Globaler Holzkohlemarkt, nach Produkt (Stückholzkohle, Holzkohlebriketts, japanische Holzkohle, Zuckerkohle und andere), Anwendung (Outdoor-Aktivitäten, Restaurantgeschäft, metallurgischer Brennstoff, Industriebrennstoff, Filtration und andere), Branchentrends und Prognose bis 2029.

Marktdefinition

Holzkohle ist ein von Menschenhand hergestelltes Rußrückstandsprodukt , das aus Pflanzenmaterialien wie Holz gewonnen wird. Dieser Prozess wird in Gegenwart von Sauerstoff durchgeführt, um flüchtige Bestandteile und Wasser zu entfernen. Aufgrund der gestiegenen Nachfrage nach dem Produkt in den Bereichen Freizeitkochen, Metallverarbeitung, Bauwesen , Gesundheitswesen, industrielle Filterung und pharmazeutische Anwendungen wird der globale Holzkohlemarkt im Prognosezeitraum voraussichtlich deutlich wachsen. Beim Freizeitkochen kann Holzkohle als Ersatz für Kohle verwendet werden. Darüber hinaus wird die zunehmende Beliebtheit des Grillens in Restaurants wahrscheinlich die Nachfrage nach Holzkohle steigern.

Marktanalyse und Größe

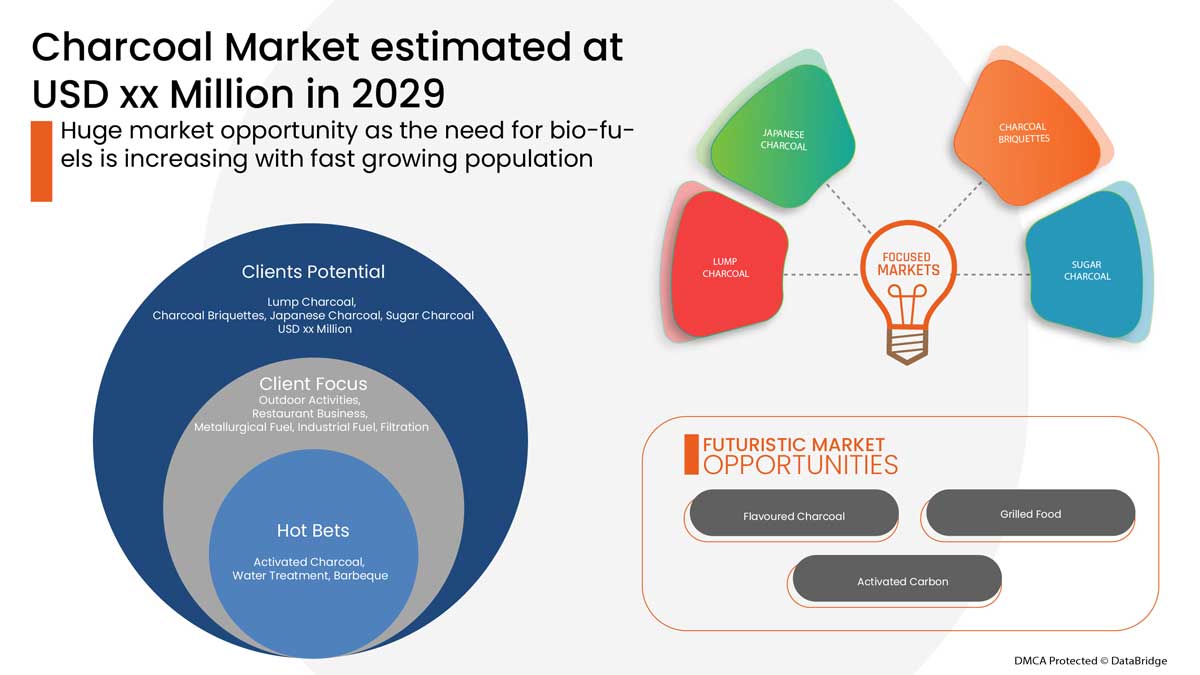

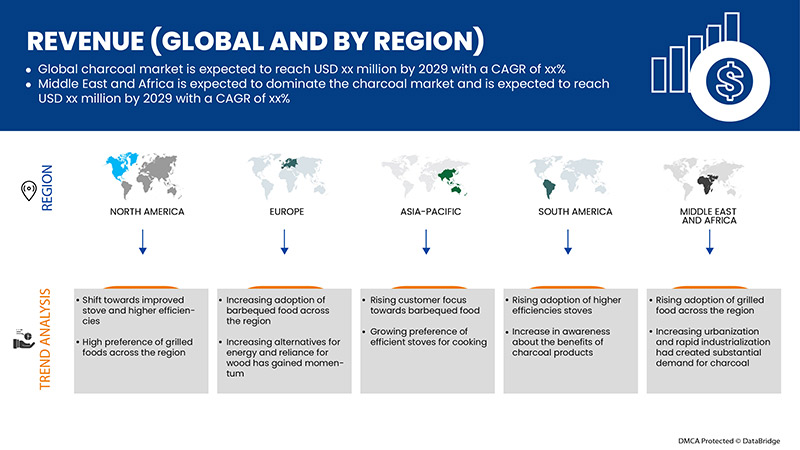

Data Bridge Market Research analysiert, dass der Holzkohlemarkt bis 2029 voraussichtlich einen Wert von 6.946,21 Millionen USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 2,7 % während des Prognosezeitraums entspricht. Der Bericht zum Holzkohlemarkt behandelt auch ausführlich Preisanalysen, Patentanalysen und technologische Fortschritte.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 |

|

Quantitative Einheiten |

Umsatz in Millionen USD, Preise in USD |

|

Abgedeckte Segmente |

Nach Produkt (Holzkohlestücke, Holzkohlebriketts, japanische Holzkohle, Zuckerkohle und andere), Anwendung (Outdoor-Aktivitäten, Gastronomie, metallurgischer Brennstoff, Industriebrennstoff, Filtration und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Hongkong, Taiwan, Restlicher Asien-Pazifik-Raum (APAC) im Asien-Pazifik-Raum (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika. |

|

Abgedeckte Marktteilnehmer |

Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal und Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal und Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc. |

Dynamik des Holzkohlemarktes

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Die zunehmende Urbanisierung und die rasche Industrialisierung hatten eine erhebliche Nachfrage nach Holzkohle geschaffen

Die Nachfrage nach Holzkohle steigt vor allem aufgrund der städtischen Bevölkerung in Entwicklungsländern. Mehr als die Hälfte der Weltbevölkerung lebt heute in Städten, und Stadtbewohner sind aufgrund der einfachen Produktion, des Zugangs, des Transports und der Tradition auf die Verwendung von Holzkohle beschränkt. Die Urbanisierung hat die Art der verwendeten Brennstoffe und auch den Gesamtenergieverbrauch für verschiedene Funktionen beeinflusst, was die Nachfrage nach Holzkohleproduktion in der gesamten Region weiter erhöht hat.

- Anstieg des Konsums von Grillgerichten

In weiten Teilen der Welt ist Grillen vor allem im Sommer eine ganz normale Aktivität. Während manche Menschen mit Gas oder Strom grillen, bevorzugen viele das Grillen mit Holzkohle, da ihr Essen dadurch ein besonders rauchiges Aroma erhält. In Nordamerika und Europa wird Holzkohle vor allem zum Grillen zum Vergnügen verwendet, in den meisten afrikanischen Ländern ist sie jedoch der wichtigste Brennstoff zum Kochen. Darüber hinaus wird berichtet, dass der Markt vor allem durch den steigenden Einfluss von Grillgerichten weltweit und die zunehmende Akzeptanz von Grillgerichten unter der Generation Y angetrieben wird. Darüber hinaus haben die Ausgangsbeschränkungen und die Notwendigkeit, aufgrund der anhaltenden COVID-19-Pandemie soziale Distanz zu wahren, dazu geführt, dass mehr Menschen zu Hause bleiben. Daher beginnen immer mehr Menschen zu Hause zu kochen und kleine gesellschaftliche Veranstaltungen zu organisieren. Diese Situation hat zu einer steigenden Nachfrage nach Geräten und Materialien zum Kochen zu Hause geführt.

Gelegenheit

- Umstellung auf verbesserte Öfen und höhere Wirkungsgrade

Herkömmliche Öfen zum Heizen und Kochen im Haushalt sind in der Regel ineffizient und verursachen erhebliche Luftverschmutzung in Innenräumen, die sich nachteilig auf die Gesundheit auswirken kann. In vielen Ländern wurden verbesserte Kochherde eingeführt, um die Koch- und Heizeffizienz zu verbessern und die Luftverschmutzung in Innenräumen zu verringern. Darüber hinaus kann Holzkohle sauber und sicher verbrannt werden, wenn sie richtig zubereitet und in effizienten Geräten richtig verwendet wird. Verbesserte Kochherde haben eine konvexe Form und sind allseitig isoliert. Aufgrund ihrer Isolierung benötigen sie weniger Holzkohle, um eine gleichwertige Menge an Nutzwärme zu erzeugen, und sie speichern die Wärme länger. Außerdem wurden kürzlich verbesserte Kochherde eingeführt, die die Treibhausgasemissionen reduzieren können, indem sie die Brennstoffeffizienz verbessern und dadurch den Bedarf an Holzkohle für die gleiche Menge an Kochenergie verringern.

Einschränkungen/Herausforderungen

- Strenge staatliche Vorschriften für die Holzkohleproduktion

Für die Holzkohleproduktion wurden eine Reihe von Richtlinien und Standards eingeführt, um die Qualität und den sicheren Umgang mit dem Produkt zu gewährleisten. Beispielsweise befasst sich das Canada Consumer Product Safety Act (SC 2010, c. 21) mit der Gefährdung der menschlichen Gesundheit oder Sicherheit durch Verbraucherprodukte in Kanada, einschließlich derer, die innerhalb Kanadas im Umlauf sind und derer, die importiert werden.

- Unzureichende Basisinformationen für die Politikgestaltung im Zusammenhang mit Holzkohle

Bevölkerungswachstum und die Umstellung von Brennholz auf Holzkohle wurden als die wichtigsten treibenden Faktoren für das Wachstum des Holzkohlemarktes hervorgehoben . Die Nutzung von Holzbrennstoffen allein ist jedoch eindeutig keine pauschale Erklärung für die anhaltende Abholzung auf nationaler Ebene. Die Probleme im Zusammenhang mit Holzbrennstoffen haben sich aufgrund unstrukturierter Basisinformationen zu verschiedenen Richtlinien der Holzkohleproduktion verschärft, die in der gesamten Region eine weitere Lücke zwischen Angebot und Nachfrage von Holzkohle verursacht haben. Daher müssen genaue Daten zur Holzkohle-Wertschöpfungskette bereitgestellt werden, um einen hervorragenden Ausgangspunkt für die Gestaltung geeigneter politischer Rahmenbedingungen zu schaffen. Dies bietet den verschiedenen Beteiligten auch die Möglichkeit, bei jedem Schritt oder Glied der Wertschöpfungskette der Holzkohleproduktion Wissen, Innovationskapital und Technologie einzubringen. Daher stellen die unzureichenden Basisinformationen für die Politikgestaltung eine große Herausforderung für das Wachstum des Marktes dar.

Auswirkungen von COVID-19 auf den Holzkohlemarkt

COVID-19 hatte erhebliche Auswirkungen auf den Holzkohlemarkt, da sich fast alle Länder für die Schließung aller Produktionsstätten entschieden haben, mit Ausnahme derjenigen, die lebensnotwendige Güter herstellen.

Die COVID-19-Pandemie hat sich in gewissem Maße negativ auf den Holzkohlemarkt ausgewirkt. So hat der Markt im Vergleich zu 2019 eine niedrigere geschätzte jährliche Wachstumsrate verzeichnet, da die mit dem Holzkohlemarkt verbundenen Sektoren weniger aktiv waren. Nach der Marktöffnung nach COVID-19 war das Wachstum jedoch hoch, und es wird erwartet, dass es aufgrund der höheren Nachfrage nach Grillgerichten zu einem erheblichen Wachstum in der Branche kommen wird. Und dieser Faktor wird voraussichtlich das Gesamtwachstum des Marktes weiter vorantreiben.

Die Hersteller treffen verschiedene strategische Entscheidungen, um nach COVID-19 wieder auf die Beine zu kommen. Die Akteure führen zahlreiche Forschungs- und Entwicklungsaktivitäten durch, um die Technologie der Holzkohle zu verbessern. Damit werden die Unternehmen fortschrittliche Technologien auf den Markt bringen. Darüber hinaus haben staatliche Initiativen zur Nutzung von Elektrofahrzeugen zum Wachstum des Marktes geführt.

Jüngste Entwicklung

- Im März 2022 brachte die Kingsford Products Company, eine Tochtergesellschaft der Clorox Company, eine neue Produktlinie mit charakteristisch aromatisierten Holzkohlen und Hartholzpellets auf den Markt. Das Hauptziel dieser Produkteinführung ist es, das Grillerlebnis mit verschiedenen Geschmacksrichtungen und Aromen zu verbessern. Dies wird das Produktportfolio des Unternehmens verbessern

Globaler Markt für Holzkohle

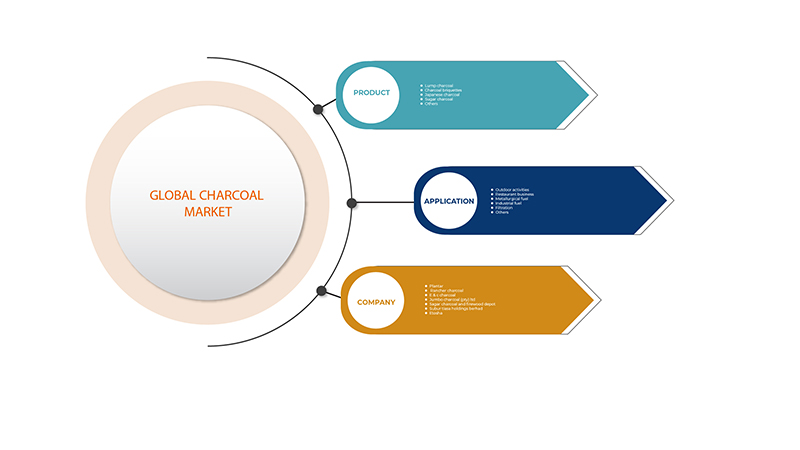

Der Holzkohlemarkt ist nach Produkt und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Stückholzkohle

- Holzkohlebriketts

- Japanische Kohle

- Zuckerkohle

- Sonstiges

Auf der Grundlage des Produkts ist der globale Holzkohlemarkt in Holzkohlestücke, Holzkohlebriketts, japanische Holzkohle, Zuckerkohle und andere unterteilt.

Anwendung

- Outdoor-Aktivitäten

- Restaurantgeschäft

- Metallurgischer Brennstoff

- Industrieller Kraftstoff

- Filtration

- Sonstiges

Auf der Grundlage der Anwendung wurde der globale Holzkohlemarkt in die folgenden Segmente unterteilt: Outdoor-Aktivitäten, Restaurantgeschäft, metallurgischer Brennstoff, Industriebrennstoff, Filtration und Sonstiges.

Regionale Analyse/Einblicke zum Holzkohlemarkt

Der Holzkohlemarkt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkt und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht für Holzkohle abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Hongkong, Taiwan, Restlicher asiatisch-pazifischer Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

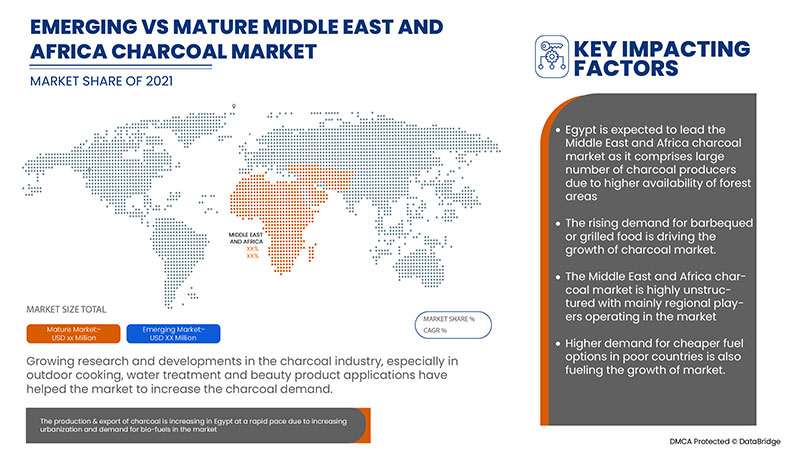

Der Nahe Osten und Afrika dominieren den Holzkohlemarkt, da dort eine starke Nachfrage nach Industrieabfällen und Wasseraufbereitung mittels Aktivkohle besteht.

Ägypten ist in der Region des Nahen Ostens und Afrikas führend, da in diesem Land eine enorme Nachfrage nach billigerem und effizienterem Brennholz besteht.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Holzkohle

Die Wettbewerbslandschaft des Holzkohlemarktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Holzkohlemarkt.

Zu den wichtigsten Akteuren auf dem Holzkohlemarkt zählen Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHARCOAL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.2 IMPORT-EXPORT SCENARIO

4.3 RAW MATERIAL PRODUCTION COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.5 LIST OF KEY BUYERS BY REGION

4.5.1 NORTH AMERICA

4.5.2 EUROPE

4.5.3 ASIA-PACIFIC

4.5.4 SOUTH AMERICA

4.5.5 MIDDLE EAST AND AFRICA

4.6 PORTER'S FIVE FORCES

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.9 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 AN INCREASE IN URBANIZATION AND RAPID INDUSTRIALIZATION HAS CREATED SUBSTANTIAL DEMAND FOR CHARCOAL

7.1.2 RISE IN CONSUMPTION OF BARBEQUED FOOD

7.1.3 INCREASING ALTERNATIVES FOR ENERGY AND RELIANCE ON WOOD HAS GAINED MOMENTUM

7.1.4 GROWING DEMAND FOR INDUSTRIAL WASTE AND WATER TREATMENT USING ACTIVATED CARBON

7.2 RESTRAINTS

7.2.1 STRINGENT GOVERNMENT REGULATIONS FOR CHARCOAL PRODUCTION

7.2.2 HIGHER ENVIRONMENTAL IMPACTS OF CHARCOAL PRODUCTION IN TROPICAL ECOSYSTEM

7.3 OPPORTUNITIES

7.3.1 SHIFT TOWARDS IMPROVED STOVE AND HIGHER EFFICIENCIES

7.3.2 INCREASE IN SOURCE OF INCOME FOR RURAL DWELLERS WITH CHARCOAL PRODUCTION

7.3.3 HIGH PREFERENCE FOR GRILLED FOODS ACROSS THE REGION

7.4 CHALLENGES

7.4.1 INADEQUATE BASELINE INFORMATION FOR POLICY FORMULATION RELATED TO CHARCOAL

7.4.2 LACK OF AWARENESS OF THE ENVIRONMENTAL EFFECTS OF CHARCOAL PRODUCTION

8 IMPACT OF COVID-19 ON THE GLOBAL CHARCOAL MARKET

8.1 AFTERMATH AND GOVERNMENT INITIATIVES FOR THE CHARCOAL MARKET

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 IMPACT ON DEMAND AND PRICE

8.4 IMPACT ON SUPPLY CHAIN

8.5 CONCLUSION

9 GLOBAL CHARCOAL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 LUMP CHARCOAL

9.3 CHARCOAL BRIQUETTES

9.4 JAPANESE CHARCOAL

9.5 SUGAR CHARCOAL

9.6 OTHERS

10 GLOBAL CHARCOAL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 OUTDOOR ACTIVITIES

10.3 RESTAURANT BUSINESS

10.4 METALLURGICAL FUEL

10.5 INDUSTRIAL FUEL

10.6 FILTRATION

10.7 OTHERS

11 GLOBAL CHARCOAL MARKET, BY REGION

11.1 OVERVIEW

11.2 MIDDLE EAST & AFRICA

11.2.1 EGYPT

11.2.2 SOUTH AFRICA

11.2.3 SAUDI ARABIA

11.2.4 U.A.E.

11.2.5 ISRAEL

11.2.6 REST OF MIDDLE EAST & AFRICA

11.3 ASIA-PACIFIC

11.3.1 CHINA

11.3.2 INDIA

11.3.3 JAPAN

11.3.4 SOUTH KOREA

11.3.5 THAILAND

11.3.6 INDONESIA

11.3.7 AUSTRALIA

11.3.8 MALAYSIA

11.3.9 SINGAPORE

11.3.10 PHILIPPINES

11.3.11 HONG KONG

11.3.12 TAIWAN

11.3.13 REST OF ASIA-PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 NORTH AMERICA

11.5.1 U.S.

11.5.2 CANADA

11.5.3 MEXICO

11.6 EUROPE

11.6.1 GERMANY

11.6.2 FRANCE

11.6.3 U.K.

11.6.4 ITALY

11.6.5 NETHERLANDS

11.6.6 SPAIN

11.6.7 RUSSIA

11.6.8 BELGIUM

11.6.9 SWITZERLAND

11.6.10 TURKEY

11.6.11 REST OF EUROPE

12 GLOBAL CHARCOAL MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.4 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROYAL OAK ENTERPRISES, LLC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 DURAFLAME, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 SUBUR TIASA HOLDINGS BERHAD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NAMCO CHARCOAL AND TIMBER PRODUCTS

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 COOK IN WOOD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 E&C CHARCOAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ETOSHA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FIRE & FLAVOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FOGOCHARCOAL.COM

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 JUMBO CHARCOAL (PTY) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MAUROBERA.COM

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MESJAYA SDN BHD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NAMCHAR

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 RANCHER CHARCOAL

14.15.1 COMPANY SNPASHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SAGAR CHARCOAL AND FIREWOOD DEPOT

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 TIMBER CHARCOAL CO. LLC

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 PLANTAR

14.18.1 COMPANY SNAPSHOT

14.18.2 SOLUTION PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 VALUES OF CERTAIN CHARCOAL CHARACTERISTICS PURSUANT TO THE EUROPEAN EN 1860-2 AND GERMAN DIN 51749 STANDARD

TABLE 2 CHARCOAL TRANSPORTATION COSTS WITH DISTANCE TRAVELED THROUGH DIFFERENT DISTRICTS OF THAILAND ARE BELOW:

TABLE 3 GLOBAL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL LUMP CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL CHARCOAL BRIQUETTES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL JAPANESE CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL SUGAR CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL OUTDOOR ACTIVITIES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL RESTAURANT BUSINESS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL METALLURGICAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL INDUSTRIAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 14 GLOBAL FILTRATION IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 EGYPT CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 EGYPT CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 SAUDI ARABIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 SAUDI ARABIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ISRAEL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 ISRAEL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 REST OF MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 CHINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 INDIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 37 INDIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 JAPAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 JAPAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 SOUTH KOREA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 THAILAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 THAILAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 INDONESIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MALAYSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SINGAPORE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 SINGAPORE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 PHILIPPINES CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 PHILIPPINES CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 HONG KONG CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 HONG KONG CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 TAIWAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 TAIWAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 REST OF ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 BRAZIL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 BRAZIL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ARGENTINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 ARGENTINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 REST OF SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.S. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 U.S. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 CANADA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 CANADA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 77 EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 EUROPE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 GERMANY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 80 GERMANY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 FRANCE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 FRANCE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.K. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.K. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 ITALY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 NETHERLANDS CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 NETHERLANDS CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SPAIN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 SPAIN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SWITZERLAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 SWITZERLAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 TURKEY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 TURKEY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 REST OF EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 2 GLOBAL CHARCOAL MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CHARCOAL MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CHARCOAL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CHARCOAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CHARCOAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL CHARCOAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL CHARCOAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF BARBEQUED FOOD IS EXPECTED TO DRIVE THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 LUMP CHARCOAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL CHARCOAL MARKET IN 2022 & 2029

FIGURE 12 MIDDLE EAST & AFRICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 MIDDLE EAST & AFRICA IS THE FASTEST GROWING MARKET FOR CHARCOAL MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2020)

FIGURE 15 TOP IMPORTERS OF WOOD CHARCOAL 2020

FIGURE 16 TOP EXPORTERS OF WOOD CHARCOAL 2020

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF GLOBAL CHARCOAL MARKET

FIGURE 18 AVERAGE WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2019-2020)

FIGURE 19 GLOBAL CHARCOAL MARKET: BY PRODUCT, 2021

FIGURE 20 GLOBAL CHARCOAL MARKET: BY APPLICATION, 2021

FIGURE 21 GLOBAL CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 22 GLOBAL CHARCOAL MARKET: BY REGION (2021)

FIGURE 23 GLOBAL CHARCOAL MARKET: BY REGION (2022 & 2029)

FIGURE 24 GLOBAL CHARCOAL MARKET: BY REGION (2021 & 2029)

FIGURE 25 GLOBAL CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 31 ASIA-PACIFIC CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 36 SOUTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 37 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 38 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 SOUTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 41 NORTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 46 EUROPE CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 47 EUROPE CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 48 EUROPE CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 EUROPE CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 EUROPE CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 51 GLOBAL CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 ASIA-PACIFIC CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE CHARCOAL MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.