Europe Aluminum Casting Market

Marktgröße in Milliarden USD

CAGR :

%

USD

19.43 Billion

USD

35.96 Billion

2024

2032

USD

19.43 Billion

USD

35.96 Billion

2024

2032

| 2025 –2032 | |

| USD 19.43 Billion | |

| USD 35.96 Billion | |

|

|

|

|

Marktsegmentierung für Aluminiumguss in Europa nach Verfahren (Verbrauchsformguss und Mehrwegformguss), Quelle (Primärrohstoff (Frischaluminium) und Sekundärrohstoff (Recyclingaluminium)), Anwendung (Ansaugkrümmer, Ölwanne, Strukturbauteile, Fahrwerksteile, Zylinderköpfe, Motorblöcke, Getriebe, Räder und Bremsen, Wärmeübertragung und Sonstiges), Endverbraucher (Automobilindustrie, Bauwesen, Industrie, Haushaltsgeräte, Luft- und Raumfahrt, Elektronik und Elektrotechnik, Werkzeuge und Sonstiges) – Branchentrends und Prognose bis 2032

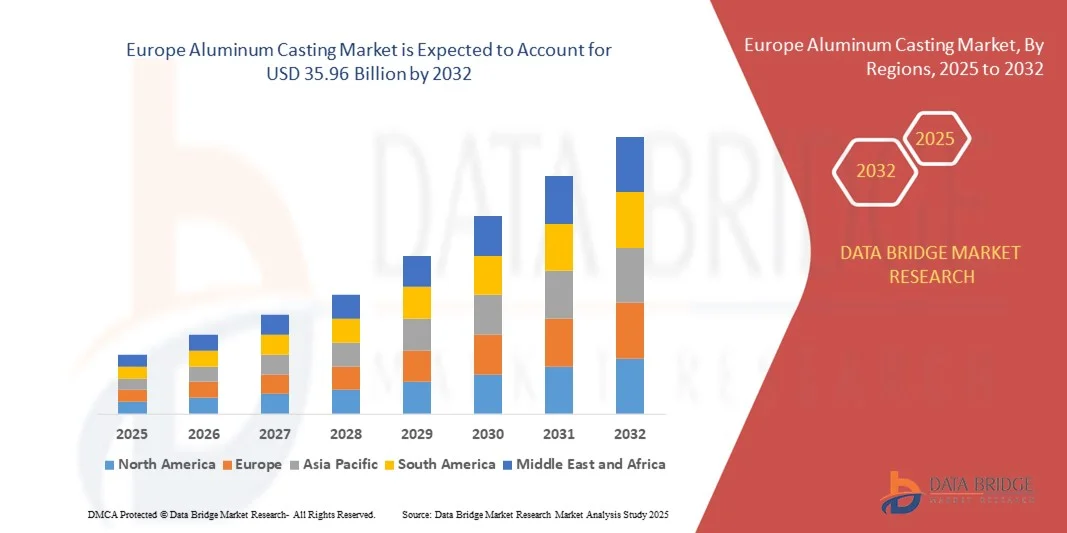

Marktgröße für Aluminiumguss in Europa

- Der europäische Markt für Aluminiumguss hatte im Jahr 2024 einen Wert von 19,43 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 35,96 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,00 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird in erster Linie durch die steigende Nachfrage nach leichten und langlebigen Bauteilen in den Bereichen Automobil, Luft- und Raumfahrt sowie Industriemaschinen angetrieben, verbunden mit Fortschritten bei den Gießtechnologien, die Präzision und Effizienz verbessern.

- Zudem fördern strenge Umweltauflagen und der Trend zu kraftstoffsparenden Fahrzeugen den Einsatz von Aluminium gegenüber traditionellen Metallen und beschleunigen so die Verbreitung von Aluminiumgussverfahren. Diese Faktoren zusammen treiben das Marktwachstum an und festigen den Wachstumskurs der Branche.

Analyse des europäischen Marktes für Aluminiumguss

- Aluminiumguss, der leichte und hochfeste Bauteile für die Automobil-, Luft- und Raumfahrt- sowie Industrieanwendungen liefert, ist aufgrund seiner Langlebigkeit, Korrosionsbeständigkeit und energieeffizienten Produktionsmöglichkeiten sowohl im kommerziellen als auch im industriellen Bereich in der modernen Fertigung zunehmend von entscheidender Bedeutung.

- Die steigende Nachfrage nach Aluminiumguss wird vor allem durch die Verlagerung der Automobilindustrie hin zu Leichtbaufahrzeugen, das Wachstum in der Luft- und Raumfahrt- sowie der Verteidigungsindustrie und durch Fortschritte bei den Gießtechnologien angetrieben, die die Präzision verbessern und die Produktionskosten senken.

- Deutschland dominierte den europäischen Markt für Aluminiumguss mit dem größten Umsatzanteil von 38,5 % im Jahr 2024. Dies ist auf eine fortschrittliche Fertigungsinfrastruktur, eine hohe Akzeptanz von Elektro- und Hybridfahrzeugen sowie eine starke Präsenz wichtiger Gießereiunternehmen zurückzuführen. Deutschland und Italien verzeichneten ein substanzielles Wachstum bei Anwendungen im Automobil- und Industriebereich, das durch Innovationen bei Niederdruck-Druckguss- und Hochdruck-Dauergussverfahren vorangetrieben wurde.

- Es wird erwartet, dass Großbritannien im Prognosezeitraum die am schnellsten wachsende Region auf dem europäischen Markt für Aluminiumguss sein wird, bedingt durch die rasche Industrialisierung, die Expansion des Automobilsektors und die zunehmenden Investitionen in die Luft- und Raumfahrtindustrie.

- Das Segment der Einweg-Formengussverfahren dominierte den Markt mit dem größten Umsatzanteil von 62,4 % im Jahr 2024. Dies ist auf seine Kosteneffizienz, die Flexibilität bei der Herstellung komplexer Formen und die Eignung für Klein- und Großserien zurückzuführen.

Berichtsgegenstand und Marktsegmentierung für Aluminiumguss in Europa

|

Attribute |

Wichtigste Markteinblicke in den Aluminiumguss |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem europäischen Markt für Aluminiumguss

Technologische Fortschritte beim automatisierten und Präzisionsgießen

- Ein bedeutender und sich beschleunigender Trend im europäischen Aluminiumgussmarkt ist die zunehmende Integration von Automatisierung, Robotik und künstlicher Intelligenz (KI) in die Gießereiprozesse. Diese technologische Konvergenz verbessert Präzision, Produktionseffizienz und die allgemeine Qualitätskontrolle in Gießereien und Produktionsstätten.

- Führende Hersteller wie Rheinmetall Automotive und Constellium setzen beispielsweise verstärkt auf automatisierte Druckgussverfahren und Echtzeit-Qualitätsüberwachungssysteme, um den Metallfluss zu optimieren, Fehler zu reduzieren und Materialverschwendung in der Produktion zu minimieren. Auch Gränges AB nutzt fortschrittliche Datenanalysen, um eine gleichbleibende Legierungszusammensetzung und Gussqualität zu gewährleisten.

- Die Integration von KI in Aluminiumgussverfahren ermöglicht vorausschauende Wartung, adaptive Prozesssteuerung und intelligente Fehlererkennung. KI-gestützte Systeme analysieren Gussparameter in Echtzeit, prognostizieren Anomalien und passen Temperatur und Druck automatisch an, um eine optimale Leistung zu gewährleisten. Darüber hinaus sorgen Robotik und Automatisierung für gleichbleibende Zykluszeiten, erhöhte Sicherheit und einen geringeren Personalaufwand in der Serienfertigung.

- Die nahtlose Nutzung digitaler Zwillinge und Industrie-4.0-Lösungen ermöglicht es Herstellern, Gießprozesse zu simulieren, den Energieverbrauch zu überwachen und die Prozessrückverfolgbarkeit zu verbessern. Über zentrale digitale Plattformen können Unternehmen Produktionslinien verwalten, Leistungsdaten analysieren und Lieferkettensysteme integrieren, was für mehr Transparenz und operative Effizienz sorgt.

- Dieser Trend hin zu intelligenteren, vernetzteren und datengesteuerten Aluminiumgießereien definiert die industriellen Fertigungsstandards in ganz Europa neu. Unternehmen wie Hydro Aluminium und Nemak investieren daher massiv in KI-gestützte Gießereien, die auf Nachhaltigkeit, Automatisierung und gleichbleibend hohe Produktqualität setzen.

- Die Nachfrage nach technologisch fortschrittlichen und automatisierten Gießlösungen steigt in der Automobil-, Luft- und Raumfahrt- sowie Industriebranche rasant an, da die Hersteller zunehmend Wert auf Leichtbaumaterialien, Effizienz und digitalisierte Produktionsmöglichkeiten legen.

Marktdynamik der europäischen Aluminiumgussindustrie

Treiber

Steigende Nachfrage aufgrund der Produktion von Leichtbaufahrzeugen und der industriellen Expansion

- Der zunehmende Fokus auf Kraftstoffeffizienz, CO₂-Reduzierung und nachhaltige Produktionsverfahren in ganz Europa treibt die steigende Nachfrage nach Aluminiumguss maßgeblich an. Leichtbauteile aus Aluminium werden in der Automobil-, Luft- und Raumfahrt- sowie in industriellen Anwendungen immer wichtiger, um Leistung und Energieeffizienz zu verbessern.

- So kündigte beispielsweise Constellium SE im März 2024 den Ausbau seiner Aluminiumgießerei in Frankreich an, um die wachsende Produktion von Elektrofahrzeugen und leichten Automobilstrukturen zu unterstützen. Solche strategischen Initiativen wichtiger Marktteilnehmer dürften das Marktwachstum im gesamten Prognosezeitraum vorantreiben.

- Da die Automobilhersteller verstärkt auf Elektrofahrzeuge und Hybridfahrzeuge setzen, bietet Aluminiumguss Vorteile wie ein hohes Festigkeits-Gewichts-Verhältnis, Korrosionsbeständigkeit und Recyclingfähigkeit – was ihn zur bevorzugten Wahl gegenüber schwereren Materialien wie Stahl oder Eisen macht.

- Darüber hinaus verstärken die rasante industrielle Expansion und die Einführung von Automatisierungs- und Präzisionsgusstechnologien die Nachfrage in den Bereichen Maschinenbau, Bauwesen und Luft- und Raumfahrt. Die Möglichkeit, komplexe Geometrien und Hochleistungsbauteile effizient herzustellen, treibt die zunehmende Integration des Aluminiumgusses in verschiedene Anwendungsbereiche voran.

- Die Vorteile des geringeren Energieverbrauchs in der Produktion, der Recyclingfähigkeit und des reduzierten Materialabfalls sind Schlüsselfaktoren für die zunehmende Verbreitung des Aluminiumgusses. Darüber hinaus steigern kontinuierliche Innovationen bei Druckguss-, Sandguss- und Feingussverfahren die Effizienz und Leistungsfähigkeit branchenübergreifend.

Zurückhaltung/Herausforderung

Hohe Energiekosten und schwankende Rohstoffpreise

- Der hohe Energieverbrauch und die Volatilität der Rohstoffpreise, insbesondere für Aluminiumbarren, stellen die nachhaltige Rentabilität des europäischen Aluminiumgussmarktes vor große Herausforderungen. Da die Aluminiumproduktion und die Schmelzprozesse energieintensiv sind, wirken sich steigende Stromkosten in ganz Europa direkt auf die Produktionskosten aus.

- Beispielsweise führte die Energiekrise in den Jahren 2023–2024 zu vorübergehenden Produktionsstopps und Kostensteigerungen bei mehreren europäischen Gießereien, was deren Fähigkeit beeinträchtigte, die wachsende Nachfrage zu decken.

- Die Bewältigung dieser kostenbezogenen Herausforderungen durch energieeffiziente Ofentechnologien, den Einsatz erneuerbarer Energien und verbesserte Recyclingprozesse wird für Hersteller immer wichtiger, um wettbewerbsfähig zu bleiben. Führende Unternehmen wie Hydro Aluminium und Rheinmetall Automotive konzentrieren sich verstärkt auf Kreislaufproduktionsmodelle und CO₂-arme Gießverfahren, um diese Risiken zu minimieren.

- Darüber hinaus können schwankende Aluminiumpreise auf dem Weltmarkt, bedingt durch geopolitische Unsicherheiten und Unterbrechungen der Lieferkette, die Gewinnmargen beeinträchtigen und Großinvestitionen in neue Gießereianlagen einschränken.

- Die Bewältigung dieser Herausforderungen durch nachhaltige Beschaffung, Energieoptimierung und technologische Innovation wird unerlässlich sein, um langfristiges Wachstum und Widerstandsfähigkeit auf dem europäischen Markt für Aluminiumguss zu gewährleisten.

Marktübersicht für Aluminiumguss in Europa

Der europäische Markt für Aluminiumguss ist nach Verfahren, Quelle, Anwendung und Endverbraucher segmentiert.

- Durch Prozess

Basierend auf dem Herstellungsverfahren ist der europäische Markt für Aluminiumguss in Formguss mit Einwegformen und Formguss mit Mehrwegformen unterteilt. Das Segment Formguss dominierte den Markt mit einem Umsatzanteil von 62,4 % im Jahr 2024. Dies ist auf seine Kosteneffizienz, die Flexibilität bei der Herstellung komplexer Formen und die Eignung für Klein- und Großserien zurückzuführen. Verfahren wie Sandguss und Feinguss werden aufgrund ihrer Fähigkeit, komplexe Geometrien mit exzellenter Oberflächengüte zu erzeugen, häufig in der Automobil- und Industriebranche eingesetzt.

Das Segment der nicht-verbrauchenden Formgussteile wird voraussichtlich von 2025 bis 2032 das schnellste jährliche Wachstum verzeichnen. Treiber dieses Wachstums ist die zunehmende Verbreitung von Kokillen- und Druckgussverfahren, die eine hohe Maßgenauigkeit, kürzere Zykluszeiten und überlegene mechanische Eigenschaften bieten. Die fortschreitende Automatisierung und technologischen Entwicklungen im Hochdruck-Druckguss tragen zusätzlich zum Wachstum dieses Segments bei.

- Nach Quelle

Der europäische Markt für Aluminiumguss wird nach Herkunft in Primär- (Neualuminium) und Sekundäraluminium (Recyclingaluminium) unterteilt. Das Segment Sekundäraluminium (Recyclingaluminium) dominierte den Markt mit einem Umsatzanteil von 57,8 % im Jahr 2024. Treiber dieses Wachstums sind der zunehmende Fokus auf Nachhaltigkeit, Energieeffizienz und Kostensenkung. Die Herstellung von Recyclingaluminium benötigt deutlich weniger Energie als die Primärproduktion und entspricht damit den strengen europäischen Umweltauflagen und Klimaschutzzielen.

Das Segment Primäraluminium wird voraussichtlich von 2025 bis 2032 das schnellste jährliche Wachstum verzeichnen, gestützt durch die steigende Nachfrage nach hochreinen Aluminiumlegierungen in der Luft- und Raumfahrt sowie der Automobilindustrie. Kontinuierliche Verbesserungen der Schmelztechnologien und die Verfügbarkeit hochwertiger Rohstoffe dürften das Marktpotenzial von Primäraluminium im Prognosezeitraum weiter steigern.

- Durch Bewerbung

Basierend auf den Anwendungsbereichen ist der europäische Markt für Aluminiumguss in Ansaugkrümmer, Ölwanne, Strukturbauteile, Fahrwerksteile, Zylinderköpfe, Motorblöcke, Getriebe, Räder und Bremsen, Wärmeübertragung und Sonstiges unterteilt. Das Segment der Motorblöcke dominierte den Markt mit einem Umsatzanteil von 24,6 % im Jahr 2024, da Aluminium-Motorkomponenten ein hervorragendes Verhältnis von Festigkeit zu Gewicht, Wärmeleitfähigkeit und Korrosionsbeständigkeit bieten. Automobilhersteller ersetzen zunehmend Gusseisen durch Aluminium, um die Fahrzeugleistung und Kraftstoffeffizienz zu verbessern.

Das Segment der Strukturbauteile wird voraussichtlich von 2025 bis 2032 das schnellste jährliche Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach Leichtbaumaterialien für Elektrofahrzeuge und Luft- und Raumfahrtkomponenten. Fortschritte im Präzisionsguss und in der Legierungsentwicklung ermöglichen die Herstellung von festeren, leichteren und langlebigeren Strukturbauteilen.

- Vom Endbenutzer

Basierend auf den Endverbrauchern ist der europäische Markt für Aluminiumguss in die Segmente Automobilindustrie, Bauwesen, Industrie, Haushaltsgeräte, Luft- und Raumfahrt, Elektronik und Elektrotechnik, Werkzeuge und Sonstige unterteilt. Das Segment Automobilindustrie dominierte den Markt mit einem Umsatzanteil von 46,3 % im Jahr 2024. Dies ist auf den zunehmenden Fokus der Region auf Fahrzeuggewichtsreduzierung, verbesserte Kraftstoffeffizienz und die Einhaltung von Emissionsvorschriften zurückzuführen. Aluminiumguss wird häufig für Motor-, Fahrwerks- und Getriebekomponenten verwendet.

Der Luft- und Raumfahrtsektor dürfte von 2025 bis 2032 das schnellste durchschnittliche jährliche Wachstum verzeichnen. Treiber dieses Wachstums ist der zunehmende Einsatz von leichten, hochfesten Aluminiumlegierungen in Flugzeugstrukturen und Triebwerksteilen. Die steigende Nachfrage nach Flugreisen sowie Investitionen in die Flugzeugfertigung der nächsten Generation werden das Wachstum dieses Segments voraussichtlich weiter beschleunigen.

Regionale Analyse des europäischen Marktes für Aluminiumguss

- Deutschland dominierte den europäischen Markt für Aluminiumguss mit dem größten Umsatzanteil von 38,5 % im Jahr 2024. Dies ist auf die starke Präsenz von Produktionszentren für die Automobil- und Luftfahrtindustrie in Ländern wie Deutschland, Frankreich und Italien sowie auf die zunehmende Verwendung von Leichtbaumaterialien zur Erfüllung strenger Emissions- und Effizienzstandards zurückzuführen.

- Die Hersteller in der Region legen Wert auf Präzisionstechnik, Automatisierung und Nachhaltigkeit. Für die Produktion von wichtigen Automobilmotorenteilen, Strukturbauteilen und Industriemaschinen werden fortschrittliche Aluminiumgusstechnologien eingesetzt.

- Diese breite Akzeptanz wird zusätzlich unterstützt durch staatliche Initiativen zur Förderung der Elektrofahrzeugproduktion, eine gut etablierte industrielle Basis und wachsende Investitionen in energieeffiziente und recycelbare Materialien. Dadurch positioniert sich der Aluminiumguss als bevorzugte Lösung für Mobilitäts- und Industrieanwendungen der nächsten Generation in ganz Europa.

Einblick in den deutschen Markt für Aluminiumguss

Der deutsche Markt für Aluminiumguss erzielte 2024 den größten Umsatzanteil in Europa, angetrieben durch die starke Automobil- und Industriebasis des Landes. Deutschlands ausgeprägter Fokus auf Ingenieurskunst, Präzisionsfertigung und Innovation fördert die breite Anwendung fortschrittlicher Gießverfahren wie Hochdruck- und Vakuumguss. Die steigende Nachfrage nach leichten und kraftstoffsparenden Fahrzeugen, verbunden mit dem deutschen Engagement für Elektromobilität, treibt den Einsatz von Aluminiumkomponenten in Motoren, Fahrgestellen und Batteriegehäusen voran. Darüber hinaus steht Deutschlands Fokus auf Nachhaltigkeit und Recycling im Einklang mit dem zunehmenden Einsatz von Sekundäraluminium (Recyclingaluminium) in der Produktion und gewährleistet so Kosteneffizienz und Umweltverantwortung.

Einblick in den französischen Markt für Aluminiumguss

Der französische Markt für Aluminiumguss wird im Prognosezeitraum voraussichtlich ein stetiges Wachstum verzeichnen, gestützt durch die steigende Nachfrage aus der Automobil-, Luft- und Raumfahrt- sowie Verteidigungsindustrie. Frankreichs etablierter Luft- und Raumfahrtsektor, angeführt von Branchengrößen wie Airbus, ist ein Hauptabnehmer von Hochleistungs-Aluminiumgussteilen für Flugzeugstrukturen und Triebwerkskomponenten. Der Übergang zu Elektrofahrzeugen und staatliche Initiativen zur Förderung emissionsarmer Produktionsverfahren treiben den Aluminiumverbrauch in der Automobilindustrie an. Investitionen in die Modernisierung von Gießereien sowie die Einführung von Automatisierung und KI-gestützten Qualitätskontrollsystemen verbessern zudem die Produktionseffizienz und die Gussgenauigkeit in französischen Produktionsstätten.

Einblick in den britischen Markt für Aluminiumguss

Der britische Markt für Aluminiumguss wird im Prognosezeitraum voraussichtlich ein beachtliches jährliches Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach Leichtbaumaterialien in der Automobil-, Bau- und Luftfahrtindustrie. Angesichts des zunehmenden Fokus des Landes auf Nachhaltigkeit und Emissionsreduzierung ersetzen Hersteller traditionelle Eisenwerkstoffe durch Aluminiumlegierungen, die verbesserte Leistung und Recyclingfähigkeit bieten. Moderne Entwicklungs- und Forschungseinrichtungen sowie Investitionen in Hochdruck-Druckguss und additive Fertigung beschleunigen das Marktwachstum. Darüber hinaus dürften das wachsende Ökosystem der Elektrofahrzeugproduktion in Großbritannien und das starke Exportpotenzial für Aluminiumkomponenten die Position des Landes als wichtigen europäischen Standort für Aluminiumguss festigen.

Einblick in den niederländischen Markt für Aluminiumguss

Der niederländische Markt für Aluminiumguss wird im Prognosezeitraum voraussichtlich ein gesundes Wachstum verzeichnen. Treiber dieser Entwicklung sind die fortschrittliche industrielle Infrastruktur und das Engagement für nachhaltige Produktion. Die strategische Lage des Landes als Logistik- und Produktionszentrum in Europa erleichtert den Export hochwertiger Aluminiumkomponenten in die Nachbarländer. Steigende Investitionen in erneuerbare Energien, Elektromobilität und industrielle Automatisierung kurbeln die Nachfrage nach präzisionsgegossenen Aluminiumteilen an. Niederländische Hersteller konzentrieren sich auf die Implementierung energieeffizienter Gießtechnologien, Recyclinginitiativen und digitaler Gießereilösungen, um die Produktivität zu optimieren und CO₂-Emissionen zu reduzieren. Die Kombination aus technologischer Innovation, Nachhaltigkeitsfokus und starker Integration der Lieferkette positioniert die Niederlande als aufstrebenden Akteur auf dem regionalen Markt für Aluminiumguss.

Marktanteil von Aluminiumguss in Europa

Die Aluminiumgussindustrie wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

• Gränges AB (Schweden)

• Nemak (Mexiko)

• Constellium (Frankreich)

• Rheinmetall Automotive (Deutschland)

• Sapa-Gruppe (Schweden)

• Novelis Inc. (USA)

• Aluminium Rheinfelden GmbH (Deutschland)

• Kaiser Aluminium (USA)

• ALCOA Corporation (USA)

• Aleris (USA)

• Novelis Europe (Deutschland)

• Conalcast Europe (Belgien)

• Foseco International (UK)

• Sidenor (Spanien)

• Hydro Aluminium (Norwegen)

• SLM Solutions (Deutschland)

• Arconic Corporation (USA)

• Metalúrgica de Castromil (Spanien)

• Alumeco (Polen)

• Aleris Rolled Products (Deutschland)

Welche aktuellen Entwicklungen gibt es auf dem europäischen Markt für Aluminiumguss?

- Im April 2024 gab Constellium SE, ein führender globaler Hersteller von Aluminiumprodukten mit Hauptsitz in Frankreich, die Erweiterung seines Aluminiumgießwerks im deutschen Singen bekannt. Ziel ist es, die steigende Nachfrage nach Leichtbaukomponenten für Elektrofahrzeuge zu decken. Die Erweiterung konzentriert sich auf die Steigerung der Kapazität im Hochdruck-Druckguss und die Verbesserung der Nachhaltigkeit durch energieeffiziente Öfen. Diese Initiative unterstreicht Constelliums Engagement für den europäischen Wandel hin zu saubereren Mobilitätslösungen und stärkt gleichzeitig seine Position auf dem globalen europäischen Markt für Aluminiumguss.

- Im März 2024 nahm die Rheinmetall Automotive AG (Deutschland) in ihrem Werk Neckarsulm eine neue, hochmoderne Niederdruck-Druckgussanlage in Betrieb. Die neue Anlage dient der Herstellung komplexer Aluminium-Motor- und Strukturbauteile für Hybrid- und Elektrofahrzeuge mit verbesserter Festigkeit und reduziertem Gewicht. Diese Entwicklung unterstreicht das Engagement von Rheinmetall für mehr Effizienz, Präzision und Nachhaltigkeit in der Fertigung und stärkt die führende Position des Unternehmens in der europäischen Aluminiumgussindustrie.

- Im Februar 2024 stellte Hydro Aluminium ASA (Norwegen) ein umfangreiches Investitionsprogramm zur Förderung des Recycling-Aluminiumgusses in ihrem Werk in Clervaux, Luxemburg, vor. Ziel des Projekts ist es, den Einsatz von Altmetall zu erhöhen und die CO₂-Emissionen entlang der gesamten Produktionskette zu reduzieren. Diese strategische Investition unterstreicht Hydros Bemühungen, die Prinzipien der Kreislaufwirtschaft in der Metallproduktion voranzutreiben und damit die europäischen Nachhaltigkeits- und Klimaneutralitätsziele für 2030 zu unterstützen.

- Im Januar 2024 eröffnete Nemak SAB de CV (Niederlassung Mexiko/Europa) ein hochmodernes Forschungs- und Entwicklungszentrum für Aluminiumguss in Tschechien. Das Zentrum widmet sich der Entwicklung von Gusslegierungen der nächsten Generation und Leichtbaulösungen für Gehäuse und Strukturbauteile von Elektrofahrzeugbatterien. Durch die Integration von Simulationstechnologien und KI-gestützter Qualitätskontrolle will Nemak Innovationen im Bereich des nachhaltigen Gießens beschleunigen und seine Marktpräsenz in Europa stärken.

- Im Dezember 2023 gab Gränges AB (Schweden) den Abschluss des Modernisierungsprojekts ihrer Gießerei am Standort Konin, Polen, bekannt. Das Projekt konzentrierte sich auf die Verbesserung der Energieeffizienz und die Steigerung der Produktionskapazität für gewalzte und gegossene Aluminiumprodukte, die in Wärmetauschern für die Automobilindustrie und in industriellen Anwendungen eingesetzt werden. Diese Modernisierung unterstreicht die kontinuierlichen Bemühungen von Gränges, die Leistung zu steigern, Emissionen zu reduzieren und die stark steigende Nachfrage nach hochwertigen Aluminiumgussprodukten in ganz Europa zu decken.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.