Asia Pacific Molded Fiber Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

10.88 Billion

USD

17.48 Billion

2025

2033

USD

10.88 Billion

USD

17.48 Billion

2025

2033

| 2026 –2033 | |

| USD 10.88 Billion | |

| USD 17.48 Billion | |

|

|

|

|

Marktsegmentierung für Formfaserverpackungen im asiatisch-pazifischen Raum nach Typ (Dickwandig, Transferformverfahren, Tiefziehfaser und Zellstoff), Rohstoff (Holzzellstoff und Nicht-Holzzellstoff), Produkt (Schalen, Klappverpackungen, Kartons, Endkappen und Sonstiges), Endverbraucher (Lebensmittel und Getränke, Elektronik, Körperpflege, Gesundheitswesen und Sonstiges) – Branchentrends und Prognose bis 2033

Marktgröße für Formfaserverpackungen im asiatisch-pazifischen Raum

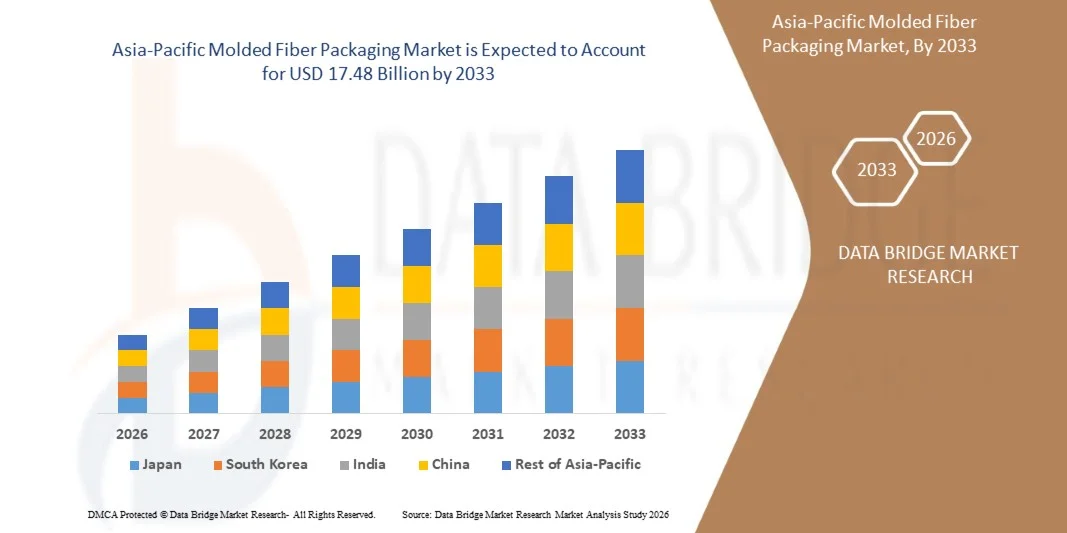

- Der Markt für Formfaserverpackungen im asiatisch-pazifischen Raum hatte im Jahr 2025 einen Wert von 10,88 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 17,48 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,10 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach nachhaltigen und umweltfreundlichen Verpackungslösungen in den Bereichen Lebensmittel und Getränke, Elektronik und Konsumgüter sowie durch die zunehmende regulatorische Unterstützung für biologisch abbaubare Materialien angetrieben.

- Darüber hinaus ermutigen Fortschritte bei den Formgebungstechnologien und die Einführung innovativer, leichter und langlebiger Verpackungsdesigns die Hersteller dazu, von traditionellen Kunststoffen auf Formfaserlösungen umzusteigen, was die Expansion des Marktes erheblich vorantreibt.

Marktanalyse für Formfaserverpackungen im asiatisch-pazifischen Raum

- Formfaserverpackungen, die nachhaltige und biologisch abbaubare Alternativen zu herkömmlichen Kunststoff- und Schaumstoffverpackungen bieten, gewinnen aufgrund ihrer umweltfreundlichen Eigenschaften, ihrer Kosteneffizienz und ihrer Anpassungsfähigkeit an verschiedene Produktformen und -größen in den Bereichen Lebensmittel und Getränke, Elektronik und Konsumgüter zunehmend an Bedeutung.

- Die steigende Nachfrage nach Formfaserverpackungen wird vor allem durch das wachsende Umweltbewusstsein der Verbraucher, strenge staatliche Vorschriften für Einwegkunststoffe und die zunehmende Präferenz für recycelbare und kompostierbare Verpackungslösungen angetrieben.

- China dominierte den asiatisch-pazifischen Markt für Formfaserverpackungen mit dem größten Umsatzanteil von 34 % im Jahr 2025. Charakteristisch hierfür waren die frühe Einführung nachhaltiger Verpackungspraktiken, eine starke regulatorische Unterstützung und die hohe Präsenz wichtiger Branchenakteure. In den USA war ein signifikantes Wachstum beim Einsatz von Formfaser in der Lebensmittel- und Elektronikverpackung zu verzeichnen, angetrieben durch Innovationen sowohl etablierter Hersteller als auch von Startups, die sich auf leichte und langlebige Designs konzentrieren.

- Indien dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für geformte Faserverpackungen im asiatisch-pazifischen Raum sein, bedingt durch die zunehmende Industrialisierung, steigende verfügbare Einkommen und die wachsende Nachfrage aus den Bereichen Lebensmittel und Getränke sowie E-Commerce.

- Das Segment der verarbeiteten Zellstoffe dominierte den Markt mit dem größten Umsatzanteil von 42,5 % im Jahr 2025, was auf seine Vielseitigkeit, Kosteneffizienz und breite Anwendung in der Lebensmittel- und Getränkeindustrie sowie bei Verpackungen für Unterhaltungselektronik zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Formfaserverpackungen im asiatisch-pazifischen Raum

|

Attribute |

Wichtigste Markteinblicke in Formfaserverpackungen im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem asiatisch-pazifischen Markt für Formfaserverpackungen

„Innovation durch nachhaltige und intelligente Verpackungslösungen“

- Ein bedeutender und sich beschleunigender Trend im asiatisch-pazifischen Markt für Formfaserverpackungen ist die zunehmende Nutzung innovativer, nachhaltiger und intelligenter Verpackungslösungen, die den Produktschutz, die Haltbarkeit und die Umweltverträglichkeit verbessern. Dazu gehört die Entwicklung von Formfaserverpackungen mit erhöhter Haltbarkeit, geringem Gewicht und Kompatibilität mit automatisierten Verpackungslinien.

- Die Formfaserschalen von Huhtamaki beispielsweise eignen sich sowohl für Lebensmittel- als auch für Elektronikverpackungen und bieten robusten Schutz bei gleichzeitig vollständiger Recycling- und Kompostierbarkeit. Ebenso stellen die Formfaser-Getränketräger von Greenpac leichte, langlebige und umweltfreundliche Alternativen zu herkömmlichen Kunststoffen dar.

- Zu den Innovationen bei Formfaserverpackungen zählen auch die Integration feuchtigkeitsbeständiger Beschichtungen, kundenspezifische Formen für empfindliche Produkte sowie Materialien, die für automatisierte Abfüll- und Handhabungssysteme optimiert sind. Diese Entwicklungen reduzieren Produktschäden beim Transport, minimieren Abfall und verbessern die Effizienz der gesamten Lieferkette.

- Die nahtlose Integration von Formfaserverpackungen in E-Commerce- und Einzelhandelsabläufe ermöglicht Herstellern und Händlern die Bereitstellung nachhaltiger Verpackungslösungen bei gleichzeitig hohem Komfort und Kosteneffizienz. Durch optimierte Designs können Unternehmen den Materialverbrauch reduzieren, die Stapelbarkeit verbessern und das Auspackerlebnis für den Kunden optimieren.

- Dieser Trend hin zu funktionaleren, umweltfreundlicheren und technologisch optimierten Verpackungen verändert grundlegend die Erwartungen an eine nachhaltige Produktlieferung. Unternehmen wie Huhtamaki, WestRock und Oji Holdings entwickeln daher Formfaserlösungen, die Langlebigkeit, geringes Gewicht und Recyclingfähigkeit vereinen, um den sich wandelnden Anforderungen der Branche gerecht zu werden.

- Die Nachfrage nach innovativen Verpackungslösungen aus Formfaser wächst rasant sowohl im Industrie- als auch im Konsumgüterbereich, da Unternehmen und Verbraucher zunehmend Wert auf Nachhaltigkeit, Produktschutz und Effizienz der Lieferkette legen.

Marktdynamik für Formfaserverpackungen im asiatisch-pazifischen Raum

Treiber

„Wachsender Bedarf aufgrund von Umweltauflagen und zunehmendem Nachhaltigkeitsbewusstsein“

- Der zunehmende Fokus auf Umweltschutz, verbunden mit steigenden staatlichen Vorschriften für Einwegkunststoffe, ist ein wesentlicher Faktor für die erhöhte Nachfrage nach Formfaserverpackungen.

- So kündigte Huhtamaki beispielsweise im Jahr 2025 neue Investitionen in nachhaltige Formfaserverpackungslinien für Lebensmittel und Getränke an, mit dem Ziel, herkömmliche Kunststoffverpackungen durch vollständig recycelbare und kompostierbare Alternativen zu ersetzen. Solche Initiativen führender Unternehmen dürften das Marktwachstum im Prognosezeitraum ankurbeln.

- Da Verbraucher und Unternehmen zunehmend umweltbewusster werden, bieten Formfaserverpackungen biologisch abbaubare, umweltfreundliche und leichte Alternativen, die Plastikmüll und den CO2-Fußabdruck reduzieren und somit ein überzeugendes Upgrade gegenüber herkömmlichen Verpackungsmaterialien darstellen.

- Darüber hinaus führen die wachsende Beliebtheit des E-Commerce und die Nachfrage nach sicheren, langlebigen und nachhaltigen Verpackungslösungen dazu, dass Formfaserprodukte zu einem integralen Bestandteil moderner Lieferketten werden. Sie ermöglichen eine reibungslose Handhabung und einen reibungslosen Transport von Waren bei gleichzeitiger Reduzierung der Umweltbelastung.

- Die einfache Handhabung vorgeformter Schalen, Schutzeinsätze und Getränketräger sowie die Kompatibilität mit automatisierten Verpackungssystemen sind Schlüsselfaktoren für die zunehmende Verbreitung von Formfaserverpackungen in der Lebensmittel- und Getränkeindustrie, der Unterhaltungselektronik und anderen Industriezweigen. Der Trend zu innovativen, umweltfreundlichen Designs und die steigende Verfügbarkeit kostengünstiger Lösungen tragen zusätzlich zum Marktwachstum bei.

Zurückhaltung/Herausforderung

„Bedenken hinsichtlich der Kostenwettbewerbsfähigkeit und der Materialbeschränkungen“

- Bedenken hinsichtlich der höheren Anfangskosten von Formfaserverpackungen im Vergleich zu herkömmlichen Kunststoff- oder Schaumstoffalternativen stellen eine erhebliche Herausforderung für eine breitere Marktdurchdringung dar, insbesondere in preissensiblen Regionen.

- Kleinere Verpackungshersteller zögern beispielsweise aufgrund der Gerätekosten oder der höheren Materialkosten pro Einheit, in Formfaserlösungen zu investieren, was die Einführung trotz regulatorischer Anreize verlangsamt.

- Die Bewältigung dieser Kostenbedenken durch skalierbare Produktionstechnologien, Materialoptimierung und staatliche Subventionen ist entscheidend für eine breite Akzeptanz. Unternehmen wie WestRock und Oji Holdings setzen auf kosteneffiziente Produktionsprozesse für große Stückzahlen, um Formfaserverpackungen wettbewerbsfähig gegenüber traditionellen Materialien zu machen. Darüber hinaus können bestimmte Materialbeschränkungen, wie beispielsweise eine geringere Wasserbeständigkeit oder eine reduzierte Festigkeit für bestimmte Anwendungen, Hindernisse für den Ersatz von Kunststoffen in einigen Branchen darstellen.

- Fortschritte wie Beschichtungstechnologien und Hybridkonstruktionen überwinden diese Einschränkungen zwar nach und nach, doch wahrgenommene Leistungslücken können die Akzeptanz weiterhin behindern, insbesondere bei Anwendungen, die eine langfristige Haltbarkeit oder Feuchtigkeitsbeständigkeit erfordern.

- Die Bewältigung dieser Herausforderungen durch Innovationen bei der Faserbehandlung, Aufklärung der Verbraucher über die Vorteile der Nachhaltigkeit und die Entwicklung erschwinglicher, leistungsstarker Formfaseroptionen wird für ein nachhaltiges Marktwachstum von entscheidender Bedeutung sein.

Umfang des Marktes für Formfaserverpackungen im asiatisch-pazifischen Raum

Der Markt für Formfaserverpackungen ist nach Art, Herkunft, Produkt und Endverbraucher segmentiert.

• Nach Typ

Basierend auf der Verpackungsart ist der Markt für Formfaserverpackungen im asiatisch-pazifischen Raum in dickwandige, transfergeformte, tiefgezogene Faser- und Zellstoffverpackungen unterteilt. Das Segment der Zellstoffverpackungen dominierte den Markt mit einem Umsatzanteil von 42,5 % im Jahr 2025. Dies ist auf die Vielseitigkeit, Kosteneffizienz und die breite Anwendung in der Lebensmittel- und Getränkeindustrie sowie bei Verpackungen für Unterhaltungselektronik zurückzuführen. Zellstoffverpackungen bieten hervorragende Polsterung, Stoßdämpfung und individuelle Formgebungsmöglichkeiten und eignen sich daher ideal zum Schutz empfindlicher Produkte während Lagerung und Transport.

Dickwandige Formfaser wird aufgrund ihrer hohen Festigkeit und Langlebigkeit voraussichtlich von 20,8 % im Zeitraum von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen. Ihre Verwendung nimmt in industriellen Anwendungen und bei Schwerlastverpackungen zu, wo eine hohe strukturelle Integrität unerlässlich ist. Hersteller investieren in dickwandige Lösungen für Trays, Kisten und Verpackungen schwerer Produkte, um der steigenden Nachfrage nach nachhaltigen Alternativen zu Kunststoffen gerecht zu werden.

• Nach Quelle

Basierend auf der Rohstoffquelle ist der Markt für Formfaserverpackungen im asiatisch-pazifischen Raum in Holzzellstoff und Nicht-Holzzellstoff unterteilt. Das Segment Holzzellstoff erzielte 2025 mit 55,3 % den größten Marktanteil, was auf die reichliche Verfügbarkeit, die hohe Faserfestigkeit und die etablierten Verarbeitungstechnologien zurückzuführen ist. Holzzellstoff liefert hochwertige, langlebige Formfaserprodukte, die sich für Lebensmittelverpackungen, Getränkebehälter und den Schutz elektronischer Geräte eignen.

Für Zellstoff aus Nicht-Holz-Rohstoffen wird jedoch von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 19,7 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind die ökologischen Vorteile und der zunehmende Trend zu Verpackungen auf Basis von Agrarabfällen. Hersteller erforschen verstärkt alternative Zellstoffquellen wie Bagasse, Weizenstroh und Bambus, um die Abhängigkeit von Holz zu verringern, den CO₂-Fußabdruck zu reduzieren und die steigende Nachfrage nach nachhaltigen und biologisch abbaubaren Verpackungslösungen in Schwellenländern zu decken.

• Nebenprodukt

Basierend auf den Produkten ist der Markt für Formfaserverpackungen im asiatisch-pazifischen Raum in Schalen, Klappverpackungen, Kartons, Endkappen und Sonstiges unterteilt. Das Segment der Schalen dominierte den Markt mit einem Umsatzanteil von 38,6 % im Jahr 2025, vor allem aufgrund seiner weitverbreiteten Verwendung im Lebensmittel- und Getränkesektor für Eier, Obst und Fertiggerichte. Schalen bieten leichte, schützende und stapelbare Lösungen, die sich sowohl für den Einzelhandel als auch für die industrielle Distribution eignen.

Für Klappverpackungen wird von 2026 bis 2033 ein rasantes Wachstum von 21,2 % erwartet. Treiber dieser Entwicklung sind der Boom im E-Commerce, die Zunahme von Take-away-Verpackungen und der Trend zum Konsum unterwegs. Ihre einfache Handhabung, die Fähigkeit, Frische zu bewahren, und die Kompatibilität mit Recyclingprozessen machen Klappverpackungen bei umweltbewussten Verbrauchern und Unternehmen gleichermaßen immer beliebter.

• Vom Endbenutzer

Basierend auf den Endverbrauchern ist der Markt für Formfaserverpackungen im asiatisch-pazifischen Raum in die Segmente Lebensmittel & Getränke, Elektronik, Körperpflege, Gesundheitswesen und Sonstige unterteilt. Das Segment Lebensmittel & Getränke erzielte 2025 mit 46,8 % den größten Marktanteil, getrieben durch die steigende Nachfrage nach nachhaltigen Verpackungen für verarbeitete Lebensmittel, Getränke, Obst und Backwaren. Formfaserverpackungen bieten Schutz, sind leicht und umweltfreundlich und entsprechen den Verbraucherwünschen nach biologisch abbaubaren und recycelbaren Lösungen.

Für den Elektroniksektor wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist der steigende Bedarf an sicheren, stoßdämpfenden und leichten Verpackungen für den Transport von Smartphones, Tablets, Laptops und anderen empfindlichen Geräten. Zunehmende Online-Verkäufe und strenge Anforderungen an die E-Commerce-Lieferung beschleunigen die Verbreitung von Formfaser in der Elektronikverpackung zusätzlich.

Regionale Analyse des Marktes für Formfaserverpackungen im asiatisch-pazifischen Raum

- China dominierte den Markt für Formfaserverpackungen im asiatisch-pazifischen Raum mit dem größten Umsatzanteil von 34 % im Jahr 2025, angetrieben durch die wachsende Nachfrage nach nachhaltigen und umweltfreundlichen Verpackungslösungen in den Bereichen Lebensmittel und Getränke, Konsumgüter und Elektronik.

- Unternehmen und Verbraucher in der Region legen zunehmend Wert auf biologisch abbaubare, recycelbare und kompostierbare Verpackungen, um die Umweltbelastung zu reduzieren, gesetzliche Vorgaben zu erfüllen und den sich wandelnden Nachhaltigkeitserwartungen gerecht zu werden.

- Diese breite Akzeptanz wird zusätzlich unterstützt durch fortschrittliche Fertigungskapazitäten, starke regulatorische Rahmenbedingungen, die umweltfreundliche Materialien fördern, und ein hohes Bewusstsein für Umweltfragen. Dadurch etablieren sich Formfaserverpackungen als bevorzugte Alternative zu herkömmlichen Kunststoffen sowohl für industrielle als auch für Einzelhandelsanwendungen.

Einblick in den chinesischen Markt für Formfaserverpackungen

Der chinesische Markt für Formfaserverpackungen wird 2025 den größten Umsatzanteil im asiatisch-pazifischen Raum erzielen. Treiber dieser Entwicklung sind die rasante Urbanisierung, die wachsende Mittelschicht und das steigende Umweltbewusstsein. Chinas starker Lebensmittel- und Getränkesektor sowie der E-Commerce-Sektor treiben die Nachfrage nach nachhaltigen Verpackungslösungen an, während staatliche Regulierungen zur Reduzierung von Einwegplastik das Marktwachstum zusätzlich fördern. Chinesische Hersteller investieren in fortschrittliche Formtechnologien und ermöglichen so die Herstellung kostengünstiger und qualitativ hochwertiger Formfaserverpackungen, die herkömmliche Kunststoffe zunehmend im gewerblichen und privaten Bereich ersetzen.

Einblick in den japanischen Markt für Formfaserverpackungen

Der japanische Markt für Formfaserverpackungen gewinnt aufgrund des nationalen Fokus auf Nachhaltigkeit, technologische Innovation und hohe Fertigungsstandards zunehmend an Bedeutung. Die Lebensmittel-, Elektronik- und Gesundheitsbranche treiben die Einführung von Formfaserlösungen voran, insbesondere für die Verpackung empfindlicher oder verderblicher Produkte. Japans etablierte Recyclinginfrastruktur und die Präferenz der Verbraucher für umweltfreundliche Produkte sind neben staatlichen Initiativen zur Förderung umweltverträglicher Verpackungspraktiken Schlüsselfaktoren für den Einsatz von Formfaser.

Einblick in den indischen Markt für Formfaserverpackungen

Der indische Markt für Formfaserverpackungen dürfte im asiatisch-pazifischen Raum das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die rasante Urbanisierung, steigende verfügbare Einkommen und ein wachsendes Bewusstsein für ökologische Nachhaltigkeit. Das Wachstum des E-Commerce sowie der Lebensmittel- und Getränkeindustrie treibt die Nachfrage nach Formfaserverpackungen deutlich an. Darüber hinaus tragen staatliche Förderprogramme für biologisch abbaubare und kompostierbare Materialien sowie Investitionen in lokale Produktionsstätten dazu bei, dass Formfaserverpackungen landesweit zugänglicher und erschwinglicher werden.

Einblick in den südkoreanischen Markt für Formfaserverpackungen

Der südkoreanische Markt für Formfaserverpackungen wächst stetig, angetrieben durch die steigende Nachfrage aus der Lebensmittel-, Getränke-, Elektronik- und Kosmetikindustrie. Das hohe Nachhaltigkeitsbewusstsein der Verbraucher und die regulatorische Förderung umweltfreundlicher Verpackungen ermutigen Unternehmen, Formfaserlösungen einzusetzen. Südkoreas fortschrittliche Fertigungskapazitäten und Innovationsorientierung ermöglichen die Herstellung langlebiger, leichter und recycelbarer Formfaserprodukte und machen diese daher bei Unternehmen, die nachhaltige Alternativen zu herkömmlichen Kunststoffen suchen, immer beliebter.

Marktanteil von Formfaserverpackungen im asiatisch-pazifischen Raum

Die Branche der Formfaserverpackungen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Huhtamaki (Finnland)

- WestRock (USA)

- Oji Holdings Corporation (Japan)

- Evergreen Packaging (USA)

- Greenpac (China)

- Stora Enso (Finnland)

- International Paper (USA)

- DS Smith (GB)

- Smurfit Kappa (Irland)

- Berry Global (USA)

- Nippon Paper Industries (Japan)

- Rengo Co., Ltd. (Japan)

- Mondi Group (Österreich)

- Sonoco-Produkte (USA)

- Graphic Packaging International (USA)

- Winpak Ltd. (Kanada)

- Huhtamaki PPL (Indien)

- Ball Corporation (USA)

- Oji Fiber Solutions (Japan)

- Huhtamaki India Pvt. Ltd. (Indien)

Welche aktuellen Entwicklungen gibt es auf dem Markt für Formfaserverpackungen im asiatisch-pazifischen Raum?

- Im April 2024 startete Huhtamaki, ein weltweit führender Anbieter nachhaltiger Verpackungslösungen, eine strategische Initiative in China mit dem Ziel, die Produktion von Formfaserverpackungen für Lebensmittel und Getränke auszubauen. Diese Initiative unterstreicht das Engagement des Unternehmens für umweltfreundliche und hochwertige Verpackungen, die den wachsenden Umwelt- und Regulierungsanforderungen des chinesischen Marktes gerecht werden. Durch die Nutzung seiner globalen Expertise und fortschrittlichen Fertigungstechnologien stärkt Huhtamaki seine Position im schnell wachsenden Markt für Formfaserverpackungen im asiatisch-pazifischen Raum.

- Im März 2024 stellte die WestRock Corporation eine neue Produktlinie thermogeformter Fasertrays speziell für die Elektronikindustrie in Indien vor. Die innovativen Verpackungslösungen bieten optimalen Schutz für empfindliche Bauteile und reduzieren gleichzeitig den Kunststoffverbrauch. Dies unterstreicht WestRocks Engagement für nachhaltige und funktionale Verpackungen, die den sich wandelnden Bedürfnissen industrieller Kunden gerecht werden.

- Im März 2024 nahm die Oji Holdings Corporation in Japan erfolgreich eine erweiterte Produktionsanlage für Formfaserverpackungen in Betrieb. Ziel ist es, den wachsenden Lebensmittel- und Körperpflegemarkt mit biologisch abbaubaren Schalen, Klappverpackungen und Behältern zu beliefern. Dieses Projekt unterstreicht den Fokus des Unternehmens auf nachhaltige Materialien und fortschrittliche Produktionstechniken zur Förderung umweltverträglicher Lieferketten.

- Im Februar 2024 gab Greenpac, ein führender Anbieter von Formfaserverpackungen, eine strategische Partnerschaft mit der südkoreanischen E-Commerce-Branche bekannt. Ziel der Partnerschaft ist die Lieferung leichter, recycelbarer Klappverpackungen und Trays für den Online-Lebensmittelversand und den Einzelhandel. Die Zusammenarbeit soll die Nachhaltigkeit und die betriebliche Effizienz steigern und Greenpacs Engagement für Innovation und umweltfreundliche Verpackungspraktiken unterstreichen.

- Im Januar 2024 stellte Evergreen Packaging auf der Asia-Pacific Packaging Expo 2024 eine neue Produktlinie von Getränketrägern aus verarbeitetem Zellstoff vor. Die Träger zeichnen sich durch verbesserte Haltbarkeit und Stapelbarkeit aus und unterstreichen das Engagement des Unternehmens für die Herstellung hochwertiger, nachhaltiger Verpackungslösungen aus Formfaser. Sie bieten Unternehmen eine umweltfreundliche Alternative zu herkömmlichen Kunststoffen und gewährleisten gleichzeitig Komfort und Produktschutz.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.