen in Geldautomaten, Online-Banking, Mobile-Banking, Bankfilialen und weitere segmentiert. Das Mobile-Banking-Segment wird voraussichtlich im Jahr 2024 mit 45 % den größten Marktanteil halten, was auf die zunehmende Verbreitung von Smartphones und die Vorliebe der Verbraucher für bequeme Bankdienstleistungen für unterwegs zurückzuführen ist.

Das Segment Internetbanking dürfte zwischen 2025 und 2032 ein erhebliches Wachstum verzeichnen, da Finanzinstitute in benutzerfreundliche Online-Plattformen investieren, um die Kundenbindung zu verbessern und einen nahtlosen Zugang zu Bankdienstleistungen zu ermöglichen, insbesondere in technikaffinen Regionen wie Nordamerika und dem asiatisch-pazifischen Raum.

- Nach Funktion

Der globale Markt für Kernbankenlösungen ist funktional in die Bereiche Kontoverwaltung, Transaktionsverarbeitung, Risikomanagement, Kundenbeziehungsmanagement, Reporting und Analyse, Produktmanagement, Kreditmanagement, Compliance-Management und weitere segmentiert. Das Segment Transaktionsverarbeitung wird voraussichtlich im Jahr 2024 mit 40 % den größten Marktanteil halten, da es eine entscheidende Rolle bei der Echtzeit-, sicheren und effizienten Abwicklung von Finanztransaktionen über mehrere Kanäle hinweg spielt.

Das Segment Reporting und Analytics wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen. Grund dafür ist die steigende Nachfrage nach datenbasierten Erkenntnissen zur Verbesserung der Entscheidungsfindung, Optimierung von Abläufen und Erfüllung regulatorischer Berichtspflichten. Die Integration von KI und Advanced Analytics treibt die Akzeptanz zusätzlich voran.

- Nach Endbenutzer

Der globale Markt für Kernbankenlösungen ist nach Endnutzern in Banken, Kreditgenossenschaften, Regionalbanken und andere Finanzinstitute segmentiert. Das Bankensegment dominierte 2024 den Marktumsatz mit 73 % aufgrund des hohen Transaktionsvolumens, der ausgedehnten Filialnetze und des Bedarfs an fortschrittlichen Kernbankensystemen zur Unterstützung vielfältiger Dienstleistungen.

Für das Segment der Kreditgenossenschaften und Gemeinschaftsbanken wird zwischen 2025 und 2032 ein rasantes Wachstum von 19,8 % erwartet. Dieser Anstieg ist auf die zunehmende Einführung moderner Kernbanklösungen zurückzuführen, die die Betriebseffizienz steigern, das Kundenerlebnis verbessern und den Wettbewerb mit größeren Finanzinstituten, insbesondere in Regionen wie dem asiatisch-pazifischen Raum, fördern.

Regionale Analyse des Marktes für Kernbankenlösungen

- Nordamerika dominierte den Markt für Kernbanklösungen mit dem größten Umsatzanteil von 42,5 % im Jahr 2024, was auf die frühe Einführung digitaler Banktechnologien, hohe Investitionen in die IT-Infrastruktur und die Präsenz wichtiger Marktteilnehmer zurückzuführen ist.

- Finanzinstitute priorisieren Kernbankenlösungen, um die Betriebseffizienz zu steigern, das Kundenerlebnis zu verbessern und die Einhaltung gesetzlicher Vorschriften sicherzustellen, insbesondere in Regionen mit unterschiedlichen wirtschaftlichen Bedingungen.

- Das Wachstum wird durch Fortschritte bei der Bankensoftware, einschließlich Cloud-basierter Plattformen und KI-gestützter Analytik, sowie durch die zunehmende Akzeptanz sowohl bei großen Unternehmen als auch bei kleinen und mittleren Unternehmen (KMU) unterstützt.

Markteinblick in Kernbankenlösungen in den USA

Der US-Markt für Kernbankenlösungen erzielte 2024 mit 84,8 % den größten Umsatzanteil in Nordamerika. Dies ist auf die starke Nachfrage nach digitaler Transformation im Bankwesen und das wachsende Bewusstsein für die Vorteile integrierter Bankplattformen zurückzuführen. Der Trend zu personalisierten Bankdienstleistungen und strenge regulatorische Standards treiben das Marktwachstum zusätzlich voran. Die zunehmende Nutzung cloudbasierter Lösungen durch Finanzinstitute ergänzt traditionelle On-Premise-Implementierungen und schafft so ein vielfältiges Produkt-Ökosystem.

Markteinblick in europäische Kernbankenlösungen

Der europäische Markt für Kernbankenlösungen wird voraussichtlich deutlich wachsen, unterstützt durch den regulatorischen Schwerpunkt auf finanzieller Transparenz und kundenorientierten Bankdienstleistungen. Banken und Finanzinstitute suchen nach Lösungen, die die Transaktionsverarbeitung, das Risikomanagement und das Kundenbeziehungsmanagement verbessern. Sowohl bei der Implementierung neuer Systeme als auch bei der Modernisierung bestehender Systeme ist das Wachstum deutlich ausgeprägt. Länder wie Deutschland und Frankreich verzeichnen aufgrund des zunehmenden Trends zum digitalen Banking und der wirtschaftlichen Stabilität eine hohe Akzeptanz.

Markteinblick in Kernbankenlösungen in Großbritannien

Der britische Markt für Kernbankenlösungen wird voraussichtlich rasant wachsen, angetrieben von der Nachfrage nach verbesserten Kundenerlebnissen und nahtlosen digitalen Bankdienstleistungen in städtischen und vorstädtischen Gebieten. Das zunehmende Interesse an Mobile- und Internet-Banking sowie das wachsende Bewusstsein für Datensicherheit und Compliance-Vorteile fördern die Akzeptanz. Die sich entwickelnden Finanzvorschriften beeinflussen die Entscheidungen der Banken und sorgen für ein Gleichgewicht zwischen Innovation und regulatorischer Compliance.

Markteinblick in Kernbankenlösungen in Deutschland

In Deutschland wird ein rasantes Wachstum im Markt für Kernbanklösungen erwartet. Dies ist auf den fortschrittlichen Finanzdienstleistungssektor und den hohen Fokus auf operative Effizienz und Kundenzufriedenheit zurückzuführen. Deutsche Banken bevorzugen technologisch fortschrittliche Lösungen, die Kontoverwaltung, Transaktionsabwicklung und Compliance-Management optimieren. Die Integration dieser Lösungen in Großunternehmen und KMU fördert nachhaltiges Marktwachstum.

Markteinblicke für Kernbankenlösungen im asiatisch-pazifischen Raum

Der asiatisch-pazifische Raum wird voraussichtlich das höchste Wachstum verzeichnen, angetrieben durch expandierende Finanzdienstleistungssektoren und die zunehmende Digitalisierung in Ländern wie China, Indien und Japan. Das zunehmende Bewusstsein für Lösungen im Bereich Kundenbeziehungsmanagement, Risikomanagement und Transaktionsabwicklung treibt die Nachfrage an. Regierungsinitiativen zur Förderung der finanziellen Inklusion und des digitalen Bankings fördern die Einführung fortschrittlicher Kernbankenlösungen zusätzlich.

Markteinblick in Kernbankenlösungen in Japan

Der japanische Markt für Kernbanklösungen dürfte aufgrund der starken Präferenz der Verbraucher für hochwertige, technologisch fortschrittliche Bankplattformen, die die Betriebseffizienz und Kundenzufriedenheit steigern, rasant wachsen. Die Präsenz großer Finanzinstitute und die Integration von Kernbanklösungen in Unternehmenssysteme beschleunigen die Marktdurchdringung. Das steigende Interesse an Mobile- und Internet-Banking trägt ebenfalls zum Wachstum bei.

Markteinblick in Kernbankenlösungen in China

China hält den größten Marktanteil im asiatisch-pazifischen Markt für Kernbankenlösungen. Dies ist auf die rasante Urbanisierung, die zunehmende Präsenz von Finanzinstituten und die steigende Nachfrage nach digitalen Banklösungen zurückzuführen. Die wachsende Mittelschicht des Landes und der Fokus auf intelligente Finanzdienstleistungen fördern die Einführung fortschrittlicher Kernbankenplattformen. Starke inländische Softwareentwicklungskapazitäten und wettbewerbsfähige Preise verbessern die Marktzugänglichkeit.

Marktanteil von Kernbankenlösungen

Die Branche der Kernbankenlösungen wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- FIS (Fidelity National Information Services, Inc.) (USA)

- Bricknode (Schweden)

- Jayam-Lösungen (Indien)

- Forbis (Litauen)

- NCR VOYIX Corporation (USA)

- HCL Technologies Limited (Indien)

- Unisys (USA)

- Infosys Limited (Indien)

- TATA Consultancy Services Limited (Indien)

- Jack Henry & Associates, Inc. (USA)

- SAP (Deutschland)

- Oracle (USA)

- Capgemini (Frankreich)

- nCino (USA)

- Finastra (Großbritannien)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für Kernbankenlösungen?

- Im Juli 2025 stellte 10x Banking Meta Core vor, eine bahnbrechende Cloud-native Banking-Plattform, die die digitale Transformation von Finanzinstituten beschleunigen soll. Meta Core vereinfacht die Entwicklung von Bankanwendungen durch die Abstraktion gemeinsamer Produktelemente und des Hauptbuchs. Banken können so mit nur 2.000 Zeilen Code maßgeschneiderte Produkte entwickeln. Dies reduziert Komplexität und Risiko im Vergleich zu Legacy-Systemen drastisch. Die Plattform bietet Sicherheit auf Unternehmensniveau, eine KI-fähige Datenarchitektur und unbegrenzte Skalierbarkeit. So können Banken schneller Innovationen entwickeln und ihre Kunden effektiver bedienen. Meta Core markiert einen wichtigen Schritt hin zur Cloud-nativen Modernisierung im Bankensektor.

- Im Mai 2025 brachte Temenos eine innovative generative KI-Lösung auf den Markt, die den Umgang von Banken mit ihren Daten revolutionieren und die betriebliche Effizienz steigern soll. Integriert in die Temenos Core- und Financial Crime Mitigation (FCM)-Plattformen ermöglicht die Lösung Nutzern die Interaktion mit komplexen Bankdaten durch Abfragen in natürlicher Sprache, liefert sofortige Erkenntnisse und vereinfacht die Entscheidungsfindung. Sie unterstützt sichere, erklärbare und überprüfbare KI-Praktiken und hilft Banken, Produktivität, Compliance und Rentabilität zu steigern. Diese Innovation spiegelt das Engagement von Temenos für verantwortungsvolle KI wider und ermöglicht Finanzinstituten die Entwicklung hyperpersonalisierter Dienstleistungen und die Optimierung der Leistung im gesamten Betrieb.

- Im April 2025 gab die Zand Bank, die erste rein digitale Bank der VAE, die Einführung der Infosys Finacle Solutions Suite zur Verbesserung ihrer Firmenkundendienstleistungen bekannt. Die auf Microsoft Azure gehostete Cloud-native Plattform ermöglicht Zand ein kundenorientiertes, zukunftssicheres Bankerlebnis mit fortschrittlichen Funktionen in den Bereichen KI, Predictive Analytics und Blockchain-Integration. Die modulare Architektur und die offenen APIs von Finacle beschleunigen Innovationen, verbessern die Skalierbarkeit und optimieren Abläufe. Dieser strategische Schritt positioniert Zand an der Spitze des digitalen Finanzwesens und ermöglicht es dem Unternehmen, Firmenkunden sichere, personalisierte und effiziente Dienstleistungen anzubieten.

- Im Januar 2025 gründeten 10x Banking und DLT Apps eine strategische Partnerschaft, um die Datenmigration für Finanzinstitute zu revolutionieren. Durch die Kombination der Cloud-nativen Meta-Core-Banking-Plattform von 10x mit den KI-gestützten TerraAi- und MigratIO-Tools von DLT Apps bietet die Zusammenarbeit einen schnellen, sicheren und prüffähigen Migrationspfad von Legacy- und Nicht-Legacy-Systemen. Die gemeinsame Lösung ermöglicht es Banken, Daten in beliebiger Reihenfolge zu laden, in einer kontrollierten Umgebung zu validieren und vollständige Prüfpfade zu führen – dies gewährleistet Datenintegrität, -qualität und minimale Ausfallzeiten. Diese Partnerschaft ermöglicht es Instituten, ihre digitale Transformation sicher zu modernisieren und zu beschleunigen.

- Im Januar 2025 gaben Temenos und Deloitte eine strategische Partnerschaft bekannt, um US-Finanzinstitute bei der Modernisierung ihrer Kernbank- und Zahlungssysteme durch Cloud-basierte Lösungen zu unterstützen. Durch die Kombination der umfassenden Beratungskompetenz von Deloitte mit der zusammensetzbaren SaaS-Banking-Plattform von Temenos zielt die Zusammenarbeit darauf ab, die Bereitstellung moderner digitaler Erlebnisse zu beschleunigen und gleichzeitig Kosten und Implementierungsrisiken zu reduzieren. Die Partnerschaft unterstützt zudem neue Geschäftsmodelle wie Banking-as-a-Service (BaaS) und Instant Payments und ermöglicht es Banken, ihre operative Belastbarkeit und Kundenbindung zu verbessern. Diese gemeinsame Markteinführungsstrategie stärkt die Präsenz von Temenos in den USA und ermöglicht Banken, die digitale Transformation erfolgreich zu meistern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.