Global Cloud Discovery Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.65 Billion

USD

5.78 Billion

2024

2032

USD

1.65 Billion

USD

5.78 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 5.78 Billion | |

|

|

|

|

Globale Marktsegmentierung für Cloud Discovery nach Komponenten (Lösungen und Services), Unternehmensgröße (Großunternehmen sowie kleine und mittlere Unternehmen), Branchen (Banken, Finanzdienstleistungen und Versicherungen (BFSI), Gesundheitswesen und Biowissenschaften, Telekommunikation und IT, Einzelhandel und Konsumgüter, Regierung und öffentlicher Sektor, Medien und Unterhaltung, Fertigung, Transport und Logistik und andere) – Branchentrends und Prognose bis 2032

Wie groß ist der globale Cloud Discovery-Markt und wie hoch ist seine Wachstumsrate?

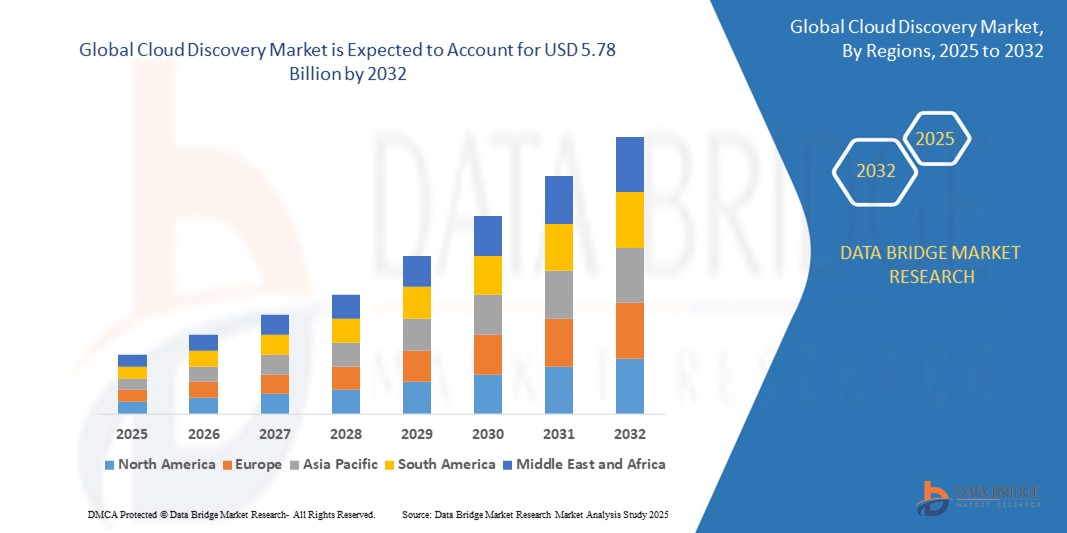

- Der globale Markt für Cloud-Discovery wird im Jahr 2024 auf 1,65 Milliarden US-Dollar geschätzt und soll bis 2032 5,78 Milliarden US-Dollar erreichen , bei einer CAGR von 16,90 % im Prognosezeitraum.

- Der Markt für Cloud-Discovery verzeichnet ein starkes Wachstum, angetrieben durch die Einführung fortschrittlicher Methoden und Technologien, die die Transparenz und Kontrolle über Cloud-Ressourcen verbessern. Eine der neuesten Methoden ist die Integration von KI- und Machine-Learning-Algorithmen, die die Erkennung von Cloud-Ressourcen in Multi-Cloud-Umgebungen automatisieren.

- Diese Technologien ermöglichen es Unternehmen, Schatten-IT zu identifizieren, Sicherheitsrisiken zu reduzieren und die Cloud-Nutzung zu optimieren, indem sie Echtzeit-Einblicke in die Cloud-Nutzungsmuster bieten.

Was sind die wichtigsten Erkenntnisse des Cloud Discovery-Marktes?

- Das Wachstum von Hybrid- und Multi-Cloud-Strategien treibt die Nachfrage nach umfassenden Cloud-Discovery-Lösungen weiter an. Darüber hinaus zwingt der Anstieg von Remote-Arbeit und digitalen Transformationsinitiativen Unternehmen dazu, nach anspruchsvolleren Tools für die Verwaltung ihrer Cloud-Umgebungen zu suchen.

- Infolgedessen wird der Cloud-Discovery-Markt voraussichtlich rasant wachsen. Unternehmen investieren zunehmend in Technologien, die mehr Transparenz, verbesserte Sicherheit und höhere Betriebseffizienz bieten. Dieser Trend dürfte sich fortsetzen, wobei das Marktwachstum durch kontinuierliche Innovationen bei KI-gesteuerten Cloud-Management-Lösungen vorangetrieben wird.

- Nordamerika dominierte den globalen Cloud-Discovery-Markt und erzielte im Jahr 2024 mit 41,2 % den größten Umsatzanteil. Dies ist auf die fortschrittliche Cloud-Infrastruktur, die hohe Cloud-Nutzung in Unternehmen und den wachsenden Bedarf an Einblicken in Schatten-IT-Umgebungen zurückzuführen.

- Der Markt für Cloud-Entdeckung im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer CAGR von 18,5 % am schnellsten wachsen. Dies ist auf die beschleunigte Cloud-Einführung, das steigende Bewusstsein für Cybersicherheit und staatliche digitale Initiativen in Ländern wie China, Indien, Japan und Südostasien zurückzuführen.

- Das Segment Solutions dominierte den Cloud-Discovery-Markt mit dem größten Marktanteil von 61,3 % im Jahr 2024, angetrieben durch die steigende Nachfrage der Unternehmen nach umfassenden Tools, die Echtzeit-Einblicke in Cloud-Umgebungen, Schatten-IT-Erkennung und die Einhaltung gesetzlicher Vorschriften ermöglichen.

Berichtsumfang und Marktsegmentierung für Cloud Discovery

|

Eigenschaften |

Wichtige Markteinblicke in die Cloud-Erkennung |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Was ist der wichtigste Trend im Cloud-Discovery-Markt?

„ KI-gesteuerte Automatisierung und Sichtbarkeit transformieren Multi-Cloud-Umgebungen “

- Ein prominenter und sich beschleunigender Trend im globalen Cloud-Discovery-Markt ist die Integration von Künstlicher Intelligenz (KI) und Automatisierungstools, um umfassende Transparenz in komplexen Multi-Cloud-Umgebungen zu gewährleisten. Unternehmen setzen zunehmend KI-gestützte Discovery-Plattformen ein, um Cloud-Ressourcen automatisch zu erkennen, abzubilden und zu überwachen und so eine bessere Governance, Sicherheit und betriebliche Effizienz zu gewährleisten.

- Beispielsweise erweitern Unternehmen wie IBM und Microsoft ihre Cloud-Discovery-Lösungen mit KI und maschinellem Lernen, um Echtzeit-Einblicke in Schatten-IT, unbefugte Cloud-Nutzung und versteckte Workloads zu bieten. So können Unternehmen Risiken minimieren und die Compliance verbessern.

- KI ermöglicht außerdem erweiterte Analyse- und Vorhersagefunktionen in Cloud-Discovery-Tools und hilft IT-Teams, potenzielle Sicherheitslücken, Compliance-Verstöße oder Kostenineffizienzen in Hybrid- und Multi-Cloud-Infrastrukturen proaktiv zu identifizieren.

- Darüber hinaus ermöglicht die Integration mit automatisierten Korrekturtools und Cloud-Management-Plattformen Unternehmen, schnell auf Erkenntnisse aus der Entdeckung zu reagieren und so manuelle Eingriffe und den Betriebsaufwand zu reduzieren.

- Dieser Trend zu KI-gestützter Echtzeit-Transparenz verändert die Cloud-Strategien von Unternehmen und macht Cloud-Discovery-Lösungen zu einer wesentlichen Komponente für Unternehmen, die die Ausbreitung der Cloud verwalten, Kosten optimieren und die Sicherheit in einer zunehmend verteilten IT-Landschaft verbessern möchten.

- Da die Cloud-Nutzung exponentiell zunimmt, wird die KI-gestützte Cloud-Erkennung zu einem zentralen Faktor für die weltweite Erzielung operativer Stabilität, Einhaltung gesetzlicher Vorschriften und effizientes Multi-Cloud-Management.

Was sind die Haupttreiber des Cloud Discovery-Marktes?

- Die zunehmende Komplexität von IT-Umgebungen, die durch die schnelle Einführung von Multi-Cloud- und Hybrid-Cloud-Architekturen vorangetrieben wird, ist ein wichtiger Treiber für die steigende Nachfrage nach Cloud-Discovery-Lösungen. Unternehmen benötigen Echtzeit-Einblicke in alle Cloud-Ressourcen, um Sicherheit, Compliance und Kostenmanagement zu verbessern.

- So kündigte Cisco Systems im März 2024 Erweiterungen seines Cloud-Sicherheitsportfolios mit integrierten Erkennungsfunktionen an, die Unternehmen dabei helfen sollen, unbefugte Cloud-Nutzung zu erkennen und die Governance zu verbessern.

- Die zunehmende Verbreitung von Schatten-IT, bei der Mitarbeiter nicht genehmigte Cloud-Anwendungen einsetzen, birgt erhebliche Sicherheits- und Compliance-Risiken. Daher sind Cloud-Discovery-Tools für die Identifizierung versteckter Ressourcen von entscheidender Bedeutung.

- Darüber hinaus treibt die wachsende Notwendigkeit, strenge Datenschutz- und Regulierungsrahmen wie DSGVO, CCPA und regionale Gesetze zur Datensouveränität einzuhalten, die Nachfrage nach automatisierter Cloud-Transparenz und Bestandsverwaltung an.

- Cloud Discovery spielt auch eine Schlüsselrolle bei der Kostenoptimierung, da Unternehmen nicht ausgelastete oder redundante Cloud-Ressourcen identifizieren können, was zur Senkung der Betriebskosten und zur Verbesserung der Effizienz beiträgt.

- Da Unternehmen der sicheren digitalen Transformation Priorität einräumen und unternehmenskritische Workloads in die Cloud migrieren, wird die Nachfrage nach robusten, KI-gesteuerten Cloud-Discovery-Plattformen voraussichtlich stark ansteigen und das Marktwachstum weltweit unterstützen.

Welcher Faktor behindert das Wachstum des Cloud Discovery-Marktes?

- Der Mangel an standardisierten Frameworks, Integrationsprobleme zwischen verschiedenen Cloud-Plattformen und Datenschutzbedenken bleiben die größten Hindernisse für eine breitere Einführung von Cloud-Discovery-Lösungen. Die Verwaltung der Transparenz in hochkomplexen, verteilten Cloud-Umgebungen stellt für viele Unternehmen technische Hürden dar.

- Beispielsweise kämpfen Unternehmen, die mehrere öffentliche Cloud-Anbieter wie AWS, Azure und Google Cloud nutzen, oft mit fragmentierten Discovery-Tools, denen eine zentrale Sichtbarkeit fehlt, was die betriebliche Komplexität erhöht.

- Darüber hinaus werfen Bedenken hinsichtlich der Datensicherheit und des unbefugten Zugriffs auf vertrauliche Offenlegungsinformationen Fragen zum Datenschutz und zur Einhaltung von Vorschriften auf, insbesondere in regulierten Branchen wie dem Finanz- oder Gesundheitswesen.

- Der Mangel an qualifiziertem IT-Personal mit Fachkenntnissen in Cloud-Governance und KI-gestützten Discovery-Tools hemmt das Marktwachstum zusätzlich, insbesondere für kleine und mittlere Unternehmen mit begrenzten technischen Ressourcen.

- Darüber hinaus können hohe Implementierungskosten für fortschrittliche Cloud-Discovery-Plattformen, insbesondere solche mit integrierter KI und Automatisierung, die Einführung bei kostenbewussten Unternehmen behindern.

- Die Bewältigung dieser Herausforderungen erfordert eine stärkere Standardisierung, eine verbesserte Interoperabilität zwischen Cloud-Plattformen, Investitionen in die Schulung der Mitarbeiter und die Entwicklung skalierbarer, kostengünstiger Cloud-Discovery-Lösungen, die auf die unterschiedlichen Geschäftsanforderungen zugeschnitten sind.

Wie ist der Cloud Discovery-Markt segmentiert?

Der Markt ist nach Komponenten, Unternehmensgröße und Branche segmentiert.

• Nach Komponente

Der Cloud-Discovery-Markt ist nach Komponenten in Lösungen und Services unterteilt. Das Segment Lösungen dominierte den Cloud-Discovery-Markt mit dem größten Marktanteil von 61,3 % im Jahr 2024. Dies ist auf die steigende Nachfrage der Unternehmen nach umfassenden Tools zurückzuführen, die Echtzeit-Einblicke in Cloud-Umgebungen, Schatten-IT-Erkennung und die Einhaltung gesetzlicher Vorschriften ermöglichen. Unternehmen priorisieren automatisierte Lösungen, um die Sicherheit zu erhöhen, Kosten zu optimieren und komplexe Multi-Cloud-Infrastrukturen effizient zu verwalten.

Das Segment Services wird im Prognosezeitraum voraussichtlich die höchste jährliche Wachstumsrate verzeichnen. Dies wird durch den wachsenden Bedarf an Managed Services, Beratung und technischem Support unterstützt, der Unternehmen bei der Implementierung, Integration und Wartung von Cloud-Discovery-Plattformen unterstützt. Die rasante Cloud-Einführung und der Mangel an internem Know-how steigern die Nachfrage nach Dienstleistern, die eine effektive Bereitstellung und kontinuierliche Verwaltung von Cloud-Discovery-Tools gewährleisten können.

• Nach Organisationsgröße

Der Cloud-Discovery-Markt ist nach Unternehmensgröße in Großunternehmen sowie kleine und mittlere Unternehmen (KMU) segmentiert. Das Segment der Großunternehmen dominierte den Markt mit dem größten Umsatzanteil von 69,8 % im Jahr 2024 aufgrund ihrer komplexen IT-Infrastrukturen, höheren Cloud-Akzeptanzraten und strengen Governance-Anforderungen. Große Unternehmen investieren massiv in fortschrittliche Cloud-Discovery-Lösungen, um weitläufige Cloud-Umgebungen zu verwalten, Compliance zu gewährleisten und Sicherheitsrisiken zu minimieren.

Das Segment der kleinen und mittleren Unternehmen (KMU) wird voraussichtlich von 2025 bis 2032 die höchste jährliche Wachstumsrate verzeichnen. Grund hierfür sind die zunehmende Erschwinglichkeit von Cloud-Lösungen, das wachsende Bewusstsein für Schatten-IT-Risiken und die steigende Nachfrage nach vereinfachten, skalierbaren Cloud-Discovery-Tools. KMU nutzen diese Plattformen, um Transparenz zu gewinnen, die Sicherheit zu verbessern und Cloud-Kosten zu optimieren, ohne umfangreiche IT-Ressourcen zu benötigen.

• Nach Vertikale

Der Cloud-Discovery-Markt ist branchenübergreifend in Banken, Finanzdienstleistungen und Versicherungen (BFSI), Gesundheitswesen und Biowissenschaften, Telekommunikation und IT, Einzelhandel und Konsumgüter, öffentliche Verwaltung, Medien und Unterhaltung, Fertigung, Transport und Logistik sowie Sonstige segmentiert. Das BFSI-Segment dominierte den Markt mit dem größten Umsatzanteil von 27,4 % im Jahr 2024. Dies ist auf die strengen regulatorischen Anforderungen, die hohen Sicherheitsanforderungen und die schnelle Einführung digitaler Bank- und Finanzplattformen zurückzuführen. Finanzinstitute nutzen Cloud Discovery, um Schatten-IT zu erkennen, die Compliance zu verbessern und Cloud-Sicherheitsrisiken zu minimieren.

Das Segment Gesundheitswesen und Biowissenschaften wird im Prognosezeitraum voraussichtlich die höchste jährliche Wachstumsrate verzeichnen, was auf die zunehmende Nutzung von Cloud-Infrastrukturen für elektronische Patientenakten, Telemedizin und Forschungsanwendungen zurückzuführen ist. Angesichts zunehmender Bedenken hinsichtlich Datenschutz und Einhaltung gesetzlicher Vorschriften wie HIPAA setzen Gesundheitsorganisationen auf Cloud-Discovery-Lösungen, um Transparenz zu schaffen, Sicherheit zu gewährleisten und komplexe Cloud-Ökosysteme effektiv zu verwalten.

Welche Region hält den größten Anteil am Cloud Discovery-Markt?

- Nordamerika dominierte den globalen Cloud-Discovery-Markt und erzielte im Jahr 2024 mit 41,2 % den größten Umsatzanteil. Dies ist auf die fortschrittliche Cloud-Infrastruktur, die hohe Cloud-Nutzung in Unternehmen und den wachsenden Bedarf an Einblicken in Schatten-IT-Umgebungen zurückzuführen.

- Unternehmen in der Region legen Wert auf Echtzeiterkennung, Compliance-Überwachung und Cloud-Sicherheit, unterstützt durch ausgereifte IT-Ökosysteme und strenge regulatorische Anforderungen.

- Die Führungsrolle der Region wird durch hohe Investitionen in Cybersicherheit, den weit verbreiteten Einsatz von Hybrid- und Multi-Cloud-Architekturen sowie die Präsenz führender Cloud-Discovery-Anbieter gestärkt, wodurch Nordamerika eine Vorreiterrolle bei Marktwachstum und Innovation einnimmt.

Einblicke in den US-Cloud Discovery-Markt

Der US-amerikanische Cloud-Discovery-Markt hatte 2024 den größten Umsatzanteil innerhalb Nordamerikas, angetrieben durch die rasante digitale Transformation, komplexe Multi-Cloud-Umgebungen und zunehmende Sicherheitsbedenken in allen Branchen. Unternehmen aus Branchen wie Finanzwesen, Gesundheit und öffentliche Verwaltung setzen zunehmend Cloud-Discovery-Lösungen ein, um die Ausbreitung der Cloud zu kontrollieren, die Compliance zu verbessern und die mit Schatten-IT verbundenen Risiken zu minimieren. Das regulatorische Umfeld und der hohe Stellenwert des Datenschutzes treiben die Nachfrage nach robusten Cloud-Discovery-Tools weiter an, insbesondere bei großen Unternehmen, die sensible Daten verwalten.

Einblicke in den europäischen Cloud Discovery-Markt

Der europäische Cloud-Discovery-Markt wird voraussichtlich stetig wachsen, angetrieben durch strenge Datenschutzgesetze, einschließlich der DSGVO, und die zunehmende Bedeutung von Cybersicherheit und Cloud-Transparenz. Unternehmen aller Branchen setzen Cloud-Discovery-Plattformen ein, um ihre Governance zu verbessern, Risiken zu reduzieren und neue Vorschriften einzuhalten. Der Fokus der Region auf digitale Souveränität und die zunehmende Cloud-Nutzung in Branchen wie Finanzen, Gesundheitswesen und öffentlichem Dienst beschleunigen das Marktwachstum. Die Nachfrage nach automatisierten, skalierbaren Cloud-Discovery-Lösungen ist groß.

Einblicke in den britischen Cloud Discovery-Markt

Der britische Cloud-Discovery-Markt wird im Prognosezeitraum voraussichtlich mit einer gesunden jährlichen Wachstumsrate wachsen, angetrieben durch die zunehmende Nutzung hybrider Cloud-Umgebungen und wachsende Anforderungen an die Einhaltung gesetzlicher Vorschriften. Großbritanniens Position als wichtiger Finanzplatz und sein starker Fokus auf Cybersicherheit führen zu einer steigenden Nachfrage nach Cloud-Discovery-Plattformen bei Unternehmen, die Schatten-IT kontrollieren, die Datenverwaltung verbessern und regulatorische Standards erfüllen möchten.

Markteinblick in die Cloud-Erkennung in Deutschland

Der deutsche Cloud-Discovery-Markt verzeichnet ein stetiges Wachstum, unterstützt durch den Fokus des Landes auf Datenschutz, Cloud-Sicherheit und technologische Innovation. Deutsche Unternehmen setzen Cloud-Discovery-Lösungen ein, um Einblick in Cloud-Ressourcen zu erhalten, Datenlecks zu verhindern und die Einhaltung nationaler und EU-Vorschriften zu gewährleisten. Die zunehmende Digitalisierung in Fertigung, Finanzwesen und öffentlichem Sektor trägt zusätzlich zum Marktwachstum bei.

Welche Region ist die am schnellsten wachsende Region im Cloud Discovery-Markt?

Der Cloud-Discovery-Markt im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 18,5 % wachsen. Dies ist auf die zunehmende Cloud-Nutzung, das steigende Bewusstsein für Cybersicherheit und staatliche digitale Initiativen in Ländern wie China, Indien, Japan und Südostasien zurückzuführen. Die wachsende digitale Wirtschaft der Region, gepaart mit zunehmenden Hybrid- und Multi-Cloud-Implementierungen, führt zu einer starken Nachfrage nach Cloud-Discovery-Lösungen zur Bewältigung von Sicherheit, Compliance und betrieblicher Komplexität.

Einblicke in den japanischen Cloud Discovery-Markt

Der japanische Cloud-Discovery-Markt wächst. Dies ist auf die fortschrittliche Technologieinfrastruktur des Landes, den Fokus auf Datensicherheit und die zunehmende Nutzung von Cloud-Diensten in Unternehmen zurückzuführen. Unternehmen setzen Cloud-Discovery-Plattformen ein, um Schatten-IT zu kontrollieren, die Einhaltung gesetzlicher Vorschriften zu gewährleisten und die Transparenz in komplexen IT-Umgebungen zu verbessern, insbesondere in kritischen Sektoren wie dem Finanz- und Gesundheitswesen.

Einblicke in den Cloud Discovery-Markt in China

Der chinesische Cloud-Discovery-Markt erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf die rasante digitale Transformation, die zunehmende Nutzung der Cloud in Unternehmen und eine starke staatliche Politik zur Förderung von Cybersicherheit und Cloud-Governance zurückzuführen. Chinesische Unternehmen aller Branchen nutzen Cloud-Discovery-Lösungen, um die Transparenz ihrer Assets zu verbessern, Risiken zu managen und die sich entwickelnden Datenschutzgesetze einzuhalten. Dies unterstützt das weitere Marktwachstum.

Welches sind die Top-Unternehmen im Cloud Discovery-Markt?

Die Cloud-Discovery-Branche wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- AO Kaspersky Lab (Russland)

- ASG Technologies (USA)

- Geistiges Eigentum von AT&T (USA)

- BlueCat Networks (USA)

- BMC Software Inc. (USA)

- Certero (Großbritannien)

- Cisco Systems Inc. (USA)

- IBM Corporation (USA)

- Lookout Inc. (USA)

- McAfee LLC. (USA)

- Microsoft (US)

- Netskope Inc. (USA)

- Nippon Telegraph and Telephone Corporation (Japan)

- Palo Alto Networks (USA)

- Puppet Inc. (USA)

- Qualys Inc. (USA)

- ServiceNow (USA)

- TechNEXA Technologies Private Limited (Indien)

- Virima Inc. (USA)

- Zscaler. Inc. (USA)

Was sind die jüngsten Entwicklungen auf dem globalen Cloud Discovery-Markt?

- Im Februar 2025 gab Tencent Cloud die Eröffnung seines ersten Rechenzentrums im Nahen Osten in Saudi-Arabien bekannt. Die Anlage mit zwei Verfügbarkeitszonen soll die Ausfallsicherheit und Leistung von Cloud-Diensten in der gesamten Region verbessern. Diese Initiative unterstützt Saudi-Arabiens Vision 2030-Plan zur Weiterentwicklung seiner digitalen Infrastruktur und spiegelt Tencents Engagement für globale Expansion wider. Dieser Schritt soll die lokalen Cloud-Kapazitäten deutlich stärken und die regionale digitale Transformation fördern.

- Im August 2024 führte Amazon Web Services, eine Tochtergesellschaft von Amazon.com, Inc., den AWS Parallel Computing Service ein, eine neue verwaltete Lösung, die Unternehmen bei der Bereitstellung und dem Betrieb von High-Performance-Computing-Clustern (HPC) auf AWS unterstützt. Dieser Service zielt darauf ab, wissenschaftliche Forschung und technische Arbeitslasten durch die Bereitstellung skalierbarer virtueller Computerumgebungen zu beschleunigen. Diese Entwicklung stärkt die Position von AWS als führender Anbieter von Cloud-Diensten für datenintensive Branchen.

- Im September 2023 kooperierte NVIDIA mit Jio Platforms, um eine cloudbasierte KI-Infrastruktur für einige der bedeutendsten KI-Projekte Indiens zu entwickeln. Die Zusammenarbeit konzentriert sich auf die Beschleunigung von Fortschritten in Bereichen wie Arzneimittelforschung, Klimaforschung, KI-Chatbots und mehr. Diese Partnerschaft wird eine entscheidende Rolle bei der Stärkung des indischen KI-Ökosystems und der Unterstützung groß angelegter Innovationsinitiativen spielen.

- Im Februar 2023 ging Google Cloud eine Partnerschaft mit Accenture ein, um Einzelhändler bei der Modernisierung ihrer Betriebsabläufe zu unterstützen. Dazu wurden die KI-, Produkterkennungs- und Datenanalysefunktionen von Google Cloud in die RETAIL-Plattform von Accenture integriert. Die Zusammenarbeit umfasst gemeinsame Marketingstrategien und zielt darauf ab, den Filialbetrieb und die Geschäftsoptimierung für Einzelhändler zu verbessern. Diese Initiative soll Einzelhändlern KI-gestützte Tools für mehr Effizienz und Wettbewerbsfähigkeit bieten.

- Im Oktober 2022 kooperierte Wipro mit Outokumpu, einem weltweit führenden Edelstahlhersteller, um die Cloud-Transformation des Unternehmens zu beschleunigen. Die Partnerschaft konzentriert sich auf den Aufbau einer Microsoft Azure-basierten Plattform, die Modernisierung von Anwendungen und die Implementierung eines agilen, DevSecOps-gesteuerten IT-Modells zur Verbesserung der Verfügbarkeit und Reduzierung von Ausfallzeiten. Dieses Projekt steht im Einklang mit Outokumpu's Vision, ein agileres, datengetriebenes und nachhaltigkeitsorientiertes Unternehmen zu werden.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.