Global Cardiovascular Ultrasound System Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.93 Billion

USD

2.93 Billion

2024

2032

USD

1.93 Billion

USD

2.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.93 Billion | |

| USD 2.93 Billion | |

|

|

|

|

Globale Marktsegmentierung für kardiovaskuläre Ultraschallsysteme nach Testtyp (transthorakales Echokardiogramm, transösophageales Echokardiogramm, Stress-Echokardiogramm und andere Echokardiogramme), Technologie (2D-Ultraschall, 3D- und 4D-Ultraschall und Doppler-Bildgebung), Geräteanzeige (Farbanzeige und Schwarzweißanzeige), Endbenutzer (Krankenhäuser und kardiologische Zentren, häusliche und ambulante Pflegeeinrichtungen, Forschungsinstitute, Medizingeräte- und Pharmaunternehmen und andere Endbenutzer) – Branchentrends und Prognose bis 2032

Marktgröße für kardiovaskuläre Ultraschallsysteme

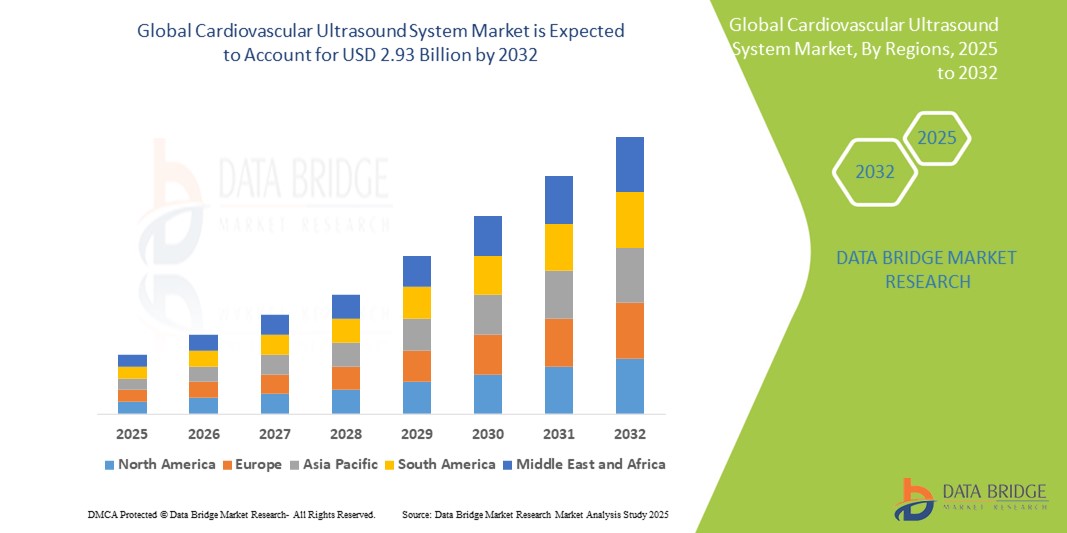

- Der globale Markt für kardiovaskuläre Ultraschallsysteme wurde im Jahr 2024 auf 1,93 Milliarden US-Dollar geschätzt und dürfte bis 2032 einen Wert von 2,93 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 5,37 % im Prognosezeitraum entspricht.

- Dieses Wachstum wird durch Faktoren wie die zunehmende Verbreitung von Herz-Kreislauf-Erkrankungen, die wachsende Nachfrage nach nicht-invasiver Diagnostik, technologische Fortschritte, eine alternde Bevölkerung und erhöhte Gesundheitsausgaben vorangetrieben.

Marktanalyse für kardiovaskuläre Ultraschallsysteme

- Kardiovaskuläre Ultraschallsysteme sind nicht-invasive Bildgebungsverfahren zur Beurteilung der Herzstruktur und -funktion, die in Krankenhäusern, kardiologischen Zentren und ambulanten Einrichtungen weit verbreitet sind. Sie bieten fortschrittliche Bildgebung durch 2D-, 3D/4D- und Doppler-Technologien mit hochauflösenden Farbdisplays.

- Der Markt wächst stetig aufgrund der steigenden Prävalenz von Herzerkrankungen, der steigenden Nachfrage nach nicht-invasiver Diagnostik, der Fortschritte in der Bildgebungstechnologie, einer wachsenden älteren Bevölkerung und der zunehmenden Nutzung tragbarer Geräte in Point-of-Care-Umgebungen

- Nordamerika wird voraussichtlich den Markt für kardiovaskuläre Ultraschallsysteme mit einem Anteil von 29,5 % dominieren , was auf die zunehmende Verbreitung präventiver Gesundheitspraktiken, die weit verbreitete Einführung fortschrittlicher Technologien und eine robuste Gesundheitsinfrastruktur zurückzuführen ist.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der steigenden Prävalenz chronischer Krankheiten, der rasanten Urbanisierung und der zunehmenden Fokussierung auf Verbesserungen der Gesundheitsinfrastruktur die am schnellsten wachsende Region im Markt für kardiovaskuläre Ultraschallsysteme sein.

- Das Farbdisplay-Segment wird voraussichtlich mit einem Marktanteil von 84,5 % den Markt dominieren, da es eine verbesserte Bildschärfe und Echtzeit-Visualisierung des Blutflusses bietet, was die diagnostische Genauigkeit deutlich verbessert. Diese Technologie ermöglicht es Ärzten, Herz-Kreislauf-Erkrankungen im Vergleich zu Schwarz-Weiß-Displays effizienter zu erkennen. Die steigende Nachfrage nach fortschrittlichen Bildgebungsinstrumenten in Krankenhäusern und Diagnosezentren, die durch die zunehmende Verbreitung von Herzerkrankungen und die Notwendigkeit einer frühzeitigen, präzisen Diagnose bedingt ist, treibt die Einführung von Farbdisplaysystemen weiter voran.

Berichtsumfang und Marktsegmentierung für kardiovaskuläre Ultraschallsysteme

|

Eigenschaften |

Wichtige Markteinblicke in kardiovaskuläre Ultraschallsysteme |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Markttrends für kardiovaskuläre Ultraschallsysteme

„Wachsendes Bewusstsein für Frühdiagnose“

- Ein herausragender Trend auf dem weltweiten Markt für kardiovaskuläre Ultraschallsysteme ist das wachsende Bewusstsein für eine frühzeitige Diagnose

- Dieser Trend wird durch die zunehmende Anerkennung der Vorteile einer Früherkennung bei der Behandlung von Herz-Kreislauf-Erkrankungen, ein steigendes Gesundheitsbewusstsein und die Verlagerung hin zur präventiven Gesundheitsfürsorge vorangetrieben.

- So führen Gesundheitsdienstleister wie die Mayo Clinic und die Cleveland Clinic zunehmend routinemäßige Herzuntersuchungen mit Ultraschallsystemen durch, um Erkrankungen wie Klappenerkrankungen und Kardiomyopathie in früheren, besser behandelbaren Stadien zu erkennen.

- Die Nachfrage nach Frühdiagnoseinstrumenten steigt sowohl in Industrie- als auch in Schwellenländern, da Patienten und Ärzte rechtzeitige Interventionen und bessere Ergebnisse priorisieren.

- Da die Frühdiagnose in der Herz-Kreislauf-Behandlung immer mehr im Mittelpunkt steht, dürfte dieser Trend die Einführung fortschrittlicher Ultraschalltechnologien vorantreiben und ein nachhaltiges Marktwachstum unterstützen.

Marktdynamik für kardiovaskuläre Ultraschallsysteme

Treiber

„Steigende Prävalenz von Herz-Kreislauf-Erkrankungen“

- Die zunehmende Verbreitung von Herz-Kreislauf-Erkrankungen ist ein wichtiger Treiber für das Wachstum des Marktes für kardiovaskuläre Ultraschallsysteme, da Gesundheitsdienstleister nach fortschrittlichen Diagnoseinstrumenten suchen, um diese Erkrankungen effektiv zu behandeln und zu überwachen.

- Dieser Bedarf ist besonders ausgeprägt bei der alternden Bevölkerung, bei Personen mit Risikofaktoren wie Bluthochdruck oder Diabetes sowie bei Personen mit Herzerkrankungen in der Familienanamnese.

- Da die Belastung durch Herz-Kreislauf-Erkrankungen weltweit zunimmt, wird der Schwerpunkt zunehmend auf Früherkennung und nicht-invasive Diagnosemethoden gelegt, was die Nachfrage nach kardiovaskulären Ultraschallsystemen ankurbelt.

- Die Hersteller reagieren darauf mit der Entwicklung fortschrittlicher Ultraschallgeräte , die eine verbesserte Bildqualität, Mobilität und Echtzeitdiagnostik bieten und so die klinische Entscheidungsfindung verbessern.

- Der Trend zu präziserer und zugänglicherer kardiovaskulärer Diagnostik führt zu einer zunehmenden Nutzung dieser Ultraschallsysteme in Krankenhäusern, Diagnosezentren und Ambulanzen.

Zum Beispiel,

- Führende Marken im Bereich der medizinischen Bildgebung, wie Philips und GE Healthcare, haben innovative tragbare Ultraschallgeräte eingeführt, die speziell auf kardiovaskuläre Anwendungen zugeschnitten sind.

- Auch High-End-Hersteller erweitern ihr Angebot um KI-gestützte Ultraschallsysteme, um die Diagnosegenauigkeit zu verbessern und die Abhängigkeit von spezialisierten Technikern zu verringern.

- Da die kardiovaskuläre Gesundheit zu einem zentralen Schwerpunkt globaler Gesundheitsstrategien wird, wird erwartet, dass dieser Treiber kontinuierliche Produktverbesserungen und ein nachhaltiges Marktwachstum im Bereich des kardiovaskulären Ultraschalls fördert.

Gelegenheit

„Personalisierte Medizin und Point-of-Care-Tests“

- Der wachsende Trend zur personalisierten Medizin und zu Point-of-Care-Tests bietet eine bedeutende Chance für den Markt für kardiovaskuläre Ultraschallsysteme und ermöglicht es Anbietern, maßgeschneiderte Diagnoselösungen direkt am Standort des Patienten anzubieten.

- Hersteller von kardiovaskulären Ultraschallgeräten untersuchen die Integration fortschrittlicher Technologien wie KI-gestützter Analytik und tragbarer Geräte, um eine personalisiertere und effizientere Herzversorgung am Behandlungsort zu ermöglichen.

- Diese Möglichkeit steht im Einklang mit der steigenden Nachfrage nach schneller, präziser Diagnostik und dem Wunsch, die Behandlungsergebnisse der Patienten durch individuelle Behandlungspläne zu verbessern, insbesondere in abgelegenen oder unterversorgten Gebieten.

Zum Beispiel,

- Unternehmen wie Philips und Siemens Healthineers entwickeln tragbare Ultraschallsysteme, die personalisierte kardiovaskuläre Untersuchungen vor Ort ermöglichen und die Benutzerfreundlichkeit in Kliniken, Krankenhäusern und sogar zu Hause fördern.

- Innovationen in den Bereichen KI und Cloud-basierter Datenaustausch verbessern die Fähigkeit von medizinischem Fachpersonal, maßgeschneiderte kardiovaskuläre Versorgung in Echtzeit bereitzustellen, was potenziell die Marktchancen erweitert.

- Da der Gesundheitssektor zunehmend personalisierte und dezentrale Pflegemodelle anstrebt, ist der Markt für kardiovaskuläre Ultraschallsysteme bereit, von dieser Chance durch innovative Produktentwicklung und breitere Akzeptanz in verschiedenen Gesundheitsumgebungen zu profitieren.

Einschränkung/Herausforderung

„Hohe Kosten für Ultraschallgeräte“

- Die hohen Kosten für Ultraschallgeräte stellen eine erhebliche Herausforderung für den Markt für kardiovaskuläre Ultraschallsysteme dar, da die Kosten für fortschrittliche Bildgebungstechnologien direkte Auswirkungen auf die Erschwinglichkeit und Zugänglichkeit haben.

- Die Notwendigkeit, hochmoderne Funktionen wie hochauflösende Bildgebung, Portabilität und KI-Integration zu integrieren, erhöht sowohl die Produktions- als auch die Wartungskosten und erschwert es den Herstellern, wettbewerbsfähige Preise anzubieten, ohne Kompromisse bei Qualität und Innovation einzugehen.

- Diese Herausforderung stellt insbesondere kleinere Gesundheitseinrichtungen oder solche in preissensiblen Regionen vor eine große Belastung, da dort hohe Gerätekosten den Zugang zu modernster kardiovaskulärer Diagnostik trotz steigender Nachfrage nach Früherkennung und nicht-invasiven Tests einschränken können.

Zum Beispiel,

- Führende Ultraschallhersteller wie GE Healthcare und Philips müssen mit erheblichen Forschungs- und Entwicklungskosten rechnen, was zu höheren Preisen für ihre fortschrittlichen kardiovaskulären Ultraschallsysteme führt.

- Ohne Innovationen bei kosteneffizienten Herstellungsprozessen oder alternativen Preismodellen könnten die hohen Kosten für Ultraschallgeräte das Marktwachstum bremsen und die Zugänglichkeit einschränken, insbesondere in Schwellenländern und Regionen mit begrenzten Gesundheitsbudgets.

Marktumfang für kardiovaskuläre Ultraschallsysteme

Der Markt ist nach Testtyp, Technologie, Geräteanzeige und Endbenutzer segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Testtyp |

|

|

Nach Technologie |

|

|

Nach Geräteanzeige |

|

|

Nach Endbenutzer

|

|

Im Jahr 2025 wird das Farbdisplay-Segment voraussichtlich den Markt dominieren und den größten Anteil am Gerätedisplay-Segment haben.

Das Farbdisplay-Segment wird voraussichtlich den Markt für kardiovaskuläre Ultraschallsysteme mit einem Marktanteil von 84,5 % im Jahr 2025 dominieren. Dies ist auf die verbesserte Bildschärfe und Echtzeit-Visualisierung des Blutflusses zurückzuführen, was die diagnostische Genauigkeit deutlich verbessert. Diese Technologie ermöglicht es Ärzten, kardiovaskuläre Anomalien im Vergleich zu Schwarz-Weiß-Displays effizienter zu erkennen. Die steigende Nachfrage nach fortschrittlichen Bildgebungsinstrumenten in Krankenhäusern und Diagnosezentren, die durch die zunehmende Verbreitung von Herzerkrankungen und den Bedarf an frühzeitiger und präziser Diagnose bedingt ist, treibt die Einführung von Farbdisplaysystemen zusätzlich voran.

Das transthorakale Echokardiogramm wird voraussichtlich im Prognosezeitraum den größten Anteil im Testtypsegment einnehmen

Im Jahr 2025 wird das transthorakale Echokardiogramm voraussichtlich den Markt mit einem Marktanteil von 55,9 % dominieren. Dies ist auf seine nichtinvasive Natur, seine breite Verfügbarkeit und seine Kosteneffizienz zurückzuführen. Es ist die am häufigsten eingesetzte echokardiografische Technik für die erste Herzuntersuchung und daher eine bevorzugte Wahl bei Gesundheitsdienstleistern. Darüber hinaus tragen Fortschritte bei tragbaren Ultraschallgeräten und der zunehmende Einsatz in ambulanten und Notfallambulanzen zur starken Marktposition dieses Segments bei.

Regionale Analyse des Marktes für kardiovaskuläre Ultraschallsysteme

„Nordamerika hält den größten Anteil am Markt für kardiovaskuläre Ultraschallsysteme“

- Nordamerika dominiert den Markt für kardiovaskuläre Ultraschallsysteme mit einem Anteil von 29,5 % , was auf die zunehmende Verbreitung präventiver Gesundheitspraktiken, die weitverbreitete Einführung fortschrittlicher Technologien und eine robuste Gesundheitsinfrastruktur zurückzuführen ist.

- Die USA halten einen bedeutenden Anteil aufgrund der Präsenz großer Hersteller medizinischer Geräte, der starken Nachfrage nach nicht-invasiven Diagnoseinstrumenten und der steigenden Gesundheitsausgaben für die Prävention von Herzkrankheiten

- Die Führungsrolle der Region wird durch Innovationen in der Bildgebungstechnologie, ein hohes Maß an Gesundheitsbewusstsein und kontinuierliche Weiterentwicklungen bei tragbaren und KI-gesteuerten Ultraschallsystemen weiter unterstützt.

- Mit einem wachsenden Fokus auf die Früherkennung von Herz-Kreislauf-Erkrankungen und der zunehmenden Einführung modernster Ultraschallsysteme wird Nordamerika voraussichtlich seine beherrschende Stellung auf dem globalen Markt für kardiovaskuläre Ultraschallsysteme bis 2032 behaupten.

„Der asiatisch-pazifische Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im Markt für kardiovaskuläre Ultraschallsysteme verzeichnen“

- Im asiatisch-pazifischen Raum wird das höchste Wachstum im Markt für kardiovaskuläre Ultraschallsysteme erwartet , was auf die steigende Prävalenz chronischer Krankheiten, die schnelle Urbanisierung und einen zunehmenden Fokus auf Verbesserungen der Gesundheitsinfrastruktur zurückzuführen ist.

- China und Indien verfügen über bedeutende Anteile aufgrund der großen Bevölkerung, der steigenden Gesundheitsausgaben und der Einführung fortschrittlicher Diagnoseinstrumente sowohl in städtischen als auch in ländlichen Gebieten

- Das Wachstum der Region wird zusätzlich durch günstige Erstattungsrichtlinien, regulatorische Rahmenbedingungen zur Förderung fortschrittlicher Gesundheitstechnologien und eine steigende Nachfrage nach nicht-invasiver kardiovaskulärer Diagnostik unterstützt.

- Angesichts des zunehmenden Bewusstseins für die Risiken von Herzerkrankungen und der zunehmenden Hinwendung zur Präventivmedizin wird sich der asiatisch-pazifische Raum bis 2032 voraussichtlich zur am schnellsten wachsenden Region auf dem globalen Markt für kardiovaskuläre Ultraschallsysteme entwickeln.

Marktanteil kardiovaskulärer Ultraschallsysteme

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- GE Healthcare (USA)

- Koninklijke Philips NV (Niederlande)

- FUJIFILM Holdings Corporation (Japan)

- Siemens Healthineers AG (Deutschland)

- Hitachi Medical Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Samsung Electronics Co. Ltd. (Südkorea)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Chison Medical Imaging Co. Ltd. (China)

- Esaote SPA (Italien)

- Kalamed GmbH Medical Systems (USA)

- Unetixs Vascular, Inc. (USA)

Neueste Entwicklungen auf dem globalen Markt für kardiovaskuläre Ultraschallsysteme

- Im Mai 2024 stellte Siemens Healthineers fortschrittliche KI-Anwendungen für sein Ultraschallsystem Acuson Sequoia sowie einen neuen 4D-transösophagealen (TEE) Transducer für kardiologische Untersuchungen vor. Zu den neuen KI-gestützten Kardiologiefunktionen gehören AI Measure, das die Erfassung wichtiger Messungen für routinemäßige Echokardiographie-Untersuchungen automatisiert, und 2D HeartAI, das die Effizienz und den Workflow bei der Herzdruckbildgebung verbessert.

- Im Februar 2024 kündigte Royal Philips die Integration künstlicher Intelligenz in seine Herzultraschallgeräte und sein umfassenderes Angebot zur Herzbehandlung an, um die klinische Sicherheit und die betriebliche Effizienz zu verbessern. Das Philips Ultrasound Compact System 5500 CV, eine tragbare Lösung, verfügt nun über ein KI-gesteuertes Automatisierungstool, die sogenannte automatisierte Strain-Quantifizierung. Dieses Tool unterstützt die Beurteilung der Funktion des linken Ventrikels, einem wichtigen Parameter für die Herzgesundheit.

- Im August 2023 stellte Siemens Healthineers auf der Jahrestagung der European Society of Cardiology (ESC) den Acuson Origin vor, ein spezialisiertes kardiovaskuläres Ultraschallsystem mit fortschrittlichen Funktionen der künstlichen Intelligenz.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.