Global Aerospace And Defense C Class Parts Market

Marktgröße in Milliarden USD

CAGR :

%

USD

16.77 Billion

USD

24.78 Billion

2021

2029

USD

16.77 Billion

USD

24.78 Billion

2021

2029

| 2022 –2029 | |

| USD 16.77 Billion | |

| USD 24.78 Billion | |

|

|

|

|

Globaler Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung, nach Produkt (Befestigungselemente, Lager, elektrische Teile, bearbeitete Teile), Anwendung (Motor, Flugzeugstruktur , Innenausstattung, Ausrüstung, Sicherheit und Support; Avionik), Endverbrauch (kommerzielle, militärische, Geschäfts- und allgemeine Luftfahrt, sonstige), Vertriebskanal (OEM, Aftermarkets), Flugzeugtyp (kommerzielle Flugzeuge, Regionalflugzeuge, allgemeine Luftfahrt, Hubschrauber, Militärflugzeuge) – Branchentrends und Prognose bis 2029.

Marktanalyse und -größe für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Die Auswahl hochwertiger Teile ist ein entscheidender Faktor in der Luft- und Raumfahrt- sowie der Verteidigungsindustrie. Sie beeinflusst mehrere Aspekte der Flugzeugleistung von der Entwurfsphase bis zur Entsorgung, wie Sicherheit und Zuverlässigkeit, Lebenszykluskosten, Recyclingfähigkeit, strukturelle Effizienz, Flugleistung, Nutzlast, Energieverbrauch und Entsorgungsfähigkeit. Das Produktsegment „Befestigungselemente“ ist aufgrund des hohen Verbrauchs an Befestigungselementen, darunter Unterlegscheiben, Muttern, Dichtungen, Nieten, Bolzen, Schrauben und Ringe, die als wichtige Komponenten bei der Montage von Flugzeugteilen verwendet werden, das am schnellsten wachsende Produktsegment. Darüber hinaus steigt die Nachfrage nach C-Klasse-Teilen für die Luft- und Raumfahrt und Verteidigung in Luftfahrtanwendungen aufgrund der zunehmenden Betonung der Verbesserung von Komfort und Sicherheit von Flugzeugen im Prognosezeitraum.

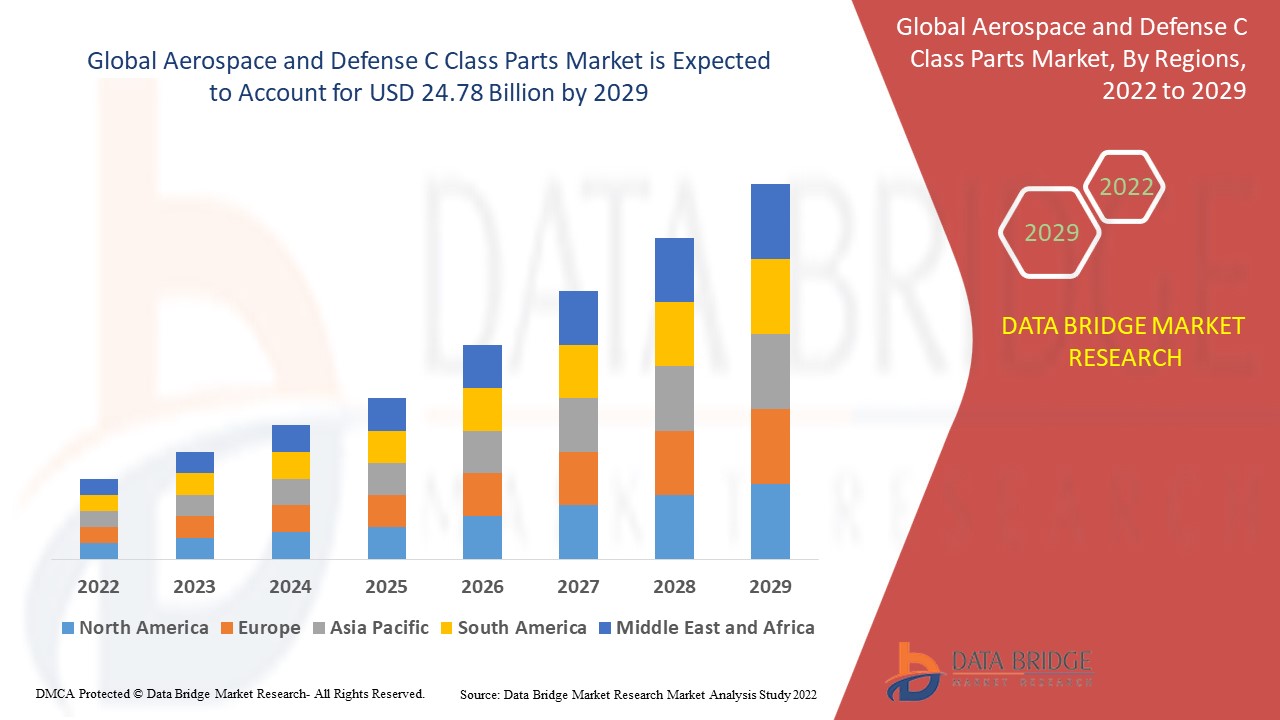

Data Bridge Market Research analysiert, dass der Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung im Jahr 2021 einen Wert von 16,77 Milliarden US-Dollar hatte und bis 2029 voraussichtlich 24,78 Milliarden US-Dollar erreichen wird, was einer CAGR von 5,00 % während des Prognosezeitraums von 2022 bis 2029 entspricht. Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktualisierte Preistrendanalysen und Defizitanalysen von Lieferkette und Nachfrage.

Marktumfang und -segmentierung für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 (Anpassbar auf 2014 – 2019) |

|

Quantitative Einheiten |

Umsatz in Mrd. USD, Volumen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Produkt (Befestigungselemente, Lager, elektrische Teile, bearbeitete Teile), Anwendung (Motor, Flugzeugstruktur, Innenausstattung, Ausrüstung, Sicherheit und Support; Avionik), Endverbrauch (kommerzielle, militärische, Geschäfts- und allgemeine Luftfahrt, andere), Vertriebskanal (OEM, Aftermarkets), Flugzeugtyp (kommerzielle Flugzeuge, Regionalflugzeuge, allgemeine Luftfahrt, Hubschrauber, Militärflugzeuge) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

Eaton (Irland), NTN BEARING CORPORATION OF AMERICA (USA), Amphenol Aerospace (USA), Berkshire Hathaway Inc., (USA), Arconic (USA), RBC Bearings Incorporated (USA), Stanley Black & Decker, Inc. (USA), TriMas (USA), National Aerospace Fasteners Corporation (Taiwan), LISI AEROSPACE (Frankreich), Triumph Group (USA), Safran (Frankreich), SKF (Schweden), TE Connectivity (Schweiz), Satcom Direct, Inc. (USA), Boeing (USA), Airbus SAS (Frankreich), Embraer (Brasilien), ATR (Frankreich), Lockheed Martin Corporation (USA), Textron Aviation Inc., (USA) |

|

Marktchancen |

|

Marktdefinition

Die C-Klasse für Luft- und Raumfahrt sowie Verteidigung umfasst Massenteile mit hohem Volumen und niedrigen Kosten, wie Lager und Befestigungselemente. Zu den Befestigungselementen zählen Nieten, Muttern, Dichtungen, Bolzen, Schrauben, Unterlegscheiben und Ringe, die wichtige Komponenten bei der Flugzeugmontage sind. Während Lager verwendet werden, um Leiterrisse und Hitzeschäden in Fahrwerksstreben oder Stoßdämpfern zu vermeiden.

Globale Marktdynamik für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Treiber

- Steigende Nachfrage nach effektiven Verbindungselementen

Verbindungselemente sind Hardware- Werkzeuge, die bei der Flugzeugherstellung und -konstruktion zwei oder mehr Objekte miteinander verbinden . Der Verbrauch der Verbindungselemente steigt, da sie Muttern, Dichtungen, Nieten, Bolzen, Schrauben, Unterlegscheiben und Ringe umfassen. Diese Komponenten werden als wesentliche Komponenten bei der Montage von Flugzeugteilen verwendet. Die steigende Nachfrage nach hochkorrosionsbeständigen und leichten Verbindungselementen ist der Hauptfaktor, der den Bedarf auf dem globalen Markt für C-Klasse-Teile für die Luft- und Raumfahrt und Verteidigung steigert.

- Steigende Verteidigungsausgaben

Die Militärausgaben sind in den letzten Jahren weltweit erheblich gestiegen. Laut dem Bericht des Stockholmer Friedensforschungsinstituts (SIPRI) stiegen die weltweiten Militärausgaben von 2017 bis 2018 um etwa 2,6 %. Der Anstieg der Verteidigungsausgaben dürfte die Nachfrage nach technologisch fortschrittlichen Flugzeugen wie Hubschraubern, Kampfjets und Transportflugzeugen steigern, was voraussichtlich das Wachstum des Marktes für C-Klasse-Teile für die Luft- und Raumfahrt und Verteidigung vorantreiben wird.

Darüber hinaus wird erwartet, dass die wachsende Luft- und Raumfahrtindustrie und die zunehmende Verwendung des Produkts in Luft- und Raumfahrtanwendungen zur Verbesserung der Festigkeit und Haltbarkeit sowie von Flugzeugpaneelen die Nachfrage nach C-Klasse-Teilen für die Luft- und Raumfahrt und Verteidigung auf dem Markt steigern werden. Auch die steigende Zahl des Passagierverkehrs und die einfache Verfügbarkeit kundenspezifischer Komponenten sind weitere wichtige Faktoren, die das Wachstum des Marktes für C-Klasse-Teile für die Luft- und Raumfahrt und Verteidigung im Prognosezeitraum 2022–2029 wahrscheinlich steigern werden.

Gelegenheiten

- Ausbau der Lufttourismusbranche

Der Ausbau der Lufttourismusbranche steigert den Absatz von Verkehrsflugzeugen, was sich voraussichtlich direkt auf den Absatz von Teilen der C-Klasse für die Luft- und Raumfahrt sowie die Verteidigung auswirken wird. Mehrere Länder investieren mehr in den Luftfahrtsektor, um die Flugverbindungen zwischen Städten und anderen Ländern zu verbessern, was das Wachstum des Marktes für Teile der C-Klasse für die Luft- und Raumfahrt sowie die Verteidigung ankurbeln dürfte.

- Technologischer Fortschritt

Die Hersteller konzentrieren sich auf technologische Fortschritte, sodass die Unternehmen moderne und anspruchsvolle Montagelösungen liefern. Das Unternehmen möchte mit dem Referenzdesign und der Software für intelligente und energieeffiziente C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung dazu beitragen, die Entwicklungskosten zu senken und die Entwicklungszeit zu verkürzen. Dies dürfte die Nachfrage nach C-Klasse-Teilen für die Luft- und Raumfahrt sowie die Verteidigung steigern und günstige Marktchancen schaffen .

Einschränkungen/Herausforderungen

- Nachteile im Zusammenhang mit dem Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Die Verfügbarkeit von Produktersatzstoffen und die Verbreitung nicht vertrauenswürdiger Hersteller werden voraussichtlich als marktbeschränkender Faktor für den Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung wirken und das Marktwachstum im Prognosezeitraum 2022–2029 hemmen.

Dieser Marktbericht für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Auswirkungen von COVID-19 auf den Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Der Hersteller von C-Klasse-Teilen für die Luft- und Raumfahrt sowie die Verteidigung ist größtenteils von den während dieser Pandemie eingestellten Produktionsaktivitäten abhängig und hat das Lieferkettennetzwerk unterbrochen. Die meisten Hersteller von C-Klasse-Teilen für die Luft- und Raumfahrt sowie die Verteidigung sind sich aufgrund der COVID-19-Pandemie nicht sicher, ob die normalen Werksaktivitäten wieder aufgenommen werden können, was das Nachfrage- und Liefernetzwerk des betroffenen Unternehmens erheblich beeinträchtigt. Während dieser Pandemie sind viele Probleme entstanden, wie die Schließung von Fabriken und die Nichtverfügbarkeit von Arbeitskräften in den betroffenen Ländern. Dies führte letztendlich zu einem großen Liquiditätsproblem für den Hersteller von C-Klasse-Teilen für die Luft- und Raumfahrt sowie die Verteidigung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Globaler Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Der Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung ist nach Produkt, Anwendung, Endverbrauch, Vertriebskanal und Flugzeugtyp segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Verbindungselemente

- Lager

- Elektrische Teile

- Bearbeitete Teile

Anwendung

- Motor

- Flugzeugstruktur

- Innenräume

- Ausrüstung

- Sicherheit und Support

- Avionik

Endverbrauch

- Kommerziell

- Militär

- Geschäfts- und allgemeine Luftfahrt

- Sonstiges

Vertriebskanal

- OEM

- Ersatzteilmärkte

Flugzeugtyp

- Verkehrsflugzeuge

- Regionalflugzeuge

- Allgemeine Luftfahrt

- Hubschrauber

- Militärflugzeuge

Regionale Analyse/Einblicke zum Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie Verteidigung

Der Markt für C-Klasse-Teile für die Luft- und Raumfahrt sowie die Verteidigung wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkt, Anwendung, Endverbrauch, Vertriebskanal und Flugzeugtyp wie oben angegeben bereitgestellt.

The countries covered in the aerospace and defense C class parts market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the aerospace and defense C class parts market in terms of market share due to the rapid growth in the manufacture of cabin interior components. This is due to the prevalence of well-established aviation industry with the developing defence industry in this region.

Asia-Pacific is expected to be the fastest developing regions during the forecast period of 2022-2029 due to the growing military spending. Moreover, rising levels of disposable income of the people and increasing demand for military aircraft are some other major factors that will likely increase the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Aerospace and Defense C Class Parts Market Share Analysis

The aerospace and defense C class parts market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus related to aerospace and defense C class parts market.

Some of the major players operating in the aerospace and defense C class parts market are:

- Eaton. (Ireland)

- NTN BEARING CORPORATION OF AMERICA (U.S.)

- Amphenol Aerospace (U.S.)

- Berkshire Hathaway Inc., (U.S.)

- Arconic (U.S.)

- RBC Bearings Incorporated (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- TriMas (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- LISI AEROSPACE (France)

- Triumph Group (U.S.)

- Safran (France)

- SKF (Sweden)

- TE Connectivity (Switzerland)

- Satcom Direct, Inc. (U.S.)

- Boeing (U.S.)

- Airbus S.A.S (France)

- Embraer (Brazil)

- ATR (France)

- Lockheed Martin Corporation (U.S.)

- Textron Aviation Inc (U.S.)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.