Global Additive Manufacturing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

91.84 Billion

USD

419.22 Billion

2024

2032

USD

91.84 Billion

USD

419.22 Billion

2024

2032

| 2025 –2032 | |

| USD 91.84 Billion | |

| USD 419.22 Billion | |

|

|

|

|

Global Additive Manufacturing Market Segmentation, By Material Type (Metal, Plastic, Alloys, and Ceramics), Technology (Stereolithography (SLA), Fused Disposition Modelling (FDM), Laser Sintering (LS), Binder Jetting Printing, Polyjet Printing, Electron Beam Melting (EBM), Laminated Object Manufacturing (LOM), and Others), Application (Automotive, Healthcare, Aerospace, Consumer Goods, Industrial, Defence, Architecture, and Others) - Industry Trends and Forecast to 2031

Additive Manufacturing Market Analysis

The additive manufacturing market is witnessing significant growth, driven by advancements in technology and increasing adoption across various industries. Key developments include the integration of artificial intelligence and machine learning to enhance production efficiency and reduce material waste. In addition, the introduction of new materials, such as advanced polymers and metal alloys, has expanded the application range of additive manufacturing in sectors such as aerospace, healthcare, and automotive. For instance, companies such as Stratasys and Materialise are pioneering solutions that enable the rapid prototyping and production of complex geometries, significantly shortening lead times. Furthermore, the growing trend toward customized products, driven by consumer demand for personalization, is propelling the market forward. Governments are also investing in additive manufacturing technologies to boost local manufacturing capabilities and reduce dependency on global supply chains. As these developments continue to unfold, the additive manufacturing market is set to revolutionize traditional manufacturing processes, offering innovative solutions and enhancing production capabilities across industries.

Additive Manufacturing Market Size

The global additive manufacturing market size was valued at USD 75.97 billion in 2023 and is projected to reach USD 111.05 billion by 2031, with a CAGR of 20.90% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Additive Manufacturing Market Trends

“Increasing Use of Metal 3D Printing Technologies”

The additive manufacturing market is witnessing significant growth, driven by advancements in technology and increasing adoption across various industries. One prominent trend in the additive manufacturing market is the increasing use of metal 3D printing technologies, particularly in the aerospace and automotive sectors. As manufacturers seek to optimize their supply chains and reduce production costs, metal additive manufacturing provides a solution by enabling the production of complex geometries that are often impossible to achieve with traditional methods. For instance, companies such as GE Aviation are utilizing metal 3D printing to create lightweight, high-performance components for jet engines, resulting in significant weight savings and improved fuel efficiency. Furthermore, the development of advanced metal powders and printing techniques, such as Direct Energy Deposition (DED) and Powder Bed Fusion (PBF), is enhancing the capabilities of additive manufacturing. This trend is driving innovation in product design and allowing for more sustainable manufacturing practices, as the precision of additive processes minimizes material waste. As the technology continues to mature, the adoption of metal 3D printing is expected to expand, reshaping the future of manufacturing across various industries.

Report Scope and Additive Manufacturing Market Segmentation

|

Attributes |

Additive Manufacturing Key Market Insights |

|

Segments Covered |

By Application: Automotive, Healthcare, Aerospace, Consumer Goods, Industrial, Defense, Architecture, and Others |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ANSYS, Inc. (U.S.), Höganäs AB (Sweden), EOS (Germany), ARBURG GmbH + Co KG (Germany), Stratasys (U.S.), Renishaw plc. (U.K.), YAMAZAKI MAZAK CORPORATION (Japan), Materialise (Belgium), Markforged (U.S.), Titomic Limited. (Australia), SLM Solutions (Germany), Proto Labs (U.S.), ENVISIONTEC US LLC (U.S.), Ultimaker BV (Netherlands), American Additive Manufacturing LLC (U.S.), Optomec, Inc. (U.S.), 3D Systems Inc. (U.S.), and ExOne (U.S.) |

|

Market Opportunities |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen. |

Marktdefinition für additive Fertigung

Additive Fertigung (AM) unterscheidet sich von traditionellen subtraktiven Fertigungsmethoden, bei denen überschüssiges Material von einem festen Block entfernt wird. In industriellen Anwendungen bezieht sich additive Fertigung normalerweise auf 3D-Druck. Bei diesem Verfahren wird Material in Schichten schrittweise hinzugefügt, um ein Objekt zu erstellen. Dabei wird es von einer dreidimensionalen digitalen Datei geleitet und über eine 3D-Druckersoftware gesteuert. Die Wahl der additiven Fertigungstechnologie richtet sich nach der spezifischen Anwendung und den Anforderungen, wobei aus einer Reihe verfügbarer Technologien ausgewählt wird.

Marktdynamik im Bereich additive Fertigung

Treiber

- Steigende Nachfrage nach Leichtbauteilen

Die steigende Nachfrage nach Leichtbauteilen ist ein wichtiger Treiber des Marktes für additive Fertigung, insbesondere in der Luft- und Raumfahrt sowie im Automobilsektor. Da die Hersteller versuchen, die Kraftstoffeffizienz zu verbessern und die Emissionen zu reduzieren, spielen Leichtbaumaterialien bei der Erreichung dieser Ziele eine entscheidende Rolle. Laut einem Bericht der International Air Transport Association (IATA) kann eine Gewichtsreduzierung eines Flugzeugs um nur 1 % zu einer Kraftstoffeinsparung von etwa 0,75 % führen. Dies hat Unternehmen wie Boeing und Airbus dazu veranlasst, additive Fertigungstechniken anzuwenden, um leichtere Teile wie Halterungen und Strukturkomponenten herzustellen, die zur allgemeinen Gewichtsreduzierung beitragen können. Da die Industrien weiterhin Wert auf Nachhaltigkeit und Effizienz legen, wird die Nachfrage nach Leichtbauteilen das Wachstum des Marktes für additive Fertigung erheblich beeinflussen und Innovationen und Investitionen in diesem Bereich vorantreiben.

- Erweiterte Anwendungen in verschiedenen Endverbraucherbranchen

Die zunehmende Anwendung der additiven Fertigung in verschiedenen Endverbraucherbranchen ist ein wichtiger Markttreiber, da Unternehmen zunehmend das Potenzial der Technologie zur Steigerung von Produktivität und Innovation erkennen. Branchen wie die Luft- und Raumfahrt, die Automobilindustrie, das Gesundheitswesen und die Konsumgüterindustrie nutzen die additive Fertigung, um Produktionsprozesse zu rationalisieren, Abfall zu reduzieren und komplexe Designs zu ermöglichen, die zuvor nicht realisierbar waren. Unternehmen wie Airbus nutzen den Metalldruck zur Herstellung von Leichtbauteilen, die dazu beitragen, den Kraftstoffverbrauch und die Gesamtkosten zu senken. Im Gesundheitswesen hat die additive Fertigung die Herstellung maßgeschneiderter medizinischer Geräte und Implantate revolutioniert, wie Unternehmen wie Stratasys zeigen, das mit Krankenhäusern zusammengearbeitet hat, um patientenspezifische chirurgische Modelle herzustellen. Darüber hinaus nutzt die Automobilindustrie zunehmend 3D-Druck für die Prototypenentwicklung und die Herstellung von Endverbrauchsteilen. Diese zunehmende Akzeptanz in allen Branchen unterstreicht die wachsende Bedeutung der additiven Fertigung in modernen Fertigungsstrategien und treibt so das Marktwachstum voran.

Gelegenheiten

- Zunehmende Individualisierung und Massenproduktion

Die additive Fertigung unterscheidet sich von der traditionellen Fertigung dadurch, dass die zusätzlichen Kosten entfallen, die normalerweise mit der Anpassung verbunden sind, und dass keine speziellen Formen oder Werkzeuge erforderlich sind. Stattdessen ist nur ein 3D-Prototypdesign erforderlich, das der Kunde häufig selbst erstellen kann. Diese einfache Anpassung und die schnellen Produktionsmöglichkeiten führen zu einer hohen Nachfrage und ermöglichen die Massenproduktion einzigartiger Designs ohne Kompromisse bei Kosten oder Zeit bei der Verwendung von 3D-Druckern. Darüber hinaus erleichtert dieser Ansatz die Massenanpassung und verbessert das Kundenerlebnis, indem er ein Gefühl der Zugehörigkeit und Zufriedenheit fördert, das bei herkömmlichen Herstellungsverfahren häufig fehlt. Kunden genießen die Freiheit, ihre bevorzugten Designs auszuwählen, wie beispielsweise NIKE, das auf seiner Website Schuhe mit 3D-Designoptionen anbietet, mit denen Verbraucher mühelos ihre eigenen Farbkombinationen auswählen können. Diese Fähigkeit stärkt die Verbindung zwischen Herstellern und ihren Kunden und bietet einen Wettbewerbsvorteil auf dem Markt, indem sie personalisierte Erfahrungen ermöglicht und letztendlich größere Marktchancen schafft.

- Erhöhung der staatlichen Finanzierung

Die Erhöhung staatlicher Mittel zur Förderung der additiven Fertigung bietet eine bedeutende Marktchance, da Regierungen weltweit das Potenzial der Technologie erkennen, Innovationen voranzutreiben, die Wettbewerbsfähigkeit zu steigern und Arbeitsplätze zu schaffen. So hat die US-Regierung über das Advanced Manufacturing National Program Office (AMNPO) über 300 Millionen US-Dollar in die Forschung zur additiven Fertigung investiert, um die Einführung dieser Technologie in verschiedenen Branchen zu beschleunigen. Darüber hinaus hat das Verteidigungsministerium (DoD) dem Manufacturing Innovation Institute for Advanced Materials and Processes Mittel zugewiesen, das sich auf die Weiterentwicklung additiver Fertigungstechniken für militärische Anwendungen konzentriert. Diese Finanzierung erleichtert Forschung und Entwicklung und fördert die Zusammenarbeit zwischen Branchenteilnehmern, akademischen Einrichtungen und Regierungsbehörden. Infolgedessen werden Länder, die aktiv in die additive Fertigung investieren, wahrscheinlich ihre industriellen Kapazitäten verbessern, was zu einer höheren Produktionseffizienz und niedrigeren Kosten führt. Die zunehmende staatliche Unterstützung unterstreicht das Potenzial der additiven Fertigung, Branchen zu verändern und eine widerstandsfähigere Wirtschaftslandschaft zu schaffen, was sie zu einer wertvollen Chance für Unternehmen und Investoren macht.

Einschränkungen/Herausforderungen

- Hohe Kosten für Ausrüstung und Maschinen

Die hohen Kosten für Ausrüstung und Maschinen stellen eine große Herausforderung für den Markt der additiven Fertigung dar und verhindern möglicherweise eine breite Einführung, insbesondere bei kleinen und mittleren Unternehmen (KMU). Industrielle 3D-Drucker können beispielsweise zwischen Zehntausenden und mehreren Millionen Dollar kosten, je nach Leistungsfähigkeit und verwendeten Materialien. Diese finanzielle Hürde hält kleinere Unternehmen oft davon ab, in additive Fertigungstechnologien zu investieren, und schränkt ihre Wettbewerbsfähigkeit in einem Markt ein, der zunehmend von Individualisierung und Rapid Prototyping geprägt ist. Darüber hinaus verschärfen die Kosten für Wartung, Materialien und Fachpersonal die finanziellen Herausforderungen noch weiter. Dies behindert das allgemeine Marktwachstum.

- Mangelnde Softwareeffizienz

Additive Fertigung mit dem Pulverbettschmelzverfahren (PBF) mittels Laser kann komplexe und komplizierte Formen erzeugen, darunter auch organische Strukturen, deren Herstellung mit herkömmlichen Fertigungsmethoden bisher zu teuer oder zu kompliziert war. Die durch das Laser-PBF ermöglichten Designfreiheiten ermöglichen beispielsweise die Entwicklung von Leichtbauteilen mit komplizierten Gitterstrukturen und optimieren so den Materialeinsatz. Allerdings bringt das Laser-PBF auch gewisse Herausforderungen mit sich. Dazu gehören das Ausfallrisiko bei dünnwandigen oder hochaspektierten Teilen während der Produktion, Schwierigkeiten beim Entfernen von Stützstrukturen, Variationen in der Oberflächenrauheit aufgrund von Schichteffekten und die Notwendigkeit unterschiedlicher Prozessparametereinstellungen, wie z. B. Laseranpassungen für Up-Skin- und Down-Skin-Oberflächen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden. Neben dem Standardbericht bieten wir auch eine eingehende Analyse des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Rohstoffanalyse, Produktionsanalyse, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalyse, Lösungen zum Risikomanagement der Lieferkette, erweitertes Benchmarking und andere Dienstleistungen für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Marktumfang der additiven Fertigung

Der Markt ist nach Materialtyp, Technologie und Anwendung segmentiert . Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Materialtyp

- Metall

- Plastik

- Legierungen

- Keramik

Technologie

- Stereolithografie (SLA)

- Fused Deposition Modeling (FDM)

- Lasersintern (LS)

- Binder Jetting Druck

- Polyjet-Druck

- Elektronenstrahlschmelzen (EBM)

- Herstellung laminierter Objekte (LOM)

- Sonstiges

Anwendung

- Automobilindustrie

- Gesundheitspflege

- Luft- und Raumfahrt

- Konsumgüter

- Industrie

- Verteidigung

- Architektur

- Sonstiges

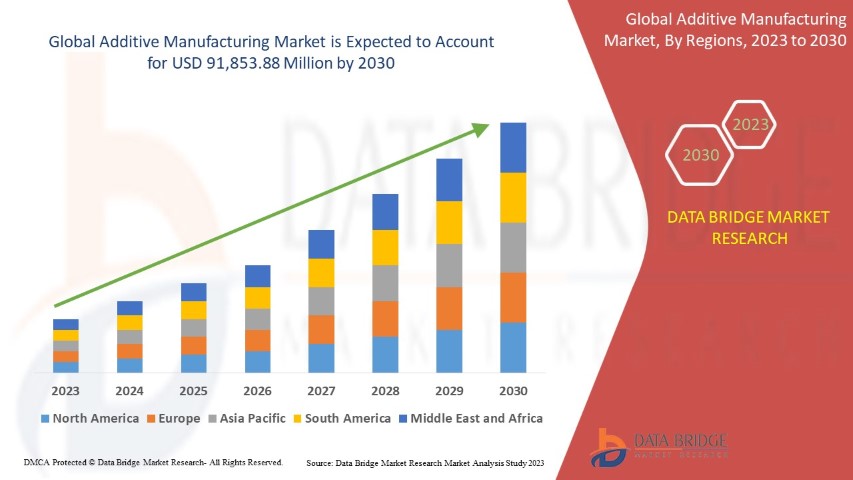

Regionale Analyse des Marktes für additive Fertigung

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Materialtyp, Technologie und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika nimmt auf dem globalen Markt für additive Fertigung eine führende Position ein, wobei die USA bei diesem Wachstum ganz vorn liegen. Die Dominanz der USA in der Region ist auf ihre fortschrittlichen technologischen Entwicklungen und Innovationen im 3D-Druck zurückzuführen, die ein robustes Ökosystem für die additive Fertigung hervorgebracht haben. Darüber hinaus hat eine starke Präsenz wichtiger Branchenakteure, gepaart mit erheblichen Investitionen in Forschung und Entwicklung, die USA weiter an die Spitze der additiven Fertigungslandschaft katapultiert.

Der asiatisch-pazifische Raum wird voraussichtlich stark wachsen. Der regionale Markt wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate erreichen. Dieses Wachstum ist in erster Linie auf die laufenden Fortschritte und Modernisierungen zurückzuführen, die von wichtigen Akteuren im Fertigungssektor in der gesamten Region durchgeführt werden. Der asiatisch-pazifische Raum wird zunehmend als Fertigungszentrum für Branchen wie Automobil, Gesundheitswesen und Unterhaltungselektronik anerkannt. Darüber hinaus wird erwartet, dass die rasche Urbanisierung im Prognosezeitraum eine entscheidende Rolle bei der Förderung der Einführung des 3D-Drucks in der Region spielen wird.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil der additiven Fertigung

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den einzelnen Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die auf dem Markt tätigen Marktführer im Bereich additive Fertigung sind:

- ANSYS, Inc. (USA)

- Höganäs AB (Schweden)

- EOS (Deutschland)

- ARBURG GmbH + Co KG (Deutschland)

- Stratasys (USA)

- Renishaw plc. (Großbritannien)

- YAMAZAKI MAZAK CORPORATION (Japan)

- Materialise (Belgien)

- Markforged (USA)

- Titomic Limited. (Australien)

- SLM Solutions (Deutschland)

- Proto Labs (USA)

- ENVISIONTEC US LLC (USA)

- Ultimaker BV (Niederlande)

- American Additive Manufacturing LLC (USA)

- Optomec, Inc. (USA)

- 3D Systems Inc. (USA)

- ExOne (USA)

Neueste Entwicklungen auf dem Markt für additive Fertigung

- Im November 2023 stellte Autodesk Inc. Autodesk AI vor, eine neue, in seine Produkte integrierte Technologie, die generative Fähigkeiten und intelligente Unterstützung bietet. Diese Innovation soll Fehler reduzieren, indem sie sich wiederholende Aufgaben automatisiert und auf Kundenbedürfnisse eingeht

- Im März 2023 stellte 3D Systems, Inc. zwei neue Druckmaterialien vor, NextDent Cast und NextDent Base, sowie die Druckplattform NextDent LCD1, die die Materialeigenschaften verbessern und einen benutzerfreundlichen Kleinformatdrucker bieten sollen. Diese Produkteinführungen sollen Kunden dabei unterstützen, die Einführung der additiven Fertigung zu beschleunigen

- Im Oktober 2022 brachte das US-Unternehmen GE Additive seine neue Binder-Jetting-Plattform der Serie 3 auf den Markt, die für die industrielle Produktion von Metallteilen wie Gussteilen konzipiert ist. Das Unternehmen hat über 140.000 dieser Komponenten hergestellt, die im Vergleich zu Standardalternativen eine um 15 % höhere Kraftstoffeffizienz bieten.

- Im Juli 2022 begann Toyota mit der Herstellung von Lagerteilen im HP Multi Jet Fusion 3D-Druck und bot diese neben traditionell produzierten Ersatzteilen an. Diese Initiative zielt darauf ab, die Designs zu optimieren und die Vorlaufzeiten für neu entwickelte Komponenten im Automobilsektor zu verkürzen.

- Im Februar 2022 gab Dassault Systèmes eine strategische Partnerschaft mit Cadence Design Systems, Inc. bekannt, um integrierte Lösungen für die Entwicklung leistungsstarker elektronischer Systeme für Unternehmenskunden in verschiedenen Branchen bereitzustellen, darunter Hightech, Industrieausrüstung, Transport und Mobilität, Luft- und Raumfahrt und Verteidigung sowie Gesundheitswesen

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.