Europa Papier- und Kartonverpackungsmarkt, nach Produkt (Pappbecher, Kraftpapierkarton, Karton, Faltschachteln und -etuis, Papiertüten und andere), Typ (Aufkleber, Shopper, Beschichtung, Verpackung, Einladungen / Umschläge / Briefpapier, Etiketten, Umschläge, Kataloge und Digitaldruck), Eigenschaft (farbig, natürlich, beschichtet, Perlglanz, Textur, Recycling, Baumwolle und andere), Gewicht (70 G/M2 bis 100 G/M2, 101 G/M2 bis 150 G/M2, 151 G/M2 bis 200 G/M2, 201 G/M2 bis 250 G/M2 und mehr als 250 G/M2), Endverbraucher (Körperpflege und Kosmetik , Lebensmittel und Getränke, Gesundheitswesen, Konsumgüter, Bildung und Schreibwaren und andere), Land (Deutschland, Frankreich, Italien, Großbritannien, Belgien, Spanien, Russland, Türkei, Niederlande, Schweiz und Rest von Europa) Branchentrends und Prognose für 2029

Marktanalyse und Einblicke: Europäischer Markt für Papier- und Kartonverpackungen

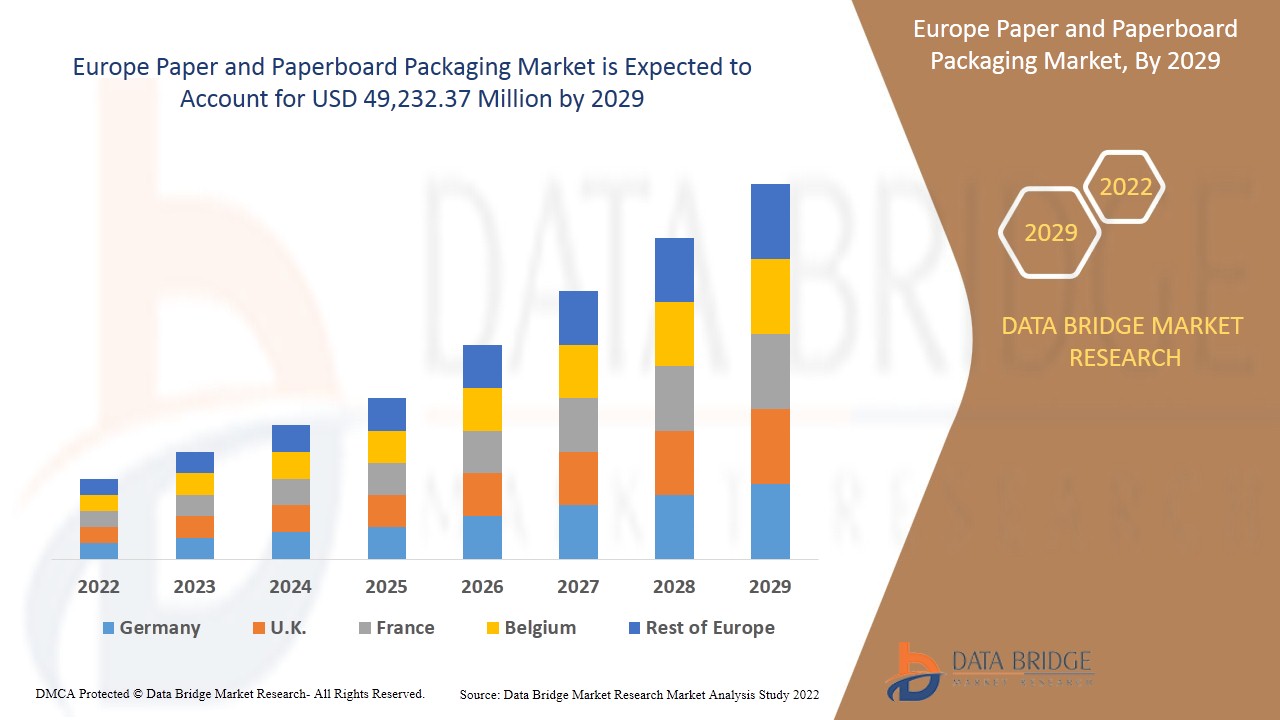

Es wird erwartet, dass der europäische Markt für Papier- und Kartonverpackungen im Prognosezeitraum von 2022 bis 2029 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 4,6 % wächst und bis 2029 voraussichtlich 49.232,37 Millionen USD erreichen wird.

Papier wird aus Zellulosefasern hergestellt, die aus Bäumen, Altpapier und einjährigen Pflanzenfasern wie Getreidehalmen gewonnen werden. Heute werden etwa 97 Prozent des weltweit produzierten Papiers und Kartons aus Holzzellstoff hergestellt, und etwa 85 Prozent des verwendeten Holzzellstoffs stammen von Fichten, Tannen und Kiefern. Außerdem können Papier und Karton auf viele verschiedene Arten in Kontakt mit Lebensmitteln kommen, entweder direkt oder indirekt und entweder einzeln oder laminiert mit anderen Materialien wie Kunststoff oder Metallfolie.

Die steigende Nachfrage der Gesundheitsbranche nach Kartonverpackungen hat erhebliche Auswirkungen auf die Expansion des Marktes für Papier- und Kartonverpackungen. In diesem Zusammenhang sind das zunehmende Bewusstsein für nachhaltige Verpackungsmaterialien, die Verwendung umweltfreundlicher Verpackungen und die steigende Nachfrage der E-Commerce-Branche nach Papier- und Kartonbehältern wichtige Faktoren, die das Wachstum des Marktes für Papier- und Kartonverpackungen im Prognosezeitraum begünstigen.

Staatliche Vorschriften zur Verwendung von Verpackungsmaterialien können jedoch die Wachstumsrate des Marktes für Papier- und Kartonverpackungen stark hemmen. Zudem ist es ziemlich schwierig, die Qualität der papierbasierten Verpackungsprodukte aufrechtzuerhalten. Dies könnte das Wachstum des Marktes für Papier- und Kartonverpackungen im Prognosezeitraum beeinträchtigen.

Dieser Marktbericht zu Papier- und Kartonverpackungen enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Europa: Marktumfang und Marktgröße für Papier- und Kartonverpackungen

Der europäische Markt für Papier- und Kartonverpackungen ist in fünf wichtige Segmente unterteilt, die auf Typ, Produkt, Eigenschaft, Gewicht und Endverbraucher basieren. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

- Der globale Markt für Papier- und Kartonverpackungen ist nach Typ in Aufkleber, Einkaufstaschen, Beschichtungen, Verpackungen, Einladungen/Umschläge/Briefpapier, Etiketten, Umschläge, Kataloge und Digitaldruck unterteilt. Im Jahr 2022 wird das Verpackungssegment voraussichtlich den Markt dominieren, da die E-Commerce-Branche eine wachsende Nachfrage nach Papierboxen hat.

- Der globale Markt für Papier- und Kartonverpackungen ist nach Produkten segmentiert in Pappbecher , Kraftpapierkarton, Karton, Faltschachteln und -etuis, Papiertüten und andere. Im Jahr 2022 wird das Segment Kraftpapierkarton voraussichtlich den Markt dominieren, da Kraftpapierkarton eine hohe Haltbarkeit aufweist, was die Nachfrage in Europa erhöht.

- Auf der Grundlage der Eigenschaften ist der globale Markt für Papier- und Kartonverpackungen in farbige, natürliche, beschichtete, perlmuttartige, strukturierte, recycelte, Baumwoll- und andere Verpackungen segmentiert. Im Jahr 2022 wird das Recyclingsegment voraussichtlich den Markt dominieren, da das Recycling von Eigenschaften zur Reduzierung der Umweltverschmutzung beiträgt, was die Nachfrage nach Recycling in Europa erhöht.

- Auf der Grundlage des Gewichts ist der globale Markt für Papier- und Kartonverpackungen in 70 g/m2 bis 100 g/m2, 101 g/m2 bis 150 g/m2, 151 g/m2 bis 200 g/m2, 201 g/m2 bis 250 g/m2 und mehr als 250 g/m2 unterteilt. Im Jahr 2022 wird das Segment 151 g/m2 bis 200 g/m2 voraussichtlich den Markt dominieren, da dieses Gewicht leichter zu tragen ist, was die Nachfrage in Europa erhöht.

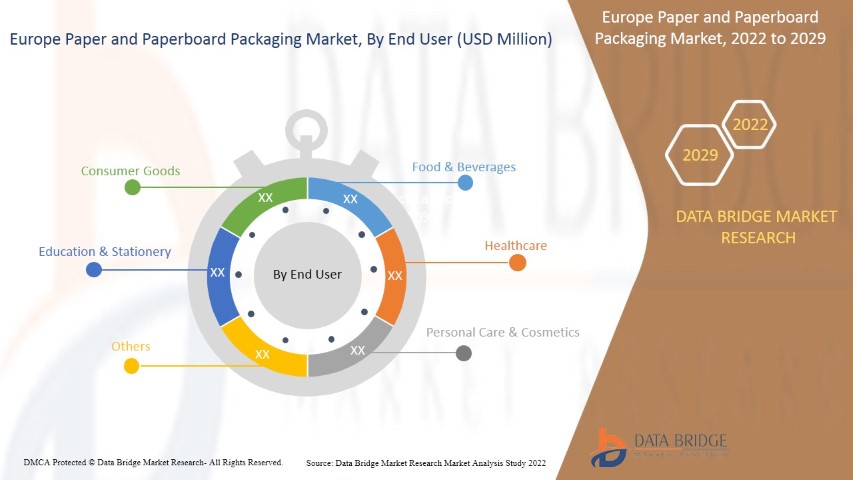

- Auf der Grundlage des Endverbrauchers ist der globale Markt für Papier- und Kartonverpackungen in Körperpflege und Kosmetik, Lebensmittel und Getränke, Gesundheitswesen, Konsumgüter, Bildung und Schreibwaren und andere unterteilt. Im Jahr 2022 wird das Segment Lebensmittel und Getränke voraussichtlich den Markt dominieren, da Papier- und Kartonverpackungen eine gute Flexibilität zur Lagerung verschiedener Arten von Lebensmitteln bieten, was ihre Nachfrage in Europa erhöht.

Europa: Papier- und Kartonverpackungen Markt – Länderebene Analyse

Der europäische Markt für Papier- und Kartonverpackungen ist in vier wichtige Segmente unterteilt, die auf Typ, Produkt, Eigenschaft, Gewicht und Endverbraucher basieren.

Die im europäischen Marktbericht zu Papier- und Kartonverpackungen abgedeckten Länder sind Deutschland, Frankreich, Italien, Großbritannien, Belgien, Spanien, Russland, Türkei, Niederlande, Schweiz und das übrige Europa. Deutschland dominiert den europäischen Markt aufgrund der zunehmenden Verwendung von papierbasierten Verpackungen in der Lebensmittelindustrie, was die Nachfrage nach Papier- und Kartonverpackungen in der Region erhöht.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit europäischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wachsende Nachfrage nach Kartonverpackungen aus der Gesundheitsbranche

Verpackungsmaterialien aus Papier und Pappe spielen eine wichtige Rolle für Verpackungen und Displays im Medizin- und Pharmasektor. Die grundlegende Funktion der Arzneimittelverpackung besteht darin, das Produkt einzuschließen. Bei der Gestaltung hochwertiger Verpackungen müssen Produktanforderungen sowie Herstellungs- und Vertriebssysteme berücksichtigt werden. Dies erfordert, dass die Verpackung dicht ist, das Produkt nicht auslaufen oder eindringen lässt und stabil genug ist, um den Inhalt bei normaler Handhabung zu halten.

Der Gesundheitssektor trägt zu einem steigenden Bedarf an Verpackungen bei. Kartons werden benötigt, um Gesundheitsprodukte und Medikamente an die verschiedenen Verteilungsorte zu transportieren. Die Verpackung muss das Produkt vor allen äußeren schädlichen Einflüssen schützen, die die Qualität oder Wirksamkeit beeinträchtigen könnten, wie etwa Licht, Feuchtigkeit, Sauerstoff, biologische Kontamination, mechanische Beschädigung, Fälschung oder Nachahmung.

Daher müssen Pharmahersteller die Verpackung sorgfältig prüfen, da die Arzneimittelsicherheit wichtig ist, um verheerende Fehler, ineffektive Lagerung und das Risiko von Medikamentenmanipulationen und gefälschten Produkten zu verhindern. Dies wiederum erhöht die Nachfrage nach Kartons und trägt somit zum Wachstum des globalen Marktes für Papier- und Kartonverpackungen bei.

Wettbewerbsumfeld und Papier- und Kartonverpackungen Analyse der Marktanteile

Die Wettbewerbslandschaft des europäischen Marktes für Papier- und Kartonverpackungen liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz in Europa, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den europäischen Markt für Papier- und Kartonverpackungen.

Die wichtigsten Marktteilnehmer auf dem europäischen Markt für Papier- und Kartonverpackungen sind Amcor plc, Cascades inc., Packaging Corporation of America, DS Smith, Fedrigoni SPA Atlantic Packaging, International Paper, Smurfit Kappa, Svenska Cellulosa Aktiebolaget SCA, Mondi, Nippon Paper Industries Co., Ltd., Stora Enso, METSÄ GROUP, Georgia-Pacific, Oji Holdings Corporation, Mayr-Melnhof Karton AG, UPM, Rengo Co., Ltd., WestRock Company und andere.

Zum Beispiel,

- Im November 2021 kündigte Nippon Paper Industries Co., Ltd. allen seinen Agenturen Preisanpassungen für Druckpapier, Kommunikationspapier und Industriepapier auf dem heimischen Markt an. Dies wiederum hat dem Unternehmen geholfen, seinen Umsatz langfristig zu steigern.

- Im November 2021 gab die Oji Holdings Corporation die Errichtung eines neuen Wellpappbehälterwerks in Vietnam bekannt. Dies hat dem Unternehmen weiter geholfen, sein Produktionsvolumen für Wellpappkartons im asiatisch-pazifischen Raum zu steigern.

- Im Dezember 2021 erhielt Stora Enso von Tetra Pak die Auszeichnung „Best Circular Solution“ für seine bedeutenden Erfolge bei der Innovation im Bereich des Recyclings von Getränkekartons. Dies hat dem Unternehmen geholfen, seine Position weltweit zu stärken.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 THE TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY OVERVIEW

4.1.1 CORRUGATED SHEET

4.1.2 BUTTER PAPER

4.1.3 CARDBOARD

4.1.4 VIRGIN PAPER

4.1.5 KRAFT LINER

4.1.6 TESTLINER

4.1.7 SBS (SOLID BLEACHED SULFATE) BOARD

4.1.8 CCNB (CLAY COATED NEWS BACKBOARD)

4.2 MANUFACTURING INSIGHTS

5 REGIONAL SUMMARY

5.1 EUROPE

5.2 EUROPE

5.3 THE MIDDLE EAST AND AFRICA

5.4 ASIA-PACIFIC

5.5 NORTH AMERICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR PAPERBOARD PACKAGING BOXES FROM THE HEALTHCARE INDUSTRY

6.1.2 INCREASING AWARENESS ABOUT SUSTAINABLE PACKAGING MATERIAL AND ADOPTION OF ECO-FRIENDLY PACKAGING

6.1.3 INCREASING ADOPTION OF PAPER-BASED PACKAGING IN THE FOOD INDUSTRY

6.1.4 MOUNTING REQUIREMENT FOR LIGHTWEIGHT PACKAGING BOARDS

6.1.5 INCREASING USE OF PAPERBOARD PACKAGING BY E-COMMERCE INDUSTRIES

6.2 RESTRAINTS

6.2.1 REGULATIONS IMPOSED BY GOVERNMENTS REGARDING THE USE OF PACKAGING MATERIALS

6.2.2 INCREASING COMPETITION FROM FLEXIBLE PLASTIC PACKAGING

6.3 OPPORTUNITIES

6.3.1 ENVIRONMENTAL BENEFITS ASSOCIATED WITH PAPER AND PAPERBOARD PACKAGING

6.3.2 STRONG EMPHASIS ON PAPER RECYCLING INITIATIVES IN SEVERAL COUNTRIES

6.3.3 SURGE IN INNOVATIVE PACKAGING SOLUTIONS WITH DIGITAL PRINTING

6.3.4 INCREASING USAGE OF COMPOSITE CARDBOARD PACKAGING IN THE PERSONAL CARE INDUSTRY

6.4 CHALLENGES

6.4.1 DIFFICULTY IN MAINTAINING QUALITY OF PAPER-BASED PACKAGING PRODUCTS

6.4.2 TEMPERATURE FLUCTUATIONS MAY AFFECT STRENGTH OF THE PAPERBOARD BOXES

7 IMPACT OF COVID-19 ON EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST EUROPE PAPER AND PAPERBOARD MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON PRICE

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 KRAFT PAPER BOARDS

8.3 FOLDING BOXES AND CASES

8.4 PAPER CUPS

8.4.1 COLD PAPER CUPS

8.4.1.1 Serving Cups

8.4.1.2 Portion Cups

8.4.1.3 OTHERS

8.4.2 HOT PAPER CUPS

8.4.2.1 Serving Cups

8.4.2.2 Portion Cups

8.4.2.3 OTHERS

8.5 PAPER BAGS

8.6 BOXBOARD

8.7 OTHERS

9 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACKAGING

9.3 SHOPPER

9.4 LABELS

9.5 COATING

9.6 CATALOGS

9.7 COVERS

9.8 DIGITAL PRINT

9.9 STICKERS

9.1 INVITATIONS/ENVELOPES/NOTEPAPER

10 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY

10.1 OVERVIEW

10.2 RECYCLE

10.3 COLORED

10.4 NATURAL

10.5 COATED

10.6 PEARLESCENT

10.7 TEXTURE

10.8 COTTON

10.9 OTHERS

11 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT

11.1 OVERVIEW

11.2 G/M2 TO 200 G/M2

11.3 G/M2 TO 150 G/M2

11.4 G/M2 TO 100 G/M2

11.5 G/M2 TO 250 G/M2

11.6 MORE THAN 250 G/M2

12 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES, BY END-USER

12.2.1.1 FRUITS & VEGETABLES

12.2.1.2 BAKERY & CONFECTIONERY

12.2.1.3 PROCESSED FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 MEAT & POULTRY PRODUCTS

12.2.1.6 DAIRY PRODUCTS

12.2.1.7 MILK & MILK DERIVED PRODUCTS

12.2.1.8 JUICES

12.2.1.9 OTHERS

12.2.2 FOOD & BEVERAGES, BY TYPE

12.2.2.1 PACKAGING

12.2.2.2 SHOPPER

12.2.2.3 LABELS

12.2.2.4 COATING

12.2.2.5 CATALOGS

12.2.2.6 COVERS

12.2.2.7 DIGITAL PRINT

12.2.2.8 STICKERS

12.2.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.3 HEALTHCARE

12.3.1 HEALTHCARE, BY TYPE

12.3.1.1 PACKAGING

12.3.1.2 SHOPPER

12.3.1.3 LABELS

12.3.1.4 COATING

12.3.1.5 CATALOGS

12.3.1.6 COVERS

12.3.1.7 DIGITAL PRINT

12.3.1.8 STICKERS

12.3.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.4 PERSONAL CARE & COSMETICS

12.4.1 PERSONAL CARE & COSMETICS, BY END-USER

12.4.1.1 SKIN CARE

12.4.1.2 HAIR CARE

12.4.1.3 NAIL CARE

12.4.1.4 OTHERS

12.4.2 PERSONAL CARE & COSMETICS, BY TYPE

12.4.2.1 PACKAGING

12.4.2.2 SHOPPER

12.4.2.3 LABELS

12.4.2.4 COATING

12.4.2.5 CATALOGS

12.4.2.6 COVERS

12.4.2.7 DIGITAL PRINT

12.4.2.8 STICKERS

12.4.2.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.5 CONSUMER GOODS

12.5.1 CONSUMER GOODS, BY TYPE

12.5.1.1 PACKAGING

12.5.1.2 SHOPPER

12.5.1.3 LABELS

12.5.1.4 COATING

12.5.1.5 CATALOGS

12.5.1.6 COVERS

12.5.1.7 DIGITAL PRINT

12.5.1.8 STICKERS

12.5.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.6 EDUCATION & STATIONERY

12.6.1 EDUCATION & STATIONERY, BY TYPE

12.6.1.1 PACKAGING

12.6.1.2 SHOPPER

12.6.1.3 LABELS

12.6.1.4 COATING

12.6.1.5 CATALOGS

12.6.1.6 COVERS

12.6.1.7 DIGITAL PRINT

12.6.1.8 STICKERS

12.6.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 PACKAGING

12.7.1.2 SHOPPER

12.7.1.3 LABELS

12.7.1.4 COATING

12.7.1.5 CATALOGS

12.7.1.6 COVERS

12.7.1.7 DIGITAL PRINT

12.7.1.8 STICKERS

12.7.1.9 INVITATIONS / ENVELOPES / NOTEPAPER

13 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 ITALY

13.1.4 FRANCE

13.1.5 RUSSIA

13.1.6 SPAIN

13.1.7 NETHERLANDS

13.1.8 BELGIUM

13.1.9 TURKEY

13.1.10 SWITZERLAND

13.1.11 REST OF EUROPE

14 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INTERNATIONAL PAPER

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 WESTROCK COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 OJI HOLDINGS CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 AMCOR PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 PACKAGING CORPORATION OF AMERICA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ATLANTIC PACKAGING

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 CASCADES INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DS SMITH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 FEDRIGONI S.P.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GEORGIA-PACIFIC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 MAYR-MELNHOF KARTON AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 METSÄ GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 MONDI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NIPPON PAPER INDUSTRIES CO., LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 RENGO CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 SMURFIT KAPPA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SONOCO PRODUCTS COMPANY

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 STORA ENSO

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 UPM

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 2 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING OR WEBS OF CELLULOSE FIBRES, N.E.S.; BOX FILES, LETTER TRAYS, AND SIMILAR ARTICLES, OF PAPERBOARD OF A KIND USED IN OFFICES, SHOPS , HS CODE: 4819 (USD THOUSAND)

TABLE 3 TYPES OF RAW MATERIALS USED IN PHARMACEUTICAL PACKAGING

TABLE 4 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 EUROPE KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE KRAFT PAPER BOARDS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 EUROPE FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE FOLDING BOXES AND CASES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 10 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 12 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 EUROPE COLD PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 EUROPE HOT PAPER CUPS IN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PAPER BAGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 17 EUROPE BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BOXBOARD IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 19 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (TONS)

TABLE 21 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PACKAGING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SHOPPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE LABELS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE COATING IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE CATALOGS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE COVERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIGITAL PRINT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE STICKERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE INVITATIONS/ENVELOPES/NOTEPAPER IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE RECYCLE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE COLORED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE NATURAL IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE COATED IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PEARLESCENT IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TEXTURE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE COTTON IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 41 EUROPE 151 G/M2 TO 200 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE 101 G/M2 TO 150 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE 70 G/M2 TO 100 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE 201 G/M2 TO 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE MORE THAN 250 G/M2 IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 EUROPE HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE HEALTHCARE IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 63 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 65 EUROPE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 EUROPE COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 EUROPE HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 70 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 71 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 73 EUROPE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 EUROPE HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 76 EUROPE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 EUROPE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 EUROPE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 GERMANY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 GERMANY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 GERMANY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 87 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 88 GERMANY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 89 GERMANY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 90 GERMANY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 93 GERMANY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 GERMANY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 99 U.K. PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 U.K. COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 U.K. HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 104 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 105 U.K. PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 106 U.K. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 107 U.K. FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.K. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 110 U.K. PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.K. CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.K. OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 ITALY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 ITALY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 ITALY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 121 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 122 ITALY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 123 ITALY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 ITALY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ITALY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 ITALY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 ITALY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 ITALY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ITALY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 133 FRANCE PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 FRANCE COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 FRANCE HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 138 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 139 FRANCE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 140 FRANCE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 141 FRANCE FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 FRANCE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 144 FRANCE PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 FRANCE CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 FRANCE EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 FRANCE OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 150 RUSSIA PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 RUSSIA PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 167 SPAIN PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 SPAIN COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 SPAIN HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 172 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 173 SPAIN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 174 SPAIN FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 175 SPAIN FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SPAIN HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SPAIN PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 178 SPAIN PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 SPAIN CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SPAIN EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SPAIN OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 184 NETHERLANDS PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 NETHERLANDS PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 NETHERLANDS EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 201 BELGIUM PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 217 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 218 TURKEY PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 219 TURKEY COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 220 TURKEY HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 221 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 223 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 224 TURKEY PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 225 TURKEY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 226 TURKEY FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 TURKEY HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 TURKEY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 229 TURKEY PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 TURKEY CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 TURKEY EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 TURKEY OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 235 SWITZERLAND PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 236 SWITZERLAND COLD PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 237 SWITZERLAND HOT PAPER CUPS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 238 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2020-2029 (USD MILLION)

TABLE 240 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 241 SWITZERLAND PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 242 SWITZERLAND FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 243 SWITZERLAND FOOD & BEVERAGES IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 SWITZERLAND HEALTHCARE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SWITZERLAND PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 246 SWITZERLAND PERSONAL CARE & COSMETICS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 SWITZERLAND CONSUMER GOODS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SWITZERLAND EDUCATION & STATIONERY IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 SWITZERLAND OTHERS IN PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 REST OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 REST OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2020-2029 (TONS)

Abbildungsverzeichnis

FIGURE 1 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: THE TYPE LINE CURVE

FIGURE 7 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FROM THE E-COMMERCE INDUSTRY FOR PAPER AND PAPERBOARD CONTAINERS IS EXPECTED TO DRIVE THE EUROPE PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 KRAFT PAPER BOARDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PAPER AND PAPERBOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 16 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR PAPER AND PAPERBOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PAPER AND PAPERBOARD PACKAGING MARKET

FIGURE 18 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 19 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY TYPE, 2021

FIGURE 20 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY PROPERTY, 2021

FIGURE 21 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY WEIGHT, 2021

FIGURE 22 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET, BY END-USER, 2021

FIGURE 23 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 28 EUROPE PAPER AND PAPERBOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.