Asia Pacific Hydrochloric Acid Market

Marktgröße in Milliarden USD

CAGR :

%

USD

714.72 Million

USD

1,122.07 Million

2025

2033

USD

714.72 Million

USD

1,122.07 Million

2025

2033

| 2026 –2033 | |

| USD 714.72 Million | |

| USD 1,122.07 Million | |

|

|

|

|

Marktsegmentierung für Salzsäure im asiatisch-pazifischen Raum nach Typ (synthetische Salzsäure und Nebenprodukt-Salzsäure), Form (wasserbasiert, wässrig und Lösung), Anwendung (Stahlbeizen, Säurebehandlung von Ölquellen, Erzverarbeitung, Lebensmittelverarbeitung, Poolreinigung, Calciumchlorid und Sonstiges), Vertriebskanal (E-Commerce, B2B, Fachgeschäfte und Sonstiges) und Endverbraucher (Lebensmittel und Getränke, Pharmazeutika, Textilien, Öl und Gas, Stahlindustrie, Chemieindustrie und Sonstiges) – Branchentrends und Prognose bis 2033

Marktgröße für Salzsäure im asiatisch-pazifischen Raum

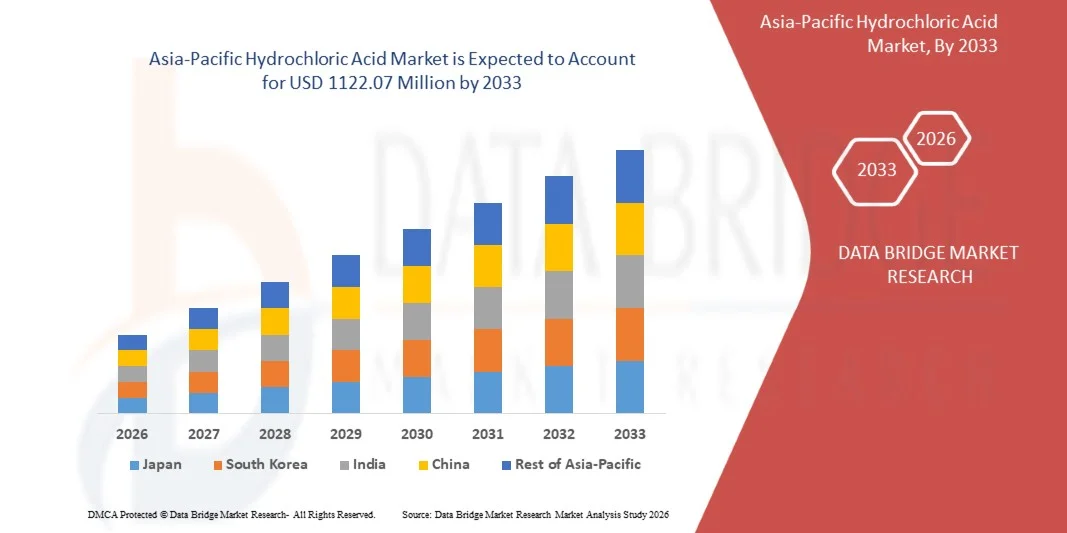

- Der Markt für Salzsäure im asiatisch-pazifischen Raum hatte im Jahr 2025 einen Wert von 714,72 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 1122,07 Millionen US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,8 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch den zunehmenden Einsatz von Salzsäure in wichtigen industriellen Prozessen wie dem Beizen von Stahl, der Säurebehandlung von Ölquellen, der Lebensmittelverarbeitung und der chemischen Synthese angetrieben. Dies ist auf die steigende Produktionsleistung und die wachsende Nachfrage aus der Schwerindustrie zurückzuführen. Der zunehmende Bedarf an hochreiner Salzsäure in der Pharma- und Elektronikindustrie steigert die Produktionsmengen zusätzlich und verbessert die Verbrauchsaussichten.

- Darüber hinaus verbessert die zunehmende Nutzung von Salzsäure als Nebenprodukt aus Chloralkali-Anlagen und nachhaltigkeitsorientierten Rückgewinnungssystemen die Versorgungssicherheit für Endverbraucherbranchen. Diese zusammenwirkenden Faktoren beschleunigen die industrielle Nutzung von HCl und fördern ein stabiles Nachfragewachstum in etablierten und neuen Anwendungsbereichen.

Analyse des Salzsäuremarktes im asiatisch-pazifischen Raum

- Salzsäure, eine wichtige anorganische Chemikalie für die Metallbehandlung, pH-Wert-Regulierung, chemische Prozesse und Rohstoffrückgewinnung, ist nach wie vor ein grundlegender Rohstoff für Branchen wie Stahl, Öl und Gas, Lebensmittelverarbeitung und Pharmazie. Ihre Vielseitigkeit und ihre zentrale Rolle in großtechnischen Prozessen unterstreichen weiterhin ihre Bedeutung für die globale Fertigung und Wertschöpfungskette.

- Die steigende Nachfrage nach Salzsäure wird primär durch den Ausbau der Infrastruktur, die zunehmende Erdölförderung mit dem damit verbundenen Säurebedarf sowie den steigenden Konsum von verarbeiteten Lebensmitteln und Spezialchemikalien angetrieben. Diese Markttreiber verstärken die langfristigen Nutzungstrends und tragen zu einem stetigen Wachstum sowohl der synthetischen als auch der als Nebenprodukt gewonnenen Salzsäureproduktion bei.

- Japan dominierte den asiatisch-pazifischen Markt für Salzsäure im Jahr 2025 aufgrund seiner starken chemischen Produktionsbasis, seiner fortschrittlichen industriellen Infrastruktur und seines hohen Verbrauchs in der Elektronik-, Automobil- und Spezialchemieindustrie.

- Indien dürfte im Prognosezeitraum aufgrund der expandierenden Stahlproduktion, des rasanten Infrastrukturausbaus und der steigenden Nachfrage in der Pharma-, Textil- und Lebensmittelindustrie das am schnellsten wachsende Land im asiatisch-pazifischen Markt für Salzsäure sein. Auch die zunehmende Verwendung von Salzsäure für die Rohölaufbereitung und Raffinationsprozesse trägt zu diesem starken Wachstum bei.

- Synthetische Salzsäure dominierte den Markt bis 2025 mit einem Marktanteil von 74,5 %. Gründe hierfür waren die gleichbleibende Reinheit, der kontrollierte Produktionsprozess und die Eignung für Branchen, die eine präzise chemische Zusammensetzung erfordern. Hersteller bevorzugen synthetische Varianten für Anwendungen wie die Pharmaindustrie, die Lebensmittelverarbeitung und die Wasseraufbereitung, wo die Zuverlässigkeit der Qualität direkten Einfluss auf die Produktionsleistung hat. Die Verfügbarkeit großtechnischer, kosteneffizienter Produktionsanlagen stärkt die Marktpräsenz in Industrie- und Entwicklungsländern gleichermaßen. Branchen, die synthetische Salzsäure verwenden, profitieren von gleichmäßigen Konzentrationen, die die Prozessvariabilität reduzieren und die Endproduktqualität verbessern. Das Segment profitiert zudem von verbesserten Handhabungstechnologien und steigenden Investitionen in globale Chemiecluster, was seinen Marktanteil weiter erhöht.

Berichtsumfang und Marktsegmentierung für Salzsäure im asiatisch-pazifischen Raum

|

Attribute |

Salzsäure – Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem Salzsäuremarkt im asiatisch-pazifischen Raum

„Zunehmende Verbreitung von auf Rückgewinnung basierenden Salzsäureproduktionssystemen“

- Ein wichtiger Trend auf dem Salzsäuremarkt im asiatisch-pazifischen Raum ist der zunehmende Übergang zu rückgewinnungsbasierten Produktionstechnologien, die eine effiziente Wiederverwendung von Chlorwasserstoffgas aus industriellen Prozessen ermöglichen. Dieser Wandel wird durch die Notwendigkeit angetrieben, chemische Abfälle zu reduzieren, Produktionskosten zu senken und Umweltauflagen zur Förderung nachhaltiger Industriepraktiken zu erfüllen.

- Beispielsweise haben die Covestro AG und die BASF SE in ihre Polycarbonat- und Isocyanat-Produktionsanlagen integrierte Systeme zur Rückgewinnung von Chlorwasserstoff implementiert. Diese geschlossenen Kreislaufsysteme fangen Chlorwasserstoffgas auf und wandeln es in wiederverwendbare Salzsäure um, wodurch die Ressourceneffizienz verbessert und die Emissionen in den Chemieanlagen reduziert werden.

- Die Nutzung von Rückgewinnungssystemen nimmt in der Chloralkali- und Petrochemieindustrie zu, da bei diesen Prozessen große Mengen Chlorwasserstoff als Nebenprodukt anfallen. Durch die Umwandlung dieses Gases in marktfähige Salzsäure verbessern Unternehmen ihre betriebliche Nachhaltigkeit und optimieren gleichzeitig ihre Kostenstrukturen und Lieferketteneffizienz.

- Die zunehmende technologische Innovation bei Säurerückgewinnungsanlagen, wie beispielsweise Membranseparatoren und thermische Rückgewinnungsmodule, steigert die Prozesseffizienz weiter. Diese Fortschritte ermöglichen höhere Reinheitsgrade und minimieren den Energieverbrauch, was die langfristige Wirtschaftlichkeit nachhaltiger Säureproduktionssysteme unterstützt.

- Zudem fördert der zunehmende Fokus auf Kreislaufwirtschaft in der chemischen Produktion die Integration von zurückgewonnener Salzsäure in Wertschöpfungsketten der Metallurgie, Lebensmittelverarbeitung und Wasseraufbereitung. Diese Integration steht im Einklang mit globalen Bemühungen zur Reduzierung des CO₂-Fußabdrucks und zur Verbesserung der industriellen Ressourcennutzung.

- Der weitverbreitete Trend hin zur ressourcenschonenden Salzsäureproduktion spiegelt das branchenweite Engagement für Nachhaltigkeit und operative Resilienz wider. Da Unternehmen weiterhin in geschlossene Kreislaufsysteme und umweltfreundliche Produktionskonzepte investieren, werden diese Technologien voraussichtlich neue Maßstäbe in der Säureherstellung und der Ressourceneffizienz setzen.

Marktdynamik für Salzsäure im asiatisch-pazifischen Raum

Treiber

„Steigende Nachfrage aus den Bereichen Stahlbeizen und Säurebehandlung von Ölquellen“

- Die steigende Nachfrage aus der Stahlbeiz- und Ölquellen-Säurebehandlungsindustrie ist ein wesentlicher Treiber für den Salzsäuremarkt im asiatisch-pazifischen Raum. In der Stahlproduktion spielt Salzsäure eine entscheidende Rolle bei der Entfernung von Verunreinigungen und Oxidschichten von Metalloberflächen vor dem Verzinken oder Beschichten. Dies gewährleistet eine hohe Produktqualität und Korrosionsbeständigkeit.

- Beispielsweise haben ArcelorMittal und Tata Steel eigene Salzsäure-Regenerationsanlagen in ihre Produktionsstätten integriert, um eine kontinuierliche Versorgung für Beizprozesse sicherzustellen. Auch Ölfeldserviceunternehmen wie Halliburton und Schlumberger sind stark auf Salzsäure für Säurebehandlungen angewiesen, um die Permeabilität in Karbonatgesteinen zu verbessern.

- Die Ausweitung von Öl- und Gasexplorationsprojekten in Verbindung mit dem Wachstum der nachgelagerten Raffineriebetriebe führt zu einem erhöhten Verbrauch von Salzsäure. Aufgrund ihrer Wirksamkeit beim Auflösen von Mineralablagerungen und Reinigen von Bohrlochoberflächen ist die Salzsäure unverzichtbar für die Aufrechterhaltung der Produktionseffizienz bei Bohr- und Stimulationsprozessen.

- In der Stahlherstellung sichern die Modernisierung der Verarbeitungsanlagen und die Entwicklung fortschrittlicher Beizanlagen die langfristige Nachfrage. Der Einsatz von Salzsäure in kontinuierlichen Beizprozessen ermöglicht im Vergleich zu älteren Schwefelsäureverfahren sauberere Metalloberflächen, höhere Produktivität und eine geringere Umweltbelastung.

- Der kontinuierliche Anstieg von Bau-, Automobil- und Industrieinfrastrukturprojekten weltweit sichert einen stetigen Bedarf an hochwertigem Stahl und untermauert damit die Nachfrage nach Salzsäure. Die kombinierte Verwendung in den Bereichen Energie, Metallurgie und Fertigung positioniert die Verbindung als unverzichtbare Industriechemikalie, die die globale Wirtschaftstätigkeit antreibt.

Zurückhaltung/Herausforderung

„Schwankungen bei Chlor und der Rohstoffversorgung“

- Die Volatilität der Chlorversorgung und -preise, einem wichtigen Rohstoff für die Salzsäureproduktion, stellt Hersteller vor erhebliche Herausforderungen. Da die Chlorverfügbarkeit eng mit den Abläufen der Chloralkali-Industrie verknüpft ist, können Schwankungen in der Produktion oder der Nachfrage nach Natronlauge die Salzsäureproduktion und die Preisstabilität direkt beeinflussen.

- Beispielsweise berichteten große Hersteller wie Olin Corporation und Westlake Chemical in Zeiten knapper Chlorversorgung von Produktionsengpässen und gestiegenen Beschaffungskosten für Derivate wie Salzsäure. Diese Angebotsungleichgewichte können vertragliche Verpflichtungen beeinträchtigen und die Rentabilität abhängiger Branchen mindern.

- Die zyklische Natur der Chlorproduktion führt in Verbindung mit logistischen und lagertechnischen Einschränkungen häufig zu einem Ungleichgewicht zwischen Angebot und Nachfrage. Da Salzsäure aus Sicherheitsgründen nur schwer über weite Strecken transportiert werden kann, können regionale Produktionsengpässe lokale Preisanstiege und eine eingeschränkte Verfügbarkeit zur Folge haben.

- Zudem können globale Konjunkturschwankungen und Wartungsarbeiten an Chloralkali-Anlagen die Rohstoffknappheit weiter verschärfen. Schwankungen der Energiepreise und Produktionskosten wirken sich ebenfalls auf die Wirtschaftlichkeit der Chlorherstellung aus und beeinflussen somit die Preisentwicklung von Salzsäure in den verschiedenen Industrieregionen.

- Die Sicherstellung einer kontinuierlichen Rohstoffversorgung und die Entwicklung effizienter, auf Rohstoffrückgewinnung basierender Produktionsmodelle sind unerlässlich, um Marktschwankungen entgegenzuwirken. Strategische Kooperationen, Rückwärtsintegration und die Einführung zirkulärer chemischer Produktionssysteme dürften dazu beitragen, Lieferketten zu stabilisieren und langfristig eine zuverlässige Salzsäureproduktion zu gewährleisten.

Umfang des Salzsäuremarktes im asiatisch-pazifischen Raum

Der Markt ist segmentiert nach Art, Form, Anwendung, Vertriebskanal und Endnutzer.

• Nach Typ

Basierend auf der Art ist der Markt in synthetische Salzsäure und Salzsäure aus Nebenprodukten unterteilt. Das Segment der synthetischen Salzsäure dominierte den Markt mit einem Anteil von 74,5 % im Jahr 2025 aufgrund seiner gleichbleibenden Reinheit, des kontrollierten Produktionsprozesses und seiner Eignung für Branchen, die eine präzise chemische Zusammensetzung erfordern. Hersteller bevorzugen synthetische Varianten für Anwendungen wie die Pharmaindustrie, die Lebensmittelverarbeitung und die Wasseraufbereitung, wo die Zuverlässigkeit der Qualität direkten Einfluss auf die Betriebsleistung hat. Die Verfügbarkeit von großtechnischen, kosteneffizienten Produktionsanlagen stärkt die Marktpräsenz in Industrie- und Entwicklungsländern gleichermaßen. Branchen, die synthetische Salzsäure verwenden, profitieren von gleichmäßigen Konzentrationen, die die Prozessvariabilität reduzieren und die Endproduktqualität verbessern. Das Segment entwickelt sich zudem durch verbesserte Handhabungstechnologien und steigende Investitionen in Chemiecluster weltweit weiter und erhöht so seinen Marktanteil.

Das Segment der Salzsäure als Nebenprodukt wird voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen, getrieben durch die zunehmende Verfügbarkeit aus integrierten Stahl- und Chemieanlagen. Diese Produktart gewinnt an Bedeutung, da die Industrie aufgrund des wachsenden Fokus auf Ressourceneffizienz und Kreislaufwirtschaft nach kostengünstigen Alternativen sucht. Ihre Verwendung wird verstärkt, da Stahlwerke ihre Betriebsabläufe modernisieren und größere Mengen an Salzsäure als Nebenprodukt erzeugen, die für die Weiterverarbeitung geeignet ist. Viele Endverbraucherbranchen akzeptieren Varianten des Nebenprodukts für Anwendungen wie die Metallverarbeitung und die Erdölförderung, bei denen höchste Reinheit nicht zwingend erforderlich ist. Umweltaspekte und reduzierte Produktionskosten beschleunigen das Wachstum auf den globalen Märkten zusätzlich.

• Nach Formular

Basierend auf der Darreichungsform wird der Markt in wasserbasierte, wässrige und flüssige Salzsäure unterteilt. Das Segment der wasserbasierten Salzsäure dominierte den asiatisch-pazifischen Markt im Jahr 2025 aufgrund seiner breiten Anwendbarkeit in der chemischen Synthese, der Metallbehandlung und der industriellen Verarbeitung. Wasserbasierte Salzsäure wird aufgrund ihrer ausgewogenen Konzentrationen, der einfacheren Handhabung und der Kompatibilität mit großen Industrieanlagen bevorzugt. Endverbraucherbranchen schätzen diese Darreichungsform, da sie stabile Reaktionsgeschwindigkeiten ermöglicht und die Risiken hochkonzentrierter Säuren reduziert. Das Segment profitiert vom Ausbau der Produktionskapazitäten in der Stahl- und Öl- und Gasindustrie, wo wasserbasierte Varianten weit verbreitet sind. Die Kosteneffizienz und die Sicherheitsvorteile gewährleisten eine kontinuierliche Nachfrage sowohl von Großabnehmern als auch von Spezialchemikalienabnehmern.

Das Segment der wässrigen und gelösten Salzsäure (HCl) wird aufgrund der zunehmenden Anwendung in Laboren, kontrollierten industriellen Prozessen und der präzisionsbasierten chemischen Synthese voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen. Diese Darreichungsformen bieten individuell anpassbare Konzentrationen, die den strengen Anforderungen der Pharma-, Lebensmittel- und Elektronikindustrie gerecht werden. Das Wachstum wird zusätzlich durch die zunehmende Automatisierung von Dosiersystemen begünstigt, die auf standardisierte Lösungsformate angewiesen sind, um Schwankungen zu vermeiden. Das Segment profitiert von der Erweiterung der Anwendungsbereiche, in denen ein gleichbleibendes chemisches Verhalten und sichere Handhabung höchste Priorität haben. Diese Flexibilität bei der Formulierung unterstützt die rasche Expansion in neue Endverbraucherbranchen.

• Auf Antrag

Basierend auf den Anwendungsgebieten ist der Markt in Stahlbeizen, Säurebehandlung von Ölquellen, Erzverarbeitung, Lebensmittelverarbeitung, Poolreinigung, Calciumchlorid und Sonstiges unterteilt. Die Stahlbeizung dominierte den Markt im Jahr 2025 aufgrund der unverzichtbaren Rolle der Säure bei der Entfernung von Zunder, Rost und Verunreinigungen während der Stahlverarbeitung. Salzsäure bietet im Vergleich zu alternativen Säuren eine überlegene Beizeffizienz, da sie schnellere Reaktionsgeschwindigkeiten und eine sauberere Oberflächenvorbereitung für nachfolgende Prozesse ermöglicht. Die Expansion der globalen Stahlproduktion, insbesondere im asiatisch-pazifischen Raum, stärkt ihre führende Position zusätzlich. Stahlhersteller bevorzugen Salzsäure aufgrund ihrer Recyclingfähigkeit durch Säureregenerationssysteme, wodurch die Umweltbelastung und die Betriebskosten reduziert werden. Das Segment behauptet seine starke Position dank der kontinuierlichen Modernisierung von Beizanlagen und der Nachfrage aus der Automobil-, Bau- und Schwerindustrie.

Die Säurebehandlung von Ölquellen wird voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen, getrieben durch die zunehmenden Bohraktivitäten in konventionellen und unkonventionellen Lagerstätten. Salzsäure wird aufgrund ihrer Fähigkeit, Karbonate aufzulösen, die Permeabilität des Reservoirs zu erhöhen und die Kohlenwasserstoff-Förderrate zu verbessern, bevorzugt eingesetzt. Die Ausweitung der Schiefergasexploration und der Projekte zur verbesserten Ölgewinnung verstärkt die Nachfrage nach leistungsstarken Säurebehandlungslösungen. Der Fokus der Branche auf die Maximierung der Bohrlochproduktivität und die Reduzierung von Ausfallzeiten fördert die verstärkte Anwendung von HCl-basierten Formulierungen. Steigende Investitionen in Ölfelddienstleistungen und fortschrittliche Stimulationstechniken rücken dieses Segment an die Spitze des zukünftigen Wachstums.

• Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in E-Commerce, B2B, Fachgeschäfte und Sonstige unterteilt. Der B2B-Vertriebskanal dominierte den Markt für Salzsäure im asiatisch-pazifischen Raum im Jahr 2025 aufgrund der Großeinkaufsmuster industrieller Abnehmer aus den Bereichen Stahl, Chemie sowie Öl und Gas. Unternehmen bevorzugen Direktlieferverträge, um eine unterbrechungsfreie Verfügbarkeit, stabile Preise und maßgeschneiderte Konzentrationen zu gewährleisten. Chemiehersteller und -händler stärken diesen Kanal durch etablierte Logistiknetzwerke und langfristige Servicevereinbarungen. Großabnehmer profitieren von integrierten Lager-, Transport- und Sicherheitssystemen, die Lieferungen großer Mengen optimieren. Dieser Kanal bleibt dominant, da die Abhängigkeit der Industrie von einer kontrollierten und termingerechten Versorgung weltweit weiter zunimmt.

Der E-Commerce-Sektor wird aufgrund der zunehmenden Digitalisierung von Beschaffungsprozessen und der Expansion von Online-Marktplätzen für Chemikalien voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen. Kleine und mittlere Unternehmen setzen vermehrt auf Online-Plattformen für transparente Preise, Produktvergleiche und eine schnelle Auftragsabwicklung. E-Commerce-Plattformen ermöglichen einen einfacheren Zugriff auf Sicherheitsdatenblätter, Zertifizierungen und technische Spezifikationen und tragen so zu fundierten Entscheidungen bei. Auch der Trend zu dezentraler Beschaffung und die Nachfrage nach kleineren Verpackungseinheiten fördern das Wachstum. Die steigende Beteiligung von Chemielieferanten am Online-Vertrieb beschleunigt die Expansion des Segments zusätzlich.

• Vom Endbenutzer

Basierend auf den Endverbrauchern ist der Markt in die Segmente Lebensmittel und Getränke, Pharmazeutika, Textilien, Öl und Gas, Stahlindustrie, Chemieindustrie und Sonstige unterteilt. Die Stahlindustrie dominierte den Markt im Jahr 2025 aufgrund des hohen Verbrauchs von Salzsäure für Beizprozesse, Entzunderung und Produktionsoptimierung. Stahlwerke sind auf Salzsäure angewiesen, um saubere Oberflächen zu erzielen, Verunreinigungen zu reduzieren und effiziente Walz- und Endbearbeitungsprozesse zu ermöglichen. Das kontinuierliche Wachstum der Bau-, Automobil- und Infrastrukturbranche sorgt für eine hohe Stahlproduktion. Technologien zur Säureregeneration fördern deren Anwendung zusätzlich, indem sie Abfall reduzieren und die Kosteneffizienz verbessern. Das Segment profitiert von den laufenden Kapazitätserweiterungen in wichtigen Stahlproduktionsregionen und sichert so seine anhaltende Marktführerschaft.

Der Öl- und Gassektor wird voraussichtlich von 2026 bis 2033 am schnellsten wachsen. Treiber dieser Entwicklung sind die steigenden Anforderungen an Säurebehandlung, Bohrlochreinigung und verbesserte Förderverfahren. Salzsäure spielt eine entscheidende Rolle bei der Verbesserung der Lagerstättenleistung, insbesondere in Karbonatformationen, wo die Säurebehandlung unerlässlich ist. Das Wachstum der Schiefergasförderung und der Tiefbohrungen steigert die Nachfrage nach maßgeschneiderten Säuremischungen. Der Sektor setzt verstärkt auf fortschrittliche chemische Lösungen, um die Ausbeute und die betriebliche Effizienz zu maximieren. Steigende globale Investitionen in Explorations- und Produktionsprojekte gewährleisten ein rasches Wachstum dieses Endverbrauchersegments.

Regionale Analyse des Salzsäuremarktes im asiatisch-pazifischen Raum

- Japan dominierte den asiatisch-pazifischen Markt für Salzsäure mit dem größten Umsatzanteil im Jahr 2025, angetrieben durch seine starke chemische Produktionsbasis, seine fortschrittliche industrielle Infrastruktur und den hohen Verbrauch in der Elektronik-, Automobil- und Spezialchemieproduktion.

- Japans Führungsrolle wird durch den umfassenden Einsatz von hochreiner Salzsäure in der Halbleiterfertigung, der pharmazeutischen Synthese und der Präzisionsmetallverarbeitung gestärkt – Sektoren, in denen das Land seine globale Wettbewerbsfähigkeit behauptet.

- Die Präsenz etablierter Chemieproduzenten, kontinuierliche technologische Modernisierungen und strenge Qualitätsstandards stärken Japans Lieferkapazitäten und sichern eine stetige Nachfrage der heimischen Industrie. Steigende Investitionen in Elektronik und Batteriematerialien festigen Japans dominante Position im Prognosezeitraum zusätzlich.

Einblick in den chinesischen und asiatisch-pazifischen Markt für Salzsäure

China zählt zu den größten und dynamischsten Märkten für Salzsäure. Dies wird durch sein umfassendes Ökosystem der chemischen Industrie, seine hohe Stahlproduktionskapazität und die wachsende Industrieproduktion begünstigt. Zunehmende Aktivitäten in der Erzverarbeitung, der Kunststoffherstellung und der Abwasserbehandlung steigern den HCl-Verbrauch erheblich. Steigende Investitionen in Spezialchemikalien, Elektronikfertigung und erneuerbare Energien treiben die Nachfrage nach synthetischer und als Nebenprodukt gewonnener Salzsäure weiter an. Chinas starke Exportbasis, die Verfügbarkeit von Rohstoffen und die großtechnische Chloralkali-Produktion unterstreichen seine strategische Bedeutung in der Region.

Einblick in den Salzsäuremarkt in Indien und im asiatisch-pazifischen Raum

Indien wird im asiatisch-pazifischen Markt für Salzsäure im Zeitraum 2026–2033 voraussichtlich das schnellste jährliche Wachstum verzeichnen. Treiber dieses Wachstums sind die expandierende Stahlproduktion, der rasante Infrastrukturausbau und die steigende Nachfrage in der Pharma-, Textil- und Lebensmittelindustrie. Auch die zunehmende Verwendung von Salzsäure für die Rohölaufbereitung und Raffination trägt zu diesem starken Wachstum bei. Die beschleunigte Industrialisierung, die steigende Chloralkali-Produktion und staatliche Produktionsinitiativen stärken die Inlandsnachfrage. Verbesserte Logistiknetze, der Ausbau der Vertriebskanäle und die stärkere Beteiligung globaler Chemielieferanten positionieren Indien als den am schnellsten wachsenden Markt der Region.

Marktanteil von Salzsäure im asiatisch-pazifischen Raum

Die Salzsäureindustrie wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Olin Corporation (USA)

- Occidental Petroleum Corporation (USA)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- BASF SE (Deutschland)

- UNID (Südkorea)

- Detrex Corporation – Italmatch Chemicals SpA (USA/Italien)

- Tronox Holdings plc (USA)

- IXOM (Australien)

- Nouryon (Niederlande)

- ERCO Worldwide – Superior Plus (Kanada)

- SEQUENS (Frankreich)

- Formosa Plastics Corporation (Taiwan)

- Tessenderlo-Gruppe (Belgien)

- Westlake Chemical Corporation (USA)

- Aditya Birla Chemicals (Indien)

- AGC Chemicals Americas (USA/Japan)

- TOAGOSEI CO., LTD (Japan)

Neueste Entwicklungen auf dem Salzsäuremarkt im asiatisch-pazifischen Raum

- Im November 2025 führte die US-Umweltschutzbehörde (EPA) verschärfte Emissionsvorschriften für Anlagen zur Verbrennung gefährlicher Abfälle ein. Diese strengeren Kontrollen betreffen Anlagen, die Salzsäure aus Abfallströmen gewinnen. Die aktualisierten Standards erhöhen den Bedarf an fortschrittlichen Emissionskontrolltechnologien und damit die Betriebs- und Compliance-Kosten für Salzsäure-Rückgewinnungsanlagen. Diese Entwicklung dürfte die Wirtschaftlichkeit der Salzsäureproduktion als Nebenprodukt beeinflussen, den Ausbau neuer Rückgewinnungskapazitäten möglicherweise verlangsamen und die Hersteller veranlassen, ihre langfristigen Investitionsstrategien in Abfallverwertungsanlagen zu überdenken.

- Im Juli 2025 erweiterte die Olin Corporation ihre Produktionskapazität für Salzsäure an ihrem Standort in Louisiana, um der steigenden Nachfrage aus der Stahlverarbeitung, der chemischen Synthese und der Wasseraufbereitung gerecht zu werden. Diese Erweiterung stärkt Olins Fähigkeit, regionale und internationale Lieferanforderungen zu erfüllen, verringert die Abhängigkeit von Importmengen und stabilisiert die Verfügbarkeit in allen Endverbrauchersegmenten. Durch die Erhöhung der Produktionssicherheit verbessert Olin zudem seinen Wettbewerbsvorteil innerhalb der Chloralkali-Wertschöpfungskette und trägt so zum Marktgleichgewicht bei steigendem Verbrauch bei.

- Im Januar 2025 schloss Jones-Hamilton Co. die Übernahme von Nexchlor LLC ab und erweiterte damit seine Produktionskapazitäten für Salzsäure sowie seine geografische Präsenz erheblich. Die Integration stärkt die Position des Unternehmens auf dem Weltmarkt, verbessert die Versorgungssicherheit und ermöglicht eine breitere Serviceabdeckung in über 20 Ländern. Mit der Ernennung von Jon Cupps zum Bereichsleiter für das Salzsäuregeschäft will das Unternehmen die Abläufe optimieren und die strategische Ausrichtung verbessern. CEO Tim Poure betonte, wie die gebündelte Expertise die Kundenbeziehungen und die langfristige Lieferleistung stärken wird.

- Im August 2024 veranstaltete die Westlake Corporation eine öffentliche Anhörung, um ihren Vorschlag zur Installation zweier mit gefährlichen Abfällen befeuerter Salzsäureöfen zur Rückgewinnung von Salzsäure aus Industrieabfällen zu erörtern. Das Projekt unterstreicht den zunehmenden Fokus der Industrie auf Ressourceneffizienz und nachhaltige Produktionswege. Obwohl Anwohner Bedenken hinsichtlich der Auswirkungen auf Umwelt und Sicherheit äußerten, betonten Experten die strikte Einhaltung der Vorschriften zur Schadstoffbeseitigung gemäß dem US-amerikanischen Gesetz zur Ressourcenschonung und -wiederverwertung (Resource Conservation and Recovery Act). Der Fortschritt des Projekts könnte die regionale Versorgung verbessern und Kreislaufwirtschaftsmodelle fördern, wobei die behördliche Prüfung und das Feedback der Anwohner den endgültigen Zeitplan für die Umsetzung beeinflussen können.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.