Global Cardiac Biomarkers Testing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

12,098.97 Billion

USD

28,491.13 Billion

2022

2030

USD

12,098.97 Billion

USD

28,491.13 Billion

2022

2030

| 2023 –2030 | |

| USD 12,098.97 Billion | |

| USD 28,491.13 Billion | |

|

|

|

|

Globaler Markt für Tests kardialer Biomarker, nach Typ (Myokardmuskel-Kreatinkinase (CK-MB), Troponine (T und I), Myoglobin, Brain Natriuretic Peptide (BNPs) oder NT-proBNP, Ischämie-modifiziertes Albumin (IMA)), Anwendung (Myokardinfarkt, kongestive Herzinsuffizienz, akutes Koronarsyndrom, Arteriosklerose ), Ort der Tests (Point of Care, Labor) – Branchentrends und Prognose bis 2030.

Marktanalyse und -größe für Tests kardialer Biomarker

Laut Weltgesundheitsorganisation leiden in Indien etwa 4,77 Millionen Menschen an Herz-Kreislauf-Erkrankungen, wobei Fettleibigkeit bei etwa 3,1 % der Bevölkerung Angina Pectoris verursacht. Um die Krankheitslast zu verringern, startet die indische Regierung eine Reihe von Initiativen, um das Bewusstsein in ländlichen Gebieten zu schärfen. Mehrere staatliche und private Gesundheitsinstitute und Diagnoselabore führen Diagnosetestkits für Herz-Biomarker ein, um der wachsenden Patientenzahl gerecht zu werden.

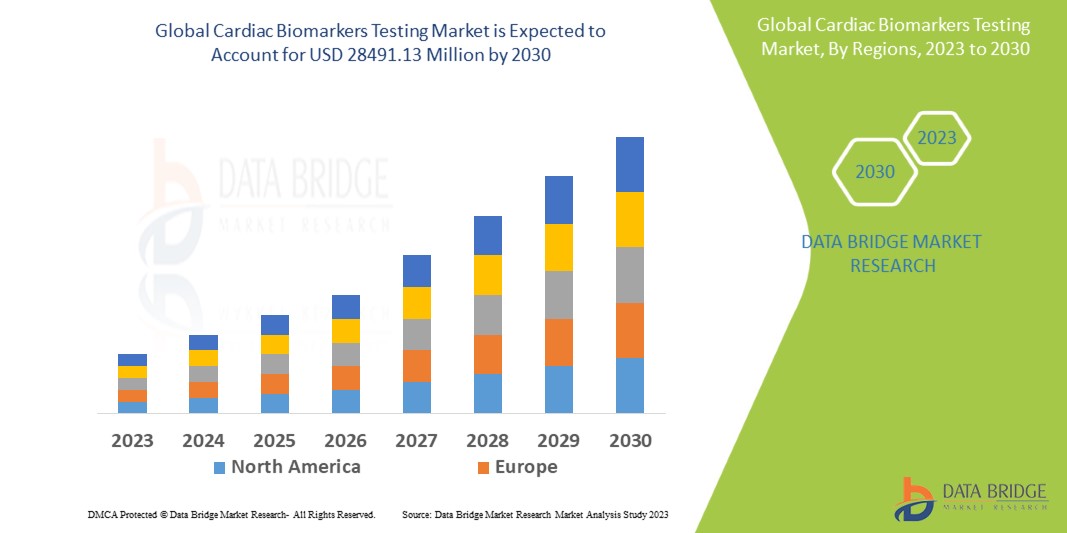

Data Bridge Market Research analysiert, dass der Markt für Tests kardialer Biomarker, der im Jahr 2022 12.098,97 Millionen USD beträgt, bis 2030 voraussichtlich 28.491,13 Millionen USD erreichen wird, was einer CAGR von 11,30 % während des Prognosezeitraums 2023 bis 2030 entspricht. Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

Marktumfang und -segmentierung für Tests kardialer Biomarker

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2015 – 2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Typ (Myokardmuskel-Kreatinkinase (CK-MB), Troponine (T und I), Myoglobin, Brain Natriuretic Peptide (BNPs) oder NT-proBNP, Ischemia Modified Albumin (IMA)), Anwendung (Myokardinfarkt, kongestive Herzinsuffizienz, akutes Koronarsyndrom, Arteriosklerose), Ort der Untersuchung (Point of Care, Labor) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

F. Hoffmann-La Roche Ltd. (Schweiz), Thermo Fisher Scientific Inc. (USA), Abbott (USA), QIAGEN (Deutschland), PerkinElmer, Inc. (USA), Merck KGaA (Deutschland), Bio-Rad Laboratories, Inc. (USA), Enzo Biochem, Inc. (USA), Charles River Laboratories (USA), Eurofins Scientific (Luxemburg), Agilent Technologies, Inc. (USA), Bruker (USA), Siemens (Deutschland), Epigenomics AG (Deutschland), General Electric (USA) |

|

Marktchancen |

|

Marktdefinition

Kardiale Marker, auch kardiale Biomarker genannt, werden in den Blutkreislauf freigesetzt, wenn das Herz belastet ist oder seine Muskeln beschädigt sind. Zu diesen Markern gehören Enzyme, Hormone und Proteine wie kardiale Troponine, Kreatinkinase (CK), Ischämie-modifiziertes Albumin (IMA) und Myoglobin. Die Messung und Prüfung dieser Marker kann bei der Diagnose von Herzerkrankungen wie Herzischämie und akutem Koronarsyndrom (ACS) helfen. Derzeit basieren die Triage- und Diagnosesysteme zur Bestimmung des Risikos dieser Erkrankungen auf Elektrokardiogrammen (EKGs) und der Krankengeschichte.

Marktdynamik für Tests kardialer Biomarker

Treiber

- Steigende Prävalenz von Herz-Kreislauf-Erkrankungen

Angesichts der steigenden Zahl von Herz-Kreislauf-Erkrankungen dürfte die Nachfrage nach diesen Diagnosetestkits in den kommenden Jahren steigen. Laut WHO steigt die Sterberate durch Herzversagen und macht mehr als 15,60 % aller Todesfälle im Land aus. Um den Anstieg zu verlangsamen, ergreifen Regierung und Gesundheitsorganisationen vorbeugende Maßnahmen, um die Öffentlichkeit über die Vorteile dieser Testkits aufzuklären. Aufgrund der oben genannten Faktoren wird erwartet, dass der Markt für Tests auf Herzbiomarker im Prognosezeitraum wachsen wird.

- Steigende Prävalenz der koronaren Herzkrankheit

Die steigende Prävalenz koronarer Herzkrankheiten hat die Zahl der Fälle von Angina Pectoris/Brustschmerzen erhöht, insbesondere bei älteren Menschen. Laut der Weltgesundheitsorganisation starben 2019 fast 17 Millionen Menschen an Herz-Kreislauf-Erkrankungen. Bei etwa 20 % davon wurde Angina Pectoris diagnostiziert. Da die Millennials zudem ungesündere Lebensmittel zu sich nehmen, hat die Prävalenz von Angina Pectoris zugenommen. Daher wird erwartet, dass die Nachfrage nach Tests auf Herz-Biomarker steigen wird, um der wachsenden Patientenzahl gerecht zu werden.

Gelegenheiten

- Regierungsinitiativen

Im Zuge des Ausbruchs von COVID-19 haben Regierungen weltweit eine Reihe von Initiativen zur Verbesserung der Gesundheitsinfrastruktur gestartet. Steigende Gesundheitsausgaben, insbesondere in Schwellenländern wie Indien, Südkorea und Japan, haben die Nachfrage nach fortschrittlichen medizinischen Geräten wie Diagnosetestkits für Herzbiomarker erhöht. Laut der India Brand Equity Foundation (IBEF) hat die indische Regierung im Union Budget für 2021-22 die Fortsetzung der „National Health Mission“ mit einem Budget von 5,10 Milliarden US-Dollar genehmigt. Im Rahmen dieser Politik wird die Regierung in ländlichen Gebieten fortschrittliche medizinische Geräte für Kardiologie, Neurologie und andere Krankheiten bereitstellen, um die globale Sterblichkeit zu senken. Eine Reihe solcher Initiativen auf der ganzen Welt dürften Marktwachstumsmöglichkeiten schaffen.

Einschränkungen/Herausforderungen

- Nebenwirkungen im Zusammenhang mit kardialen Biomarkern

Zunehmende Nebenwirkungen wie Skelettmuskelverletzungen und in einigen Fällen eine eingeschränkte Spezifität werden das Marktwachstum behindern und das Wachstum des Marktes für Tests kardialer Biomarker im Prognosezeitraum weiter beeinträchtigen.

Dieser Marktbericht für Herzbiomarkertests enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Herzbiomarkertests zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Jüngste Entwicklungen

- Im Jahr 2021 kündigte Roche die Einführung von fünf neuen Verwendungszwecken für zwei wichtige kardiale Biomarker an, die die Elecsys-Technologie verwenden: hochempfindliches kardiales Troponin T (cTnT-hs) und N-terminales Pro-Brain-natriuretisches Peptid (NT-proBNP). Diese Biomarker helfen bei der Behandlung von Herz-Kreislauf-Erkrankungen und können Ärzte bei der Diagnose von Herzinfarkten und der Behandlung von Herzinsuffizienz unterstützen.

- Im Jahr 2021 wird Baxter International Inc., ein weltweit führendes Unternehmen in der Akutversorgung, mit bioMérieux, einem weltweit führenden Unternehmen in der In-vitro-Diagnostik, zusammenarbeiten, um die CE-Kennzeichnung des NEPHROCLEARTM CCL14-Tests einzuführen.

Globaler Markt für Tests kardialer Biomarker

Der Markt für Herzbiomarkertests ist nach Art, Anwendung und Ort der Tests segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Myokardmuskel-Kreatinkinase (CK-MB)

- Troponine (T und I)

- Myoglobin, natriuretisches Peptid des Gehirns (BNPs)

- NT-proBNP

- Ischämiemodifiziertes Albumin (IMA)

Anwendung

- Herzinfarkt

- Kongestive Herzinsuffizienz

- Akutes Koronarsyndrom

- Arteriosklerose

Ort der Prüfung

- Behandlungsort

- Labor

Regionale Analyse/Einblicke zum Testen kardialer Biomarker

Der Markt für Tests kardialer Biomarker wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Art, Anwendung und Testort, wie oben angegeben, bereitgestellt.

Die im Marktbericht für Tests auf kardiale Biomarker abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher asiatisch-pazifischer Raum (APAC) in der Region Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika dominiert den Markt für Tests auf kardiale Biomarker aufgrund der gestiegenen Nachfrage nach Herztests, der hohen Prävalenz kardiovaskulärer Erkrankungen und des gestiegenen Bewusstseins für Lösungen zur Herzdiagnostik.

Im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2023 bis 2030 aufgrund der zunehmenden Modernisierung, der steigenden verfügbaren Einkommen und der zunehmenden Erschwinglichkeit von Gütern voraussichtlich die höchste Wachstumsrate verzeichnet.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wachstum der Infrastruktur im Gesundheitswesen, installierte Basis und Durchdringung mit neuen Technologien

Der Markt für Herzbiomarkertests bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das Wachstum der Gesundheitsausgaben für Investitionsgüter, die installierte Basis verschiedener Arten von Produkten für den Markt für Herzbiomarkertests, die Auswirkungen der Technologie anhand von Lebenslinienkurven und Änderungen der regulatorischen Szenarien im Gesundheitswesen und deren Auswirkungen auf den Markt für Herzbiomarkertests. Die Daten sind für den historischen Zeitraum 2011–2021 verfügbar.

Wettbewerbsumfeld und Tests auf kardiale Biomarker Analyse der Marktanteile

Die Wettbewerbslandschaft auf dem Markt für Herzbiomarkertests liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Herzbiomarkertests.

Zu den wichtigsten Akteuren auf dem Markt für Tests kardialer Biomarker zählen:

- F. Hoffmann-La Roche Ltd. (Schweiz)

- Thermo Fisher Scientific Inc. (USA)

- Abbott (USA)

- QIAGEN (Deutschland)

- PerkinElmer, Inc. (USA)

- Merck KGaA (Deutschland)

- Bio-Rad Laboratories, Inc. (USA)

- Enzo Biochem, Inc. (USA)

- Charles River Laboratories (USA)

- Eurofins Scientific (Luxemburg)

- Agilent Technologies, Inc. (USA)

- Bruker (USA)

- Siemens (Deutschland)

- Epigenomics AG (Deutschland)

- General Electric (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.