Europe Foam Insulation Market

Marktgröße in Milliarden USD

CAGR :

%

USD

5.25 Billion

USD

8.31 Billion

2024

2032

USD

5.25 Billion

USD

8.31 Billion

2024

2032

| 2025 –2032 | |

| USD 5.25 Billion | |

| USD 8.31 Billion | |

|

|

|

|

Marktsegmentierung für Schaumstoffisolierungen in Europa nach Form (Sprüh-, Flex-, Hart- und andere), Anwendung (Böden, Wände, Dächer und andere), Typ (Polystyrolschaum, Polyurethan- und Polyisocyanuratschaum, Polyolefinschaum, Phenolschaum, Elastomerschaum und andere), Endverbrauch (Bauwesen, Haushaltsgeräte, Transport, Automobilindustrie, Elektro- und Elektronikindustrie, Verpackung und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Schaumstoffisolierungen in Europa

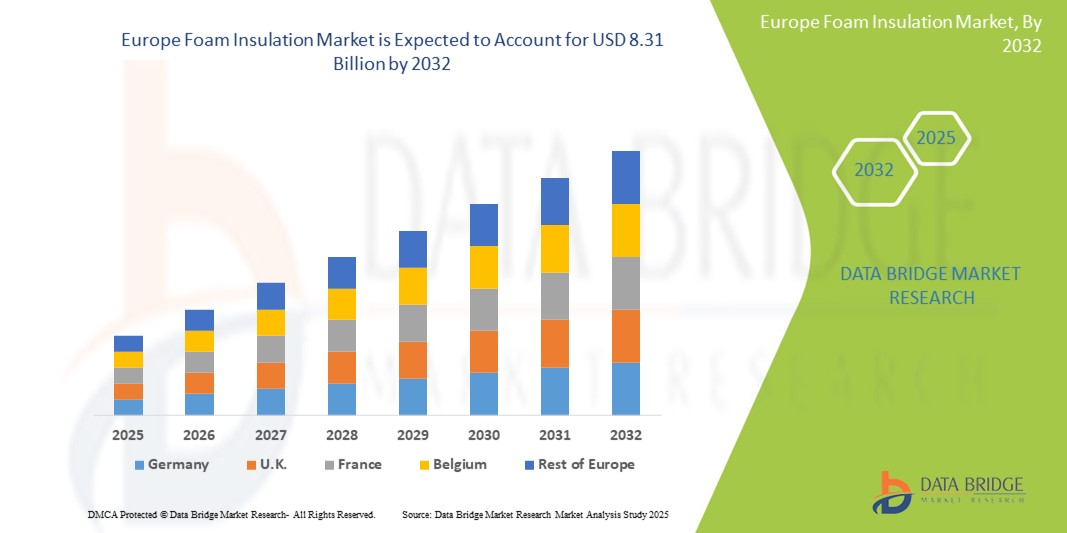

- Der europäische Markt für Schaumstoffisolierungen hatte im Jahr 2024 einen Wert von 5,25 Milliarden US-Dollar und dürfte bis 2032 einen Wert von 8,31 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 5,90 % im Prognosezeitraum entspricht.

- Dieses Wachstum ist auf Faktoren wie die zunehmende Betonung energieeffizienter Gebäude, strenge Bauvorschriften und -bestimmungen zur Förderung der Wärmedämmung, steigende Renovierungsaktivitäten im Wohn- und Gewerbesektor sowie ein wachsendes Bewusstsein für ökologische Nachhaltigkeit und die Reduzierung des CO2-Fußabdrucks zurückzuführen.

Marktanalyse für Schaumstoffisolierungen in Europa

- Der europäische Markt für Schaumstoffisolierungen wächst weiterhin stetig, da die Nutzung in Anwendungen wie Wandhohlräumen, Dachsystemen und industriellen Anlagen, in denen die Wärmeleistung entscheidend ist, zunimmt.

- Marktteilnehmer konzentrieren sich auf Produktinnovationen, die die Haltbarkeit und Leistung in anspruchsvollen Umgebungen, einschließlich Nachrüstungen und Neubauten, verbessern.

- Deutschland wird voraussichtlich den europäischen Markt für Schaumisolierungen mit einem Anteil von 21,05 % dominieren, da der Bausektor stark ist und Deutschland sich für energieeffizientes Bauen einsetzt.

- Frankreich dürfte im Prognosezeitraum aufgrund seiner wachsenden Bautätigkeit und Energieeffizienzprogramme die am schnellsten wachsende Region auf dem europäischen Markt für Schaumisolierungen sein.

- Das Baugewerbe wird voraussichtlich den europäischen Markt für Schaumstoffdämmstoffe mit einem Anteil von 72,05 % im Jahr 2025 dominieren. Grund dafür sind die steigende Nachfrage nach energieeffizienten Gebäuden, strenge Umweltvorschriften und die zunehmende Fokussierung auf die Reduzierung der CO2-Emissionen im Bausektor. Darüber hinaus trägt der Einsatz von Schaumstoffdämmstoffen zur Verbesserung der Wärmeleistung und zur Energieeinsparung in Wohn- und Geschäftsgebäuden bei.

Berichtsumfang und Marktsegmentierung für Schaumstoffisolierungen in Europa

|

Eigenschaften |

Wichtige Markteinblicke in die Schaumstoffisolierung in Europa |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Markttrends für Schaumstoffisolierungen in Europa

„Umstellung auf umweltfreundliche Schaumstoff-Dämmlösungen“

- Der europäische Markt für Schaumstoffisolierungen verzeichnet einen wachsenden Trend zur nachhaltigen Produktentwicklung mit einer starken Verlagerung hin zu umweltfreundlichen Dämmlösungen.

- Viele Hersteller investieren in Schaumstoffe aus pflanzlichen Quellen und recycelten Materialien, um die Ziele des grünen Bauens zu erreichen.

- So bieten Unternehmen beispielsweise Dämmstoffe aus erneuerbaren Materialien wie Sojaöl oder recyceltem Kunststoff an, um umweltschonende Baupraktiken zu unterstützen.

- Dieser Trend wird auch durch die Vorliebe der Verbraucher für energieeffiziente und zugleich umweltverträgliche Bauprodukte geprägt.

- Zusammenfassend lässt sich sagen, dass sich der Markt in Richtung einer Zukunft entwickelt, in der Innovation und Nachhaltigkeit Hand in Hand gehen und die Art und Weise, wie Dämmstoffe hergestellt und angewendet werden, verändert wird.

Marktdynamik für Schaumstoffisolierungen in Europa

Treiber

„Steigende Nachfrage nach energieeffizienten Baulösungen“

- Energieeffizientes Bauen steigert die Nachfrage nach Schaumstoffisolierungen, da Gebäude laut der Europäischen Kommission rund 40 Prozent des gesamten Energieverbrauchs in Europa ausmachen, insbesondere für Heizung und Kühlung.

- Schaumisolierung trägt zur Minimierung des Energieverlusts bei, indem sie thermische Barrieren schafft und die Stabilität der Innentemperatur verbessert, was mit EU-Richtlinien wie der Richtlinie über die Gesamtenergieeffizienz von Gebäuden übereinstimmt.

- So haben beispielsweise Länder wie Deutschland und Frankreich strenge Dämmanforderungen für neue Wohn- und Gewerbeprojekte eingeführt, um die nationalen Energiesparziele zu erreichen.

- Hochleistungsmaterialien wie Polyurethan-Sprühschaum und expandierter Polystyrolschaum werden zunehmend eingesetzt, um die Anforderungen an Öko-Bauzertifizierungen zu erfüllen und die Energiekosten langfristig zu senken.

- Da das Bewusstsein von Hausbesitzern und Unternehmen hinsichtlich reduzierter Energiekosten und verbessertem Komfort wächst, ist Schaumisolierung nicht mehr optional, sondern unerlässlich, um moderne Baustandards zu erfüllen.

- Zusammenfassend lässt sich sagen, dass gesetzliche Auflagen und Energieeinsparungen dazu führen, dass Schaumisolierung bei Bauprojekten in Europa eine bevorzugte Lösung darstellt.

Gelegenheit

„Steigende Sanierungs- und Nachrüstungsaktivitäten in alternder Infrastruktur“

- Die Nachrüstung und Renovierung alternder Gebäude bietet eine große Chance für die Schaumisolierung, da viele Gebäude, die vor den 1990er Jahren gebaut wurden, nicht über moderne Dämmstandards verfügen, was zu hohen Energiekosten führt.

- Schaumstoffisolierung eignet sich ideal für Modernisierungen, da sie sich an unregelmäßige Formen anpasst und einen hohen Wärmewiderstand bietet, ohne dass größere strukturelle Änderungen erforderlich sind.

- So zielt die Strategie der Europäischen Union zur Renovierungswelle darauf ab, bis 2030 über 35 Millionen Gebäude zu renovieren, was einen enormen Spielraum für den Einbau von Dämmsystemen bietet.

- Finanzielle Unterstützung wie Subventionen, Steuergutschriften und grüne Kredite ermutigen Immobilienbesitzer, die Energieeffizienz durch Dämmverbesserungen zu verbessern, insbesondere in Wohngebäuden und in der öffentlichen Infrastruktur.

- Bei der Sanierung von Schulen, Gesundheitszentren und Regierungsgebäuden werden schaumbasierte Außendämmsysteme eingesetzt, die sowohl die Effizienz als auch das äußere Erscheinungsbild verbessern.

- Zusammenfassend lässt sich sagen, dass der Vorstoß zur Renovierung des veralteten europäischen Gebäudebestands eine stetige langfristige Nachfrage nach fortschrittlichen Schaumdämmlösungen freisetzt.

Einschränkung/Herausforderung

„Volatilität der Rohstoffpreise und Störungen in der Lieferkette“

- Volatile Rohstoffpreise bleiben eine große Herausforderung für den Markt für Schaumstoffisolierungen, da wichtige Rohstoffe wie Polyurethan und Polystyrol aus Öl und Gas gewonnen werden, die globalen Preisschwankungen unterliegen.

- Während der Energiekrise 2021 in Europa sahen sich die Dämmstoffhersteller beispielsweise aufgrund steigender Rohölpreise und einer geringeren petrochemischen Produktion mit einem starken Anstieg der Rohstoffkosten konfrontiert.

- Unterbrechungen der Lieferketten, die durch Ereignisse wie die COVID-19-Pandemie, den Russland-Ukraine-Konflikt und Containerknappheit ausgelöst wurden, führten zu unregelmäßigen Lieferplänen und überhöhten Kosten.

- Diese Unvorhersehbarkeit erschwert es den Herstellern, stabile Preise anzubieten oder langfristige Verträge abzuschließen. Dies kann zu Projektverzögerungen, Neuausschreibungen oder einer Umstellung auf preisstabilere Alternativen führen.

- Vor allem kleinere Akteure haben Schwierigkeiten, Kostensteigerungen aufzufangen und ihre Wettbewerbsfähigkeit aufrechtzuerhalten, was ein Hindernis für die konsequente Einführung von Schaumisolierungen in kostensensiblen Bausegmenten darstellt.

- Zusammenfassend lässt sich sagen, dass die Abhängigkeit der Industrie von fossilen Rohstoffen sie anfällig für wirtschaftliche und geopolitische Schocks macht, was die Notwendigkeit einer Diversifizierung und widerstandsfähigerer Beschaffungsstrategien unterstreicht.

Marktumfang für Schaumstoffisolierungen in Europa

Der Markt ist nach Form, Anwendung, Typ und Endnutzung segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Formular |

|

|

Nach Anwendung |

|

|

Nach Typ |

|

|

Nach Endverwendung

|

|

Im Jahr 2025 wird das Bau- und Konstruktionssegment voraussichtlich den Markt dominieren und den größten Anteil am Endverbrauchssegment haben.

Das Baugewerbe wird voraussichtlich bis 2025 mit 72,05 % den europäischen Markt für Schaumstoffdämmstoffe dominieren. Grund dafür sind die steigende Nachfrage nach energieeffizienten Gebäuden, strenge Umweltvorschriften und die zunehmende Fokussierung auf die Reduzierung der CO2-Emissionen im Bausektor. Darüber hinaus trägt der Einsatz von Schaumstoffdämmstoffen zur Verbesserung der Wärmedämmung und zur Energieeinsparung in Wohn- und Geschäftsgebäuden bei.

Das Segment Böden wird voraussichtlich im Prognosezeitraum den größten Anteil im Anwendungssegment ausmachen

Im Jahr 2025 wird das Segment Fußböden voraussichtlich den Markt dominieren und den größten Marktanteil einnehmen, da es eine entscheidende Rolle bei der Minimierung von Energieverlusten durch Gebäudefundamente und der Verbesserung der Gesamtwärmeleistung in Wohn- und Geschäftsgebäuden spielt.

Regionale Analyse des europäischen Marktes für Schaumisolierung

„Deutschland hält den größten Anteil am europäischen Markt für Schaumstoffisolierungen“

- Deutschland ist mit einem Anteil von 21,05 % der führende Markt für Schaumstoffisolierungen in Europa. Grund dafür ist die starke Bauwirtschaft und das Engagement für energieeffizientes Bauen.

- Das Land verfügt über strenge Energievorschriften, die den Einsatz moderner Dämmstoffe sowohl bei Neubauten als auch bei Renovierungsprojekten fördern.

- In Deutschland ist die Nachfrage nach Schaumisolierungen hoch, da sowohl der Wohn- als auch der Gewerbesektor auf die Verbesserung der Energieeffizienz setzen.

- Staatliche Anreize und Initiativen für umweltfreundliches Bauen treiben das Wachstum von Schaumstoff-Dämmprodukten in verschiedenen Sektoren weiter voran

- Die wichtigsten Hersteller von Schaumstoffisolierungen haben ihren Sitz in Deutschland und stärken ihre marktbeherrschende Stellung durch kontinuierliche Innovationen und hohe Produktverfügbarkeit.

„Frankreich wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate auf dem europäischen Markt für Schaumstoffisolierungen verzeichnen“

- Frankreich verzeichnet das schnellste Wachstum im Markt für Schaumstoffisolierungen, angetrieben durch die zunehmende Bautätigkeit und Energieeffizienzprogramme.

- Das Engagement der Regierung zur Reduzierung der Kohlenstoffemissionen und zur Förderung nachhaltiger Baupraktiken hat zu einer erhöhten Nachfrage nach Dämmlösungen geführt

- Bei Renovierungsprojekten, insbesondere in älteren Gebäuden, wurde verstärkt auf Schaumstoffisolierung gesetzt, um die Wärmeeffizienz und den Komfort zu verbessern.

- Der französische Markt profitiert von neuen Infrastrukturentwicklungen, die eine leistungsstarke Isolierung erfordern, um modernen Baustandards zu entsprechen

- Finanzielle Anreize und Subventionen für energieeffiziente Baumaterialien beschleunigen die Verbreitung von Schaumstoffdämmstoffen im Wohn- und Gewerbebereich zusätzlich.

Marktanteil von Schaumstoffisolierungen in Europa

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Rogers Corporation (USA)

- Sealed Air (USA)

- DuPont (USA)

- Dow (USA)

- NOVA Chemicals Corporate (Kanada)

- JSP (Japan)

- KANEKA CORPORATION (Japan)

- Loyal Group (Indien)

- JIANGSU LEASTY CHEMICAL CO., LTD. (China)

- Wuxi Xingda Schaumstoff Neues Material Limited (China)

- Taita Chemical Co., Ltd. (Taiwan)

- Reliance Industries Limited (Indien)

- BASF SE (Deutschland)

- ARMACELL (Luxemburg)

- Recticel NV (Belgien)

- Arkema (Deutschland)

- Zotefoams Plc (Großbritannien)

- Synthos (Polen)

- Versalis SpA (Italien)

- SABIC (Saudi-Arabien)

Neueste Entwicklungen auf dem europäischen Markt für Schaumisolierung

- Im Mai 2025 eröffnete Armacell ein neues Aerogel-Dämmstoffwerk in Indien und brachte seine Aerogel-Produktlinie der nächsten Generation auf den Markt. Mit dieser neuen Anlage kann das Unternehmen die wachsende Nachfrage nach Hochleistungsdämmstoffen in der Region decken. Die Produktlinie bietet hervorragende Wärme- und Schalldämmeigenschaften für verschiedene Branchen, darunter Energie, Öl und Gas sowie Bauwesen.

- Im Dezember 2023 gab Saint-Gobain bekannt, im Rahmen seines strategischen Veräußerungsplans die Mehrheitsbeteiligung an seinem britischen Schaumstoff-Dämmstoffunternehmen Celotex veräußern zu wollen. Die Vermögenswerte von Celotex werden in ein neu gegründetes, unabhängiges Unternehmen überführt. Soprema, ein privates französisches Unternehmen, das auf Abdichtung und Dämmung spezialisiert ist, erwirbt 75 % der Anteile. Saint-Gobain behält eine Minderheitsbeteiligung von 25 % an dem neuen Unternehmen. Diese Entscheidung spiegelt die strategische Neuausrichtung und Optimierung des Geschäftsportfolios von Saint-Gobain wider und ergänzt die Expertise von Soprema im Dämmstoffsektor.

- Im Juni 2022 übernahm Owens Corning Natural Polymers LLC und nutzte damit strategisch Polyurethan-Sprühschaumisolierungen für Bau- und Konstruktionsanwendungen, stärkte seine Marktposition und förderte Wachstum und Innovationsfähigkeit.

- Im August 2021 brachte Owens Corning die PINK Next Gen Fiberglas-Dämmung auf den Markt. Sie zeichnet sich durch fortschrittliche Fasertechnologie aus, die eine bis zu 23 % schnellere Installation ermöglicht und damit sein Engagement für Innovation und Effizienz auf dem Dämmstoffmarkt unterstreicht.

- Im Mai 2021 brachte DuPont eine HFC-freie Version seiner Sprüh-Polyurethanschaumisolierung auf den Markt und erweiterte damit sein Produktportfolio um umweltfreundliche Lösungen, richtet sich an nachhaltigkeitsbewusste Verbraucher und vergrößerte seine Marktreichweite.

- Im Juli 2021 schloss Xtratherm, eine Tochtergesellschaft von Unilin Insulation, die Übernahme der irischen und britischen Niederlassungen von Ballytherm ab, einschließlich einer PIR-Dämmanlage und Expansionsplänen. Damit stärkte Xtratherm seine Präsenz in Großbritannien und Irland und positionierte sich für eine nachhaltige Marktexpansion.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.