Europäischer Markt für Proteinhydrolysate, nach Typ (Milch, Fleisch, Meeresfrüchte, Pflanzen, Eier und andere), Quelle (Tiere, Pflanzen und Mikroben), Form (flüssig und Pulver), Verfahren (enzymatische Hydrolyse und saure Hydrolyse), Anwendung ( Tierfutter , Säuglingsernährung, klinische Ernährung, Sporternährung, Nahrungsergänzungsmittel und andere), Land (Deutschland, Großbritannien, Frankreich, Italien, Spanien, Niederlande, Belgien, Russland, Türkei, Schweiz, Luxemburg und übriges Europa), Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke : Europäischer Markt für Proteinhydrolysate

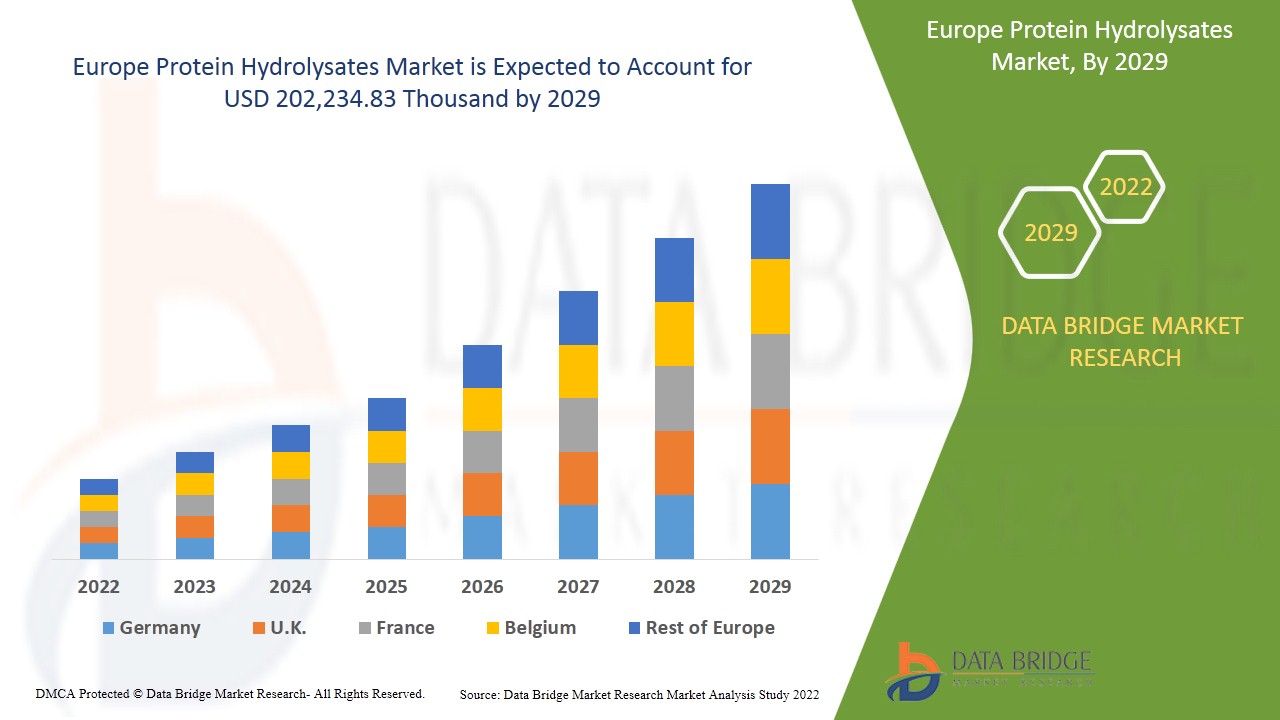

Es wird erwartet, dass der Markt für Proteinhydrolysate im Prognosezeitraum von 2022 bis 2029 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 4,6 % wächst und bis 2029 voraussichtlich 202.234,83 Tausend USD erreichen wird.

Proteinhydrolysate werden aus gereinigten Proteinquellen durch Zugabe von proteolytischen Enzymen und anschließende Reinigungsverfahren hergestellt. Jedes Proteinhydrolysat ist eine komplexe Mischung aus Peptiden unterschiedlicher Kettenlänge und freien Aminosäuren, die durch einen globalen Wert definiert werden können, der als Hydrolysegrad bezeichnet wird. Dabei handelt es sich um den Anteil der Peptidbindungen, die im Ausgangsprotein gespalten wurden. Solche Präparate liefern das Nährstoffäquivalent des ursprünglichen Materials in seinen Aminosäurebestandteilen und werden als Nährstoff- und Flüssigkeitsergänzung bei Spezialdiäten oder für Patienten verwendet, die keine normalen Nahrungsproteine zu sich nehmen können. Es bietet zahlreiche gesundheitliche Vorteile, z. B. hilft es dem Körper, Aminosäuren schneller aufzunehmen als intaktes Protein, wodurch die Nährstoffzufuhr maximiert wird. Außerdem gibt es verschiedene Anwendungen in der Lebensmittel- und Getränkeindustrie. Die Anwendung von Proteinhydrolysaten findet besondere Anwendung in der Sportmedizin, da die in Proteinhydrolysaten enthaltenen Aminosäuren leichter vom Körper aufgenommen werden als intakte Proteine, was die Nährstoffzufuhr in die Muskeln erhöht. Es wird auch in der Biotechnologiebranche zur Ergänzung von Zellkulturen verwendet.

Der Anstieg der Nachfrage nach Säuglingsnahrung in verschiedenen Regionen hat das Wachstum des Marktes für Proteinhydrolysate vorangetrieben. Der Verzehr von Säuglingsnahrung, die aus Proteinhydrolysat besteht, gilt als vorteilhafter als Säuglingsnahrung aus Kuhmilch, da Proteinhydrolysate von Säuglingen im Gegensatz zu milchbasierten Produkten leicht verdaut werden können, was das Wachstum des europäischen Marktes für Proteinhydrolysate voraussichtlich stark ankurbeln wird.

Die starke Nachfrage nach Produkten zur Gewichtskontrolle für Säuglings- und Sportlernahrung sowie das steigende Gesundheitsbewusstsein der Verbraucher, das zum Verzehr funktioneller und nahrhafter Lebensmittel führt, sind die treibenden Kräfte für den europäischen Markt für Proteinhydrolysate. Allerdings dürfte die Verfügbarkeit von Alternativen wie Isolaten das Marktwachstum bremsen.

Die weltweit zunehmende Zahl veganer Menschen kann dem europäischen Markt für Proteinhydrolysate künftig Wachstumschancen eröffnen.

Die hohen Verarbeitungskosten von hydrolysiertem Protein werden voraussichtlich das Wachstum des europäischen Marktes für Proteinhydrolysate in naher Zukunft erschweren.

Dieser Marktbericht für Proteinhydrolysate in Europa enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Proteinhydrolysate – Marktumfang und Marktgröße in Europa

Der europäische Markt für Proteinhydrolysate ist segmentiert und nach Typ, Quelle, Form, Verfahren und Anwendung kategorisiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktansprache sowie bei der Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihrem Zielmarkt.

- Der europäische Markt für Proteinhydrolysate ist nach Typ in Milch, Fleisch, Meeresfrüchte, Pflanzen, Eier und andere unterteilt. Im Jahr 2022 werden Milchproteinhydrolysate voraussichtlich den europäischen Markt dominieren, da sie bemerkenswerte blutdrucksenkende, antioxidative, entzündungshemmende und cholesterinsenkende Wirkungen haben und vor allem von der vegetarischen Bevölkerung bevorzugt werden.

- Auf der Grundlage der Quelle ist der europäische Markt für Proteinhydrolysate in Tier, Pflanze und Mikroben unterteilt. In Europa wird das Tiersegment voraussichtlich dominieren, da tierische Quellen im Vergleich zu ihren Gegenstücken einen hohen Proteingehalt aufweisen.

- Der europäische Markt für Proteinhydrolysate ist nach Form in Flüssigkeit und Pulver unterteilt. In Europa wird das Segment der Proteinhydrolysate in Pulverform voraussichtlich dominieren, da es dem Körper leichter zur Verfügung steht und die Erholung nach dem Training effizienter macht.

- Auf der Grundlage des Verfahrens ist der europäische Markt für Proteinhydrolysate in enzymatische Hydrolyse und Säurehydrolyse unterteilt. In Europa wird die enzymatische Hydrolyse voraussichtlich dominieren, da der Umfang der Behandlung aufgrund der inhärenten Spezifität verschiedener Proteasen kontrolliert werden kann.

- Auf der Grundlage der Anwendung ist der europäische Markt für Proteinhydrolysate in Tierfutter, Säuglingsnahrung, klinische Ernährung, Sportnahrung , Nahrungsergänzungsmittel und andere unterteilt. In Europa wird das Segment der Nahrungsergänzungsmittel voraussichtlich dominieren, da sie Personen, die nicht in der Lage sind, ausreichend Nahrung in herkömmlicher Form aufzunehmen, eine vollständige oder teilweise Ernährung bieten.

Proteinhydrolysate Markt – Länderebene Analyse

Der europäische Markt für Proteinhydrolysate ist nach Typ, Quelle, Form, Verfahren und Anwendung segmentiert.

Die im europäischen Marktbericht zu Proteinhydrolysaten abgedeckten Länder sind Deutschland, Großbritannien, Italien, Frankreich, Spanien, Russland, die Schweiz, die Türkei, Belgien, die Niederlande, Luxemburg und das übrige Europa.

Aufgrund des zunehmenden Wachstums bei Nahrungsergänzungsmitteln dominiert Großbritannien in der europäischen Region, gefolgt von Frankreich, das aufgrund der zunehmenden Verwendung von Fischproteinhydrolysat in Aquakulturfutter das zweitgrößte Land in der Region ist. Frankreich wächst aufgrund der zunehmenden Vorliebe der Verbraucher für Produkte zur Gewichtskontrolle.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wachsende vegane Bevölkerung auf der ganzen Welt

Der europäische Markt für Proteinhydrolysate bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das Wachstum der installierten Basis verschiedener Arten von Produkten für den Markt für Proteinhydrolysate, die Auswirkungen der Technologie anhand von Lebenslinienkurven und Änderungen der regulatorischen Szenarien für Säuglingsanfangsnahrung und deren Auswirkungen auf den Markt für Proteinhydrolysate. Die Daten sind für den historischen Zeitraum 2019 bis 2029 verfügbar.

Wettbewerbsumfeld und Proteinhydrolysate Marktanteilsanalyse

Die Wettbewerbslandschaft des europäischen Marktes für Proteinhydrolysate liefert Einzelheiten nach Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz in Europa, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den Markt für Proteinhydrolysate.

Einige der im Bericht behandelten Hauptakteure sind BRF Global, Scanbio Marine Group AS, Novozymes, Copalis, Bioiberica SAU, Azelis, Kemin Industries Inc., Bio-marine Ingredients Ireland, Titan Biotech, SUBONEYO Chemicals Pharmaceuticals P Limited und andere in- und ausländische Akteure. DBMR-Analysten kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Zum Beispiel,

- Im August 2021 spendete BRF Global 1,2 Millionen BRL, um den Aufbau der Intensivstationen der Santa Casa de Misericórdia der Tatuí-Einheit zu unterstützen und so zur Bekämpfung der Covid-19-Pandemie beizutragen. Dies wird die Position des Unternehmens auf dem Markt und in sozialen Gemeinschaften stärken.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PROTEIN HYDROLYSATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND IN WEIGHT MANAGEMENT PRODUCTS FOR INFANT AND SPORTS NUTRITION

5.1.2 INCREASING HEALTH AWARENESS AMONG CONSUMERS LEADING TO CONSUMPTION OF FUNCTIONAL AND NUTRITIONAL FOODS

5.1.3 RISING DEMAND ACROSS A DIVERSE RANGE OF APPLICATIONS

5.1.4 INCREASED USAGE OF FISH PROTEIN HYDROLYSATE IN AQUAFEED

5.2 RESTRAINTS

5.2.1 HEALTH ISSUES RELATED TO HIGH AND LONG TERM CONSUMPTION OF PROTEIN-BASED DIET

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.2.3 AVAILABILITY OF ALTERNATIVES SUCH AS ISOLATES AND CONCENTRATES

5.3 OPPORTUNITIES

5.3.1 INCREASING VEGAN POPULATION ACROSS THE GLOBE

5.3.2 HIGH DEMAND FOR ORGANIC FOOD INGREDIENTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCTION COST OF HYDROLYZED PROTEIN

5.4.2 LACK OF AWARENESS IN DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON EUROPE PROTEIN HYDROLYSATES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON EUROPE PROTEIN HYDROLYSATES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST EUROPE PROTEIN HYDROLYSATES MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE

7.1 OVERVIEW

7.2 MILK

7.2.1 MILK, BY TYPE

7.2.1.1 WHEY

7.2.1.2 CASEIN

7.3 MEAT

7.3.1 MEAT, BY TYPE

7.3.1.1 BOVINE

7.3.1.2 POULTRY

7.3.1.3 SWINE

7.4 PLANT

7.4.1 PLANT, BY TYPE

7.4.1.1 SOY

7.4.1.2 WHEAT

7.4.1.3 OTHERS

7.5 EGGS

7.6 MARINE

7.6.1 MARINE, BY TYPE

7.6.1.1 FISH

7.6.1.1.1 FISH, BY TYPE

7.6.1.1.1.1 TUNA

7.6.1.1.1.2 SALMON

7.6.1.1.1.3 OTHERS

7.6.1.2 ALGAE

7.7 OTHERS

8 EUROPE PROTEIN HYDROLYSATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ANIMALS

8.3 PLANTS

8.4 MICROBES

9 EUROPE PROTEIN HYDROLYSATES MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 EUROPE PROTEIN HYDROLYSATES MARKET, BY PROCESS

10.1 OVERVIEW

10.2 ENZYMATIC HYDROLYSIS

10.3 ACID HYDROLYSIS

11 EUROPE PROTEIN HYDROLYSATES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIETARY SUPPLEMENTS

11.3 INFANT NUTRITION

11.4 SPORTS NUTRITION

11.5 ANIMAL FEED

11.6 CLINICAL NUTRITION

11.7 OTHERS

12 EUROPE PROTEIN HYDROLYSATES MARKET, BY REGION

12.1 EUROPE

12.1.1 U.K.

12.1.2 FRANCE

12.1.3 GERMANY

12.1.4 NETHERLANDS

12.1.5 SPAIN

12.1.6 BELGIUM

12.1.7 ITALY

12.1.8 RUSSIA

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 LUXEMBOURG

12.1.12 REST OF EUROPE

13 EUROPE PROTEIN HYDROLYSATES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

13.5 PARTNERSHIPS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BRF EUROPE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 NOVOZYMES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 AZELIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 SCANBIO MARINE GROUP AS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 BIOIBERICA S.A.U

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 KEMIN INDUSTRIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 COPALIS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 BIO-MARINE INGREDIENTS IRELAND

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 JANATHA FISH MEAL & OIL PRODUCTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NAN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 NEW ALLIANCE DYE CHEM PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 SAMPI

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SUBONEYO CHEMICAL PHARMACEUTICALS P LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

15.14 TITAN BIOTECH

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ZXCHEM USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE - 350400 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE – 350400 (USD THOUSAND)

TABLE 3 EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 5 EUROPE MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 7 EUROPE MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 10 EUROPE MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 13 EUROPE PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 16 EUROPE MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 18 EUROPE MARINE IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE FISH IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (TONNE)

TABLE 22 EUROPE PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE ANIMALS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE PLANTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE MICROBES IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE POWDER IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE LIQUID IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE ENZYMATIC HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE ACID HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE DIETARY SUPPLEMENTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE INFANT NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE SPORTS NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE ANIMAL FEED IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (TONNE)

TABLE 41 EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 43 EUROPE MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.K. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.K. PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 54 U.K. MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.K. MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.K. MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.K. PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 62 U.K. PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 65 FRANCE MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 FRANCE PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 71 FRANCE PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 FRANCE PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 73 FRANCE PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 GERMANY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 GERMANY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 76 GERMANY MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 GERMANY MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 GERMANY MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 GERMANY FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 GERMANY PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 GERMANY PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 82 GERMANY PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 GERMANY PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 84 GERMANY PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 87 NETHERLANDS MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 NETHERLANDS MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 NETHERLANDS MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 NETHERLANDS FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 NETHERLANDS PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 93 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 95 NETHERLANDS PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SPAIN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 SPAIN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 98 SPAIN MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 SPAIN MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 SPAIN MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 SPAIN FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SPAIN PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 104 SPAIN PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 BELGIUM PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 BELGIUM PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 109 BELGIUM MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BELGIUM MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BELGIUM MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BELGIUM FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BELGIUM PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BELGIUM PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 115 BELGIUM PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 BELGIUM PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 117 BELGIUM PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 ITALY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 ITALY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 120 ITALY MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 ITALY MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 ITALY MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 ITALY FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 ITALY PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 ITALY PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 126 ITALY PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 ITALY PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 ITALY PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 RUSSIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 RUSSIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 131 RUSSIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 RUSSIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 RUSSIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 RUSSIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 RUSSIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 RUSSIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 142 SWITZERLAND MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 SWITZERLAND MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 SWITZERLAND MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 SWITZERLAND FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 SWITZERLAND PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 148 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 150 SWITZERLAND PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 TURKEY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 152 TURKEY PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 153 TURKEY MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 TURKEY MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 TURKEY MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 TURKEY FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 TURKEY PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 TURKEY PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 159 TURKEY PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 160 TURKEY PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 161 TURKEY PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 162 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 164 LUXEMBOURG MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 LUXEMBOURG MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 LUXEMBOURG MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 LUXEMBOURG FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 LUXEMBOURG PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 170 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 171 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 172 LUXEMBOURG PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 REST OF EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 REST OF EUROPE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

Abbildungsverzeichnis

FIGURE 1 EUROPE PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 2 EUROPE PROTEIN HYDROLYSATES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PROTEIN HYDROLYSATES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PROTEIN HYDROLYSATES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PROTEIN HYDROLYSATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PROTEIN HYDROLYSATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 EUROPE PROTEIN HYDROLYSATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PROTEIN HYDROLYSATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PROTEIN HYDROLYSATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PROTEIN HYDROLYSATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE PROTEIN HYDROLYSATES MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE PROTEIN HYDROLYSATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE PROTEIN HYDROLYSATES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASED DEMAND FOR INFANT NUTRITION AND SPORTS NUTRITION IS EXPECTED TO DRIVE THE EUROPE PROTEIN HYDROLYSATES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PROTEIN HYDROLYSATES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PROTEIN HYDROLYSATES MARKET

FIGURE 18 WORLD CAPTURE FISHERIES FROM 1950 TO 2018

FIGURE 19 EUROPE PROTEIN HYDROLYSATES, BY TYPE, 2021

FIGURE 20 EUROPE PROTEIN HYDROLYSATES, BY SOURCE, 2021

FIGURE 21 EUROPE PROTEIN HYDROLYSATES, BY FORM, 2021

FIGURE 22 EUROPE PROTEIN HYDROLYSATES, BY PROCESS, 2021

FIGURE 23 EUROPE PROTEIN HYDROLYSATES, BY APPLICATION, 2021

FIGURE 24 EUROPE PROTEIN HYDROLYSATES MARKET : SNAPSHOT (2021)

FIGURE 25 EUROPE PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2021)

FIGURE 26 EUROPE PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE PROTEIN HYDROLYSATES MARKET : BY TYPE (2022-2029)

FIGURE 29 EUROPE PROTEIN HYDROLYSATES MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.