Global Aerospace Parts Manufacturing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

971.99 Million

USD

1,381.84 Million

2024

2032

USD

971.99 Million

USD

1,381.84 Million

2024

2032

| 2025 –2032 | |

| USD 971.99 Million | |

| USD 1,381.84 Million | |

|

|

|

|

Globale Marktsegmentierung für die Herstellung von Teilen für die Luft- und Raumfahrt, nach Produkt (Triebwerke, Flugzeugbau, Kabinenausstattung, Avionik, Isolationskomponenten und -ausrüstung sowie System und Support), Anwendung (Verkehrsflugzeuge, Geschäftsflugzeuge, Militärflugzeuge und andere) – Branchentrends und Prognose bis 2032

Wie groß ist der globale Markt für die Herstellung von Luft- und Raumfahrtteilen und wie hoch ist seine Wachstumsrate?

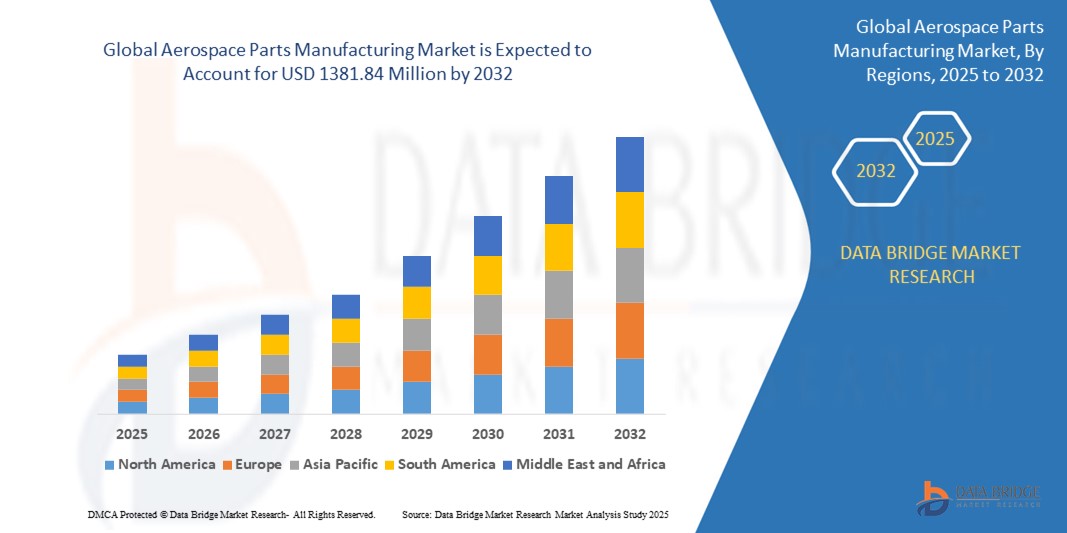

- Der globale Markt für die Herstellung von Luft- und Raumfahrtteilen wurde im Jahr 2024 auf 971,69 Millionen US-Dollar geschätzt und soll bis 2032 1381,84 Millionen US-Dollar erreichen , bei einer CAGR von 4,50 % im Prognosezeitraum.

- Der globale Markt für die Herstellung von Luft- und Raumfahrtteilen ist robust und wird von der Nachfrage sowohl von Verkehrsflugzeugherstellern als auch von Weltraumraketenherstellern angetrieben. Das stetige Wachstum der kommerziellen Luftfahrt, gekennzeichnet durch eine steigende Nachfrage nach Flugreisen, treibt den Markt für Flugzeugkomponenten an.

- Ebenso verstärkt der Anstieg der Weltraumforschung und des Satelliteneinsatzes die Nachfrage nach Raketenteilen. So erweitern Unternehmen wie Boeing und SpaceX ihre Flotten kontinuierlich und tragen so zum Aufwärtstrend im Markt für die Herstellung von Luft- und Raumfahrtteilen bei.

Was sind die wichtigsten Erkenntnisse des Marktes für die Herstellung von Luft- und Raumfahrtteilen?

- Innovationen wie leichte Verbundwerkstoffe, additive Fertigungsverfahren und fortschrittliche Antriebssysteme verändern den Markt für die Herstellung von Luft- und Raumfahrtteilen kontinuierlich. Diese technologischen Durchbrüche ermöglichen die Produktion effizienterer, langlebigerer und leistungsstärkerer Luft- und Raumfahrtkomponenten.

- Sie ermöglichen die Entwicklung von Flugzeugen und Raumfahrzeugen der nächsten Generation und erfüllen die steigenden Kundenanforderungen hinsichtlich Treibstoffeffizienz, Sicherheit und Nachhaltigkeit.

- Nordamerika dominierte den globalen Markt für die Herstellung von Luft- und Raumfahrtteilen und erzielte im Jahr 2024 mit 51,2 % den größten Umsatzanteil. Dies ist auf hohe Verteidigungsausgaben, einen robusten kommerziellen Luftfahrtsektor und die Präsenz führender Luft- und Raumfahrthersteller und -zulieferer zurückzuführen.

- Der Markt für die Herstellung von Luft- und Raumfahrtteilen im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer CAGR von 17,3 % am schnellsten wachsen, angetrieben durch die steigende Nachfrage nach Flugreisen, steigende Verteidigungsbudgets und die schnelle Ausweitung inländischer Flugzeugbauprogramme in Ländern wie China, Indien und Japan.

- Das Segment Triebwerke dominierte den Markt für die Herstellung von Luft- und Raumfahrtteilen mit dem größten Marktanteil von 36,4 % im Jahr 2024, angetrieben durch die steigende weltweite Nachfrage nach treibstoffeffizienten, leichten und leistungsstarken Flugzeugtriebwerken.

Berichtsumfang und Marktsegmentierung für die Herstellung von Luft- und Raumfahrtteilen

|

Eigenschaften |

Wichtige Markteinblicke in die Herstellung von Luft- und Raumfahrtteilen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Was ist der wichtigste Trend auf dem Markt für die Herstellung von Teilen für die Luft- und Raumfahrt?

„ KI-gesteuerte Automatisierung und additive Fertigung verändern die Luft- und Raumfahrtproduktion “

- Ein herausragender und sich beschleunigender Trend auf dem globalen Markt für die Herstellung von Luft- und Raumfahrtteilen ist die weit verbreitete Einführung von KI-gesteuerter Automatisierung und additiver Fertigung ( 3D-Druck ), die die Produktion komplexer Flugzeugkomponenten mit verbesserter Präzision, geringeren Kosten und kürzeren Vorlaufzeiten revolutioniert.

- So setzen führende Luft- und Raumfahrtunternehmen wie Boeing und Airbus zunehmend KI-gestützte Roboter und additive Fertigungstechnologien ein, um leichte Strukturteile, Triebwerkskomponenten und Innenausstattungen herzustellen und so die Betriebseffizienz und Produktleistung deutlich zu steigern.

- KI-gestützte vorausschauende Wartung und intelligente Qualitätskontrollsysteme verändern auch die Fertigungsprozesse, indem sie Defekte minimieren, den Materialverbrauch optimieren und die Einhaltung strenger Luft- und Raumfahrtstandards gewährleisten.

- Darüber hinaus ermöglicht die Kombination aus digitalen Zwillingen , KI-Simulation und fortschrittlicher Fertigung Unternehmen, Komponenten virtuell zu entwerfen, zu testen und zu produzieren, wodurch Entwicklungszyklen verkürzt und ein schnelles Prototyping für Flugzeuge der nächsten Generation ermöglicht wird.

- Dieser Trend hin zu automatisierten, intelligenten und digital vernetzten Fertigungsökosystemen verändert die Wettbewerbslandschaft und zwingt Luft- und Raumfahrtzulieferer dazu, intelligente Fabriken und datengesteuerte Produktionsmodelle zu integrieren, um weiterhin relevant zu bleiben.

- Da die weltweite Nachfrage nach treibstoffeffizienten, leichten und nachhaltigen Flugzeugen steigt, werden KI und fortschrittliche Fertigungstechnologien zu zentralen Faktoren für Innovationen und fördern Effizienz, Kosteneffizienz und individuelle Anpassung im gesamten Sektor der Herstellung von Luft- und Raumfahrtteilen.

Was sind die Haupttreiber des Marktes für die Herstellung von Luft- und Raumfahrtteilen?

- Die weltweit wachsende Nachfrage nach treibstoffeffizienten, leichten und leistungsstarken Flugzeugen, gepaart mit Fortschritten in der Materialwissenschaft, der KI und den Produktionstechnologien, ist ein wichtiger Treiber für den Markt der Herstellung von Luft- und Raumfahrtteilen.

- So stellte Airbus im März 2024 neue 3D-gedruckte Titankomponenten für seine Verkehrsflugzeuge vor, die das Teilegewicht reduzieren und die Treibstoffeffizienz verbessern und damit den Wandel der Branche hin zu innovativen Fertigungslösungen verdeutlichen.

- Der Anstieg des Flugverkehrs, die boomenden Verteidigungsausgaben und die rasante Urbanisierung in den Schwellenländern treiben die Nachfrage nach Verkehrsflugzeugen, Verteidigungsflugzeugen und Hubschraubern an und schaffen damit erhebliche Wachstumschancen für Zulieferer von Luft- und Raumfahrtkomponenten.

- Darüber hinaus beschleunigt der Übergang zu Elektro- und Hybrid-Elektroflugzeugen, unterstützt durch strenge Emissionsvorschriften, den Bedarf an fortschrittlichen Materialien, präzisionsgefertigten Teilen und effizienten Produktionstechniken.

- Erhöhte Investitionen in intelligente Fabriken, Robotik und Datenanalyse steigern die Produktionskapazitäten, verbessern die Qualitätskontrolle und ermöglichen eine skalierbare, kosteneffiziente Teilefertigung

- Die zunehmende Betonung der Belastbarkeit der Lieferketten und der lokalen Produktion steigert die Nachfrage nach fortschrittlichen Lösungen für die Herstellung von Teilen für die Luft- und Raumfahrt weiter, gewährleistet die Betriebskontinuität und verringert die Abhängigkeit von globalen Versorgungsunterbrechungen.

Welcher Faktor stellt das Wachstum des Marktes für die Herstellung von Luft- und Raumfahrtteilen in Frage?

- Die hohen Kapitalinvestitionen, die technologische Komplexität und die strengen gesetzlichen Anforderungen im Zusammenhang mit der Herstellung von Luft- und Raumfahrtteilen stellen weiterhin erhebliche Hindernisse für das Marktwachstum dar, insbesondere für kleine und mittelgroße Zulieferer.

- So wird beispielsweise in der Luft- und Raumfahrtindustrie die Qualität, Sicherheit und Einhaltung von Normen wie AS9100 strengsten Kontrollen unterzogen. Für Hersteller ist es daher eine Herausforderung, neue Technologien ohne umfassende Zertifizierungsprozesse und Tests einzuführen.

- Darüber hinaus haben die durch geopolitische Spannungen, Rohstoffknappheit und pandemiebedingte Einschränkungen verursachten Lieferkettenunterbrechungen Schwachstellen offengelegt, Produktionspläne verzögert und die Betriebsrisiken erhöht.

- Die Integration von KI, Automatisierung und fortschrittlichen Materialien erfordert eine erhebliche Weiterbildung der Belegschaft, Infrastrukturverbesserungen und Investitionen in die Cybersicherheit und stellt traditionelle Hersteller mit begrenztem technischen Know-how vor Herausforderungen.

- Darüber hinaus können die hohen Kosten für additive Fertigungsmaterialien, komplexe Designvalidierungsprozesse und begrenzte Möglichkeiten für den 3D-Druck im großen Maßstab eine breite Einführung behindern, insbesondere bei kritischen Strukturkomponenten.

- Die Bewältigung dieser Herausforderungen erfordert die Zusammenarbeit zwischen OEMs der Luft- und Raumfahrtindustrie, Technologieanbietern und Regulierungsbehörden sowie nachhaltige Investitionen in Forschung und Entwicklung, um Kosten zu senken, die Zertifizierung zu rationalisieren und die Skalierbarkeit fortschrittlicher Fertigungslösungen zu verbessern und so ein langfristiges Marktwachstum zu gewährleisten.

Wie ist der Markt für die Herstellung von Luft- und Raumfahrtteilen segmentiert?

Der Markt ist nach Produkt und Anwendung segmentiert.

• Nach Produkt

Der Markt für die Herstellung von Luft- und Raumfahrtteilen ist produktbezogen in die Bereiche Triebwerke, Flugzeugbau, Kabinenausstattung, Avionik, Isolationskomponenten und -ausrüstung sowie System und Support unterteilt. Das Segment Triebwerke dominierte den Markt für die Herstellung von Luft- und Raumfahrtteilen mit dem größten Marktanteil von 36,4 % im Jahr 2024, angetrieben durch die weltweit steigende Nachfrage nach treibstoffsparenden, leichten und leistungsstarken Flugzeugtriebwerken. Kontinuierliche Fortschritte bei Triebwerksdesign, Materialien und Herstellungsprozessen steigern die Treibstoffeffizienz, reduzieren Emissionen und verbessern die Zuverlässigkeit, was Triebwerke zu einem wichtigen Schwerpunkt für Luft- und Raumfahrthersteller macht.

Das Avionik-Segment wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, angetrieben durch den steigenden Bedarf an fortschrittlichen Navigations-, Kommunikations- und Flugsteuerungssystemen. Die Integration modernster Avionik-Technologien, einschließlich KI-gestütztem Flugmanagement und autonomen Fähigkeiten, verändert den Flugbetrieb und sorgt für starkes Wachstum in diesem Segment.

• Nach Anwendung

Der Markt für die Herstellung von Luft- und Raumfahrtteilen ist nach Anwendung in Verkehrsflugzeuge, Geschäftsflugzeuge, Militärflugzeuge und Sonstige unterteilt. Das Segment Verkehrsflugzeuge hatte 2024 den größten Marktanteil, angetrieben durch den Anstieg der Flugreisenachfrage, Flottenmodernisierungsinitiativen und den weltweiten Vorstoß zu treibstoffeffizienteren, leichteren Flugzeugen. Unternehmen der Luft- und Raumfahrtteilefertigung konzentrieren sich auf die Bereitstellung innovativer, leistungsstarker Komponenten, um den sich entwickelnden Anforderungen der Verkehrsluftfahrt gerecht zu werden, was zur Dominanz des Segments beiträgt.

Das Segment Militärflugzeuge wird im Prognosezeitraum voraussichtlich die höchste jährliche Wachstumsrate verzeichnen. Grund hierfür sind steigende Verteidigungsausgaben, Modernisierungsprogramme und die Nachfrage nach fortschrittlichen, einsatzkritischen Luft- und Raumfahrtkomponenten. Die zunehmende Bedeutung von Stealth-Technologie, Leichtbauwerkstoffen und Militärflugzeugen der nächsten Generation treibt das robuste Wachstum in diesem Anwendungssegment voran.

Welche Region hält den größten Anteil am Markt für die Herstellung von Luft- und Raumfahrtteilen?

- Nordamerika dominierte den globalen Markt für die Herstellung von Luft- und Raumfahrtteilen und erzielte im Jahr 2024 mit 51,2 % den größten Umsatzanteil. Dies ist auf hohe Verteidigungsausgaben, einen robusten kommerziellen Luftfahrtsektor und die Präsenz führender Luft- und Raumfahrthersteller und -zulieferer zurückzuführen.

- Die Region profitiert von fortschrittlichen Forschungs- und Entwicklungskapazitäten, der breiten Nutzung von Materialien der nächsten Generation und erheblichen Investitionen in Flugzeugmodernisierungsprogramme, was die kontinuierliche Nachfrage nach Luft- und Raumfahrtkomponenten fördert.

- Diese regionale Führungsrolle wird durch Partnerschaften zwischen OEMs wie Boeing, Technologie-Innovatoren und Regierungsinitiativen zur Förderung der heimischen Luft- und Raumfahrtproduktion weiter unterstützt, wodurch Nordamerika als globales Zentrum für Innovationen und Komponentenfertigung in der Luft- und Raumfahrt positioniert wird.

Einblicke in den Markt für die Herstellung von Luft- und Raumfahrtteilen in den USA

Der US-Markt für die Herstellung von Luft- und Raumfahrtteilen erzielte 2024 den größten Umsatzanteil innerhalb Nordamerikas, angetrieben durch die florierenden Verteidigungs- und Verkehrsluftfahrtsektoren des Landes. Die USA beherbergen einige der weltweit größten Luft- und Raumfahrtunternehmen, darunter Boeing, Lockheed Martin und Textron, was zu einer konstanten Nachfrage nach Flugzeugtriebwerken, Strukturkomponenten und Avionik führt. Der Schwerpunkt der USA auf militärischer Modernisierung und die hohe Nachfrage nach treibstoffeffizienten Verkehrsflugzeugen beschleunigen die Produktion von Luft- und Raumfahrtteilen weiter. Darüber hinaus stärken technologische Fortschritte in der additiven Fertigung und der KI-gesteuerten Automatisierung die Wettbewerbsfähigkeit der US-amerikanischen Luft- und Raumfahrtzulieferer.

Einblicke in den europäischen Markt für die Herstellung von Luft- und Raumfahrtteilen

Der europäische Markt für die Herstellung von Luft- und Raumfahrtteilen wird im Prognosezeitraum voraussichtlich stetig wachsen. Dies wird durch die Präsenz großer Flugzeughersteller wie Airbus sowie durch starke Initiativen für Nachhaltigkeit und Innovation unterstützt. Europäische Luft- und Raumfahrtunternehmen konzentrieren sich auf Leichtbaumaterialien, Treibstoffeffizienz und umweltfreundliche Luftfahrttechnologien und treiben so die Nachfrage nach fortschrittlichen Teilen und Komponenten an. Die Expertise der Region im Bereich Feinmechanik sowie verstärkte Investitionen in Weltraumforschung und Verteidigungsprojekte tragen zusätzlich zum Ausbau der Luft- und Raumfahrtteilefertigung in ganz Europa bei.

Einblicke in den britischen Markt für die Herstellung von Luft- und Raumfahrtteilen

Der britische Markt für die Herstellung von Luft- und Raumfahrtteilen wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen, angetrieben von der etablierten Position Großbritanniens als führender Anbieter von Flugzeugtriebwerken, modernen Materialien und Verteidigungskomponenten. Die britische Luft- und Raumfahrtindustrie, unterstützt von Unternehmen wie Rolls-Royce, spielt eine wichtige Rolle in der globalen Lieferkette und konzentriert sich auf die Herstellung von Triebwerken, Avionik und hochmodernen Verbundwerkstoffen. Die staatlichen Investitionen in Innovation und Nachhaltigkeit in der Luft- und Raumfahrt sowie der Zugang zu europäischen und globalen Märkten positionieren Großbritannien als wichtigen Akteur in der Produktion von Luft- und Raumfahrtkomponenten.

Markteinblick in die Herstellung von Luft- und Raumfahrtteilen in Deutschland

Der deutsche Markt für die Herstellung von Luft- und Raumfahrtteilen wird voraussichtlich stetig wachsen, angetrieben von der technologischen Expertise des Landes, seinen Fähigkeiten im Feinmechanikbereich und seinem starken Fokus auf Qualität und Innovation. Deutschland ist ein wichtiger Bestandteil der Airbus-Lieferkette und investiert in Leichtbaumaterialien, fortschrittliche Kabinenausstattung und Avionik der nächsten Generation. Kooperationen zwischen deutschen Luft- und Raumfahrtunternehmen, Forschungseinrichtungen und globalen OEMs stärken die Rolle Deutschlands bei der Herstellung von Hochleistungskomponenten für die Luft- und Raumfahrt, insbesondere in der kommerziellen Luftfahrt und im Verteidigungssektor.

Welche Region ist die am schnellsten wachsende Region im Markt für die Herstellung von Luft- und Raumfahrtteilen?

Der Markt für die Herstellung von Luft- und Raumfahrtteilen im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 17,3 % wachsen. Dies ist auf die steigende Nachfrage nach Flugreisen, steigende Verteidigungsbudgets und den schnellen Ausbau inländischer Flugzeugbauprogramme in Ländern wie China, Indien und Japan zurückzuführen. Die wachsende Mittelschicht in der Region, die Modernisierung der Flotten und staatlich geförderte Luft- und Raumfahrtinitiativen eröffnen bedeutende Chancen für Zulieferer von Luft- und Raumfahrtteilen, insbesondere für Leichtbaustrukturen, Triebwerkskomponenten und Avionik. Darüber hinaus fördern steigende Investitionen in MRO-Einrichtungen (Wartung, Reparatur und Überholung) und die Verteidigungsluftfahrt das regionale Marktwachstum.

Einblicke in den japanischen Markt für die Herstellung von Luft- und Raumfahrtteilen

Der japanische Markt für die Herstellung von Luft- und Raumfahrtteilen wächst stetig, unterstützt durch den Ruf des Landes für Spitzentechnologie, Materialinnovation und Präzisionsfertigung. Japanische Luft- und Raumfahrtunternehmen sind wichtige Zulieferer von Komponenten sowohl für Verkehrsflugzeuge als auch für Verteidigungsprogramme und legen dabei einen starken Fokus auf Hochleistungsmaterialien und Avionik. Der Fokus der Regierung auf die Stärkung der nationalen Luft- und Raumfahrtkapazitäten und internationaler Partnerschaften, insbesondere im Mitsubishi SpaceJet- und Verteidigungssektor, stärkt Japans Rolle in der globalen Lieferkette für Luft- und Raumfahrtteile.

Einblicke in den Markt für die Herstellung von Luft- und Raumfahrtteilen in China

Der chinesische Markt für die Herstellung von Luft- und Raumfahrtteilen erwirtschaftete 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf erhebliche Investitionen in inländische Flugzeugprogramme wie die COMAC C919, den Ausbau von MRO-Einrichtungen und einen zunehmenden Fokus auf die Autarkie der Luft- und Raumfahrt zurückzuführen. Chinas rasant wachsender Luft- und Raumfahrtsektor, unterstützt durch eine günstige Regierungspolitik und Partnerschaften mit globalen OEMs, treibt die starke Nachfrage nach Flugzeugstrukturen, Innenausstattungen und Triebwerkskomponenten voran. Die zunehmende Beteiligung des Landes an internationalen Lieferketten der Luft- und Raumfahrt und der Fokus auf fortschrittliche Fertigungstechnologien beschleunigen das Marktwachstum in der kommerziellen und militärischen Luftfahrt.

Welches sind die Top-Unternehmen auf dem Markt für die Herstellung von Luft- und Raumfahrtteilen?

Die Branche der Herstellung von Teilen für die Luft- und Raumfahrt wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Eaton (Irland)

- NTN BEARING CORPORATION OF AMERICA (USA)

- Amphenol Aerospace (USA)

- Berkshire Hathaway Inc. (USA)

- Arconic (USA)

- RBC Bearings Incorporated (USA)

- Stanley Black & Decker, Inc. (USA)

- TriMas (USA)

- Nationale Luft- und Raumfahrtbefestigungsgesellschaft (Taiwan)

- LISI AEROSPACE (Frankreich)

- Triumph Group (USA)

- Safran (Frankreich)

- SKF (Schweden)

- TE Connectivity (Schweiz)

- Satcom Direct, Inc. (USA)

- Boeing (USA)

- Airbus SAS (Frankreich)

- Embraer (Brasilien)

- ATR (Frankreich)

- Lockheed Martin Corporation (USA)

- Textron Aviation Inc. (USA)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für die Herstellung von Luft- und Raumfahrtteilen?

- Im August 2022 hat Safran Data Systems, ein Geschäftsbereich von Safran Electronics & Defense, das indische Unternehmen Captronic Systems übernommen. Safran Data Systems erweitert damit sein Produktportfolio und stärkt seine internationalen Aktivitäten in diesem strategisch wichtigen Land als führender Akteur der Raumfahrtindustrie. Das Unternehmen liefert Instrumente für Tests, Telemetrie und die Kommunikation mit Satelliten und Trägerraketen. Dies stärkt Indiens Kapazitäten, zieht Investitionen an, fördert Innovationen und treibt die allgemeine Marktentwicklung voran.

- Im Mai 2022 gab die JAMCO Corporation die Unterzeichnung einer Supporter-Vereinbarung mit SkyDrive Inc. bekannt, einem Unternehmen, das fliegende Autos entwickelt. JAMCO wird die Zusammenarbeit beginnen, indem es SkyDrive seine Entwicklungsexperten für Flugzeuginnenausstattung zur Verfügung stellt. Diese Zusammenarbeit erweitert die Fähigkeiten von SkyDrive, beschleunigt die Produktentwicklung und stärkt seine Marktposition.

- Im Dezember 2021 kooperierte Intrex Aerospace mit Eaton und UTC Aerospace und entwickelte eine neue Geschäftsstrategie, um den Markt für Luft- und Raumfahrtteile zu erobern. Diese Zusammenarbeit nutzt das gebündelte Know-how und die Ressourcen, um Innovationen voranzutreiben, das Produktangebot zu erweitern und neue Marktchancen zu erschließen. Dies fördert das allgemeine Branchenwachstum.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.