Global Animal Feed Testing Service Market, By Testing Type (Pathogen Testing, Fats and Oils Analysis, Feed Ingredient Analysis, Metal and Mineral Analysis, Pesticides and Fertilizers Analysis, Drugs and Antibiotics Analysis, Mycotoxin Testing, Nutritional Labeling, Proximate Analysis, Others), Feed Type (Pet Food, Equine Feeds, Aquatic Animals Feeds, Poultry Feed, Cattle Feed, Swine Feed, Others), Equipment Type (Bomb Calorimeter, Atomic Absorption Spectroscope (AAS), Gas Chromatograph-Flame Ionization Detector (GC-FID), Gas Chromatograph-Mass Spectrometer (GC-MS), High Performance Liquid Chromatography (HPLC), Others), Consumables (Glass Wares, Reference Standards, Solvents and Reagents, Others), End User (Manufacturers, Third Party Testers and Growers / Non-Profits) – Industry Trends and Forecast to 2029.

Animal Feed Testing Service Market Analysis and Size

According to the Food and Agriculture Organization of the United Nations (FAO), mycotoxins, which are toxic secondary metabolites of moulds, are present in nearly 25% of the world's food. There are about 400 known species of mycotoxins from various chemical compound classes, with 25 of them being quite common due to their frequency of occurrence. As the world's population grows, so does the demand for food, necessitating a greater emphasis on animal feed testing.

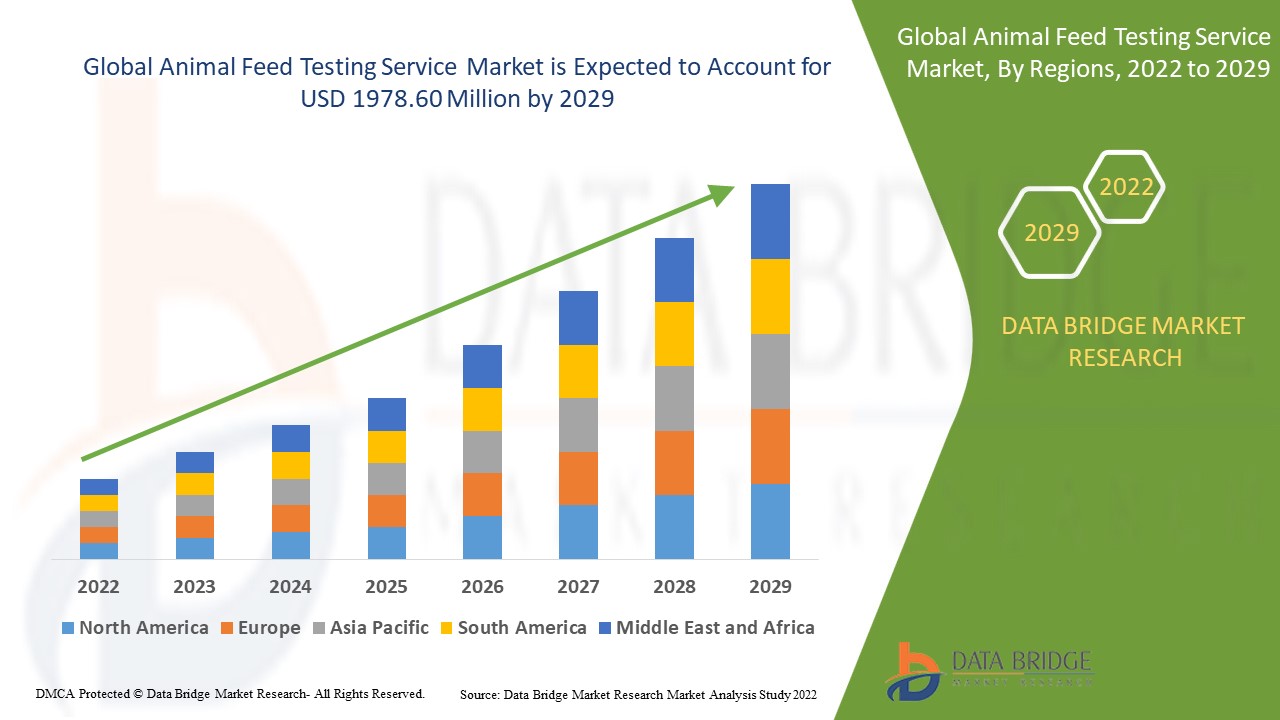

Data Bridge Market Research analyses that the animal feed testing service market was valued at 1022.63 million in 2021 is expected to reach the value of USD 1978.60 million by 2029, at aw CAGR of 8.60% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Animal Feed Testing Service Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Testart (Krankheitserregertests, Fett- und Ölanalyse, Futtermittelinhaltsstoffanalyse, Metall- und Mineralanalyse, Pestizid- und Düngemittelanalyse, Arzneimittel- und Antibiotikaanalyse, Mykotoxintests, Nährwertkennzeichnung, Proximate-Analyse, Sonstiges), Futtermitteltyp (Tiernahrung, Pferdefutter, Futter für Wassertiere , Geflügelfutter, Rinderfutter, Schweinefutter, Sonstiges), Gerätetyp (Bombenkalorimeter, Atomabsorptionsspektroskop (AAS), Gaschromatograph-Flammenionisationsdetektor (GC-FID), Gaschromatograph-Massenspektrometer (GC-MS), Hochleistungsflüssigkeitschromatographie (HPLC), Sonstiges), Verbrauchsmaterialien (Glaswaren, Referenzstandards, Lösungsmittel und Reagenzien, Sonstiges), Endverbraucher (Hersteller, externe Tester und Züchter/gemeinnützige Organisationen) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

SGS Société Générale de Surveillance SA (Schweiz), Bureau Veritas (Frankreich), Eurofins Scientifics (Luxemburg), Intertek Group plc (Großbritannien), Mérieux NutriSciences Corporation (USA), ALS (Australien), Neogen Corporation (USA), AsureQuality (Neuseeland), Charm Sciences (USA), Premier Analytical Services (Großbritannien), Dairyland Laboratories (USA), Bio-Check (Großbritannien), AES Laboratories (Indien), IEH Laboratories and Consulting Group (USA), Envirologix Inc. (USA), EMSL Analytical, Inc. (USA) und Krishgen Biosystems (USA) |

|

Gelegenheiten |

|

Marktdefinition

Das Verfahren zum Erreichen eines genauen Gleichgewichts zwischen den verfügbaren Futterzutaten wird als Futterprüfung bezeichnet. Das Hauptziel des Futterprogramms besteht darin, den Kontaminationsgrad im Tierfutter zu verringern. Für eine erfolgreiche Futterprüfung sind Informationen zum Nährstoffgehalt der Futterzutaten erforderlich. Unter anderem werden Futtermittel auf Pestizide, Mykotoxine, Mineralien, Krankheitserreger, Metalle, Antibiotika und Medikamente getestet, um das Fehlen von Verunreinigungen festzustellen, die Toxizität, durch Lebensmittel übertragene Krankheiten und Vergiftungen verursachen können.

Globale Marktdynamik für Tierfuttertests

Treiber

- Bedenken der Erzeuger hinsichtlich der Gesundheit und Sicherheit der Tiere

Die steigende Nachfrage nach hochwertigem Tierfutter treibt das Wachstum des Marktes für Futtermittelprüfungsdienste voran. Die schnelle Urbanisierung und die steigenden Betriebskosten der Futtermittelproduktion werden den Markt vorantreiben. Die steigende Nachfrage aus verschiedenen Endverbrauchsbranchen wird das Wachstum des Marktes für Futtermittelprüfungsdienste ankurbeln. Darüber hinaus wird die wachsende Besorgnis über die Gesundheit und Sicherheit der Tiere bei Viehzüchtern, Landwirten und Regierungsbehörden das Wachstum des Marktes für Futtermittelprüfungsdienste vorantreiben. Ein weiterer kritischer Faktor ist die Zunahme von Tierkrankheiten, die das Wachstum des Marktes weiter dämpfen wird. Andere Faktoren wie die obligatorische Analyse der Futtersicherheit und -qualität, maßgeschneiderte Dienstleistungen, die sich als kosten- und zeiteffiziente Lösungen herauskristallisieren, und die Betriebskosten der Futtermittelproduktion werden sich positiv auf das Wachstum des Marktes für Futtermittelprüfungsdienste auswirken.

- Strenge Vorschriften der Regierung zur Durchführung von Tests

Verschiedene Regierungen und Aufsichtsbehörden auf der ganzen Welt haben die Prüfung von Tierfutter und Lebensmittelzutaten obligatorisch gemacht. Tierfutter darf erst vermarktet werden, wenn seine Sicherheit und Wirksamkeit nachgewiesen wurden. Solche Vorsichtsmaßnahmen zur Vermeidung von Kontamination, Chemikalien und toxischen Einflüssen hatten einen erheblichen Einfluss auf das Wachstum des Marktes für Mykotoxintests. Zum Schutz der Gesundheit von Mensch und Tier haben viele Länder spezielle Vorschriften für Mykotoxine in Lebensmitteln und Tierfutter erlassen.

Gelegenheiten

- Zunehmender Lebensmittelhandel

Der zunehmende Lebensmittelhandel über die Grenzen der Schwellenmärkte hinweg erweitert das Wachstumspotenzial des Marktes. Die steigende Zahl von durch Lebensmittel verursachten Krankheiten sowie die schlechten Hygiene- und Verarbeitungsbedingungen in einigen Fabriken machen Tierfuttertests erforderlich. Die Regulierungen in Schwellenländern, die den Lebensmittelhandel betreffen, sowie die Ermächtigung der Behörden, den Import und die Lieferung kontaminierter Lebensmittel zu verbieten und Lebensmittelrückrufe durchzuführen, werden voraussichtlich die Nachfrage nach Testdiensten in diesen Regionen erhöhen.

Beschränkungen

- Hohe Kosten und mangelndes Bewusstsein

Die hohen Kosten und die umfangreiche Probenvorbereitung werden jedoch das Wachstum des Marktes für Tierfutter-Testdienste verlangsamen. Darüber hinaus werden fehlendes Wissen über Futtermittelvorschriften und ein Mangel an Expertenanalytikern für fortgeschrittene Tests das Wachstum des Marktes erheblich behindern. Das mangelnde Bewusstsein der Landwirte für Tierfuttertests und die hohen Kosten der Tests werden als große Markthemmnisse wirken und das Wachstum des Marktes für Tierfutter-Testdienste verlangsamen.

Dieser Marktbericht zum Testservice für Tierfutter enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Testservices für Tierfutter zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Auswirkungen von COVID-19 auf den Markt für Tierfutterprüfdienste

Während der Welthandel aufgrund der Lockdowns zur Eindämmung der Verbreitung des neuartigen Coronavirus zum Erliegen kam, wurde die Lebensmittelindustrie durch schwere Frachtprobleme hart getroffen. Die Fleisch- und Milchverkäufe gingen in der Lebensmittelindustrie zurück, insbesondere im Gastronomie- und Gaststättengewerbe. Dieser Abschwung in der globalen Lebensmittelindustrie hatte negative Auswirkungen auf den Markt für Futtermitteltests. In der Anfangsphase der Pandemie waren Viehzüchter mit einer Überversorgung konfrontiert, die sie zu Kostensenkungen zwang. Obwohl es ein Nettowachstum in der Futtermittelproduktion gibt, ist es niedriger als das vor der Pandemie prognostizierte Wachstum, so Deepak Roda, Vizepräsident für Markt- und Geschäftsentwicklung und Enzyminnovation. Verlangsamungen in den Fleisch- und Futtermittelversorgungsketten sowie ein geringerer Konsum von Fleisch und fleischbasierten Produkten reduzierten den Futtermittelverbrauch. Infolgedessen haben sich die Gesamtnachfrage nach und die Produktion von Futtermitteln verlangsamt. Es wird jedoch erwartet, dass sich der Markt nach dem Ende der Pandemie wieder normalisiert. Die eigentliche Herausforderung besteht dann darin, die unerwartet hohe Nachfrage zu decken.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Jüngste Entwicklung

- Im Oktober 2019 gab SGS die Erweiterung seines neuen mikrobiologischen Lebensmitteltestlabors in Fairfield, New Jersey, USA, bekannt. Die 185 Quadratmeter große mikrobiologische Testeinrichtung nutzt eine Informationstechnologieplattform, um Lebensmittelproduzenten, Herstellern und Lieferanten aus allen Lebensmittelkategorien Testdienstleistungen anzubieten.

- Im März 2019 gab SGS die Erweiterung seines neuen mikrobiologischen Lebensmitteltestlabors in Carson, Kalifornien, bekannt. Die mikrobiologische Testeinrichtung ist 220 Quadratmeter groß. Die geografische Abdeckung des Unternehmens sowie sein globales Netzwerk an Landwirtschafts- und Lebensmittellaboren werden durch diese Erweiterung erweitert.

Globaler Marktumfang für Tierfutterprüfdienste

Der Markt für Tierfutter-Testdienste ist nach Testart, Futterart, Gerätetyp, Verbrauchsmaterialien und Endverbraucher segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Prüfart

- Erregertests

- Fett- und Ölanalyse

- Futterinhaltsstoffanalyse

- Metall- und Mineralienanalyse

- Pestizid- und Düngemittelanalyse

- Arzneimittel- und Antibiotikaanalyse

- Mykotoxin-Tests

- Nährwertkennzeichnung

- Ungefähre Analyse

- Sonstiges

Futterart

- Tiernahrung

- Pferdefutter

- Futter für Wassertiere

- Geflügelfutter

- Viehfutter

- Schweinefutter

- Sonstiges

Gerätetyp

- Bombenkalorimeter

- Atomabsorptionsspektroskop (AAS)

- Gaschromatograph-Flammenionisationsdetektor (GC-FID)

- Gaschromatograph-Massenspektrometer (GC-MS)

- Hochleistungsflüssigkeitschromatographie (HPLC)

- Sonstiges

Verbrauchsmaterial

- Glaswaren

- Referenzstandards

- Lösungsmittel und Reagenzien

- Sonstiges

Endbenutzer

- Hersteller

- Tester von Drittanbietern

- Erzeuger/gemeinnützige Organisationen

Regionale Analyse/Einblicke zum Markt für Tierfutterprüfdienste

Der Markt für Prüfdienstleistungen für Tierfutter wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Prüfart, Futterart, Gerätetyp, Verbrauchsmaterialien und Endbenutzer wie oben angegeben bereitgestellt.

Die im Marktbericht zu Prüfdiensten für Tierfutter abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher asiatisch-pazifischer Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika ist aufgrund des Ausbruchs mehrerer Krankheiten, die die Gesundheit von Tieren und Menschen in der Region beeinträchtigen, führend auf dem Markt für Dienstleistungen im Bereich der Futtermittelprüfung.

Im asiatisch-pazifischen Raum wird aufgrund des technischen Fortschritts bei Prüfgeräten für Tierfutter und einer rasanten Zunahme großer Hersteller in dieser Region zwischen 2022 und 2029 ein deutliches Wachstum erwartet.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Tierfutterprüfdiensten

Die Wettbewerbslandschaft auf dem Markt für Tierfutter-Testdienste liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Tierfutter-Testdienste.

Zu den wichtigsten Akteuren auf dem Markt für Prüfdienstleistungen für Tierfutter zählen:

- SGS Société Générale de Surveillance SA (Schweiz)

- Bureau Veritas (Frankreich)

- Eurofins Scientifics (Luxemburg)

- Intertek Group plc (Großbritannien)

- Mérieux NutriSciences Corporation (USA)

- ALS (Australien)

- Neogen Corporation (USA)

- AsureQuality (Neuseeland)

- Charm Sciences (USA)

- Premier Analytical Services (Großbritannien)

- Dairyland Laboratories (USA)

- Bio-Check (Großbritannien)

- AES Laboratories (Indien)

- IEH Laboratories und Consulting Group (USA)

- Envirologix Inc. (USA)

- EMSL Analytical, Inc. (USA)

- Krishgen Biosystems (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.