Europe Foot And Ankle Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

973.60 Million

USD

1,749.70 Million

2024

2032

USD

973.60 Million

USD

1,749.70 Million

2024

2032

| 2025 –2032 | |

| USD 973.60 Million | |

| USD 1,749.70 Million | |

|

|

|

|

Marktsegmentierung für Fuß- und Sprunggelenkgeräte in Europa nach Produkttyp (orthopädische Implantate und Geräte, Stütz- und Stützgeräte, Prothesen), Anwendung (Trauma, Hammerzehen, Osteoarthritis, rheumatoide Arthritis, Ballenzehen, neurologische Erkrankungen, Osteoporose usw.), Endbenutzer (Krankenhäuser, Traumazentren, ambulante chirurgische Zentren, Fachkliniken usw.) – Branchentrends und Prognose bis 2032

Marktgröße für Fuß- und Knöchelgeräte

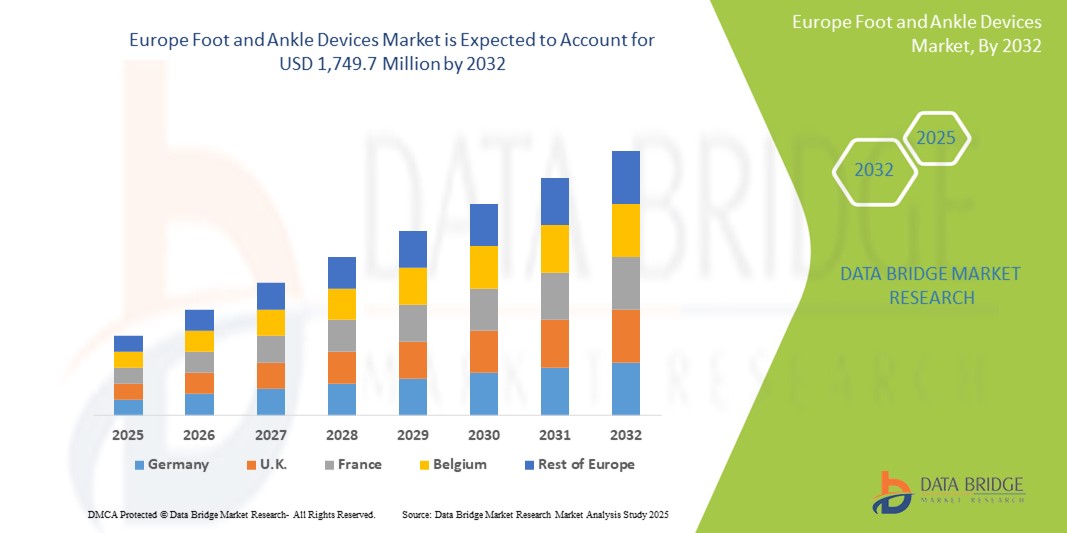

- Der europäische Markt für Fuß- und Knöchelgeräte wurde im Jahr 2024 auf 973,6 Millionen US-Dollar geschätzt und soll bis 2032 1.749,7 Millionen US-Dollar erreichen , bei einer CAGR von 7,6 % im Prognosezeitraum.

- Das Marktwachstum wird größtenteils durch die zunehmende Verbreitung von Fuß- und Knöchelerkrankungen, eine steigende Zahl unfallbedingter Verkehrs- und Sportverletzungen sowie die wachsende geriatrische Bevölkerung in ganz Europa vorangetrieben.

- Darüber hinaus treiben technologische Fortschritte im Bereich der Fuß- und Knöchelprothesen, wie verbesserte Biomaterialien, minimalinvasive Operationstechniken und personalisierte 3D-gedruckte Orthesen und Prothesen, das Marktwachstum voran. Diese zusammenlaufenden Faktoren beschleunigen die Verbreitung von Fuß- und Knöchelprothesen und fördern so das Branchenwachstum erheblich.

Marktanalyse für Fuß- und Knöchelgeräte

- Der Markt für Fuß- und Sprunggelenksprothesen umfasst eine breite Palette medizinischer Geräte zur Diagnose, Behandlung und Rehabilitation von Fuß- und Sprunggelenkserkrankungen. Dazu gehören orthopädische Implantate und Geräte (wie Gelenkimplantate, Fixationsvorrichtungen), Schienen und Stützvorrichtungen sowie Prothesen. Diese Geräte sind für die Behandlung einer Reihe von Problemen unerlässlich, darunter Traumata, Sportverletzungen, diabetische Fußkomplikationen, Arthritis (Osteoarthritis und rheumatoide Arthritis) und verschiedene Deformitäten. Der Markt wird durch die zunehmende Häufigkeit dieser Erkrankungen, die alternde Bevölkerung und kontinuierliche Fortschritte bei Operationstechniken und Gerätetechnologie angetrieben.

- Die steigende Nachfrage nach Fuß- und Knöchelgeräten wird vor allem durch das zunehmende Bewusstsein für die Gesundheit von Füßen und Knöcheln, die wachsende Nachfrage nach wirksamer Rehabilitation und Vorsorge sowie die steigenden Gesundheitsausgaben in der Region angetrieben.

- Deutschland dominiert den Markt für Fuß- und Sprunggelenkprothesen in Europa und hält mit 26,7 % im Jahr 2025 den größten Umsatzanteil. Dies wird durch eine robuste orthopädische Versorgungsinfrastruktur, ein hohes Operationsvolumen und eine starke Nachfrage nach technologisch fortschrittlichen Implantaten und Fixationsvorrichtungen unterstützt. Das etablierte Erstattungssystem des Landes und die frühe Einführung minimalinvasiver Fuß- und Sprunggelenkprothesen haben zur zunehmenden Nutzung von Platten, Schrauben und Gelenkersatzsystemen in öffentlichen und privaten Krankenhäusern beigetragen.

- Deutschland dürfte im Prognosezeitraum auch das am schnellsten wachsende Land im europäischen Markt für Fuß- und Sprunggelenksprothesen sein. Gründe hierfür sind die alternde Bevölkerung, die zunehmende Verbreitung von Arthrose und Sportverletzungen sowie der starke Fokus auf die posttraumatische Rehabilitation. Kontinuierliche Investitionen in orthopädische Innovationen und der Ausbau spezialisierter orthopädischer Zentren sowie die Zusammenarbeit zwischen Forschungseinrichtungen und Medizintechnikherstellern unterstützen das Marktwachstum zusätzlich.

- Orthopädische Implantate und Geräte, darunter Platten, Schrauben und Marknägel, werden voraussichtlich den europäischen Markt für Fuß- und Sprunggelenksimplantate mit einem Marktanteil von 39,2 % im Jahr 2025 dominieren. Dies ist auf ihre breite Anwendung bei der Behandlung von Frakturen, Deformitäten und komplexen rekonstruktiven Eingriffen zurückzuführen. Das Segment profitiert von der Weiterentwicklung von Biomaterialien, darunter Titan und bioresorbierbare Polymere, sowie von der zunehmenden Nutzung patientenspezifischer chirurgischer Planungsinstrumente, die die Behandlungsergebnisse verbessern und die Genesungszeit verkürzen.

Berichtsumfang und Marktsegmentierung für Fuß- und Knöchelgeräte

|

Eigenschaften |

Wichtige Markteinblicke zu Fuß- und Knöchelgeräten |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Fuß- und Knöchelgeräte

„Fortschritte bei minimalinvasiven Operationstechniken “

- Technologische Fortschritte bei minimalinvasiven Eingriffen und personalisierten Geräten: Ein bedeutender und zunehmender Trend auf dem europäischen Markt für Fuß- und Sprunggelenksprothesen ist der kontinuierliche technologische Fortschritt, insbesondere bei minimalinvasiven Operationstechniken und der Entwicklung personalisierter Geräte. Diese Entwicklung verbessert die Behandlungsergebnisse deutlich, verkürzt die Genesungszeit und verbessert die allgemeine Behandlungswirksamkeit.

- Innovationen bei orthopädischen Implantaten und Fixationsvorrichtungen ermöglichen es Chirurgen beispielsweise, komplexe Eingriffe mit weniger Komplikationen und einer schnelleren Genesung durchzuführen. Die zunehmende Anwendung minimalinvasiver Verfahren, die Vorteile wie weniger Schmerzen und Narbenbildung bieten, führt zu einer Ausweitung des Einsatzes spezialisierter Fuß- und Sprunggelenksprothesen.

- Der Markt verzeichnet zudem einen wachsenden Trend zu personalisierten Geräten, angetrieben durch die 3D-Drucktechnologie. Dies ermöglicht die Herstellung maßgeschneiderter Orthesen und Prothesen, die auf die spezifischen Bedürfnisse jedes Patienten zugeschnitten sind und so bessere Passform, Halt und Funktionalität bieten.

- Darüber hinaus liegt der Fokus verstärkt auf Rehabilitation und Prävention. Dies führt zu einer Nachfrage nach Orthesen, Schienen und intelligenten Rehabilitationsgeräten, die die Genesung unterstützen und zukünftigen Verletzungen vorbeugen. Tragbare Technologien spielen in diesem Bereich eine wichtige Rolle, da sie Feedback und Überwachung in Echtzeit ermöglichen.

- Dieser Trend zu präziseren, weniger invasiven und patientenspezifischen Lösungen verändert die Behandlungslandschaft für Fuß- und Knöchelerkrankungen in Europa grundlegend.

Marktdynamik für Fuß- und Knöchelgeräte

Treiber

„Zunehmende Prävalenz von Fuß- und Knöchelerkrankungen (Trauma, Diabetes, Arthritis)“

- Steigende Häufigkeit von Fuß- und Knöchelerkrankungen und alternde Bevölkerung: Die zunehmende Verbreitung von Fuß- und Knöchelerkrankungen, einschließlich solcher, die durch Traumata, Diabetes und altersbedingte Erkrankungen wie Arthritis und Osteoporose verursacht werden, ist ein wichtiger Treiber für das Wachstum des Marktes für Fuß- und Knöchelgeräte in Europa.

- Beispielsweise ist die wachsende geriatrische Bevölkerung in der europäischen Region anfälliger für Fuß- und Knöchelprobleme wie Arthritis und Frakturen, was die Nachfrage nach diesen Geräten direkt steigert.

- Auch die steigende Zahl von Sportverletzungen und Verkehrsunfällen trägt erheblich zur Nachfrage nach Fuß- und Sprunggelenksprothesen für die Behandlung und Rehabilitation bei.

- Darüber hinaus führt das wachsende Bewusstsein für die Gesundheit von Füßen und Knöcheln in der Bevölkerung und bei medizinischem Fachpersonal zu früheren Diagnosen und Eingriffen, was das Marktwachstum weiter vorantreibt.

- Technologische Fortschritte, die Geräte effektiver, komfortabler und benutzerfreundlicher machen, sowie steigende Gesundheitsausgaben sind weitere wichtige Treiber

Einschränkung/Herausforderung

„ Hohe Kosten für moderne Fuß- und Knöchelgeräte “

- Hohe Gerätekosten und strenge Vorschriften: Die hohen Kosten einiger moderner Fuß- und Knöchelgeräte stellen in Verbindung mit strengen gesetzlichen Richtlinien eine erhebliche Herausforderung für eine breite Marktakzeptanz in Europa dar.

- Beispielsweise kann die Herstellung verschiedener Produkte für Fuß und Knöchel die Kapitalkosten für Medizintechnikunternehmen erheblich erhöhen. Die hohen Anfangsinvestitionen für fortschrittliche Implantate und Prothesen können deren Zugänglichkeit einschränken, insbesondere in öffentlich finanzierten Gesundheitssystemen oder für Patienten ohne umfassenden Versicherungsschutz.

- Strenge regulatorische Rahmenbedingungen wie die EU-Medizinprodukteverordnung (MDR) ersetzen ältere Richtlinien, was zu erheblichen Änderungen beim Marktzugang führt und eine umfassende Validierung und Dokumentation erfordert, was den Herstellern zusätzlichen Zeit- und Kostenaufwand beschert.

- Darüber hinaus kann der Mangel an qualifizierten Fachkräften für Fuß- und Sprunggelenkchirurgie und Rehabilitation die effektive Nutzung und Einführung dieser fortschrittlichen Geräte behindern. Bedenken hinsichtlich der Lockerung von Knochenplatten im Laufe der Zeit, die einen Austausch erforderlich machen, stellen ebenfalls eine Herausforderung dar.

Marktumfang für Fuß- und Knöchelgeräte

Der Markt ist nach Produkttyp, Anwendung und Endbenutzer segmentiert.

- Nach Produkt

Der Markt für Fuß- und Sprunggelenksprothesen umfasst orthopädische Fixationsvorrichtungen, Gelenkimplantate, Weichteilprothesen, Stütz- und Stützvorrichtungen sowie Prothesen. Das Segment orthopädische Fixationsvorrichtungen wird voraussichtlich den Markt mit dem größten Umsatzanteil von 39,2 % im Jahr 2025 dominieren, was auf ihre weit verbreitete Verwendung in der Frakturheilung, Deformitätskorrektur und rekonstruktiven Chirurgie zurückzuführen ist. Diese Vorrichtungen – darunter Platten, Schrauben, Drähte und Marknägel – werden häufig bei Traumata und Wahleingriffen eingesetzt. Technologische Fortschritte wie anatomisch geformte Implantate und bioresorbierbare Materialien haben die klinischen Ergebnisse und die Patientenrehabilitation verbessert und die Führungsrolle dieses Segments gestärkt.

Das Segment Stütz- und Stützsysteme wird voraussichtlich von 2025 bis 2032 mit 5,2 % das höchste Wachstum verzeichnen, unterstützt durch die steigende Zahl von Osteoarthritis und rheumatoider Arthritis in der alternden Bevölkerung. Die steigende Nachfrage nach Knöchelersatz und Fortschritte im Implantatdesign – wie 3D-gedruckte Komponenten und maßgeschneiderte Lösungen – treiben die Akzeptanz in chirurgischen Zentren in Deutschland, Großbritannien und Frankreich voran.

- Nach Anwendung

Der Markt für Fuß- und Knöchelprothesen ist nach Anwendungsgebieten in Trauma, Osteoarthritis, Deformitätskorrektur, rheumatoide Arthritis und andere Bereiche unterteilt. Der Bereich Trauma hatte 2025 den größten Marktanteil, da viele Fuß- und Knöchelverletzungen im Zusammenhang mit Sport, Verkehrsunfällen und Arbeitsunfällen auftreten. Ein schneller chirurgischer Eingriff mit Fixiervorrichtungen und Implantaten ist für eine optimale Genesung und Mobilität entscheidend, weshalb Trauma in ganz Europa zum dominierenden Anwendungsbereich zählt.

Es wird erwartet, dass die Arthrose von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnet, was auf die alternde europäische Bevölkerung und die zunehmende Verbreitung degenerativer Gelenkerkrankungen zurückzuführen ist. Minimalinvasive Operationstechniken und Innovationen im Bereich des Gelenkersatzes fördern die Einführung von Fuß- und Knöchellösungen, die auf langfristige Mobilität und Schmerzbehandlung zugeschnitten sind.

- Von Endbenutzern

Der Markt für Fuß- und Sprunggelenksprothesen ist nach Endverbrauchern in Krankenhäuser, ambulante Operationszentren (ASCs) und orthopädische Kliniken unterteilt. Das Krankenhaussegment erzielte 2024 den größten Marktanteil, unterstützt durch hohe Behandlungsvolumina, multidisziplinäre Versorgungsstrukturen und den Zugang zu fortschrittlicher Bildgebung und chirurgischer Navigation. Öffentliche Krankenhäuser in Ländern wie Deutschland, Italien und den Niederlanden profitieren von zentralisierten Beschaffungsrichtlinien und staatlichen Investitionen in die orthopädische Infrastruktur.

Das Segment der ambulanten Operationszentren (ASCs) wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, da ambulante Operationen in ganz Europa immer häufiger durchgeführt werden. ASCs sind zunehmend für minimalinvasive Fuß- und Knöcheloperationen ausgestattet und bieten so eine kostengünstige Versorgung, kürzere Genesungszeiten der Patienten und höhere Betriebseffizienz. Der Trend zu ambulanten orthopädischen Operationen ist besonders in Großbritannien, Spanien und den nordischen Ländern deutlich spürbar.

Regionale Analyse des Marktes für Fuß- und Knöchelgeräte

- Deutschland dominiert den europäischen Markt für Fuß- und Sprunggelenksprothesen und erzielte 2025 mit 26,7 % den größten Umsatzanteil. Dies ist auf die fortschrittliche orthopädische Versorgungsinfrastruktur, die hohe Anzahl an Trauma- und rekonstruktiven Operationen sowie die starke Erstattungssituation für Gelenkimplantate und Fixationsvorrichtungen zurückzuführen. Das Land ist führend bei der Einführung innovativer orthopädischer Lösungen, darunter patientenindividuelle Implantate und minimalinvasive Fixationstechnologien.

- Die orthopädische Exzellenz Deutschlands wird durch ein starkes Netzwerk spezialisierter chirurgischer Zentren, Universitätskliniken und Kooperationen mit globalen Medizintechnikherstellern wie Zimmer Biomet, Stryker und Waldemar Link unterstützt. Diese Partnerschaften gewährleisten einen kontinuierlichen Zugang zu modernsten Geräten und chirurgischen Systemen.

- Darüber hinaus treiben die alternde Bevölkerung und die zunehmende Prävalenz von Arthrose und diabetischen Fußkomplikationen das Wachstum der Verfahren voran. Der Schwerpunkt Deutschlands auf postoperativer Rehabilitation und Mobilitätserhalt fördert auch die Nachfrage nach leistungsstarken Fuß- und Sprunggelenkimplantaten.

Markteinblick für Fuß- und Knöchelgeräte in Frankreich

Der französische Markt für Fuß- und Sprunggelenksprothesen wird im Prognosezeitraum voraussichtlich mit einer signifikanten jährlichen Wachstumsrate wachsen, unterstützt durch ein gut etabliertes öffentliches Gesundheitssystem und nationale Strategien zur Verbesserung der Gesundheit des Bewegungsapparats. Frankreich verzeichnet eine steigende Nachfrage nach chirurgischen Eingriffen bei Traumata, Sportverletzungen und degenerativen Fuß- und Sprunggelenkserkrankungen, insbesondere bei älteren Menschen. Öffentliche Krankenhäuser und orthopädische Einrichtungen in Frankreich setzen zunehmend auf 3D-Bildgebung und chirurgische Navigation, um eine präzise Implantatplatzierung und bessere Ergebnisse bei der Korrektur von Deformitäten und der Rekonstruktion von Gelenken zu erzielen. Regulatorische Unterstützung durch die französische Nationale Agentur für die Sicherheit von Arzneimitteln und Gesundheitsprodukten (ANSM) und gemeinsame Forschungs- und Entwicklungsprojekte zwischen orthopädischen Chirurgen und lokalen Herstellern ermöglichen einen schnelleren Marktzugang für fortschrittliche Geräte und Implantate.

Markteinblicke für Fuß- und Knöchelgeräte in Großbritannien

Der britische Markt für Fuß- und Sprunggelenksprothesen steht vor einem starken Wachstum. Beflügelt werden diese Entwicklung durch NHS-Initiativen zur Reduzierung von Operationsrückständen, zur Verkürzung der Wartezeiten in der Orthopädie und zur Verbesserung des Zugangs zu minimalinvasiven Operationen im öffentlichen und privaten Gesundheitswesen. Die zunehmende Zahl diabetesbedingter Fußkomplikationen, Sportverletzungen und Arthrose führt zu einer deutlich steigenden Nachfrage nach Implantaten, Fixiervorrichtungen und Stützsystemen. Fuß- und Sprunggelenksprothesen werden zunehmend in ambulanten Operationszentren und Ambulanzen durchgeführt, was den Einsatz kompakter, effizienter chirurgischer Instrumente fördert. Die British Orthopaedic Foot & Ankle Society (BOFAS) und verwandte Berufsverbände spielen eine zentrale Rolle bei der Förderung bewährter Verfahren, der chirurgischen Ausbildung und der Einführung innovativer Technologien wie maßgefertigter Implantate, Navigationssysteme und regenerativer orthopädischer Produkte.

Marktanteil von Fuß- und Knöchelgeräten

Die Branche der Fuß- und Knöchelgeräte wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Stryker Corporation (USA)

- Johnson & Johnson (DePuy Synthes) (USA)

- Zimmer Biomet Holdings, Inc. (USA)

- Smith & Nephew plc (Großbritannien)

- Enovis Corporation (USA)

- Acumed, LLC (USA)

- Arthrex, Inc. (USA)

- Paragon 28 Inc. (USA)

- Orthofix Medical Inc. (USA)

- Medtronic plc (Irland)

- DJO LLC (USA)

- Össur hf. (Island)

- B. Braun Melsungen AG (Deutschland)

- Bauerfeind AG (Deutschland)

- Otto Bock Healthcare GmbH (Deutschland)

- Thuasne-Gruppe (Frankreich)

- Fillauer LLC (USA)

Neueste Entwicklungen auf dem europäischen Markt für Fuß- und Knöchelgeräte

- Im Mai 2023 brachte Paragon 28 sein Gorilla Supramalleolar Osteotomy (SMO) Plating und PRESERVE SMO Allograft System auf den Markt und bietet Chirurgen anpassbare Plattenkonfigurationen und Transplantationsoptionen zur Verbesserung der Ergebnisse und Flexibilität bei supramalleolären Osteotomien zur Korrektur komplexer Fuß- und Knöcheldeformitäten.

- Im Dezember 2022 erhielt die Enovis Corporation die FDA-Zulassung für ihr STAR PSI-System. Es ermöglicht Chirurgen die Erstellung personalisierter 3D-Voroperationspläne für den vollständigen Knöchelersatz und verbessert so die Genauigkeit der Implantatpositionierung, die chirurgische Effizienz und die patientenspezifischen Ergebnisse bei orthopädischen Eingriffen.

- Im Februar 2020 übernahm DePuy Synthes, Teil von Johnson & Johnson, CrossRoads Extremity Systems, um sein Fuß- und Knöchelportfolio zu erweitern. Die Übernahme stärkt die Position des Unternehmens in der orthopädischen Versorgung mit fortschrittlichen Technologien für Gelenkversteifung, Ballenzehenkorrektur und Weichteilrekonstruktion.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.