Europe Excipients Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.89 Billion

USD

2.96 Billion

2024

2032

USD

1.89 Billion

USD

2.96 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.96 Billion | |

|

|

|

|

Marktsegmentierung für Hilfsstoffe in Europa nach Herkunft (organisch und anorganisch), Kategorie (primäre und sekundäre Hilfsstoffe), Produkten (Polymere, Zucker, Alkohole, Mineralien, Gelatine und Sonstige), chemischer Art (pflanzlich, tierisch, synthetisch und mineralisch), chemischer Synthese (Laktose-Monohydrat, Sucralose, Polysorbat, Benzylalkohol, Cetostearylalkohol, Sojalecithin, vorverkleisterte Stärke und Sonstige), Funktionalität (Bindemittel und Klebstoffe, Sprengmittel, Überzugsmaterialien, Lösungsvermittler, Aromen, Süßungsmittel, Verdünnungsmittel, Gleitmittel, Puffer, Emulgatoren, Konservierungsmittel, Antioxidationsmittel, Sorptionsmittel, Lösungsmittel, Weichmacher, Gleitmittel, Chelatbildner, Entschäumer und Sonstige), Darreichungsform (fest, halbfest und flüssig), Verabreichungsweg (oral). Hilfsstoffe (einschließlich topischer, parenteraler und sonstiger Hilfsstoffe), Endverbraucher (Pharmazeutische und biopharmazeutische Unternehmen, Auftragsformulierer, Forschungseinrichtungen und Hochschulen sowie Sonstige), Vertriebskanal (Direktvergabe, Einzelhandel und Sonstige) – Branchentrends und Prognose bis 2032

Marktgröße für Hilfsstoffe in Europa

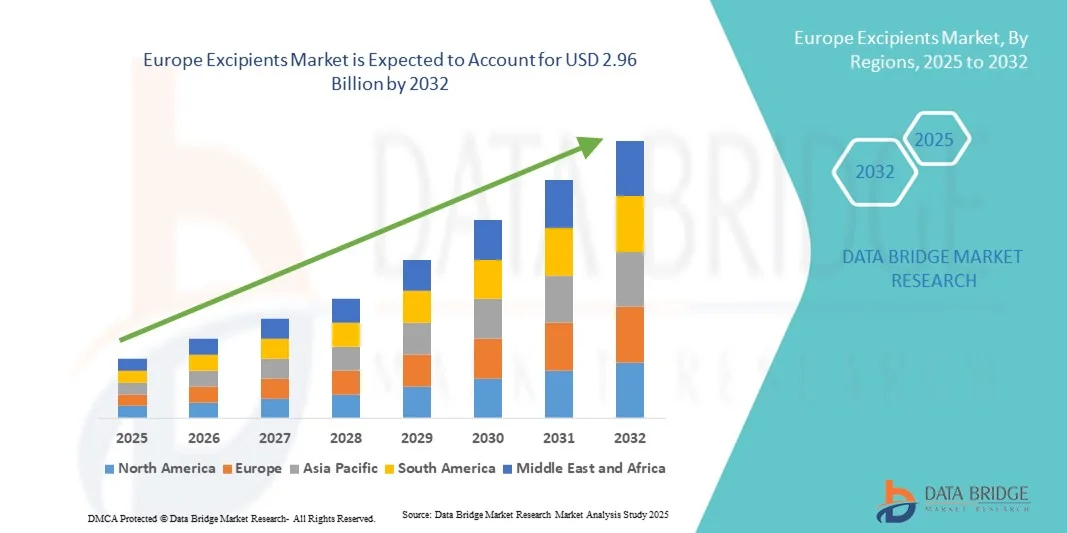

- Der europäische Markt für Hilfsstoffe hatte im Jahr 2024 einen Wert von 1,89 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 2,96 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,80 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach pharmazeutischen Formulierungen und die zunehmende Anwendung fortschrittlicher Arzneimittelverabreichungstechnologien in entwickelten und aufstrebenden Märkten angetrieben.

- Darüber hinaus treibt der zunehmende Fokus auf die Verbesserung der Arzneimittelstabilität, der Wirksamkeit und der Patientenadhärenz die Nutzung von Hilfsstofflösungen voran und steigert damit das Wachstum der Branche erheblich.

Analyse des europäischen Hilfsstoffmarktes

- Der Markt für Hilfsstoffe, der Substanzen zur Verbesserung der Stabilität, Bioverfügbarkeit und Wirksamkeit pharmazeutischer Formulierungen umfasst, verzeichnet aufgrund der steigenden Nachfrage nach optimierten Arzneimittelverabreichungssystemen und der Expansion der pharmazeutischen Industrie ein signifikantes Wachstum.

- Die steigende Nachfrage nach Hilfsstoffen wird vor allem durch die wachsende Produktion oraler und injizierbarer Medikamente, den zunehmenden Fokus auf neuartige Arzneimittelverabreichungssysteme und den steigenden Bedarf an kostengünstigen Formulierungslösungen angetrieben.

- Deutschland dominierte 2024 mit einem Umsatzanteil von 41,5 % den Markt für Hilfsstoffe. Dies ist auf eine starke pharmazeutische Produktionsbasis, hohe Gesundheitsausgaben und die Präsenz wichtiger Branchenakteure zurückzuführen. Das Land verzeichnete ein deutliches Wachstum bei der Anwendung von Hilfsstoffen in oralen, injizierbaren und topischen Darreichungsformen.

- Frankreich dürfte im Prognosezeitraum aufgrund der steigenden pharmazeutischen Produktion, der Einführung fortschrittlicher Arzneimittelverabreichungstechnologien und zunehmender Investitionen in die Gesundheitsinfrastruktur die am schnellsten wachsende Region im Markt für Hilfsstoffe sein.

- Das Segment der primären Hilfsstoffe erzielte 2024 mit 47,3 % den größten Umsatzanteil. Dies ist auf ihre zentrale Rolle in pharmazeutischen Formulierungen zurückzuführen, darunter Bindemittel, Verdünnungsmittel und Sprengmittel. Primäre Hilfsstoffe bilden das Rückgrat von Arzneimittelformulierungen und bieten Stabilität, verbesserte Handhabung und optimierte Bioverfügbarkeit.

Berichtsumfang und Marktsegmentierung für Hilfsstoffe

|

Attribute |

Hilfsstoffe – Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Trends auf dem europäischen Hilfsstoffmarkt

Steigende Nachfrage nach Hochleistungs- und Funktionshilfsstoffen

- Ein bedeutender und sich beschleunigender Trend auf dem globalen Markt für Amyloidneuropathie ist die verstärkte Betonung der Früherkennung und der Entwicklung personalisierter Therapien zur Verbesserung der Patientenergebnisse.

- So berichtete beispielsweise Ionis Pharmaceuticals im März 2023 über Fortschritte in ihren Phase-2-Studien zur Antisense-Oligonukleotid-Therapie gegen erbliche Amyloidneuropathie und unterstrich damit den Fokus des Marktes auf zielgerichtete Therapien.

- Fortschritte bei Diagnosetechnologien wie Gentests und Gewebebiopsien ermöglichen eine frühere Erkennung und bessere Charakterisierung von Amyloidneuropathien.

- Personalisierte Medizinansätze treiben die Entwicklung maßgeschneiderter Behandlungspläne voran, die auf patientenspezifischen genetischen und klinischen Profilen basieren.

- Kliniker setzen zunehmend auf multimodale Behandlungsstrategien, die Medikamente, Lebensstilinterventionen und unterstützende Maßnahmen kombinieren, um optimale Patientenergebnisse zu erzielen.

- Es zeichnet sich ein Trend hin zu weniger invasiven und sichereren Therapieoptionen ab, die Nebenwirkungen reduzieren und die Patientenadhärenz verbessern.

- Die laufende Forschung und Entwicklung konzentriert sich auf die Entwicklung neuartiger Moleküle und Wirkstoffträgersysteme, die gezielt Amyloidablagerungen und Nervendegeneration behandeln. Der Markttrend umfasst auch Kombinationstherapien und mehrstufige Behandlungsprotokolle, die die Wirksamkeit bei verschiedenen Patientengruppen verbessern sollen.

- Studien mit Erkenntnissen aus der Praxis und Daten aus klinischen Studien beeinflussen die Entscheidungen von Ärzten und fördern die Anwendung fortschrittlicher Behandlungsmethoden. Initiativen zur Patientenaufklärung verbessern das Bewusstsein für den Krankheitsverlauf und die Bedeutung eines rechtzeitigen Eingreifens.

- Gesundheitsdienstleister kooperieren mit Pharmaunternehmen, um genetische Screenings und Biomarkeranalysen in die klinische Routine zu integrieren. Dieser Trend wird durch steigende Investitionen im Gesundheitswesen und die Entwicklung spezialisierter neurologischer Zentren in wichtigen Regionen verstärkt.

Marktdynamik für Hilfsstoffe in Europa

Treiber

Zunehmende Verbreitung von Amyloidneuropathien und steigendes Patientenbewusstsein

- Verbesserte Diagnosemöglichkeiten und zunehmende klinische Forschungsaktivitäten fördern die Früherkennung und Intervention.

- So erhielt beispielsweise Alnylam Pharmaceuticals im Juni 2022 die FDA-Zulassung für Onpattro (Patisiran), ein Medikament zur Behandlung der erblichen Transthyretin-vermittelten Amyloidneuropathie, was die Bedeutung innovativer Therapien für das Marktwachstum unterstreicht.

- Der Ausbau von Fachkliniken und neurologischen Zentren verbessert den Zugang zu Behandlung und Versorgung für Patienten. Die Anwendung fortschrittlicher Therapien, die auf spezifische Amyloidproteine abzielen, beschleunigt das Marktwachstum.

- Gesundheitspolitische Maßnahmen zur Förderung des Bewusstseins für seltene Erkrankungen tragen zu höheren Diagnosequoten bei. Steigende verfügbare Einkommen in entwickelten Regionen ermöglichen es Patienten, leichter Zugang zu fortschrittlichen Therapien zu erhalten. Pharmaunternehmen investieren massiv in Forschung und Entwicklung, um sicherere und wirksamere Medikamente zu entwickeln.

- Die zunehmende Zusammenarbeit zwischen Krankenhäusern, Forschungsinstituten und Biotechnologieunternehmen fördert Innovationen. Patientenorientierte Versorgungsmodelle treiben die Nachfrage nach personalisierten Therapien an. Telemedizin und digitale Gesundheitslösungen erleichtern die Behandlungsplanung und -überwachung.

Zurückhaltung/Herausforderung

Hohe Kosten im Zusammenhang mit fortschrittlicher Diagnostik und zielgerichteten Therapien

- Die begrenzte Verfügbarkeit spezialisierter neurologischer Zentren in bestimmten Regionen stellt ein Zugangsproblem dar. Komplexe Zulassungsverfahren für Therapien seltener Erkrankungen können die Produktzulassung verzögern. Die unterschiedliche Reaktion der Patienten auf die Therapie kann die Standardisierung von Behandlungsprotokollen erschweren.

- Die Einhaltung langfristiger Behandlungspläne sicherzustellen, stellt sowohl für Patienten als auch für Behandler eine Herausforderung dar. Fehlendes Wissen unter Hausärzten kann zu verzögerter Diagnose und Behandlung führen. Lieferkettenprobleme bei Spezialmedikamenten und Biologika können die Verfügbarkeit beeinträchtigen.

- Beispielsweise verdeutlichte der im September 2021 eingeschränkte Zugang zu Tafamidis in mehreren europäischen Ländern aufgrund der hohen Kosten die Probleme der Bezahlbarkeit und Verfügbarkeit auf dem Markt für Amyloidneuropathie.

- Kostenträger können Einschränkungen auferlegen oder einen Nachweis der Kosteneffektivität verlangen, bevor sie neue Therapien übernehmen. Erstattungsprobleme für neuartige Behandlungen können in manchen Regionen Hürden für Patienten darstellen. Kontinuierliche Innovation erfordert erhebliche Investitionen in klinische Studien und die Produktion. Der Mangel an groß angelegten epidemiologischen Daten in einigen Regionen erschwert Marktprognosen und die Planung klinischer Studien.

- Mögliche Nebenwirkungen und Sicherheitsbedenken bei neuen Therapien können die Akzeptanz bei vorsichtigen Patienten und Ärzten verlangsamen. Ethische und logistische Herausforderungen bei der Durchführung von Studien zu seltenen erblichen Formen der Amyloidneuropathie können die Therapieentwicklung verzögern.

- Eine begrenzte Patientenzahl in klinischen Studien kann die statistische Aussagekraft verringern und die Arzneimittelzulassung verzögern. Unterschiede in der Gesundheitsinfrastruktur zwischen städtischen und ländlichen Regionen können den Zugang zu Diagnose und Behandlung einschränken. Lücken im Versicherungsschutz und hohe Zuzahlungen können Patienten davon abhalten, rechtzeitig medizinische Hilfe in Anspruch zu nehmen.

- Ärzte zögern aufgrund unzureichender Langzeitdaten zur Sicherheit, neu zugelassene Therapien anzuwenden. Die Variabilität des Krankheitsverlaufs erschwert die Erstellung standardisierter Behandlungsleitlinien. Die Koordination zwischen multidisziplinären Behandlungsteams kann bei der Behandlung systemischer Krankheitsmanifestationen eine Herausforderung darstellen.

Umfang des europäischen Hilfsstoffmarktes

Der Markt für Hilfsstoffe ist segmentiert nach Herkunft, Kategorie, Produkten, chemischer Art, chemischer Synthese, Funktionalität, Darreichungsform, Verabreichungsweg, Endverbraucher und Vertriebskanal.

- Nach Herkunft

Der europäische Markt für Hilfsstoffe ist nach Herkunft in organische und anorganische Hilfsstoffe unterteilt. Das Segment der organischen Hilfsstoffe dominierte 2024 mit einem Marktanteil von 45,1 %, was auf die steigende Nachfrage nach natürlich gewonnenen Hilfsstoffen in pharmazeutischen Formulierungen zurückzuführen ist. Hersteller und Formulierer bevorzugen organische Hilfsstoffe aufgrund ihrer Biokompatibilität, minimalen Nebenwirkungen und der Einhaltung von Patientensicherheitsstandards. Die wachsende Nachfrage nach Clean-Label- und nachhaltigen Arzneimitteln verstärkt das Wachstum dieses Segments zusätzlich. Organische Hilfsstoffe bieten zudem vielseitige Einsatzmöglichkeiten in verschiedenen Darreichungsformen, darunter feste, halbfeste und flüssige Formulierungen. Die regulatorische Unterstützung für natürliche Inhaltsstoffe in Arzneimitteln hat deren Akzeptanz, insbesondere in Europa, positiv beeinflusst. Darüber hinaus tragen organische Hilfsstoffe zu einer verbesserten Bioverfügbarkeit, Stabilität und Patienten-Compliance bei, wodurch sie sowohl für Generika als auch für innovative Arzneimittel sehr attraktiv sind. Führende Akteure investieren aktiv in Forschung und Entwicklung, um die Extraktion und Reinigung pflanzlicher und tierischer Hilfsstoffe zu optimieren. Dieser Trend ist besonders bei der Entwicklung oraler und parenteraler Formulierungen ausgeprägt. Der zunehmende Trend zu patientenorientierten und umweltfreundlichen Arzneimittelformulierungen trägt zur anhaltenden Dominanz organischer Hilfsstoffe bei. So erweiterte beispielsweise ein führender europäischer Anbieter im Jahr 2023 sein Portfolio an organischen Polymeren, um der pharmazeutischen Nachfrage gerecht zu werden.

Für das Segment der anorganischen Hilfsstoffe wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,4 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die zunehmende Verwendung in Spezialformulierungen wie Antazida, Pufferlösungen und Tablettenüberzügen. Anorganische Hilfsstoffe bieten Vorteile hinsichtlich präziser chemischer Stabilität, Kosteneffizienz und Skalierbarkeit. Steigende Anwendungen in der großtechnischen Herstellung von Generika und Nutrazeutika fördern die Nutzung anorganischer Hilfsstoffe. Darüber hinaus steigert das wachsende Bewusstsein für die Funktionalität von Hilfsstoffen zur Verbesserung der Löslichkeit und des Auflösungsprofils die Nachfrage. Anorganische Hilfsstoffe werden bevorzugt in Anwendungen eingesetzt, die hohe Reinheit und die Einhaltung regulatorischer Vorgaben erfordern. Hersteller entwickeln innovative, modifizierte Mineralien und Salze, um die Funktionalität in festen und halbfesten Darreichungsformen zu erweitern. Die steigende pharmazeutische Produktion in aufstrebenden europäischen Ländern trägt zusätzlich zum Wachstum bei. Zulassungen und die Standardisierung anorganischer Hilfsstoffe für therapeutische Zwecke stärken das Vertrauen und die Akzeptanz bei den Formulierern.

- Nach Kategorie

Basierend auf der Produktkategorie ist der Markt in Primär- und Sekundärhilfsstoffe unterteilt. Das Segment der Primärhilfsstoffe erzielte 2024 mit 47,3 % den größten Umsatzanteil. Dies ist auf ihre zentrale Rolle in pharmazeutischen Formulierungen zurückzuführen, darunter Bindemittel, Verdünnungsmittel und Sprengmittel. Primärhilfsstoffe bilden das Rückgrat von Arzneimittelformulierungen und sorgen für Stabilität, verbesserte Handhabung und optimierte Bioverfügbarkeit. Hersteller verlassen sich auf Primärhilfsstoffe, um Konsistenz, Wirksamkeit und Haltbarkeit ihrer Produkte zu gewährleisten. Die steigende Nachfrage nach festen Darreichungsformen wie Tabletten und Kapseln hat dieses Segment gestärkt. Primärhilfsstoffe unterstützen zudem die Entwicklung von Formulierungen mit kontrollierter und sofortiger Wirkstofffreisetzung. Das Segment profitiert von der regulatorischen Fokussierung auf hochwertige Rohstoffe. Pharmaunternehmen priorisieren Primärhilfsstoffe, um die Anforderungen der Guten Herstellungspraxis (GMP) zu erfüllen. Innovationen bei polymerbasierten Hilfsstoffen und natürlich gewonnenen Bindemitteln treiben das Wachstum zusätzlich an. Beispielsweise erweiterte im Jahr 2022 ein europäischer Polymerlieferant sein Portfolio um orale feste Darreichungsformen.

Das Segment der Hilfsstoffe wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,9 % das schnellste Wachstum verzeichnen. Treiber dieses Wachstums ist der zunehmende Einsatz in fortschrittlichen Formulierungen, beispielsweise als Überzüge, Lösungsvermittler, Aromen und Konservierungsmittel. Hilfsstoffe ermöglichen eine verbesserte Stabilität, höhere Patientenakzeptanz und eine gezielte Wirkstofffreisetzung. Innovationen bei funktionellen Hilfsstoffen zur Geschmacksmaskierung und Löslichkeitsverbesserung treiben das Wachstum an. Auftragshersteller und biopharmazeutische Unternehmen integrieren Hilfsstoffe, um ihre Produkte besser zu differenzieren. Die steigende Nachfrage wird durch den zunehmenden Einsatz in pädiatrischen und geriatrischen Formulierungen weiter angekurbelt. Zulassungsverfahren und der Bedarf an Sicherheitsdaten für Hilfsstoffe beschleunigen die Akzeptanz. Neue Trends bei Kombinationstherapien und Mehrkomponenten-Darreichungsformen stärken das Segment zusätzlich. So brachte beispielsweise ein europäisches Unternehmen im März 2023 einen neuen Überzugshilfsstoff zur Verbesserung der Stabilität von Tabletten für Kinder auf den Markt.

- Nebenprodukte

Basierend auf den Produkten ist der Markt in Polymere, Zucker, Alkohole, Mineralien, Gelatine und Sonstige unterteilt. Das Segment der Polymere dominierte 2024 mit einem Umsatzanteil von 44,7 % aufgrund ihrer Multifunktionalität als Bindemittel, Beschichtungen und Trägermaterialien für die kontrollierte Wirkstofffreisetzung. Polymere verbessern die Stabilität, Löslichkeit und Verarbeitbarkeit von Formulierungen und sind daher bei Pharmaunternehmen sehr gefragt. Die zunehmende Anwendung in oralen, topischen und parenteralen Darreichungsformen treibt das Segment an. Polymerhilfsstoffe ermöglichen zudem die Entwicklung innovativer Verabreichungssysteme wie Nanopartikel und Hydrogele. Intensive Forschung und Entwicklung im Bereich biokompatibler Polymere sichert deren anhaltende Nachfrage. Die regulatorische Akzeptanz von Polymeren in pharmazeutischer Qualität fördert deren Einsatz zusätzlich. Die Möglichkeit, die Polymereigenschaften an die Eigenschaften von Arzneimitteln anzupassen, erhöht die Flexibilität der Formulierung. Polymere werden zunehmend in hochwertigen Therapien, einschließlich Biologika, eingesetzt. So erweiterte beispielsweise ein europäischer Anbieter im Jahr 2022 sein Portfolio an Hydroxypropylmethylcellulose für orale und topische Anwendungen.

Das Segment Zucker wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,1 % das schnellste Wachstum verzeichnen. Grund dafür ist die zunehmende Verwendung von Zucker als Süßungsmittel, Füllstoff und Stabilisator in oralen Darreichungsformen. Die steigende Nachfrage nach patientenfreundlichen Formulierungen, darunter Kautabletten und Sirupe, trägt zum Wachstum bei. Zucker verbessern zudem den Geschmack und die Stabilität von Wirkstoffen. Die zunehmende Verbreitung von Medikamenten für Kinder und ältere Menschen trägt zur Expansion dieses Segments bei. Europäische Pharmaunternehmen konzentrieren sich aufgrund des Nachhaltigkeitstrends auf natürlich gewonnene Zucker. Funktionelle Zucker gewinnen aufgrund ihrer Fähigkeit, die Freisetzung zu modulieren und die Löslichkeit zu verbessern, an Bedeutung. Das Marktwachstum wird auch durch die Verwendung von Zucker in Nutrazeutika und Nahrungsergänzungsmitteln unterstützt. Im Jahr 2023 brachte ein Hersteller einen vorverkleisterten Zuckerhilfsstoff speziell für Kautabletten auf den Markt.

- Nach Chemieart

Basierend auf der chemischen Zusammensetzung ist der Markt in pflanzliche, tierische, synthetische und mineralische Hilfsstoffe unterteilt. Das Segment der pflanzlichen Hilfsstoffe erzielte 2024 mit 45,8 % den größten Umsatzanteil, was auf die steigende Nachfrage nach natürlichen, biokompatiblen Hilfsstoffen in pharmazeutischen und nutrazeutischen Formulierungen zurückzuführen ist. Pflanzliche Hilfsstoffe bieten Sicherheit, einfache regulatorische Handhabung und Kompatibilität mit verschiedenen Darreichungsformen. Die hohe Verbrauchernachfrage nach Clean-Label- und umweltfreundlichen Inhaltsstoffen treibt das Wachstum an. Intensive Forschung und Entwicklung im Bereich Extraktions- und Stabilisierungstechniken verbessern die Anwendbarkeit. Anwendungen in Tabletten, Kapseln und halbfesten Darreichungsformen fördern die Akzeptanz. Das wachsende Bewusstsein für Patientensicherheit und weniger Nebenwirkungen spricht für pflanzliche Hilfsstoffe. Staatliche und regulatorische Unterstützung für natürliche Hilfsstoffe steigert die Akzeptanz. So erweiterte beispielsweise ein europäisches Unternehmen 2023 sein Portfolio an pflanzenbasierten Polymeren für orale Formulierungen.

Für das Segment der synthetischen Hilfsstoffe wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,7 % das schnellste Wachstum erwartet. Gründe hierfür sind Vorteile wie Skalierbarkeit, chemische Stabilität und Kosteneffizienz. Synthetische Hilfsstoffe finden breite Anwendung in der Massenproduktion und bei Formulierungen mit kontrollierter Wirkstofffreisetzung. Innovationen bei synthetischen Polymeren und Tensiden treiben das Wachstum zusätzlich an. Pharmaunternehmen, die eine präzise Formulierung anstreben, beschleunigen die Einführung synthetischer Hilfsstoffe. Die Zulassung synthetischer Hilfsstoffe für neuartige Therapeutika unterstützt die Expansion. Synthetische Hilfsstoffe werden zunehmend sowohl in festen als auch in flüssigen Darreichungsformen eingesetzt. Auch die steigende Nachfrage von Auftragsherstellern trägt dazu bei. So wurde beispielsweise 2024 in Europa ein synthetischer Polymerhilfsstoff für Tabletten mit sofortiger Wirkstofffreisetzung eingeführt.

- Durch chemische Synthese

Auf Basis der chemischen Synthese ist der Markt in Lactose-Monohydrat, Sucralose, Polysorbat, Benzylalkohol, Cetostearylalkohol, Sojalecithin, vorverkleisterte Stärke und Sonstige unterteilt. Das Segment Lactose-Monohydrat erzielte 2024 mit 43,5 % den größten Umsatzanteil, was auf seine breite Anwendung als Füllstoff, Verdünnungsmittel und Stabilisator in Tabletten und Kapseln zurückzuführen ist. Seine Kompatibilität mit verschiedenen Wirkstoffen und seine hervorragenden Fließeigenschaften machen es zu einer bevorzugten Wahl für Pharmahersteller. Lactose-Monohydrat wird auch aufgrund seiner Rolle bei der Verbesserung der Kompressibilität, der Gewährleistung einer gleichmäßigen Dosierung und der Erhöhung der Produktstabilität sehr geschätzt. Das Segment profitiert von der etablierten regulatorischen Akzeptanz in Europa, wodurch Formulierungsrisiken reduziert werden. Seine Vielseitigkeit in festen und halbfesten Darreichungsformen fördert die Akzeptanz zusätzlich. Hersteller bevorzugen Lactose-Monohydrat auch für Medikamente für Kinder und ältere Menschen aufgrund seiner geringen Toxizität und hohen Akzeptanz. Beispielsweise erweiterte im Jahr 2023 ein führender europäischer Lieferant sein Portfolio an Lactose-Monohydrat, um die Produktion von oralen Darreichungsformen in großen Mengen zu unterstützen.

Für das Sucralose-Segment wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 24,0 % das schnellste Wachstum erwartet. Treiber dieses Wachstums ist die zunehmende Verwendung in gesüßten Zubereitungen, Kautabletten und Sirupen. Sucralose bietet funktionelle Vorteile wie Geschmacksmaskierung, verbesserte Patientencompliance und Stabilität unter verschiedenen Verarbeitungsbedingungen. Die steigende Nachfrage nach pädiatrischen und geriatrischen Zubereitungen fördert die Akzeptanz zusätzlich. Europäische Hersteller integrieren Sucralose vermehrt in Nahrungsergänzungsmittel und rezeptfreie Produkte. Innovationen bei Sucralose-Derivaten ermöglichen eine bessere Löslichkeit und kontrollierte Freisetzung in oralen Darreichungsformen. Die Zulassung für die Verwendung in pharmazeutischen Zubereitungen stärkt das Marktvertrauen. Auch die zunehmenden Anwendungen in funktionellen Lebensmitteln und Nahrungsergänzungsmitteln tragen zum Wachstum bei. So brachte beispielsweise ein europäisches Hilfsstoffunternehmen im Jahr 2024 einen auf Sucralose basierenden Süßstoff speziell für Kautabletten auf den Markt.

- Nach Funktionalität

Basierend auf ihrer Funktionalität ist der Markt in Bindemittel und Klebstoffe, Sprengmittel, Überzugsmaterialien, Lösungsvermittler, Aromen, Süßungsmittel, Verdünnungsmittel, Gleitmittel, Puffer, Emulgatoren, Konservierungsmittel, Antioxidantien, Sorptionsmittel, Lösungsmittel, Weichmacher, Gleitmittel, Chelatbildner, Entschäumer und Sonstige unterteilt. Das Segment der Bindemittel und Klebstoffe erzielte 2024 mit 44,9 % den größten Umsatzanteil. Dies ist auf ihre zentrale Rolle bei der Aufrechterhaltung der Tablettenintegrität, der Kontrolle der Wirkstofffreisetzung und der Verbesserung der Formulierungsstabilität zurückzuführen. Bindemittel gewährleisten optimale Kompaktierung und Kohäsion, die für die Tablettenproduktion in großen Mengen entscheidend sind. Die zunehmende Verwendung fester oraler Darreichungsformen sowie die Einhaltung regulatorischer Anforderungen an die Hilfsstoffqualität stützen dieses Segment. Pharmaunternehmen konzentrieren sich auf polymere Bindemittel, um eine kontrollierte Freisetzung und verbesserte Bioverfügbarkeit zu erreichen. Die steigende Nachfrage nach festen oralen Darreichungsformen in Europa verstärkt diese Nachfrage zusätzlich. Beispielsweise erweiterte im Jahr 2023 ein führender europäischer Lieferant sein Portfolio an Bindemitteln für Tabletten mit sofortiger und modifizierter Wirkstofffreisetzung.

Für das Segment der Sprengmittel wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach schneller Wirkstofffreisetzung und verbesserter Bioverfügbarkeit in oralen Darreichungsformen. Sprengmittel ermöglichen ein schnelles Aufbrechen und eine verbesserte Absorption der Tablette und steigern so die therapeutische Wirksamkeit. Das Wachstum wird durch die zunehmende Verbreitung chronischer Erkrankungen, die orale Therapien erfordern, und den Bedarf an patientenfreundlichen Formulierungen befeuert. Europäische Hersteller setzen innovative Supersprengmittel ein, um die Leistung zu optimieren. Die zunehmende Verwendung in Kautabletten, Brausetabletten und schnell auflösenden Tabletten beschleunigt das Wachstum zusätzlich. Regulatorische Vorgaben und gleichbleibende Qualität fördern die Akzeptanz weiter. Im Jahr 2024 brachte ein führender Hilfsstoffhersteller ein neuartiges, für Kindertabletten optimiertes Sprengmittel auf den Markt.

- Nach Darreichungsform

Basierend auf der Darreichungsform ist der Markt in feste, halbfeste und flüssige Darreichungsformen unterteilt. Das Segment der festen Darreichungsformen erzielte 2024 mit 46,2 % den größten Umsatzanteil. Dies ist auf die weite Verbreitung, die Kosteneffizienz und die einfache Lagerung, den Transport und die Verabreichung zurückzuführen. Tabletten und Kapseln werden von Ärzten und Patienten aufgrund der einfachen Dosierung und der hohen Patientenadhärenz bevorzugt. Feste Darreichungsformen zeichnen sich durch eine stabile Haltbarkeit und Skalierbarkeit in der Produktion aus und eignen sich daher für Generika und innovative Arzneimittelformulierungen. Die starke Nachfrage nach oralen Medikamenten und Therapien zur Behandlung chronischer Erkrankungen trägt zur Marktführerschaft dieses Segments bei. So erweiterte beispielsweise ein europäischer Hilfsstofflieferant im Jahr 2023 seine Produktionslinien für Polymer- und Zuckerhilfsstoffe zur Tablettenherstellung.

Das Segment der flüssigen Darreichungsformen wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 24,1 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach pädiatrischen Sirupen, Injektionslösungen und Suspensionen zum Einnehmen. Flüssige Formulierungen verbessern die Patientenadhärenz, insbesondere bei Kindern und älteren Menschen. Die zunehmende Anwendung parenteraler und topischer Medikamente trägt zum Wachstum bei. Innovationen bei Lösungsvermittlern, Süßungsmitteln und Stabilisatoren steigern das Marktpotenzial zusätzlich. Die Zulassung sicherer Hilfsstoffe in Flüssigkeiten beschleunigt die Markteinführung. Die Marktexpansion wird außerdem durch die zunehmende Verbreitung chronischer Erkrankungen und die steigende Nachfrage nach Nahrungsergänzungsmitteln in flüssiger Form unterstützt. Anfang 2024 brachte ein europäisches Unternehmen einen neuen Lösungsvermittler auf den Markt, der speziell für orale Sirupe und Suspensionen optimiert ist.

- Auf dem Weg der Verwaltung

Basierend auf der Art der Verabreichung ist der Markt in orale, topische, parenterale und sonstige Hilfsstoffe unterteilt. Das Segment der oralen Hilfsstoffe erzielte 2024 mit 45,6 % den größten Umsatzanteil, was auf die weit verbreitete Präferenz für orale Medikamente in Form von Tabletten, Kapseln und Sirupen zurückzuführen ist. Orale Hilfsstoffe tragen zur Geschmacksmaskierung, Stabilität, kontrollierten Freisetzung und verbesserten Bioverfügbarkeit bei. Die zunehmende Verbreitung chronischer Erkrankungen und die Bedenken der Patienten hinsichtlich der Therapietreue verstärken die Dominanz dieses Segments. Innovationen bei Polymeren, Zuckern und Sprengmitteln verbessern die Qualität oraler Formulierungen. So brachte beispielsweise ein europäisches Unternehmen 2023 einen polymerbasierten oralen Hilfsstoff auf den Markt, der die Löslichkeit in Tabletten verbessert.

Das Segment der parenteralen Hilfsstoffe wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,8 % das schnellste Wachstum verzeichnen. Treiber dieses Wachstums ist die steigende Nachfrage nach injizierbaren Biologika, Impfstoffen und hochwertigen Therapien. Parenterale Hilfsstoffe gewährleisten Sterilität, Stabilität und Kompatibilität von Formulierungen. Das Wachstum wird durch zunehmende Investitionen in biopharmazeutische Forschung und Entwicklung sowie in die Auftragsfertigung unterstützt. Regulatorische Richtlinien zur Sicherheit injizierbarer Hilfsstoffe stärken das Marktvertrauen. Die zunehmende Anwendung in Krankenhäusern, Fachkliniken und der häuslichen Pflege treibt die Expansion des Segments zusätzlich an. Anfang 2024 brachte ein europäischer Anbieter einen neuen, für parenterale Biologika optimierten Stabilisierungshilfsstoff auf den Markt.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der europäische Markt für Hilfsstoffe in Pharma- und Biopharmaunternehmen, Auftragsformulierer, Forschungseinrichtungen und Hochschulen sowie Sonstige unterteilt. Das Segment der Pharma- und Biopharmaunternehmen erzielte 2024 mit 47,0 % den größten Umsatzanteil und unterstreicht damit seine dominante Rolle in der Arzneimittelproduktion mit hohem Volumen, einschließlich oraler, injizierbarer und topischer Formulierungen. Diese Unternehmen sind stark auf hochwertige Hilfsstoffe angewiesen, um Produktstabilität, die Einhaltung regulatorischer Vorgaben und eine optimale Bioverfügbarkeit zu gewährleisten, die sowohl für Generika als auch für innovative Arzneimittel entscheidend sind. Die weltweit steigende Nachfrage nach Generika, gepaart mit einem Anstieg innovativer Therapien, stärkt die führende Position dieses Segments zusätzlich. Kontinuierliche Investitionen in Forschung und Entwicklung, insbesondere in fortschrittliche Arzneimittelverabreichungssysteme und Formulierungstechnologien, haben die Verwendung spezialisierter Hilfsstoffe gefördert. So erweiterte beispielsweise ein führendes europäisches Pharmaunternehmen im Jahr 2023 strategisch seine Hilfsstoffbeschaffung, um die Qualität und Wirksamkeit oraler fester Darreichungsformen zu verbessern.

Für das Segment der Auftragsformulierer wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,9 % das schnellste Wachstum erwartet. Treiber dieses Wachstums ist der zunehmende Trend, die pharmazeutische Entwicklung und Herstellung auszulagern. Auftragsformulierer benötigen vielseitige und multifunktionale Hilfsstoffe, um die unterschiedlichen kundenspezifischen Formulierungsanforderungen zu erfüllen, darunter Stabilisierungs-, Lösungs- und Funktionsaufgaben. Die Expansion der Auftragsfertigung in ganz Europa, unterstützt durch günstige regulatorische Rahmenbedingungen und strenge Qualitätsstandards, treibt das Wachstum dieses Segments zusätzlich an. Darüber hinaus ermutigt die steigende Nachfrage nach Lösungen mit kürzerer Markteinführungszeit, gepaart mit dem Fokus der Branche auf innovative Darreichungsformen und personalisierte Medizin, Auftragsformulierer zur Anwendung fortschrittlicher Hilfsstofflösungen. Diese Faktoren machen Auftragsformulierer insgesamt zum am schnellsten wachsenden Endkundensegment im europäischen Hilfsstoffmarkt.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvertrieb, Einzelhandel und Sonstige unterteilt. Das Segment Direktvertrieb erzielte 2024 mit 46,5 % den größten Umsatzanteil, vor allem aufgrund von Großeinkäufen durch Pharma- und Biopharmaunternehmen. Dieser Ansatz gewährleistet eine kontinuierliche Versorgung, senkt die Kosten durch Skaleneffekte und ermöglicht eine strenge Qualitätskontrolle. Langfristige Verträge mit zuverlässigen Hilfsstoffherstellern stärken die Stabilität der Lieferketten zusätzlich. Die zunehmende pharmazeutische Produktion und die Expansion europäischer Unternehmen in Schwellenländer festigen die Bedeutung dieses Vertriebskanals. So sicherte sich beispielsweise ein führender europäischer Hilfsstoffhersteller 2023 mehrere Direktlieferverträge mit führenden Pharmaunternehmen und stärkte damit seine Marktposition und Zuverlässigkeit.

Das Segment Einzelhandel wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,3 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach rezeptfreien Medikamenten, Nahrungsergänzungsmitteln und Produkten für Forschungszwecke. Der Einzelhandel bietet Zugang zu funktionellen Hilfsstoffen für die Produktion in kleineren Mengen, die akademische Forschung und spezielle Formulierungsanforderungen. Das rasante Wachstum von E-Commerce-Plattformen und spezialisierten Distributoren hat die Reichweite des Einzelhandels weiter ausgebaut und Hilfsstoffe auch für kleinere Akteure im pharmazeutischen Ökosystem leichter verfügbar gemacht. Zulassungen von Hilfsstoffen für Consumer-Healthcare-Produkte und rezeptfreie Arzneimittel stärken ebenfalls das Vertrauen und die Akzeptanz. Anfang 2024 brachte ein europäischer Anbieter eine speziell für Forschungslabore und Entwickler kleinerer Formulierungen konzipierte Hilfsstofflinie auf den Markt und unterstreicht damit die zunehmende Bedeutung des Einzelhandelsvertriebs.

Regionale Analyse des europäischen Hilfsstoffmarktes

- Der europäische Markt für Hilfsstoffe wird im Prognosezeitraum voraussichtlich ein deutliches Wachstum verzeichnen. Treiber dieses Wachstums sind die zunehmende pharmazeutische Produktion, die steigende Nachfrage nach hochwertigen Hilfsstoffen für orale, injizierbare und topische Darreichungsformen sowie die wachsende Verbreitung fortschrittlicher Arzneimittelverabreichungstechnologien.

- Die Region profitiert von einer robusten Gesundheitsinfrastruktur, etablierten regulatorischen Rahmenbedingungen und einem starken Fokus auf Forschung und Entwicklung, was Innovationen bei der Anwendung von Hilfsstoffen in verschiedenen Darreichungsformen fördert.

- In europäischen Ländern werden erhebliche Investitionen in Spezialhilfsstoffe für die kontrollierte Freisetzung, die Verbesserung der Löslichkeit und die Stabilität getätigt, was das Marktwachstum weiter ankurbelt.

Markteinblicke für Hilfsstoffe in Deutschland:

Deutschland dominierte den Hilfsstoffmarkt 2024 mit dem größten Umsatzanteil von 41,5 %. Dies ist auf eine starke pharmazeutische Produktionsbasis, hohe Gesundheitsausgaben und die Präsenz wichtiger Branchenakteure zurückzuführen. Deutschland verzeichnet ein deutliches Wachstum bei der Anwendung von Hilfsstoffen in oralen, injizierbaren und topischen Darreichungsformen. Der Fokus auf Qualitätsstandards, kontinuierliche Innovationen in der Formulierungstechnologie und etablierte Lieferketten stärken die Marktposition Deutschlands zusätzlich. Die steigende Nachfrage nach Spezialhilfsstoffen in der modernen Therapie, kombiniert mit strategischen Partnerschaften und Kooperationen zwischen Pharmaunternehmen, beschleunigt die Einführung innovativer Hilfsstofflösungen.

Markteinblicke für Hilfsstoffe in Frankreich:

Frankreich wird im Prognosezeitraum voraussichtlich die am schnellsten wachsende Region im Markt für Hilfsstoffe sein. Treiber dieses Wachstums sind die steigende pharmazeutische Produktion, die zunehmende Anwendung fortschrittlicher Arzneimittelverabreichungstechnologien und die wachsenden Investitionen in die Gesundheitsinfrastruktur. Der Fokus des Landes auf Innovation und die Entwicklung neuartiger Hilfsstoffe für hochwertige Formulierungen fördert die Marktdurchdringung. Darüber hinaus beflügelt die staatliche Förderung der Biotechnologie- und Pharmaforschung sowie die steigende Nachfrage nach Generika und Spezialformulierungen das Wachstum. Frankreich verzeichnet ein rasantes Wachstum bei der Anwendung von Hilfsstoffen für die kontrollierte Freisetzung, die gezielte Verabreichung und die verbesserte Bioverfügbarkeit und positioniert sich damit als wichtiger aufstrebender Markt in Europa.

Marktanteil bei Hilfsstoffen in Europa

Die Hilfsstoffindustrie wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Croda International (UK)

- ABITEC Corporation (Niederlande)

- Roquette Frères (Frankreich)

- DuPont Nutrition & Biosciences (Frankreich)

- BASF SE (Deutschland)

- DSM Nutritional Products (Niederlande)

- Ingredion Incorporated (Deutschland)

- FMC Corporation (Deutschland)

- Signet Chemical Corporation (UK)

- JRS Pharma GmbH & Co. KG (Deutschland)

- Merck KGaA (Deutschland)

- Azelis (Belgien)

- Gattefossé (Frankreich)

- IMCD-Gruppe (Niederlande)

- Ingredion Deutschland GmbH (Deutschland)

Neueste Entwicklungen auf dem europäischen Hilfsstoffmarkt

- Im Oktober 2025 erließ die indische Zentralbehörde für Arzneimittelzulassung (CDSCO) eine Richtlinie an alle staatlichen Arzneimittelbehörden, um sicherzustellen, dass die in der Arzneimittelherstellung verwendeten Rohstoffe, einschließlich Hilfsstoffe und Wirkstoffe, den vorgeschriebenen Standards entsprechen. Dieser Schritt erfolgte nach dem Tod mehrerer Kinder im Zusammenhang mit giftigen Hustensäften und unterstrich die Bedeutung strenger Qualitätskontrollen von Hilfsstoffen.

- Im Oktober 2025 kündigte Asahi Kasei Pläne an, ab 2027 pharmazeutische Hilfsstoffe gemäß den Richtlinien der Guten Herstellungspraxis (GMP) zu liefern. Das Unternehmen strebt an, internationale Richtlinien für pharmazeutische Hilfsstoffe und Verunreinigungen zu erfüllen und so die Entwicklung injizierbarer Arzneimittel zu unterstützen. Muster beider Qualitäten mit garantierten analytischen Werten sind ab sofort für die präklinische Entwicklung verfügbar und bilden die Grundlage für eine breitere Anwendung in der klinischen Entwicklung.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.