Asia Pacific Pharmaceutical Vials Market

Marktgröße in Milliarden USD

CAGR :

%

USD

17.23 Billion

USD

28.31 Billion

2025

2033

USD

17.23 Billion

USD

28.31 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 28.31 Billion | |

|

|

|

|

Marktsegmentierung für pharmazeutische Vials im asiatisch-pazifischen Raum nach Material (Glas, Kunststoff und Sonstige), Halstyp (Schraubverschluss, Bördelverschluss, Doppelkammerverschluss, Klappverschluss und Sonstige), Verschlussgröße (13–425 mm, 15–425 mm, 18–400 mm, 22–350 mm, 24–400 mm, 8–425 mm, 9 mm und Sonstige), Vertriebskanal (Direktvertrieb, Apotheken/Medizinproduktehandlungen, E-Commerce und Sonstige), Kapazität (1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml und Sonstige), Arzneimitteltyp (Injektionspräparate und nicht-injizierbare Arzneimittel), Anwendung (oral, nasal, injizierbar und Sonstige), Endverbraucher (Pharmazeutische Unternehmen, Biopharmazeutische Unternehmen, Auftragsentwicklungs- und -herstellungsunternehmen, Rezepturapotheken und Sonstige), Marktsegment (Parenteral, Gastroenterologie, HNO und Sonstige) – Branchentrends und Prognose bis 2033

Marktgröße für pharmazeutische Vials im asiatisch-pazifischen Raum

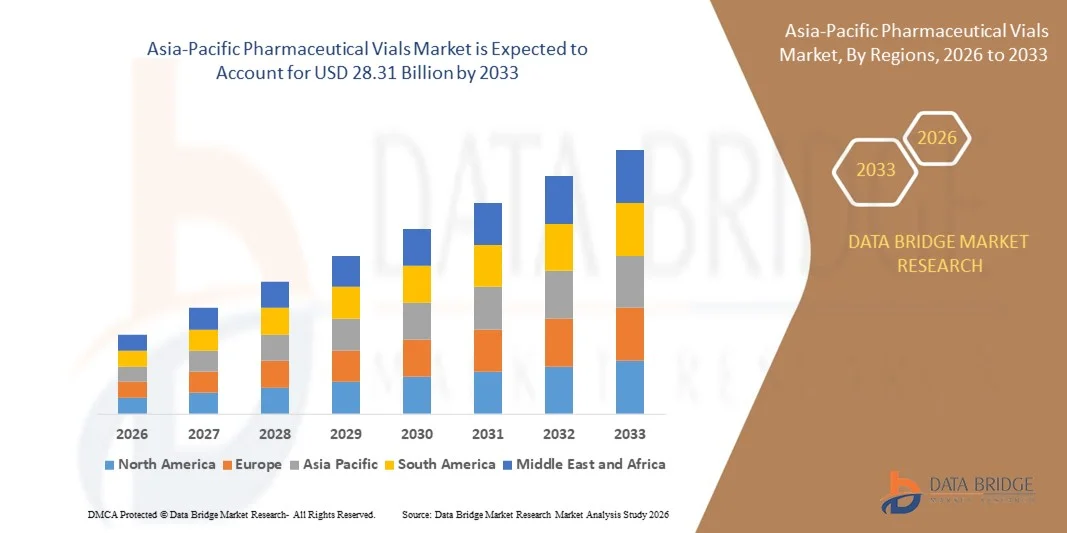

- Der Markt für pharmazeutische Vials im asiatisch-pazifischen Raum hatte im Jahr 2025 einen Wert von 17,23 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 28,31 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,40 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende pharmazeutische Produktion und die steigende Nachfrage nach injizierbaren Arzneimitteln, Impfstoffen und Biologika in der gesamten Region angetrieben, unterstützt durch den Ausbau der Gesundheitsinfrastruktur und die behördlichen Zulassungen.

- Darüber hinaus steigern Fortschritte bei den Herstellungstechnologien für Ampullen, wie Sterilisation, verbesserte Glasqualität und Mehrdosenlösungen, die Produktionseffizienz und die Sicherheitsstandards. Diese zusammenwirkenden Faktoren beschleunigen die Einführung von pharmazeutischen Ampullen und treiben so das Wachstum der Branche maßgeblich voran.

Analyse des asiatisch-pazifischen Marktes für pharmazeutische Vials

- Pharmazeutische Ampullen, die zur Lagerung und zum Transport von injizierbaren Arzneimitteln, Impfstoffen und Biologika verwendet werden, sind aufgrund ihrer verbesserten Sterilität, Haltbarkeit und Kompatibilität mit modernen Arzneimittelverabreichungssystemen zunehmend unverzichtbare Bestandteile moderner Lieferketten im Gesundheitswesen und der Pharmaindustrie, sowohl in Krankenhäusern als auch in Laboren.

- Die steigende Nachfrage nach pharmazeutischen Ampullen wird vor allem durch die wachsende Produktion von injizierbaren Arzneimitteln, zunehmende Impfprogramme und die verstärkte Anwendung von Biologika und Spezialarzneimitteln angetrieben.

- China dominierte den asiatisch-pazifischen Markt für pharmazeutische Vials mit dem größten Umsatzanteil von 32,2 % im Jahr 2025. Charakteristisch hierfür waren eine gut etablierte pharmazeutische Produktionsinfrastruktur, hohe Gesundheitsausgaben und eine starke Präsenz führender Vials-Hersteller. In den USA war ein deutliches Wachstum bei der Verwendung von Mehrdosen- und vorgefüllten Vials zu verzeichnen, das auf Innovationen in den Bereichen Glasqualität, Sterilisationsverfahren und Einhaltung gesetzlicher Vorschriften zurückzuführen ist.

- Indien dürfte im Prognosezeitraum die am schnellsten wachsende Region im asiatisch-pazifischen Markt für pharmazeutische Vials sein, bedingt durch die Ausweitung der pharmazeutischen Produktion, zunehmende staatliche Gesundheitsinitiativen und die steigende Nachfrage nach Impfstoffen und Biologika.

- Das Segment Glas dominierte den Markt mit dem größten Umsatzanteil von 47,5 % im Jahr 2025, was auf seine nachgewiesene chemische Beständigkeit, Sterilität und Kompatibilität mit einer breiten Palette von Arzneimittelformulierungen, einschließlich Biologika und Impfstoffen, zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für pharmazeutische Vials im asiatisch-pazifischen Raum

|

Attribute |

Wichtige Markteinblicke in pharmazeutische Vials |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem asiatisch-pazifischen Markt für pharmazeutische Vials

Verbesserte Effizienz durch fortschrittliche Vial-Technologien

- Ein bedeutender und sich beschleunigender Trend im asiatisch-pazifischen Markt für pharmazeutische Vials ist die Einführung fortschrittlicher Fertigungstechnologien und digitaler Lösungen, darunter Automatisierung, Präzisionsabfüllsysteme und Echtzeit-Qualitätsüberwachung. Diese Innovationen verbessern die Produktionseffizienz, die Produktsicherheit und die Konsistenz entlang der gesamten pharmazeutischen Lieferkette erheblich.

- Beispielsweise ermöglichen automatisierte Abfüllanlagen mit integrierten Sterilisations- und Verschließsystemen den Herstellern einen hohen Durchsatz bei gleichzeitig minimalem Kontaminationsrisiko. Ebenso vereinfachen vorgefüllte und Mehrdosen-Durchstechflaschen die Arzneimittelverabreichung und reduzieren Dosierungsfehler im klinischen und stationären Bereich.

- Die digitale Integration in die Vial-Herstellung ermöglicht Funktionen wie die Echtzeitüberwachung von Produktionsparametern, vorausschauende Wartung und verbesserte Rückverfolgbarkeit entlang der gesamten Lieferkette. Beispielsweise nutzen einige Lösungen der Stevanato Group und der Schott AG IoT-fähige Sensoren, um die Vial-Integrität zu überwachen und die Einhaltung regulatorischer Standards sicherzustellen. Darüber hinaus erleichtern automatisierte Tracking- und Etikettierungssysteme die Bestandsverwaltung und die Chargenrückverfolgbarkeit.

- Die nahtlose Integration von Arzneimittelfläschchen in digitale Qualitätskontrollplattformen und intelligente Verpackungslösungen ermöglicht die zentrale Überwachung von Produktion, Lagerung und Vertrieb. Über ein einziges System können Hersteller mehrere Produktionslinien überwachen, Sterilität sicherstellen und Chargen in Echtzeit verfolgen – für einen hocheffizienten und zuverlässigen Arbeitsablauf.

- Dieser Trend hin zu stärker automatisierten, präziseren und vernetzten Fertigungs- und Qualitätskontrollsystemen verändert grundlegend die Erwartungen an die Produktion von Arzneimittelfläschchen. Unternehmen wie Corning, West Pharmaceutical Services und die Stevanato Group entwickeln daher Hightech-Fläschchen mit Funktionen wie KI-gestützter Qualitätsüberwachung, automatisierungsfähigen Designs und Kompatibilität mit modernen Arzneimittelverabreichungssystemen.

- Die Nachfrage nach pharmazeutischen Vials, die eine höhere Fertigungseffizienz, Sicherheit und digitale Integration bieten, wächst rasant sowohl im Krankenhaus- als auch im kommerziellen Pharmabereich, da die Hersteller zunehmend Wert auf Produktqualität, Einhaltung gesetzlicher Vorschriften und optimierte Abläufe legen.

Marktdynamik für pharmazeutische Ampullen im asiatisch-pazifischen Raum

Treiber

Wachsender Bedarf aufgrund steigender Nachfrage nach injizierbaren Medikamenten und Impfstoffen

- Die zunehmende Verbreitung chronischer Krankheiten in Verbindung mit der steigenden Nachfrage nach Impfstoffen und Biologika ist ein wesentlicher Faktor für die verstärkte Verwendung von Arzneimittelampullen.

- Beispielsweise kündigten führende Hersteller wie die Schott AG und die Stevanato Group im Jahr 2025 den Ausbau ihrer automatisierten Produktionslinien für Ampullen an, um die steigende Nachfrage nach Mehrdosenimpfstoffen gegen COVID-19 und Grippe zu decken. Solche Strategien großer Unternehmen dürften das Wachstum des Marktes für pharmazeutische Ampullen im Prognosezeitraum vorantreiben.

- Da Gesundheitsdienstleister und Pharmaunternehmen eine sichere, sterile und effiziente Arzneimittelverabreichung anstreben, bieten pharmazeutische Vials fortschrittliche Funktionen wie die Möglichkeit zur Mehrfachdosierung, die Kompatibilität mit vorgefüllten Spritzen und eine verbesserte Sterilität und stellen damit einen überzeugenden Vorteil gegenüber alternativen Verpackungsformaten dar.

- Darüber hinaus führt die zunehmende Betonung von Impfprogrammen, Biologika und injizierbaren Spezialarzneimitteln dazu, dass pharmazeutische Ampullen zu einem integralen Bestandteil moderner Lieferketten im Gesundheitswesen werden und eine nahtlose Integration mit automatisierten Abfüll-, Lager- und Vertriebssystemen ermöglichen.

- Der Komfort vorgefüllter Mehrdosen- und automatisierungsfertiger Durchstechflaschen sowie die Einhaltung regulatorischer Vorgaben und die Rückverfolgbarkeit sind Schlüsselfaktoren für die zunehmende Akzeptanz in Krankenhäusern, Kliniken und der pharmazeutischen Industrie. Der Trend zu skalierbaren Produktionslinien und benutzerfreundlichen Durchstechflaschendesigns trägt zusätzlich zum Marktwachstum bei.

Zurückhaltung/Herausforderung

Bedenken hinsichtlich der Einhaltung gesetzlicher Vorschriften und der Produktionskosten

- Bedenken hinsichtlich strenger regulatorischer Anforderungen und hoher Produktionskosten stellen eine erhebliche Herausforderung für eine breitere Marktexpansion dar. Pharmazeutische Vials müssen strenge Standards hinsichtlich Sterilität, Glasqualität und Biokompatibilität erfüllen, was die Komplexität und die Kosten der Herstellung erhöht.

- Die Einhaltung der FDA-, EMA- und ISO-Standards erfordert beispielsweise strenge Tests und Validierungen, was die Markteinführungszeit für neue Fläschchendesigns verlängern kann.

- Die Bewältigung dieser regulatorischen Herausforderungen durch strenge Qualitätskontrollen, automatisierte Produktionssysteme und die Einhaltung globaler Standards ist entscheidend für den Aufbau von Vertrauen bei Pharmaunternehmen. Hersteller wie West Pharmaceutical Services und Corning legen in ihren Produktionsprozessen Wert auf Compliance und Qualitätssicherung, um ihren Kunden Sicherheit zu geben. Darüber hinaus können die vergleichsweise hohen Kosten von modernen Glas- oder Mehrdosenfläschchen im Vergleich zu Standardfläschchen insbesondere für kleinere Pharmahersteller in Schwellenländern ein Hindernis darstellen.

- Während die Effizienzsteigerungen in der Fertigung und die Skaleneffekte die Kosten nach und nach senken, kann der wahrgenommene Aufpreis für hochwertige, sterile Fläschchen die breite Akzeptanz immer noch behindern, insbesondere bei preissensiblen Käufern.

- Die Bewältigung dieser Herausforderungen durch verbesserte Automatisierung, kosteneffiziente Produktionsmethoden und die konsequente Einhaltung globaler Qualitätsstandards wird für ein nachhaltiges Marktwachstum von entscheidender Bedeutung sein.

Umfang des Marktes für pharmazeutische Ampullen im asiatisch-pazifischen Raum

Der Markt für pharmazeutische Vials ist segmentiert nach Material, Halstyp, Verschlussgröße, Vertriebskanal, Kapazität, Arzneimitteltyp, Anwendung, Endverbraucher und Markt.

- Nach Material

Basierend auf dem Material ist der Markt für pharmazeutische Vials im asiatisch-pazifischen Raum in Glas, Kunststoff und Sonstige unterteilt. Das Glassegment dominierte den Markt mit dem größten Umsatzanteil von 47,5 % im Jahr 2025. Dies ist auf die nachgewiesene chemische Beständigkeit, Sterilität und Kompatibilität mit einer Vielzahl von Arzneimittelformulierungen, einschließlich Biologika und Impfstoffen, zurückzuführen. Glasvials werden von Pharmaherstellern aufgrund ihrer Stabilität und geringen Reaktivität bevorzugt für hochwertige injizierbare Arzneimittel verwendet.

Für das Segment der Kunststoffverpackungen wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,3 % das schnellste Wachstum erwartet. Gründe hierfür sind das geringe Gewicht, die Bruchsicherheit und die Eignung für die großflächige Impfstoffverteilung. Kunststofffläschchen werden zunehmend als kostengünstige Lösungen eingesetzt, insbesondere in Schwellenländern und für Anwendungen, die ein geringes Bruchrisiko beim Transport erfordern. Die steigende Nachfrage nach sicheren, leichten und einfach zu transportierenden Arzneimittelbehältern dürfte das Gesamtwachstum beider Materialarten ankurbeln.

- Nach Halsart

Basierend auf dem Halstyp ist der Markt in Schraubverschluss-, Bördelverschluss-, Doppelkammer-, Klappverschluss- und sonstige Verschlüsse unterteilt. Das Segment der Schraubverschluss-Vials dominierte 2025 mit einem Marktanteil von 44,6 %. Dies ist auf die einfache Versiegelung, die Kompatibilität mit automatisierten Verschließmaschinen und die weitverbreitete Anwendung bei injizierbaren Arzneimitteln und Biologika zurückzuführen. Schraubverschluss-Vials bieten einen zuverlässigen, auslaufsicheren Verschluss und werden sowohl für Einzeldosis- als auch für Mehrdosenanwendungen bevorzugt.

Das Segment der Doppelkammer-Vials wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,8 % das schnellste Wachstum verzeichnen. Dies ist auf die Möglichkeit zurückzuführen, lyophilisierte Arzneimittel getrennt von Lösungsmitteln zu lagern, was eine verbesserte Arzneimittelverabreichung und -stabilität ermöglicht. Die zunehmende Verwendung lyophilisierter Biologika und Kombinationstherapien dürfte das Wachstum in diesem Segment weiter ankurbeln, insbesondere bei biopharmazeutischen Herstellern, die innovative Vials für komplexe Formulierungen suchen.

- Nach Kappengröße

Der Markt für pharmazeutische Vials im asiatisch-pazifischen Raum ist nach Verschlussgröße in verschiedene Größen von 8–425 mm bis 24–400 mm unterteilt. Das Segment 13–425 mm dominierte 2025 mit einem Marktanteil von 41,2 %. Dies ist auf seine Vielseitigkeit bei der Verpackung einer breiten Palette injizierbarer Arzneimittel und die einfache Handhabung mit Standard-Verschließmaschinen zurückzuführen. Diese Verschlussgröße wird in Krankenhäusern und bei groß angelegten Impfprogrammen aufgrund ihrer Kompatibilität mit gängigen Spritzen und Abfüllanlagen bevorzugt.

Für das Segment der Verschlussgrößen von 22–350 mm wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,0 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach großvolumigen Durchstechflaschen für Mehrdosenimpfstoffe und Biologika. Die zunehmende Produktion von injizierbaren Therapien in großen Volumina und die Ausweitung von Impfprogrammen im asiatisch-pazifischen Raum fördern die Verwendung dieser Verschlussgrößen sowohl im kommerziellen als auch im klinischen Bereich.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvertrieb, Apotheken/Apotheken, E-Commerce und Sonstige unterteilt. Der Direktvertrieb dominierte 2025 mit einem Marktanteil von 45,7 %, was auf die engen Beziehungen zwischen Pharmaherstellern und Krankenhäusern, Kliniken sowie großen Arzneimittelgroßhändlern zurückzuführen ist. Der Direktvertrieb ermöglicht Großeinkauf, Qualitätssicherung und die Einhaltung gesetzlicher Bestimmungen und ist daher der bevorzugte Vertriebskanal für große Pharmaunternehmen.

Für den E-Commerce-Sektor wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,1 % das schnellste Wachstum erwartet. Treiber dieses Wachstums sind der zunehmende Online-Handel mit Arzneimitteln, die fortschreitende Digitalisierung und die Bequemlichkeit der Hauszustellung für kleinere Gesundheitsdienstleister und Apotheken. Besonders auffällig ist die steigende Nutzung von E-Commerce-Kanälen in den aufstrebenden Märkten des asiatisch-pazifischen Raums, wo die Verfügbarkeit von medizinischen Produkten rasant zunimmt.

- Nach Kapazität

Basierend auf dem Fassungsvermögen ist der Markt in verschiedene Vial-Volumina unterteilt. Das 10-ml-Segment dominierte 2025 mit einem Marktanteil von 42,8 %, da es häufig für injizierbare Arzneimittel, Impfstoffe und Mehrdosenformulierungen verwendet wird. Es bietet ein optimales Gleichgewicht zwischen Dosierungsflexibilität und Lagereffizienz.

Für das 2-ml-Segment wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,6 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Produktion hochwertiger Biologika und Impfstoffe, die eine Dosierung in kleinen Volumina erfordern. Kleinvolumige Vials werden bevorzugt für Lyophilisate, Fertigspritzen und pädiatrische Formulierungen eingesetzt und erzeugen so eine starke Nachfrage in Krankenhäusern, Kliniken und bei pharmazeutischen Herstellern.

- Nach Arzneimitteltyp

Basierend auf der Art des Arzneimittels ist der Markt in injizierbare und nicht-injizierbare Arzneimittel unterteilt. Das Segment der injizierbaren Arzneimittel dominierte 2025 mit einem Marktanteil von 56,3 %, bedingt durch die zunehmende Verwendung von Impfstoffen, Biologika und Spezialinjektionspräparaten im Krankenhaus- und Klinikbereich. Injektionsfläschchen sind entscheidend für die Gewährleistung von Sterilität, Dosierungsgenauigkeit und sicherer Lagerung.

Für das Segment der nicht-injizierbaren Arzneimittel wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,5 % das schnellste Wachstum erwartet. Treiber dieses Wachstums sind die steigende Nachfrage nach oralen Flüssigpräparaten, Nasensprays und topischen Medikamenten in kleinen Ampullen. Die wachsende Produktpipeline und die zunehmende Entwicklung patientenorientierter Formulierungen dürften das Wachstum in diesem Segment weiter beschleunigen.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt in orale, nasale, injizierbare und sonstige Darreichungsformen unterteilt. Das Segment der injizierbaren Arzneimittel dominierte 2025 mit einem Marktanteil von 57,1 %, bedingt durch die hohe Nachfrage nach Impfstoffen, Biologika und parenteralen Arzneimitteln. Injektionsfläschchen gewährleisten Sterilität, präzise Dosierung und Langzeitstabilität und sind daher in Krankenhäusern, Kliniken und der pharmazeutischen Produktion unverzichtbar.

Für den Nasenbereich wird von 2026 bis 2033 das schnellste jährliche Wachstum von 21,9 % erwartet. Treiber dieser Entwicklung sind die zunehmende Beliebtheit von Nasenimpfstoffen, Medikamentenverabreichungssystemen für chronische Erkrankungen und patientenorientierten, nicht-invasiven Therapien. Innovationen bei nasalen Arzneimittelformulierungen und der Kompatibilität mit Geräten fördern die Akzeptanz in der Region.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Pharmaunternehmen, Biopharmaunternehmen, Auftragsentwicklungs- und -herstellungsunternehmen (CDMO), Rezepturapotheken und Sonstige unterteilt. Das Segment der Pharmaunternehmen dominierte 2025 mit einem Marktanteil von 48,5 %, angetrieben durch die großtechnische Produktion von Impfstoffen, Biologika und injizierbaren Arzneimitteln. Etablierte Pharmaunternehmen bevorzugen zuverlässige Lieferanten, um eine gleichbleibende Qualität der Ampullen und die Einhaltung regulatorischer Vorgaben zu gewährleisten.

Im Segment der biopharmazeutischen Unternehmen wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,7 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind der wachsende Sektor der Biologika und Biosimilars, die zunehmende Anzahl von Forschungs- und Entwicklungsprojekten sowie der Bedarf an speziellen Vial-Formaten für empfindliche Substanzen.

- Nach Marktsegment: Parenteral, Gastrointestinal, HNO und Sonstige

Basierend auf den Marktgegebenheiten ist der asiatisch-pazifische Markt für pharmazeutische Vials in die Segmente Parenteralia, Gastrointestinaltrakt, HNO und Sonstige unterteilt. Das Segment Parenteralia dominierte 2025 mit einem Marktanteil von 54,2 %, bedingt durch die hohe Nachfrage nach injizierbaren Arzneimitteln, Impfstoffen und Biologika, die eine sterile und zuverlässige Lagerung in Vials erfordern. Parenterale Vials sind in Krankenhäusern und Kliniken unerlässlich, um die Patientensicherheit zu gewährleisten und die Wirksamkeit der Medikamente aufrechtzuerhalten.

Für den HNO-Bereich wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,3 % das schnellste Wachstum erwartet. Dies wird durch den zunehmenden Einsatz spezialisierter Arzneimittelverabreichungssysteme für die Therapie von Hals-Nasen-Ohren-Erkrankungen, insbesondere in der ambulanten Versorgung und in spezialisierten Kliniken, begünstigt. Das wachsende Bewusstsein für krankheitsspezifische Behandlungen und die zunehmende pharmazeutische Innovation treiben das Wachstum dieses Segments an.

Regionale Analyse des Marktes für pharmazeutische Vials im asiatisch-pazifischen Raum

- China dominierte den Markt für pharmazeutische Vials im asiatisch-pazifischen Raum mit dem größten Umsatzanteil von 32,2 % im Jahr 2025. Treiber dieser Entwicklung waren eine wachsende pharmazeutische Produktionsbasis, eine hohe Nachfrage nach Impfstoffen und Biologika sowie eine gut etablierte Gesundheitsinfrastruktur.

- Gesundheitsdienstleister und Pharmaunternehmen in der Region legen aufgrund ihrer Zuverlässigkeit, Sterilität und Kompatibilität mit einer breiten Palette von injizierbaren und biologischen Arzneimitteln Wert auf qualitativ hochwertige Ampullen.

- Diese weite Verbreitung wird zusätzlich durch strenge regulatorische Standards, fortschrittliche Fertigungstechnologien und enge Beziehungen zwischen den Lieferanten von Ampullen und großen Pharmaunternehmen unterstützt, wodurch sich hochwertige Glas- und Spezialampullen als bevorzugte Wahl sowohl für die kommerzielle Produktion als auch für den Krankenhausgebrauch etabliert haben.

Einblick in den Markt für pharmazeutische Vials in China und im asiatisch-pazifischen Raum

Der chinesische Markt für pharmazeutische Vials wird 2025 den größten Umsatzanteil im asiatisch-pazifischen Raum erzielen. Treiber dieses Wachstums sind die starke pharmazeutische Produktionsbasis des Landes, die steigende Impfstoffproduktion und die wachsende Nachfrage nach Biologika und injizierbaren Arzneimitteln. Die rasche Urbanisierung, steigende Gesundheitsausgaben und staatliche Initiativen zur Verbesserung des Zugangs zur Gesundheitsversorgung beflügeln das Marktwachstum zusätzlich. China entwickelt sich außerdem zu einem wichtigen Produktionsstandort für pharmazeutische Vials und ermöglicht die Herstellung kostengünstiger, qualitativ hochwertiger Glas- und Kunststoffvials für inländische und internationale Lieferketten.

Einblick in den japanischen und asiatisch-pazifischen Markt für pharmazeutische Vials

Der japanische Markt für pharmazeutische Vials verzeichnet ein stetiges Wachstum, angetrieben durch die hohe Nachfrage des Landes nach fortschrittlichen Biologika, Impfstoffen und injizierbaren Arzneimitteln. Japans Fokus auf technologische Innovation, strenge Qualitätsstandards und die alternde Bevölkerung fördern die Verwendung von vorgefüllten und Mehrdosen-Vials, die Komfort, Sterilität und Sicherheit bieten. Die Integration automatisierter Abfüll- und Verpackungssysteme in die japanische Pharmaproduktion stärkt das Marktwachstum zusätzlich.

Einblick in den Markt für pharmazeutische Vials in Indien und im asiatisch-pazifischen Raum

Der indische Markt für pharmazeutische Ampullen wird im Prognosezeitraum voraussichtlich das schnellste Wachstum im asiatisch-pazifischen Raum verzeichnen. Treiber dieses Wachstums sind die zunehmende pharmazeutische Produktion, die steigende Impfstoffproduktion und der Ausbau biopharmazeutischer Anlagen. Staatliche Initiativen zur Förderung von Impfkampagnen, ein wachsendes Gesundheitsbewusstsein und der steigende Export injizierbarer Medikamente tragen zur raschen Verbreitung von Glas- und Kunststoffampullen bei. Indiens wettbewerbsfähiges Produktionsumfeld zieht zudem globale Pharmaunternehmen an, die eine zuverlässige Versorgung mit Ampullen suchen.

Einblick in den Markt für pharmazeutische Vials in Südkorea und im asiatisch-pazifischen Raum

Der südkoreanische Markt für pharmazeutische Vials wächst stetig aufgrund steigender Investitionen in Biologika, Impfstoffe und die Herstellung steriler Injektionspräparate. Die zunehmende Verwendung hochwertiger Glasvials, die Einhaltung strenger regulatorischer Vorgaben und technologische Fortschritte bei Sterilisations- und Abfüllsystemen für Vials tragen zum Marktwachstum bei. Darüber hinaus treiben die gut ausgebaute pharmazeutische Infrastruktur und die exportorientierte Produktion des Landes die Nachfrage sowohl für den Inlandsmarkt als auch für den internationalen Markt an.

Marktanteil von pharmazeutischen Vials im asiatisch-pazifischen Raum

Die Branche der pharmazeutischen Ampullen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

• Schott AG (Deutschland)

• Stevanato Group (Italien)

• Corning Inc. (USA)

• West Pharmaceutical Services, Inc. (USA)

• BD (Becton, Dickinson and Company) (USA)

• Suzhou Hengrui Medicine (China)

• Vials India Limited (Indien)

• Sun Pharmaceutical Industries Ltd. (Indien)

• Flexion Therapeutics (USA)

• SG Pharma (Indien)

• Huhtamaki PPL (Finnland)

• Daikyo Seiko Ltd. (Japan)

• Agilent Technologies (USA)

• Camber Pharma (Großbritannien)

• Kangtai Biological Products (China)

• Hikma Pharmaceuticals (Großbritannien)

• Ricerca Biosciences (USA)

• Stein Pharma (China)

• Corning Life Sciences (USA)

• Daikyo Pharmaceutical Packaging (Japan)

Welche aktuellen Entwicklungen gibt es auf dem Markt für pharmazeutische Ampullen im asiatisch-pazifischen Raum?

- Im April 2024 startete die Schott AG, ein weltweit führender Anbieter von Spezialglaslösungen, in Indien eine strategische Initiative zur Steigerung der Produktion und des Angebots hochwertiger pharmazeutischer Vials für Impfstoffe und Biologika. Diese Initiative unterstreicht das Engagement des Unternehmens für die Bereitstellung zuverlässiger, steriler und regulatorisch konformer Vials, die auf die wachsenden Bedürfnisse des regionalen Gesundheitswesens zugeschnitten sind. Durch die Nutzung ihrer globalen Expertise und fortschrittlichen Fertigungstechnologien begegnet die Schott AG nicht nur regionalen Herausforderungen im Pharmabereich, sondern stärkt auch ihre Position im schnell wachsenden asiatisch-pazifischen Markt für pharmazeutische Vials.

- Im März 2024 stellte die Stevanato Group, ein italienischer Hersteller von Durchstechflaschen und Fertigspritzen, eine neue Produktlinie von Mehrdosen-Durchstechflaschen vor, die speziell für großangelegte Impfprogramme in Südostasien entwickelt wurde. Das innovative Design der Durchstechflaschen gewährleistet verbesserte Sterilität, reduziertes Kontaminationsrisiko und Kompatibilität mit automatisierten Abfüllanlagen. Diese Entwicklung unterstreicht das Engagement der Stevanato Group für die Unterstützung von Massenimpfungen und die Steigerung der betrieblichen Effizienz für Gesundheitsdienstleister.

- Im März 2024 erweiterte Corning Inc. erfolgreich seine Produktionskapazitäten für Injektionsfläschchen in China, um der steigenden Nachfrage nach Impfstoffen, Biologika und Spezialarzneimitteln gerecht zu werden. Diese Initiative nutzt modernste Produktionstechnologien, um qualitativ hochwertige, konsistente und sterile Fläschchen zu gewährleisten und unterstreicht Cornings Engagement für die Unterstützung der schnell wachsenden pharmazeutischen Industrie der Region.

- Im Februar 2024 gab West Pharmaceutical Services, Inc., ein führender Anbieter von Lösungen zur Verabreichung injizierbarer Arzneimittel, eine strategische Partnerschaft mit mehreren regionalen biopharmazeutischen Herstellern in Japan bekannt. Ziel der Partnerschaft ist die Lieferung von vorgefüllten und Mehrdosen-Durchstechflaschen. Die Zusammenarbeit soll die Produktionseffizienz steigern, die Zuverlässigkeit der Lieferkette verbessern und die Distribution an Krankenhäuser und Kliniken optimieren. Diese Initiative unterstreicht das Engagement von West für Innovation und operative Exzellenz im Pharmasektor.

- Im Januar 2024 präsentierte BD (Becton, Dickinson and Company) auf der Asia-Pacific Pharmaceutical Expo 2024 seine fortschrittliche Produktlinie vorgefüllter und Glasfläschchen. Dank verbesserter Sterilität und Kompatibilität mit automatisierten Abfüllsystemen ermöglichen diese Fläschchen Pharmaunternehmen eine effizientere Produktion und Distribution. Die BD-Fläschchen unterstreichen das Engagement des Unternehmens für die Integration modernster Technologien in pharmazeutische Verpackungslösungen und bieten Herstellern so mehr Qualität, Sicherheit und Bedienkomfort.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.