Global Aws Managed Services Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.12 Billion

USD

3.49 Billion

2024

2032

USD

1.12 Billion

USD

3.49 Billion

2024

2032

| 2025 –2032 | |

| USD 1.12 Billion | |

| USD 3.49 Billion | |

|

|

|

|

Globale Marktsegmentierung für AWS Managed Services nach Serviceart (Betriebsdienste, Cloud-Migrationsdienste und Beratungsdienste), Bereitstellungsmodus (On-Premises und Cloud), Unternehmensgröße (KMU und Großunternehmen), Branchensegment (Banken, Finanzdienstleistungen und Versicherungen, Gesundheitswesen, Fertigung, Regierung und Verteidigung, Medien und Unterhaltung, IT und Telekommunikation sowie Sonstige) – Branchentrends und Prognose bis 2032

Marktgröße für AWS Managed Services

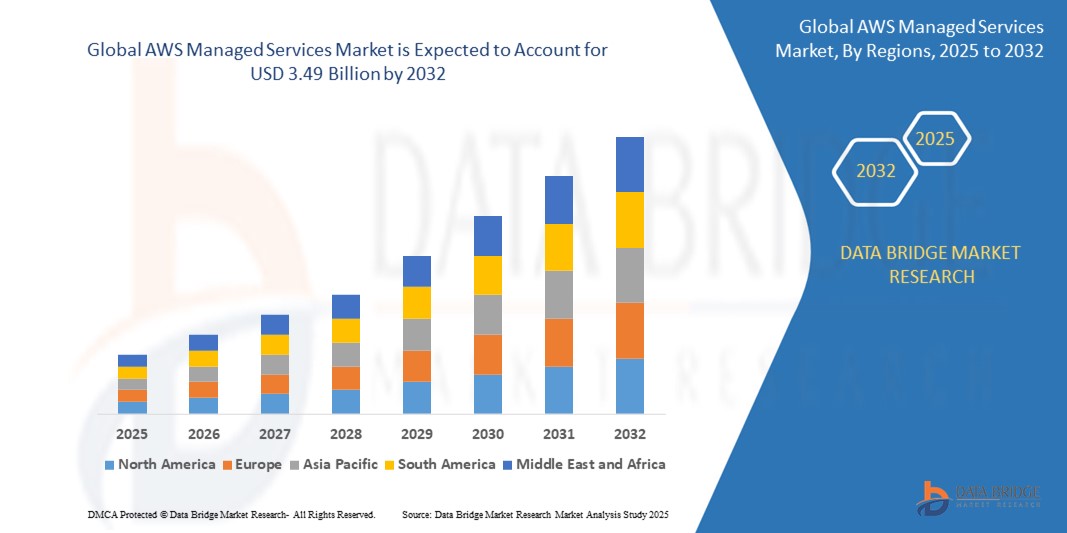

- Der globale Markt für AWS Managed Services hatte im Jahr 2024 einen Wert von 1,12 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 3,49 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 15,3 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch Faktoren wie die zunehmende Cloud-Nutzung in Unternehmen, den steigenden Bedarf an reduziertem IT-Betriebsaufwand, den wachsenden Fokus auf Kostenoptimierung, den Wandel hin zur digitalen Transformation und die Nachfrage nach verbesserter Sicherheit, Compliance und Governance in Cloud-Umgebungen angetrieben.

- Technologische Fortschritte wie Automatisierung, KI -gestützte Überwachung und prädiktive Analysen steigern die Effizienz der AWS Managed Services. Die zunehmende Nutzung von Hybrid- und Multi-Cloud-Strategien erhöht die Nachfrage nach Expertenmanagement. Darüber hinaus sind die Skalierbarkeit, Flexibilität und nutzungsbasierte Abrechnung der AWS-Services für Unternehmen attraktiv, die agile Infrastrukturlösungen suchen.

Marktanalyse für AWS Managed Services

- Die AWS Managed Services umfassen eine Reihe von Expertendiensten, die den Betrieb und die Optimierung der AWS-Umgebung eines Kunden übernehmen und es Unternehmen ermöglichen, sich auf ihre Kernziele zu konzentrieren. Ihr zunehmender Wert ergibt sich aus verbesserter betrieblicher Effizienz, leistungsstarkem Monitoring und Reporting sowie der reibungslosen Integration mit anderen Diensten.

- Die zunehmende Nutzung von AWS Managed Services wird hauptsächlich durch den steigenden Bedarf an spezialisierter Cloud-Management-Unterstützung, die wachsende Nachfrage nach skalierbaren und flexiblen Betriebslösungen für sich wandelnde Geschäftsanforderungen sowie einen stärkeren Fokus von Unternehmen auf die Nutzung von Expertenwissen zur Steigerung der Cloud-Performance und Kostensenkung angetrieben.

- Nordamerika wird voraussichtlich den Markt für AWS Managed Services mit einem Anteil von dominieren , was auf die frühe und weitverbreitete Einführung von Cloud-Technologien und die bedeutende Präsenz großer Cloud-nativer Unternehmen und großer Unternehmen zurückzuführen ist, die stark auf die AWS-Infrastruktur angewiesen sind.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für AWS Managed Services sein und einen Marktanteil von [ Wert einfügen] erreichen. Dies ist auf die rasante Zunahme der Cloud-Einführung in verschiedenen Branchen und die steigende Komplexität der Verwaltung dieser Cloud-Umgebungen in Ländern wie China, Japan und Indien zurückzuführen.

- Es wird erwartet, dass das Cloud-Segment den Markt aufgrund der inhärenten Skalierbarkeit, Flexibilität und Kosteneffizienz, die es Unternehmen jeder Größe bietet, dominieren wird. Die einfache Bereitstellung, die Zugänglichkeit und die reduzierten Vorabinvestitionen in die Infrastruktur tragen zusätzlich zu seiner weitverbreiteten Nutzung für Managed Services bei.

Berichtsumfang und Marktsegmentierung für AWS Managed Services

|

Attribute |

AWS Managed Services: Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team erstellte Marktbericht detaillierte Expertenanalysen, Import-/Exportanalysen, Preisanalysen, Produktions- und Verbrauchsanalysen sowie eine PESTLE-Analyse. |

Markttrends für AWS Managed Services

„Zunehmende Bedeutung des AWS-MSP-Status“

- Ein bedeutender und sich beschleunigender Trend im Markt für AWS Managed Services ist die zunehmende Bedeutung des AWS Managed Service Provider (MSP)-Status. Dieser belegt die nachgewiesene Expertise und Kompetenz eines Anbieters bei der Bereitstellung umfassender AWS-Lösungen. Die Zertifizierung stärkt das Kundenvertrauen und verschafft den Anbietern einen Wettbewerbsvorteil.

- Beispielsweise werden Unternehmen wie Accenture und Deloitte, die über den AWS MSP-Status verfügen, häufig von großen Unternehmen bevorzugt, die komplexe Cloud-Migrationen und laufendes Management benötigen, da diese Firmen die Einhaltung der strengen AWS-Standards nachgewiesen haben.

- Der AWS-MSP-Status ermöglicht es Anbietern, ein breiteres Spektrum an hochwertigen Dienstleistungen anzubieten, darunter komplexe Cloud-Migrationen, proaktives Monitoring, Sicherheitsmanagement und kontinuierliche Optimierung. Dies führt zu höherer Kundenzufriedenheit und -bindung. Darüber hinaus erhalten AWS-MSPs häufig Zugang zu exklusiven AWS-Programmen und -Ressourcen, wie z. B. frühzeitigem Zugriff auf neue Services und erweitertem Support, was ihnen einen Wettbewerbsvorteil verschafft.

- Um den AWS MSP-Status zu erlangen, müssen Anbieter ein strenges Audit durchlaufen, in dem sie ihre technische Kompetenz, ihre wirtschaftliche Stabilität und ihren Kundenerfolg nachweisen. Durch diesen Prozess wird die Fähigkeit von AWS MSPs bestätigt, konstant hochwertige Ergebnisse zu liefern, was das Vertrauen von Kunden stärkt, die ihr Cloud-Management auslagern möchten.

- Dieser Trend hin zur Erlangung und Validierung des AWS-MSP-Status verändert die Wettbewerbslandschaft des AWS-Managed-Services-Marktes grundlegend. Unternehmen wie Capgemini und Tata Consultancy Services (TCS) investieren daher massiv in den Erwerb und die Aufrechterhaltung dieser Zertifizierung, um ihre Cloud-Kompetenz zu demonstrieren und einen größeren Anteil der wachsenden Nachfrage nach professionellem AWS-Management zu gewinnen.

- Die Nachfrage nach AWS Managed Service Providern mit verifiziertem AWS-MSP-Status wächst branchenübergreifend rasant, da Unternehmen zunehmend Wert auf die Zusammenarbeit mit vertrauenswürdigen Experten legen, die ihnen helfen, die Komplexität der AWS-Cloud zu bewältigen und ihren Return on Investment zu maximieren.

Marktdynamik der AWS Managed Services

Treiber

„Wachsende Cloud-First-Strategien“

- Die zunehmende Verbreitung von Cloud-First-Strategien und der wachsende Bedarf von Unternehmen an skalierbarer und zuverlässiger Infrastruktur sind wesentliche Treiber für die gestiegene Nachfrage nach AWS Managed Services.

- Beispielsweise nutzen Unternehmen wie Netflix und Airbnb, die stark auf Cloud-Infrastruktur angewiesen sind, AWS Managed Services, um einen reibungslosen Betrieb und Skalierbarkeit zu gewährleisten. Dies unterstreicht die Notwendigkeit eines robusten Cloud-Managements. Solche strategischen Verlagerungen hin zu Cloud-nativen Architekturen dürften das Wachstum des Marktes für AWS Managed Services im Prognosezeitraum vorantreiben.

- Da Unternehmen durch die Einführung von Cloud-Lösungen Agilität und Kosteneffizienz priorisieren und IT-Teams sich auf Kerninnovationen anstatt auf Infrastrukturmanagement konzentrieren, bietet AWS Managed Services umfassende Lösungen wie automatisierte Bereitstellung, Leistungsüberwachung und Sicherheitsmanagement und stellt damit eine überzeugende Alternative zum internen IT-Betrieb dar.

- Darüber hinaus führt die zunehmende Erkenntnis der Komplexität der Verwaltung komplexer Cloud-Umgebungen und der steigende Fokus auf Sicherheit und Compliance in einer sich rasant entwickelnden digitalen Landschaft dazu, dass AWS Managed Services zu einem integralen Bestandteil der IT-Strategien von Unternehmen werden und eine nahtlose Integration mit verschiedenen AWS-Services und Tools von Drittanbietern ermöglichen.

- Die Möglichkeit, die Infrastrukturverwaltung auszulagern, der Zugriff auf spezialisiertes Fachwissen und die Skalierbarkeit der AWS-Cloud-Plattform sind Schlüsselfaktoren für die zunehmende Nutzung von AWS Managed Services in Großunternehmen und Startups. Der Trend zu serverlosen Architekturen und die wachsende Verfügbarkeit ausgefeilter Management-Tools im AWS-Ökosystem tragen zusätzlich zum Marktwachstum bei.

Zurückhaltung/Herausforderung

„Hohe Bedenken hinsichtlich der Datensouveränität“

- Bedenken hinsichtlich hoher Anforderungen an die Datensouveränität und regulatorischer Komplexität stellen eine erhebliche Herausforderung für die breitere Akzeptanz von AWS Managed Services dar, insbesondere für Organisationen, die in stark regulierten Branchen oder bestimmten geografischen Regionen tätig sind.

- Beispielsweise könnten Finanzinstitute wie die Deutsche Bank oder Gesundheitsdienstleister wie Philips, die mit sensiblen Kundendaten arbeiten und einer strengen regulatorischen Aufsicht unterliegen (DSGVO, HIPAA), Vorsicht walten lassen oder spezifische Konfigurationen und Zusicherungen verlangen, bevor sie AWS Managed Services vollständig für kritische Workloads einsetzen.

- Die Bewältigung dieser Bedenken hinsichtlich der Datensouveränität durch regionsspezifische Rechenzentren, fortschrittliche Verschlüsselungsmechanismen und umfassende Compliance-Zertifizierungen ist für eine breitere Akzeptanz entscheidend. AWS bietet Dienste wie AWS Local Zones und AWS Outposts an, um spezifische Anforderungen an Datenresidenz und geringe Latenz zu erfüllen und diese Bedenken auszuräumen.

- Die Vorteile von AWS Managed Services, wie verbesserte Skalierbarkeit und geringerer Betriebsaufwand, sind zwar attraktiv, doch die wahrgenommenen Herausforderungen bei der Wahrung der Datensouveränität und der Einhaltung lokaler regulatorischer Anforderungen können eine breite Akzeptanz weiterhin behindern, insbesondere für Organisationen mit strengen Richtlinien zur Datenverwaltung oder solche, die in Ländern mit strengen Gesetzen zur Datenlokalisierung tätig sind.

- Die Bewältigung dieser Herausforderungen durch kontinuierliche Investitionen in die regionale Infrastruktur, transparente Richtlinien für den Umgang mit Daten, robuste Compliance-Zertifizierungen und die Bereitstellung klarer Leitlinien für die Einhaltung der Anforderungen an die Datensouveränität wird für ein nachhaltiges Marktwachstum der AWS Managed Services in verschiedenen Branchen und Regionen von entscheidender Bedeutung sein.

Marktumfang für AWS Managed Services

Der Markt ist segmentiert nach Art der Dienstleistungen, Bereitstellungsmodus, Unternehmensgröße und Branche.

- Nach Dienstleistungsart

Basierend auf der Art der Dienstleistungen ist der Markt in Betriebsdienstleistungen, Cloud-Migrationsdienstleistungen und Beratungsdienstleistungen unterteilt. Das Segment der Betriebsdienstleistungen wird 2025 den größten Marktanteil erzielen, getrieben durch den kontinuierlichen Bedarf an Expertenmanagement, -überwachung und -optimierung von AWS-Umgebungen, um Leistung, Sicherheit und Kosteneffizienz zu gewährleisten. Dies umfasst kritische Aspekte wie Infrastrukturmanagement, Sicherheitsdienste und Kostenoptimierung.

Im Segment der Beratungsdienstleistungen wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) erwartet. Treiber dieser Entwicklung sind die zunehmende Komplexität von Cloud-Implementierungen und die wachsende Nachfrage nach strategischer Beratung zu Cloud-Einführung, Architekturdesign und Best Practices.

- Nach Bereitstellungsmodus

Basierend auf dem Bereitstellungsmodus ist der Markt in On-Premises- und Cloud-Lösungen unterteilt. Das Cloud-Segment wird 2025 den größten Marktanteil erzielen, was auf die inhärente Skalierbarkeit, Flexibilität und Kosteneffizienz zurückzuführen ist, die es Unternehmen jeder Größe bietet. Die einfache Bereitstellung, die Zugänglichkeit und die geringeren anfänglichen Infrastrukturinvestitionen tragen zusätzlich zur breiten Akzeptanz von Managed Services bei.

Im Segment der On-Premises-Lösungen wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage von Unternehmen mit strengen Anforderungen an Datensicherheit und Compliance, da ihnen dadurch eine bessere Kontrolle über ihre Daten und Infrastruktur ermöglicht wird.

- Nach Organisationsgröße

Basierend auf der Unternehmensgröße ist der Markt in KMU und Großunternehmen unterteilt. Das Segment der Großunternehmen wird 2025 den größten Marktanteil erzielen. Dies ist auf ihre umfangreichen und komplexen AWS-Implementierungen zurückzuführen, die umfassende Managed Services für optimale Leistung, Sicherheit und Governance im großen Maßstab erfordern. Ihre beträchtliche Cloud-Infrastruktur bedingt ein robustes Management und eine kontinuierliche Optimierung.

Für den Mittelstand wird von 2025 bis 2032 das schnellste jährliche Wachstum erwartet. Treiber dieser Entwicklung ist die zunehmende Nutzung von Cloud-Technologien durch KMU und deren wachsender Bedarf an Managed Services zur Unterstützung ihrer digitalen Transformationsinitiativen, ohne dass dafür umfangreiche interne IT-Expertise aufgewendet werden muss. Die Verfügbarkeit maßgeschneiderter und kosteneffizienter Managed-Service-Angebote treibt dieses Wachstum zusätzlich an.

- Nach Branchensegment

Basierend auf den Branchensegmenten ist der Markt in Banken, Finanzdienstleistungen und Versicherungen (BFSI), Gesundheitswesen, Fertigung, Regierung und Verteidigung, Medien und Unterhaltung, IT und Telekommunikation sowie Sonstige unterteilt. Das Segment IT und Telekommunikation wird 2025 den größten Marktanteil erzielen. Dies ist auf die branchenspezifische Abhängigkeit von robuster und skalierbarer Cloud-Infrastruktur sowie den Bedarf an spezialisierten Managed Services zur Unterstützung ihrer technologieintensiven Abläufe und Servicebereitstellung zurückzuführen.

Im Gesundheitssektor wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) erzielt werden. Treiber dieser Entwicklung sind die zunehmende Nutzung cloudbasierter Lösungen für Datenmanagement, Analytik und Anwendungshosting sowie die strengen Sicherheits- und Compliance-Anforderungen, die spezialisierte Expertise im Bereich AWS Managed Services erfordern.

Regionale Marktanalyse für AWS Managed Services

- Nordamerika dominiert den Markt für AWS Managed Services mit dem größten Umsatzanteil im Jahr 2024. Dies ist auf die frühe und weitverbreitete Einführung von Cloud-Technologien sowie die bedeutende Präsenz großer Cloud-nativer Unternehmen und Großunternehmen zurückzuführen, die stark auf die AWS-Infrastruktur angewiesen sind.

- Unternehmen in der Region legen großen Wert auf die Nutzung von Managed Services, um ihre Cloud-Umgebungen zu optimieren, die betriebliche Effizienz zu steigern und sich auf Kerninnovationen anstatt auf Infrastrukturmanagement zu konzentrieren.

- Dieser beträchtliche Marktanteil wird zudem durch ein ausgereiftes technologisches Ökosystem, eine starke Basis an qualifizierten Cloud-Experten und den zunehmenden Fokus auf Cloud-Sicherheit und Compliance gestützt, was den Bedarf an spezialisierten Managed Service Providern verstärkt.

Markteinblicke für AWS Managed Services in den USA

Der US-amerikanische Markt für AWS Managed Services erzielte 2025 den größten Umsatzanteil in Nordamerika. Treiber dieses Wachstums sind die weitverbreitete Nutzung von Cloud Computing und der dringende Bedarf an professionellem Management komplexer AWS-Umgebungen. Unternehmen legen zunehmend Wert auf optimierte Cloud-Infrastruktur und operative Effizienz durch spezialisierte Managed Services. Die steigende Nachfrage nach skalierbaren und sicheren Cloud-Lösungen sowie die starke Nachfrage nach Kostenoptimierung und Compliance-Management beflügeln die AWS Managed Services-Branche zusätzlich. Darüber hinaus erfordert die zunehmende Integration von AWS-Services mit fortschrittlichen Technologien wie KI und maschinellem Lernen qualifiziertes Management und Support, was maßgeblich zum Marktwachstum beiträgt.

Markteinblicke für AWS Managed Services in Europa

Der europäische Markt für AWS Managed Services wird im Prognosezeitraum voraussichtlich ein deutliches Wachstum verzeichnen. Diese regionale Marktexpansion wird maßgeblich durch die zunehmende Erkenntnis europäischer Unternehmen getragen, dass AWS strategische Vorteile für die digitale Transformation und operative Effizienz bietet. Infolgedessen setzen Organisationen in ganz Europa verstärkt auf AWS-Infrastruktur und damit einhergehend auf den Bedarf an professionellen Managed Services zur Optimierung ihrer Cloud-Umgebungen. Darüber hinaus treibt der steigende Fokus von Unternehmen auf die Einhaltung der Datenschutzbestimmungen in der Europäischen Union die Nachfrage nach Managed-Service-Anbietern mit spezifischer Expertise in der Umsetzung dieser komplexen Anforderungen an und etabliert AWS Managed Services als entscheidend für einen sicheren und konformen Cloud-Betrieb.

Markteinblicke für AWS Managed Services in Großbritannien

Der britische Markt für AWS Managed Services wird im Prognosezeitraum voraussichtlich ein beachtliches jährliches Wachstum verzeichnen. Treiber dieser Entwicklung sind die zunehmende Nutzung von Cloud-Lösungen und der Wunsch nach höherer betrieblicher Effizienz und Skalierbarkeit. Darüber hinaus führt der steigende Bedarf an professionellem Cloud-Management und -Sicherheit dazu, dass sowohl Großunternehmen als auch KMU umfassende AWS Managed Services-Lösungen in Anspruch nehmen. Die Digitalisierungsoffensive Großbritanniens sowie seine robuste Geschäfts- und Technologieinfrastruktur dürften das Marktwachstum in diesem Sektor weiterhin beflügeln.

Markteinblicke für AWS Managed Services in Deutschland

Der deutsche Markt für AWS Managed Services wird im Prognosezeitraum voraussichtlich ein beachtliches Wachstum verzeichnen. Treiber dieser Entwicklung sind die zunehmende Nutzung von Cloud Computing in verschiedenen Branchen und der wachsende Bedarf an spezialisiertem Fachwissen für die Verwaltung komplexer AWS-Umgebungen. Deutschlands starke Industriebasis und der Fokus auf Digitalisierung bewegen Unternehmen dazu, AWS für Skalierbarkeit und Innovation zu nutzen, wodurch die Nachfrage nach Managed Services steigt. Darüber hinaus erfordern die strengen Datenschutzbestimmungen in Deutschland Managed-Service-Anbieter mit fundierten Compliance-Kenntnissen und fördern so die Nutzung sicherer und lokal konformer AWS-Lösungen.

Markteinblicke für AWS Managed Services im asiatisch-pazifischen Raum

Der Markt für AWS Managed Services im asiatisch-pazifischen Raum wird voraussichtlich bis 2025 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) verzeichnen. Treiber dieses Wachstums sind die rasante Zunahme der Cloud-Einführung in verschiedenen Branchen und die steigende Komplexität der Verwaltung dieser Cloud-Umgebungen in Ländern wie China, Japan und Indien. Der wachsende Fokus der Region auf die digitale Transformation und der Bedarf an spezialisiertem Fachwissen zur Optimierung der Cloud-Infrastruktur und Gewährleistung der Sicherheit treiben die Nutzung robuster AWS Managed Services-Plattformen voran. Da sich der asiatisch-pazifische Raum zudem zu einem wichtigen Zentrum für digitale Innovation und Cloud-First-Strategien entwickelt, steigt die Nachfrage nach effizienten und skalierbaren Cloud-Management-Lösungen auf ein breiteres Spektrum von Organisationen, darunter KMU und Großunternehmen gleichermaßen.

Einblick in den japanischen Markt für AWS Managed Services

Der japanische Markt für AWS Managed Services gewinnt aufgrund der fortschrittlichen Technologielandschaft des Landes, der zunehmenden Nutzung von Cloud Computing und der Nachfrage nach zuverlässigen und effizienten Cloud-Management-Lösungen an Dynamik. Der japanische Markt legt großen Wert auf operative Exzellenz und Sicherheit, und die Nutzung anspruchsvoller AWS Managed Services wird durch den steigenden Bedarf an professionellem Cloud-Infrastrukturmanagement und Compliance-Konformität vorangetrieben. Die Integration von AWS-Services in andere IT-Systeme von Unternehmen und der Fokus auf die Optimierung der Cloud-Performance fördern das Wachstum zusätzlich.

Markteinblicke für AWS Managed Services in China

Der chinesische Markt für AWS Managed Services wird 2025 den größten Marktanteil im asiatisch-pazifischen Raum erzielen. Dies ist auf die rasant wachsende digitale Wirtschaft des Landes, die weitverbreitete Nutzung von Cloud Computing in Unternehmen und die zunehmende Komplexität der Verwaltung großflächiger Cloud-Implementierungen zurückzuführen. China zählt zu den größten und am schnellsten wachsenden Märkten für Cloud-Infrastrukturdienste. Der Bedarf an professionellen AWS Managed Services wird für Unternehmen aller Größen und Branchen immer wichtiger, um ihre Cloud-Investitionen zu optimieren. Die starke staatliche Förderung der digitalen Infrastrukturentwicklung und der dynamische und wettbewerbsintensive Markt für Cloud-Service-Anbieter sind Schlüsselfaktoren für das Wachstum des Marktes für AWS Managed Services in China.

Marktanteil von AWS Managed Services

Die AWS-Managed-Services-Branche wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- RACKSPACE US INC . (USA)

- Mission Cloud Services, Inc. (USA)

- Claranet Limited (UK)

- DXC Technology Company (USA)

- Onica (USA)

- Slalom, LLC (USA)

- e-Zest Solutions (Indien)

- Großartiges Softwarelabor (Indien)

- Cloudnexa (USA)

- Logicworks (USA)

- CLOUDREACH (UK)

- AllCloud (Israel)

- Hitachi Vantara LLC (USA)

- SMX (USA)

Neueste Entwicklungen auf dem globalen Markt für AWS Managed Services

- Im Mai 2022 schlossen EY und IBM eine Kooperation, um die digitale Innovation und Resilienz globaler Unternehmen zu stärken. Sie gründeten ein Talent Center of Excellence (COE) mit Fokus auf datengetriebene KI und Hybrid-Cloud-Lösungen. Diese Initiative unterstützt Unternehmen in den Bereichen Talentmanagement, HR-Transformation und Weiterbildung ihrer Mitarbeiter und trägt so dem dringenden Bedarf an agilen Personalstrategien Rechnung.

- Im Mai 2022 gaben IBM und Amazon Web Services Inc. (AWS) eine strategische Kooperationsvereinbarung (SCA) bekannt, um den IBM-Softwarekatalog als Software-as-a-Service (SaaS) auf AWS anzubieten. Diese Zusammenarbeit ermöglicht es Kunden, IBM-Software auf AWS zu nutzen und so moderne, sichere und intelligente Workflows schnell bereitzustellen. Dadurch werden die Agilität des Unternehmens und die Wertschöpfung gesteigert.

- Im Januar 2022 starteten Rackspace Technology und BT eine Kooperation zur Transformation der Cloud-Services multinationaler BT-Kunden. Die Lösungen von Rackspace Technology bilden die Grundlage für die Hybrid-Cloud-Services von BT, die in BT-Rechenzentren zusammen mit der Rackspace Fabric-Managementschicht bereitgestellt werden. Ziel dieser Partnerschaft ist die Verbesserung der Cloud-Service-Bereitstellung und die Unterstützung der sich wandelnden digitalen Anforderungen multinationaler Unternehmen. Sie verdeutlicht die Wettbewerbsdynamik im Markt für AWS Managed Services, in dem sich Branchenführer auf die sich verändernden Anforderungen ausrichten.

- Im März 2021 hat IBM Security einen neuen, verbesserten Service eingeführt, der Unternehmen bei der Verwaltung von Richtlinien, Cloud-Sicherheitsstrategien und Kontrollen in hybriden Cloud-Umgebungen unterstützt. Angesichts der zunehmenden Komplexität von Cyberbedrohungen und regulatorischen Anforderungen bietet dieser Service umfassende Lösungen zum Schutz digitaler Assets. IBMs proaktives Vorgehen unterstreicht die wachsende Bedeutung robuster Sicherheitsangebote im Markt für AWS Managed Services, da Unternehmen dem Schutz ihrer digitalen Assets angesichts sich ständig weiterentwickelnder Cyberbedrohungen und regulatorischer Rahmenbedingungen höchste Priorität einräumen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AWS MANAGED SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AWS MANAGED SERVICES MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AWS MANAGED SERVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 PORTER’S FIVE FORCES ANALYSIS

5.3 TECHNOLOGICAL ANALYSIS

5.3.1 BIG DATA AND ANALYTICS

5.3.2 CLOUD COMPUTING

5.3.3 ARTIFICIAL INTELLIGENCE

5.3.4 MACHINE LEARNING

5.4 REGULATORY FRAMEWORK

6 GLOBAL AWS MANAGED SERVICES MARKET, BY SERVICES TYPE

6.1 OVERVIEW

6.2 OPERATIONS SERVICES

6.3 CLOUD MIGRATION

6.4 ADVISORY SERVICES

7 GLOBAL AWS MANAGED SERVICES MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISES

7.3 SMALL AND MEDIUM ENTERPRISES (SMES)

8 GLOBAL AWS MANAGED SERVICES MARKET, BY DEPLOYMENT TYPE

8.1 OVERVIEW

8.2 ON-PREMISE

8.3 CLOUD

9 GLOBAL AWS MANAGED SERVICES MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 BFSI

9.2.1 OPERATIONS SERVICES

9.2.2 CLOUD MIGRATION

9.2.3 ADVISORY SERVICES

9.3 HEALTHCARE

9.3.1 OPERATIONS SERVICES

9.3.2 CLOUD MIGRATION

9.3.3 ADVISORY SERVICES

9.4 MANUFACTURING

9.4.1 OPERATIONS SERVICES

9.4.2 CLOUD MIGRATION

9.4.3 ADVISORY SERVICES

9.5 GOVERNMENT & DEFENSE

9.5.1 OPERATIONS SERVICES

9.5.2 CLOUD MIGRATION

9.5.3 ADVISORY SERVICES

9.6 MEDIA & ENTERTAINMENT

9.6.1 OPERATIONS SERVICES

9.6.2 CLOUD MIGRATION

9.6.3 ADVISORY SERVICES

9.7 IT & TELECOMMUNICATION

9.7.1 OPERATIONS SERVICES

9.7.2 CLOUD MIGRATION

9.7.3 ADVISORY SERVICES

9.8 OTHERS

10 GLOBAL AWS MANAGED SERVICES MARKET, BY REGION

10.1 GLOBAL AWS MANAGED SERVICES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 GLOBAL

10.1.2 GCC COUNTRIES

10.1.2.1. UNITED ARAB EMIRATES

10.1.2.2. SAUDI ARABIA

10.1.2.3. QATAR

10.1.2.4. OMAN

10.1.2.5. KUWAIT

10.1.2.6. BAHRAIN

10.1.3 MENA COUNTRIES

10.1.3.1. ALGERIA

10.1.3.2. EGYPT

10.1.3.3. IRAN

10.1.3.4. IRAQ

10.1.3.5. OTHERS

10.1.4 REST OF MIDDLE EAST AND AFRICA

10.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11 GLOBAL AWS MANAGED SERVICES MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 MERGERS & ACQUISITIONS

11.3 NEW PRODUCT DEVELOPMENT & APPROVALS

11.4 EXPANSIONS

11.5 REGULATORY CHANGES

11.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL AWS MANAGED SERVICES MARKET, SWOT ANALYSIS

13 GLOBAL AWS MANAGED SERVICES MARKET, COMPANY PROFILE

13.1 ACCENTURE PLC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 CLOUDNEXA INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 CAPGEMINI SE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 CLARANET GROUP

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 DXC TECHNOLOGY COMPANY

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 MICROSOFT AZURE

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 RACKSPACE INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 RELIAM LLC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 SMARTRONIX INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 SLALOM LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14 QUESTIONNAIRE

15 RELATED REPORTS

16 ABOUT DATA BRIDGE MARKET RESEARCH

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.