Asia Pacific Mobility As A Service Market

Marktgröße in Milliarden USD

CAGR :

%

USD

109.08 Billion

USD

1,113.81 Billion

2025

2033

USD

109.08 Billion

USD

1,113.81 Billion

2025

2033

| 2026 –2033 | |

| USD 109.08 Billion | |

| USD 1,113.81 Billion | |

|

|

|

|

Mobilität als Dienstleistungsmarkt im asiatisch-pazifischen Raum, nach Dienstleistungstyp (Carsharing, Bussharing, Bahn, Mitfahrdienste, Fahrradsharing, selbstfahrende Autos und andere), Lösung (Navigationslösungen, Ticketlösungen, Technologieplattformen, Versicherungsdienste, Anbieter von Telekommunikationsverbindungen und Zahlungsmaschinen), Transporttyp (öffentlich und privat), Fahrzeugtyp (Vierräder, Bus, Bahn und Mikromobilität), Anwendungsplattform (iOS, Android und andere), Anforderungstyp (Konnektivität der ersten und letzten Meile, Pendeln außerhalb der Hauptverkehrszeiten und im Schichtdienst, tägliche Pendlerfahrten, Fahrten zu Flughäfen oder öffentlichen Verkehrsmitteln, Fahrten zwischen Städten und andere), Organisationsgröße (Großunternehmen und kleine und mittlere Unternehmen (KMU)), Nutzung (kommerziell und persönlich), Land (China, Indien, Südkorea, Australien, Japan, Singapur, Malaysia, Thailand, Indonesien, Philippinen und Rest des asiatisch-pazifischen Raums) Branchentrends und Prognose bis 2028

Marktanalyse und Einblicke: Mobility-as-a-Service-Markt im asiatisch-pazifischen Raum

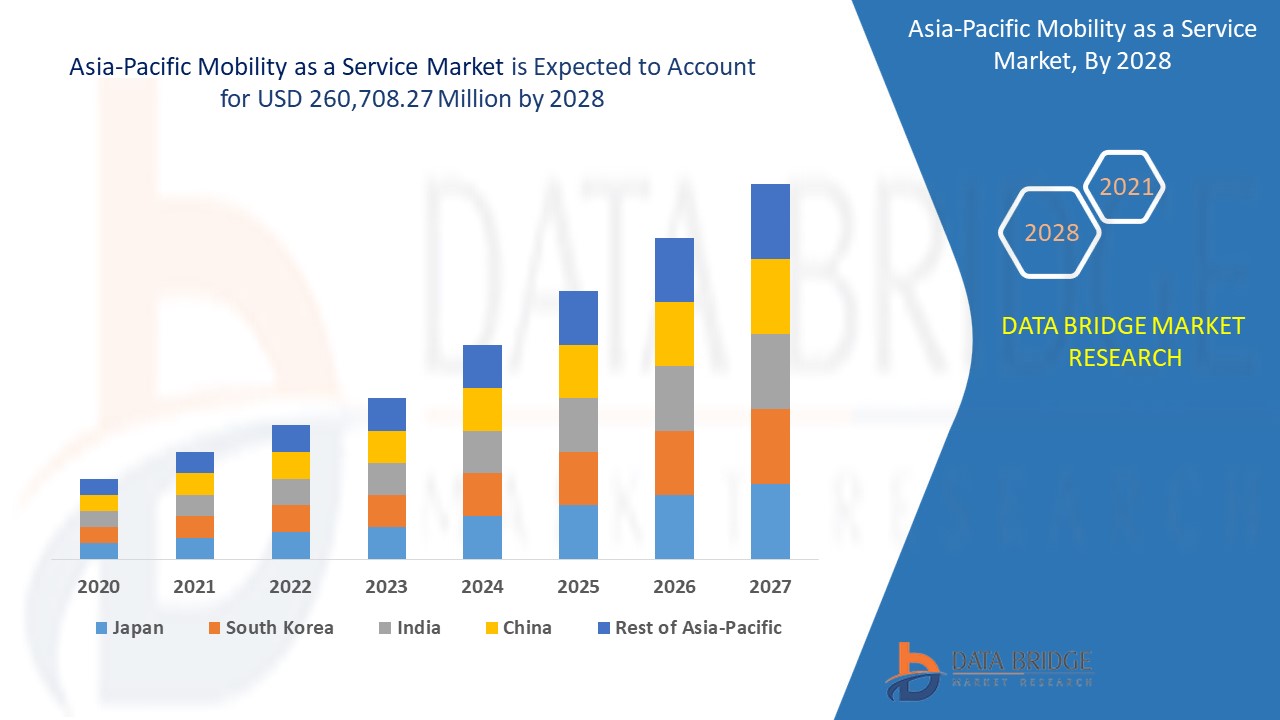

Der Markt für Mobilität als Dienstleistung im asiatisch-pazifischen Raum wird im Prognosezeitraum 2021 bis 2028 voraussichtlich an Marktwachstum gewinnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2021 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate von 33,7 % wächst und bis 2028 voraussichtlich 260.708,27 Millionen USD erreichen wird. Das Wachstum des Marktes wird durch die zunehmende Bevölkerung und Urbanisierung mit der Notwendigkeit einer Reduzierung von CO2-Emissionen und Verkehrsstaus vorangetrieben.

Mobility as a Service ist ein verbraucherorientiertes Modell zur Bereitstellung von Transportmöglichkeiten für Menschen. Mobility as a Service wird auch als MaaS bezeichnet und manchmal auch als Transportation as a Service (TaaS). Mobility as a Service ist die Integration von Transportmethoden wie Car- und Bike-Sharing, Taxis und Autovermietungen/-leasing über digitale Kanäle, die es Verbrauchern ermöglicht, verschiedene Arten von Mobilitätsdiensten zu planen, zu buchen und zu bezahlen. Das Hauptkonzept der Entwicklung von MaaS besteht darin, Reisenden Mobilitätslösungen basierend auf ihren Reisebedürfnissen anzubieten.

Die zunehmende Urbanisierung und Smart-City-Initiativen treiben das Wachstum des Marktes für Mobilität als Dienstleistung voran, wobei die Nachfrage nach fortschrittlichen Produkten mit verbesserter Konnektivität und Leistung steigt. Die Marktteilnehmer müssen die regulatorischen Standards jedes Landes erfüllen, in dem sie ihre Produkte verkaufen, was das Wachstum des Marktes für Mobilität als Dienstleistung begrenzt. Das Wachstum von Elektrofahrzeugen für komfortablen und sauberen Transport zu geringeren Kosten schafft Chancen für den Markt für Mobilität als Dienstleistung. Das geringe Bewusstsein für die Lebenszykluskosten von Privatfahrzeugen und Servicebesitz wird eine große Herausforderung für den Markt für Mobilität als Dienstleistung darstellen.

Dieser Marktbericht zu Mobility as a Service enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzlösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Mobility as a Service – Marktumfang und Marktgröße

Der Markt für Mobilität als Dienstleistung ist segmentiert nach Servicetyp, Lösung, Transporttyp, Fahrzeugtyp, Anwendungsplattform, Anforderungstyp, Organisationsgröße und Nutzung. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage der Serviceart ist der Markt für Mobilität als Dienstleistung in Carsharing, Bussharing, Bahn, Mitfahrdienste, Fahrradsharing, selbstfahrende Autos und andere unterteilt. Im Jahr 2021 hatte das Segment Mitfahrdienste einen größeren Anteil am Markt für Mobilität als Dienstleistung aufgrund der wachsenden Buchungsoptionen und des Komforts, die die Nachfrage nach Bahndiensten erhöht haben.

- Auf der Grundlage der Lösung ist der Markt für Mobilität als Dienstleistung in Navigationslösungen, Ticketlösungen, Technologieplattformen, Versicherungsdienste, Anbieter von Telekommunikationsverbindungen und Zahlungsmaschinen unterteilt. Im Jahr 2021 hat die Kategorie der Navigationslösungen den größten Marktanteil, da die Sicherheit der Passagiere immer wichtiger wird und das wachsende Bestreben, die Reisezeit zu minimieren, die Nachfrage nach Navigationslösungen erhöht hat.

- Auf der Grundlage der Transportart wird der Markt für Mobilität als Dienstleistung in öffentlich und privat segmentiert. Im Jahr 2021 hat die öffentliche Kategorie aufgrund des steigenden Autoverkehrs, der die Nachfrage nach Mobilitätsdiensten erhöht hat, den größten Marktanteil.

- Auf der Grundlage des Fahrzeugtyps ist der Markt für Mobilität als Dienstleistung in Vierräder, Bus, Bahn und Mikromobilität segmentiert. Im Jahr 2021 hatte das Segment der Vierräder den größten Marktanteil, was hauptsächlich auf steigende Investitionen in die Verkehrsinfrastruktur zurückzuführen ist, die die Nachfrage nach Mobilitätsdiensten angekurbelt haben.

- Auf der Grundlage der Anwendungsplattform ist der Markt für Mobilität als Dienstleistung in iOS, Android und andere segmentiert. Im Jahr 2021 hat die Android-Kategorie aufgrund der steigenden Internetdurchdringung und der zunehmenden Nutzung von Mobiltelefonen in den Entwicklungsländern den größten Marktanteil, was zu einer steigenden Nachfrage nach Mobilitätsdiensten für die Android-Anwendung geführt hat.

- Auf der Grundlage der Art der Anforderungen ist der Markt für Mobilität als Dienstleistung segmentiert in Konnektivität der ersten und letzten Meile, Pendeln außerhalb der Hauptverkehrszeiten und im Schichtdienst, tägliches Pendeln, Fahrten zum Flughafen oder zu öffentlichen Verkehrsmitteln, Fahrten zwischen Städten und andere. Im Jahr 2021 hatte die Kategorie der Fahrten zwischen Städten aufgrund des steigenden Autoverkehrs, der die Nachfrage nach Mobilitätsdiensten erhöht hat, einen größeren Marktanteil.

- Auf der Grundlage der Unternehmensgröße ist der Markt für Mobilität als Dienstleistung in Großunternehmen sowie kleine und mittlere Unternehmen (KMU) segmentiert. Im Jahr 2021 hatte das Segment der Großunternehmen einen größeren Marktanteil aufgrund der wachsenden Investitionen der verschiedenen Technologiegiganten in die Bereiche Carsharing und Transportinfrastruktur, die in der Transportbranche präsent sind.

- Auf der Grundlage der Nutzung wird der Markt für Mobilität als Dienstleistung in gewerbliche und private unterteilt. Im Jahr 2021 hatte die gewerbliche Kategorie aufgrund des wachsenden Bedarfs an sicheren, effektiven und kostengünstigen Transportmöglichkeiten für Waren und Materialien einen größeren Marktanteil.

Mobility-as-Service-Markt – Länderebene-Analyse

Der Markt für Mobilität als Dienstleistung wird analysiert und Informationen zur Marktgröße werden nach Land, Dienstleistungstyp, Lösung, Transporttyp, Fahrzeugtyp, Anwendungsplattform, Anforderungstyp, Organisationsgröße und Nutzung wie oben angegeben bereitgestellt.

Die im globalen Marktbericht „Mobility as a Service“ abgedeckten Länder sind China, Indien, Japan, Südkorea, Australien, Singapur, Thailand, Indonesien, Malaysia, die Philippinen und der restliche asiatisch-pazifische Raum.

China dominiert den Markt für Mobilität als Dienstleistung im asiatisch-pazifischen Raum und wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate aufweisen, gefolgt von Japan und Indien aufgrund des Bevölkerungswachstums und der Urbanisierung in den Entwicklungsländern, die zum Wachstum des MaaS-Marktes in diesen Ländern beitragen. Auch die zunehmende Reduzierung von Fahrzeugabgasen und Verkehrsstaus in der gesamten Region stärkt den Markt für Mobilität als Dienstleistung im asiatisch-pazifischen Raum.

Der Länderabschnitt des Mobility-as-a-Service-Marktberichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit von Marken aus dem asiatisch-pazifischen Raum und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wachsende Zahl von Original Equipment Manufacturers (OEMs)

Der Mobility-as-a-Service-Markt bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das Wachstum der installierten Basis verschiedener Arten von Produkten für den Mobility-as-a-Service-Markt, die Auswirkungen der Technologie anhand von Lebenslinienkurven und Änderungen der Regulierungsszenarien und deren Auswirkungen auf den Mobility-as-a-Service-Markt. Die Daten sind für den historischen Zeitraum von 2010 bis 2018 verfügbar.

Wettbewerbsumfeld und Mobility-as-a-Service-Marktanteilsanalyse

Die Wettbewerbslandschaft des Mobility-as-a-Service-Marktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im asiatisch-pazifischen Raum, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Mobility-as-a-Service-Markt im asiatisch-pazifischen Raum.

Die wichtigsten Akteure, die im Bericht zum Mobility-as-a-Service-Markt behandelt werden, sind unter anderem Moovit Inc. (eine Tochtergesellschaft der Intel Corporation), UbiGo Innovation AB, MaaS Global Oy, SkedGo Pty Ltd, Beijing Xiaoju Technology Co, Ltd., Uber Technologies, Inc., EasyMile, Ridecell, Inc., Bolt Technology OÜ, Citymapper Limited, Cubic Corporation, innovation in traffic systems SE, BRIDJ Pty Ltd, ANI Technologies Pvt. Ltd., Splyt Technologies Ltd. und BlaBlaCar. Die Analysten von DBMR kennen die Stärken der Konkurrenz und erstellen für jeden einzelnen Wettbewerber eine Wettbewerbsanalyse.

Zum Beispiel,

- Im November 2020 brachte Beijing Xiaoju Technology Co., Ltd. das erste speziell für Mitfahrdienste gebaute Elektrofahrzeug mit dem Namen D1 auf den Markt. Dieses D1 wurde für chinesische Großstädte entwickelt. D1 ist die Weiterentwicklung der Technologie für autonomes Fahren und künstliche Intelligenz. Mit dieser Produkteinführung ist das Unternehmen in der Lage, durch gemeinsame Mobilität ein besseres Reiseerlebnis zu bieten.

- Im November 2020 brachte Uber Technologies, Inc. E-Rikschas für die Konnektivität auf der ersten und letzten Meile auf den Markt. Diese E-Rikschas werden an 26 Stationen der blauen Linie der Delhi Metro in Indien verfügbar sein. Dieses Produkt bietet den Fahrgästen Mobilitätslösungen für eine bessere Konnektivität. Dadurch kann das Unternehmen sein Produktportfolio auf dem Markt erweitern.

Produkteinführungen, Akquisitionen und andere Strategien steigern den Marktanteil des Unternehmens durch größere Reichweite und Präsenz. Darüber hinaus bietet es den Unternehmen den Vorteil, ihr Angebot für Mobilität als Dienstleistung durch das Produktportfolio der Unternehmen zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.