Global Contactless Payment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

15.74 Billion

USD

36.79 Billion

2024

2032

USD

15.74 Billion

USD

36.79 Billion

2024

2032

| 2025 –2032 | |

| USD 15.74 Billion | |

| USD 36.79 Billion | |

|

|

|

|

Globale Marktsegmentierung für kontaktloses Bezahlen nach Technologie (Radiofrequenz-Identifikation, Nahfeldkommunikation und Hostkarten-Emulation), Zahlungsmodus (Smartphones, Smartcards und andere), Komponente (Hardware, Dienste und Lösungen), Betriebsfrequenz (Niederfrequenz, Hochfrequenz und Ultrahochfrequenz), Transaktionsmodellen (Speedpass, EZ Pass, Track 1- und Track 2-Daten, EMV-Karte und Offline-Wertkarte), Branche (Banken, Finanzdienstleistungen und Versicherungen (BFSI), Einzelhandel, Gesundheitswesen, Gastgewerbe, Energie- und Versorgungsunternehmen, Transport und Logistik und andere Branchen) – Branchentrends und Prognose bis 2032

Marktgröße für kontaktlose Zahlungen

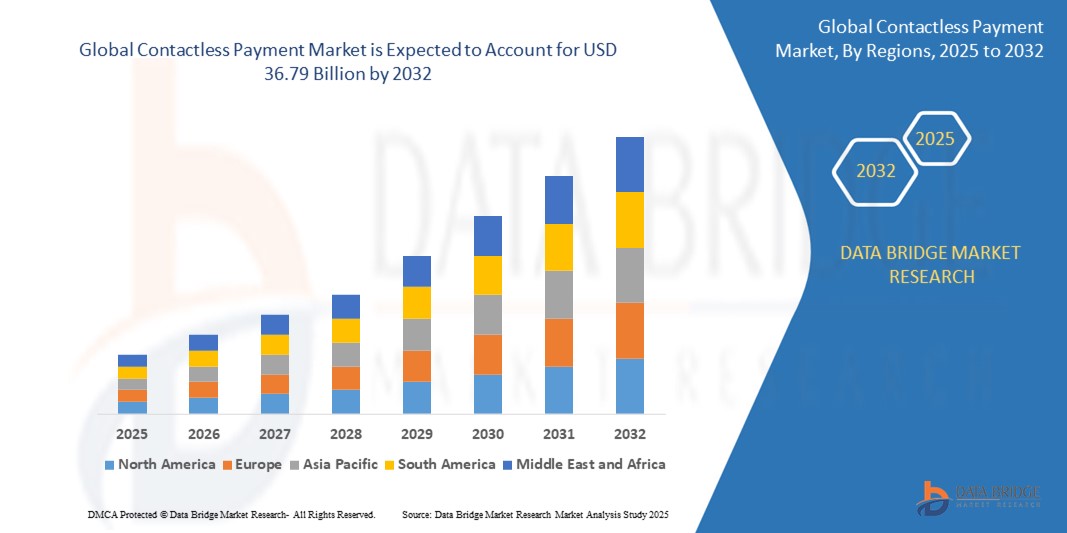

- Der globale Markt für kontaktlose Zahlungen wurde im Jahr 2024 auf 15,74 Milliarden US-Dollar geschätzt und soll bis 2032 36,79 Milliarden US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer jährlichen Wachstumsrate von 11,20 % wachsen, vor allem getrieben durch technologische Innovationen.

- Dieses Wachstum wird durch Faktoren wie verbesserte NFC-Technologie und Cloud-basierte Zahlungslösungen vorangetrieben

Marktanalyse für kontaktloses Bezahlen

- Kontaktloses Bezahlen ist eine sichere Methode für Transaktionen mit Debitkarten, Kreditkarten, Schlüsselanhängern, Smartphones und anderen Geräten. Diese Zahlungsmittel werden häufig in der Nähe akzeptiert. Die Technologie für kontaktloses Bezahlen umfasst einen integrierten Chip und eine Antenne. Dadurch können Transaktionen ohne PIN-Eingabe durchgeführt werden.

- Das Wachstum des Marktes für kontaktloses Bezahlen wird vor allem durch die zunehmende Vorliebe der Verbraucher für schnelle und sichere Transaktionen, die zunehmende Verbreitung von Smartphones und mobilen Geldbörsen sowie Fortschritte in der NFC-Technologie vorangetrieben.

- Kontaktlose Zahlungslösungen ermöglichen Unternehmen und Verbrauchern schnelle Transaktionen, verkürzen die Checkout-Zeiten und erhöhen die Zahlungssicherheit durch Tokenisierung und Verschlüsselung. Diese Lösungen umfassen häufig Funktionen wie NFC-basiertes Tap-to-Pay, biometrische Authentifizierung, die Integration mobiler Geldbörsen und Echtzeit-Transaktionsüberwachung.

- So haben beispielsweise führende Finanzinstitute und Anbieter von Zahlungslösungen wie Visa, Mastercard und Apple Pay ihre Angebote für kontaktlose Zahlungen erweitert, um ein breiteres Spektrum an Transaktionen zu unterstützen, darunter Transportsysteme, Einzelhandel und Online-Zahlungen.

- Der Markt für kontaktloses Bezahlen steht vor einem kontinuierlichen Wachstum. Dies wird durch die zunehmende Akzeptanz digitaler Zahlungsmethoden, Fortschritte in der biometrischen Sicherheit und die regulatorische Unterstützung bargeldloser Volkswirtschaften vorangetrieben. Da Unternehmen und Verbraucher weiterhin digitale Zahlungsmethoden nutzen, wird die Nachfrage nach innovativen und sicheren kontaktlosen Zahlungslösungen weiter steigen.

Berichtsumfang und Marktsegmentierung für kontaktloses Bezahlen

|

Eigenschaften |

Wichtige Markteinblicke zum kontaktlosen Bezahlen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für kontaktlose Zahlungen

„Zunehmende Akzeptanz kontaktloser Zahlungen auf QR-Code-Basis“

- Ein herausragender Trend auf dem globalen Markt für kontaktloses Bezahlen ist die zunehmende Akzeptanz von QR-Code-basierten kontaktlosen Zahlungen.

- Dieser Trend wird durch den Bedarf an kostengünstigen, zugänglichen und skalierbaren Zahlungslösungen vorangetrieben, die keine spezielle Hardware wie NFC-fähige POS-Terminals erfordern. QR-Code-Zahlungen bieten Unternehmen und Verbrauchern eine einfache und bequeme Methode für Transaktionen mit lediglich einer Smartphone-Kamera und einer Internetverbindung.

- So haben beispielsweise große Zahlungsanbieter wie Alipay, WeChat Pay und PayPal ihre QR-Code-Zahlungsdienste erweitert, um nahtlose Transaktionen im Einzelhandel, Transportwesen und Peer-to-Peer-Zahlungen zu unterstützen und so der steigenden Nachfrage nach reibungslosen digitalen Zahlungen gerecht zu werden.

- Darüber hinaus wird erwartet, dass sich der Übergang zu mobilen Zahlungssystemen und die Integration der QR-Code-Technologie in digitale Geldbörsen beschleunigen werden, wodurch kontaktlose Zahlungen insbesondere für kleine Unternehmen und bargeldbasierte Volkswirtschaften integrativer werden.

- Angesichts des zunehmenden Wettbewerbs werden Zahlungsanbieter QR-Code-basierte Zahlungslösungen weiter verbessern, indem sie mehr Sicherheit, KI-gestützte Betrugserkennung und eine stärkere Integration in E-Commerce- und Banking-Plattformen bieten. Die breite Akzeptanz von QR-Code-Zahlungen wird das Marktwachstum vorantreiben und ihre Rolle als Schlüsselkomponente des globalen kontaktlosen Zahlungssystems stärken.

Marktdynamik für kontaktlose Zahlungen

Treiber

„Steigende Akzeptanz digitaler Zahlungsplattformen“

- Die zunehmende Nutzung digitaler Zahlungsplattformen ist ein wichtiger Wachstumstreiber im Markt für kontaktloses Bezahlen. Da Verbraucher und Unternehmen zunehmend auf bargeldlose Transaktionen umsteigen, ist die Nachfrage nach sicheren, schnellen und reibungslosen digitalen Zahlungslösungen stark gestiegen. Digitale Zahlungsplattformen sind daher ein wichtiger Wegbereiter für kontaktlose Transaktionen.

- Dieser Wandel ist besonders in Branchen wie Einzelhandel, E-Commerce, Transport und Gastgewerbe deutlich zu erkennen, wo eine schnelle und sichere Zahlungsabwicklung für die Verbesserung des Kundenerlebnisses und der betrieblichen Effizienz unerlässlich ist.

- Da Unternehmen ihre Zahlungssysteme modernisieren und den sich wandelnden Verbraucherpräferenzen gerecht werden möchten, ist der Bedarf an integrierten, benutzerfreundlichen Zahlungsplattformen, die kontaktlose Transaktionen unterstützen, unerlässlich geworden.

- Unternehmen nutzen zunehmend mobile Geldbörsen, Fintech-Zahlungslösungen und Online-Banking-Plattformen, um kontaktlose Transaktionen zu ermöglichen, die Sicherheit zu erhöhen und den Zugang zu Finanzdienstleistungen zu verbessern.

- Diese Plattformen bieten Vorteile wie Echtzeit-Transaktionsüberwachung, Betrugserkennung und nahtlose grenzüberschreitende Zahlungen, was die Akzeptanz weiter fördert.

Zum Beispiel,

- Führende digitale Zahlungsanbieter wie PayPal, Square und Stripe haben ihre kontaktlosen Zahlungsmöglichkeiten durch die Integration von NFC, QR-Codes und biometrischer Authentifizierung erweitert, um der wachsenden Nachfrage nach reibungslosen digitalen Transaktionen gerecht zu werden.

- Unternehmen wie Google Pay, Apple Pay und Samsung Pay verbessern ihre Plattformen kontinuierlich durch die Integration von KI-gestützter Betrugserkennung und Echtzeit-Transaktionsanalysen und gewährleisten so sowohl Sicherheit als auch Benutzerfreundlichkeit.

- Da die Abhängigkeit von digitalen Zahlungen weiter zunimmt, angetrieben durch die regulatorische Unterstützung bargeldloser Volkswirtschaften, Fortschritte im Fintech-Bereich und die Nachfrage der Verbraucher nach Komfort, wird erwartet, dass der Markt für kontaktlose Zahlungen ein anhaltendes Wachstum verzeichnen wird. Dies stärkt die Rolle digitaler Zahlungsplattformen bei der Gestaltung der Zukunft von Finanztransaktionen.

Gelegenheit

„Steigende Nachfrage nach mobilen und tragbaren Zahlungsgeräten“

- Die steigende Nachfrage nach mobilen und tragbaren Zahlungsgeräten bietet erhebliche Chancen für den Markt für kontaktloses Bezahlen. Da Verbraucher zunehmend Smartphones, Smartwatches und andere tragbare Geräte für alltägliche Transaktionen nutzen, wächst der Bedarf an Zahlungslösungen, die sich nahtlos in diese Technologien integrieren lassen.

- Mobile und tragbare Zahlungsgeräte erfreuen sich aufgrund ihrer Bequemlichkeit, Sicherheit und Geschwindigkeit zunehmender Beliebtheit und ermöglichen Transaktionen mit einem einfachen Fingertipp. Diese Geräte machen physische Karten oder Bargeld überflüssig und sind daher besonders für technisch versierte Verbraucher und diejenigen attraktiv, die reibungslose Zahlungserlebnisse suchen.

- Die zunehmende Verbreitung von NFC-fähigen Smartphones und Smartwatches hat den Trend zum kontaktlosen Bezahlen beschleunigt und die Nachfrage nach Zahlungsplattformen mit mobilen Geldbörsen und tragbaren Zahlungslösungen erhöht. Unternehmen und Finanzinstitute nutzen diesen Trend, indem sie ihre digitalen Zahlungsangebote erweitern, um der zunehmenden Nutzung dieser Geräte gerecht zu werden.

Zum Beispiel,

- Unternehmen wie Apple, Samsung und Garmin haben ihre tragbaren Zahlungsfunktionen verbessert und ermöglichen es Benutzern, Transaktionen mit Geräten wie der Apple Watch, der Samsung Galaxy Watch und Garmin Pay-fähigen Smartwatches durchzuführen.

- Zahlungsanbieter wie Visa und Mastercard haben sich mit Technologieunternehmen zusammengeschlossen, um die Unterstützung kontaktloser Zahlungen für mobile und tragbare Geräte zu erweitern und so nahtlose und sichere Transaktionen in verschiedenen Branchen zu gewährleisten.

- Mit der zunehmenden Verbreitung mobiler und tragbarer Zahlungsgeräte werden die Investitionen in fortschrittliche Sicherheitsfunktionen, biometrische Authentifizierung und verbesserte Zahlungsintegrationen steigen. Dieser Trend wird Innovationen im Markt für kontaktloses Bezahlen vorantreiben und mobile und tragbare Zahlungsmittel zu einem Schlüsselelement der zukünftigen digitalen Wirtschaft machen.

Einschränkung/Herausforderung

„Hohe Kosten für den Einsatz von Technologien“

- Die hohen Kosten für die Bereitstellung von Technologien stellen eine erhebliche Herausforderung für die Einführung mobiler und tragbarer Zahlungsgeräte im kontaktlosen Zahlungsmarkt dar. Unternehmen und Finanzinstitute stehen oft vor einem erheblichen Investitionsbedarf für die Modernisierung der Infrastruktur, die Integration von Zahlungssystemen und die Einhaltung von Sicherheitsstandards.

- Die Implementierung mobiler und tragbarer Zahlungslösungen erfordert spezielle Hardware, NFC-fähige Geräte und erweiterte Sicherheitsmaßnahmen wie Verschlüsselung und biometrische Authentifizierung. Diese Kosten erschweren es kleinen Unternehmen und Entwicklungsländern, diese Zahlungsmethoden effektiv zu übernehmen und zu unterstützen.

- Darüber hinaus erfordert die rasante Entwicklung von Zahlungstechnologien kontinuierliche Upgrades, um Sicherheitsprotokollen, Kompatibilitätsstandards und den Erwartungen der Verbraucher gerecht zu werden. Dieser ständige Innovationsbedarf erhöht die Betriebskosten und verlangsamt die breite Akzeptanz bei Unternehmen mit begrenzten finanziellen und technologischen Ressourcen.

Zum Beispiel,

- Unternehmen in Schwellenländern haben möglicherweise Schwierigkeiten, mobile und tragbare Zahlungslösungen zu implementieren, da die Anschaffungskosten hoch sind. Dies führt dazu, dass sie auf traditionelle Zahlungsmethoden zurückgreifen, anstatt in eine fortschrittliche digitale Zahlungsinfrastruktur zu investieren.

- Da der Wettbewerb im Markt für kontaktloses Bezahlen zunimmt, könnten die hohen Kosten für die Einführung von Technologien die Einführung mobiler und tragbarer Zahlungsmittel verlangsamen, insbesondere in Regionen mit begrenzten finanziellen Ressourcen und technologischem Know-how. Diese Herausforderung könnte das Marktwachstum behindern, insbesondere für kleine Unternehmen, denen das Kapital für Investitionen in moderne kontaktlose Zahlungslösungen fehlt.

Marktumfang für kontaktlose Zahlungen

Der Markt ist nach Technologie, Zahlungsart, Komponente, Betriebshäufigkeit, Transaktionsmodellen und Branche segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Technologie |

|

|

Nach Zahlungsart |

|

|

Nach Komponente |

|

|

Nach Betriebsfrequenz

|

|

|

Nach Transaktionsmodellen |

|

|

Nach Vertikal |

|

Regionale Analyse des Marktes für kontaktlose Zahlungen

„Europa ist die dominierende Region im Markt für kontaktloses Bezahlen“

- Europa dominiert den Markt für kontaktloses Bezahlen , was auf die hohe Verbreitung von Smartphones, Fortschritte in der Smart-Chip-Technologie und die zunehmende Nutzung der Near-Field-Communication-Technologie (NFC) zurückzuführen ist. Die gut etablierte digitale Zahlungsinfrastruktur und die starke regulatorische Unterstützung tragen zusätzlich zur Marktführerschaft bei.

- Großbritannien hält einen bedeutenden Anteil aufgrund seines gut entwickelten Bankensektors, der zunehmenden Präferenz der Verbraucher für digitale Geldbörsen wie Apple Pay, Google Pay und PayPal sowie der zunehmenden Verbreitung kontaktloser Karten im Einzelhandel, im Transportwesen und im Gastgewerbe .

- Die steigende Nachfrage nach sicheren und reibungslosen Zahlungsmethoden sowie staatliche Initiativen zur Förderung bargeldloser Transaktionen beschleunigen die Einführung kontaktloser Zahlungen in ganz Europa weiter.

- Darüber hinaus stärkt die Präsenz führender Anbieter von Zahlungslösungen und Fintech-Unternehmen in der Region, wie beispielsweise Worldline, Ingenico und SumUp, den Markt zusätzlich, indem sie ihre Angebote kontinuierlich erneuern und erweitern.

„Asien-Pazifik wird voraussichtlich die höchste Wachstumsrate verzeichnen“

- Der asiatisch-pazifische Raum wird voraussichtlich die höchsten Wachstumsraten im Markt für kontaktloses Bezahlen verzeichnen, angetrieben durch die schnelle Verbreitung mobiler und digitaler Zahlungslösungen . Die zunehmende Verbreitung von Smartphones und die zunehmende Präferenz für digitale Geldbörsen in Ländern wie China, Indien und Japan treiben das Marktwachstum voran.

- China ist in der Region führend bei der weit verbreiteten Nutzung von QR-Code-basierten Zahlungen und mobilen Geldbörsen wie Alipay und WeChat Pay, während staatliche Initiativen in Indien wie Digital India und die Einführung von UPI erheblich zum Wachstum kontaktloser Transaktionen beigetragen haben.

- Das Wachstum im asiatisch-pazifischen Raum wird zusätzlich durch die steigende Zahl von Marktteilnehmern unterstützt, die kostengünstige und innovative Zahlungslösungen anbieten und so ein äußerst wettbewerbsintensives Umfeld schaffen.

- Der wachsende E-Commerce-Sektor der Region, steigende Fintech-Investitionen und die steigende Nachfrage nach schnelleren und sichereren Transaktionen machen den asiatisch-pazifischen Raum zu einem Schlüsselmarkt für Anbieter kontaktloser Zahlungen, die ihre globale Präsenz ausbauen möchten.

Marktanteile kontaktloser Zahlungen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Thales (Frankreich)

- Infineon Technologies AG (Deutschland)

- Gemalto NV (Niederlande)

- Infineon Technologies AG (Deutschland)

- Ingenico Group SA (Frankreich)

- Wirecard AG (Deutschland)

- Verifone Systems, Inc. (USA)

- Giesecke+Devrient GmbH (Deutschland)

- IDEMIA France SAS (Frankreich)

- On Track Innovations Ltd. (Israel)

- Identiv, Inc. (USA)

- CPI Card Group Inc. (USA)

- Bitel Co., Ltd. (Südkorea)

- Setomatic Systems (USA)

- Valitor hf. (Island)

- PAX Global Technology Limited (Hongkong)

- MYPINPAD Ltd. ((Großbritannien))

- Mobeewave Inc. (Kanada)

- Alcineo (Frankreich)

- Castles Technology Co., Ltd. (Taiwan)

- SumUp Limited (Großbritannien)

- PayCore (Türkei)

Neueste Entwicklungen auf dem globalen Markt für kontaktloses Bezahlen

- Im Oktober 2024 kündigte Tappy Technologies die Einführung des weltweit ersten Fitness- und Bezahlrings an, der Fitness-Tracking mit Netzwerkkarten-Tokenisierung für kontaktloses Bezahlen kombiniert. Diese Innovation, die auf der Hong Kong Fintech Week 2024 vorgestellt wurde, stärkt Tappys Position im Markt für tragbare Bezahllösungen durch die Kombination von Gesundheits- und Finanztechnologie. Die Einführung multifunktionaler tragbarer Bezahllösungen dürfte das Marktwachstum beschleunigen und technikaffine Verbraucher ansprechen, die nahtlose, sichere und gesundheitsintegrierte Zahlungslösungen suchen.

- Im März 2024 brachte die IndusInd Bank „Indus PayWear“ auf den Markt, Indiens erste tokenisierbare All-in-One-Wearables für kontaktloses Bezahlen für Debit- und Kreditkarten, exklusiv auf Mastercard. Die Ausweitung auf weitere Netzwerke ist geplant. Diese Innovation stärkt die Position der IndusInd Bank im Markt für kontaktloses Bezahlen und erhöht den Komfort und die Sicherheit der Verbraucher. Die Einführung tragbarer Zahlungslösungen dürfte die Marktakzeptanz fördern und der wachsenden Nachfrage nach nahtlosen und sicheren digitalen Transaktionen in Indien gerecht werden.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.