Markt für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum, nach Produkt (konventionell wasserunlöslich und wasserlöslich), Anwendung (Hydrauliköl, Getriebeöl, Kompressoröl, Metallbearbeitungsflüssigkeiten, Schmierfette und andere), Endverbrauch (Automobil, Luft- und Raumfahrt, Schifffahrt, Werkzeuge und Industrieausrüstung, Heizungs-, Lüftungs- und Klimatechnik und Kühlung und andere), Land (Japan, China, Südkorea, Indien, Australien und Neuseeland, Taiwan, Hongkong, Singapur, Thailand, Malaysia, Indonesien, Philippinen und restlicher asiatisch-pazifischer Raum), Markttrends und Prognose bis 2029.

Marktanalyse und Einblicke : Markt für Polyalkylenglykol (PAG)-Grundöl im asiatisch-pazifischen Raum

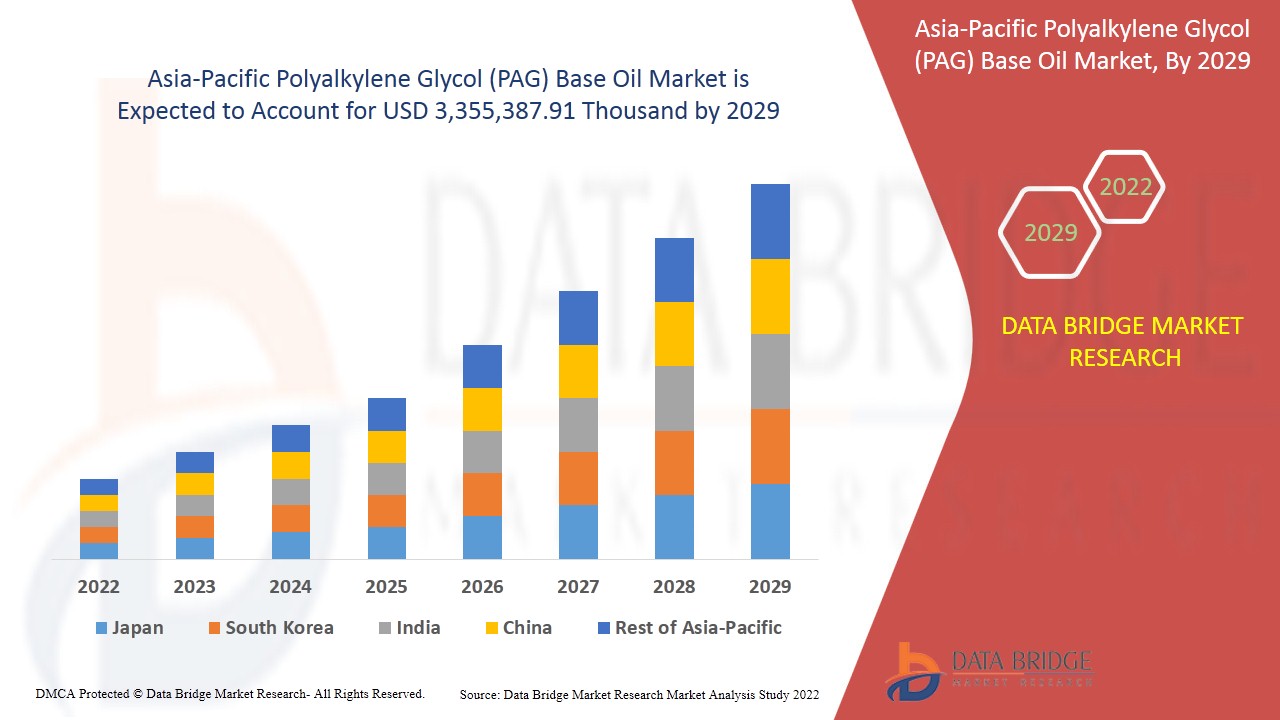

Der Markt für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum wird im Prognosezeitraum 2022 bis 2029 voraussichtlich deutlich wachsen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 4,4 % wächst und bis 2029 voraussichtlich 3.355.387,91 Tausend USD erreichen wird. Die erhebliche Nachfrage nach Polyalkylenglykol (PAG)-Grundölen in der Automobilindustrie hat das Wachstum des Marktes für Polyalkylenglykol (PAG)-Grundöle vorangetrieben.

PAG-Öl oder Polyalkylenglykol ist ein vollständig synthetisches hygroskopisches Öl, das speziell für Klimakompressoren in Autos vorgesehen ist. Es wird häufig als Kompressoröl verwendet. Darüber hinaus wird es in Anwendungen wie Schmiermittel für abgenutzte Getriebe, wasserfreie, feuerfeste Hydraulikflüssigkeit, Metallbearbeitungsflüssigkeit und anderen eingesetzt. Diese PAG-Öle haben einen hohen Viskositätsindex, sind gut wasserlöslich, scherstabil und bei hohen Temperaturen weniger flüchtig. PAG-Basisöle werden auch als Textilschmiermittel und Abschreckmittel bei der Wärmebehandlung von Metallen verwendet.

Polyalkylenglykol (PAG)-Grundöle werden nach ihrem Gewichtsanteil an Oxypropylen- und Oxyethyleneinheiten in der Polymerkette klassifiziert. Polyalkylenglykol (PAG)-Grundöle mit 100 Gewichtsprozent Oxypropylengruppen sind wasserunlöslich, wohingegen solche mit 50 bis 75 Gewichtsprozent Oxyethylen bei Raumtemperatur wasserlöslich sind. Obwohl Polyalkylenglykol (PAG)-Grundöle schon lange als Industrieschmierstoffe verwendet werden, führten neuere Arbeiten zur Entwicklung von Polyalkylenglykol (PAG)-Schmierstoffen für den Einsatz in Geräten der Lebensmittelverarbeitungsindustrie. Diese Produkte sind als lebensmitteltaugliche Schmierstoffe bekannt.

Die erhebliche Nachfrage nach Polyalkylenglykol-Grundölen in der Automobilindustrie hat das Wachstum des Marktes für Polyalkylenglykol-Grundöle (PAG) vorangetrieben. Die deutliche Zunahme der Bautätigkeit und der Infrastrukturentwicklung weltweit dürfte das Marktwachstum weiter ankurbeln. Die größte Einschränkung, die sich negativ auf den globalen Markt für Polyalkylenglykol-Grundöle (PAG) auswirkt, ist die Volatilität der Rohölpreise. Andererseits kann die zunehmende Verwendung biologisch abbaubarer PAG-Öle Chancen für den globalen Markt für Polyalkylenglykol-Grundöle (PAG) mit sich bringen. Es wird jedoch erwartet, dass die Präsenz von Ersatzstoffen auf dem Markt das Marktwachstum in naher Zukunft bremsen wird.

Der Marktbericht zu Polyalkylenglykol (PAG)-Grundölen enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Marktumfang und Marktgröße für Polyalkylenglykol (PAG)-Grundöl im asiatisch-pazifischen Raum

Der Markt für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum ist nach Produkt, Anwendung und Endverbrauch segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und bestimmt Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage des Produkts wird der Markt in konventionelle (wasserunlösliche) und wasserlösliche unterteilt. Im Jahr 2022 wird das konventionelle (wasserunlösliche) Segment voraussichtlich den Markt dominieren, da es einen sehr hohen Viskositätsindex und gute Nieder- und Hochtemperatureigenschaften aufweist, was dazu beiträgt, die Nachfrage im Prognosejahr anzukurbeln.

- Auf der Grundlage der Anwendung ist der Markt in Hydrauliköl , Getriebeöl, Kompressoröl , Metallbearbeitungsflüssigkeiten, Fette und andere unterteilt. Im Jahr 2022 wird das Segment Kompressoröl voraussichtlich den Markt dominieren, da Kompressoröl den Verschleiß rotierender Teile verringert und verhindert, dass Metall an Metall reibt, was dazu beiträgt, die Nachfrage im Prognosejahr anzukurbeln.

- Auf der Grundlage der Endnutzung ist der Markt in Automobil, Luft- und Raumfahrt, Schifffahrt, Werkzeug- und Industrieausrüstung, Heizungs-, Lüftungs- und Klimatechnik und Kühlung und andere unterteilt. Im Jahr 2022 wird das Automobilsegment voraussichtlich den Markt dominieren, da PAG-Öl hilft, Reibung und Verschleiß im Automotor zu kontrollieren, was dazu beiträgt, die Nachfrage im Prognosejahr anzukurbeln.

Polyalkylenglykol (PAG)-Basisöl Markt – Länderebeneanalyse

Der asiatisch-pazifische Markt wird analysiert und Informationen zur Marktgröße werden basierend auf Land, Produkt, Anwendung und Endverbrauch wie oben angegeben bereitgestellt.

Die im Marktbericht für Polyalkylenglykol (PAG)-Basisöle im asiatisch-pazifischen Raum abgedeckten Länder sind Japan, China, Südkorea, Indien, Singapur, Thailand, Indonesien, Malaysia, die Philippinen, Australien und Neuseeland, Hongkong, Taiwan sowie der restliche asiatisch-pazifische Raum.

Der Markt für Polyalkylenglykol-Grundöle (PAG) im asiatisch-pazifischen Raum dominiert aufgrund der erheblichen Nachfrage nach PAGs in der Automobilindustrie, was die Nachfrage nach Polyalkylenglykol-Grundölen (PAG) in der Region steigert.

Globaler Markt für Polyalkylenglykol (PAG)-Grundöle

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Große Nachfrage nach PAGs in der Automobilindustrie

Der Markt für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das Wachstum der installierten Basis verschiedener Arten von Produkten für den Markt für Polyalkylenglykol (PAG)-Grundöle, die Auswirkungen der Technologie anhand von Lebenslinienkurven und Änderungen der Produktionstechnologie, regulatorische Szenarien und deren Auswirkungen auf den Markt für Polyalkylenglykol (PAG)-Grundöle. Die Daten sind für den historischen Zeitraum 2012 bis 2020 verfügbar.

Wettbewerbsumfeld und Polyalkylenglykol (PAG)-Basisöl Marktanteilsanalyse

Die Wettbewerbslandschaft des Marktes für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum bietet Einzelheiten nach Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Polyalkylenglykol (PAG)-Grundöle im asiatisch-pazifischen Raum.

Zu den im Bericht behandelten Hauptakteuren zählen Phillips 66 Company, Exxon Mobil Corporation, Total Energies, Royal Dutch Shell Plc, Denso Corporation, BASF SE, ENI Oil Products, Chevron Corporation, FUCHS, Croda International Plc, HANNONG Chemicals Inc., Petronas Lubricants International, LIQUI MOLY GmbH, Morris Lubricants, Ultrachem Inc und Idemitsu Kosan Co., Ltd. sowie weitere in- und ausländische Akteure. Die Analysten von DBMR kennen die Stärken der Konkurrenz und erstellen für jeden einzelnen Wettbewerber eine Wettbewerbsanalyse.

Zum Beispiel,

- Im März 2021 hat sich die Independent Truck Repair Group (iTRG) mit Phillips 66 Lubricants zusammengetan, um ihren Mitgliedern ein nationales Ölprogramm anzubieten. Durch dieses neue Programm erhalten iTRG-Mitglieder Zugang zu Sonderpreisen, Werbematerialien, Rabatten sowie verbesserter Schulung und technischem Support für Premium-Dieselprodukte der Phillips 66 Company. Dies wird der Phillips 66 Company mehr Kunden bringen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OILS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DATA TRIANGULATION

2.7 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DROC ANALYSIS

2.8 PRODUCT LIFE LINE CURVE

2.9 MULTIVARIATE MODELING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET END-USE COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 DBMR VENDOR SHARE ANALYSIS

2.15 IMPORT-EXPORT DATA

2.16 SECONDARY SOURCES

2.17 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND FOR PAG IN AUTOMOTIVE INDUSTRY

5.1.2 RISING TECHNOLOGICAL ADVANCEMENTS AND MODERNIZATION IN PRODUCTION TECHNIQUES

5.1.3 CONSIDERABLE INCREASE IN CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS GLOBE

5.1.4 GROWING USE IN FOOD-GRADE PRODUCTS

5.2 RESTRAINTS

5.2.1 RISE IN COST OF SYNTHETIC FIBERS

5.2.2 VOLATILITY IN CRUDE OIL PRICES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIO-DEGRADABLE PAG OILS

5.3.2 GROWING RESEARCH AND DEVELOPMENT ACTIVITIES

5.4 CHALLENGES

5.4.1 PRESENCE OF SUBSTITUTES IN MARKET

5.4.2 HIGH COST COMPARED TO CONVENTIONAL MINERAL OILS

6 IMPACT OF COVID-19 IMPACT ON THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

6.3 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CONVENTIONAL (WATER INSOLUBLE)

7.3 WATER SOLUBLE

8 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMPRESSOR OIL

8.3 HYDRAULIC OIL

8.4 METAL WORKING FLUIDS

8.5 GEAR OIL

8.6 GREASES

8.7 OTHERS

9 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.3 TOOLING & INDUSTRIAL EQUIPMENT

9.4 MARINE

9.5 AEROSPACE

9.6 HVAC & REFRIGERATION

9.7 OTHERS

10 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 MALAYSIA

10.1.5 THAILAND

10.1.6 AUSTRALIA & NEW ZEALAND

10.1.7 SOUTH KOREA

10.1.8 INDONESIA

10.1.9 HONG KONG

10.1.10 SINGAPORE

10.1.11 TAIWAN

10.1.12 PHILIPPINES

10.1.13 REST OF ASIA-PACIFIC

11 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 MERGERS & ACQUISITIONS

11.3 EXPANSIONS

11.4 NEW PRODUCT DEVELOPMENTS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 PHILLIPS 66 COMPANY

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 EXXON MOBIL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 TOTALENERGIES

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ROYAL DUTCH SHELL PLC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DENSO CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 BASF SE

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 CHEVRON CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 CRODA INTERNATIONAL PLC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 ENI OIL PRODUCTS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 FUCHS

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 HANNONG CHEMICALS INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 HORNETT BROS & CO LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 IDEMITSU KOSAN CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 LIQUI MOLY GMBH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 MORRIS LUBRICANTS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

13.16 PETRONAS LUBRICANTS INTERNATIONAL

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT UPDATES

13.17 ULTRACHEM INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 IMPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3403 LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST… (USD THOUSAND)

TABLE 3 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 5 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRICE, 2020-2029 (USD/KILOTONNE)

TABLE 6 ASIA PACIFIC CONVENTIONAL (WATER INSOLUBLE) IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC CONVENTIONAL (WATER INSOLUBLE) IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (THOUSAND KILOTONNES)

TABLE 8 ASIA PACIFIC WATER SOLUBLE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC WATER SOLUBLE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (THOUSAND KILOTONNES)

TABLE 10 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC COMPRESSOR OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC HYDRAULIC OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC METAL WORKING FLUIDS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC GEAR OIL IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC GREASES IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC AUTOMOTIVE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC TOOLING & INDUSTRIAL EQUIPMENT IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC MARINE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC AEROSPACE IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC HVAC & REFRIGERATION IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC OTHERS IN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY COUNTRY, 2020-2029 (THOUSAND KILOTONNES)

TABLE 26 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 28 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 30 CHINA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 CHINA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 32 CHINA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 CHINA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 34 INDIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 INDIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 36 INDIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 INDIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 38 JAPAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 JAPAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 40 JAPAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 JAPAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 42 MALAYSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 MALAYSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 44 MALAYSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 MALAYSIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 46 THAILAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 THAILAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 48 THAILAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 THAILAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 52 AUSTRALIA & NEW ZEALAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 54 SOUTH KOREA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 SOUTH KOREA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 56 SOUTH KOREA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 SOUTH KOREA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 58 INDONESIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 INDONESIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 60 INDONESIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 INDONESIA POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 62 HONG KONG POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 HONG KONG POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 64 HONG KONG POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 HONG KONG POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 66 SINGAPORE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 SINGAPORE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 68 SINGAPORE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SINGAPORE POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 70 TAIWAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 TAIWAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 72 TAIWAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 TAIWAN POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 PHILIPPINES POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 PHILIPPINES POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

TABLE 76 PHILIPPINES POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 PHILIPPINES POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 78 REST OF ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 79 REST OF ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2020-2029 (THOUSAND KILOTONNES)

Abbildungsverzeichnis

FIGURE 1 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 3 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 4 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: PRODUCT LIFE LINE CURVE

FIGURE 5 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MULTIVARIATE MODELLING

FIGURE 6 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 SIGNIFICANT DEMAND FOR PAGS IN AUTOMOTIVE INDUSTRY IS DRIVING THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 CONVENTIONAL (WATER INSOLUBLE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET

FIGURE 16 VOLATILE CRUDE OIL PRICES

FIGURE 17 VOLATILITY IN CRUDE OIL PRICES BY THE U.S. ENERGY INFORMATION ADMINISTRATION

FIGURE 18 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY PRODUCT, 2021

FIGURE 19 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY APPLICATION, 2021

FIGURE 20 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET, BY END-USE, 2021

FIGURE 21 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: SNAPSHOT (2021)

FIGURE 22 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021)

FIGURE 23 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 ASIA-PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: BY PRODUCT (2022-2029)

FIGURE 26 ASIA PACIFIC POLYALKYLENE GLYCOL (PAG) BASE OIL MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.