Europe Automated Guided Vehicles Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.12 Billion

USD

2.62 Billion

2024

2032

USD

1.12 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.12 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Marktsegmentierung für fahrerlose Transportfahrzeuge in Europa nach Typ (Zugfahrzeuge, Stückgutträger, Gabelstapler, Palettenhubwagen, Fließbandfahrzeuge und andere), Navigationstechnologie (Magnetführung, Laserführung, Sichtführung, optische Bandführung, induktive Führung und andere), Batterietyp (Blei, Lithium-Ionen, Nickelbasis und andere), Anwendung (Bewegung von unfertigen Erzeugnissen, Handhabung von Rohstoffen, Palettenhandhabung, Handhabung von Endprodukten, Handhabung von Containern, Handhabung von Rollen, Anhängerbeladung und andere), Branche (Gesundheitswesen, Fertigung, Logistik, Einzelhandel, Lebensmittel und Getränke, Papier und Druck, Tabak, Chemie und andere) – Branchentrends und Prognose bis 2032

Marktgröße für fahrerlose Transportfahrzeuge in Europa

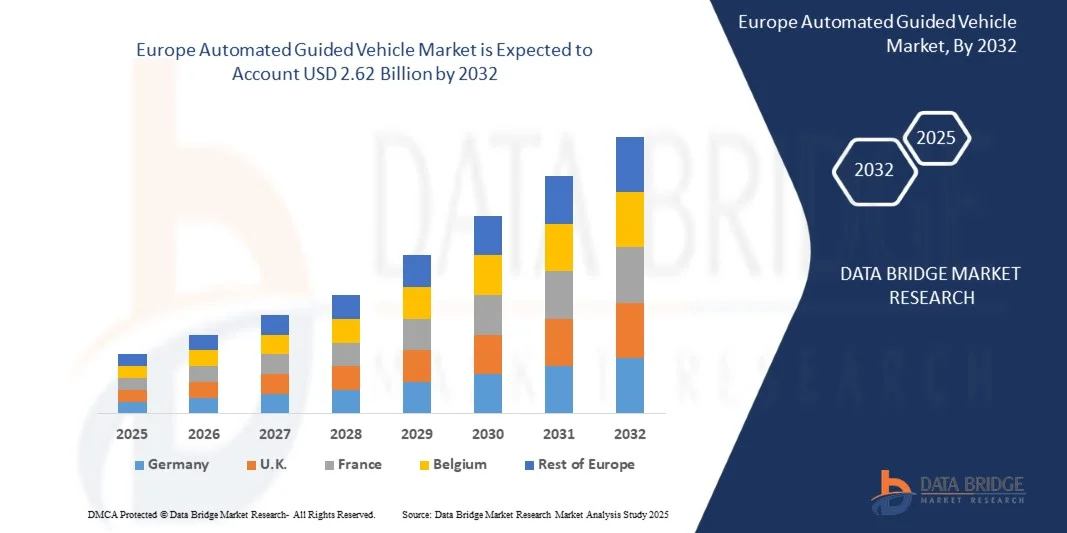

- Der europäische Markt für fahrerlose Transportsysteme (FTS) hatte im Jahr 2024 ein Volumen von 1,12 Milliarden US-Dollar und dürfte bis 2032 ein Volumen von 2,62 Millionen US-Dollar erreichen , bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,2 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach Automatisierung in den Bereichen Fertigung, Logistik und Lagerhaltung angetrieben, die durch Arbeitskräftemangel, steigende Arbeitskosten und den Drang nach betrieblicher Effizienz bedingt ist.

- Darüber hinaus ermöglicht die Integration von FTS mit Industrie 4.0-Technologien wie IoT, KI und maschinellem Lernen intelligentere, flexiblere und datengesteuerte Materialflusssysteme. Diese Faktoren beschleunigen die Einführung von FTS in allen Branchen und tragen maßgeblich zur Marktexpansion bei.

Marktanalyse für fahrerlose Transportfahrzeuge in Europa

- Fahrerlose Transportsysteme (FTS) sind selbstfahrende Transportsysteme für den Materialtransport und die Bewegung in Lagern, Fabriken und Vertriebszentren. Sie nutzen Technologien wie Laserführung, Magnetstreifen, visuelle Navigation und KI-basiertes Routing, um wiederkehrende Aufgaben effizient und mit minimalem menschlichen Eingriff auszuführen.

- Der zunehmende Einsatz von AGVs ist vor allem auf die Notwendigkeit zurückzuführen, die Effizienz der Lieferkette zu verbessern, die Betriebskosten zu senken und Arbeitsunfälle zu minimieren. Darüber hinaus treibt die zunehmende Verbreitung des E-Commerce und die zunehmende Verbreitung von Smart-Factory-Initiativen die Nachfrage nach skalierbaren und intelligenten Automatisierungslösungen wie AGVs an.

- Deutschland dominierte im Jahr 2024 den europäischen Markt für fahrerlose Transportsysteme aufgrund seiner starken industriellen Basis, der fortschrittlichen Automobilproduktion und der umfassenden Einführung von Industrie 4.0-Technologien.

- Großbritannien wird im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land auf dem europäischen Markt für fahrerlose Transportsysteme sein, da die Nutzung von FTS in den Bereichen Logistik, E-Commerce sowie Lebensmittel und Getränke zunimmt.

- Das Segment der Zugfahrzeuge dominierte den Markt mit einem Marktanteil von 39 % im Jahr 2024 aufgrund ihrer nachgewiesenen Effizienz beim Transport schwerer Lasten über lange Strecken innerhalb von Industrieanlagen. Ihre Fähigkeit, die Arbeitsabhängigkeit zu reduzieren und die Betriebssicherheit zu erhöhen, macht sie zur bevorzugten Wahl in Fertigungs- und Logistikumgebungen. Darüber hinaus bieten Zugfahrzeuge eine hohe Anpassungsfähigkeit an unterschiedliche Grundrisse und lassen sich nahtlos in Lagerverwaltungssysteme integrieren, was ihre Nachfrage weiter stärkt.

Berichtsumfang und Marktsegmentierung für fahrerlose Transportfahrzeuge in Europa

|

Eigenschaften |

Wichtige Markteinblicke für fahrerlose Transportfahrzeuge |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für fahrerlose Transportfahrzeuge in Europa

„Steigende Nachfrage nach Automatisierung in Logistik und Fertigung“

- Der Markt für fahrerlose Transportsysteme (FTS) verzeichnet aufgrund des steigenden Automatisierungsbedarfs in der Logistik- und Fertigungsindustrie ein starkes Wachstum. Unternehmen integrieren FTS, um den Materialtransport zu optimieren, die Abhängigkeit von Menschen zu reduzieren und die Gesamteffizienz in Produktions- und Lagereinrichtungen zu steigern.

- So führte Toyota Material Handling beispielsweise fortschrittliche AGV-Lösungen mit KI-gesteuerten Navigations- und Flottenmanagementsystemen für Lager von Amazon und BMW ein. Diese Fahrzeuge ermöglichen präzisen Warentransport, optimieren die Routeneffizienz und gewährleisten die Sicherheit am Arbeitsplatz.

- Die Einführung von FTS beschleunigt sich, da Fabriken und Vertriebszentren auf Industrie 4.0-Standards umstellen. Die Technologie bietet eine nahtlose Konnektivität mit Lagerverwaltungssystemen (WMS) und Enterprise-Resource-Planning-Software (ERP), wodurch Echtzeit-Einblicke in die Betriebsabläufe ermöglicht und die Bestandsgenauigkeit verbessert wird.

- Darüber hinaus nutzen Branchen wie die Automobil-, Lebensmittel- und Getränkeindustrie sowie die Pharmaindustrie AGVs für wiederkehrende und großvolumige Materialtransportaufgaben. Dieser Wandel steigert die Produktivität und reduziert die mit manueller Arbeit verbundenen Risiken in anspruchsvollen Fertigungsumgebungen.

- Der wachsende Trend zum E-Commerce und die Notwendigkeit einer schnelleren Auftragsabwicklung treiben auch die Nachfrage nach automatisierten Logistiklösungen voran. Mit Sensoren und KI-Systemen ausgestattete AGVs unterstützen den effizienten Warentransport in großen Fulfillment-Centern und sorgen so für Kosteneinsparungen und einen verbesserten Durchsatz.

- Die zunehmende Integration von Automatisierungstechnologien in Industrie- und Logistikbetrieben macht AGVs zu einem zentralen Bestandteil moderner Lieferketteninfrastrukturen. Dieser Trend verändert Materialflussprozesse weltweit und treibt die Entwicklung flexibler Fertigungssysteme voran.

Marktdynamik für fahrerlose Transportfahrzeuge in Europa

Treiber

„Steigende Nachfrage nach effizienter Materialhandhabung“

- Der zunehmende Einsatz industrieller Automatisierung und der Bedarf an effizientem Materialfluss in Fertigungsanlagen sind Schlüsselfaktoren für die Einführung von FTS. Unternehmen setzen auf automatisierte Systeme, um einen konstanten Durchsatz zu erzielen, Betriebsrisiken zu reduzieren und die Handhabungsgenauigkeit in dynamischen Produktionsumgebungen zu verbessern.

- So entwickelten beispielsweise die KUKA AG und Daifuku Co., Ltd. intelligente AGVs mit Präzisionssensoren und lasergesteuerter Navigation, um komplexe Lagerlayouts effektiv zu verwalten. Ihr Einsatz in Automobilmontagewerken hat die Handlingzeiten deutlich verkürzt und Logistikfehler minimiert.

- AGVs steigern die Produktionseffizienz, indem sie einen kontinuierlichen Materialtransport zwischen Arbeitsstationen ohne menschliches Eingreifen ermöglichen. Diese Betriebskonsistenz reduziert Ausfallzeiten und verbessert die Synchronisierung zwischen Fertigungs- und Lagervorgängen, insbesondere in schlanken Produktionsumgebungen.

- Darüber hinaus ermöglicht die Integration von AGVs mit IoT-basierten Überwachungsplattformen den Vorgesetzten, Leistungskennzahlen in Echtzeit zu verfolgen. Diese Konnektivität unterstützt die vorausschauende Wartung und datengesteuerte Entscheidungsfindung und verbessert so die Gesamteffizienz der Anlagen.

- Der Wandel hin zur digitalen Fertigung und zu automatisierten Lagern verstärkt die Notwendigkeit schneller, sicherer und präziser Materialbewegungen. Daher werden AGVs zu unverzichtbaren Ressourcen für Branchen, die ihre Wettbewerbsfähigkeit und operative Flexibilität erhalten wollen.

Einschränkung/Herausforderung

„Anfangsinvestitionskosten begrenzen die Akzeptanzrate“

- Die hohen Anfangsinvestitionen für den Einsatz fahrerloser Transportsysteme stellen für kleine und mittlere Unternehmen (KMU) eine große Herausforderung dar. Die Kosten für moderne Navigationssysteme, Sensoren und die Integration in bestehende Lagerverwaltungssysteme können das Budget für Automatisierungsprojekte einschränken.

- So haben beispielsweise kleinere Logistikunternehmen und Lagerbetreiber Schwierigkeiten, AGV-Systeme von Unternehmen wie Swisslog und Jungheinrich AG einzuführen, da die Einrichtungs- und Anpassungskosten hoch sind. Diese Kosten umfassen Softwareintegration, Mapping und Mitarbeiterschulungen, was die flächendeckende Einführung verzögert.

- Die Wartung und Modernisierung von FTS-Flotten erhöht die Gesamtbetriebskosten zusätzlich. Komplexe Komponenten und spezielle Wartungsanforderungen erfordern qualifizierte Techniker, was die Servicekosten für Industriekunden mit begrenzten technischen Ressourcen erhöhen kann.

- Darüber hinaus erfordert die Integration von FTS in bestehende Fertigungssysteme häufig Infrastrukturänderungen, wie z. B. Bodenführung oder Upgrades der drahtlosen Konnektivität. Diese Anpassungen sind kostspielig und können bestehende Arbeitsabläufe während der Installationsphase vorübergehend stören.

- Um eine breitere Akzeptanz zu gewährleisten, müssen sich Hersteller auf die Entwicklung skalierbarer und kosteneffizienter AGV-Plattformen konzentrieren. Die Reduzierung der Integrationskomplexität und das Angebot von Leasing- oder modularen Lösungen sind entscheidend, um die AGV-Nutzung in kostensensiblen Branchen und bei Kleinbetrieben zu fördern.

Marktumfang für fahrerlose Transportfahrzeuge in Europa

Der Markt ist nach Typ, Navigationstechnologie, Batterietyp, Anwendung und Branche segmentiert.

• Nach Typ

Der AGV-Markt ist nach Typ in Zugfahrzeuge, Stückgutträger, Gabelstapler, Palettenhubwagen, Fließbandfahrzeuge und Sonstiges unterteilt. Das Segment der Zugfahrzeuge dominierte den Markt mit dem größten Umsatzanteil von 39 % im Jahr 2024, was auf ihre nachgewiesene Effizienz beim Transport schwerer Lasten über lange Strecken innerhalb von Industrieanlagen zurückzuführen ist. Ihre Fähigkeit, die Arbeitsabhängigkeit zu reduzieren und die Betriebssicherheit zu erhöhen, macht sie zu einer bevorzugten Wahl in Fertigungs- und Logistikumgebungen. Darüber hinaus bieten Zugfahrzeuge eine hohe Anpassungsfähigkeit an unterschiedliche Grundrisse und lassen sich nahtlos in Lagerverwaltungssysteme integrieren, was ihre Nachfrage weiter steigert.

Das Segment der Stückgutträger wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die zunehmende Nutzung in E-Commerce-Fulfillment-Centern und Großlagern. Ihre Fähigkeit, standardisierte Ladungen effizient zu transportieren und gleichzeitig die Bearbeitungszeit zu verkürzen und Produktschäden zu minimieren, macht sie für Unternehmen attraktiv, die einen schnelleren Durchsatz anstreben. Der modulare Aufbau und die Kompatibilität mit modernen Navigationssystemen tragen ebenfalls zu ihrer schnellen Verbreitung in verschiedenen Branchen bei.

• Durch Navigationstechnologie

Basierend auf der Navigationstechnologie ist der AGV-Markt in Magnetische Führung, Laserführung, Sichtführung, Optische Bandführung, Induktive Führung und Sonstiges unterteilt. Das Segment Laserführung hatte 2024 den größten Umsatzanteil, da es hohe Präzision und Flexibilität bei der Routenplanung ohne physische Bodenanpassungen bietet. Lasergeführte AGVs werden häufig für dynamische Lagerlayouts und Fertigungsanlagen bevorzugt, bei denen Anpassungsfähigkeit und Sicherheit entscheidend sind. Ihre fortschrittlichen Sensorsysteme ermöglichen die Hinderniserkennung in Echtzeit, was die Betriebseffizienz steigert und Ausfallzeiten reduziert.

Das Segment Vision Guidance wird voraussichtlich von 2025 bis 2032 das schnellste Wachstum verzeichnen, angetrieben durch die zunehmende Implementierung KI-basierter visueller Systeme in AGVs. Vision-geführte AGVs können autonom durch komplexe Umgebungen navigieren, Objekte erkennen und Wege für einen schnelleren Materialtransport optimieren. Ihre Fähigkeit, in unstrukturierten Umgebungen zu operieren und sich in intelligente Fabriksysteme zu integrieren, beschleunigt die Akzeptanz in der fortschrittlichen Fertigung und Logistik.

• Nach Batterietyp

Der AGV-Markt ist nach Batterietyp in Blei-, Lithium-Ionen-, Nickel-basierte und andere Batterien unterteilt. Das Lithium-Ionen-Segment dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, was auf die längere Lebensdauer, schnellere Ladefähigkeit und höhere Energiedichte im Vergleich zu herkömmlichen Batterien zurückzuführen ist. Lithium-Ionen-Batterien steigern die Betriebseffizienz von AGVs, indem sie Ausfallzeiten und Wartungsaufwand reduzieren und sie so für den kontinuierlichen Industriebetrieb geeignet machen. Ihre leichte Bauweise trägt zudem zu Energieeinsparungen und verbesserter Manövrierfähigkeit auf engstem Raum bei.

Das Segment der nickelbasierten Batterien wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach kostengünstigen und umweltfreundlichen Batterielösungen in Entwicklungsländern. Nickelbasierte Batterien bieten zuverlässige Leistung in Hochtemperaturumgebungen und werden bevorzugt in Anwendungen eingesetzt, bei denen Sicherheit und Haltbarkeit wichtiger sind als die Energiedichte. Die zunehmende industrielle Automatisierung in Schwellenländern fördert die Verbreitung dieser Batterietypen.

• Nach Anwendung

Der AGV-Markt ist je nach Anwendung in die Bereiche Prozessbewegung, Rohstoffhandhabung, Palettenhandhabung, Endprodukthandhabung, Containerhandhabung, Rollenhandhabung, Anhängerbeladung und Sonstiges unterteilt. Das Segment Palettenhandhabung erzielte 2024 den größten Umsatzanteil, was auf seine entscheidende Rolle bei der Optimierung des Lagerbetriebs und der Rationalisierung der Ein- und Auslagerung von Waren zurückzuführen ist. Palettenhandhabungs-AGVs reduzieren den manuellen Arbeitsaufwand, minimieren Produktschäden und ermöglichen eine Echtzeit-Bestandsverfolgung, die für Branchen mit hohem Warenaufkommen wie Einzelhandel und Logistik von entscheidender Bedeutung ist.

Das Segment der Bewegung unfertiger Produkte wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die Einführung intelligenter Fertigungsprinzipien und Industrie 4.0-Frameworks. AGVs, die für den Transport unfertiger Produkte eingesetzt werden, erhöhen die Effizienz der Produktionslinien, reduzieren Engpässe und unterstützen Just-in-Time-Fertigungsstrategien. Ihre Integration in Produktionsüberwachungssysteme ermöglicht eine nahtlose Koordination und vorausschauende Wartung und steigert so die Gesamtproduktivität.

• Nach Branche

Der AGV-Markt ist branchenbezogen in die Branchen Gesundheitswesen, Fertigung, Logistik, Einzelhandel, Lebensmittel und Getränke, Papier und Druck, Tabak, Chemie und Sonstige unterteilt. Das Segment Fertigung dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024 aufgrund des hohen Bedarfs an automatisierter Materialhandhabung und Prozessoptimierung in Montagelinien und Produktionsanlagen. AGVs in der Fertigung tragen dazu bei, Betriebskosten zu senken, Sicherheitsstandards zu verbessern und einen hohen Durchsatz bei gleichbleibender Qualität zu ermöglichen.

Das Logistiksegment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage im E-Commerce und den Bedarf an schnelleren und zuverlässigeren Lager- und Distributionszentren. Logistikunternehmen setzen zunehmend AGVs für den Warentransport, das Be- und Entladen sowie die Auftragsabwicklung ein, um enge Lieferfristen einzuhalten und die Effizienz der Lieferkette zu steigern. Fortschrittliche Tracking- und Navigationsfunktionen beschleunigen die Einführung in diesem Sektor zusätzlich.

Regionale Analyse des europäischen Marktes für fahrerlose Transportfahrzeuge

- Deutschland dominierte den europäischen Markt für fahrerlose Transportsysteme mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch seine starke industrielle Basis, die fortschrittliche Automobilproduktion und die umfassende Einführung von Industrie 4.0-Technologien.

- Der Fokus des Landes auf Automatisierung zur Steigerung der Produktivität, Verringerung der Arbeitsabhängigkeit und Optimierung der Intralogistik hat den Einsatz von AGVs deutlich erhöht.

- Kontinuierliche technologische Fortschritte bei Navigationssystemen, KI-Integration und Robotik sowie die Zusammenarbeit zwischen nationalen Automatisierungsunternehmen und globalen Akteuren stärken Deutschlands führende Position auf dem regionalen Markt. Steigende Investitionen in intelligente Fabriken und der Ausbau vernetzter Fertigungsökosysteme stärken Deutschlands dominante Position weiter.

Markteinblick für fahrerlose Transportfahrzeuge in Großbritannien und Europa

Der britische Markt wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate in Europa verzeichnen, angetrieben durch die zunehmende Nutzung von AGVs in den Bereichen Logistik, E-Commerce sowie Lebensmittel und Getränke. Der zunehmende Fokus auf Lagerautomatisierung, verbunden mit Arbeitskräftemangel und steigenden Betriebskosten, beschleunigt den Übergang zu autonomen Materialflusslösungen. Investitionen in KI-basierte Navigation, datengesteuerte Logistik und nachhaltige Automatisierungstechnologien fördern das Marktwachstum. Der Schwerpunkt Großbritanniens auf Innovation, intelligenter Infrastruktur und der Zusammenarbeit zwischen Technologieanbietern und Herstellern untermauert seine Entwicklung zum am schnellsten wachsenden Markt der Region.

Markteinblick für fahrerlose Transportfahrzeuge in Frankreich und Europa

Für Frankreich wird zwischen 2025 und 2032 ein stetiges Wachstum erwartet, das durch die Expansion des Fertigungs- und Automobilsektors sowie die zunehmende Betonung der Betriebseffizienz unterstützt wird. Der Einsatz von AGVs in Logistikzentren und Produktionsanlagen nimmt zu, da die Industrie auf mehr Flexibilität, Sicherheit und Prozessautomatisierung setzt. Fördernde staatliche Initiativen zur Förderung der digitalen Transformation und nachhaltiger Industriebetriebe treiben das Marktwachstum weiter voran. Partnerschaften zwischen globalen AGV-Entwicklern und lokalen Systemintegratoren stärken Frankreichs Automatisierungskompetenz und unterstützen seine stabilen langfristigen Marktaussichten.

Marktanteil fahrerloser Transportfahrzeuge in Europa

Die Branche der fahrerlosen Transportsysteme wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Robert Bosch GmbH (Deutschland)

- Hanwha Techwin Co., Ltd. (Südkorea)

- Honeywell International Inc. (USA)

- Schneider Electric (Frankreich)

- Axis Communications AB (Schweden)

- Johnson Controls (Irland)

- Hangzhou Hikvision Digital Technology Co., Ltd.

- NetApp (USA)

- Dahua Technology (China)

- KEDACOM (China)

- Verint Systems Inc. (USA)

- LTIMindtree Limited (Indien)

- AxxonSoft. (USA)

- eInfochips (USA)

- Panasonic Holdings Corporation (Japan)

- Panopto (USA)

- Backstreet-Überwachung (USA)

- Eagle Eye Solutions Group Plc. (USA)

- Arcules, Inc. (USA)

Neueste Entwicklungen auf dem europäischen Markt für fahrerlose Transportfahrzeuge

- Im Juli 2024 eröffnete Bastian Solutions, LLC seinen neuen Produktions- und Firmencampus in Noblesville, Indiana. Diese strategisch günstig gelegene, konsolidierte Anlage soll die Betriebseffizienz und Produktionskapazität des Unternehmens steigern, seine Wettbewerbsposition auf dem europäischen Markt für fahrerlose Transportsysteme stärken und die wachsende Nachfrage nach fortschrittlichen Automatisierungslösungen in Schlüsselindustrien unterstützen.

- Im Juni 2023 erweitern Mitsubishi Logisnext Americas und Jungheinrich ihre Partnerschaft und gründen Rocrich AGV Solutions in Nordamerika. Diese Zusammenarbeit nutzt das gebündelte Know-how von Jungheinrich und Rocla, um ein umfassendes Sortiment an AGVs und automatisierten Gabelstaplern anzubieten, das den unterschiedlichen Kundenbedürfnissen von Standard- bis hin zu Spezialanwendungen gerecht wird.

- Im August 2022 startet Swissport am Frankfurter Flughafen ein Pilotprogramm mit dem Einsatz unbemannter Automated Guided Vehicles (AGVs) für Stückguttransporte in seinem neuen Frachtzentrum. Ziel ist es, die Effizienz durch den Ersatz manueller Frachttransporte zu steigern und Swissports Engagement für innovative Frachtlogistik- und Abfertigungslösungen zu unterstreichen.

- Im März 2022 geben Third Wave Automation (TWA) und CLARK Material Handling Company ihre Partnerschaft bekannt und präsentieren Pläne für den „TWA Reach“, einen automatisierten Schubmaststapler, der im Frühjahr 2023 auf den Markt kommen soll. Die Zusammenarbeit integriert die Automatisierungstechnologie und die intelligenten Flottenmanagementfunktionen von TWA mit dem Schubmaststapler NPX von CLARK und bietet so fortschrittliche autonome Materialflusslösungen.

- Im März 2022 intensivieren KNAPP und Covariant ihre Zusammenarbeit zur Weiterentwicklung KI-gestützter Roboterlösungen. Im Mittelpunkt der gemeinsamen Bemühungen steht der Pick-it-Easy Robot von KNAPP, der für seine Vielseitigkeit im Umgang mit unterschiedlichsten Artikeln bekannt ist und die Effizienz im Lager steigern soll. Ziel der Partnerschaft ist es, die Marktpräsenz auszubauen und die KI-Robotik in der Logistik voranzutreiben.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.