Europäischer Markt für tragbare Konferenztechnologie, nach Angebot (Hardware, Software und Dienste), Konferenztyp ( Audiokonferenzen und Videokonferenzen ), Bereitstellungsmodus (vor Ort und in der Cloud ), Organisationsgröße (kleine und mittlere Organisationen und große Organisationen), Anwendung (Verbraucher und Unternehmen), Endnutzung (Unternehmen, Bildung, Gesundheitswesen, Regierung und Verteidigung, Banken, Finanzdienstleistungen und Versicherungen (BSFI), Medien und Unterhaltung und andere), Land (Deutschland, Großbritannien, Frankreich, Italien, Spanien, Russland, Niederlande, Belgien, Schweiz, Türkei und übriges Europa) Branchentrends und Prognose bis 2029

Marktanalyse und Einblicke : Europäischer Markt für tragbare Konferenztechnologie

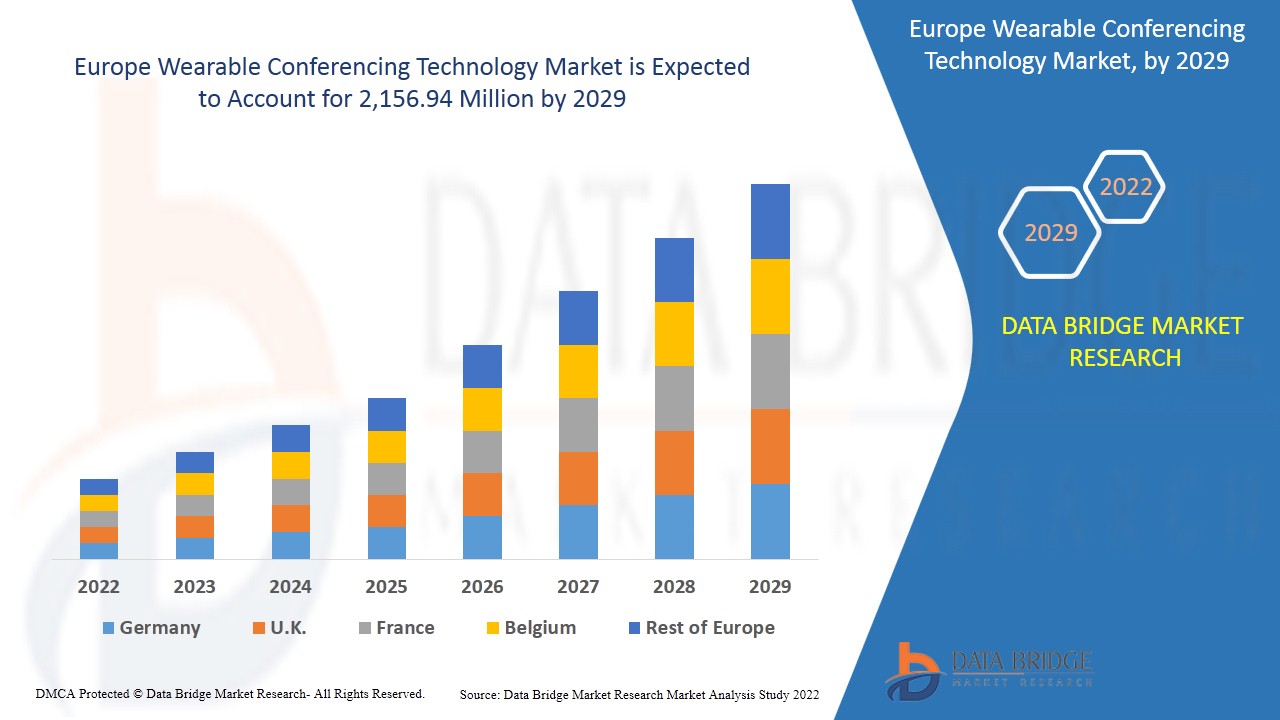

Der europäische Markt für tragbare Konferenztechnologie wird im Prognosezeitraum von 2022 bis 2029 voraussichtlich an Marktwachstum gewinnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 12,7 % wächst und bis 2029 voraussichtlich 2.156,94 Millionen USD erreichen wird. Der zunehmende Fokus auf und die Einführung einer Remote-Arbeitskultur beflügelt den europäischen Markt für tragbare Konferenztechnologie.

Tragbare Technologie, oft auch als „Wearables“ bezeichnet, ist eine Klasse von elektronischen Geräten, die am Körper getragen werden können. Die Gadgets sind Freisprechgeräte mit praktischen Anwendungen, die von Mikroprozessoren angetrieben werden und Daten über das Internet senden und empfangen können. Mit Konferenzlösungen ist eine Echtzeit-Zusammenarbeit zwischen mehreren Geräten möglich. Teilnehmer können sich über eine Konferenzplattform mit ihren Mobilgeräten, Laptops oder Personalcomputern (PCs) an einem einzigen digitalen Ort treffen. Benutzer können über eine Internetverbindung auf Konferenztechnologien zugreifen, die als Software as a Service (SaaS) bereitgestellt werden. Eine Webkonferenzplattform kann auch vor Ort bereitgestellt werden, wobei die Rechenzentrumskapazitäten eines Unternehmens genutzt werden. Es handelt sich also um eine Technologie, die in Geräten wie Google Glasses oder Microsoft HoloLens für die Anwendung von Konferenzen und Zusammenarbeit über Audio- oder Videomedien verwendet wird. Derzeit hat dieser Markt breite Anwendungsmöglichkeiten in der Unternehmenswelt für professionelle Zusammenarbeit und in den Bereichen Bildung und Ausbildung.

Der zunehmende Fokus und die Einführung einer Remote-Arbeitskultur wirken als Treiber auf dem europäischen Markt für tragbare Konferenztechnologie. Die unregelmäßige Verfügbarkeit von Windenergie stellt eine Herausforderung dar. Es wird jedoch erwartet, dass die Zunahme verschiedener strategischer Entscheidungen wie Partnerschaften Chancen für den europäischen Markt für tragbare Konferenztechnologie bietet. Die hohen Kosten der Konferenzinfrastruktur können sich als Hemmnis für den Markt erweisen.

Der europäische Marktbericht für tragbare Konferenztechnologie liefert Details zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das europäische Marktszenario für tragbare Konferenztechnologie zu verstehen, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team wird Ihnen helfen, eine Umsatzlösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Tragbare Konferenztechnologie – Marktumfang und Marktgröße in Europa

Der europäische Markt für tragbare Konferenztechnologie ist segmentiert nach Angebot, Konferenztyp, Bereitstellungsmodus, Unternehmensgröße, Anwendung und Endverbrauch. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und bestimmt Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten.

- Basierend auf dem Angebot ist der europäische Markt für tragbare Konferenztechnologie in Hardware, Software und Dienstleistungen unterteilt. Hardware ist weiter unterteilt in Kamera, Mikrofon und Sonstiges. Darüber hinaus sind Dienstleistungen weiter unterteilt in Managed Services und Professional Services. Im Jahr 2022 wird Hardware voraussichtlich den europäischen Markt für tragbare Konferenztechnologie dominieren, da sie Funktionen wie Live-Zusammenarbeit bei der Herstellung bietet und eine Plattform für die Ausführung der Software bereitstellt.

- Basierend auf der Art der Konferenz ist der europäische Markt für tragbare Konferenztechnologie in Audiokonferenzen und Videokonferenzen unterteilt . Im Jahr 2022 wird das Segment Videokonferenzen voraussichtlich dominieren, da es virtuelle Meetings und Zusammenarbeit auf globaler Ebene ermöglicht und so die Reichweite des Unternehmens erhöht, um Meetings besser mit visueller Hilfe durchzuführen.

- Basierend auf dem Bereitstellungsmodus ist der europäische Markt für tragbare Konferenztechnologie in On-Premise und Cloud segmentiert. Im Jahr 2022 wird das On-Premise-Segment voraussichtlich den Markt dominieren, da es dazu beiträgt, Sicherheit und Privatsphäre der Infrastruktur im Unternehmen zu gewährleisten. Es hilft auch, das Video für die zukünftige Verwendung sicher aufzuzeichnen, wodurch die Nachfrage auf dem Markt steigt.

- Basierend auf der Unternehmensgröße ist der europäische Markt für tragbare Konferenztechnologie in kleine und mittlere Unternehmen sowie große Unternehmen segmentiert. Im Jahr 2022 wird das Segment der großen Unternehmen voraussichtlich den Markt dominieren, da die Lösung dem Unternehmen hilft, seine Ziele durch Produktivitätssteigerung und Betriebsoptimierung effizienter zu erreichen.

- Basierend auf der Anwendung ist der europäische Markt für tragbare Konferenztechnologie in Verbraucher und Unternehmen unterteilt. Im Jahr 2022 wird das Unternehmenssegment voraussichtlich den Markt dominieren, da die Lösung den Mitarbeitern hilft, problemlos aus der Ferne zu arbeiten und ihren Unternehmensbetrieb zu vervollständigen.

- Basierend auf der Endnutzung ist der europäische Markt für tragbare Konferenztechnologie in Unternehmen, Bildung, Gesundheitswesen , Regierung und Verteidigung, Banken, Finanzdienstleistungen und Versicherungen (BSFI), Medien und Unterhaltung und Sonstige unterteilt. Alle Segmente sind weiter nach Bereitstellungsmodus und Organisationsgröße unterteilt. Der Bereitstellungsmodus umfasst vor Ort und in der Cloud. Die Organisationsgröße umfasst kleine und mittlere Organisationen sowie große Organisationen. Im Jahr 2022 wird das Unternehmenssegment voraussichtlich den Markt dominieren, da Konferenzlösungen den Mitarbeitern helfen, effizient und in Echtzeit zusammenzuarbeiten und an Projekten zu arbeiten.

Europa Tragbare Konferenztechnologie Markt – Länderebene Analyse

Der europäische Markt für tragbare Konferenztechnologie wird analysiert und die Marktgröße des Angebots, der Konferenztyp, der Bereitstellungsmodus, die Organisationsgröße, die Anwendung und der Endverbrauch werden wie oben angegeben berücksichtigt.

Die im europäischen Marktbericht für tragbare Konferenztechnologie abgedeckten Länder sind Deutschland, Großbritannien, Frankreich, Italien, Spanien, Russland, die Niederlande, Belgien, die Schweiz, die Türkei und das übrige Europa. Deutschland dominiert den europäischen Markt für tragbare Konferenztechnologie aufgrund der hohen Nachfrage von größeren Unternehmen, die über weltweit verteilte Produktionsstätten verfügen und Fernunterstützung benötigen. Großbritannien belegt den zweiten Platz aufgrund der steigenden Nachfrage aus neuen Anwendungen wie dem Gesundheitswesen und dem Bildungswesen nach Fernschulungen. Frankreich belegt den dritten Platz aufgrund der technologischen Forschung im Gesundheitswesen und der Nachfrage nach entfernten Produktionsstätten.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit europäischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Die zunehmende Verbreitung von Smart-Geräten und Internetdiensten fördert das Marktwachstum des europäischen Marktes für tragbare Konferenztechnologie

Der europäische Markt für tragbare Konferenztechnologie bietet Ihnen außerdem eine detaillierte Marktanalyse zum Wachstum jedes Landes in einem bestimmten Markt. Darüber hinaus bietet es detaillierte Informationen zur Strategie der Marktteilnehmer und ihrer geografischen Präsenz. Die Daten sind für den historischen Zeitraum 2011 bis 2020 verfügbar.

Wettbewerbsumfeld und Marktanteilsanalyse für tragbare Konferenztechnologie in Europa

Die Wettbewerbslandschaft des europäischen Marktes für tragbare Konferenztechnologie liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den europäischen Markt für tragbare Konferenztechnologie.

Die wichtigsten Unternehmen, die sich mit tragbarer Konferenztechnologie in Europa befassen, sind Logitech, Vuzix Corporation, Vidyo, Inc., Ricoh, Zoom Video Communications, Inc., Microsoft, LogMeIn, Inc., RealWear, Inc., DIALPAD, INC., Google (eine Tochtergesellschaft von Alphabet Inc.), Chironix, Seiko Epson Corporation, Iristick, Robert Bosch GmbH, ezTalks, HTC Corporation, Sony Corporation, Lenovo, EON Reality, TeamViewer und andere inländische Akteure. DBMR-Analysten kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Darüber hinaus werden von den Unternehmen weltweit zahlreiche Verträge und Vereinbarungen initiiert, was den europäischen Markt für tragbare Konferenztechnologie ankurbelt.

Zum Beispiel

- Im Oktober 2021 hat LogMeIn, Inc. GoToConnect Legal veröffentlicht, eine neue Version seiner Unified Communications as a Service (UCaaS)-Plattform. Die Plattform wurde entwickelt, um den Anforderungen von Rechtsexperten gerecht zu werden, indem sie die Zusammenarbeit mit Kunden und Kollegen erleichtert, um die abrechenbaren Stunden zu maximieren. Die Lösung ermöglicht es, nicht abgerechnete Zeit zu minimieren, den Umsatz zu maximieren, Vorschriften von Verwaltungsorganen zu verwalten und eine hohe Sicherheit in der Praxis aufrechtzuerhalten. Auf diese Weise wird das Unternehmen dazu beitragen, seinen Kunden qualitativ hochwertige und leicht abrechenbare Dienstleistungen anzubieten.

- Im Dezember 2021 stellte Vidyo, Inc. neue VidyoRoom Solutions-Schnittstellen vor, darunter drei neue Videokonferenz-Erlebnisse für das Büro, die darauf zugeschnitten sind, die beste Zusammenarbeitsumgebung für hybride Teams zu bieten. Neue Schnittstellen für kleine Besprechungsräume, Konferenzräume und Sitzungssäle, einschließlich Konferenzsteuerung und Unterstützung für immersive Erlebnisse, werden immer wichtiger, da Mitarbeiter nach der Pandemie versuchen, ins Büro zurückzukehren, während andere weiterhin aus der Ferne arbeiten. Damit wird das Unternehmen seinen Kunden benutzerfreundliche Erfahrungen bieten können.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF Europe Wearable conferencing technology Market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- type timeline curve

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- surging focus and adoption of remote working culture

- INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

- RISE IN ADOPTION OF conferencing technology BY EDUCATIONAL INSTITUTES

- RESTRAINTS

- high cost of conferencing infrastructure

- LOSS OF DATA AND PRIVACY

- OPPORTUNITIES

- INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

- RISE IN Initiatives by government

- Challenges

- EUROPE ECONOMIC SLOWDOWN LIMITS

- Electronic components are pushing smart glasses boundAries

- IMPACT ANALYSIS OF COVID-19 on Europe Wearable conferencing technology market

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- Strategic decision by manufacturers and government initiatives after covid-19

- Impact on demand

- PRICE IMPACT

- Impact on supply chain

- Conclusion

- Europe Wearable conferencing technology Market, BY offering

- overview

- Hardware

- Camera

- Microphone

- Others

- Software

- Services

- Managed Services

- Professional Services

- Europe Wearable conferencing technology Market, BY conferencing type

- overview

- Video Conferencing

- Audio Conferencing

- Europe Wearable conferencing technology Market, BY deployment mode

- overview

- on-premise

- cloud

- Europe Wearable conferencing technology Market, BY organization size

- overview

- large organization

- small & medium organization

- Europe Wearable conferencing technology Market, BY application

- overview

- enterprise

- consumer

- Europe Wearable conferencing technology Market, BY end use

- overview

- Corporate

- Market By deployment mode

- ON-PREMISE

- CLOUD

- Market By organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Education

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Healthcare

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Government and Defense

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Media and Entertainment

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Banking, Financial Services and Insurance (BFSI)

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Other

- MARKET BY DEPLOYMENT MODE

- ON-PREMISE

- CLOUD

- MARKET BY organization size

- LARGE ORGANIZATION

- SMALL & MEDIUM ORGANIZATION

- Europe Wearable conferencing technology Market, by REGION

- EUROPE

- germany

- u.k.

- france

- italy

- spain

- russia

- netherlands

- belgium

- switzerland

- turkey

- rest of europe

- EUROPE Wearable conferencing technology market: COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- Company profile

- GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MICROSOFT

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LENEVO

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- RICOH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SEIKO EPSON CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CHIRONIX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DIALPAD, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- EON REALITY

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- EZTALKS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HTC CORPORATION

- COMPANY PROFILE

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- IRISTICK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LOGITECH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LOGMEIN, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- REALWEAR, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ROBERT BOSCH GMBH

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SONY CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- TEAMVIEWER

- COMPANY SNAPSHOT

- REVNUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VIDYO, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- VUZIX CORPORATION

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ZOOM VIDEO COMMUNICATIONS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Tabellenverzeichnis

TABLE 1 Europe Wearable conferencing technology Market, BY offering, 2020-2029 (USD Million)

TABLE 2 Europe Hardware in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 3 Europe Hardware in wearable conferencing technology Market, By Type, 2020-2029 (USD Million)

TABLE 4 Europe Software in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 5 Europe Services in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 6 Europe Services in wearable conferencing technology Market, By Type, 2020-2029 (USD Million)

TABLE 7 Europe Wearable conferencing technology Market, BY conferencing type, 2020-2029 (USD Million)

TABLE 8 Europe Video Conferencing in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 9 Europe Audio Conferencing in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 10 Europe Wearable conferencing technology Market, BY deployment mode, 2020-2029 (USD Million)

TABLE 11 Europe on-premise in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 12 Europe cloud in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 13 Europe Wearable conferencing technology Market, BY organization size, 2020-2029 (USD Million)

TABLE 14 Europe large organization in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 15 Europe small & medium organization in wearable conferencing technology Market, By Region, 2020-2029 (USD Million)

TABLE 16 Europe Wearable conferencing technology Market, BY application, 2020-2029 (USD Million)

TABLE 17 Europe enterprise in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 18 Europe consumer in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 19 Europe Wearable conferencing technology Market, BY end use, 2020-2029 (USD Million)

TABLE 20 Europe Corporate in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 21 Europe Corporate in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 22 Europe Corporate in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 23 Europe Education in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 24 Europe Education in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 25 Europe Education in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 26 Europe Healthcare in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 27 Europe Healthcare in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 28 Europe Healthcare in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 29 Europe Government and Defense in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 30 Europe Government and Defense in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 31 Europe Government and Defense in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 32 Europe Media and Entertainment in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 33 Europe Media and Entertainment in wearable conferencing technology Market, By Deployment Mode, 2020-2029 (USD Million)

TABLE 34 Europe Media and Entertainment in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 35 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 36 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 37 Europe Banking, Financial Services and Insurance (BFSI) in wearable conferencing technology Market, By organization size, 2020-2029 (USD Million)

TABLE 38 Europe Other in wearable conferencing technology Market, By region, 2020-2029 (USD Million)

TABLE 39 Europe Other in wearable conferencing technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 40 Europe Other in wearable conferencing technology Market, By Organization Size, 2020-2029 (USD Million)

TABLE 41 Europe Wearable Conferencing Technology Market, By Country, 2020-2029 (USD Million)

TABLE 42 Europe Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 43 Europe hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 44 Europe Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 45 Europe Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 46 Europe Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 47 Europe Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 48 Europe Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 49 Europe Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 50 Europe corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 51 Europe corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 52 Europe education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 53 Europe education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 54 Europe healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 55 Europe healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 56 Europe government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 57 Europe government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 58 Europe media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 59 Europe media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 60 Europe banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 61 Europe BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 62 Europe other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 63 Europe other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 64 germany Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 65 GERMANY hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 66 GERMANY Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 67 GERMANY Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 68 GERMANY Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 69 GERMANY Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 70 GERMANY Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 71 GERMANY Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 72 GERMANY corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 73 GERMANY corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 74 GERMANY education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 75 GERMANY education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 76 GERMANY healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 77 GERMANY healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 78 GERMANY government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 79 GERMANY government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 80 GERMANY media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 81 GERMANY media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 82 GERMANY banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 83 GERMANY BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 84 GERMANY other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 85 GERMANY Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 86 U.K. Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 87 U.K. hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 88 U.K. Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 89 U.K. Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 90 U.K. Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 91 U.K. Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 92 U.K. Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 93 U.K. Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 94 U.K. corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 95 U.K. corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 96 U.K. education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 97 U.K. education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 98 U.K. healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 99 U.K. healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 100 U.K. government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 101 U.K. government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 102 U.K. media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 103 U.K. media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 104 U.K. banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 105 U.K. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 106 U.K. other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 107 U.K. Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 108 France Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 109 France hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 110 France Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 111 France Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 112 France Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 113 France Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 114 France Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 115 France Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 116 France corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 117 France corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 118 France education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 119 France education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 120 France healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 121 France healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 122 France government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 123 France government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 124 France media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 125 France media and entertainment Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 126 France banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 127 France BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 128 France other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 129 France Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 130 Italy Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 131 Italy hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 132 Italy Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 133 Italy Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 134 Italy Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 135 Italy Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 136 Italy Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 137 Italy Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 138 Italy corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 139 Italy corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 140 Italy education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 141 Italy education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 142 Italy healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 143 Italy healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 144 Italy government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 145 Italy government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 146 Italy media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 147 Italy media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 148 Italy banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 149 Italy BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 150 Italy other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 151 Italy Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 152 Spain Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 153 Spain hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 154 Spain Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 155 Spain Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 156 Spain Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 157 Spain Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 158 Spain Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 159 Spain Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 160 Spain corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 161 Spain corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 162 Spain education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 163 Spain education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 164 Spain healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 165 Spain healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 166 Spain government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 167 Spain government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 168 Spain media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 169 Spain media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 170 Spain banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 171 Spain BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 172 Spain other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 173 Spain Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 174 Russia Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 175 Russia hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 176 Russia Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 177 Russia Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 178 Russia Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 179 Russia Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 180 Russia Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 181 Russia Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 182 Russia corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 183 Russia corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 184 Russia education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 185 Russia education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 186 Russia healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 187 Russia healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 188 Russia government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 189 Russia government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 190 Russia media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 191 Russia media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 192 Russia banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 193 Russia BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 194 Russia other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 195 Russia Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 196 Netherlands Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 197 Netherlands hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 198 Netherlands Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 199 Netherlands Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 200 Netherlands Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 201 Netherlands Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 202 Netherlands Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 203 Netherlands Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 204 Netherlands corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 205 Netherlands corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 206 Netherlands education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 207 Netherlands education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 208 Netherlands healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 209 Netherlands healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 210 Netherlands government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 211 Netherlands government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 212 Netherlands media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 213 Netherlands media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 214 Netherlands banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 215 Netherlands BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 216 Netherlands other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 217 Netherlands Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 218 Belgium Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 219 Belgium hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 220 Belgium Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 221 Belgium Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 222 Belgium Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 223 Belgium Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 224 Belgium Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 225 Belgium Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 226 Belgium corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 227 Belgium corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 228 Belgium education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 229 Belgium education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 230 Belgium healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 231 Belgium healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 232 Belgium government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 233 Belgium government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 234 Belgium media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 235 Belgium media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 236 Belgium banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 237 Belgium BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 238 Belgium other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 239 Belgium Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 240 Switzerland Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 241 Switzerland hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 242 Switzerland Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 243 Switzerland Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 244 Switzerland Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 245 Switzerland Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 246 Switzerland Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 247 Switzerland Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 248 Switzerland corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 249 Switzerland corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 250 Switzerland education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 251 Switzerland education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 252 Switzerland healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 253 Switzerland healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 254 Switzerland government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 255 Switzerland government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 256 Switzerland media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 257 Switzerland media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 258 Switzerland banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 259 Switzerland BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 260 Switzerland other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 261 Switzerland Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 262 Turkey Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

TABLE 263 Turkey hardware in Wearable Conferencing Technology Market, By Type, 2020-2029 (USD Million)

TABLE 264 Turkey Services in Wearable Conferencing Technology Market, By type, 2020-2029 (USD Million)

TABLE 265 Turkey Wearable Conferencing Technology Market, By Conferencing type, 2020-2029 (USD Million)

TABLE 266 Turkey Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 267 Turkey Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 268 Turkey Wearable Conferencing Technology Market, By application, 2020-2029 (USD Million)

TABLE 269 Turkey Wearable Conferencing Technology Market, By end use, 2020-2029 (USD Million)

TABLE 270 Turkey corporate in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 271 Turkey corporate in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 272 Turkey education in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 273 Turkey education in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 274 Turkey healthcare in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 275 Turkey healthcare in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 276 Turkey government and defense in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 277 Turkey government and defense in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 278 Turkey media and entertainment in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 279 Turkey media and entertainment in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 280 Turkey banking, financial services and insurance (Bfsi) in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 281 Turkey BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 282 Turkey other in Wearable Conferencing Technology Market, By deployment mode, 2020-2029 (USD Million)

TABLE 283 Turkey Other in Wearable Conferencing Technology Market, By organization size, 2020-2029 (USD Million)

TABLE 284 Rest of Europe Wearable Conferencing Technology Market, By offering, 2020-2029 (USD Million)

Abbildungsverzeichnis

FIGURE 1 Europe Wearable conferencing technology Market: segmentation

FIGURE 2 Europe Wearable conferencing technology Market: data triangulation

FIGURE 3 Europe Wearable conferencing technology market: DROC ANALYSIS

FIGURE 4 Europe Wearable conferencing technology Market: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe Wearable conferencing technology Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe Wearable conferencing technology Market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe Wearable conferencing technology Market: DBMR MARKET POSITION GRID

FIGURE 8 Europe Wearable conferencing technology Market: vendor share analysis

FIGURE 9 Europe Wearable conferencing technology Market: MARKET APPLICATION COVERAGE GRID

FIGURE 10 Europe Wearable conferencing technology market: SEGMENTATION

FIGURE 11 Rising preference for remote working is EXPECTED TO DRIVE EUROPE WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE segment is expected to account for the largest share of Europe Wearable conferencing technology marketin 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGEs OF Europe WEARABLE CONFERENCING TECHNOLOGY Market

FIGURE 14 Europe Wearable conferencing technology Market: BY offering, 2021

FIGURE 15 Europe Wearable conferencing technology Market: BY conferencing type, 2021

FIGURE 16 Europe Wearable conferencing technology Market: BY deployment mode, 2021

FIGURE 17 Europe Wearable conferencing technology Market: BY organization size, 2021

FIGURE 18 Europe Wearable conferencing technology Market: BY application, 2021

FIGURE 19 Europe Wearable conferencing technology Market: BY end use, 2021

FIGURE 20 EUROPE Wearable Conferencing Technology MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE WEARABLE CONFERENCING TECHNOLOGY MARKET: by Country (2021)

FIGURE 22 EUROPE Wearable Conferencing Technology MARKET: by Country (2022 & 2029)

FIGURE 23 EUROPE Wearable Conferencing Technology MARKET: by Country (2021 & 2029)

FIGURE 24 EUROPE Wearable Conferencing Technology MARKET: by offering (2022-2029)

FIGURE 25 Europe Wearable conferencing technology Market: company share 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.