Europe Cardiac Computed Tomography Cct Market

Marktgröße in Milliarden USD

CAGR :

%

USD

514.75 Million

USD

808.14 Million

2020

2028

USD

514.75 Million

USD

808.14 Million

2020

2028

| 2021 –2028 | |

| USD 514.75 Million | |

| USD 808.14 Million | |

|

|

|

Europäischer Markt für kardiale Computertomographie (CCT), nach Angeboten (System, Service, Software), Produkttyp (Single Source CT, Dual Source Cardiac CT, Spectral CT), Anwendung (Calcium-Scoring, Koronar- CT-Angiographie, Geräteimplantation, Pulmonalvenenisolation , Verschluss des linken Vorhofohrs ), Endbenutzer ( Krankenhäuser , Fachzentren, Diagnose- und Bildgebungszentren und andere), Vertriebskanal (Direktausschreibung und Drittanbieter), Land (Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, Türkei, Belgien, Niederlande, Schweiz, übriges Europa), Branchentrends und Prognose bis 2028

Marktanalyse und Einblicke: Europäischer Markt für kardiale Computertomographie (CCT)

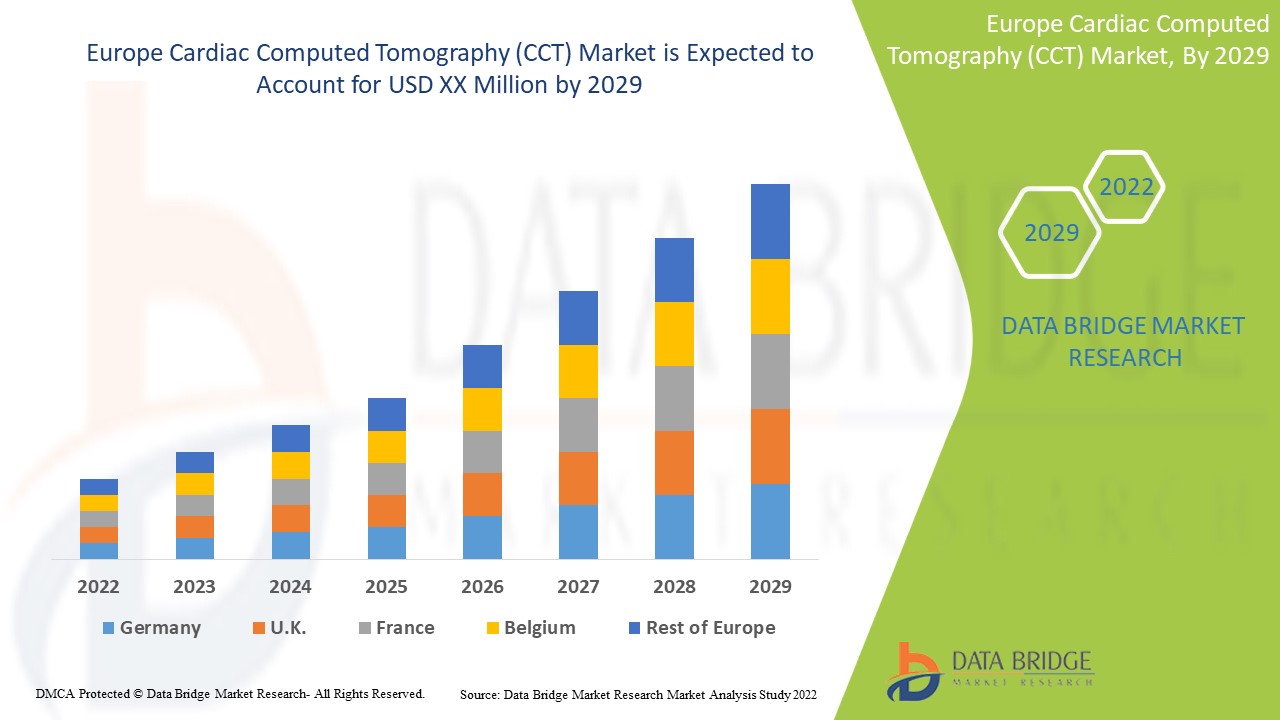

Der Markt für Herz-Computertomographie (CCT) wird im Prognosezeitraum 2021 bis 2028 voraussichtlich deutlich wachsen. Data Bridge Market Research analysiert, dass der europäische Markt für Herz-Computertomographie (CCT) im Prognosezeitraum 2021 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate von 6,1 % wächst und von 514,75 Millionen USD im Jahr 2020 auf 808,14 Millionen USD im Jahr 2028 ansteigen dürfte. Steigende Gesundheitsausgaben und ein Anstieg bei Innovation und Technologien sind die Haupttreiber, die das Wachstum des Marktes im Prognosezeitraum voraussichtlich vorantreiben werden.

Die Kardiale Computertomographie (CT) ist ein bildgebendes Verfahren, bei dem Röntgenstrahlen verwendet werden, um Details der Arterien und Venen des Herzens darzustellen. Die Bilder werden verwendet, um festzustellen, ob sich in Ihren Blutgefäßen Plaque oder Kalkablagerungen befinden und ob diese eine Blockade verursachen. Bei der Kardialen CT wird die fortschrittliche CT-Technologie mit intravenösem Kontrastmittel (Farbstoff) verwendet, um Ihre Herzanatomie, Ihren Herzkreislauf und Ihre großen Gefäße zu visualisieren. Eine Kardiale Computertomographie wird auch Koronar-CT-Angiographie, MSCT, CT, Kardiale CT, Koronar-CTA oder Kardiale CAT-Scan genannt.

Die zunehmende Verbreitung von Herz-Kreislauf-Erkrankungen und die steigenden Gesundheitsausgaben haben den Bedarf an Herz-Computertomographie zur Krankheitsdiagnose in Gesundheitseinrichtungen beschleunigt. Der Anstieg an Innovationen und Technologien sowie die steigende staatliche Finanzierung treiben das Wachstum des Marktes ebenfalls voran.

Der steigende Bedarf an Diagnose und Tests aufgrund der weltweit steigenden Zahl von Herzpatienten und die verstärkten F&E-Aktivitäten treiben die Nachfrage nach dem globalen Markt für Herz-Computertomographie (CCT) im Prognosezeitraum an. Die strengen Regulierungsrichtlinien könnten jedoch das Wachstum des Marktes für Herz-Computertomographie (CCT) im Prognosezeitraum behindern.

Der Marktbericht zur Kardio-Computertomographie (CCT) enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Umsatzquellen, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Kardiale Computertomographie (CCT) – Marktumfang und Marktgröße

Der Markt für Kardio-Computertomographie (CCT) ist nach Angebot, Produkttyp, Anwendung, Endnutzer und Vertriebskanal segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und bestimmt Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage des Angebots ist der Markt für Kardio-Computertomographie (CCT) in Systeme, Dienste und Software unterteilt. Im Jahr 2021 wird das Systemsegment voraussichtlich den Markt dominieren, da dieser Krankheitstyp in der Zielgruppe immer häufiger auftritt.

- Auf der Grundlage des Produkttyps ist der Markt für Kardio-Computertomographie (CCT) in Single-Source-CT, Dual-Source-Kardio-CT und Spektral-CT segmentiert. Im Jahr 2021 wird das Single-Source-CT-Segment aufgrund des technologischen Fortschritts und der steigenden Gesundheitsausgaben voraussichtlich den Markt dominieren.

- Auf der Grundlage der Anwendung ist der Markt für kardiale Computertomographie (CCT) in Kalzium-Scoring, koronare CT-Angiographie, Geräteimplantation, Lungenvenenisolation und Verschluss des linken Vorhofohrs segmentiert. Im Jahr 2021 wird das Kalzium-Scoring-Segment voraussichtlich den Markt dominieren, da die Zahl der Herz-Kreislauf-Erkrankungen in der Zielgruppe zunimmt

- Auf der Grundlage des Endverbrauchers ist der Markt für Herz-Computertomographie (CCT) in Krankenhäuser, Fachzentren, Diagnose- und Bildgebungszentren und andere unterteilt. Im Jahr 2021 wird das Krankenhaussegment voraussichtlich den Markt dominieren, da die Zahl der Herzpatienten stark zunimmt.

- Auf der Grundlage des Vertriebskanals ist der Markt für Herz-Computertomographie (CCT) in Direktausschreibungen und Drittanbieter unterteilt. Im Jahr 2021 wird das Direktausschreibungssegment voraussichtlich den Markt dominieren, da es dort eine große Anzahl von Marktteilnehmern gibt und die F&E-Aktivitäten zunehmen.

Kardiale Computertomographie (CCT) Markt – Länderebene Analyse

Der Markt für Herz-Computertomographie (CCT) wird analysiert und Informationen zur Marktgröße werden basierend auf Angebot, Produkttyp, Anwendung, Endbenutzer und Vertriebskanal bereitgestellt.

Die im Marktbericht zur Herz-Computertomographie (CCT) abgedeckten Länder sind Deutschland, Frankreich, Großbritannien, Belgien, Polen, Italien, Spanien, Russland, Türkei, Niederlande, Schweiz und das übrige Europa.

Aufgrund des technologischen Fortschritts in der Region wird für Europa im Prognosezeitraum 2021 bis 2028 ein deutliches Wachstum erwartet. Deutschland dominiert den europäischen Markt aufgrund der großen Anzahl an Marktteilnehmern.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Steigende Gesundheitsausgaben und die zunehmende Entwicklung von Innovationen und Technologien auf dem Markt für Herz-Computertomographie (CCT) schaffen neue Chancen für Akteure auf dem globalen Markt für Herz-Computertomographie (CCT).

Der Markt für Herz-Computertomographie (CCT) bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land mit Branchenwachstum, Medikamentenverkäufen, Auswirkungen von Fortschritten, Technologie und Änderungen in regulatorischen Szenarien mit ihrer Unterstützung für die Herz-Computertomographie (CCT). Die Daten sind für den historischen Zeitraum 2010 bis 2019 verfügbar.

Wettbewerbsumfeld und Kardiale Computertomographie (CCT) Marktanteilsanalyse

Die Wettbewerbslandschaft auf dem Markt für Herz-Computertomographie (CCT) liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -einrichtungen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz und Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Herz-Computertomographie (CCT).

Die wichtigsten Unternehmen, die auf dem Markt für Computertomographie (CCT) für Herzerkrankungen tätig sind, sind Siemens Healthcare GmbH, Neusoft Corporation, Shenzhen Anke High-tech Co., Ltd., Arineta, Medviso.com, SinoVision, United Imaging Healthcare Co., Ltd., Koninklijke Philips NV, GE Healthcare (eine Tochtergesellschaft von General Electric), CANON MEDICAL SYSTEMS CORPORATION (eine Tochtergesellschaft von Canon Inc.), FUJIFILM Corporation sowie andere inländische und internationale Unternehmen. DBMR-Analysten kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Darüber hinaus werden von den Unternehmen weltweit zahlreiche Produkteinführungen und Vereinbarungen initiiert, die den Markt für die Herz-Computertomographie (CCT) weiter vorantreiben.

Zum Beispiel,

- Im März 2018 gab Hikma Pharmaceuticals PLC im Rahmen der Einführung seiner neuen Unternehmensmarke eine vierjährige globale Partnerschaft mit Direct Relief bekannt, einer der weltweit führenden medizinischen Hilfsorganisationen. Ihr Ziel ist es, Menschen auf der ganzen Welt eine bessere Gesundheit zu ermöglichen. Die Finanzierungszusage für die kommenden Jahre sowie die Bereitstellung hochwertiger Medikamente werden dies ermöglichen. Dies wird dem Unternehmen helfen, sein Geschäft auszubauen und sein Produktprofil zu stärken.

- Im August 2021 startete Differin eine Partnerschaft zur Verbesserung des Zugangs zu sauberem Wasser in La Guajira, Kolumbien, einer der wasserärmsten Regionen des Landes. Ein Zuschuss von 1,5 Millionen US-Dollar von der Stiftung finanziert die dreijährige Initiative, die darauf abzielt, Tausenden von Kindern, Jugendlichen, Familien und Gemeinden durch eine vielschichtige Strategie, die sich auf Rehabilitation, Bildung und Zusammenarbeit konzentriert, grundlegende Wasser-, Sanitär- und Hygienedienste (WASH) zu ermöglichen. Dies hat das Marktwachstum angekurbelt und trägt zur Umsatzgenerierung bei.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 REGULATIONS

5.1 U.S.

5.2 EUROPE

5.3 INDIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES

6.1.2 RISING CASES OF CHRONIC DISEASES

6.1.3 RISING GERIATRIC POPULATION

6.1.4 RISING RATES OF OBESITY

6.2 RESTRAINTS

6.2.1 RISK ASSOCIATED WITH THE CARDIAC CT SCANNERS

6.2.2 HIGH COST OF CT DEVICES

6.3 OPPORTUNITIES

6.3.1 RISING EXPENDITURE ON HEALTHCARE

6.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.3 RISING DISPOSABLE INCOME

6.3.4 INCREASE IN R&D ACTIVITIES BY MEDICAL DEVICE COMPANIES

6.4 CHALLENGES

6.4.1 STRICT REGULATORY FRAMEWORK

6.4.2 SHORTAGE OF SKILLED PROFESSIONALS

7 IMPACT OF COVID-19 ON EUROPE CARDIAC COMPUTED TOMOGRAPGY (CCT) MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY

7.4 KEY INITIATIVES BY MARKET PLAYER DURING COVID-19

7.5 CONCLUSION:

8 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS

8.1 OVERVIEW

8.2 SYSTEM

8.2.1 LOW SLICE

8.2.2 MEDIUM SLICE

8.2.3 HIGH SLICE

8.3 SERVICE

8.4 SOFTWARE

9 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SINGLE SOURCE CT

9.3 DUAL SOURCE CARDIAC CT

9.4 SPECTRAL CT

10 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CALCIUM SCORING

10.3 CORONARY CT ANGIOGRAPHY

10.4 DEVICE IMPLANTATION

10.4.1 POST-PROCEDURAL IMAGING

10.4.2 PRE-PROCEDURAL IMAGING

10.5 PULMONARY VEIN ISOLATION

10.5.1 POST-PROCEDURAL IMAGING

10.5.2 PRE-PROCEDURAL IMAGING

10.6 LEFT ATRIAL APPENDAGE OCCLUSION

10.6.1 POST-PROCEDURAL IMAGING

10.6.2 PRE-PROCEDURAL IMAGING

10.7 OTHERS

11 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS

11.1 OVERVIEW

11.2 HOSPITALS

11.3 SPECIALTY CENTERS

11.4 DIAGNOSTIC & IMAGING CENTERS

11.5 OTHERS

12 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 THIRD PARTY DISTRIBUTOR

13 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION

13.1 EUROPE

13.1.4 OVERVIEW

13.1.5 GERMANY

13.1.6 FRANCE

13.1.7 U.K.

13.1.8 ITALY

13.1.9 SPAIN

13.1.10 RUSSIA

13.1.11 NETHERLANDS

13.1.12 SWITZERLAND

13.1.13 TURKEY

13.1.14 BELGIUM

13.1.15 REST OF EUROPE

14 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SIEMENS HEALTHCARE GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GE HEALTHCARE (A SUBSIDIARY OF GENERAL ELECTRIC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CANON MEDICAL SYSTEMS CORPORATION (A SUBSIDIARY OF CANON INC.)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 KONINKLIJKE PHILIPS N.V.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 FUJIFILM CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ARINETA

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 MEDVISO.COM

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 NEUSOFT CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 SHENZHEN ANKE HIGH-TECH CO., LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SINOVISION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 UNITED IMAGING HEALTHCARE CO., LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC IN 2020

TABLE 2 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 3 EUROPE SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 EUROPE SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 5 EUROPE SERVICE IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION 2019-2028 (USD MILLION)

TABLE 6 EUROPE SOFTWARE IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 8 EUROPE SINGLE SOURCE CT IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 EUROPE DUAL SOURCE CARDIAC CT IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 EUROPE DUAL SOURCE CARDIAC CT IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 12 EUROPE CALCIUM SCORING IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 EUROPE CORONARY CT ANGIOGRAPHY IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 EUROPE DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 EUROPE DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 16 EUROPE PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 EUROPE PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 18 EUROPE LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 EUROPE LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 20 EUROPE OTHERS IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 22 EUROPE HOSPITALS IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 EUROPE SPECIALTY CLINICS IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 EUROPE DIAGNOSTIC & IMAGING CENTERS IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 EUROPE OTHERS IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 27 EUROPE DIRECT TENDER IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 EUROPE THIRD PARTY DISTRIBUTOR IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 30 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 31 EUROPE SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 32 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 33 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 34 EUROPE DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 EUROPE PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 EUROPE LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 37 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 38 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 39 GERMANY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 40 GERMANY SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 41 GERMANY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 42 GERMANY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 43 GERMANY DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 44 GERMANY PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 45 GERMANY LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 46 GERMANY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 47 GERMANY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 48 FRANCE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 49 FRANCE SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 50 FRANCE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 51 FRANCE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 52 FRANCE DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 53 FRANCE PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 FRANCE LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 FRANCE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 56 FRANCE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 57 U.K. CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 58 U.K. SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 59 U.K. CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 60 U.K. CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 U.K. DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 U.K. PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 U.K. LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 U.K. CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 65 U.K. CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 66 ITALY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 67 ITALY SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 68 ITALY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 69 ITALY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 70 ITALY DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 71 ITALY PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 72 ITALY LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 73 ITALY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 74 ITALY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 75 SPAIN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 76 SPAIN SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 77 SPAIN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 78 SPAIN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 SPAIN DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 80 SPAIN PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 81 SPAIN LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 82 SPAIN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 83 SPAIN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 84 RUSSIA CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 85 RUSSIA SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 86 RUSSIA CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 87 RUSSIA CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 88 RUSSIA DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 89 RUSSIA PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 90 RUSSIA LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 RUSSIA CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 92 RUSSIA CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 93 NETHERLANDS CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 94 NETHERLANDS SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 95 NETHERLANDS CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 96 NETHERLANDS CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 97 NETHERLANDS DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 98 NETHERLANDS PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 NETHERLANDS LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 100 NETHERLANDS CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 101 NETHERLANDS CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 102 SWITZERLAND CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 103 SWITZERLAND SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 104 SWITZERLAND CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 105 SWITZERLAND CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 106 SWITZERLAND DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 107 SWITZERLAND PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 108 SWITZERLAND LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 SWITZERLAND CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 110 SWITZERLAND CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 111 TURKEY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 112 TURKEY SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 113 TURKEY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 114 TURKEY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 TURKEY DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 TURKEY PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 117 TURKEY LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 118 TURKEY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 119 TURKEY CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 120 BELGIUM CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 121 BELGIUM SYSTEM IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

TABLE 122 BELGIUM CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 123 BELGIUM CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 BELGIUM DEVICE IMPLANTATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 BELGIUM PULMONARY VEIN ISOLATION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 BELGIUM LEFT ATRIAL APPENDAGE OCCLUSION IN CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 127 BELGIUM CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY END USERS, 2019-2028 (USD MILLION)

TABLE 128 BELGIUM CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 129 REST OF EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET, BY OFFERINGS, 2019-2028 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: SEGMENTATION

FIGURE 2 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CHRONIC DISEASES AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 OFFERINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET AND ASIA-PACIFIC EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 BELOW IS THE REGULATORY ROADMAP FOR MEDICAL DEVICE SOFTWARE:

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES: EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET

FIGURE 16 PREVALENCE OF ASTHMA IN THE FOLLOWING COUNTRIES.

FIGURE 17 AGEING POPULATION IN THE WORLD (IN MILLIONS)

FIGURE 18 NORTH AMERICA AGEING POPULATION (IN MILLION)

FIGURE 19 EUROPE AGEING POPULATION (IN MILLION)

FIGURE 20 MEDICAL DEVICE SPENDING VS. NATIONAL HEALTH EXPENDITURES, 2016

FIGURE 21 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY OFFERINGS, 2020

FIGURE 22 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY OFFERINGS, 2019-2028 (USD MILLION)

FIGURE 23 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY OFFERINGS, CAGR (2021-2028)

FIGURE 24 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY OFFERINGS, LIFELINE CURVE

FIGURE 25 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY PRODUCT TYPE, 2020

FIGURE 26 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY PRODUCT TYPE, 2019-2028 (USD MILLION)

FIGURE 27 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY PRODUCT TYPE, CAGR (2021-2028)

FIGURE 28 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 29 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: APPLICATION, 2020

FIGURE 30 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: APPLICATION, 2019-2028 (USD MILLION)

FIGURE 31 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: APPLICATION, CAGR (2021-2028)

FIGURE 32 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: APPLICATION, LIFELINE CURVE

FIGURE 33 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY END USERS, 2020

FIGURE 34 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY END USERS, 2019-2028 (USD MILLION)

FIGURE 35 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY END USERS, CAGR (2021-2028)

FIGURE 36 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY END USERS, LIFELINE CURVE

FIGURE 37 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 38 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 39 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY DISTRIBUTION CHANNEL ,CAGR (2021-2028)

FIGURE 40 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: SNAPSHOT (2020)

FIGURE 42 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY COUNTRY (2020)

FIGURE 43 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 44 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 45 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: BY OFFERINGS (2021-2028)

FIGURE 46 EUROPE CARDIAC COMPUTED TOMOGRAPHY (CCT) MARKET: COMPANY SHARE 2020 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.